Beruflich Dokumente

Kultur Dokumente

Major Assignment

Hochgeladen von

kasmshahabCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Major Assignment

Hochgeladen von

kasmshahabCopyright:

Verfügbare Formate

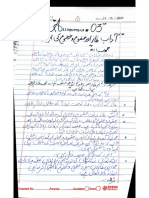

Major Assignment

10 marks (Part 1 and Part 2)

Viva

10 marks (Part 1 and Part 2)

PART 1:

1. Collect consecutive six months spot and future share prices data of the assigned companies

2. Find the hedge ratio between spot and future prices

3. Assume that you have a long position of 3000 shares in the assigned company, then find the number of

future contracts (N) to hedge your position

4. Tell whether short-selling or taking a long-position will hedge your existing position

5. Calculate profit or loss right after the six months period (the period which you have used for

calculating the hedge ratio)

6. Tell whether your position is fully hedged or not based on the findings in step 5

Name

Companies

Sayeda Tayyaba Shah

PPL

Adil Raza

SNGP

Irfan Ullah

PIOC

Palwasha Jamshed

OGDC

Sundus Sheraz

FATIMA

Mian Umar Sohail

ATRL

Mohammad Nabi

DAWH

Fazlullah

NCL

Arshid Ali

FFC

Asim Ullah

FFBL

Sayed Fayez Khan

UBL

Hameeda

BAFL

Helina

AHCL

Amanat Khan

FCCL

Zarnageen Naseer

DGKC

Kashmala Mukhtiar

EFOODS

Ali Mohsin Jadoon

MCB

Faizan Pervaiz

NBP

Muhammad Ilyas

SSGC

Muhammad Hassnain

AICL

Imrann Ullah

PSO

Rahim u Din Khan

Any (other than above)

Abdul Basit Irfan

Any (other than above)

PART 2:

Search and provide the answers of the followings:

1. Highlight different aspects of future contracts on KSE, such as their rules, eligible scripts, settlement process,

short-selling, margin requirements, etc.

2. Pakistan Mercantile Exchange Ltd., what it is, which commodities are traded on it, how to trade on it, its rules for

trading and settlement, who is eligible to trade on it, etc.

3. Is risk management practiced in Islamic financial institutions (IFI)? What is the State Bank of Pakistan guidelines

for risk management in IFI?

4. What is Basel Accord? What are its three main pillars?

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Sources of Business FinanceDokument26 SeitenSources of Business FinancePrashanthChauhanNoch keine Bewertungen

- Uw eMBA Wikibook-Managerial-Accounting PDFDokument103 SeitenUw eMBA Wikibook-Managerial-Accounting PDFEswari Gk100% (1)

- Research Methodology Full Notes PDFDokument87 SeitenResearch Methodology Full Notes PDFwgl.joshi100% (17)

- Sources of Innovations With ExamplesDokument5 SeitenSources of Innovations With ExampleskasmshahabNoch keine Bewertungen

- 6 - Research Strategies ShortDokument30 Seiten6 - Research Strategies ShortJaved IqbalNoch keine Bewertungen

- Writing and Presenting Your Project ReportDokument56 SeitenWriting and Presenting Your Project ReportkasmshahabNoch keine Bewertungen

- Research Service QualityDokument64 SeitenResearch Service QualitykasmshahabNoch keine Bewertungen

- ABSTRACTDokument1 SeiteABSTRACTkasmshahabNoch keine Bewertungen

- Impact of Women Support Program To Empower: A Case Study of Dist. Charsadda of Khyber PakhtunkhwaDokument46 SeitenImpact of Women Support Program To Empower: A Case Study of Dist. Charsadda of Khyber PakhtunkhwakasmshahabNoch keine Bewertungen

- 2019 Global and Regional Trends For Corporate GovernanceDokument12 Seiten2019 Global and Regional Trends For Corporate GovernancekasmshahabNoch keine Bewertungen

- Writing and Presenting Your Project ReportDokument18 SeitenWriting and Presenting Your Project ReportseescriNoch keine Bewertungen

- Chapter IvDokument34 SeitenChapter IvkasmshahabNoch keine Bewertungen

- Introdution: 1.1 Background of The StudyDokument52 SeitenIntrodution: 1.1 Background of The StudykasmshahabNoch keine Bewertungen

- Paper 5Dokument23 SeitenPaper 5kasmshahabNoch keine Bewertungen

- District Charsadda (Male) : District Name School CodesDokument2 SeitenDistrict Charsadda (Male) : District Name School CodeskasmshahabNoch keine Bewertungen

- Impact of Job Stress On Teachers Performance at Secondary Level in District PeshawarDokument2 SeitenImpact of Job Stress On Teachers Performance at Secondary Level in District PeshawarkasmshahabNoch keine Bewertungen

- List of Sample SchoolDokument1 SeiteList of Sample SchoolkasmshahabNoch keine Bewertungen

- Paper 3Dokument13 SeitenPaper 3kasmshahabNoch keine Bewertungen

- Paper 4Dokument13 SeitenPaper 4kasmshahabNoch keine Bewertungen

- English GrammarCompostion by Mureed Hussain JasraDokument234 SeitenEnglish GrammarCompostion by Mureed Hussain JasraGhulam Abbas67% (3)

- English GrammarCompostion by Mureed Hussain JasraDokument234 SeitenEnglish GrammarCompostion by Mureed Hussain JasraGhulam Abbas67% (3)

- Aina Islami Tahzeeb o TamaddanDokument723 SeitenAina Islami Tahzeeb o TamaddankasmshahabNoch keine Bewertungen

- Promoters Guide Formation and Incorporation of Companies Under Pakistan Companies Oridinance 1984Dokument17 SeitenPromoters Guide Formation and Incorporation of Companies Under Pakistan Companies Oridinance 1984ReaderNoch keine Bewertungen

- McqsDokument204 SeitenMcqskasmshahabNoch keine Bewertungen

- More Than 2000 Solved Mcqs On Research MethodsDokument130 SeitenMore Than 2000 Solved Mcqs On Research MethodskasmshahabNoch keine Bewertungen

- Assignment 05Dokument9 SeitenAssignment 05kasmshahabNoch keine Bewertungen

- Css Pms Islamiat Notes in Urdu Complete PDFDokument53 SeitenCss Pms Islamiat Notes in Urdu Complete PDFAhmed HassanNoch keine Bewertungen

- Background of The Study: 1.2 Problem StatementDokument10 SeitenBackground of The Study: 1.2 Problem StatementkasmshahabNoch keine Bewertungen

- Assignment 3Dokument7 SeitenAssignment 3kasmshahabNoch keine Bewertungen

- Revised Thesis Data Hasham SaibDokument39 SeitenRevised Thesis Data Hasham SaibkasmshahabNoch keine Bewertungen