Beruflich Dokumente

Kultur Dokumente

Valuation of Shares Need and Methods

Hochgeladen von

nishuppt100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

12K Ansichten7 SeitenNishu

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenNishu

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

12K Ansichten7 SeitenValuation of Shares Need and Methods

Hochgeladen von

nishupptNishu

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

VALUATION OF SHARES

Need and Methods

Shares

Meaning:-

The capital of the company can be divided into

different units with definite values called shares.

Thus a share is the shared capital in the firm giving

ownership right to the shareholder

Types of Shares

There are two types of shares that a company

may issue-

1. Preference Shares: A Preference share has

following two features-

(i) A right to receive dividend at a given

rate or amount before any dividend is paid.

(ii) A right to repayment of capital in the

event of winding-up of company.

2. Equity Shares: An Equity share has following

features-

(i) It gets dividend and repayment after payment

to preference shareholders.

(ii) Rate of dividend is not fixed and is determined

by Directors.

(iii) Such shareholders may go without any

dividend if no profit is made.

(iv) They also have voting rights proportionate to

one’s share in the paid-up equity capital.

Par value of shares:

An amount is noted on each share of a company.

This is known as the Par value of the share. It is

also known as the face value of the share.

Market value of Share:

It is the value at which the share is sold or

purchased in the market.

Market value may be more or less than the face

value of the share.

Valuation of Shares

The shares which are included in the list of stock exchange

are quoted but the shares which are not quoted are

valued by various methods.

Need for Valuation:-

(i) When two or more companies amalgamate

(ii) When absorption of a company takes place.

(iii) When some shareholders do not give their consent for

reconstruction of the company, there shares are valued for the

purpose of acquisition.

(iv) When shares are held by the partners jointly in a company and

dissolution takes place., it becomes necessary to value the

shares for proper distribution of partnership property among

the partners.

(v) When a loan is advanced on the security of

shares.

(vi) When shares of one type are converted into

shares of another type

(vii) When some company is taken over by the

government, compensation is paid to the

shareholders of such company and on this

occasion, valuation of shares is made.

(viii) When a portion of shares is to be given by a

member of proprietary company to another

member, fair price of these shares has to be

made by an auditor or accountant.

Das könnte Ihnen auch gefallen

- Final Accounts of Banking Company - Lecture 01 - 21-08-2020Dokument8 SeitenFinal Accounts of Banking Company - Lecture 01 - 21-08-2020akash gautamNoch keine Bewertungen

- Corporate Accounting Theory For First Unit-2Dokument9 SeitenCorporate Accounting Theory For First Unit-2Rigved PrasadNoch keine Bewertungen

- Redemption of DebenturesDokument11 SeitenRedemption of Debenturesadeeba_kaziiNoch keine Bewertungen

- Rights, Duties and Liabilities of An AuditorDokument8 SeitenRights, Duties and Liabilities of An AuditorShailee ShahNoch keine Bewertungen

- Methods of Floating New IssuesDokument8 SeitenMethods of Floating New IssuespriyaNoch keine Bewertungen

- Rights and Duties of Company AuditorDokument8 SeitenRights and Duties of Company AuditorShaji JkNoch keine Bewertungen

- Share Valuation - 1 PDFDokument7 SeitenShare Valuation - 1 PDFbonnie.barma2831100% (1)

- Statutory AuditDokument20 SeitenStatutory Auditkalpesh mhatreNoch keine Bewertungen

- Notes Toredemption of Preference SharesDokument40 SeitenNotes Toredemption of Preference Sharesaparna bingiNoch keine Bewertungen

- Divisible ProfitDokument5 SeitenDivisible ProfitAzhar Ahmed SheikhNoch keine Bewertungen

- Tax Planning and Managerial DecisionDokument188 SeitenTax Planning and Managerial Decisionkomal_nath2375% (4)

- Liabilities of An AuditorDokument4 SeitenLiabilities of An AuditorAbhimanyu SethNoch keine Bewertungen

- 6 Sem Bcom - Management Accounting PDFDokument71 Seiten6 Sem Bcom - Management Accounting PDFaldhhdNoch keine Bewertungen

- Primary MarketDokument27 SeitenPrimary MarketMrunal Chetan Josih0% (1)

- Profits and Gains From Business and ProfessionDokument4 SeitenProfits and Gains From Business and ProfessionAyaan AhmedNoch keine Bewertungen

- New Issue MarketDokument18 SeitenNew Issue Marketoureducation.inNoch keine Bewertungen

- Dominance of MNCsDokument11 SeitenDominance of MNCssuchitaNoch keine Bewertungen

- Note On Public IssueDokument9 SeitenNote On Public IssueKrish KalraNoch keine Bewertungen

- Read With Companies (Declaration and Payment of Dividend) Rules, 2014Dokument27 SeitenRead With Companies (Declaration and Payment of Dividend) Rules, 2014nsk2231Noch keine Bewertungen

- AuditingDokument21 SeitenAuditingShilpan ShahNoch keine Bewertungen

- Reconstruction InternalDokument12 SeitenReconstruction InternalsviimaNoch keine Bewertungen

