Beruflich Dokumente

Kultur Dokumente

Maria Financial Case Study

Hochgeladen von

api-252844849Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Maria Financial Case Study

Hochgeladen von

api-252844849Copyright:

Verfügbare Formate

Name: Shaye Dumas

Period: 2A

FINANCIAL CASE STUDY: MARIA LOPEZ

Instructions: Read the case and fill in the blanks using local estimates for income

and expenses including food, clothing, housing, car, insurance, and other items.

Use this financial information as you prepare a financial plan for Maria, a single

young adult living away from home. The financial plan should enable Maria to live

within her income and save for future goals.

Net Worth Statement

Maria is 22 years old. She works as a Veterinarian

in Salt Lake City.

Marias Assets. Maria owns a used car valued at

$6,000. She has $200 cash in her apartment and

$900 in a bank checking account. She owns jewelry

valued at $400, a CD sound system valued at $300,

and a computer valued at $1,200.

Personal items such as clothes, books, luggage, a

bicycle, furniture, and dishes are valued at $1,100.

Maria did not purchase the optional term life

insurance policy available through her employer

because she has no dependents.

Car

Cash

Bank

Jewelry

CD System

Computer

Personal

Mutual Fund

Total Assets

$6,000.00

$200.00

$900.00

$400.00

$300.00

$1,200.00

$1,100.00

$1,500.00

$11,600.00

Car

Student Loan

Credit Card

Total Liabilities

$4,000.00

$6,000.00

$700.00

$10,700.00

Net Worth

$900.00

Maria owns a stock mutual fund with a current value

of $1,500.

Marias Liabilities. Maria owes $4,000 on her car

and $6,000 on a student loan. Her credit card

purchases were for furniture for the apartment and

clothes for work.

Income and Expense Statement

Marias Financial Goals. Maria would like to pay

off her student loan, reduce her credit card debt,

and increase her savings. She wants to buy a TV

set and continue to upgrade her wardrobe for work.

A summer trip with friends would also be nice.

INCOME

(Monthly)

Salary

Take-home pay

Gifts

Total Income

$7,770.84

$7,382.30

$1,000.00

$8,382.30

Maria wants to begin contributing to her employerbased retirement savings plan at work. It is called a

401(k) plan, and her employer matches her

contribution. This is a salary reduction plan, so

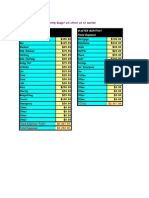

EXPENSES

Rent

Electrical

Telephone

$1,000.00

$50.00

$25.00

Maria would not pay income tax on the

contributions and earnings are tax-deferred.

Calculate Marias Net Worth: Total Assets-Total

Liabilities =

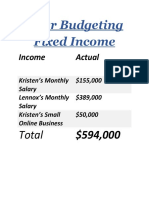

MARIAS INCOME

Marias annual salary is $93,250. After taxes, her

take-home pay is approximately $88,587.52, which

is automatically deposited into her bank checking

account. In addition, Maria receives an annual cash

gift of $1,000 from her grandparents. Maria

reinvests her earnings in her mutual fund account.

She expects no other income this year.

MARIAS EXPENSES

Housing. Maria pays monthly rent of $1,000.00

and her electrical bill is $50.00

. Monthly

telephone and Internet costs are $50.00 and the gas

bill is $30.00____.

Food and Clothing. Marias food at home

averages $100.00 per month. Her food away from

home averages $50.00

. She spends about

$50.00

a month on clothing and

$30.00

on laundry and cleaning.

Car. Maria is beginning to think that her car is an

expensive convenience because public

transportation is good and she lives near a shopping

center. Gasoline averages

$30.00

per

month. Maintenance costs average

$50.00

. Parking fees are $10.00

per month

and license costs are

$30.00

per year.

Loans. Marias monthly car payment is

$200.00

and her student loan payment

is

$150.00

. She pays $50 a month on her

credit card balance.

Insurance. Marias auto insurance costs

$500.00

per year. She does not own life

or renters insurance. Her medical, dental, and

disability insurance are paid by her employer.

Recreation. Maria spends

$100.00

on

Internet

Gas

Food Home

Food Away

Clothing

Laundry/Clean

Gasoline

Car Maintenance

Parking

License

Car Loan

Student Loan

Credit Balance

Auto Insurance

Health Club

Movies

Personal

Gifts

Savings

Emergency

Mutual Fund

401(k)

$25.00

$30.00

$100.00

$50.00

$50.00

$30.00

$30.00

$50.00

$10.00

$30.00

$200.00

$150.00

$50.00

$41.67

$100.00

$30.00

$20.00

$100.00

$0.00

$900.00

$50.00

$0.00

health club dues and

$30.00

on movies.

