Beruflich Dokumente

Kultur Dokumente

E-Portfolio Term Project Paper-Adolfo Levano

Hochgeladen von

api-240741436Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

E-Portfolio Term Project Paper-Adolfo Levano

Hochgeladen von

api-240741436Copyright:

Verfügbare Formate

Adolfo Levano BUS 1010

E-Portfolio Term Project Paper

Portfolio Management Careers

Since coming to the United States I have been very interested in the stock market and

aspired to work in this industry. I know it is a challenging field and that I will have to do a lot of

preparation and hard work to get there, but if I could eventually work on Wall Street trading

stocks it would be a dream come true. I have enjoyed this opportunity to research more about this

industry and what steps I will need to take to eventually get there.

For this paper I have researched the position of a portfolio manager. A portfolio manager

generally works at an investment firm and is the person responsible for making the decision of

where to invest fund assets. These assets normally come from people who have invested with the

company so a portfolio managers goal is to get investors the best return on their money. A

portfolio manager meets with a team of financial analysts and researchers to gather ideas or

opportunities that the market can offer. However, the portfolio manager has the pressure of

making sure that the strategy that was chosen will bring profits to the company and to the

investors (Granville, 2014).

There are several characteristics that tend to be important for a portfolio manager; one of

them that I found interesting is tenacity. A portfolio manager is normally the first one at the

office and the last one to leave. He has to follow the market, financial news, and virtually all

current events that could affect markets. When the market opens early in the morning he needs to

be in the office and ready to go. Throughout the day, he follows the markets looking for

Adolfo Levano BUS 1010

opportunities to invest and meets with his team of financial analysts to get their data and ideas as

well. A portfolio manager may also have additional responsibilities such as meeting with

potential investors either in person or over the phone or to do interviews with news stations or

newspapers. There are several types of portfolio managers because there are different types of

funds and investment vehicles that they can manage (Granville, 2014).

Just like there are several types of portfolio managers, there are also several paths that

lead to being a portfolio manager, but most paths start by getting an entry-level position as a

financial analyst at either a portfolio management firm or an investment bank (Portal, 2014).

After getting to the entry-level position it is important to get additional training and pass

licensing examinations such as Series 7, 63 or 66 (Jenny, 2014). Networking is also an important

part of the job path that cant be ignored in the business world. It will probably take several years

as a financial analyst to gain the experience and connections needed to become a portfolio

manager. Another important step that can give an aspiring portfolio manager an advantage is

passing the three examinations needed for a Chartered Financial Analyst (CFA) certification

(Jenny, 2014).

Along with a Chartered Financial Analyst (CFA) certification, certain education is

needed to get on the path to becoming a portfolio manager. For starters, a bachelors degree is

needed either in finance or economics. Also experience and training about different financial

subjects such as bond valuations, capital markets and interest rates, financial statement analysis,

equity strategies, portfolio management, international economics and trade, and computer

research (Moynihan, 2014). In addition, my research shows that a masters degree in business

with emphasis in finance or economics is common among portfolio managers (Moynihan, 2014).

Adolfo Levano BUS 1010

Although a lot of education and experience is required to become a portfolio manager,

the salary can make all the effort worth it. The median salary for an entry-level portfolio

manager is $59,849 which can be increased with experience and specialization in certain markets

or investments. A mid-level portfolio manager, on average, can make $83,200 and in the state of

New York the median pay is actually $101,349. By the time a portfolio manager is experienced

in his career, median pay is $102,803 and $136,609 in New York. By the time a portfolio

manager is looking towards retirement the median pay is $128,680. Another advantage of being

a portfolio manager is the opportunity to make a bonus above and beyond the annual salary. The

average bonus for an experience portfolio manager is between $3,078 and $53,455 annually and

if that doesnt get you excited there is also the opportunity of adding profit sharing to the

portfolio managers compensation of anywhere from $1,981 to $27,404. Finally, many portfolio

managers also receive a commission based on their performance of anywhere from $1,968 to

$37,191 (PayScale, 2014). These numbers were reported by PayScale and are based on national

salary data and specifically information from 655 portfolio managers. Clearly, there is a lot of

money to be made if you can break into the world of portfolio management and perform well. It

also helps to live in New York, which is where Wall Street is located.

