Beruflich Dokumente

Kultur Dokumente

TM Contracts Article Final

Hochgeladen von

api-271171307Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TM Contracts Article Final

Hochgeladen von

api-271171307Copyright:

Verfügbare Formate

For Contract Management

Magazine

EDITORIAL

http://www.ncmahq.org/

In Defense of the T&M Subcontract

Daniel A. Chalfant, CPCM

28 October 2014

Introduction

5

10

15

20

War has been declared on the T&M contract!

The Department of Defense (DoD) is restricting the use of the

Time and Material (T&M) Contract type 1. In recent years, the

DoD has discouraged the use of the T&M contract type, and now

requires a Determination and Findings (D&F) that includes an

explanation of why another type of contract is not appropriate.

This article defends the T&M contract, not for prime recipients,

but as a valuable tool for subcontracting.

The Federal Acquisition Regulations (FAR) describe a T&M

contract as follows: provides for acquiring supplies or services

on the basis of direct labor hours at specified fixed hourly rates

that include wages, overhead, general and administrative

expenses, and profit; and actual cost for materials 2. In industry,

T&M contracts are typically used for repairs or research &

development efforts.

Although the FAR states that a T&M contract is the least

preferred type of contract 3, this FAR requirement does not apply

to subcontracts issued by prime contractors. Subcontracts are

commercial contracts and are only subject to state law and flow

down clauses from the prime contract.

25

30

35

40

DoD Limitations on T&M contracts

Some clear indications of these DoD limitations come from the

General Accountability Office (GAO) and the DoD Inspector

General (IG), where both have issued reports recently criticizing

the DoDs use of T&M contracts. The GAO recommended new

safeguards and improved controls be applied on T&M contracts 4.

The DoD IG the review, which was in regards to Air Force and

Army use of T&M contracts in Southwest Asia (Afghanistan and

Iraq), found that T&M contracts were not always properly

awarded and administered 5.

Another example is when the prime contractor is required to

obtain consent to subcontract, making it harder to award a T&M

subcontract. The requirement for consent can be found at FAR

clause 52.244-2 Subcontracts. It requires the prime contractor

to obtain consent to subcontract from the Contracting Officer

(CO) in certain situations. Additionally, FAR 44.203 states the

45

50

55

60

65

70

75

80

Contracting officers shall not consent to repetitive or unduly

protracted use of cost-reimbursement, time-and-materials, or

labor-hour subcontracts.

The DoD is also actively limiting the use of T&M Subcontracting

in many individual cases. Recently, the US Navy declined to

provide consent for a prime contractor to award a T&M

Subcontract 6. And in another case, T&M subcontracts were only

approved for small businesses without approved accounting

system. 7

Flaws of T&M subcontract

So, why is the DoD restricting the use of the T&M contract?

Some perceived flaws of the T&M contract are:

1. The profit included in the T&M rate could be

considered a cost plus percentage of cost contract.

This is prohibited by FAR No subcontract or

modification thereof placed under this contract shall

provide for payment on a cost-plus-a-percentage-ofcost basis 8.

2. This profit structure of a T&M contract is an incentive

for the contractor to increase labor hours beyond what

is considered fair and reasonable.

3. Uncompensated overtime hours for exempt employees

can be invoiced at the full T&M contract rate, despite

the fact that these hours may be at no cost to the

contractor.

4. Contractors can substitute low wage employees for

high rate labor categories.

Because of these perceptions, the Government typically

recommends the use of Cost Plus Fixed Fee (CPFF) contract type

in lieu of the T&M type contract.

Industry Preference for T&M subcontracts

Prime contractors prefer T&M subcontracts for various reasons.

The first applies to ID/IQ Multiple Award Contracts (MAC). An

ID/IQ MAC, can require task order proposals due within 5 to 10

days; leaving no time to solicit, analyze, and negotiate

subcontract cost proposals. In this instance, the benefit of the

T&M subcontract is that it allows the prime to quickly obtain

participation from subcontractors, without obtaining a cost

proposal for each task.

A second reason T&M subcontracts are preferred, are because

7

8

This journal is The National Contract Management Association 2014

Contract Management Magazine, 2014 1

10

15

20

25

30

they simplify the invoice preparation, review, and payment

approval processes. On a T&M subcontract, only the fully

burdened contract rate is included on the invoice, and there is no

need for additional rate data. This is especially beneficial when

the contract includes the Supplemental Wide Area Workflow

(WAWF) Payment Instructions 9. These payment instructions

require extensive rate detail for CPFF contracts and are a

tremendous burden on both the prime and the subcontractor.

