Beruflich Dokumente

Kultur Dokumente

Nvestopedia Explains 'Interest Rate Collar'

Hochgeladen von

Lindsay SummersOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Nvestopedia Explains 'Interest Rate Collar'

Hochgeladen von

Lindsay SummersCopyright:

Verfügbare Formate

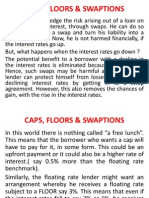

NVESTOPEDIA EXPLAINS 'INTEREST RATE COLLAR'

An interest rate collar can be an effective way of hedging interest rate risk

associated with holding bonds. Since a bond's price falls when interest rates go

up, the interest rate cap can guarantee a maximum decline in the bond's value.

While interest rate floor does limit the potential appreciation of a bond given a

decrease in rates, it provides upfront cash to help pay for the cost of the ceiling.

Let's say an investor enters a collar by purchasing a ceiling with a rate of 10%

and sells a floor at 8%. Whenever the interest rate is above 10%, the investor will

receive a payment from whoever sold the ceiling. If the interest rate drops to 7%,

which is under the floor, the investor must now make a payment to the party that

bought the floor.

Das könnte Ihnen auch gefallen

- Interest Rate CollarDokument3 SeitenInterest Rate Collarinaam mahmoodNoch keine Bewertungen

- Caps and FloorsDokument4 SeitenCaps and FloorsSanya rajNoch keine Bewertungen

- Discount: What Is A Discount?Dokument3 SeitenDiscount: What Is A Discount?Jonhmark AniñonNoch keine Bewertungen

- Also Called: Bond Callable Bond Interest RateDokument2 SeitenAlso Called: Bond Callable Bond Interest Rateasdfwerwerewrwer234eNoch keine Bewertungen

- 14.4 Bond Prices Over TimeDokument6 Seiten14.4 Bond Prices Over TimejustiraadhesaNoch keine Bewertungen

- Reinvestment Risk: Zero-Coupon BondDokument2 SeitenReinvestment Risk: Zero-Coupon BondMuneeba RustamNoch keine Bewertungen

- Bond Basics: Everything You Need To Know About BondsDokument10 SeitenBond Basics: Everything You Need To Know About BondsJAMENDEZ68Noch keine Bewertungen

- Debt Fund FeaturesDokument18 SeitenDebt Fund FeaturesAmit ShahNoch keine Bewertungen

- Bonds Concept & ValuationDokument29 SeitenBonds Concept & ValuationAditya SharmaNoch keine Bewertungen

- Investment in BondsDokument4 SeitenInvestment in BondsAnkit PandyaNoch keine Bewertungen

- DRM 1Dokument6 SeitenDRM 1zarthchahalNoch keine Bewertungen

- Investing in Fixed Income SecuritiesDokument16 SeitenInvesting in Fixed Income Securitiescao cao100% (1)

- What Are 'Marketable Securities': Default Risk Is The Chance That Companies or Individuals Will Be Unable To MakeDokument11 SeitenWhat Are 'Marketable Securities': Default Risk Is The Chance That Companies or Individuals Will Be Unable To MakeSheila Mae AramanNoch keine Bewertungen

- Why Do Interest Rates Tend To Have An Inverse Relationship With Bond PricesDokument2 SeitenWhy Do Interest Rates Tend To Have An Inverse Relationship With Bond Pricesarpitshah32_46837757Noch keine Bewertungen

- 19 - Interest Rate and Its Role in FinanceDokument18 Seiten19 - Interest Rate and Its Role in FinanceRydel CuachonNoch keine Bewertungen

- Interest Rate RiskDokument33 SeitenInterest Rate RiskirfanhaidersewagNoch keine Bewertungen

- Relationship Between Bonds Prices and Interest RatesDokument1 SeiteRelationship Between Bonds Prices and Interest RatesNikhil JoshiNoch keine Bewertungen

- Bond Market Interest Rates: Bonds CurriculumDokument4 SeitenBond Market Interest Rates: Bonds Curriculumits_different17Noch keine Bewertungen

- What Is A Zero-Coupon Treasury Bond: Guarantees The SecurityDokument7 SeitenWhat Is A Zero-Coupon Treasury Bond: Guarantees The Security88arjNoch keine Bewertungen

