Beruflich Dokumente

Kultur Dokumente

Deca Prospectus - Final

Hochgeladen von

api-283696436Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Deca Prospectus - Final

Hochgeladen von

api-283696436Copyright:

Verfügbare Formate

Ontrac Financial Consulting, LLC

FINANCIAL STATEMENT ANALYSIS

William Douglas, Thomas Dixon, & Jessy Robinson

Brent Andrus, Advisor

February 21st, 2014

Ontrac Financial Consulting, LLC

Table of Contents

Executive Summary.................................................................................................... 3

Horizontal Analysis..................................................................................................... 4

Revenues...........................................................................................

Gross Profit.........................................................................................

Net Income.........................................................................................

Income from Continuing Operations..................................................

Net Cash from Continuing Operations................................................

Total Assets........................................................................................

Vertical Analysis......................................................................................................... 6

Income Statement Analysis...........................................................................6

Product Cost Control..........................................................................

Operational Cost Control....................................................................

Debt Payment....................................................................................

Tax Burden.........................................................................................

Net Income.........................................................................................

Balance Sheet................................................................................................ 8

Current Assets....................................................................................

Property, Plant, and Equipment.........................................................

All Other Assets..................................................................................

Current Liabilities...............................................................................

Total Liabilities...................................................................................

Total Stockholders Equity................................................................

Ratio Analysis........................................................................................................... 10

Liquidity Ratio..................................................................................

Efficiency Ratio................................................................................

Solvency Ratio.................................................................................

Profitability Ratio..............................................................................

Valuation Ratio.................................................................................

Conclusions and Recommendations.........................................................................14

Public Perception...................................................................................................... 15

Appendix A: Horizontal Analysis

Appendix B: Vertical Analysis - Income Statement

Appendix C: Vertical Analysis - Balance Sheet

Appendix D: Ratio Analysis - Hasbro

Appendix E: Ratio Analysis - Mattel

Appendix F: Analyst Recommendations

Appendix G: Stock Performance

Appendix H: References

2 | Page

Ontrac Financial Consulting, LLC

Executive Summary

Hasbro, Inc. (Hasbro) and Mattel, Inc. (Mattel) are involved in the Toys

and Games Industry. The Mattel family is comprised of such best-selling brands as

Barbie, Hot Wheels, Monster High, American Girl, Thomas & Friends, Fisher-Price

brands, including, Little People, Power Wheels, as well as a wide array of

entertainment-inspired toy lines. Hasbro is well known for Transformers, Monopoly,

Play-Doh, My Little Pony, Magic: The Gathering, Nerf and Littlest Pet Shop. They also

spend time and money in television programming, motion pictures, digital gaming

and a comprehensive licensing program.

Hasbro

Mattel

Official Corporate Name

Hasbro, Inc.

Mattel, Inc.

Corporate Headquarters

Pawtucket, Rhode Island, US

Main Outsource Country

China

Year of Incorporation

1923 (as Hassenfeld

Brothers) & 1968 (as Hasbro)

El Segundo,

California, US

China

1945

Company Homepage

Hasbro.com

Mattel.com

Stock Symbol

HAS

MAT

Fiscal Year End

December 30, 2012

December 31, 2012

10-K Filing Date

February 27, 2012

February 26, 2012

Independent Auditor

KPMG, LLP

Primary Products/Services

Toys, Games, Media, and

Entertainment

Pricewaterhouse,

LLP

Toys and Games

Hasbros reliance on licensed and marketed properties put it in a precarious place,

with sales figures that go up and down rapidly. While there is some steadiness in

the form of its game line, over the past couple of years, Hasbro has seen a drop in

3 | Page

Ontrac Financial Consulting, LLC

sales as tastes change, and their licensed properties fade away over time.

Furthermore, Hasbro has been engaging in cutting costs, including reducing the

work force. On a positive note, Hasbro has been controlling their debt well.

Mattel, on the other hand, has been relying more on their familiar properties.

While it is a risk in the highly volatile toy market, it has allowed Mattel to grow more

steadily than Hasbro. As a result, they have seen greater profits than Hasbro by

increasing efficiency as opposed to reducing headcount. In terms of raw dollars

Mattel has far more debt than Hasbro, though in terms of a percentage of assets,

Mattel is in a stronger position.

Horizontal Analysis

Revenues

Between 2010 and 2011 Hasbros revenue grew by about 7% then fell by

roughly 5% between 2011 and 2012. Hasbro has a strong reliance on licenses and

media advertising to sell their brands, and thus, are subject to large fluctuations of

sales from year to year. In 2011, sales from their Marvel line, Magic: The Gathering,

Battleship, and Twister were up, but they were offset by decreased revenue from

other brands. Of note, their girl products were up 7% due to the introduction of

Furby and One Direction brands, as well as increased revenue from My Little Pony.

Mattel increased their revenue by 7% from 2010 to 2011, and then by about 2%

from 2011 to 2012. This was fueled primarily by increased sales of Monster High

and Fisher-Price Friends. It was offset by lower sales of their CARS 2 and Barbie

products. All other brands remained primarily flat.

