Beruflich Dokumente

Kultur Dokumente

Assessment 2 Group Case Study

Hochgeladen von

api-269138296Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Assessment 2 Group Case Study

Hochgeladen von

api-269138296Copyright:

Verfügbare Formate

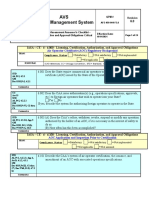

Assessment 2: Group Case

Study

BSB7400 Auditing

12/28/2014

Group Members

Class Number

Course

Tutor Name

Name

ID Number

Amal Mohamed AlShaikh

201001063

Zahra Mahdi Shamlooh

201102306

Kawthar Mahdi Busehail

201101555

Layla Mustafa Kashtakar

201100852

Zainab AbdulKarim AlAsfoor

201100592

002

BSB 7400 Auditing

Namasiku Liandu

Page 1 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

Table of contents

1.0 Overall audit strategy for the financial statements of Bahrain Flour Mills Company ............................ 3

1.1Audit Scope .......................................................................................................................................... 3

1.2 Audit Timing ........................................................................................................................................ 6

1.3 Nature of communication ................................................................................................................... 7

1.4 Resources ............................................................................................................................................ 8

1.5 Significant Factors (Materiality and Audit Risk) ................................................................................ 11

2.0 Audit plans ............................................................................................................................................ 12

2.1 Audit plan for Property, Plant & Equipment asset ........................................................................... 12

2.2 Audit plan for Trade payable liability ................................................................................................ 16

2.3 Audit plan for Share Capital .............................................................................................................. 21

3.0 Internal control procedures for payroll cycle ....................................................................................... 26

4.0 Working papers ..................................................................................................................................... 31

4.1 Working paper for the Property, Plant & Equipment ....................................................................... 31

4.1 Working paper for the payroll control .............................................................................................. 33

4.3 Working paper for Share Capital....................................................................................................... 35

4.4 Working paper for Trade payable ..................................................................................................... 37

5.0 The explanation of how the audit report would have been different there been a material

misstatement in any of the key components of the financial statements ................................................. 39

6.0 References ............................................................................................................................................ 41

Page 2 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

1.0 Overall audit strategy for the financial statements of Bahrain Flour

Mills Company

The following audit strategy is designed in accordance with ISA 300

1.1Audit Scope

Engagement terms

Our engagement letter dated 12 January 2014 sets out the terms of reference as auditors and

has been provided to the Board.

The purpose of this memorandum is to highlight the key element of the audit strategy for the

audit of Bahrain Flour Mills Company for the year ended 31 December 2013.

Audit responsibilities

Our responsibilities as auditors are:

We are required to express our audit opinion on the company financial statements which

are: the statement of financial position as at 31 December 2013, the statement of profit or loss,

the statement of other comprehensive income, the statement of changes in shareholders

equity and the statement of cash flows and summary of significant accounting policies and

other explanatory information.

Our audit is conducted with the International Standards on Auditing and in comply with the

Code of Ethics for Professional Accountants (IESBA Code) requirements.

Perform and plan the audit to get reasonable assurance whether the financial statements are

free from material misstatement

Perform procedures to obtain the evidence of audit about the amounts and disclosures in the

financial statements

Evaluate the appropriateness of accounting policies used and the reasonableness of

accounting estimates that are made by the management as well as the evaluating the overall

presentation of the financial statements.

Page 3 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

Independence

To maintain our independence as auditors we ensure that our partners and audit team have no

family, employment, investment or business relationship with the company.

Report elements

The elements of our audit report that is provided to your company:

Title

Addressee

Opening paragraph: Includes identification of the audited financial statements and a

statement of the responsibility of the entity's board of directors and the auditors responsibility

Scope paragraph that includes a description of that the auditor performed and a reference to

the standard that are used.

Opinion paragraph that includes reference to the financial reporting framework used to

prepare the financial statements, expression of the opinion on the financial statements and

report on other legal and regulatory requirements

Date of the report

Our Company address

Auditor's signature

Currency

The currency to be used in reporting is the Bahrain Dinar

Availability of data

We want to ensure that all of the data they are needed for implementing the audit is available

for the auditors in any time they require it.

Roles and responsibilities

The Board of directors is responsible for the preparation and fair presentations of the financial

statements in accordance with International Financial Reporting Standards and the

requirements of the Bahrain Commercial Companies Law, Decree Number 21 of 2001 and for

Page 4 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

such internal control as the management decides is needed to enable the preparation of

financial statements that are free from material misstatement, whether due to fraud or error.

The board of directors is responsible for:

- Identification, management, assessment the risk

- Operating, developing and monitoring the internal control system

- Providing principles for overall risk management

The Company has to maintain such books and records as will be sufficient to show the nature

of all transactions and disclose, at any time, the financial position of the company.

The Audit Committee is required to review internal financial controls of the company. The

Audit Committee is required to assess all other internal controls and approve the statements

that are included in the annual report in relation to the internal control and the risk

management.

The Audit Committee has to must receive reports from the management as to effectiveness

of the system they have established as well as the conclusions of any of testing that is

conducted by internal audit.

Audit strategy

Our audit will be as it is planned in the audit process in the following section and on the agreed

timetable of working in the Audit.

In summary of our audit strategy:

-

Updating our understanding of the company through the discussions with the Audit

Committee and the review of the accounts

Assess the internal control effectiveness and the audit risk.

Plan and perform the substantive procedures

Reviewing and analyzing variety of documents, financial records ,policies, procedures ,

transactions and review the disclosure issue in the financial statements

Perform the opinion after performing the completion and overall evaluation in order

issue the report.

Our audit approach is to

-

Documenting our understanding of the key of the financial processes by which the

transactions are recorded within the financial statements

Page 5 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

Testing and evaluating the effectiveness of the internal control through the year

Following our assessment of the controls and processes, we focus on the substantive

testing that is required to form our opinion.

1.2 Audit Timing

Our audit work is used to take three months starting from 1 th of February 2014 30th of April

2014. The following table represents the schedule for our audit:

Audit process

Planning

Preliminary

Review

Fieldwork

Time

Request the needed documents for the audit work

Determine the audit strategy and audit plan

Establish the detailed audit program and procedures

Develop audit scope and objectives

Perform risk assessment procedures

Identify the risks

Understand the internal control of the company

3 weeks

Conduct entrance meeting with the Audit Committee to

explain the audit process, audit scope and objectives, any

concerns they have for expanding the focus of the audit, audit

timing and current practices.