She enjoys reading, hiking, and swimming.

Other. Maria spends about

$20.00

a

month on haircuts and personal care. She

contributes $10.00

a month to a charitable

organization and spends about $100.00

a year

on gifts for family and friends.

Savings and Investments. Maria knows that

saving regularly is important so she sets saving as a

regular monthly expense.

Her emergency fund is the $900 in her checking

account. She would like to increase it to an amount

equal to three months living expenses. She

authorized the bank to automatically deposit $50

each month from her checking account into her

mutual fund account. She also plans to contribute to

the 401(k) plan at work.

Total Expenses $2,221.67

Cash Flow (Net Income)=Income-Expenses

Net Income $6,160.63

Maria would like to pay off her student loans, reduce her credit card debt, buy a TV

set, buy more clothes, go on a summer trip with her friends, contributing to her 401

K plan, and increase her emergency fund equal to three months rent.

The list of these goals in order from most important to least important is: Student

loans, credit card debt, she should probably also get rid of her car loan, increasing

her emergency fund, contributing to her 401 K plan, getting more clothes, getting a

TV, and going on a vacation.

Student Loans: $6,000

Credit Card Debt: $700

Car Loan: $4,000

Emergency fund: $2,100

401 K Plan: 2% of income= $147.65

Clothes: $100

TV: $200-300

Vacation: $500-2,000

Das könnte Ihnen auch gefallen

- Cashing in on Credit Cards: Scott A. Wheeler, Rt(R)(Mr)(Ct)Von EverandCashing in on Credit Cards: Scott A. Wheeler, Rt(R)(Mr)(Ct)Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- The Young Adult's Guide to The Galaxy - The Young Adult's TextbookVon EverandThe Young Adult's Guide to The Galaxy - The Young Adult's TextbookNoch keine Bewertungen

- Bookkeeping Basics: Name - Block - DateDokument12 SeitenBookkeeping Basics: Name - Block - DateMaria AparicioNoch keine Bewertungen

- Mid-Test Personal FinanceDokument5 SeitenMid-Test Personal FinanceChristy Dwita MarianaNoch keine Bewertungen

- Math SignDokument5 SeitenMath SignaliyaNoch keine Bewertungen

- Case AnalysisDokument3 SeitenCase AnalysisMohammad Nowaiser MaruhomNoch keine Bewertungen

- Topic 2 Practice QuestionDokument4 SeitenTopic 2 Practice Questionaarzu dangiNoch keine Bewertungen

- Personal CaseDokument6 SeitenPersonal CaseBhavya NawalakhaNoch keine Bewertungen

- BUSN380 Week 3 TCO 3 Problem Set 3 - Cost of CreditDokument3 SeitenBUSN380 Week 3 TCO 3 Problem Set 3 - Cost of CreditsctutorNoch keine Bewertungen

- Budget Analysis PDFDokument5 SeitenBudget Analysis PDFapi-626791287Noch keine Bewertungen

- Budget Analysis Activity-1 Kaitlyn NealDokument5 SeitenBudget Analysis Activity-1 Kaitlyn Nealapi-627152429Noch keine Bewertungen

- Kofi Royale Case StudyDokument2 SeitenKofi Royale Case StudyChintu WatwaniNoch keine Bewertungen

- That Would Make It To, If Not Keep of Them.: Easier Identify TrackDokument34 SeitenThat Would Make It To, If Not Keep of Them.: Easier Identify TrackBeNoch keine Bewertungen

- Lesson 1 DebtDokument21 SeitenLesson 1 DebtAlf ChingNoch keine Bewertungen

- Budgeting WsDokument5 SeitenBudgeting Wsapi-290878974Noch keine Bewertungen

- Ejercicios Clase 2 RespuestasDokument4 SeitenEjercicios Clase 2 RespuestasNatalia OrtizNoch keine Bewertungen

- Processing Fee 0.34 Checks Per Month 50 17 Processed Check Cost Per MonthDokument3 SeitenProcessing Fee 0.34 Checks Per Month 50 17 Processed Check Cost Per MonthKim RichNoch keine Bewertungen