4 | Page

Ontrac Financial Consulting, LLC

Gross Profit

Hasbros gross profit increased by 6% from 2010 to 2011, but then fell by 1%

from 2011 to 2012. There has been a focus to increase cost controls for the cost of

goods. First, there were costs for laying off employees in an effort to reduce

headcount, and there is a cost savings initiative ongoing to increase efficiency, and

the other reason for Hasbros decreased costs can be found in the lower inventory

obsolescence costs in 2012 as opposed to 2010 and 2011. However, none of the

above cost cutting measures could counter Hasbros decreased sales.

Mattels gross profit increased by 6% from 2010 to 2011, and 8% from 2011

to 2012. The prime reason is the continuing efforts by Mattel to decrease costs, but

Mattel also attributes the increasing gross profits to a favorable product mix,

manufacturing efficiencies, licensing, and price increases to offset higher input costs

and customer benefits.

Net Income

Hasbros net income fell by $49.3 million in 2012, added to the $12.4 million

decrease in 2011, mainly as a result of the decrease in sales. In contrast, Mattels

net income grew by $83.6 million in 2011, but only $8.0 million in 2012, despite the

high growth in Gross Profit. The main reason for the decrease in growth of net

income in 2011 is an increased effective tax rate of about 22% to 23%, depending

on jurisdiction, and an unfavorable foreign exchange rate.

Income from Continuing Operations

Hasbros income from continuing operations fell from a 1% gain in 2011 to a

7% loss in 2012, primarily caused by decreased sales. Mattel also fell from a 15%

5 | Page

Ontrac Financial Consulting, LLC

gain in 2011 to a 2% loss, primarily caused by relatively flat sales in 2012, and an

unfavorable foreign exchange rate.

Net Cash from Continuing Operations

Hasbros net cash increased $28.1 million in 2011, and by $138.7 million in

2012. In 2010, Hasbro increased their inventory by about $151.6 million, which was

then sold off in 2011 as receivables, which were then paid off in 2012. Mattel had a

similar story in that they increased their net cash by $136.7 million in 2011, and by

$610.9 million in 2012, accounting for a 92% increase in net cash provided by

operations. Similar to Hasbro, this can be found with an increase in accounts

receivable in 2010 and 2011, and were paid in 2012. Net cash also increased by tax

benefits in 2012, and deferred income taxes.

Total Assets

Hasbros total assets increased by 5% between 2010 and 2011, and this is

mainly due to Hasbro getting a new Gaming Center of Excellence which provided

a boost to the total assets. Mattels total assets increased by 4.6% in 2010 and by

15.1% in 2011. In 2011, Mattel acquired HIT Entertainment, which added to their

assets as well as to their costs.

Vertical Analysis

INCOME STATEMENT ANALYSIS

Product Cost Control

Both companies have a relatively high cost of sales, 41% for Hasbro and 47%

for Mattel, but it has been decreasing in recent years. For Hasbro, the cost of sales

6 | Page

Ontrac Financial Consulting, LLC

has been going down due to an increase of sales of Magic: The Gathering and other

game lines. The game lines have a higher contribution margin, and thus a lower

cost of sales compared to their toy lines. Mattels cost of sales was reduced from

49.6% to 46.8% through a reduction shipping costs and product production costs.

Mattel has been focusing on increasing efficiency through their Operational

Excellence 2.0 programs.

Operational Cost Control

Both companies have held fairly steady over the past two years in operating

expenses, with only about 1-2% variation year to year in each category. Mattel

maintains a lower operational cost at 37.1% of revenues compared to 45% of

revenue with Hasbro. This is due to Hasbro having a much higher royalty costs than

Mattel. With licensed toys, such as the Marvel line, doing substantially well which

increases the royalty costs. Mattel, on the other hand, has reported that a

significant driver of administrative expenses was the acquisition of HIT

Entertainment, including maintaining the administrative costs that were ongoing

during the acquisition.

Debt Payment

Interest payments for Hasbro were slightly higher in 2012, because of an extra week

in 2012, which was a 53-week year, and had an above average increase in shortterm borrowings. In March 2010, Hasbro took out a 500 million dollar long-term

debt with an interest rate of 6.35%, which was used to pay for the Hasbros

Gaming Center of Excellence building.

7 | Page

Ontrac Financial Consulting, LLC

Mattel issued 500 million dollars of senior notes in September 2010, and an

additional 600 million dollars of senior notes in November 2011, and these two

notes represented a large share of the interest expense. This was offset, however,

by 250 million dollars that matured in 2011, and there was lower than average

interest rates.

