Beruflich Dokumente

Kultur Dokumente

What Is Cost of Equity of TATA POWER Company Limited?

Hochgeladen von

YbrantSachin0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten6 Seitentata power cost of capital

Originaltitel

Tata Power

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldentata power cost of capital

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten6 SeitenWhat Is Cost of Equity of TATA POWER Company Limited?

Hochgeladen von

YbrantSachintata power cost of capital

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 6

What is Cost of Equity of TATA POWER Company

Limited?

Cost of Equity = Rf + (Rm-Rf)

Rf = Risk free return

Rm = Market return

= beta

Risk-free rate of return

Beta

Market rate of return

Cost of Equity

7.728

1.53

11.97

14.2183

The cost of equity is the rate of return required by the

company's ordinary shareholders in order for that investor to

bear the risk of holding that company's shares. The return

consists both of dividend and capital gains

Cost of equity of TATA POWER Company LTD is

14.2183 which represents the compensation that the market

demands in exchange for owning the asset and bearing the

risk of ownership.

What is Cost of Debt of TATA POWER Company

Limited?

Cost of Debt= Nominal rate*(1- corporate tax rate)

Nominal Rate

Corporate tax rate= (Tax/PBT)*100

Nominal rate

16.65

corporate tax rate

0.308

Cost of Debt

11.5218

The effective rate that a company pays on its current debt.

Company will use various bonds, loans and other forms of

debt, so this measure is useful for giving an idea as to the

overall rate being paid by the company to use debt

financing.

Cost of Debt of TATA POWER Company LTD is 11.5218

which also give investors an idea as to the riskiness of the

company compared to others, because riskier companies

generally have a higher cost of debt.

What is the equity value per share?

How does it compare with that of Historical market value

of share?

Equity value per share= shares holder fund/ no. of equity share

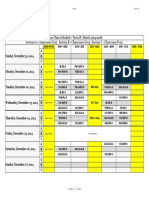

Year shareholder fund(in crs) no. of equity share Equity value

2011

11,239.99

23.73crs

473.647

2012

11,821.01

237.30crs

49.813

2013

12,260.85

237.30crs

51.666

2014

13,127.36

237.30crs

55.317

Market value per share

Year

Market value of share

2011

133.75

2012

131.78

2013

84.2

2014

106.49

TATA POWER

500

0

2011

2012

2013

2014

Equity value per share

Market value per share

Das könnte Ihnen auch gefallen

- AOL.com (Review and Analysis of Swisher's Book)Von EverandAOL.com (Review and Analysis of Swisher's Book)Noch keine Bewertungen

- Microeconomics ProjectDokument5 SeitenMicroeconomics ProjectRakesh ChoudharyNoch keine Bewertungen

- Marketing Assignment WRIT 1 PDFDokument11 SeitenMarketing Assignment WRIT 1 PDFAlolika Dutta RoyNoch keine Bewertungen

- India's Traditional Costumes and Emerging Fashion TrendsDokument12 SeitenIndia's Traditional Costumes and Emerging Fashion TrendsUday AaronNoch keine Bewertungen

- ZEEL Strategy Group5 SecF V 4.0Dokument17 SeitenZEEL Strategy Group5 SecF V 4.0VinodhKumarNoch keine Bewertungen

- Jindal Steel ReportDokument19 SeitenJindal Steel ReportAshish AroraNoch keine Bewertungen

- WACC TemplateDokument13 SeitenWACC TemplateAsad AminNoch keine Bewertungen

- Mahindra Global StrategyDokument11 SeitenMahindra Global StrategyShivendra SinghNoch keine Bewertungen

- Group1 Keda's SAP ImplementationDokument6 SeitenGroup1 Keda's SAP ImplementationSiddharth BalekarNoch keine Bewertungen

- IBM Strategic Analysis Highlights Key FactorsDokument22 SeitenIBM Strategic Analysis Highlights Key FactorsAnilchaurasiyaNoch keine Bewertungen

