Beruflich Dokumente

Kultur Dokumente

Ch15 - Other Assurance Services

Hochgeladen von

IzZa RiveraCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ch15 - Other Assurance Services

Hochgeladen von

IzZa RiveraCopyright:

Verfügbare Formate

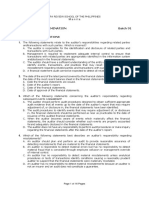

Chapter 15 Other Assurance Services 254

Other Assurance Services

MULTIPLE CHOICE:

1. A study and evaluation of internal control made in

connection with an annual audit is usually not sufficient

to express an opinion on an entity's internal control

because

a.

Weaknesses in the system may go unnoticed during the

audit engagement.

b.

A study and evaluation of internal control is not

necessarily made during an audit engagement.

c.

Only those controls of interest to the auditor are

reviewed, tested, and evaluated.

d.

Internal controls can change each year.

ANSWER:

2.

Of the following statements, which one does not describe a

distinction between the auditing standards and the

attestation standards?

a.

Unlike the auditing standards, the attestation

standards do not require the auditor to obtain an

understanding of the client's internal control system

b.

The attestation standards are broader in coverage than

the auditing standards.

c.

In performing an attest engagement, the CPA need not be

independent.

d.

In an attest engagement, unlike an audit, generally

accepted accounting principles are not the standard

used to measure the reasonableness of assertions.

ANSWER:

3.

Each page of a non-public entity's financial statements

reviewed by an accountant should include the following

reference:

a.

See Accountant's Review Report.

b.

Reviewed, No Accountant's Assurance Expressed.

c.

See Accompanying Accountant's Footnotes.

d.

Reviewed, No Material Modifications Required.

ANSWER:

4.

A CPA may accept an engagement to apply agreed-upon

procedures to prospective financial statements provided

255

Chapter 15 Other Assurance Services

a.

b.

c.

d.

All parties have agreed on the procedures to be

applied.

The CPA has previously audited the entity for which the

agreed-upon procedures are to be applied.

Users have participated in establishing the nature and

scope of the engagement, distribution of the report is

limited to the users involved, and the prospective

statements include a summary of significant

assumptions.

The set of agreed-upon procedures include, at a

minimum, a study and evaluation of the existing

internal control.

ANSWER:

5.

The statement that "nothing came to our attention which

would indicate that these statements are not fairly

presented" expresses which of the following?

a.

Disclaimer of an opinion.

b.

Negative assurance.

c.

Negative confirmation.

d.

Piecemeal opinion.

ANSWER:

6.

Which of the following is not a distinction between a

compilation and a review?

a.

The CPA must be independent as a prerequisite to

performing a review engagement, but need not be

independent to perform a compilation.

b.

In conducting a review, the CPA must obtain an

understanding of the client's internal control system;

but this is not necessary for a compilation engagement.

c.

Analytical procedures are applied in a review

engagement, but are not required in a compilation.

d.

A compilation offers no assurance, whereas a review

provides limited assurance.

ANSWER:

7.

During a compilation of a non-public entity's financial

statements, an accountant would be least likely to

a.

Omit substantially all of the disclosures required

by generally accepted accounting principles.

b.

Issue a compilation report on one or more, but not

all, of the basic financial statements.

c.

Perform analytical procedures designed to identify

Chapter 15 Other Assurance Services

256

relationships that appear to be unusual.

Read the compiled financial statements and consider

whether they appear to include adequate

disclosure.

d.

ANSWER:

8.

When an independent CPA is associated with the financial

statements of a publicly held entity but has not audited or

reviewed such statements, the appropriate form of report to

be issued must include a(an)

a.

Compilation report.

b.

Disclaimer of opinion.

c.

Unaudited association report.

d.

Qualified opinion.

ANSWER:

9.

When an auditor issues an unqualified opinion on an entity's

internal control, it is implied that the

a.

Entity has not violated provisions of the Foreign

Corrupt Practices Act.

b.

Likelihood of management fraud is minimal.

c.

Financial records are sufficiently reliable to permit

the preparation of financial statements.

d.

Entity's internal control system is in conformity

with criteria established by its audit committee.

ANSWER:

10.

Which of the following statements best distinguishes a

forecast from a projection?

a.

A forecast contains one or more hypothetical

assumptions, whereas a projection reflects conditions

expected to exist.

b.

A projection is appropriate for general distribution to

third parties, whereas a forecast is more tentative and

should be restricted to those parties with whom the

client is negotiating directly.

c.

The CPA may review a financial forecast, but may only

compile a projection.

d.