The position of a portfolio manager is closely linked to the economy and how the markets

are doing; meaning if the markets and the economy are doing well, then there will be a lot more

positions open for this type of job. On the other hand, if the economy goes through another

Great Depression then portfolio management jobs will be harder to find. However, just like

with any career, when the economy is down people are going to lose their jobs, but the ones who

perform best will be most likely to keep their jobs. In an interview with a high profile portfolio

manager he talks about getting laid off during the recent recession due to the fact that the

Adolfo Levano BUS 1010

company was struggling. In his case he got a good severance package and was able to find a new

job in the financial industry (Lee, 2014). Though the availability of jobs will ebb and flow with

the stock market, as long as there is a stock market in the United States or in the world there will

always be portfolio management jobs.

To gain further insight into portfolio management, I interviewed one of my neighbors

who works for a major financial institution. He got started by getting a bachelors degree in

business and eventually got a masters degree in finance while he was working at a bank. He

worked his way up in the banking industry to his current position as a portfolio manager. In an

average day, he talks to his clients, goes to meetings, and he mentioned how important it is to be

informed of the current financial news at all times. He said that he likes solving problems and

figuring out the best ways to keep his clients happy and to increase his clients assets. His least

favorite part of his job is the required paperwork and documentation, but overall he really enjoys

his job and hopes to continue working in this industry for a long time (Carlson, 2014).

My research agrees with the opinion of my neighbor about the pros and cons of being a

portfolio manager. The most common pros are that a portfolio manager enjoys the challenges

that the job offers and, since it is based on the markets, it is very stimulating. It is exciting to

work with the amount of money that a portfolio manager is in charge of managing and to get

well compensated for performing well. There is always the paperwork and the administrative

stuff that it is not as much fun and the schedule can be a con for some people. Portfolio

management is a competitive and intense career so it means a lot of hours at the office, arriving

at the office before the market opens and not leaving until after it closes. Individuals that cant

Adolfo Levano BUS 1010

handle intense pressure may struggle in this industry. It is not an ideal job for everyone (Lee,

2014).

As far as my fit in this career, I now have a clearer picture of what it will actually take

to become a portfolio manager and the hard work and responsibility that is needed to hold this

position. I feel that with the experience I have from working in sales for eight years and now

managing mortgage-backed security loans, I have proven to myself that I can handle a high

pressure environment. I would describe myself as tenacious and willing to work harder and

longer than the next guy. My old boss used to tell me that in order to succeed, you have to be the

first one in the office and the last one to leave. I have always remembered that saying and

followed it in whatever job I have worked. I also have good interpersonal skills and sales

experience, which can increase pay for a portfolio manager. In the last couple years, I have done

some trading in currency markets and I have learned that it takes discipline and self-control to

stick to a trading strategy. These are also skills that I have and am developing that would help me

as a portfolio manager. I am currently close to finishing an associates degree in business and I

have plans to get a bachelors degree in finance or accounting and after that I would also like to

get a masters degree in business. The portfolio management industry is heavily focused in New

York and I would love to live there and even work on Wall Street.

In conclusion, after researching and increasing my understanding of the portfolio

management industry, I am more excited than ever to pursue a career in portfolio management. I

was surprised to learn how important staying up on current events is for a portfolio manager. I

plan to pay more attention to national and world news from now on. I recognize that it will be a

long road to become a portfolio manager, but Im taking the first steps now by completing my

Adolfo Levano BUS 1010

associates degree in business, working in my current job, and trading on the side. Its only a

matter of time, but I will accomplish my goals.