- What Are Bonds?Dokument21 SeitenWhat Are Bonds?ashish20gupta86Noch keine Bewertungen

- Valuation of Long Term SecuritiesDokument18 SeitenValuation of Long Term SecuritiessabeehahsanNoch keine Bewertungen

- Yield - Concept, Theories and MeasuresDokument10 SeitenYield - Concept, Theories and Measurespriyanka mehtaNoch keine Bewertungen

- January 2020 Banking CHPT 2Dokument18 SeitenJanuary 2020 Banking CHPT 2Bonolo MphaNoch keine Bewertungen

- Definition of 'Accrual Bond': Sinking Fund (Formula) HandoutDokument3 SeitenDefinition of 'Accrual Bond': Sinking Fund (Formula) HandoutKatrina Vianca DecapiaNoch keine Bewertungen

- CollarDokument4 SeitenCollarYogesh SinghNoch keine Bewertungen

- Coupon RateDokument2 SeitenCoupon RateVirajRautNoch keine Bewertungen

- Bond Basics: Yield, Price and Other Confusion: Néstor Morán M., MSCDokument8 SeitenBond Basics: Yield, Price and Other Confusion: Néstor Morán M., MSCAndreaGarciaNoch keine Bewertungen

- Five-Caps, Floors & Swaptions 8Dokument8 SeitenFive-Caps, Floors & Swaptions 8Akhilesh SinghNoch keine Bewertungen

- Bonds Valuation: Answers To End-Of-Chapter QuestionsDokument24 SeitenBonds Valuation: Answers To End-Of-Chapter QuestionsDominic RomeroNoch keine Bewertungen

- Bond and Equity ValuationDokument18 SeitenBond and Equity Valuationclassmate0% (1)

- Credit Risk & Its Spread DerivativesDokument6 SeitenCredit Risk & Its Spread DerivativestinotendacarltonNoch keine Bewertungen

- Case Study BondsDokument5 SeitenCase Study BondsAbhijeit BhosaleNoch keine Bewertungen

- Quiz Bomb FDDokument12 SeitenQuiz Bomb FDTshering Pasang SherpaNoch keine Bewertungen

- Everything You Need To Know About Bonds - PIMCODokument12 SeitenEverything You Need To Know About Bonds - PIMCOrthakkar97Noch keine Bewertungen

- Bond ValuationDokument3 SeitenBond ValuationAsad AliNoch keine Bewertungen

- Pricing Fixed-Income SecuritiesDokument50 SeitenPricing Fixed-Income SecuritiesyeehawwwwNoch keine Bewertungen

- Week 5 - Assignment Short-Answer QuestionsDokument1 SeiteWeek 5 - Assignment Short-Answer QuestionsArsalan chhipaNoch keine Bewertungen

- BondsDokument17 SeitenBondsjaneNoch keine Bewertungen

- Chapter 4 Interest RatesDokument4 SeitenChapter 4 Interest Ratessamrawithagos2002Noch keine Bewertungen

- Lecture 8-Bond N SukukDokument40 SeitenLecture 8-Bond N SukukfarahNoch keine Bewertungen

- Derivatives Future & OptionsDokument6 SeitenDerivatives Future & OptionsNiraj Kumar SahNoch keine Bewertungen

- Investment Module 4Dokument6 SeitenInvestment Module 4miyanoharuka25Noch keine Bewertungen

- Financial Management Chapter 7Dokument9 SeitenFinancial Management Chapter 7beahtoni.pacundoNoch keine Bewertungen

- Eco Tes 2Dokument2 SeitenEco Tes 2coki11111Noch keine Bewertungen

- FINC 620 - ScorpionsDokument3 SeitenFINC 620 - ScorpionsparaagagrawalNoch keine Bewertungen

- Bond ValuationDokument20 SeitenBond ValuationSaravana KrishnanNoch keine Bewertungen

- Benefits and Risks PDFDokument2 SeitenBenefits and Risks PDFkirti gNoch keine Bewertungen

- 54556Dokument22 Seiten54556rellimnojNoch keine Bewertungen

- Bond InvestmentDokument5 SeitenBond InvestmentRosalyn MauricioNoch keine Bewertungen

- Lesson 12Dokument37 SeitenLesson 12Devica UditramNoch keine Bewertungen

- Understanding Corporate BondsDokument2 SeitenUnderstanding Corporate BondsjoshuadormancogNoch keine Bewertungen