- Final Part BDokument54 SeitenFinal Part Bapi-265677607Noch keine Bewertungen

- 1 Financial Plan Cover PageDokument5 Seiten1 Financial Plan Cover Pageapi-404263747Noch keine Bewertungen

- Tutorial Solution Chap 5Dokument4 SeitenTutorial Solution Chap 5Nurul AriffahNoch keine Bewertungen

- Economics Family Budget and Financial Plan Project: Ben Vargas Harry Sotiri Ben Louttit Period 2, Aronson 05-11-18Dokument6 SeitenEconomics Family Budget and Financial Plan Project: Ben Vargas Harry Sotiri Ben Louttit Period 2, Aronson 05-11-18Benjamin LouttitNoch keine Bewertungen

- Budget CalculatorDokument2 SeitenBudget Calculator20040239Noch keine Bewertungen

- Final Part BDokument62 SeitenFinal Part Bapi-315015590Noch keine Bewertungen

- After BudgetingDokument6 SeitenAfter BudgetingNyesha GrahamNoch keine Bewertungen

- Budget NeilDokument32 SeitenBudget Neilamithpatel33Noch keine Bewertungen

- Budget Analysis ActivityDokument4 SeitenBudget Analysis Activityapi-627144387Noch keine Bewertungen

- CH 4 & 5 Extra Practic Summer 2023Dokument9 SeitenCH 4 & 5 Extra Practic Summer 2023Ruth KatakaNoch keine Bewertungen

- Answer: C $300,000 in Embezzled Fines + $40,000 in Illegal Drug Sales - $30,000 in COGS +$2,500 in GamblingDokument2 SeitenAnswer: C $300,000 in Embezzled Fines + $40,000 in Illegal Drug Sales - $30,000 in COGS +$2,500 in GamblingJeramel ParejaNoch keine Bewertungen

- Fin 101 Final Part BDokument42 SeitenFin 101 Final Part Bapi-314856986Noch keine Bewertungen

- Chapter 3 QuestionDokument2 SeitenChapter 3 QuestionSwee Yi LeeNoch keine Bewertungen

- Accounting QuestionsDokument4 SeitenAccounting Questionsjohana galvezNoch keine Bewertungen

- Budget Analysis ActivityDokument4 SeitenBudget Analysis Activityapi-685760092Noch keine Bewertungen

- 407 Exam 2 CH 4 5 Spr13 W o AnswDokument7 Seiten407 Exam 2 CH 4 5 Spr13 W o AnswMolly SmithNoch keine Bewertungen

- Part B Fin 101Dokument10 SeitenPart B Fin 101api-342084443Noch keine Bewertungen

- Budget Analysis Activity PDFDokument4 SeitenBudget Analysis Activity PDFapi-685545642Noch keine Bewertungen

- Master Monthly Master Monthly Variable Expenses Fixed ExpensesDokument32 SeitenMaster Monthly Master Monthly Variable Expenses Fixed ExpensesMohammed TetteyNoch keine Bewertungen

- Personal Finance Chapter 6 - Do The MathDokument3 SeitenPersonal Finance Chapter 6 - Do The Mathapi-526065196Noch keine Bewertungen

- Smith Family Financial PDokument11 SeitenSmith Family Financial PNarinder50% (2)

- Monthly BudgetDokument1 SeiteMonthly Budgetapi-250284866Noch keine Bewertungen

- Chapter 2 SolutionsDokument8 SeitenChapter 2 SolutionsSam ParkerNoch keine Bewertungen

- Budgeting ProjectDokument14 SeitenBudgeting Projectapi-311843137Noch keine Bewertungen

- Financial Plan AssignmentDokument5 SeitenFinancial Plan Assignmentapi-363740648Noch keine Bewertungen

- Makayla BudgetDokument1 SeiteMakayla Budgetapi-341705425Noch keine Bewertungen

- Tutorial Chapter 10Dokument2 SeitenTutorial Chapter 10Princess AdaleaNoch keine Bewertungen

- 6.01 Financial Statements ActivityDokument2 Seiten6.01 Financial Statements ActivityAditya Nigam100% (1)

- Budget Performance TaskDokument1 SeiteBudget Performance TaskAvenueNoch keine Bewertungen

- Exercise PF Chapter 2Dokument3 SeitenExercise PF Chapter 2Duy Trần TấnNoch keine Bewertungen

- Home BudgetDokument6 SeitenHome Budgetapi-316937239Noch keine Bewertungen

- Acct 4220 Additional Review Questions For Final ExamDokument5 SeitenAcct 4220 Additional Review Questions For Final ExamrakutenmeeshoNoch keine Bewertungen