- Solved Problems: OlutionDokument5 SeitenSolved Problems: OlutionSavoir PenNoch keine Bewertungen

- History of Audit in IndiaDokument4 SeitenHistory of Audit in Indiapodder0% (1)

- Financial ManagementDokument17 SeitenFinancial ManagementANAND100% (1)

- Debentures ProjectDokument28 SeitenDebentures ProjectMT RA100% (1)

- Capital Budgeting Management Accounting Sem V T.y.bafDokument6 SeitenCapital Budgeting Management Accounting Sem V T.y.bafShravan BaneNoch keine Bewertungen

- Xii Mcqs CH - 9 Issue of SharesDokument7 SeitenXii Mcqs CH - 9 Issue of SharesJoanna Garcia100% (1)

- Corporate Tax PlanningDokument21 SeitenCorporate Tax Planninggauravbpit100% (3)

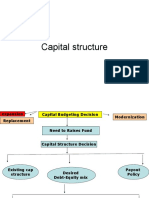

- Capital StructureDokument41 SeitenCapital StructuremobinsaiNoch keine Bewertungen

- What Is Reconstruction?: Need For Internal ReconstructionDokument31 SeitenWhat Is Reconstruction?: Need For Internal Reconstructionneeru79200079% (14)

- Audit of CompaniesDokument28 SeitenAudit of CompaniesKNOWLEDGE CREATORSNoch keine Bewertungen

- Auditing VouchingDokument6 SeitenAuditing VouchingDivakara ReddyNoch keine Bewertungen

- 4 Types of Audit ReportDokument2 Seiten4 Types of Audit ReportIana Lopez100% (2)

- Credit RatingDokument15 SeitenCredit RatingKrishna Chandran PallippuramNoch keine Bewertungen

- Merchant Banking and Financial Services Question PaperDokument248 SeitenMerchant Banking and Financial Services Question Paperexecutivesenthilkumar100% (1)

- Final AccountsDokument20 SeitenFinal AccountsSeri SummaNoch keine Bewertungen

- Clause - 49Dokument18 SeitenClause - 49Manish AroraNoch keine Bewertungen

- Difference Between Accounting and AuditingDokument5 SeitenDifference Between Accounting and Auditingaamir0% (1)

- Audit MCQ by IcaiDokument24 SeitenAudit MCQ by IcaiRahulNoch keine Bewertungen

- LeveragesDokument51 SeitenLeveragesmaitrisharma131295100% (1)

- 06 Financial Estimates and ProjectionsDokument19 Seiten06 Financial Estimates and ProjectionsSri RanjaniNoch keine Bewertungen

- Tax PlanDokument2 SeitenTax PlanMrigendra MishraNoch keine Bewertungen

- Accounting For Specialized Institution Set 2 Scheme of ValuationDokument19 SeitenAccounting For Specialized Institution Set 2 Scheme of ValuationTitus Clement100% (1)

- Cost of CapitalDokument20 SeitenCost of CapitalGagan RajpootNoch keine Bewertungen

- Final Accounts of Banking CompaniesDokument52 SeitenFinal Accounts of Banking CompaniesRohit VishwakarmaNoch keine Bewertungen

- Fortune TellerDokument3 SeitenFortune TellerbharatNoch keine Bewertungen

- Amalgamation and Absorption of CompaniesDokument89 SeitenAmalgamation and Absorption of CompaniesHarshit Kumar GuptaNoch keine Bewertungen

- Company Meeting NotesDokument14 SeitenCompany Meeting NotesManish RoydaNoch keine Bewertungen

- Vouching of The Payment Side of CashbookDokument28 SeitenVouching of The Payment Side of Cashbooksanthosh prabhu mNoch keine Bewertungen

- Accounting Standard - 20 Earnings Per ShareDokument34 SeitenAccounting Standard - 20 Earnings Per ShareVelayudham ThiyagarajanNoch keine Bewertungen

- Key Terminology in Clearing and Sattelment Process NSEDokument9 SeitenKey Terminology in Clearing and Sattelment Process NSETushali TrivediNoch keine Bewertungen

- 08-Interim AuditDokument2 Seiten08-Interim AuditRaima DollNoch keine Bewertungen

- Unit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationDokument17 SeitenUnit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationPaulomi LahaNoch keine Bewertungen

- Unit Iv-Vouching, Verification and ValuationDokument25 SeitenUnit Iv-Vouching, Verification and ValuationJABEZ SMITH100% (1)

- Qualification of An Auditor 2Dokument8 SeitenQualification of An Auditor 2sidraayaz_84Noch keine Bewertungen

- Corporate Securites Classes of Corporate Securities: Ownership Securities and Creditor Ship SecuritiesDokument11 SeitenCorporate Securites Classes of Corporate Securities: Ownership Securities and Creditor Ship SecuritiesSanjeev KumarNoch keine Bewertungen

- SHARESDokument12 SeitenSHARESHIMANSHU DARGANNoch keine Bewertungen

- Sources Fof Business Finance - CH-8Dokument53 SeitenSources Fof Business Finance - CH-8Ayesha SardarNoch keine Bewertungen