- Financial Markets and Institutions Unit 3Dokument9 SeitenFinancial Markets and Institutions Unit 3Nitin PanwarNoch keine Bewertungen

- Answers To End of Chapter QuestionsDokument3 SeitenAnswers To End of Chapter QuestionsDeepak KanojiaNoch keine Bewertungen

- Why Bond Prices Change When Interest Rates Change: Case Study FactsDokument3 SeitenWhy Bond Prices Change When Interest Rates Change: Case Study FactsLiewKianHongNoch keine Bewertungen

- Bond Yield and Price PDFDokument2 SeitenBond Yield and Price PDFps12hayNoch keine Bewertungen

- NOTES On Finma Mod 2 Bonds and Their ValuationDokument7 SeitenNOTES On Finma Mod 2 Bonds and Their ValuationLeyanna Pauleen VillanuevaNoch keine Bewertungen

- Derivatives Revision Note - PrintversionDokument9 SeitenDerivatives Revision Note - Printversionjournalist176Noch keine Bewertungen

- What Is A Coupon BondDokument3 SeitenWhat Is A Coupon BondNazrul IslamNoch keine Bewertungen

- SwapsDokument12 SeitenSwapsSilenceNoch keine Bewertungen

- Financial Management: Management Accountant - This Type of Post Would Involve Working Closely With The Head of FinanceDokument5 SeitenFinancial Management: Management Accountant - This Type of Post Would Involve Working Closely With The Head of FinanceLindsay SummersNoch keine Bewertungen

- Thanking You: MB - No. 9821076999Dokument1 SeiteThanking You: MB - No. 9821076999Lindsay SummersNoch keine Bewertungen

- Risk Taking AbilityDokument18 SeitenRisk Taking AbilityLindsay SummersNoch keine Bewertungen

- Capital Budgeting IIDokument37 SeitenCapital Budgeting IISelahi YılmazNoch keine Bewertungen

- Alcohol Free Hand SanitizersDokument56 SeitenAlcohol Free Hand SanitizersLindsay SummersNoch keine Bewertungen

- Mergers, Acquisitions & Co. RestructuringDokument3 SeitenMergers, Acquisitions & Co. RestructuringLindsay SummersNoch keine Bewertungen

- India's Pharma Sector Receives $1.26bn in FDI in First 9 Months of Current FiscalDokument2 SeitenIndia's Pharma Sector Receives $1.26bn in FDI in First 9 Months of Current FiscalLindsay SummersNoch keine Bewertungen

- AssignmentDokument2 SeitenAssignmentLindsay SummersNoch keine Bewertungen

- DispensingDokument1 SeiteDispensingLindsay SummersNoch keine Bewertungen

- Modified Date: April 07, 2014 1:03 PM: US MarketDokument4 SeitenModified Date: April 07, 2014 1:03 PM: US MarketLindsay SummersNoch keine Bewertungen

- Mergers & Amalgamations: Institute of Company Secretaries of India Hyderabad ChapterDokument20 SeitenMergers & Amalgamations: Institute of Company Secretaries of India Hyderabad ChapterGokul NairNoch keine Bewertungen

- Survey Report Rig CDokument30 SeitenSurvey Report Rig CLindsay SummersNoch keine Bewertungen

- Meyer TP Study ReportDokument23 SeitenMeyer TP Study ReportLindsay SummersNoch keine Bewertungen

- Hale & HeartyDokument2 SeitenHale & HeartyLindsay SummersNoch keine Bewertungen

- United Kingdom Lottery Promotion Council: Fill The Form BelowDokument2 SeitenUnited Kingdom Lottery Promotion Council: Fill The Form BelowLindsay SummersNoch keine Bewertungen

- Sub: Confirmation of Balance As On 31.03.2014: B/L Date Inv No Inv Date O/S Amt in UsdDokument1 SeiteSub: Confirmation of Balance As On 31.03.2014: B/L Date Inv No Inv Date O/S Amt in UsdLindsay SummersNoch keine Bewertungen

- Sub: Confirmation of Balance As On 31.03.2014: B/L Date Inv No INV Date O/S Amt in UsdDokument1 SeiteSub: Confirmation of Balance As On 31.03.2014: B/L Date Inv No INV Date O/S Amt in UsdLindsay SummersNoch keine Bewertungen