Evaluate the existing internal control structure

Test the operating effectiveness of the selected controls

Assess the design and implementation of the selected

2 weeks

controls

Assess the control risk and risk of significant misstatement

Make a questionnaire to assist the internal control

Plan the substantive procedures

Perform the substantive procedure

Consider if the evidence of audit is appropriate and

sufficient

Perform detailed testing of transactions

Collect and analyze a variety of documents, financial records

,policies, procedures , transactions

4 weeks

Evaluate the compliance with the International Financial

Reporting Standards and the requirements of the Bahrain

Commercial Companies Law, Decree Number 21 of 2001.

Page 6 of 41

Class Number: 002

Reporting

and

completion

Follow up

6

Group Case Study

BSB 7400 Auditing

Perform completion procedures

Perform overall evaluation

Form an opinion

Prepare a draft report containing the audit observations,

conclusions, and any recommendations for improvement and

distribute it to the Audit Committee

Conduct exit conference to get the Audit Committee 3 weeks

responses and recommendation about the report

Issue the final report to Audit Committee of Bahrain Flour

Mills Company

Conduct follow-up procedures after seven months of issuing of the final report.

We will revisit the company to ensure that that the corrective measures and

actions have been implemented in a timely and effective manner

1.3 Nature of communication

We welcome to conduct entrance meeting on 7th of February 2014 in the company with the

Audit Committee in order to justify the audit process, audit scope, audit timing and about any

concerns that they have for expanding the focus of the audit .

In the progress of audit work, we propose to conduct meetings with Audit Committee in the

company every week in order to discuss how the process of the audit is going and discuss the

significant findings that we reach to.

We want also to conduct exit conference meeting on 22th of April 2014 in the company after

writing the draft report in order to get Committee responses and resolve any questions or

concerns that they may have about the observations and resolve issues before the final report

is released. The Audit Committee is expected to review the review audit issues and

recommendations for the accuracy and completeness and prepare a formal response.

We would be interested to hear if there are any matters that the Audit Committee would want

us to address and to understand more fully the expectations and requirements of the

Committee from the process of audit.

Page 7 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

1.4 Resources

The following table represents the audit team that assigned to carry out the audit work in your

company:

Name of the auditor

Amal AlShaikh

Zahra

Shamlooh

Senior

Auditor

Kawthar

Busehail

Junior Auditor

Position

Senior Auditor

Days of working

Qualifications

Layla

Kashtakar

Supervisor

Auditor

50 days ( 8 per

day )

50 days ( 8

per day )

47 days ( 8 per 70 days ( 8

day )

per day )

47 days (8 per day )

Bachelors

degree in

Accounting or

related field.

CPA

certification

preferred.

Bachelors

degree in

Accounting or

related field.

CPA

certification

preferred.

Bachelor's

degree in

accounting,

finance or

business

administration

Bachelor's degree in

accounting, finance or

business administration

Qualified

Chartered

Accountant

(ACA or

equivalent).

Zainab AlAsfoor

Junior Auditor

The following table represents the auditors tasks:

Audit process

Planning

Amal

Alshaikh

Zahra

Layla

Kawthar

Shamlooh Kashtaker Busehail

Zainab

Alasfoor

Gather the needed documents

for the audit work

Determine the audit strategy and

audit plan

Establish the detailed audit

program and procedures

Develop audit scope and

objectives

Perform

risk

assessment

procedures

Identify the risks

Page 8 of 41

Class Number: 002

Group Case Study

Understand the internal control

of the company

Conduct entrance meeting with

the Audit Committee to explain

the audit process, audit scope and

objectives, any concerns they have

for expanding the focus of the

audit, audit timing and current

practices.

Preliminary

Review

Evaluate the existing internal

control structure

Test the operating effectiveness

of the selected controls

Assess

the

design

and

implementation of the selected

controls

Assess the control risk and risk of

significant misstatement

Make a questionnaire to assist

the internal control

Collect and analyze a variety of

documents,

financial

records

,policies, procedures , transactions

Plan the substantive procedures

Fieldwork

Perform

the

substantive

procedure

Consider if the evidence of audit

is appropriate and sufficient

Perform detailed testing of

transactions

Evaluate the compliance with

the

International

Financial

Reporting Standards and the

requirements of the Bahrain

Commercial

Companies

Law,

Decree Number 21 of 2001.

BSB 7400 Auditing

Page 9 of 41

Class Number: 002

Group Case Study

Perform completion procedures

Perform overall evaluation

Form an opinion

Prepare a draft report containing

the

audit

observations,

conclusions,

and

any

recommendations

for

Reporting and improvement and distribute it to

the Audit Committee

completion

Conduct exit conference to get

the Audit Committee responses

and recommendation about the

report

Issue the final report to Audit

Committee of Bahrain Flour Mills

Company

Follow up

BSB 7400 Auditing

Conduct follow-up procedures

after seven months of issuing of

the final report. We will revisit the

company to ensure that that the

corrective measures and actions

have been implemented in a

timely and effective manner.

The following table represents the budgeting that reflects on the audit work that will be carried

out:

Billing date

30 - 2 - 2014

30 - 3 2014

30 -4 - 2014

Total amount

%

35 %

55%

10 %

Amount

4025 BD

6325 BD

1150 BD

11500 BD

Page 10 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

1.5 Significant Factors (Materiality and Audit Risk)

Materiality

Since the companys main goal is to make profit, materiality will be set on at a level reflecting

the emphasis on profitability. Based on analyzing the company, planning materiality has been

set at 40% of profits. So the materiality level is BD87,710, which is the maximum amount we

are willing to accept of material misstatements. For the Performance materiality, because

inherent risk has been set as low, therefore, performance materiality has been set at 20% of

the planning materiality. This is equal to BD 17,542. Therefore anything below 5% of the

performance materiality is trivial error and should be ignored.

Audit Risk

The following is the audit risk formula:

AR = IR x CR x DR

It is best to keep the Audit risk as low as possible, therefore 5% is preferable.

After analyzing the companys risks, it shows that the inherent risks are low, and they are

estimated to be at 40%. And after assessing the companys internal controls, the control risk

would low as well, about 25%. Therefore the formula will give us a detection risk (DR) of about

50%. This tells us that the lower the material misstatement risk, the higher the level of

detection risk the auditor is willing to accept, which means we will do more substantive tests in

order to gain sufficient appropriate evidence and reduce the audit risk to as low of a

percentage as possible.