These are just a few examples of why T&M contracts are

preferable for subcontracting.

Problems with CPFF Subcontracts

Now, one reason the federal government prefers CPFF contracts

is because they are entitled to audit rights. However, industry

usually does not have the right to audit the books and records of

the subcontractor. COs often do not understand the issues created

by a prime contractors lack of audit rights. A lack of audit rights

can impact the contractor in the following ways:

1. Harder to negotiate and award CPFF subcontracts due

to lack of visibility into the cost proposal rate detail.

2. Harder to review and approve invoices from the

subcontractor due to lack of rate detail. Some prime

contractors will require two invoices from the

subcontractor, one for the CO with the rate detail, and

one without the detail for the prime contractor.

3. Harder to negotiate changes to the subcontract for

increases in rates or adding new labor categories.

4. Harder to close out the subcontract due to the inability

to negotiate final indirect cost rates as required by the

payment clause. 10 This often takes the government 7 or

8 years to make this determination.

55

3.

60

4.

65

70

75

80

Exceed (NTE) ceiling price. This price must be

determined fair and reasonable based on Price or Cost

Analysis. This reasonable NTE prevents the T&M

subcontractor from charging unreasonable amounts.

The use of Uncompensated Overtime by exempt

employees can be controlled by a subcontract clause.

The subcontract clause can state either no overtime is

authorized on this contract or any overtime must be

authorized in writing by the prime. The prime

contractor should not approve overtime by exempt

employees unless necessary.

Use of low wage employees in high rate labor

categories can be mitigated by proper Price Analysis

techniques and well established labor category

qualifications. The T&M rate for each labor category

must be reasonable for the pool of employees who meet

the qualifications for that category. If a specific

employee is highly compensated, a special labor

category should be negotiated for that person.

Conclusion

In conclusion, the Time & Material contract type is indeed

appropriate in certain subcontracting situations. Prime contractors

should consider the advantages of T&M subcontracts over CPFF

subcontracts and Contracting Officers should consider the

increased burden of CPFF subcontracts on both the prime

contractor and subcontractor. Finally, T&M subcontracts can be

advantageous for both parties, but will also require additional

oversight on the part of the prime contractor.

Notes and references

35

40

45

50

The Solution

The FAR states A time-and-materials contract provides no

positive profit incentive to the contractor for cost control or labor

efficiency. Therefore, appropriate Government surveillance of

contractor performance is required to give reasonable assurance

that efficient methods and effective cost controls are being

used 11. To incorporate the concerns of FAR regarding T&M

contracts, the prime contractor can apply the appropriate level of

subcontractor surveillance by including the following responses

to critics:

1. T&M contracts are not cost plus percentage of cost

contracts. The profit or fee is included in the fixed

hourly rates. The profit is a fixed amount for each

labor category. In addition, the DoD makes extensive

use of CPFF contracts where the Fee is a fixed rate per

hour for any labor category. The Navy SeaPort-e 12

MAC contract includes this clause. Over 2,400 firms

hold SeaPort-e contracts.

2. FAR requires all T&M contracts to include a Not to

85

90

95

100

About the Author

Daniel A. Chalfant, CPCM is a Senior Cost/Price Analyst for

General Atomics and teaches contract management at San Diego

State University. For more information, please visit his website:

www.alexanderassociatesllc.com or connect with him via email

at: alexanderassociates@cox.net.

Footnotes:

1 DARS 2012-O0016, dated Oct 11 2012

2 FAR 16.601(b)

3 FAR 16.601 (d)

4 GAO Report GAO-09-579 June 2009

5 DoD IG Report No. D-2010-081 August 27, 2010

6 Navy C4I SE N66001-12-D-0092

7 Navy C4I SR N66001-14-D-0141

8 FAR 52.244-2 Subcontracts

9 Supplemental to DFARS clause 252.232-7006

10 FAR 52.216-7 (d)

11 FAR 16.601 (c)

12 Navy SeaPort-e N00178-14-D-7587

10

This journal is The National Contract Management Association 2014

Contract Management Magazine, 2014 2

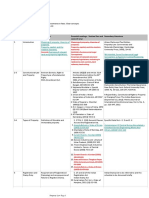

Das könnte Ihnen auch gefallen

- The Cost of Delay and Disruption 2Dokument12 SeitenThe Cost of Delay and Disruption 2Khaled AbdelbakiNoch keine Bewertungen