A forecast reflects conditions expected to exist,

whereas a projection presents financial position,

results of operations, and cash flows given one or more

hypothetical assumptions.

ANSWER:

257

11.

Chapter 15 Other Assurance Services

If an accountant concludes that unaudited financial

statements on which the accountant is disclaiming an

opinion also lack adequate disclosure, the accountant

should suggest appropriate revision. If the client does

not accept the accountant's suggestion, the accountant

should

a.

Issue an adverse opinion and describe the appropriate

revision in the report.

b.

Make reference to the appropriate revision and issue a

modified report expressing limited assurance.

c.

Describe the appropriate revision to the financial

statements in the accountant's disclaimer of opinion.

d.

Accept the client's inaction because the statements

are unaudited and the accountant has disclaimed

an opinion.

ANSWER:

12.

An accountant who reviews the financial statements of a

non-public entity should issue a report stating that a

review

a.

Is substantially less in scope than an audit.

b.

Provides negative assurance that the internal control

system is functioning as designed.

c.

Provides only limited assurance that the financial

statements are fairly presented.

d.

Is substantially more in scope than a compilation.

ANSWER:

13.

Which of the following should not be included in an

accountant's standard report based upon the compilation of

an entity's financial statements?

a.

A statement that a compilation is limited to presenting

in the form of financial statements information that is

the representation of management.

b.

A statement that the compilation was performed in

accordance with standards established by the American

Institute of CPAs.

c.

A statement that the accountant has not audited or

reviewed the financial statements.

d.

A statement that the accountant does not express an

opinion but expresses only limited assurance on the

financial statements.

ANSWER:

Chapter 15 Other Assurance Services

14.

Of the following statements, which one is not a precondition

for performing attest services?

a.

The practitioner must be a certified public accountant.

b.

The practitioner must have adequate knowledge of the

subject matter.

c.

There are reasonable measurement and disclosure

criteria concerning the subject matter.

d.

The assertions are capable of reasonably consistent

estimation or measurement using such criteria.

ANSWER:

15.

In which of the following reports should a CPA not express

negative or limited assurance?

a.

A standard compilation report on financial statements

of a non-public entity.

b.

A standard review report on financial statements of a

non-public entity.

c.

A standard review report on interim financial

statements of a public entity.

d.

A standard comfort letter on financial information

included in a registration statement of a public

entity.

ANSWER:

16.

258

In accordance with SEC requirements, a publicly held company

has included interim financial information in its annual

report to shareholders. The independent auditor has

examined the annual financial statements and believes that

they fairly present financial position, results of

operations, and cash flows. The auditor, however, has not

applied limited procedures to the interim data. In drafting

the audit report covering the annual financial statements,

therefore, the independent auditor should

a.

Qualify the audit opinion for a scope limitation,

given failure to apply the limited procedures.

b.

Issue an unqualified opinion on the financial

statements followed by an explanatory paragraph stating

that the procedures were not applied.

c.

Disclaim an opinion given the material impact of the

interim financial information.

d.

Qualify the audit opinion and describe the limited

procedures in a separate paragraph explaining the scope

restriction.

259

Chapter 15 Other Assurance Services

ANSWER:

17.

Comfort letters are ordinarily signed by the

a.

Client.

b.

Client's lawyer.

c.

Independent auditor.

d.

Internal auditor.

ANSWER:

18.

The objective of a review of interim financial information

is to provide the accountant with a basis for reporting

whether

a.

A reasonable basis exists for expressing an updated

opinion regarding the financial statements that were

previously audited.

b.

Material modifications should be made to conform with

generally accepted accounting principles.

c.

The financial statements are presented fairly in

accordance with standards of interim reporting.

d.

The financial statements are presented fairly in

accordance with generally accepted accounting

principles.

ANSWER:

20.

Before performing a review of a non-public entity's

financial statements, an accountant should

a.

Complete a series of inquiries concerning the entity's

procedures for recording, classifying, and

summarizing transactions.

b.

Apply analytical procedures to provide limited

assurance that no material modifications should be

made to the financial statements.

c.

Obtain a sufficient level of knowledge of the

accounting principles and practices of the industry

in which the entity operates.

d.

Inquire whether management has omitted substantially

all of the disclosures required by generally accepted

accounting principles.

ANSWER:

19.

Which of the

conducting a

a.

Inquiry

changes

following procedures is not necessary in

review of interim financial information?

concerning the accounting system and any

in internal control.

Chapter 15 Other Assurance Services

b.

c.

d.

260

Application of analytical procedures to the interim

information.

Inquiry of and obtaining written representations from

management concerning its responsibility for the

financial information and other matters.