Page 11 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

2.0 Audit plans

2.1 Audit plan for Property, Plant & Equipment asset

Overall Objective

Our objective is to express give an appropriate audit report on the financial statements of

Bahrain Flour Mills Company.

General Objectives

The firm has chosen to audit the Property, Plant & Equipment of the Bahrain flour mills

companys non-current assets. The company has stated on its statement of financial position

that it has BD 6,250,038 in the year ended 31 December 2013.

Audit Procedure

Audit procedure

Explanation

Assertion

Existence

Test the existence of PPE, which may include assets

that should have been written down due to end of its

useful life or disposal. Ownership agreements should

be assured and has a document of prove.

Assertion

Completeness

Assure that the PPE has been recognized including all

costs related to lease, maintenance cost and any other

costs.

Risks associated

Over-valuation

Under-valuation

The over-valuation risk is the risk that the company

increases the amount of its assets to have a favorable

presentation in its financial statement.

Under-valuation is writing the assets less than it

Page 12 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

actual value.

In the case of property, plant and equipment there is

a high risk that the company over-valuates it assets,

also because the total amount of the asset is very

material because if any decrease in the amount of the

PPE can cause the company losses and can change

profits to losses. Therefore it is a high risk and the

assertion chosen is relevant where as if the PPE does

not exist then these amounts could be changed and the

company can face serious fraud and losses issues.

Audit procedures

Compliance test

Testing the clients control system, to assure that the

recording and documentation system is appropriate,

also that it has low risk probability of having a fraud.

Audit procedure

The company owns verity of PPE therefore it would be

Substantive test

required the conformation of expertise of the same

Enquiry and confirmation directly from

field to confirm the existence of these assets and to

a third party

assure that the amount that have written are accurate

and it was not overstated

Additionally, the company has leased three properties

from the government, the company has leased three

properties

from

the

government,

therefore

conformation and lease agreement will be requested

from the government.

By doing this procedure the auditors will be fulfilling

the existence assertion, where it would confirm the

existence of these PPE.

Audit procedure

Substantive test

Recalculation and re-performance

It is performed to assure that all associated expenses of

the PPE such as maintenance or routine service or

registration fees for some assets.

Page 13 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

Therefore, the auditors will recalculate the total

amounts manually and also by using the companys

systems to assure that both methods have the same

answers and there are no over or under allocation.

This procedure will be fulfilling the completeness

assertion which is assuring all amounts has been

recognized and assured that it belongs to correct

account with the correct amount without any under or

over allocations and all relevant costs are added.

Sampling

Non-statistical sampling will be performed to test for the substantive test, where all items of

the PPE will be listed and would be numbered, and then using a computer system random

numbers will be selected. Where all the item numbers will be inserted into the computer and a

data will be created then the computer itself will randomly select item, the auditor would take

these number find the item and audits it existence by requesting from third party to confirm

also its completeness by recalculating and re-performing the figures and assuring that all totals

are accurate.

Since the risk of having items overstated is high then a high number of items should tested,

therefore a percentage of 40% of the PPE will be tested.

Budgeted Cost

Auditors

Junior

Senior

Supervisor

Total

Number of auditors

2

2

1

Rate

BD 68

BD 120

BD 400

Page 14 of 41

Days

10

4

7

total

BD 680

BD 480

BD 3600

BD 4760

Class Number: 002

Group Case Study

BSB 7400 Auditing

Substantive test

Junior auditor (2)

Trace purchase of PPE documents

Trace disposal of PPE document

Compare third parties conformation

with client statements

Create item number for PPE items

Select random sample

Test samples

Analysis of value and age of PPE

Recalculate the associated costs of

PPE

Re-perform the calculation using

client system

Review

financial

statement

classification

Identify disposed PPE

Total Hours

1

1

Senior

(2)

-

1.5

0.5

3

-

10

1

4

Page 15 of 41

auditor Audit

Supervisor (1)

Class Number: 002

Group Case Study

BSB 7400 Auditing

2.2 Audit plan for Trade payable liability

General objective

Specific objective

Risk associated

Audit procedure

Liabilities are usually Inspection: reconcile accounts

prone

be payable ledger with control

to

understated due to account to ensure that all the

the companys desire transactions

to show it is in a good control

match

account

and

the

the

healthy position of validity of the balance owing.

not having too many Also, agree accounts payable

liabilities and debts. general ledger subsidiary to

This is due to the general ledger in order to

nature

Are the accounts and trade

payables fairly stated?

Are all transactions

recorded

in

the

financial statements?

the ensure they are recorded

of

purchases.

Invoices properly and in the same

are usually received amounts. These will confirm

after

receiving

the the assertion of completeness

goods. The company of trade payables as a liability

should

keep

book in the financial statements.

open for a specific Inspection:

match

the

period of time after payments subsequent to the

the year end to make year end with the payables to

sure all invoices are ensure there are not any

recorded

in

the unrecorded

period in which they understatement

and

of

thus

the

belong. Otherwise, if liabilities.

there are no cut off

procedures,

Page 16 of 41

they Also, testing the extraction

Class Number: 002

Group Case Study

would

BSB 7400 Auditing

not

recorded

be and total of trade payables

in

the ledger

balances

and

correct period and agreement of the list of

liabilities would be balances with the control

understated.

account to ensure the validity

and

completeness

of

the

balances.

These procedures will confirm

the assertion of completeness

of trade payables as a liability

in the financial statements.

Confirmation

parties:

confirm

third

account

payables with suppliers to

Do the accounts and

trade payables reflect The

from

risk

of

this

the liability of this happening is low.

company?

ascertain

the

companys

liability towards the suppliers.

This will confirm the assertion

of rights and obligations of

trade payables as a liability in

the financial statements.

Confirmation

parties:

Do the trade payables

reflect valid liabilities There is a high risk of

at the balance sheet this not happening

date?

confirm

the

from

third

auditor

shall

account

payable

balances to suppliers and to

their original documentation

in order to make sure they

exist.

A cut-off test should be done

as well by testing a sample of

Page 17 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

receiving reports in order to

make

recorded

sure

at

they

the

were

correct

period. This will confirm the

assertion of existence of trade

payable as a liability in the

financial statements.

