Beruflich Dokumente

Kultur Dokumente

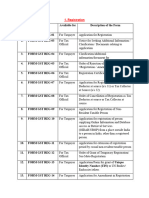

Inter State Movement of Goods

Hochgeladen von

c bhushan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten1 SeiteThis document provides details on state-wise forms/permits required for value-added tax (VAT), entry tax, and octroi in India. It lists 30 states and union territories along with their respective form numbers for VAT, whether entry tax and VAT apply in that state, and if octroi is levied. Some key points are that states like Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, and Nagaland require specific form numbers for VAT and entry tax, while others may not require a form or have different rules for registered versus non-registered customers.

Originalbeschreibung:

legal state permit

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides details on state-wise forms/permits required for value-added tax (VAT), entry tax, and octroi in India. It lists 30 states and union territories along with their respective form numbers for VAT, whether entry tax and VAT apply in that state, and if octroi is levied. Some key points are that states like Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, and Nagaland require specific form numbers for VAT and entry tax, while others may not require a form or have different rules for registered versus non-registered customers.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten1 SeiteInter State Movement of Goods

Hochgeladen von

c bhushanThis document provides details on state-wise forms/permits required for value-added tax (VAT), entry tax, and octroi in India. It lists 30 states and union territories along with their respective form numbers for VAT, whether entry tax and VAT apply in that state, and if octroi is levied. Some key points are that states like Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, and Nagaland require specific form numbers for VAT and entry tax, while others may not require a form or have different rules for registered versus non-registered customers.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

SL

STATE NAME

1 ARUNACHAL PRADESH

2

3

4

5

6

7

8

ASSAM

MANIPUR

MEGHALAYA

MIZORAM

NAGALAND

TRIPURA

JHARKHAND

STATE FORM /PERMIT DETAILS

ST FORM/PERMIT NO

Form No-3

24(REGD.)

61(GOVT.)

62(UNREGD)

35(Taxable); 37(Non-Taxable)

14

33

16A

18A/18B

JVAT504; (P) For within State/(B) For outgoing; (G) For incoming

ORISSA WAYBILL 32 IN TRIPLICATE COPY FOR REGISTERED CUSTOMERS.

VAT CHARGES & ENTRY TAX ARE NOT APPLICABLE THEN.

FOR NON-REGISTERED CUSTOMERS-FORM 402A IS THE REPLACEMENT OF VAT

ENTRY TAX

YES

VAT TAX

YES

OCTROI

NO

YES

YES

NO

NO

NO

NO

YES

NO

NO

NO

NO

NO

NO

YES

NO

NO

NO

NO

NO

NO

NO

YES

YES

NO

NO

NO

YES

NO

NO

YES

NO

NO

NO

YES

NO

NO

YES

NO

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

NO

YES

NO

YES

YES

NO

NO

NO

NO

NO

NO

NO

NO

NO

NO

NO

NO

NO

NO

NO

NO

NO

NO

NO

NO

NO

YES

NO

NO

NO

YES

YES

NO

YES

NO

NO

NO

CHARGES OF 12.5%.

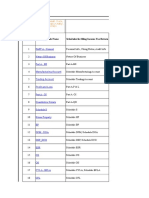

ORISSA

10

11

WEST BENGAL

MAHARASTRA

12

GUJRAT

13

CHATTISGARH

14

MADHYA PRADESH

15

RAJASTHAN

16

BIHAR

17

TAMIL NADU

18

KERALA

19

GOA

20

JAMMU & KASHMIR

21

SIKKIM

22

DELHI

23

CHANDIGARH

24

UTTARANCHAL

25

PUNJAB

26 HIMACHAL PRADESH

27

HARYANA

28

29

30

ANDHRA PRADESH

UTTAR PRADESH

KARNATAKA

IF FORM 402A IS ATTACHED ;THEN NO VAT CHARGES WILL BE LEVIED

ONLY ENTRY TAX WILL BE LEVIED.

50(INCOMING)

51(OUTGOING)

NIL

402(OUTGOING)

403(INCOMING)

404( FOR TRANSIT)

NO FORM REQUIRED ;C'NEE TIN NO IS MUST

VAT 49/VAT-50(GOVT INST/ EDUCATIONAL INST.)