- Ambuja CementDokument20 SeitenAmbuja CementArvindYadavNoch keine Bewertungen

- Econ 100 Assignment Analyzes Philippines Rice MarketDokument11 SeitenEcon 100 Assignment Analyzes Philippines Rice MarketKemas Ridho Aditya100% (1)

- Strategic Management, Jindal SteelDokument12 SeitenStrategic Management, Jindal Steellino67% (3)

- Group Discussion - Case StudyDokument2 SeitenGroup Discussion - Case Studysamar sarky100% (1)

- Strategic Decision Making Methods ComparisonDokument7 SeitenStrategic Decision Making Methods ComparisonMattheus BiondiNoch keine Bewertungen

- Optimal Product Mix Linear Programming Apparel IndustryDokument8 SeitenOptimal Product Mix Linear Programming Apparel IndustrySmriti GoelNoch keine Bewertungen

- Managerial Communication ResearchDokument13 SeitenManagerial Communication ResearchViral PatelNoch keine Bewertungen

- Instructor Manual Flying Too Low Air India 2009 & BeyondDokument7 SeitenInstructor Manual Flying Too Low Air India 2009 & BeyondArunkumarNoch keine Bewertungen

- TATA MOTORS Atif PDFDokument9 SeitenTATA MOTORS Atif PDFAtif Raza AkbarNoch keine Bewertungen

- FM Project Report On Zee EntertainmentDokument9 SeitenFM Project Report On Zee EntertainmentKumar RohitNoch keine Bewertungen

- GEP Gameplan 2022 BschoolDokument16 SeitenGEP Gameplan 2022 BschoolDiva SharmaNoch keine Bewertungen

- Managerial Economics AssignmentDokument4 SeitenManagerial Economics Assignmentharsha_295725251Noch keine Bewertungen

- Data Warehousing and Multi-Dimensional Modelling CaseDokument4 SeitenData Warehousing and Multi-Dimensional Modelling CaseAcademic BunnyNoch keine Bewertungen

- Micro Environmental Factors' Influence On The International Marketing StrategyDokument67 SeitenMicro Environmental Factors' Influence On The International Marketing StrategyLaeeq R MalikNoch keine Bewertungen

- Suzlon SolutionsDokument4 SeitenSuzlon SolutionsMahendra NutakkiNoch keine Bewertungen

- AHP for Car SelectionDokument41 SeitenAHP for Car SelectionNguyên BùiNoch keine Bewertungen

- SWOT analysis of Shopper's stop reveals strengths and weaknessesDokument8 SeitenSWOT analysis of Shopper's stop reveals strengths and weaknessessubham kunduNoch keine Bewertungen

- Value Chain Analysis of Tata MotorsDokument24 SeitenValue Chain Analysis of Tata MotorsNithesh PawarNoch keine Bewertungen

- Toyota's TPS and continuous performance improvementDokument5 SeitenToyota's TPS and continuous performance improvementMaitri BiswadharaNoch keine Bewertungen

- Tata Ace New Product Development ApproachesDokument8 SeitenTata Ace New Product Development ApproachesSaurabh SinghNoch keine Bewertungen

- Grasim ReportDokument44 SeitenGrasim ReportRahul PatilNoch keine Bewertungen

- Macro Economics Project Report - Group 7.Dokument30 SeitenMacro Economics Project Report - Group 7.Mayank Misra50% (2)

- Spicejet Strategy AssignmentDokument28 SeitenSpicejet Strategy AssignmentsaurabhdrummerboyNoch keine Bewertungen

- Maruti Suzuki's Way of LifeDokument11 SeitenMaruti Suzuki's Way of LifeAnushriNoch keine Bewertungen

- Case-Analyses Presentation "House of Tata: Acquiring A Global Footprint"Dokument36 SeitenCase-Analyses Presentation "House of Tata: Acquiring A Global Footprint"Mohit ManaktalaNoch keine Bewertungen

- Assignment 6 - Group 3 - Section EDokument6 SeitenAssignment 6 - Group 3 - Section ESHUBHAM PRASADNoch keine Bewertungen