Recalculation:

Are the balances of

the

auditor

should recalculate a sample of

trade

payables There is a high risk of invoices in order to ensure

recorded

at

the this not happening

correct amounts?

that the balances are at their

right amounts. This confirms

the assertion of accuracy.

Are

the

included

amounts

Observation and inspection:

in

observe and agree that the

the

balance according to

the company policy

and

the

financial

relevant

The

risk

of

happening is low

reporting

framework-IFRSs?

this

recording of the balances

conform to the companys

policy and the IFRSs. This

confirms the assertion of

valuation and allocation.

Sampling

Statistical ordinary sampling method will be used by choosing a random percentage of the total

trade payables in order to allow an equal chance of selection for each sampling units. Since the

risk of understanding the trade payables is high, the sample size will be 50% of the total trades

payables which should be tested.

Page 18 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

Budgeted cost

Auditors

Number of auditors

Rate

Days

total

Junior

BD 68

BD 1,224

Senior

BD 120

BD 1,920

BD 150

BD 1,200

Senior

Audit

Manager

Total

BD4,334

Substantive test

Junior auditor (2)

reconcile accounts payable ledger

with control account

agree accounts payable general ledger

subsidiary to general ledger

match the payments subsequent to

the year end with the payables

testing the extraction and total of

trade payables ledger balances

agreement of the list of balances with

the control account

confirm

account

payables

Senior

(2)

auditor Senior

Manager (1)

2

8

1.5

0.5

with

suppliers

confirm account payable balances to

2

Page 19 of 41

Audit

Class Number: 002

suppliers

and

Group Case Study

to

their

BSB 7400 Auditing

original

documentation

Cut-off test

recalculate a sample of invoices

3

2

observe and agree that the recording

of the balances conform to the 1

companys policy and the IFRSs

Total Hours

Page 20 of 41

Class Number: 002

Group Case Study

2.3 Audit plan for Share Capital

Page 21 of 41

BSB 7400 Auditing

Class Number: 002

General

objective

Assertion/Specific

objective

Are the share Accuracy and valuation

capital accounts Are all the amounts of

fairly stated?

transactions

and

records that are related

and stated in the share

capital account have

been

all

recorded

correctly

and

appropriately?

Group Case Study

BSB 7400 Auditing

Risks

Audit procedures

One risk related

to the share

capital is that the

amount is not

representing the

fair value, thus

understating or

overstating the

share capital.

Recalculation

Verify that the amount of issued share premium

has been credited to the share premium

account in order to ensure that that the amount

of the share premium has been recorded at a

correct amount. This will confirm the assertion

of accuracy of share capital account in the

financial statement.

Inspection

Check and trace the entries in bank statement

regarding shares issued for cash. To ensure that

all the recorded transactions and entries in the

bank statement for the issuing of share for cash

are recorded at a correct amount. This will

confirm the assertion of accuracy of share

capital account in the financial statement.

Inspection

Check the amount of consideration with

supporting documents for shares issued for

consideration other than cash. To ensure that

the entire amounts are recorded correctly

based on the documents regarding the issuing

of shares for non-cash consideration. This will

confirm the assertion of accuracy of share

capital account in the financial statement.

Analytical procedure

Compare the balance of each significant capital

account to the comparable balance from the

previous period. The analytical procedures that

will be conduct is reasonableness testing that

analyze the accounts and changes in the

accounts between the accounting periods. In

order to Investigate unusual or significant

fluctuations. This will confirm the assertion of

accuracy of share capital account in the financial

statement.

Page 22 of 41

Class Number: 002

Group Case Study

Existence

BSB 7400 Auditing

Confirmation

Trace the authorized share capital with the

memorandum and articles of associations and

agree any changes with proper authorized

resolution. To ensure that all the authorized

share capital exists. This will confirm the

assertion of existence.

Inspection

Agree on any issue of share capital or other

changes during the year with minutes of

meetings or resolutions and ensure that such

change is within the terms of the memorandum

and articles of association. This aim to ensure

that all records regarding issue of share capital

and changes are recorded in the company

share capital accounts. This will confirm the

assertion of completeness of share capital

account in the financial statement.

Inspection and recalculation

Agree dividends paid and proposed dividends to

the authorization made in the minutes book by

checking the accounting records regarding the

companys

dividends

accounts.

Also,

recomputed the dividend calculations with total

share capital. To ensure that the all the

transactions regarding dividends paid are

correctly recorded. This will confirm the

assertion of completeness regarding share

capital account in the financial statement.

Completeness

Are all the transactions,

records and changes

that are related to the

share capital account

have been all recorded?

Inspection

Check and agree that the balance on share

capital accounts aligned with the register of

Page 23 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

members and the amount of the total list of

issued share capital with the amount in the

nominal ledger. To ensure that all balances

included in the register of members and list of

issued capital are completed. This will confirm

the assertion of completeness regarding share

capital account in the financial statement.

Inspection

Trace any transfers of shares with

correspondence,

minutes

of

directors

meetings, cancelled share certificate and

transfer register. To ensure that all transferred

shares are recorded. This will confirm the

assertion of completeness regarding share

capital account in the financial statement.

Inspection

Trace the number of shares and value of

redemptions with the cash disbursements and

supporting records. This aim to ensure that all

the value related to share redemptions is

recorded. This will confirm the assertion of

completeness regarding share capital account in

the financial statement.

Inspection and recalculation

Trace the number of shares and proceeds from

issuance of new shares to cash receipts and

supporting records. Then, recalculate the

entries regarding par value of outstanding

shares and paid in capital. This will ensure that

all the amounts of issuance new shares are

completely recorded. This will confirm the

assertion of completeness regarding share

capital account in the financial statement. This

will confirm the assertion of completeness

regarding share capital account in the financial

statement.

Classification

Are all the share capital

Review the presentation and disclosure for

share capital to ensure that it is in compliance

Page 24 of 41

Class Number: 002

Group Case Study

accounts have been

presented,

classified

and disclosed in the

financial

statements

according

to

the

requirements

of

applicable

financial

reporting framework?

BSB 7400 Auditing

with the accounting standards and statutory

requirements. This will confirm the assertion of

classification regarding having the financial

statements at appropriate amount based on the

financial reporting framework.