- Learning Objectives: After Reading This Chapter, You Are Expected To Be Able ToDokument17 SeitenLearning Objectives: After Reading This Chapter, You Are Expected To Be Able ToBernward MwakatunduNoch keine Bewertungen

- Introduction To SHARESDokument6 SeitenIntroduction To SHARESShristi thakurNoch keine Bewertungen

- MAS-04 Relevant CostingDokument10 SeitenMAS-04 Relevant CostingPaupauNoch keine Bewertungen

- Ather Energy Series E Round of 128mnDokument2 SeitenAther Energy Series E Round of 128mnManojNoch keine Bewertungen

- Global CFO VP Director Finance in Los Angeles CA Resume Lance GatewoodDokument2 SeitenGlobal CFO VP Director Finance in Los Angeles CA Resume Lance GatewoodLanceGatewoodNoch keine Bewertungen

- Group 18 (Swiggy)Dokument2 SeitenGroup 18 (Swiggy)Arun RaoNoch keine Bewertungen

- Statement of Problem Social and Global StratificationDokument13 SeitenStatement of Problem Social and Global StratificationstudylesspartymoreNoch keine Bewertungen

- HW Microeconomics)Dokument3 SeitenHW Microeconomics)tutorsbizNoch keine Bewertungen

- Chapter 15 Sales Type LeaseDokument3 SeitenChapter 15 Sales Type LeaseNikki WanoNoch keine Bewertungen

- Case Study - Brazil and US - CottonDokument7 SeitenCase Study - Brazil and US - CottonDISHA MALHOTRANoch keine Bewertungen

- 2022 9855 1 PBDokument14 Seiten2022 9855 1 PBWahyu Widhi PrawestiNoch keine Bewertungen

- Presented By:: Rafi Sheikh Sheeraz Malik Syed Ahmed Ali Umair Ali Waqar AmeenDokument34 SeitenPresented By:: Rafi Sheikh Sheeraz Malik Syed Ahmed Ali Umair Ali Waqar AmeenSyed Ahmed AliNoch keine Bewertungen

- Practice 4a EPS & Dilutive EPSDokument2 SeitenPractice 4a EPS & Dilutive EPSParal Fabio MikhaNoch keine Bewertungen

- Topic Selection: by Tek Bahadur MadaiDokument24 SeitenTopic Selection: by Tek Bahadur Madairesh dhamiNoch keine Bewertungen

- Rich Dad, Poor Dad Summary at WikiSummaries, Free Book SummariesDokument12 SeitenRich Dad, Poor Dad Summary at WikiSummaries, Free Book SummariesKristian100% (1)

- Chipotle 2013 Organizational AnalysisDokument7 SeitenChipotle 2013 Organizational Analysistarawneh92Noch keine Bewertungen

- 10 Axioms of FinManDokument1 Seite10 Axioms of FinManNylan NylanNoch keine Bewertungen

- AbujaMasterPlanReview FinalReportDokument20 SeitenAbujaMasterPlanReview FinalReportADEWALE ADEFIOLANoch keine Bewertungen

- Commercial LawDokument144 SeitenCommercial LawlegalNoch keine Bewertungen

- Talent Management QuestionnaireDokument3 SeitenTalent Management QuestionnaireG Sindhu Ravindran100% (2)

- Activities KeyDokument7 SeitenActivities KeyCassandra Dianne Ferolino MacadoNoch keine Bewertungen

- FM - Kelompok 4 - 79D - Assignment CH9, CH10Dokument8 SeitenFM - Kelompok 4 - 79D - Assignment CH9, CH10Shavia KusumaNoch keine Bewertungen

- Townhall SustDokument21 SeitenTownhall Sustpritom173Noch keine Bewertungen

- IT Security Specialist Home Credit: About PositionDokument2 SeitenIT Security Specialist Home Credit: About PositionPatrikNoch keine Bewertungen

- Why Public Policies Fail in PakistanDokument5 SeitenWhy Public Policies Fail in PakistanbenishNoch keine Bewertungen

- MCQ On Banking Finance & Economy-1Dokument4 SeitenMCQ On Banking Finance & Economy-1Shivarajkumar JayaprakashNoch keine Bewertungen

- Afisco Insurance Corp. v. CIRDokument6 SeitenAfisco Insurance Corp. v. CIRJB GuevarraNoch keine Bewertungen

- Secret of Successful Traders - Sagar NandiDokument34 SeitenSecret of Successful Traders - Sagar NandiSagar Nandi100% (1)

- Case Study 3 - Heldon Tool Manufacturing CaseDokument3 SeitenCase Study 3 - Heldon Tool Manufacturing CasethetinkerxNoch keine Bewertungen

- Project Summary For Public DisclosureDokument2 SeitenProject Summary For Public DisclosureRohit BhamareNoch keine Bewertungen

- Yenieli CVDokument2 SeitenYenieli CVumNoch keine Bewertungen

- Empirical Methods: Uva - Instructions-Take-Home-Assignment-2018-2019Dokument4 SeitenEmpirical Methods: Uva - Instructions-Take-Home-Assignment-2018-2019Jason SpanoNoch keine Bewertungen