Confirmation of significant customer accounts

receivable as of the interim balance sheet date.

ANSWER:

21.

The accountant's report expressing an opinion on an entity's

internal control would not include a

a.

Brief explanation of the broad objectives and inherent

limitations of internal control.

b.

Specific date that the report covers, rather than a

period of time.

c.

Statement that the entity's control system is

consistent with that of the prior year after

giving

effect to subsequent changes.

d.

Description of the scope of the engagement.

ANSWER:

22.

Comfort letters are ordinarily addressed to

a.

The Securities and Exchange Commission.

b.

Underwriters of securities.

c.

Creditor financial institutions.

d.

The client's audit committee.

ANSWER:

23.

Which of the following should be included in an accountant's

standard report based upon the review of a non-public

entity's financial statements?

a.

A statement that the review was performed in

accordance with generally accepted review

standards.

b.

A statement that a review consists principally of

inquiries and analytical procedures.

c.

A statement that the accountant is independent with

respect to the entity.

d.

A statement that a review is substantially greater in

scope than a compilation.

ANSWER:

261

24.

Chapter 15 Other Assurance Services

Engagements for the purpose of expressing an opinion on

internal control differ from the CPA's evaluation of

internal control as part of a financial audit in that

a.

In an engagement to express an opinion, the CPA is

examining and reporting on controls as of a specified

date, whereas in conducting a financial audit, the CPA

frequently tests controls for effectiveness over the

period covered by the financial statements.

b.

In conducting a financial statement audit, the CPA

expresses an opinion as to the operating effectiveness

of the client's internal control system, whereas in an

engagement to express an opinion on internal control,

the CPA addresses design and implementation of control

structure.

c.

In conducting a financial statement audit, the CPA is

concerned with general controls only, whereas in an

engagement to express an opinion on internal control,

the CPA tests both general and application controls.

d.

Scope limitations that affect a financial audit are

irrelevant in an engagement to express an opinion on

internal control.

ANSWER:

25.

Each page of the financial statements compiled by an

accountant should include a reference such as

a.

See accompanying accountant's footnotes.

b.

Unaudited, see accountant's disclaimer.

c.

See accountant's compilation report.

d.

Subject to compilation restrictions.

ANSWER:

26.

The CPA is asked to audit financial statements prepared on a

modified cash basis. This is acceptable provided the CPA

a.

Converts the financial statement to an accrual basis

before rendering an audit report.

b.

Qualifies the audit opinion for a departure from GAAP.

c.

Issues an adverse opinion.

d.

States clearly in the audit report that fairness was

evaluated within the framework of the other basis

rather than GAAP.

ANSWER:

Chapter 15 Other Assurance Services

27.

A modification of the CPA's report on a review of the

interim financial statements of a publicly-held company

would be necessitated by which of the following?

a.

An uncertainty.

b.

Lack of consistency.

c.

Reference to another accountant.

d.

Inadequate disclosure.

ANSWER:

28.

262

Accepting an engagement to compile a financial projection

for a publicly held company most likely would be

inappropriate if the projection were to be distributed

to

a.

b.

c.

d.

A bank with which the entity is negotiating for a loan.

A labor union with which the entity is negotiating a

contract.

The principal stockholder, to the exclusion of the

other stockholders.

All stockholders of record as of the report date.

ANSWER:

29.

When an independent accountant issues a comfort letter to an

underwriter containing comments on data that have not been

audited, the underwriter most likely will receive

a.

A disclaimer on prospective financial statements.

b.

A limited opinion on "pro forma" financial statements.

c.

Positive assurance on supplementary disclosures.

d.

Negative assurance on capsule information.

ANSWER:

30.

31.

Which of the following professional services would be

considered an attest engagement?

a.

A management consulting engagement to provide CBIS

advice to a client.

b.

An engagement to report on compliance with statutory

requirements.

c.

An income tax engagement to prepare federal and state

tax returns.

d.

The compilation of financial statements from a

client's accounting records.

ANSWER: B

The accountant's report expressing an opinion on an entity's

internal control should state that the

263

Chapter 15 Other Assurance Services

a.

being

c.

d.

Establishment and maintenance of internal control is

the responsibility of management.

b.

Objectives of the client's internal control are

met.

Study and evaluation of internal control was

conducted in accordance with generally accepted

auditing standards.

Inherent limitations of the client's internal control

structure were examined.

ANSWER:

32.

Which of the following procedures would most likely be

included in a review engagement of a non-public entity?

a.

Preparing a bank transfer schedule.

b.

Inquiring about related party transactions.

c.