Sampling

Statistical random sampling will be used for the substantive tests regarding share capital. This

method will be used by selecting a random percentage from the total share capital which

allows an equal chance of selection. Since the risk of overstating the share capital is low, the

sample size will be 30% of the total share capital.

Budgeted cost

Auditors

Junior

Senior

Supervisor

Total

Number of auditors

2

2

1

Substantive test

Verification of amount of issued share

premium that is credited to the share

premium account.

Trace the bank statement for shares

issued for cash.

Check shares issued for consideration

other than cash documents.

Compare the balance of current year

account with the previous period.

Trace the authorized share capital with the

memorandum and articles of associations.

Agree on any issue of share capital or

other changes with minutes of meetings

Rate

BD 68

BD 120

BD 150

Days

19

7

15

Junior auditor (2)

Senior

(2)

2

Page 25 of 41

total

BD 2584

BD 1680

BD 2250

BD 6514

auditor Audit

Supervisor (1)

15

Class Number: 002

Agree on paid and proposed dividends to

the authorization made in the minutes

book

Recalculate dividend amount with total

share capital

Check the balance on share capital

accounts with the register of members

Check the amount of the total list of issued

share capital with the amount in the

nominal ledger

Trace

transfers

of

shares

with

correspondence, minutes of directors

meetings, cancelled share certificate and

transfer registers.

Trace the number of shares and value of

redemptions with the cash disbursements

and supporting records.

Trace the number of shares and proceeds

of new shares to cash receipts and

supporting records.

Review the presentation and disclosure for

share capital.

Total Days

Group Case Study

BSB 7400 Auditing

19

15

3.0 Internal control procedures for payroll cycle

The payroll cycle is the period of a beginning date and the ending date of a time length. The

payroll cycle includes a variety of activities. The following points will illustrate the activities in

the payroll cycle ("The human resources," 2010):

Update Payroll Master File.

Page 26 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

First is updating the master file of payroll in order to reflect variety types of the payroll

changes for instance: terminations, new hires, changes in the rates of pay or changes in

the discretionary withholdings.

Validate time and attendance data.

For pay schemes, the company uses an employee ID card that records the arrival and

departure of the employee times for each work shift and the total hours that worked

during the period of pay. The payroll department has the responsibility for validating the

time records for the employee.

Prepare payroll.

The payroll transaction file is sorted by the number of the employee. The sorted time

data file is then used in order to prepare the employee paychecks. All of the deduction is

subtracted from the gross pay and the overtime is added to the gross pay to obtain the

net pay. Then the payroll register and the employee paychecks are printed.

Disburse the payroll

One the paychecks have been prepared, the register of payroll is sent to the account

payable department in order to review and approval. The payroll register is returned to

the department of payroll where it is filled data along with the employee ID cards and

the job time tickets ("The human resources," 2010).

The following points illustrate the objectives of the payroll control:

Payroll transactions are recorded.

Payroll transactions are authorized.

Payroll transactions are valid.

Payroll transactions are complete.

Payroll transactions are properly classified (recorded in the correct account).

Payroll transactions are stated at their correct value or amount.

Payroll transactions are in their correct accounting period.

Page 27 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

The following paragraphs justify the internal control procedures for the payroll cycle

activities ("Standards of internal control," 2007):

1- Update Payroll Master File procedures

A payroll master file should be prepared that include all the employees. The file should contain all

information regarding the current rates of pay and withholding deductions.

Procedures should be maintained in order to physically protect master file information. As access to

master file information should require official password. Changes to master file information should be

restricted to authorized additions or deletion or changes that are supported by forms approved by

senior official for new hires, termination, decrease or increase in hourly payments and decrease or

increase in salaries. Also, log of amendment and change to data should be produced and reviewed.

An independent check has to be done of standing amendments log to supporting documentation.

Access to the payroll department and its records should be allowed only for the authorized personnel.

Formal notification regarding the termination or transformation of employees or payroll changes

should be sent promptly to the payroll department in order to make the required adjustments in the

payroll records.

The responsibilities of payroll preparation, recording, and distribution should be segregated from

payroll authorization.

Payroll has to be prepared from the payroll master file and the approved time reporting .Payroll

registers, paychecks and the earning records must be prepared simultaneously where feasible.

Controls must be maintained with sufficient edits to make sure that all sources of data are valid and

rightly input. Controls must be established to make sure unauthorized or duplicate payroll source data

might not be processed.

The departmental procedures must clearly documented for all of the major payroll functions and the

period end cut off procedures.

Restriction of access to payroll master database ("Standards of internal control," 2007).

Page 28 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

2- Validate time and attendance data procedures

The supervision of clocking on points and control over employee ID cards are essential

The employee ID cards must be authorized by a responsible official before they are sent to the payroll

departments

The payroll department must keep the ID cards that are only issued for the new employees with

contracts of employment.

The payroll department is the authorized for validating the time records for the employee ("Standards

of internal control," 2007).

3- Prepare payroll procedures

The overtime should be checked and authorized by the responsible managers before the input to the

system

Match the payroll register to the supporting documents. The registry of payroll shows grows wages,

deductions and the net play, and so good a summary document from that to trace back to the

documents for the purpose of verification.

A sample of the calculations of the payroll must be reviewed by senior responsible and the payroll

initialed

To reduce the risk of collusion in altering the rates of pay, it is required to get more than one approval

signature for the employee pay change, one by the employees supervisor and the other signature is

from the next-higher level of supervisor.

The payroll transactions is sorted by the employee number ("Standards of internal control," 2007).

4- Disburse the payroll procedures

Employee compensations should be made based on appropriate rate and then authorized. Also, any

changes into the compensation should be properly authorized.

Page 29 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

Before paying the final payroll amount to a terminated employee, Human resource

department and the supervisor of the employees department should make sure that all the

statements regarding employees outstanding advances and expense are cleared, all compute

access and accounts are cancelled, employee badges and security passes or keys have been

returned to prevent the access to the company property and data.

Control system should be established to make sure that all the source data regarding the payroll are

valid and edited. Also, control should be maintained to ensure that duplicated amount or unauthorized

payroll source data will not be processed and errors report should be produced with a list of all the

rejected items.

Conduct periodic testing for the payroll records to ensure that payroll information is similar to the

Human resource file documentations and data.

The preparation of payrolls should be based on payroll master file records and the approved time

reporting records.