- Amending Fi Dic Contracts Nick Hen ChieDokument3 SeitenAmending Fi Dic Contracts Nick Hen ChieMdms PayoeNoch keine Bewertungen

- Successful Delay and Disruption Claims: Presenting The Claim (May 2005)Dokument3 SeitenSuccessful Delay and Disruption Claims: Presenting The Claim (May 2005)mullanaNoch keine Bewertungen

- The Cost of Delay and DisruptionDokument11 SeitenThe Cost of Delay and DisruptionAmir Shaik100% (1)

- Case Study For Contract Management - Hydro Power Projects PDFDokument4 SeitenCase Study For Contract Management - Hydro Power Projects PDFpradeepsharma62100% (1)

- Splitting Contracts 101Dokument5 SeitenSplitting Contracts 101scrib07100% (1)

- Application of Loss of ProfitDokument3 SeitenApplication of Loss of ProfitBritton WhitakerNoch keine Bewertungen

- Question - Answer (Dr. Sam) - 2007-2016Dokument352 SeitenQuestion - Answer (Dr. Sam) - 2007-2016Mohammed ShafiNoch keine Bewertungen

- CONM40018 CWK Contract AdminDokument8 SeitenCONM40018 CWK Contract Adminirislin1986Noch keine Bewertungen

- Construction ClaimsDokument34 SeitenConstruction ClaimsTent ParkNoch keine Bewertungen

- Era TheoryDokument10 SeitenEra TheoryYash Raj GairaNoch keine Bewertungen

- Back To Back ContractDokument3 SeitenBack To Back ContractphanblueskyNoch keine Bewertungen

- T M LH Contracts Kevin CoxDokument16 SeitenT M LH Contracts Kevin CoxVu HdNoch keine Bewertungen

- Level of EffortDokument3 SeitenLevel of EffortMazen SalabNoch keine Bewertungen

- EPC ContractsDokument5 SeitenEPC ContractsAbdul Rahman Sabra100% (1)

- MBJ Vol 4 2010Dokument9 SeitenMBJ Vol 4 2010LokuliyanaNNoch keine Bewertungen

- Topic 01 Suspension and Termination 2014Dokument15 SeitenTopic 01 Suspension and Termination 2014Kaps RamburnNoch keine Bewertungen

- LIQUIDATED-DAMAGES-Case Studies-Anamul HoqueDokument11 SeitenLIQUIDATED-DAMAGES-Case Studies-Anamul HoqueMuhammad Anamul HoqueNoch keine Bewertungen

- Back To Back ContractsDokument4 SeitenBack To Back ContractshumaidjafriNoch keine Bewertungen

- NEC Contract ComparisonsDokument9 SeitenNEC Contract ComparisonsKarl AttardNoch keine Bewertungen

- Computer Contracts-Chap5Dokument32 SeitenComputer Contracts-Chap5Shahbaz EnginrNoch keine Bewertungen

- Builders, Subcontractors and Employers' LiabilitiesDokument52 SeitenBuilders, Subcontractors and Employers' LiabilitiesDiana Alexandra ComaromiNoch keine Bewertungen

- Provisional SumDokument7 SeitenProvisional SumTarek TarekNoch keine Bewertungen

- Payment Procedures Under The RIAI Form of Contract and The PublicDokument12 SeitenPayment Procedures Under The RIAI Form of Contract and The PublicAbd Aziz MohamedNoch keine Bewertungen

- LD & GD - Apr 2022Dokument20 SeitenLD & GD - Apr 2022Anonymous pGodzH4xLNoch keine Bewertungen

- Back To Back ContractsDokument4 SeitenBack To Back ContractsTaseer BuchhNoch keine Bewertungen

- Handling Prolongation and Disruption ClaimsDokument0 SeitenHandling Prolongation and Disruption ClaimsAnonymous pGodzH4xL100% (1)

- Claims Preparation PointsDokument15 SeitenClaims Preparation Pointslengyianchua206Noch keine Bewertungen

- Framework Aggrement-RefDokument4 SeitenFramework Aggrement-RefMoffat KangombeNoch keine Bewertungen

- Contract Management TrainingDokument29 SeitenContract Management Trainingmahdi_g100% (2)

- Conditions of Sub-Contracts ERA Sub-Contract Framework ManagementDokument11 SeitenConditions of Sub-Contracts ERA Sub-Contract Framework Managementyesuf abdulhakim50% (2)