Assessing the internal control structure.

d.

Performing cutoff tests on sales and purchases

transactions.

ANSWER:

33.

An accountant should not submit unaudited financial

statements to the management of a non-public company

unless, at a minimum, the accountant

a.

Assists in adjusting the books of account and prepares

the trial balance.

b.

Types or reproduces the financial statements on plain

paper.

c.

Complies with the standards applicable to compilation

engagements.

d.

Applies analytical procedures to the financial

statements.

ANSWER:

34.

A CPA in public practice must be independent in fact and

appearance when providing which of the following services?

Compilation

Compilation

Preparation

of a

of personal

of a

financial

financial

tax return

forecast

statements

____________

____________

______________

a.

Yes

No

No

b.

No

Yes

No

c.

No

No

Yes

d.

No

No

No

Chapter 15 Other Assurance Services

ANSWER:

264

COMPLETION:

35.

The two levels of attestation are

assurance.

ANSWER:

36.

DIRECT

INDIRECT

A report covering the application of agreed-upon procedures

an

on the financial statements because

the procedures are less extensive than those applied in an

audit.

ANSWER:

41.

NEGATIVE

A CPAs expression of an opinion on managements assertions

as to the effectiveness of a clients internal control

system is known as ______________ attestation.

ANSWER:

40.

assurance.

A CPAs expression of an opinion on the effectiveness of a

clients internal control system is known as __________

attestation.

ANSWER:

39.

LIMITED (NEGATIVE) ASSURANCE

Another term for limited assurance is

ANSWER:

38.

POSITIVE, NEGATIVE

Unlike a compilation, a review report includes, after the

disclaimer, a paragraph expressing

on

the financial statements.

ANSWER:

37.

assurance and

DISCLAIMS, OPINION

If

procedures have been applied to unaudited

data, the CPA may give

in the comfort

letter to underwriters of proposed securities issues.

ANSWER:

LIMITED, NEGATIVE ASSURANCE

265

Chapter 15 Other Assurance Services

42.

The

requires

that public companies establish and maintain adequate

systems of internal control.

ANSWER:

43.

If interim financial information which has been reviewed is

presented alone, rather than in an unaudited footnote to the

annual financial statements, a

report must

accompany the statements.

ANSWER:

44.

FOREIGN CORRUPT PRACTICES ACT OF 1977

REVIEW

An examination of prospective financial statements, like an

audit, requires a form of

.

ANSWER:

ATTESTATION (OPINION)

MATCHING:

45.

A.

B.

C.

D.

E.

F.

G.

H.

I.

J.

K.

Select the term that best fits the listed definition.

Review

Assertion

Forecast

Compilation

Prospective financial statements

Projection

Agreed-upon procedures engagement

Assurance services

Compliance attestation

Negative assurance

Attestation

____1. The CPA presents information that is the representation

of management without undertaking to express any assurance on the

statements.

____2. Independent professional services that improve the

quality of information, or its context, for decision makers.

____3. A disclaimer of opinion followed by a statement that

nothing came to the CPAs attention indicating that the financial

statements were not in conformity with GAAP.

Chapter 15 Other Assurance Services

____4.

audit.

266

More extensive than a compilation but less so than an

____5. The resulting report is in the form of procedures applied

and findings.

____6. Results in a written communication that expresses a

conclusion about the reliability of a written assertion that is

the responsibility of another party.

____7. Any declaration, or set of related declarations taken as

a whole, by a party responsible for it.

____8. Assurance regarding an entitys conformity with specified

laws, regulations, rules, contracts, or grants.

____9.

Future-oriented financial statements.

____10. Presents the entitys expected financial position,

results of operations, and cash flows reflecting conditions

expected to exist.

SOLUTION:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

D

H

J

A

G

K

B

I

E

C

PROBLEM/ESSAY

46. For each of the following engagements, indicate the nature of

the service performed (i.e., audit, review, compilation,

etc.), the standards covering the engagement (i.e., auditing,

attestation, or accounting and review), the type of report to

be issued (i.e., opinion, review, compilation), the level of

assurance provided, and the principal

procedures to be

applied.

A.

Kramer.com, a publicly-held company, has requested

Doom & Gloom, CPAs, to review its quarterly financial

267

Chapter 15 Other Assurance Services

statements presented to the companys stockholders.

B.

Brewers Investment Consortium has requested Crocker &

Benson, CPAs to apply certain procedures to a

financial projection submitted by Stevens

Developers as

part of a loan application relative to a new

river

front development project under consideration.

C.