A comparison between the actual and budgeted payroll costs should be conducted by the appropriate

department managers with an investigation and analysis of significant variances.

All disbursement accounts should be reconciled on a monthly basis.

All the additional payment requests such as bonuses, paid vacation benefits should be reviewed

documented and approved by an appropriate individual.

Before the payment, the financial management should Review and approve all the completed payroll

registers, journal reports and requests for payroll account or any documents that support the amount

being paid

All of the disbursement accounts must be reconciled on monthly basis.

Verification of identity of all employees receiving paychecks

Pre-numbering and periodically accounting for all payroll checks and review of all EFT direct deposit

transactions ("Standards of internal control," 2007).

Page 30 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

4.0 Working papers

4.1 Working paper for the Property, Plant & Equipment

Bahrain Flour Mail Company

Year ended 31 December 2013

Property, Plant & Equipment Risk

Reference: A120

Prepared by: A.S

Date: 15 Jan 2013

Reviewed: L.M

Date: 20 Jan 2013

Audit objectives

1. To verify the existence of the PPE

2. To verify the accurate cost of the PPE.

3. To verify the ownership of these PPE.

Audit Procedures (and key symbols):

# Traced payment of the PPE

< Compared ownership with third party confirmation

* Re-performed the calculation

> Confirmed the cost of PPE with third party expert

@ Work in process PPE were valuated except for those with +

Sample selection

Population: all items included in the Property, plant & equipment account

Sample: 40% of the total population that was randomly selected by a computer

program

Result of procedures

Date

Type of PPE

8/2/2013

Motor vehicles

1/5/2013

plant and machinery

21/6/2013

motor vehicles

16/9/2013

building on lease land

5/11/2013

office equipment f & f

Audit procedure

conformation Amount 1 2 3 4 5

letter

reference

8721

BD

# < * > @+

6217

6213

BD

# < * > @

1200

5219

BD

# < * > @

6400

3321

BD

# < * > @

110,870

8212

BD

# < * > @+

1350

Page 31 of 41

Class Number: 002

19/12/2013

Group Case Study

plant and machinery

5001

BSB 7400 Auditing

BD

4390

<

>

Comments

@+ These amounts include items that has been disposed during the year

Conclusion

(1) Third parties has sent conformation of existence of these properties

(2) these PPE are owned by the company except for the leased lands

(3) The amounts of the PPE has been valued and depreciated at the accurate amount, disposed

items has been deducted from the financial statements

Page 32 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

4.1 Working paper for the payroll control

Reference: A144

Prepared by: A.S

Date: 15 January 2014

Reviewed: L.M

Date: 20 January2014

Bahrain Flour Mail Company

Year ended 31 December 2013

Payroll control

Audit objectives

1. To verify the transaction has been recorded accurately

2. To verify are valid and completed

3.To verify the transactions were authorized

Audit Procedures (and key symbols):

Audit Procedures (Recalculation and re-performance):

# Traced payment made to staff

< Compared salary slips and payment

* Re-perfumed the calculation

> Confirmed that salaries paid are complied with the HR

bounce paid was authorized any account with ^ refers to allowance

Sample selection

Population: all items included in the payroll account

Sample: random selection of 25% of the total population

Result of procedures

Audit procedure

Date

paid to

payment

number

28/01/2013

Ahmed Ali

01-00891

BD 550

<

>

28/04/2013

28/06/2013

28/08/2013

28/09/2013

Sajeda Yousif

John Terry

Dana Sadeq

Komar Patel

Dawood

Mohammed

04-00122

06-00432

08-00092

09-00521

BD 1200

BD 780

BD 3000

BD 200

#

#

#

#

<

<

<

<

*

*

*

*

>

>

>

>

@

@^

@

@^

11-00302

BD 430

<

>

28/11/2013

Page 33 of 41

Amount

5

@

Class Number: 002

Group Case Study

Comments

&+ Non-Bahraini employees receive housing allowance

Conclusion

(1) Salary slip and payments made are matching.

(2) All allowances have been added to the salary.

(3) Bounce payment was authorized by authorized personal.

Page 34 of 41

BSB 7400 Auditing

Class Number: 002

Group Case Study

BSB 7400 Auditing

4.3 Working paper for Share Capital

Bahrain Flour Mail Company

Share capital

Year ended 31 December 2013

Audit objectives

1. To verify the existence of share capital accounts.

2. To verify that share capital account are accurately and

appropriately valued.

3. To verify that share capital accounts are completely

recorded.

4. To verify that share capital accounts are properly classified.

Audit Procedures (and key symbols)

# Traced the bank statements for shares issued for cash. The

entire amount in the bank statements agreed with the

recoded cash.

<Traced the authorized share capital with the memorandum

and articles of associations. All the authorized share capital are

recorded in the memorandum and articles of association

* Recalculated dividend amount with total share

capital. All the amount of dividend and total

share capital are correctly calculated.

> Agreed on paid and proposed dividends to the authorization

made in the minutes book. All the paid and proposed

dividends records agree with amount in the minutes book

@ Check the balance on share capital accounts with the register of

members.

Traced the number of shares and proceeds of new shares to cash

receipts and supporting records. All the cash receipts agreed the number

of share and proceeds except for those marked +

Sample selection

Population: all items included in the share capital accounts

Sample: 30% of the total population that was randomly selected.

Page 35 of 41

Reference: A130

Prepared by: A.S

Date: 15 Jan 2013

Reviewed: L.M

Date: 20 Jan 2013

Class Number: 002

Group Case Study

BSB 7400 Auditing

Result of procedures

Audit procedure

Date

Shareholders name

15/1/2013

Bahrain Mumtalakat

holding

Bahraini shareholders

10/2/2013

20/6/2013

Reference

No

7929

8921

Amount 1

BD

87317

BD

18952

BD

59870

BD

79899

<

>

@+

<

>

<

>

<

>

Kuwait Flour Mills and

Bakeries

Mr Abdul Rahman Bin

Yousuf Fakhroo

618

5/11/2013

Mr Ebrahim Mohammed Ali

Zainal

2073

BD

13580

< *

>

12/12/2013

Mr Mohemed Yousfuf Nass

1890

BD

43990

<

>

12/9/2013

2971

Comments

+some of these accounts were sold by the share holders to other while as some other were

recalled by the company as treasury shares.

Conclusion

(1) Capital share account existence has been tested not to be fraud.