- Computer Contracts in Professional Practice Sir ZulqiDokument34 SeitenComputer Contracts in Professional Practice Sir ZulqiHasi RajpootNoch keine Bewertungen

- JUNIOR ORGANISATION - Pre-Qualification Structured Learning Series Contractual Issues of Construction Projects Date: 27 October 2003 7:00pmDokument12 SeitenJUNIOR ORGANISATION - Pre-Qualification Structured Learning Series Contractual Issues of Construction Projects Date: 27 October 2003 7:00pmpadmasunilNoch keine Bewertungen

- Contractual Limitations and Change Management of EPC ContractsDokument18 SeitenContractual Limitations and Change Management of EPC ContractsZhijing Eu100% (2)

- Recurso 11Dokument5 SeitenRecurso 11ARQTIS SACNoch keine Bewertungen

- Contract 12 - NEC3 - Early Warning and Compensation EventsDokument5 SeitenContract 12 - NEC3 - Early Warning and Compensation Eventsjon3803100% (1)

- NEC Contracts - One Stop ShopDokument3 SeitenNEC Contracts - One Stop ShopHarish NeelakantanNoch keine Bewertungen

- Concurrent DelaysDokument13 SeitenConcurrent Delayshymerchmidt100% (1)

- GMP ContractsDokument3 SeitenGMP ContractsHr Ks100% (1)

- Liquidated Damages ResearchDokument11 SeitenLiquidated Damages ResearchNatarajan SaravananNoch keine Bewertungen

- Handbook On Works Contract ManagementDokument173 SeitenHandbook On Works Contract ManagementRohit100% (1)

- Delay and Disruption Claims Martin Waldron BL March 2014 PDFDokument32 SeitenDelay and Disruption Claims Martin Waldron BL March 2014 PDFMumthaz ahamedNoch keine Bewertungen

- Types of ContractsDokument36 SeitenTypes of ContractsmohammednatiqNoch keine Bewertungen

- The Prevention Principle, Time at Large and Extension of Time Clauses - LexologyDokument3 SeitenThe Prevention Principle, Time at Large and Extension of Time Clauses - LexologyFarrahNoch keine Bewertungen

- Negotiation of Construction ClaimsDokument27 SeitenNegotiation of Construction ClaimsGiora Rozmarin100% (3)

- Nominated Subcontractors On International ProjectsDokument9 SeitenNominated Subcontractors On International ProjectsChikwason Sarcozy MwanzaNoch keine Bewertungen

- Evaluating Contract Claims PDFDokument2 SeitenEvaluating Contract Claims PDFJustin0% (3)

- Delay and Disruption Claims March 2014 PDFDokument31 SeitenDelay and Disruption Claims March 2014 PDFNuruddin CuevaNoch keine Bewertungen

- Turnkey Contract IntroDokument3 SeitenTurnkey Contract Introsarathirv6Noch keine Bewertungen

- Delay and Disruption Claims Martin Waldron BL March 2014Dokument32 SeitenDelay and Disruption Claims Martin Waldron BL March 2014kumaravajira100% (1)

- Assessment of Tender Risks - Red Flag ClausesDokument35 SeitenAssessment of Tender Risks - Red Flag ClausesRahulRandyNoch keine Bewertungen

- The EventDokument17 SeitenThe EventSaarjoonNoch keine Bewertungen

- Is Determination of Employment and Termination of Contract The Same in Meaning and ImplicationsDokument7 SeitenIs Determination of Employment and Termination of Contract The Same in Meaning and Implicationsmrlobbo100% (1)

- Handling Prolongation ClaimsDokument17 SeitenHandling Prolongation ClaimsShakthi ThiyageswaranNoch keine Bewertungen

- Accelaration Cost On ProjectsDokument13 SeitenAccelaration Cost On ProjectsWasimuddin SheikhNoch keine Bewertungen

- Summary of Christoph Mlinarchik's Government Contracts in Plain EnglishVon EverandSummary of Christoph Mlinarchik's Government Contracts in Plain EnglishNoch keine Bewertungen

- Contract Administration Pitfalls and Solutions for Architect-Engineering Projects: A JournalVon EverandContract Administration Pitfalls and Solutions for Architect-Engineering Projects: A JournalNoch keine Bewertungen

- Cost-Based Pricing: A Guide for Government ContractorsVon EverandCost-Based Pricing: A Guide for Government ContractorsNoch keine Bewertungen

- Constitutional Analysis Flow ChartDokument6 SeitenConstitutional Analysis Flow Chartprestonlanier100% (4)