Gray Ltd., a small auto repair facility requested

Holly Lance, CPA, to prepare a set of financial

statements from the companys records. Third/Fifth

Bank has requested the statements as part of a loan

application submitted by Gray.

D.

Morley Distributors has requested Dolores Del Rio,

CPA, to perform necessary procedures for

determining

conformity to a royalty contract granting Morley 1.5%

of all domestic sales of its franchised distributors.

SOLUTION:

A.

Nature of service:

Applicable standards:

Type of report:

Level of assurance:

Principal procedures:

B.

Nature of service:

Applicable standards:

Type of report:

Level of assurance:

Principal procedures:

C.

Nature of service:

Applicable standards:

Type of report:

Level of assurance:

Principal procedures:

Review of interim financial

information

Auditing standards

Review report

Limited or negative

Inquiry and analytical

procedures

Prospective financial statements

Attestation standards

Agreed-upon procedures report

None

As agreed (inquiry, testing

assumptions for reasonableness)

Compilation of financial

statements for a nonpublic

entity

Accounting and review

Compilation report

None

Understand industry accounting

practices

268

Chapter 15 Other Assurance Services

Read the financial statements

D.

Nature of service:

Applicable standards:

Type of report:

Level of assurance:

Princpal procedures:

Compliance attestation

Attestation standards

Agreed-upon procedures report

None

As agreed (inquiry, reading

royalty agreement,

recomputing

royalty amounts)

46. You have been asked by Kromleys Recreation and Fitness

Center to review its financial statements for the year

ending December 31, 2002. Kromlelys has requested a

substantial loan from Renters Life & Casualty Insurance Ltd.

The loan proceeds will be used to construct a second

facility in the western suburbs of the city. In the past you

have compiled Kromleys financial statements, but have never

audited or reviewed them.

Required:

a.

Differentiate among audits, reviews, and compilations

in terms of procedures to be applied and level of

assurance provided.

b.

Assuming you completed your field work on February 14,

2003 and do not find any material cause for

modification of the financial statements, draft

review report.

c.

Assume that you discover that Kromley has not

recognized any asset or liability for a material

financing-type lease. What modifications should you

make to the standard review report?

d.

What should you do if management and the board do not

agree to these modifications?

the

SOLUTION:

a.

Procedures

Compilation

Inquiry

Read financial

statements

Review

Audit

Inquiry

Study and evaluate internal

Read financial

control

statements

Observe

Apply analytical Confirm

procedures

Examine

269

Chapter 15 Other Assurance Services

Calculate

Inspect

Vouch

Level of assurance

None

Limited

Positive

b.

To the Board of Directors of Kromleys Recreation and

Fitness Center:

We have reviewed the accompanying balance sheet of Kromleys

Recreation and Fitness Center as of December 31, 2002, and the

related statements of income, retained earnings, and cash flows

for the year then ended, in accordance with standards established

by the American Institute of Certified Public Accountants. All

information included in these financial statements is the

representation of the management of Kromley Recreation and

Fitness Center.

A review consists principally of inquiries of company

personnel and analytical procedures applied to financial data.

It is substantially less in scope than an examination in

accordance with generally accepted auditing standards, the

objective of which is the expression of an opinion regarding the

financial statements taken as a whole. Accordingly, we do not

express such an opinion.

Based on our review, we are not aware of any material

modifications that should be made to the accompanying financial

statements in order for them to be in conformity with generally

accepted accounting principles.

Students Name, CPA

February 14, 2003

c.

1. This departure from GAAP should be identified in the third

paragraph and explained in a separate fourth paragraph of the

review report as follows:

As disclosed in Note X to the financial statements,

generally accepted accounting principles require that financing

leases be included on the balance sheet as part of property,

plant, and equipment, and also as a long-term liability at the

present value of such obligations. Management has informed us

that the company accounts for these costs as they are disbursed

to the lessor. The effects of this departure from generally

Chapter 15 Other Assurance Services

270

accepted accounting principles on financial position, results of

operations, and cash flows have not been determined.

2. If management and the board do not agree to the above

modification, you should refuse to be associated with the

financial statements.

