Beruflich Dokumente

Kultur Dokumente

Range Chart Sample Data

Hochgeladen von

SameerbaskarOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Range Chart Sample Data

Hochgeladen von

SameerbaskarCopyright:

Verfügbare Formate

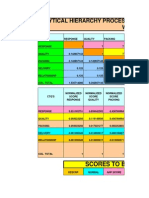

RANGE CHARTS (VERSION 1)

RANGE CHART SAMPLE DATA

DCF

Public Comp

Asset Repl

M&A Comp

Repl Cost

Sum of Parts

12-mnt High Low

Assumption 1 Assumption 2 Assumption 3 Assumption 4 Assumption 5

30

33

36

42

45

28

46

29

40

35

42

38

36

29

26

20

39

35

39

40

48

35

50

39

43

32

33

30

37

29

26

39

32

24

35

Minimum

Range

30

28

26

20

35

29

24

15

18

16

20

15

8

15

The table above provides the valuation summary of a company using different valuation tools. The assumptions

used vary from being pessimistic to optimistic valuations. The challenge of sending such data directly to the clients

is that they may not be very happy to see this table. More than that, they may not have time to do the

interpretation. Hence, as an analyst, it is of utmost importance that we should be able to represent the data in a

standardized, easy to read format.

If we make the graph shown above, then it is very easy to interpret

M&A comp method leads to a Minimum valuation of Rs20/Replacement Cost method leads to the maximum valuation of Rs50/If we use DCF, the pessimistic and aggressive valuation will be Rs30/- and Rs45/-

The above data can be neatly summarized in the form of range charts as show below

WHAT ARE RANGE CHARTS?

$60

XYZ C orp. Share Price ($)

$50

$40

$30

$20

$10

$0

DC F

Public

C omp

Asset Repl

M&A

C omp

Repl C ost

Sum of

Parts

12-mnt

High Low

www.educorporatebridge.com

Das könnte Ihnen auch gefallen

- Predictive Modelling: Linear Regression Analysis for Sales PredictionDokument35 SeitenPredictive Modelling: Linear Regression Analysis for Sales PredictionGirish Chadha100% (3)

- Project +Sweta+Kumari+ +FRA+Milestone+2 July+2021Dokument18 SeitenProject +Sweta+Kumari+ +FRA+Milestone+2 July+2021sweta kumari100% (1)

- 1 Choosing The Right Data Mining Techniques For The Job (8 Min-Utes, 4 Points)Dokument5 Seiten1 Choosing The Right Data Mining Techniques For The Job (8 Min-Utes, 4 Points)baloch45Noch keine Bewertungen

- HR Data Capstone Project Interim ReportDokument16 SeitenHR Data Capstone Project Interim Reportchinudash86% (7)

- Machine Learning Models for Employee Transport PredictionDokument118 SeitenMachine Learning Models for Employee Transport PredictionRemyaRS100% (3)

- Six SigmaDokument28 SeitenSix SigmaA.P. RajaNoch keine Bewertungen

- Timing Solution 2008Dokument189 SeitenTiming Solution 2008gaceor100% (3)

- Introducing Base CorrelationsDokument4 SeitenIntroducing Base CorrelationsLatoya AndersonNoch keine Bewertungen

- Data Mining Business Report Hansraj YadavDokument34 SeitenData Mining Business Report Hansraj YadavP Venkata Krishna Rao83% (12)

- Data Interpretation Guide For All Competitive and Admission ExamsVon EverandData Interpretation Guide For All Competitive and Admission ExamsBewertung: 2.5 von 5 Sternen2.5/5 (6)

- Employee Turnover PredictionDokument16 SeitenEmployee Turnover Predictionbhanu prakash100% (1)

- Ahp Matrix TemplateDokument79 SeitenAhp Matrix TemplateArun MathewNoch keine Bewertungen

- Machine Learning Multiple Choice Questions - Free Practice TestDokument12 SeitenMachine Learning Multiple Choice Questions - Free Practice Testarafaliwijaya100% (1)

- Chapter 3 ClassroomDokument31 SeitenChapter 3 ClassroomNimeshee SinghNoch keine Bewertungen

- Car Transport Machine LearningDokument28 SeitenCar Transport Machine LearningSatish Patnaik88% (8)

- 7-Risk and Real Options in Capital BudgetingDokument38 Seiten7-Risk and Real Options in Capital BudgetingSameerbaskarNoch keine Bewertungen

- Lecture Notes - Linear RegressionDokument26 SeitenLecture Notes - Linear RegressionAmandeep Kaur GahirNoch keine Bewertungen

- Business Forecasting: The Emerging Role of Artificial Intelligence and Machine LearningVon EverandBusiness Forecasting: The Emerging Role of Artificial Intelligence and Machine LearningNoch keine Bewertungen

- MeDEA IntroductionDokument8 SeitenMeDEA IntroductionSHRINIVASNoch keine Bewertungen