VAT-47

D-8( Within Bihar); D-9(Incoming);D-10(Outgoing)

Form XX( Not Tax-Paid)

FORM -16

NIL

VAT FORM 65

FORM 25

NIL

NIL

FORM 16/Non-Govt-17

FORM XXXVI(AVAILABLE AT CHECKPOST)

FORM 26

VAT D3 CLN INWARD

VAT D3 CLN OUTWARD

FOR OUTGOING FORM X

FOR INCOMING FORM X REQ. FOR ELECTRONIC & ELECTRICAL GOODS

YES(38 &39);FORM-21 FOR EXPORT SHIPMENT

FORM 515/505(OUTGOING)

Das könnte Ihnen auch gefallen

- New Income Tax Return BIR Form 1701 - November 2011 RevisedDokument6 SeitenNew Income Tax Return BIR Form 1701 - November 2011 RevisedBusinessTips.Ph100% (4)

- Annual Report07Dokument104 SeitenAnnual Report07c bhushanNoch keine Bewertungen

- Annual Report07Dokument104 SeitenAnnual Report07c bhushanNoch keine Bewertungen

- 2012 Itr1 Pr21Dokument5 Seiten2012 Itr1 Pr21MRLogan123Noch keine Bewertungen

- GST One LinersDokument36 SeitenGST One LinersSonali PalNoch keine Bewertungen

- FORMS ListDokument7 SeitenFORMS ListPanchal YashNoch keine Bewertungen

- Dossiers Forwarded To Other Regions of CGL 2011Dokument7 SeitenDossiers Forwarded To Other Regions of CGL 2011atoakash007Noch keine Bewertungen

- Gross Total Income (1+2+3) 4: System CalculatedDokument8 SeitenGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNoch keine Bewertungen

- Form GST REG-02 Acknowledgment: (See Rule - 8 (5) )Dokument1 SeiteForm GST REG-02 Acknowledgment: (See Rule - 8 (5) )fin helpsNoch keine Bewertungen

- Gross Total Income (1+2c) 4: Import Previous VersionDokument4 SeitenGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailNoch keine Bewertungen

- 2011 ITR1 r2Dokument3 Seiten2011 ITR1 r2Zafar IqbalNoch keine Bewertungen

- Signature Not Verified: Form Vat-03Dokument1 SeiteSignature Not Verified: Form Vat-03Bharti ChanchlaniNoch keine Bewertungen

- Assessment Year Indian Income Tax Return SahajDokument7 SeitenAssessment Year Indian Income Tax Return SahajallipraNoch keine Bewertungen

- Accounts Officer Details: Form No. 24G TDS/TCS Book Adjustment StatementDokument5 SeitenAccounts Officer Details: Form No. 24G TDS/TCS Book Adjustment StatementManikdnathNoch keine Bewertungen

- VENDOR STATUTORY DETAILS Sheeet - IndirectDokument1 SeiteVENDOR STATUTORY DETAILS Sheeet - IndirectNithinsmartNoch keine Bewertungen

- Income TaxDokument6 SeitenIncome TaxKuldeep HoodaNoch keine Bewertungen

- Quarterly Statement of Tax Collection at Source Under Section 206C of The I.T.Act, 1961 For The Quarter Ended September (Year) 2012Dokument7 SeitenQuarterly Statement of Tax Collection at Source Under Section 206C of The I.T.Act, 1961 For The Quarter Ended September (Year) 2012amit22505Noch keine Bewertungen

- 6 - Formular Blocare Si Anulare CarduriDokument1 Seite6 - Formular Blocare Si Anulare CarduriRoxana TuduracheNoch keine Bewertungen

- Indian Income Tax Return Assessment Year SahajDokument7 SeitenIndian Income Tax Return Assessment Year SahajSubrata BiswasNoch keine Bewertungen

- 1702q PDFDokument2 Seiten1702q PDFfloriza binadayNoch keine Bewertungen

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDokument3 SeitenAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinNoch keine Bewertungen

- 2015 Itr1 PR3Dokument18 Seiten2015 Itr1 PR3shubham sharmaNoch keine Bewertungen

- VAT SummaryDokument1 SeiteVAT SummarybanglauserNoch keine Bewertungen

- CGL ResultDokument95 SeitenCGL Resultvineet4207Noch keine Bewertungen

- Income Tax Certificate SuccessuptechDokument2 SeitenIncome Tax Certificate Successuptecheandc.bdNoch keine Bewertungen

- KARINDokument2 SeitenKARINannivmcs12thNoch keine Bewertungen

- I. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryDokument34 SeitenI. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryAjay PandeyNoch keine Bewertungen