- Personal Budget Project Powerpoint 2021Dokument6 SeitenPersonal Budget Project Powerpoint 2021api-560316039Noch keine Bewertungen

- Final BudgetDokument13 SeitenFinal Budgetapi-354625480Noch keine Bewertungen

- CS204 Unit 8 AssignmentDokument2 SeitenCS204 Unit 8 AssignmentBonifaceNoch keine Bewertungen

- MyfinancialplanDokument4 SeitenMyfinancialplanapi-337932889Noch keine Bewertungen

- Social Work 101 Poverty Assignment 1Dokument4 SeitenSocial Work 101 Poverty Assignment 1api-339394795Noch keine Bewertungen

- High School BudgetDokument2 SeitenHigh School Budgetapi-258216759Noch keine Bewertungen

- Marshall Budget Template 2016Dokument20 SeitenMarshall Budget Template 2016api-341192980Noch keine Bewertungen

- Goals and Objectives Case StudyDokument6 SeitenGoals and Objectives Case Studymaha.faisal.272Noch keine Bewertungen

- Slandour & Co. in Relation To This Matter. The Purpose of This Letter Is To Outline My Advices inDokument3 SeitenSlandour & Co. in Relation To This Matter. The Purpose of This Letter Is To Outline My Advices inDavid HumphreysNoch keine Bewertungen

- Mod 1 Fundamentals of Personal FinanceDokument15 SeitenMod 1 Fundamentals of Personal FinanceShruti b ahujaNoch keine Bewertungen

- Can Dogs Understand Us EssayDokument6 SeitenCan Dogs Understand Us Essayapi-252844849Noch keine Bewertungen

- Shaye Dumas ResumeDokument2 SeitenShaye Dumas Resumeapi-252844849Noch keine Bewertungen

- How Technological Improvements Affect The EnvironmentDokument6 SeitenHow Technological Improvements Affect The Environmentapi-252844849Noch keine Bewertungen

- Is Google Making Us Stupid EssayDokument5 SeitenIs Google Making Us Stupid Essayapi-252844849100% (4)

- Student TranscriptDokument2 SeitenStudent Transcriptapi-252844849Noch keine Bewertungen

- College Comparison Worksheet 1Dokument3 SeitenCollege Comparison Worksheet 1api-252844849Noch keine Bewertungen

- Annotated Bibliography2Dokument1 SeiteAnnotated Bibliography2api-252844849Noch keine Bewertungen

- Pledge of Allegiance EssayDokument3 SeitenPledge of Allegiance Essayapi-252844849Noch keine Bewertungen

- Utah Valley UniversityDokument6 SeitenUtah Valley Universityapi-252844849Noch keine Bewertungen

- The Death PenaltyDokument4 SeitenThe Death Penaltyapi-252844849Noch keine Bewertungen

- Academy of Finance ScholarshipDokument2 SeitenAcademy of Finance Scholarshipapi-252844849Noch keine Bewertungen

- Appeal To PityDokument1 SeiteAppeal To Pityapi-252844849Noch keine Bewertungen

- Annotated BibliographyDokument5 SeitenAnnotated Bibliographyapi-252844849Noch keine Bewertungen

- Self-Evaluation LetterDokument1 SeiteSelf-Evaluation Letterapi-252844849Noch keine Bewertungen

- Chapter 22-30 Ap European HistoryDokument128 SeitenChapter 22-30 Ap European Historyapi-252844849Noch keine Bewertungen

- DBQ 10Dokument2 SeitenDBQ 10api-252844849Noch keine Bewertungen

- Research QuestionsDokument1 SeiteResearch Questionsapi-252844849Noch keine Bewertungen

- Polynomial EquationsDokument6 SeitenPolynomial Equationsapi-252844849Noch keine Bewertungen

- Personal Income and Expense Statement-1Dokument2 SeitenPersonal Income and Expense Statement-1api-252844849Noch keine Bewertungen

- Horace MannDokument2 SeitenHorace Mannapi-252844849Noch keine Bewertungen

- Raoul WallenbergDokument8 SeitenRaoul Wallenbergapi-252844849Noch keine Bewertungen

- Greek Hero-TheseusDokument10 SeitenGreek Hero-Theseusapi-252844849Noch keine Bewertungen