Adolfo Levano BUS 1010

Sources

Carlson, R. (2014, December 7). What it is like to be a portfolio manager. (A. Levano,

Interviewer)

Granville, C. (2014, December 6). Preparing for a Career as a Portfolio Manager. Retrieved

from investopedia:

http://www.investopedia.com/articles/financialcareers/07/portfolio_manager.asp

Jenny, L. M. (2014, December 6). How to Become a Portfolio Manager. Retrieved from Wiki

How: http://www.wikihow.com/Become-a-Portfolio-Manager

Lee, S. H. (2014, December 12). Breaking Back Into Finance: How to Resurrect a Career in

Fund Management When Youre Stuck in a Dead-End Job. Retrieved from Mergers &

Inquisitions: http://www.mergersandinquisitions.com/breaking-into-fund-management/

Moynihan, B. (2014, December 11). Become a Portfolio Manager. Retrieved from Monster:

http://career-advice.monster.com/job-search/company-industry-research/portfoliomanagement-career/article.aspx

PayScale. (2014, December 11). Experienced Portfolio Manager Salary. Retrieved from

PayScale:

http://www.payscale.com/research/US/Job=Portfolio_Manager/Salary/4db5f988/Experie

nced

Portal, E. (2014, December 6). Portfolio Manager: Education Requirements and Career Info.

Retrieved from Education Portal: http://educationportal.com/articles/Portfolio_Manager_Education_Requirements_and_Career_Info.html

Das könnte Ihnen auch gefallen

- Bus 1010 - Final PaperDokument6 SeitenBus 1010 - Final Paperapi-509845050Noch keine Bewertungen

- The Corporate Executive’s Guide to General InvestingVon EverandThe Corporate Executive’s Guide to General InvestingNoch keine Bewertungen

- THINK LIKE A HEADHUNTER: The CFO's Guide to the Hidden Job MarketVon EverandTHINK LIKE A HEADHUNTER: The CFO's Guide to the Hidden Job MarketNoch keine Bewertungen

- Day in The Life of - Carlos Allers - Investment Compliance AnalystDokument2 SeitenDay in The Life of - Carlos Allers - Investment Compliance AnalystFast Track BermudaNoch keine Bewertungen

- Careers in Financial Markets 2010-2011 PDFDokument100 SeitenCareers in Financial Markets 2010-2011 PDFtrop41Noch keine Bewertungen

- Islamic Finance Consultancy: An Eaglemont Career Book for StudentsVon EverandIslamic Finance Consultancy: An Eaglemont Career Book for StudentsNoch keine Bewertungen

- Mirror Mirror on the Wall Am I the Most Valued of Them All?: The Ultimate Element of Differentiation is YouVon EverandMirror Mirror on the Wall Am I the Most Valued of Them All?: The Ultimate Element of Differentiation is YouNoch keine Bewertungen

- The Six-Figure Freelancer: Your Roadmap to Success in the Gig EconomyVon EverandThe Six-Figure Freelancer: Your Roadmap to Success in the Gig EconomyBewertung: 5 von 5 Sternen5/5 (4)

- Honest Conversations: Important Questions Americans Should Ask Their Financial Advisor to Have More Productive ConversationsVon EverandHonest Conversations: Important Questions Americans Should Ask Their Financial Advisor to Have More Productive ConversationsNoch keine Bewertungen

- So You Want to be a Fractional CFO: Determine Whether This is the Future For YouVon EverandSo You Want to be a Fractional CFO: Determine Whether This is the Future For YouNoch keine Bewertungen

- Freelancing Income Genesis: Internet Business Genesis Series, #2Von EverandFreelancing Income Genesis: Internet Business Genesis Series, #2Noch keine Bewertungen

- Successful Hiring for Financial Planners: The Human Capital AdvantageVon EverandSuccessful Hiring for Financial Planners: The Human Capital AdvantageNoch keine Bewertungen

- Defying expectations: A housewife guide to financial empowermentVon EverandDefying expectations: A housewife guide to financial empowermentNoch keine Bewertungen