- An Introduction to Graphing Project Charter and CTQ MetricsDokument45 SeitenAn Introduction to Graphing Project Charter and CTQ MetricsMian Umer AshfaqNoch keine Bewertungen

- Chapter 3Dokument52 SeitenChapter 3MonahelmyNoch keine Bewertungen

- KDD Cup 2009 customer prediction challengeDokument8 SeitenKDD Cup 2009 customer prediction challengeBen NgNoch keine Bewertungen

- Cumulative Correspondence Analysis To Improve The Public Train TransportDokument10 SeitenCumulative Correspondence Analysis To Improve The Public Train TransportJaime Enrique ParionaNoch keine Bewertungen

- Thera BankDokument25 SeitenThera BankSanan Olachery100% (1)

- Assignment models and transportation models for optimized decision makingDokument9 SeitenAssignment models and transportation models for optimized decision makingLopamudra SahooNoch keine Bewertungen

- Operations Manager For Excel (C) 1997-2003, User Solutions, IncDokument18 SeitenOperations Manager For Excel (C) 1997-2003, User Solutions, IncRabih DarwishNoch keine Bewertungen

- Credit Card Fraud Analysis AshutoshDokument3 SeitenCredit Card Fraud Analysis AshutoshHemang KhandelwalNoch keine Bewertungen

- MN3032 ZA d1Dokument6 SeitenMN3032 ZA d1Chloe ThamNoch keine Bewertungen

- Project 5 Surabhi Sood - ReportDokument34 SeitenProject 5 Surabhi Sood - ReportSurabhi SoodNoch keine Bewertungen

- P-149 Final PPTDokument57 SeitenP-149 Final PPTVijay rathodNoch keine Bewertungen

- Rahulsharma - 03 12 23Dokument25 SeitenRahulsharma - 03 12 23Rahul GautamNoch keine Bewertungen

- Price Optimization With Machine Learning - The Impact of Data Science On Commercial Strategies - by Ismetgocer - Academy Team - MediumDokument16 SeitenPrice Optimization With Machine Learning - The Impact of Data Science On Commercial Strategies - by Ismetgocer - Academy Team - MediumsmityajahNoch keine Bewertungen

- Credit Risk Project, Installment 1: Indian School of BusinessDokument5 SeitenCredit Risk Project, Installment 1: Indian School of BusinessTANAY SETHNoch keine Bewertungen

- Credit Risk Project, Installment 1: Indian School of BusinessDokument2 SeitenCredit Risk Project, Installment 1: Indian School of BusinessTANAY SETHNoch keine Bewertungen

- Rahulsharma - 03 12 23Dokument26 SeitenRahulsharma - 03 12 23Rahul GautamNoch keine Bewertungen

- Ahp TemplateDokument77 SeitenAhp TemplateyusrizalstNoch keine Bewertungen

- The Final Frontier A SAS Approach To Data Envelopment AnalysisDokument7 SeitenThe Final Frontier A SAS Approach To Data Envelopment AnalysisarijitroyNoch keine Bewertungen

- Map Reduce Workflow ColloquimDokument30 SeitenMap Reduce Workflow ColloquimJatin ParasharNoch keine Bewertungen

- Download Visual Data Insights Using Sas Ods Graphics A Guide To Communication Effective Data Visualization 1St Edition Leroy Bessler 2 all chapterDokument68 SeitenDownload Visual Data Insights Using Sas Ods Graphics A Guide To Communication Effective Data Visualization 1St Edition Leroy Bessler 2 all chapterbryan.nevill936100% (2)

- Literature Review On Application of Linear ProgrammingDokument6 SeitenLiterature Review On Application of Linear ProgrammingafmabreouxqmrcNoch keine Bewertungen

- Target IX-MR Charts Show Multiple SpecsDokument16 SeitenTarget IX-MR Charts Show Multiple SpecsTin NguyenNoch keine Bewertungen

- Learn key techniques for technological forecastingDokument44 SeitenLearn key techniques for technological forecastingAnkit SinghalNoch keine Bewertungen

- Installment 4 Regression ModelDokument5 SeitenInstallment 4 Regression ModelAmar ParulekarNoch keine Bewertungen

- Data Mining Project ReportDokument29 SeitenData Mining Project Reporthema aarthiNoch keine Bewertungen

- Quatech ProjectsDokument63 SeitenQuatech ProjectsBlairEmrallafNoch keine Bewertungen

- 206Dokument9 Seiten206monthlyreportcharhiNoch keine Bewertungen

- Simple Explanation of Statsmodel Linear Regression Model SummaryDokument19 SeitenSimple Explanation of Statsmodel Linear Regression Model Summaryjigsan5Noch keine Bewertungen

- Capstone AssessmentDokument18 SeitenCapstone Assessment21324jesikaNoch keine Bewertungen

- Bs Project ReportDokument17 SeitenBs Project ReportRiyaNoch keine Bewertungen

- Project Selection Methods (AHP)Dokument29 SeitenProject Selection Methods (AHP)MattiullahNoch keine Bewertungen