Das könnte Ihnen auch gefallen

- Mock PDFDokument26 SeitenMock PDFCamiNoch keine Bewertungen

- Audit Theory December 2020 AssessmentDokument6 SeitenAudit Theory December 2020 AssessmentRyan PedroNoch keine Bewertungen

- Quiz 1 AssuranceDokument13 SeitenQuiz 1 Assurancedarlenexjoyce100% (2)

- Fraud Error NoclarDokument17 SeitenFraud Error NoclarChixNaBitterNoch keine Bewertungen

- Audit of ReceivablesDokument2 SeitenAudit of ReceivablesCarmelaNoch keine Bewertungen

- Aaca Receivables and Sales ReviewerDokument13 SeitenAaca Receivables and Sales ReviewerLiberty NovaNoch keine Bewertungen

- Quiz BeeDokument15 SeitenQuiz BeeRudolf Christian Oliveras UgmaNoch keine Bewertungen

- 2022 - April-AUD - Preboard PDFDokument12 Seiten2022 - April-AUD - Preboard PDFVianney Claire RabeNoch keine Bewertungen

- Excel Professional Services, Inc.: Discussion QuestionsDokument7 SeitenExcel Professional Services, Inc.: Discussion QuestionskæsiiiNoch keine Bewertungen

- Nfjpia Nmbe Far 2017 AnsDokument9 SeitenNfjpia Nmbe Far 2017 AnsSamieeNoch keine Bewertungen

- Excel Professional Services, Inc.: Discussion QuestionsDokument7 SeitenExcel Professional Services, Inc.: Discussion QuestionskæsiiiNoch keine Bewertungen

- IAT 2020 Final Preboard (Source SimEx4 RS)Dokument15 SeitenIAT 2020 Final Preboard (Source SimEx4 RS)Mary Yvonne AresNoch keine Bewertungen

- Responsibility Accounting, Segment Reporting, and Common Cost AllocationDokument7 SeitenResponsibility Accounting, Segment Reporting, and Common Cost AllocationGilbert TiongNoch keine Bewertungen

- ReceivablesDokument16 SeitenReceivablesJanela Venice SantosNoch keine Bewertungen

- Auditing Multiple ChoicesDokument8 SeitenAuditing Multiple ChoicesyzaNoch keine Bewertungen

- Chapter 7 Audit Planning: Assessment of Control RiskDokument21 SeitenChapter 7 Audit Planning: Assessment of Control RiskLalaine JadeNoch keine Bewertungen

- First PreboardDokument5 SeitenFirst PreboardRodmae VersonNoch keine Bewertungen

- Quiz On Audit SamplingDokument5 SeitenQuiz On Audit SamplingTrisha Mae AlburoNoch keine Bewertungen

- Auditing TheoryDokument13 SeitenAuditing TheoryRaven GarciaNoch keine Bewertungen

- Fraud Error Non-Compliance and Legal Liability Final1 PDFDokument7 SeitenFraud Error Non-Compliance and Legal Liability Final1 PDFJa NilNoch keine Bewertungen

- AUD Final Preboard Examination QuestionnaireDokument16 SeitenAUD Final Preboard Examination QuestionnaireJoris YapNoch keine Bewertungen

- Questionnaires Aud Theory FinalDokument18 SeitenQuestionnaires Aud Theory FinalRandy PaderesNoch keine Bewertungen

- Seatwork#1Dokument14 SeitenSeatwork#1Tricia Mae FernandezNoch keine Bewertungen

- Chapter 13 Audit of The Acquisition and Payment Cycle: Auditing, 14e (Arens)Dokument23 SeitenChapter 13 Audit of The Acquisition and Payment Cycle: Auditing, 14e (Arens)Agnes TumandukNoch keine Bewertungen

- IS Auditing Quizzer 2020 Version PDFDokument13 SeitenIS Auditing Quizzer 2020 Version PDFPhoeza Espinosa VillanuevaNoch keine Bewertungen

- Auditing Draft PDFDokument17 SeitenAuditing Draft PDFJerry PinongpongNoch keine Bewertungen

- Toa - 2011Dokument7 SeitenToa - 2011EugeneDumalagNoch keine Bewertungen

- CHAPTER 5 Auditing-Theory-MCQs-by-Salosagcol-with-answersDokument2 SeitenCHAPTER 5 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNoch keine Bewertungen

- Auditing Theory Test BankDokument26 SeitenAuditing Theory Test Bankdfgmlk dsdwNoch keine Bewertungen

- Practice Final PB AuditingDokument14 SeitenPractice Final PB AuditingBenedict BoacNoch keine Bewertungen

- Quiz 1 AuditingDokument1 SeiteQuiz 1 AuditingSashaNoch keine Bewertungen

- AT.2821 - Professional Standards Quality Control and Legal Liabilities PDFDokument6 SeitenAT.2821 - Professional Standards Quality Control and Legal Liabilities PDFMaeNoch keine Bewertungen

- ReportsDokument5 SeitenReportsLeanne FaustinoNoch keine Bewertungen

- Ilovepdf MergedDokument688 SeitenIlovepdf MergedSpade XNoch keine Bewertungen

- 16 Aren Aud14c TBDokument22 Seiten16 Aren Aud14c TBSONITANoch keine Bewertungen