- Corporate and Investment Banking: Preparing for a Career in Sales, Trading, and Research in Global MarketsVon EverandCorporate and Investment Banking: Preparing for a Career in Sales, Trading, and Research in Global MarketsNoch keine Bewertungen

- Eportfolio Career Research PaperDokument8 SeitenEportfolio Career Research Paperapi-301981728100% (3)

- Steps to Become Rich - Grow Your Income While Working Full Time for an EmployerVon EverandSteps to Become Rich - Grow Your Income While Working Full Time for an EmployerNoch keine Bewertungen

- Compliance to Commercial: The QUIET approach to Finance Business PartneringVon EverandCompliance to Commercial: The QUIET approach to Finance Business PartneringNoch keine Bewertungen

- Road to a Venture Capital Career: Practical Strategies and Tips to Break Into The IndustryVon EverandRoad to a Venture Capital Career: Practical Strategies and Tips to Break Into The IndustryBewertung: 5 von 5 Sternen5/5 (2)

- Stock Trading: BUY LOW SELL HIGH: The Definitive Guide For Beginner Traders In The Stock MarketVon EverandStock Trading: BUY LOW SELL HIGH: The Definitive Guide For Beginner Traders In The Stock MarketNoch keine Bewertungen

- JP Morgan Interview For Financial AnalystDokument10 SeitenJP Morgan Interview For Financial AnalystVimalan Parivallal100% (3)

- Essay For MBADokument4 SeitenEssay For MBALabdhi Chopda100% (2)

- The False Hope of Global Diversification: Confessions of a Portfolio Management MaverickVon EverandThe False Hope of Global Diversification: Confessions of a Portfolio Management MaverickNoch keine Bewertungen

- Jung Doyoung Careerindustryforecast 3a 09 11 16Dokument6 SeitenJung Doyoung Careerindustryforecast 3a 09 11 16api-329810065Noch keine Bewertungen

- Finance Operations: A Practical Approach - Which Ensures Success – Where Passion Gets Translated into Measurable PerformanceVon EverandFinance Operations: A Practical Approach - Which Ensures Success – Where Passion Gets Translated into Measurable PerformanceNoch keine Bewertungen

- An easy approach to online trading: How to become an online trader and learn the introductory information that are necessary to be successful in this marketVon EverandAn easy approach to online trading: How to become an online trader and learn the introductory information that are necessary to be successful in this marketBewertung: 5 von 5 Sternen5/5 (1)

- GET IT RIGHT THE FIRST TIME: The Owner-Manager's Guide to Hiring a CFOVon EverandGET IT RIGHT THE FIRST TIME: The Owner-Manager's Guide to Hiring a CFONoch keine Bewertungen

- Wannabe Financial Analyst | Useful Tips and Resources to get you started with financial analysisVon EverandWannabe Financial Analyst | Useful Tips and Resources to get you started with financial analysisBewertung: 1 von 5 Sternen1/5 (2)

- Getting a Job in Private Equity: Behind the Scenes Insight into How Private Equity Funds HireVon EverandGetting a Job in Private Equity: Behind the Scenes Insight into How Private Equity Funds HireNoch keine Bewertungen

- Employment Tips: A Guide To Navigating Career Success In The Ever-Changing Job MarketVon EverandEmployment Tips: A Guide To Navigating Career Success In The Ever-Changing Job MarketNoch keine Bewertungen

- Investment Banking PrepDokument68 SeitenInvestment Banking PrepAkbaraly Kevin100% (1)

- CFA Essay Writing HelpDokument4 SeitenCFA Essay Writing HelpNeeraj SinghNoch keine Bewertungen

- 99 Ways to Make Money in Real Estate - Finding a Niche that PaysVon Everand99 Ways to Make Money in Real Estate - Finding a Niche that PaysBewertung: 3 von 5 Sternen3/5 (1)

- Career InterviewDokument7 SeitenCareer Interviewapi-295032978Noch keine Bewertungen