- Normalization - Reducing Redundancy and InconsistencyDokument26 SeitenNormalization - Reducing Redundancy and InconsistencyHemant SharmaNoch keine Bewertungen

- Lecture 11. Ch4. Decision Making Techniques (Part Two)Dokument32 SeitenLecture 11. Ch4. Decision Making Techniques (Part Two)Habiba MedhatNoch keine Bewertungen

- Final Report On AerosolDokument23 SeitenFinal Report On AerosoltanvirNoch keine Bewertungen

- Final Project 2015 - 000Dokument5 SeitenFinal Project 2015 - 000mohamed33Noch keine Bewertungen

- Data Interpretation TechniquesDokument7 SeitenData Interpretation Techniquesvickymaurya7192Noch keine Bewertungen

- Regression ProjectDokument1 SeiteRegression ProjectChi FongNoch keine Bewertungen

- Novated LeaseDokument7 SeitenNovated LeaseSameerbaskarNoch keine Bewertungen

- Reckon One - ProjectsDokument27 SeitenReckon One - ProjectsSameerbaskarNoch keine Bewertungen

- Ssi Excel2016 Example Exercise 03Dokument1 SeiteSsi Excel2016 Example Exercise 03SameerbaskarNoch keine Bewertungen

- Reckon One - PayrollDokument98 SeitenReckon One - PayrollSameerbaskarNoch keine Bewertungen

- Ssi Excel2016 Example Exercise 02aDokument1 SeiteSsi Excel2016 Example Exercise 02aSameerbaskarNoch keine Bewertungen

- 006-XYZ Company Basic Excel Case StudyDokument1 Seite006-XYZ Company Basic Excel Case StudySameerbaskarNoch keine Bewertungen

- Typing Excercises AustraliaDokument4 SeitenTyping Excercises AustraliaSameerbaskarNoch keine Bewertungen

- Ssi Excel2016 Example Exercise 01Dokument1 SeiteSsi Excel2016 Example Exercise 01SameerbaskarNoch keine Bewertungen

- 038-Logical Functions Quiz - Without SolutionsDokument4 Seiten038-Logical Functions Quiz - Without SolutionsSameerbaskarNoch keine Bewertungen

- Ssi Excel2016 Example Exercise 02bDokument1 SeiteSsi Excel2016 Example Exercise 02bSameerbaskarNoch keine Bewertungen

- 053-Database Functions-Dsum Daverage DcountDokument3 Seiten053-Database Functions-Dsum Daverage DcountSameerbaskarNoch keine Bewertungen

- 038-Logical Functions Quiz - Without SolutionsDokument4 Seiten038-Logical Functions Quiz - Without SolutionsSameerbaskarNoch keine Bewertungen

- 038-Logical Functions Quiz - Without SolutionsDokument4 Seiten038-Logical Functions Quiz - Without SolutionsSameerbaskarNoch keine Bewertungen

- Monthly Sales and Regional Sales ReportDokument6 SeitenMonthly Sales and Regional Sales ReportSameerbaskarNoch keine Bewertungen

- SAP SD ConditionDokument5 SeitenSAP SD ConditionSameerbaskarNoch keine Bewertungen

- Sap BPC AlignmentDokument1 SeiteSap BPC AlignmentSameerbaskarNoch keine Bewertungen

- Get Started: ML Series Bluetooth® HeadsetDokument7 SeitenGet Started: ML Series Bluetooth® HeadsetnicutaxNoch keine Bewertungen

- Cosmopolitan Chrono ResumeDokument2 SeitenCosmopolitan Chrono ResumeImran KhanNoch keine Bewertungen

- Sales For This Month Are Listed BelowDokument1 SeiteSales For This Month Are Listed BelowSameerbaskarNoch keine Bewertungen

- Sap BPC AlignmentDokument1 SeiteSap BPC AlignmentSameerbaskarNoch keine Bewertungen

- Accrual EngineDokument1 SeiteAccrual EngineSameerbaskarNoch keine Bewertungen

- MS Office custom number formatsDokument4 SeitenMS Office custom number formatsSameerbaskarNoch keine Bewertungen

- Smartart Org Chart123Dokument2 SeitenSmartart Org Chart123SameerbaskarNoch keine Bewertungen

- Product Number Product Description QuoteDokument1 SeiteProduct Number Product Description QuoteSameerbaskarNoch keine Bewertungen

- Chapter 2-Find Unmatched SampleDokument134 SeitenChapter 2-Find Unmatched SampleSameerbaskarNoch keine Bewertungen

- News Counting Text in A RangeDokument1 SeiteNews Counting Text in A RangeSameerbaskarNoch keine Bewertungen

- Capital InvestmentDokument38 SeitenCapital InvestmentSameerbaskarNoch keine Bewertungen

- Automating WordDokument1 SeiteAutomating WordSameerbaskarNoch keine Bewertungen