- 28Dokument9 Seiten28jhouvanNoch keine Bewertungen

- QUIZ 2 Airline IndustryDokument4 SeitenQUIZ 2 Airline IndustrySia DLSLNoch keine Bewertungen

- Test Bank - 02012021Dokument13 SeitenTest Bank - 02012021Charisse AbordoNoch keine Bewertungen

- Preweek Auditing Theory 2014Dokument31 SeitenPreweek Auditing Theory 2014Charry Ramos33% (3)

- Philippine Accountancy Act of 2004Dokument6 SeitenPhilippine Accountancy Act of 2004jeromyNoch keine Bewertungen

- Logo Here Auditing Theory Philippine Accountancy Act of 2004Dokument35 SeitenLogo Here Auditing Theory Philippine Accountancy Act of 2004KathleenCusipagNoch keine Bewertungen

- Assertions Audit Objectives Audit Procedures: Audit of Intangible AssetsDokument12 SeitenAssertions Audit Objectives Audit Procedures: Audit of Intangible AssetsUn knownNoch keine Bewertungen

- V. Preliminary Engagement ActivitiesDokument8 SeitenV. Preliminary Engagement ActivitiesKrizza Mae100% (1)

- 002 SHORT QUIZ - Code of Ethics - ACTG411 Assurance Principles, Professional Ethics & Good GovDokument1 Seite002 SHORT QUIZ - Code of Ethics - ACTG411 Assurance Principles, Professional Ethics & Good GovMarilou PanisalesNoch keine Bewertungen

- VIII. Consideration of Internal ControlDokument15 SeitenVIII. Consideration of Internal ControlKrizza MaeNoch keine Bewertungen

- Cpa Review School of The Philippines: ManilaDokument24 SeitenCpa Review School of The Philippines: ManilaRalph Joshua JavierNoch keine Bewertungen

- AT Quizzer 2 - Profl Practice of AcctgDokument12 SeitenAT Quizzer 2 - Profl Practice of AcctgJimmyChaoNoch keine Bewertungen

- Session 3 AUDITING AND ASSURANCE PRINCIPLESDokument29 SeitenSession 3 AUDITING AND ASSURANCE PRINCIPLESagent2100Noch keine Bewertungen

- Lspu - Audit Final ExamDokument10 SeitenLspu - Audit Final ExamJamie Rose AragonesNoch keine Bewertungen

- Excel Professional Services, Inc.: Discussion QuestionsDokument5 SeitenExcel Professional Services, Inc.: Discussion QuestionskæsiiiNoch keine Bewertungen

- 1st Eval Auditing TheoryDokument9 Seiten1st Eval Auditing TheoryTong WilsonNoch keine Bewertungen

- Reviewer For Auditing TheoryDokument10 SeitenReviewer For Auditing TheoryMharNellBantasanNoch keine Bewertungen

- AT Quizzer 2 - Profl Practice of Acctg - Summer 2020 PDFDokument12 SeitenAT Quizzer 2 - Profl Practice of Acctg - Summer 2020 PDFJohn Carlo CruzNoch keine Bewertungen

- Quiz On Audit Engagement and PlanningDokument7 SeitenQuiz On Audit Engagement and PlanningAdam SmithNoch keine Bewertungen

- Auditing Theory Pre WeekDokument35 SeitenAuditing Theory Pre WeekICPA ReviewNoch keine Bewertungen

- Acctg QuizDokument15 SeitenAcctg QuizMadi KomoaNoch keine Bewertungen

- Seatwork Answer KeyDokument6 SeitenSeatwork Answer KeyKathreen Aya Exconde100% (1)

- Audit Testbank PDFDokument76 SeitenAudit Testbank PDFEdison L. ChuNoch keine Bewertungen

- CRC Aud RevDokument13 SeitenCRC Aud Revpwcpresident.nfjpia2324Noch keine Bewertungen

- College of Accountancy Final Examination Acctg 204B Instruction: Multiple ChoiceDokument8 SeitenCollege of Accountancy Final Examination Acctg 204B Instruction: Multiple ChoiceCarmela TolinganNoch keine Bewertungen

- Audit Buddy Compiler - Prof. Hemangi MamDokument115 SeitenAudit Buddy Compiler - Prof. Hemangi Mamrupesh singhNoch keine Bewertungen

- Auditing - Final ExaminationDokument7 SeitenAuditing - Final ExaminationFrancis MateosNoch keine Bewertungen