- Cutest Pet Contest Scholarship ApplicationDokument1 SeiteCutest Pet Contest Scholarship Applicationapi-252844849Noch keine Bewertungen

- 06 Class Quiz MCQs Securities and Charges Margin DP InsuranceDokument4 Seiten06 Class Quiz MCQs Securities and Charges Margin DP InsuranceVikashKumarNoch keine Bewertungen

- Punjab and Sind Bank Services of Risk ManagementDokument12 SeitenPunjab and Sind Bank Services of Risk Managementiyaps427100% (1)

- Banking and Finance 3078Dokument67 SeitenBanking and Finance 3078Nevin AlijaNoch keine Bewertungen

- T03 - Working Capital FinanceDokument40 SeitenT03 - Working Capital FinanceJesha JotojotNoch keine Bewertungen

- California Bus Lines vs. State InvestmentDokument3 SeitenCalifornia Bus Lines vs. State Investmentshinjha73Noch keine Bewertungen

- SCR Banking KMDDokument25 SeitenSCR Banking KMDamitguptaujjNoch keine Bewertungen

- Real Estate Securitization Exam NotesDokument33 SeitenReal Estate Securitization Exam NotesHeng Kai Li100% (1)

- Telecom Business Intelligence Case StudyDokument3 SeitenTelecom Business Intelligence Case StudyScortoCorpNoch keine Bewertungen

- Trust DeedDokument18 SeitenTrust Deedsivaganesh_7100% (2)

- Internship Report On ZTBLDokument87 SeitenInternship Report On ZTBLShabnam Naz100% (3)

- Banking FraudDokument24 SeitenBanking FraudchaitudscNoch keine Bewertungen

- Guidelines For Preparation of Statement of Financial Transactions (SFT)Dokument5 SeitenGuidelines For Preparation of Statement of Financial Transactions (SFT)Mathavan RajkumarNoch keine Bewertungen

- Risk Management in International Trade FinanceDokument120 SeitenRisk Management in International Trade FinanceChirag ShahNoch keine Bewertungen

- E-Cash Report CSE SeminarDokument35 SeitenE-Cash Report CSE Seminarz1230% (1)

- DH 1217Dokument12 SeitenDH 1217The Delphos Herald100% (1)

- People's Republic of China Credit RatingDokument5 SeitenPeople's Republic of China Credit RatingasiafinancenewsNoch keine Bewertungen

- City Limits Magazine, December 1987 IssueDokument24 SeitenCity Limits Magazine, December 1987 IssueCity Limits (New York)Noch keine Bewertungen

- Ika Natassa: Project Leader - Wholesale Transaction Banking at Bank MandiriDokument7 SeitenIka Natassa: Project Leader - Wholesale Transaction Banking at Bank MandiriWisnu NugrahaNoch keine Bewertungen

- Financial ManagementDokument24 SeitenFinancial ManagementozalmistryNoch keine Bewertungen

- Orix 1Dokument11 SeitenOrix 1haroonameerNoch keine Bewertungen

- Ontario Superior Court of Justice Court File No: CV-12-9780-00CLDokument101 SeitenOntario Superior Court of Justice Court File No: CV-12-9780-00CLManchesterCFNoch keine Bewertungen

- A Project Report Submitted To Marwari Colleg1Dokument74 SeitenA Project Report Submitted To Marwari Colleg1Supriya Gautam0% (1)

- Coop Updates 3Dokument52 SeitenCoop Updates 3nelsonpm81Noch keine Bewertungen

- SEC Guide To Variable AnnuitiesDokument28 SeitenSEC Guide To Variable AnnuitiesAlex SongNoch keine Bewertungen

- Chapter 1 Credit FundamentalsDokument10 SeitenChapter 1 Credit FundamentalsRayniel Zabala71% (7)

- Financing of Foreign Trade and Institutional InfrastructureDokument26 SeitenFinancing of Foreign Trade and Institutional InfrastructurePrangya PattnaikNoch keine Bewertungen

- Debt Collection Article PDFDokument38 SeitenDebt Collection Article PDFAlexandria BurrisNoch keine Bewertungen

- Literature ReviewDokument4 SeitenLiterature ReviewJimmy JonesNoch keine Bewertungen

- Chapter 19 Money and BankingDokument43 SeitenChapter 19 Money and BankingJason ChungNoch keine Bewertungen

- Atestat Limba Engleza Anul IDokument15 SeitenAtestat Limba Engleza Anul IDan Si PunctNoch keine Bewertungen