- C3-Jay Bharat Spices PVT LTDDokument11 SeitenC3-Jay Bharat Spices PVT LTDBobbyNoch keine Bewertungen

- Group 3 LlirDokument5 SeitenGroup 3 LlirSwadhin NarayanNoch keine Bewertungen

- HDFC Standard Life - BUY (Differentiated Franchise) 20180101 PDFDokument68 SeitenHDFC Standard Life - BUY (Differentiated Franchise) 20180101 PDFAmit Kumar AgrawalNoch keine Bewertungen

- Project Report: "Working Capital Management of Tata Motors"Dokument52 SeitenProject Report: "Working Capital Management of Tata Motors"amitNoch keine Bewertungen

- Rise to renewable challengeDokument8 SeitenRise to renewable challengeNavya AgrawalNoch keine Bewertungen

- India - Market Entry SolutionsDokument55 SeitenIndia - Market Entry SolutionsAugustine ChalisseryNoch keine Bewertungen

- Case Millennium TSS J v1Dokument6 SeitenCase Millennium TSS J v1killer drama100% (1)

- Microeconomics Project 1Dokument7 SeitenMicroeconomics Project 1Rakesh ChoudharyNoch keine Bewertungen

- Royal Dutch Shell - Group 5Dokument14 SeitenRoyal Dutch Shell - Group 5Vankodoth AvinashNoch keine Bewertungen

- How Nano Was Built - Target Costing Case StudyDokument5 SeitenHow Nano Was Built - Target Costing Case Studydaveashish85Noch keine Bewertungen

- FinalDokument40 SeitenFinalRaman ManchandaNoch keine Bewertungen

- Chapter 8 Long Lived Assets - SolutionsDokument102 SeitenChapter 8 Long Lived Assets - SolutionsKate SandersNoch keine Bewertungen

- Spring21 - MGST 453 L01 - Part A - N. Cohen - v3Dokument9 SeitenSpring21 - MGST 453 L01 - Part A - N. Cohen - v3Kimmy SoaresNoch keine Bewertungen

- Process Selection and Design OptimizationDokument34 SeitenProcess Selection and Design OptimizationAlex Francis0% (1)

- Business Stratergy of Top Indian It CompanyDokument9 SeitenBusiness Stratergy of Top Indian It CompanySandeep MohantyNoch keine Bewertungen

- Corporate Social Responsibility 2Dokument21 SeitenCorporate Social Responsibility 2kumawat.payal076Noch keine Bewertungen

- Success MeasuresDokument4 SeitenSuccess MeasuresRachel YoungNoch keine Bewertungen

- IntroductionDokument18 SeitenIntroductionprasanthNoch keine Bewertungen

- Project Management-1006Dokument18 SeitenProject Management-1006api-3776226Noch keine Bewertungen

- Case Study Safaricom Limited PDFDokument5 SeitenCase Study Safaricom Limited PDFDeseree LopezNoch keine Bewertungen

- Cost of CapitalDokument23 SeitenCost of CapitalnigemahamatiNoch keine Bewertungen

- Cost of Capital Mahindra - Sohanji - FinalDokument21 SeitenCost of Capital Mahindra - Sohanji - FinalJaiprakash PandeyNoch keine Bewertungen

- Cost of Capital 2022Dokument12 SeitenCost of Capital 2022hitisha agrawalNoch keine Bewertungen

- Cost of Capital: VALMET530Dokument34 SeitenCost of Capital: VALMET530Khim Ziah Velarde BarzanasNoch keine Bewertungen

- Selco Group4Dokument5 SeitenSelco Group4YbrantSachinNoch keine Bewertungen

- TCS Kalpesh VasvaniDokument3 SeitenTCS Kalpesh VasvaniYbrantSachinNoch keine Bewertungen

- Customer Satisfaction, Cash Flow, and Shareholder Value: Journal of Marketing August 2005Dokument18 SeitenCustomer Satisfaction, Cash Flow, and Shareholder Value: Journal of Marketing August 2005YbrantSachinNoch keine Bewertungen