- Psa 315Dokument5 SeitenPsa 315kris mNoch keine Bewertungen

- Ocean ManufacturingDokument5 SeitenOcean ManufacturingАриунбаясгалан НоминтуулNoch keine Bewertungen

- Chapter 12 070804Dokument13 SeitenChapter 12 070804Shahid Nasir MalikNoch keine Bewertungen

- Data Collection Template For Af210 AssignmentDokument31 SeitenData Collection Template For Af210 AssignmentSelvindra Naidu100% (1)

- Ireneo Chapter 10 Ver 2020Dokument82 SeitenIreneo Chapter 10 Ver 2020shanNoch keine Bewertungen

- Declaration COADokument5 SeitenDeclaration COAcedieNoch keine Bewertungen

- An Accounting Associate Sets Up A New Employee in The Payroll System and Directs The Checks To Be Sent To A Post Office BoxDokument37 SeitenAn Accounting Associate Sets Up A New Employee in The Payroll System and Directs The Checks To Be Sent To A Post Office BoxPankaj MahantaNoch keine Bewertungen

- Interim and Final Audit ProceduresDokument10 SeitenInterim and Final Audit ProceduresClyton MusipaNoch keine Bewertungen

- Ulster County Industrial Development Agency - March 14, 2012 MinutesDokument8 SeitenUlster County Industrial Development Agency - March 14, 2012 MinutesNewPaltzCurrentNoch keine Bewertungen

- Assignment Auditing in Ethiopia ModifiedDokument12 SeitenAssignment Auditing in Ethiopia ModifiedWondaferewChalaNoch keine Bewertungen

- Chapter 09 QuestionsDokument12 SeitenChapter 09 QuestionsPhương NguyễnNoch keine Bewertungen

- Auditing Harold) PDFDokument251 SeitenAuditing Harold) PDFSuada Bőw Wéěžý100% (1)

- 2021 Annual Activity ReportDokument44 Seiten2021 Annual Activity Reportمحمد الشريفي mohammed alshareefiNoch keine Bewertungen

- CFO Chief Financial Officer in Spokane WA Resume Kevin WilliamsDokument2 SeitenCFO Chief Financial Officer in Spokane WA Resume Kevin WilliamsKevinWilliams2Noch keine Bewertungen

- AUD Flashcards Flashcards - QuizletDokument16 SeitenAUD Flashcards Flashcards - QuizletDieter LudwigNoch keine Bewertungen

- Summary of Standards of Auditing (SA) Issued by Institute of Chartered Accountants of IndiaDokument43 SeitenSummary of Standards of Auditing (SA) Issued by Institute of Chartered Accountants of IndiaParthasarathi MishraNoch keine Bewertungen

- Auditing and Assurance Strathmore University Notes and Revision KitDokument287 SeitenAuditing and Assurance Strathmore University Notes and Revision KitAx NgNoch keine Bewertungen

- The Certification Service Providers' Accreditation Regulations, 2008 UpdatedDokument45 SeitenThe Certification Service Providers' Accreditation Regulations, 2008 UpdatedFaiz HasanNoch keine Bewertungen

- Audit Report - QuestionnaireDokument11 SeitenAudit Report - QuestionnaireZhykiie MackNoch keine Bewertungen

- Full Text Cases A-CDokument320 SeitenFull Text Cases A-CRowela DescallarNoch keine Bewertungen

- Jurnal Audit Report LagDokument14 SeitenJurnal Audit Report LagDaniswara HerlanggaNoch keine Bewertungen

- Paper f8 Mnemonics Sample Download v1Dokument72 SeitenPaper f8 Mnemonics Sample Download v1pacorex1004355Noch keine Bewertungen

- PSA 500 (Revised) Audit Evidence (Revised)Dokument14 SeitenPSA 500 (Revised) Audit Evidence (Revised)CassieNoch keine Bewertungen

- Week 4: Other Public Accounting Services and Reports ACCT 322Dokument24 SeitenWeek 4: Other Public Accounting Services and Reports ACCT 322Dhruvi MaiyaniNoch keine Bewertungen

- Forensic Audit: Findings Report: Prime Insurance Corporation of IndiaDokument10 SeitenForensic Audit: Findings Report: Prime Insurance Corporation of IndiaabhiramNoch keine Bewertungen

- Factors Influencing Professional Judgment of AuditDokument9 SeitenFactors Influencing Professional Judgment of AuditDesak MyaNoch keine Bewertungen

- A Brief History of Auditing: Prior To 1840Dokument2 SeitenA Brief History of Auditing: Prior To 1840ken auvaNoch keine Bewertungen