- 5 Exact Trig ValuesDokument4 Seiten5 Exact Trig ValuesMaged YassaNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument7 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- Dissertation - A Study of Capital Punishment in India - Its Constitutional Validity. PDFDokument113 SeitenDissertation - A Study of Capital Punishment in India - Its Constitutional Validity. PDFEkta Choudhary100% (1)

- Course Manual: Week Broad Topic Particulars Essential Readings - Section Nos and Cases (If Any) Secondary LiteratureDokument44 SeitenCourse Manual: Week Broad Topic Particulars Essential Readings - Section Nos and Cases (If Any) Secondary LiteratureYasharth ShuklaNoch keine Bewertungen

- The Exceptions To The Principle of Autonomy of Documentary CreditsDokument343 SeitenThe Exceptions To The Principle of Autonomy of Documentary Creditsaveros12100% (2)

- Paper 1: Forensic Science: Unit-IDokument7 SeitenPaper 1: Forensic Science: Unit-IArun GautamNoch keine Bewertungen

- Women's Charter (Cap 353)Dokument71 SeitenWomen's Charter (Cap 353)elycia kohNoch keine Bewertungen

- Notice To All Law EnforcementDokument6 SeitenNotice To All Law EnforcementMin Hotep Tzaddik Bey100% (18)

- Indoor Management and Constructive NoticeDokument11 SeitenIndoor Management and Constructive NoticeAvinandan KunduNoch keine Bewertungen

- Annotated BibliographyDokument5 SeitenAnnotated Bibliographytarin15Noch keine Bewertungen

- Term Paper OutlineDokument4 SeitenTerm Paper OutlineMay Angelica TenezaNoch keine Bewertungen

- Apartment Lease Contract: This Is A Binding Document. Read Carefully Before SigningDokument42 SeitenApartment Lease Contract: This Is A Binding Document. Read Carefully Before SigningmeenonNoch keine Bewertungen

- Full Download Solution Manual For Calculus 11th Edition Ron Larson Bruce H Edwards PDF Full ChapterDokument36 SeitenFull Download Solution Manual For Calculus 11th Edition Ron Larson Bruce H Edwards PDF Full Chapteracholiaquacha.v575100% (20)

- Casil Vs CaDokument8 SeitenCasil Vs CaSamantha BaricauaNoch keine Bewertungen

- Dentegra Insurance ApplicationDokument18 SeitenDentegra Insurance ApplicationMaria Mercedes LeivaNoch keine Bewertungen

- 47 Gabin vs. MellizaDokument1 Seite47 Gabin vs. MellizaGoodyNoch keine Bewertungen

- Perkins v. Haines - Initial BriefDokument84 SeitenPerkins v. Haines - Initial BriefFloridaLegalBlogNoch keine Bewertungen

- The BART CaseDokument2 SeitenThe BART Caseblack_hole34Noch keine Bewertungen

- MergersDokument24 SeitenMergersAdina NeamtuNoch keine Bewertungen

- MAPP V. OhioDokument32 SeitenMAPP V. OhioGraden NapierNoch keine Bewertungen

- Justice ® Dr. Munir Ahmad MughalDokument140 SeitenJustice ® Dr. Munir Ahmad MughalNoor Ul Huda ChaddharNoch keine Bewertungen

- La Draft DocumentDokument2 SeitenLa Draft DocumentDeepak_pethkarNoch keine Bewertungen

- The 1935 ConstitutionDokument2 SeitenThe 1935 Constitution육한니Noch keine Bewertungen

- Safety Manual For CostructionDokument25 SeitenSafety Manual For CostructionKarthikNoch keine Bewertungen

- Gambia DV FGC Forced Marriage Rape 2013Dokument28 SeitenGambia DV FGC Forced Marriage Rape 2013Elisa Perez-SelskyNoch keine Bewertungen

- Presentatiom of Evidence CasesDokument42 SeitenPresentatiom of Evidence CasesCrizedhen VardeleonNoch keine Bewertungen

- 5 - ABC Party List v. COMELECDokument26 Seiten5 - ABC Party List v. COMELECCla SaguilNoch keine Bewertungen

- Law QuotesDokument7 SeitenLaw QuotesVaishali JadhavNoch keine Bewertungen

- The Sources of Law and The Value of Precedent - A Comparative andDokument49 SeitenThe Sources of Law and The Value of Precedent - A Comparative andZ_JahangeerNoch keine Bewertungen