- Overview of Russian EconomyDokument5 SeitenOverview of Russian EconomyYbrantSachinNoch keine Bewertungen

- Infosys Techn VeniDokument3 SeitenInfosys Techn VeniYbrantSachinNoch keine Bewertungen

- BhimsenDokument374 SeitenBhimsenPrem Panicker50% (8)

- Analysis of RatiosDokument4 SeitenAnalysis of RatiosYbrantSachinNoch keine Bewertungen

- Name: Pratik Shah (FIN & MKT)Dokument4 SeitenName: Pratik Shah (FIN & MKT)YbrantSachinNoch keine Bewertungen

- PBoI's Digital Banking Innovation RoadmapDokument14 SeitenPBoI's Digital Banking Innovation RoadmapHarjas BakshiNoch keine Bewertungen

- NoteDokument1 SeiteNoteYbrantSachinNoch keine Bewertungen

- 2015 Budget Speech Full TextDokument43 Seiten2015 Budget Speech Full TextYbrantSachinNoch keine Bewertungen

- 0.63433000 1431521300 Investor Presentation Fortis Investor Day April6 2015Dokument49 Seiten0.63433000 1431521300 Investor Presentation Fortis Investor Day April6 2015YbrantSachinNoch keine Bewertungen

- Logistics Supply Challenges HospitalsDokument10 SeitenLogistics Supply Challenges HospitalsYbrantSachinNoch keine Bewertungen

- Covariance, Correlation, Beta, Expost, and ExanteDokument6 SeitenCovariance, Correlation, Beta, Expost, and ExanteYbrantSachinNoch keine Bewertungen

- What Is Cost of Equity of TATA POWER Company Limited?Dokument6 SeitenWhat Is Cost of Equity of TATA POWER Company Limited?YbrantSachinNoch keine Bewertungen

- Case Analysis: Ford Motor Company - Supply Chain StrategyDokument7 SeitenCase Analysis: Ford Motor Company - Supply Chain StrategyYbrantSachinNoch keine Bewertungen

- DMO Case Presentation Group-B10Dokument13 SeitenDMO Case Presentation Group-B10YbrantSachinNoch keine Bewertungen

- SugarcaneDokument20 SeitenSugarcaneYbrantSachinNoch keine Bewertungen

- Brand Management by S Radhakrishnan (BRM)Dokument3 SeitenBrand Management by S Radhakrishnan (BRM)YbrantSachinNoch keine Bewertungen

- Discipline and GrievanceDokument18 SeitenDiscipline and GrievanceYbrantSachinNoch keine Bewertungen

- KsDokument12 SeitenKsYbrantSachinNoch keine Bewertungen

- Trade Unions AND Employers' AssociationsDokument9 SeitenTrade Unions AND Employers' AssociationsYbrantSachinNoch keine Bewertungen

- Discipline and GrievanceDokument18 SeitenDiscipline and GrievanceYbrantSachinNoch keine Bewertungen

- I Year Class Schedule - Term II - Batch 2014-2016 Section A - Classroom G-03 Section B - Classroom G-04 Section C - Classroom F-04Dokument3 SeitenI Year Class Schedule - Term II - Batch 2014-2016 Section A - Classroom G-03 Section B - Classroom G-04 Section C - Classroom F-04YbrantSachinNoch keine Bewertungen

- Information Technology: Key ConceptsDokument21 SeitenInformation Technology: Key ConceptsYbrantSachinNoch keine Bewertungen

- Resume TemplateDokument3 SeitenResume TemplateYbrantSachinNoch keine Bewertungen

- KsDokument12 SeitenKsYbrantSachinNoch keine Bewertungen

- Sudan: Political FactorsDokument6 SeitenSudan: Political FactorsYbrantSachinNoch keine Bewertungen

- Quality, Manufacturing Strategy, and Global Competition: An Empirical AnalysisDokument17 SeitenQuality, Manufacturing Strategy, and Global Competition: An Empirical AnalysisYbrantSachinNoch keine Bewertungen