(2) All share capital holders were identified and confirmed.

(3) Amounts on financial statements were traced and verified.

Page 36 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

4.4 Working paper for Trade payable

Bahrain Flour Mail Company

Trade payable

Year ended 31 December 2013

Reference: A124

Prepared by: A.S

Date: 15 Jan 2013

Reviewed: L.K

Date: 20 Jan 2013

Audit objectives

1. To verify the accuracy of trade payable accounts.

2. To verify the ownership of Trade payable

3. To verify the completeness of share capital

Audit Procedures (and key symbols)

# agreed accounts payable general ledger

subsidiary to general ledger. All the amount of

payable general ledger subsidiary matches the

amounts in the general ledger.

<matched the payments subsequent to the year end with the

payables. All the balance of payments match with the year end

payables except for those marked <+

*tested extraction and total of trade payables

ledger balances. All the balance of total trade

payable match with the results expected for

those marked*^

> confirmed account payable balances to suppliers and to their

original documentation. All the amount of account payable

balances agreed with suppliers documentations.

@ recalculated a sample of invoices. All the recalculated sample of

invoices is accurate.

Sample selection

Population: all items included in the Trade payable account

Sample: 50% of the total population that was randomly selected.

Result of procedures:

Date

Paid to

19/2/2013

Hussain Ali

Invoice

Number

8921

Page 37 of 41

Audit procedure

Amount 1 2 3 4 5

BD

8931

<

>

Class Number: 002

Group Case Study

16/5/2013

Mohemmed Ahmed

4619

21/6/2013

Ali Ebrahim

5892

8/9/2013

Hassan Yousuf

7927

9/11/2013

Nasser Mohemmed

8931

20/12/2013

Ahmed Hussain

9258

BSB 7400 Auditing

BD

7951

BD

8924

BD

9217

BD

2360

BD

5927

<+ *

>

<

*^ >

<

>

<

>

<

>

Comments

<+After recalculation, Payable after the year does not match the balance.

*^ After recalculation, some balances of total trade payable and extraction does not match the

balance.

Conclusion

(1) Accuracy of trade payable accounts was verified.

(2) Completeness of trade payable accounts was verified.

(2) Ownership of trade payable accounts was confirmed.

Review and discussion of results of audit procedures and conclusion, Layla Kashtakar

Signature of auditor (completed the working paper): .

Signature of the reviewer: .

Page 38 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

5.0 The explanation of how the audit report would have been

different there been a material misstatement in any of the key

components of the financial statements

According to ISA 700, when the financial statements are free from material misstatements and

sufficient appropriate evidence was obtained, the auditor would express an unmodified opinion

(IFAC, 2010 ). The audit report with an unmodified opinion will contain the address, report on the

financial statements or one of them only, the managements responsibility for the financial

statements, the auditors responsibility, opinion, report on Other Legal and Regulatory

Requirements, the auditors signature, date of the report and at last the auditors address. The

opinion for Bahrain Flour Mill company according to ISA 700 paragraphs 34 and 35 is In our

opinion, the financial statements of Bahrain Flour Mill Company for the year ended December 31,

2013 are prepared, in all material respects, in accordance with International Financial Reporting

Standards and the heading for this paragraph must be Opinion (IFAC, 2010).

However, the auditor issues a modified opinion if the financial statements are not free from

material misstatements or inability to obtain sufficient appropriate evidence by the auditors. There

are three types of modified opinion and they are: Qualified, adverse and disclaimer. When the

auditor obtain sufficient appropriate evidence and concludes with material statements in the

financial statements the modification is either going to be Qualified or adverse and this will be due

the auditors judgment about the pervasiveness of the effects or possible effects on the Financial

statements.

So if we assume that there is a misstatement which is material but not pervasive in the financial

statement of Bahrain Flour Mill Company, the auditor must express a qualified opinion. If the audit

report contains qualified opinion due to a material misstatement, it should includes: the address,

report on the financial statements or one of them only, the managements responsibility for the

financial statements, the auditors responsibility, basis of qualified opinion, qualified opinion,

Report on Other Legal and Regulatory Requirements, the auditors signature, date of the report and

at last the auditors address. In the basis of qualified opinion the auditor provides a description of

Page 39 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

the matter raised in the financial statement and any other explanation or information needed

regarding the material misstatement, and this paragraph should be placed immediately before the

qualified opinion paragraph according to ISA 705 paragraph 16,17,18 and 19 (IFAC,2010). According

to ISA 705 paragraph 22 and 23, in the opinion paragraph the auditor expresses his opinion and the

opinion for this company is In our opinion, except for the effects of the matter described in the

Basis for Qualified Opinion paragraph, the financial statements give a true and fair view of the

financial position of Bahrain Flour Mill Company as at December 31, 2012, and (of) its financial

performance and its cash flows for the year then ended in accordance with International Financial

Reporting Standards. Also the heading of this paragraph must be Qualified opinion (IFAC,2010)

But if we assumed that there is a misstatement which is material and pervasive in the financial

statement of Bahrain Flour Mill Company, the auditor should express an adverse opinion. And in

case of containing an adverse opinion in the audit report, the following must be included in the

report: the address, report on the financial statements or one of them only, the managements

responsibility for the financial statements, the auditors responsibility, basis of adverse opinion,

adverse opinion, Report on Other Legal and Regulatory Requirements, the auditors signature, date

of the report and at last the auditors address. In the basis of adverse opinion paragraph according

to ISA 705 paragraph 21, the auditor should describe and explain the reasons of the matter and its

effects. And in the adverse opinion the auditor express his opinion according to his evidence and

the matter that was already mentioned in the previous paragraph, so for this company according to

ISA 705 paragraphs 22 and 24 the opinion will be In our opinion, because of the significance of the

matter discussed in the Basis for Adverse Opinion paragraph, the consolidated financial statements

do not give a true and fair view of the financial position of Bahrain Flour Mill Company as at

December 31, 2013, and (of) their financial performance and their cash flows for the year then

ended in accordance with International Financial Reporting Standards. And the heading of this

paragraph must be Adverse opinion (IFAC, 2010)

Page 40 of 41

Class Number: 002

Group Case Study

BSB 7400 Auditing

6.0 References

-

International standard on auditing 700. (2010). Retrieved December 27, 2014, from

http://www.ifac.org/sites/default/files/downloads/a036-2010-iaasb-handbook-isa700.pdf