- The 4 biggest Mistakes in Trading: How to become a professional TraderVon EverandThe 4 biggest Mistakes in Trading: How to become a professional TraderBewertung: 5 von 5 Sternen5/5 (1)

- Ebook: Hiring A Part-Time Cfo: A Founder'S HandbookDokument16 SeitenEbook: Hiring A Part-Time Cfo: A Founder'S HandbookArafath AhmedNoch keine Bewertungen

- High Performance and the Human Touch: The pragmatic Concept of Leadership for healthy Top PerformanceVon EverandHigh Performance and the Human Touch: The pragmatic Concept of Leadership for healthy Top PerformanceNoch keine Bewertungen

- Business Financial Intelligence: A mindset and skillset few people have and all organizations need.Von EverandBusiness Financial Intelligence: A mindset and skillset few people have and all organizations need.Noch keine Bewertungen

- Vocabulary Power for Business: 500 Words You Need to Transform Your Career and Your Life: 500 Words You Need to Transform Your Career and Your LifeVon EverandVocabulary Power for Business: 500 Words You Need to Transform Your Career and Your Life: 500 Words You Need to Transform Your Career and Your LifeBewertung: 3 von 5 Sternen3/5 (3)

- MBA ASAP Reading and Understanding Financial StatementsVon EverandMBA ASAP Reading and Understanding Financial StatementsBewertung: 5 von 5 Sternen5/5 (2)

- A Complete Nail Salon Business Plan: How To Start A Nail SalonVon EverandA Complete Nail Salon Business Plan: How To Start A Nail SalonBewertung: 4 von 5 Sternen4/5 (2)

- Financial Intelligence: The Dna of Business and InvestmentsVon EverandFinancial Intelligence: The Dna of Business and InvestmentsNoch keine Bewertungen

- Nimble Leader Volumes I - VI: Unrelenting Focus Strategy | Leadership Behavior | ResultsVon EverandNimble Leader Volumes I - VI: Unrelenting Focus Strategy | Leadership Behavior | ResultsNoch keine Bewertungen

- Wealth Odyssey: The Essential Road Map for Your Financial Journey Where Is It You Are Really Trying to Go with Money?Von EverandWealth Odyssey: The Essential Road Map for Your Financial Journey Where Is It You Are Really Trying to Go with Money?Noch keine Bewertungen

- Reflective Writing EportfolioDokument3 SeitenReflective Writing Eportfolioapi-240741436Noch keine Bewertungen

- E-Portfolio Econ 1740Dokument3 SeitenE-Portfolio Econ 1740api-240741436Noch keine Bewertungen

- Final Reflective EssayDokument4 SeitenFinal Reflective Essayapi-240741436Noch keine Bewertungen

- Master Budget Assignment CH 9Dokument4 SeitenMaster Budget Assignment CH 9api-240741436Noch keine Bewertungen

- Adolfo Levanos Resume For e PortfolioDokument2 SeitenAdolfo Levanos Resume For e Portfolioapi-240741436Noch keine Bewertungen

- The Millionaire Next Door E-PortfolioDokument3 SeitenThe Millionaire Next Door E-Portfolioapi-240741436Noch keine Bewertungen

- Micro Eportfolio Part 2Dokument5 SeitenMicro Eportfolio Part 2api-240741436Noch keine Bewertungen

- Book 16Dokument4 SeitenBook 16Shubham jainNoch keine Bewertungen

- TciDokument53 SeitenTciarunzmr007Noch keine Bewertungen

- Co Operative Housing SocietyDokument29 SeitenCo Operative Housing Societyvenkynaidu100% (1)

- Introduction EbcDokument5 SeitenIntroduction EbckmkesavanNoch keine Bewertungen

- (On The Letterhead of The Bidder/CONSULTANT) : Format For Advice of Vendor DetailsDokument2 Seiten(On The Letterhead of The Bidder/CONSULTANT) : Format For Advice of Vendor DetailsNinad SherawalaNoch keine Bewertungen