- WIPROFORM16202324Dokument8 SeitenWIPROFORM16202324cagopalofficebackupNoch keine Bewertungen

- 2013 Itr1 PR11Dokument9 Seiten2013 Itr1 PR11Akshay Kumar SahooNoch keine Bewertungen

- Minar Plastic 0104 - 240329 - 151232Dokument3 SeitenMinar Plastic 0104 - 240329 - 151232minarplastic200Noch keine Bewertungen

- Annual Income Tax Return: (To Be Filled Up by The BIR)Dokument10 SeitenAnnual Income Tax Return: (To Be Filled Up by The BIR)Louie De La TorreNoch keine Bewertungen

- NBR Tin Certificate 324242267762Dokument2 SeitenNBR Tin Certificate 324242267762MdShaonNoch keine Bewertungen

- GST Forms Available 25092019Dokument13 SeitenGST Forms Available 25092019Jethwa AaryaNoch keine Bewertungen

- AA330422032960NR13042022Dokument1 SeiteAA330422032960NR13042022Ravi FrankNoch keine Bewertungen

- Spi PDFDokument3 SeitenSpi PDFAnonymous eFR5llUFNoch keine Bewertungen

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDokument2 SeitenThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionManojNoch keine Bewertungen

- Sai Irrigation Tax Inv-0246Dokument1 SeiteSai Irrigation Tax Inv-0246Chetan DeshmukhNoch keine Bewertungen

- SL No. Scheme Bank Name Branchname State District Block GrampanchayatDokument5 SeitenSL No. Scheme Bank Name Branchname State District Block GrampanchayatHaribandhu SaNoch keine Bewertungen

- Forms in GSTDokument11 SeitenForms in GSTsagayNoch keine Bewertungen

- Registration Certificate CSTDokument2 SeitenRegistration Certificate CSTcachandhiranNoch keine Bewertungen

- Fill in The Data Below: 0706764 B. Sankar SinghDokument24 SeitenFill in The Data Below: 0706764 B. Sankar SinghMurali Krishna VNoch keine Bewertungen

- ITR3 - 2019 - PR1.1 Example FileDokument208 SeitenITR3 - 2019 - PR1.1 Example FilePrateek SharmaNoch keine Bewertungen

- Improperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NoDokument6 SeitenImproperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NofatmaaleahNoch keine Bewertungen

- GST FormDokument16 SeitenGST FormPruthiv RajNoch keine Bewertungen

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDokument4 SeitenNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- Aggregate Turnover - 10 CRDokument2 SeitenAggregate Turnover - 10 CRSpeciality GeochemNoch keine Bewertungen

- Assessment Year Sahaj Indian Income Tax ReturnDokument7 SeitenAssessment Year Sahaj Indian Income Tax Returnrajshri58Noch keine Bewertungen

- SunshineDokument1 SeiteSunshineatifah3322Noch keine Bewertungen

- SunshineDokument1 SeiteSunshineatifah3322Noch keine Bewertungen

- GISExcelupload PDFDokument1 SeiteGISExcelupload PDFAnonymous 3C4egzaqBFNoch keine Bewertungen

- Acknowledgement UnlockedDokument1 SeiteAcknowledgement UnlockedcachandhiranNoch keine Bewertungen

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Dokument3 SeitenSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarNoch keine Bewertungen

- MP 1605 23 24Dokument2 SeitenMP 1605 23 24minarplastic200Noch keine Bewertungen

- Annual Income Tax Return: 0 5 1 SaleDokument6 SeitenAnnual Income Tax Return: 0 5 1 Salecaitlin888Noch keine Bewertungen

- Birth CertificateDokument1 SeiteBirth CertificateAkash100% (2)

- Expected MCQs CompressedDokument31 SeitenExpected MCQs CompressedAdithya kesavNoch keine Bewertungen

- Earnings: 10 Ca (PH Allowance)Dokument15 SeitenEarnings: 10 Ca (PH Allowance)asrahaman9Noch keine Bewertungen

- Sample 7 (Teacher Work Experience)Dokument1 SeiteSample 7 (Teacher Work Experience)c bhushanNoch keine Bewertungen

- 5055300314Dokument103 Seiten5055300314c bhushanNoch keine Bewertungen

- Sap Stands For Systems Applications and Product in Data ProcessingDokument7 SeitenSap Stands For Systems Applications and Product in Data Processingc bhushanNoch keine Bewertungen