International standard on auditing 705. (2010). Retrieved December 27, 2014, from

http://www.ifac.org/sites/default/files/downloads/a037-2010-iaasb-handbook-isa705.pdf

Standards of internal control. (2007, April). Retrieved December 27, 2014, from

http://www.asu.edu/fs/documents/standards_of_internal_controls.pdf

The human resources management /payroll cycle . (2010 ). Retrieved December 27,

2014, from

http://staff.uny.ac.id/sites/default/files/pendidikan/Diana%20Rahmawati,%20M.Si./SIA

%20Bab%2014.pdf

Page 41 of 41

Das könnte Ihnen auch gefallen

- Ogcdp First Training MembersDokument25 SeitenOgcdp First Training Membersapi-272544196Noch keine Bewertungen

- ObjectiveDokument2 SeitenObjectiveapi-272544196Noch keine Bewertungen

- Introduction To AccountingDokument17 SeitenIntroduction To Accountingapi-272544196100% (1)

- Finance Presentation 3Dokument48 SeitenFinance Presentation 3api-272544196Noch keine Bewertungen

- Financial StatementsDokument3 SeitenFinancial Statementsapi-272544196Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Vol. 499, August 28, 2006 - Supreme Court Rules on Father's Obligation to Support Children Despite Lack of Formal DemandDokument10 SeitenVol. 499, August 28, 2006 - Supreme Court Rules on Father's Obligation to Support Children Despite Lack of Formal DemandPMVNoch keine Bewertungen

- International Aviation Safety Assessment Assessor’s ChecklistDokument23 SeitenInternational Aviation Safety Assessment Assessor’s ChecklistViktor HuertaNoch keine Bewertungen

- مشكلـــة الواجبات المدرسيةDokument9 Seitenمشكلـــة الواجبات المدرسيةabdel-rahman emaraNoch keine Bewertungen

- Carbon Monoxide Safety GuideDokument2 SeitenCarbon Monoxide Safety Guidewasim akramNoch keine Bewertungen

- Juanito C. Pilar vs. Comelec G.R. NO. 115245 JULY 11, 1995: FactsDokument4 SeitenJuanito C. Pilar vs. Comelec G.R. NO. 115245 JULY 11, 1995: FactsMaria Anny YanongNoch keine Bewertungen

- Procedure For Registration (Copyright) - 0Dokument10 SeitenProcedure For Registration (Copyright) - 0Meekal ANoch keine Bewertungen

- Template - Proposal For F&B EventDokument3 SeitenTemplate - Proposal For F&B EventTrisna Djunaedi KurniawanNoch keine Bewertungen

- Professional Regulation Commission (PRC) - LuceroDokument9 SeitenProfessional Regulation Commission (PRC) - LuceroMelrick LuceroNoch keine Bewertungen

- Jeff Gasaway Investigation Report From Plano ISD April 2010Dokument21 SeitenJeff Gasaway Investigation Report From Plano ISD April 2010The Dallas Morning NewsNoch keine Bewertungen

- FCRA Renewal CertificateDokument2 SeitenFCRA Renewal CertificateBrukshya o Jeevar Bandhu ParisadNoch keine Bewertungen

- This Your Letter: of PhilippinesDokument4 SeitenThis Your Letter: of PhilippinesAlphaphilea PsNoch keine Bewertungen

- Election of 2000 WorksheetDokument3 SeitenElection of 2000 Worksheetvasanthi sambaNoch keine Bewertungen

- Columbia Aaltius: Columbia Developers Private LimitedDokument4 SeitenColumbia Aaltius: Columbia Developers Private LimitedRishav GoyalNoch keine Bewertungen

- NTA Doorman Diversion Warning Letter June 2008Dokument2 SeitenNTA Doorman Diversion Warning Letter June 2008TaxiDriverLVNoch keine Bewertungen

- For Session DTD 5th Sep by CA Alok Garg PDFDokument46 SeitenFor Session DTD 5th Sep by CA Alok Garg PDFLakshmi Narayana Murthy KapavarapuNoch keine Bewertungen

- Compensation IncomeDokument5 SeitenCompensation IncomePaula Mae Dacanay100% (1)

- 2 Presentation On Supplemental Guidelines1Dokument18 Seiten2 Presentation On Supplemental Guidelines1Muhammad Alsharif Aming AlihNoch keine Bewertungen

- DPC Cookie GuidanceDokument17 SeitenDPC Cookie GuidanceshabiumerNoch keine Bewertungen

- Determining The Number of IP NetworksDokument6 SeitenDetermining The Number of IP Networksonlycisco.tkNoch keine Bewertungen

- Balibago Faith Baptist Church V Faith in Christ Jesus Baptist ChurchDokument13 SeitenBalibago Faith Baptist Church V Faith in Christ Jesus Baptist ChurchRelmie TaasanNoch keine Bewertungen

- 13 GARCIA v. VILLARDokument1 Seite13 GARCIA v. VILLARGSSNoch keine Bewertungen

- Jurnal Deddy RandaDokument11 SeitenJurnal Deddy RandaMuh Aji Kurniawan RNoch keine Bewertungen

- 2020 Dee - v. - Dee Reyes20210424 14 mjb83kDokument4 Seiten2020 Dee - v. - Dee Reyes20210424 14 mjb83kLynielle CrisologoNoch keine Bewertungen

- Corporate Finance - Ahuja - Chauhan PDFDokument177 SeitenCorporate Finance - Ahuja - Chauhan PDFSiddharth BirjeNoch keine Bewertungen

- Ato v. Ramos CDDokument2 SeitenAto v. Ramos CDKaren AmpeloquioNoch keine Bewertungen

- Aster Pharmacy: Earnings DeductionsDokument1 SeiteAster Pharmacy: Earnings DeductionsRyalapeta Venu YadavNoch keine Bewertungen

- Group Ii - Answers To Guide Questions No. 4Dokument30 SeitenGroup Ii - Answers To Guide Questions No. 4RayBradleyEduardoNoch keine Bewertungen

- Traffic CitationsDokument1 SeiteTraffic Citationssavannahnow.comNoch keine Bewertungen

- DH - DSS Professional V8.1.1 Fix Pack - Release NotesDokument5 SeitenDH - DSS Professional V8.1.1 Fix Pack - Release NotesGolovatic VasileNoch keine Bewertungen