- Citi BankDokument21 SeitenCiti BankVysakh PkNoch keine Bewertungen

- Current Issues in Istisna & Tijarah (Final)Dokument12 SeitenCurrent Issues in Istisna & Tijarah (Final)Hasan Irfan Siddiqui100% (1)

- Monthly Current Affairs Capsule September 2018 PDFDokument35 SeitenMonthly Current Affairs Capsule September 2018 PDFbhajjiNoch keine Bewertungen

- Madina Book1 Arabic TextDokument7 SeitenMadina Book1 Arabic TextChetan ChoudharyNoch keine Bewertungen

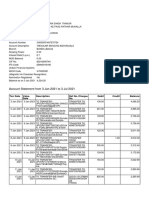

- Account Statement From 3 Jan 2021 To 3 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument8 SeitenAccount Statement From 3 Jan 2021 To 3 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSanatan ThakurNoch keine Bewertungen

- Competitive Analysis of Stock Brokers ReligareDokument92 SeitenCompetitive Analysis of Stock Brokers ReligareJaved KhanNoch keine Bewertungen

- Banking Law: PrimerDokument21 SeitenBanking Law: PrimerAnonymous XuOGlMiNoch keine Bewertungen

- CTOS ConsentDokument1 SeiteCTOS Consentkontrak ukurbahanNoch keine Bewertungen

- Definition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesDokument8 SeitenDefinition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesKae Abegail GarciaNoch keine Bewertungen

- Customer Perception Towards Internet Banking PDFDokument17 SeitenCustomer Perception Towards Internet Banking PDFarpita waruleNoch keine Bewertungen

- A Policyholder's Primer On Commercial InsuranceDokument211 SeitenA Policyholder's Primer On Commercial Insurancepauljosephwhiteyahoo.comNoch keine Bewertungen

- Salary Relief Grant Final Fill With Extra DetailsDokument4 SeitenSalary Relief Grant Final Fill With Extra DetailsShania RoopnarineNoch keine Bewertungen

- 3 Slide Đầu RevisionDokument5 Seiten3 Slide Đầu RevisionLương Mỹ DungNoch keine Bewertungen

- FNB Pricing Guide Gold AccountDokument15 SeitenFNB Pricing Guide Gold AccountAnonymous PYf0IqNoch keine Bewertungen

- Sibos Issues 2018 Wrapup Edition PDFDokument37 SeitenSibos Issues 2018 Wrapup Edition PDFwill hubberNoch keine Bewertungen

- 72-Finman Assurance Corporation vs. Court of Appeals, 361 SCRA 514 (2001)Dokument7 Seiten72-Finman Assurance Corporation vs. Court of Appeals, 361 SCRA 514 (2001)Jopan SJNoch keine Bewertungen

- Industry Profile: Banking Sector in IndiaDokument15 SeitenIndustry Profile: Banking Sector in Indiasri1031Noch keine Bewertungen

- Mozambique Tourist Visa ApplicationDokument5 SeitenMozambique Tourist Visa ApplicationMaria José Andrade PadillaNoch keine Bewertungen

- Lmdownload PDFDokument51 SeitenLmdownload PDFJose W CruzNoch keine Bewertungen

- AICPA - Develops Standards For Audits ofDokument3 SeitenAICPA - Develops Standards For Audits ofAngela PaduaNoch keine Bewertungen

- Client Manual Consumer Banking - CitibankDokument29 SeitenClient Manual Consumer Banking - CitibankNGUYEN HUU THUNoch keine Bewertungen

- FRTB - EyDokument8 SeitenFRTB - EyJamesMc1144Noch keine Bewertungen

- Cash Management Application SetupDokument16 SeitenCash Management Application SetupSriram KalidossNoch keine Bewertungen

- Barc - Citi - 500.4Dokument2 SeitenBarc - Citi - 500.4Benjamin Benji Bonilla Cocoma100% (1)

- FIN036 AssignmentDokument25 SeitenFIN036 AssignmentSandeep BholahNoch keine Bewertungen