Tax Burden

Both companies incurred a similar tax burden between Hasbros 2.87% of

Revenues and Mattels 2.63% of Revenues, and both companies have been facing a

relatively high tax burden. This is due to the increasingly global nature of the toy

industry, and complying with tax laws of various jurisdictions. Of note, Hasbro is

facing litigation in Mexico over tax assessments for taxes due in 2000-2005 and

2007. However, the company expects to succeed in these proceedings, and outside

of posting a bond, there are no further expenses listed. Mattel, on the other hand,

got some tax relief and received 16 million dollars of tax benefits, mainly from

reassessments of previous tax years based on audits and tax filings. Further tax

credits net Mattel 59.1 million dollars reflected in the provision for income tax in the

income statement.

Net Income

Net income from Hasbro was 8.22% of revenues, reflecting a decrease of

sales, the expense of opening a new building, and tax liabilities from posting a bond

in Mexico, which was listed as a tax expense. Net income for Mattel was 12.09% of

revenues, due to steady sales, and a focus on reducing costs of sales.

8 | Page

Ontrac Financial Consulting, LLC

BALANCE SHEET

Current Assets

Hasbro is more liquid than Mattel, with 57.99% of total assets compared to

54.50%, respectively. One thing of note is that Hasbro has more in proportional

receivables than Mattel, who has a bit more cash than receivables, indicating that

Mattel is doing a better job of collecting receivables from their customers than

Hasbro.

Property, Plant, and Equipment

Mattel has more in terms of property, plant, and equipment than Hasbro as a

percentage of total assets. This is due to Hasbro dealing in goods that require less

manufacturing, such as the Magic: The Gathering card game. The only expansion

that Hasbro made in the past few years is in the Hasbro Gaming Center of

Excellence. On the other hand, in 2011, Mattel acquired HIT Entertainment, which

provided a major boost to Mattels fixed assets.

All Other Assets

Other Assets for Hasbro are high, representing 36.69% of total assets. This is

made mostly of trademarks, licenses, goodwill, and other intangible assets, with

Hasbro having a bit more diversity in terms of product lines. Mattel has 19.86% of

total assets represented by other assets. While Mattel has no less intangible assets,

they have less licenses, and more original property, which is subject to

amortization. Since these properties (Barbie, Hot Wheels, etc.) have been around

for a good 20 to 30 years, the value of these properties would be affected heavily

by amortization.

9 | Page

Ontrac Financial Consulting, LLC

Current Liabilities

Both companies have relatively the same amount of current liabilities

compared to total assets, with Hasbro at 22.20% and Mattel at 26.20%. Of note,

Hasbro has a $175 million bond posted for ongoing tax litigation in Mexico, and

Mattel has $371 million set as a potential litigation bond for an ongoing legal issue

still in appeal.

Total Liabilities

Hasbro has more total debt than Mattel as a percentage of total assets, with

65.15% compared to 53.01%, respectively. Hasbro has taken out a bit more long

term debt than Mattel, with Mattel only taking out $1.1 billion in 2010 and 2011 in

total, but Hasbro has taken out $1.39 billion, with $436 million due in 2014. Mattel,

while having a greater debt load in terms of raw dollars, still has less than Hasbro in

terms of a percentage of total assets. This translates into having more money

available for stockholders, and greater general stability for the company.

Total Stockholders Equity

Hasbro has less equity as compared to liabilities in terms of total assets, with

$436 million due in 2014. This indicates that, in the long run, more money will be

used to pay debts than to give as a dividend. However, looking past those

numbers, the amount of money paid out by Hasbro to stockholders compared to

Mattel indicates that the company is doing better than what appears here.

10 | P a g e

Ontrac Financial Consulting, LLC

Ratio Analysis

Liquidity Ratio

Liquidity ratios, as a whole, measure a companys ability to generate funds

quickly to pay off short-term obligations. The main users of these ratios are

creditors and vendors.

Liquidity Ratios

Hasbr

Mattel

o

Current Ratio

Quick Ratio

2.61

2.07

2.28

1.79

.89

.93

Current

Cash/Debt

Both Hasbro and Mattel have a strong current ratio as well as a fairly healthy

quick ratio. Though Mattels 1.79 quick ratio is decent, it does not compare to

Hasbros 2.28 ratio. Based on these ratios, Hasbro is in a much stronger position

than Mattel. For every dollar in current liabilities, Hasbro has $.54 more in current

assets than Mattel. They also have $.49 more in their most liquid assets than Mattel.

Efficiency Ratio

Receivable Turnover ratio measures how often a company collects cash from

credit sales during a given year. Inventory Turnover measures how often a company

sells their inventory during a given year. A companys Asset Turnover ratio shows

how much revenue there is for every dollar a company has in assets. These ratios

together measure how efficient a company is on using their assets to generate

11 | P a g e

Ontrac Financial Consulting, LLC

revenue and grow the company. Shareholders often use these ratios to measure

how well Management is performing.

Efficiency Ratio

Receivable

Turnover

Asset Turnover

Inventory

Hasbro

Mattel

3.96

5.19

.97

1.05

5.14

6.18

Turnover

Hasbro and Mattel are almost equal when comparing their respective revenue

to their assets. Despite both companies being close in Asset Turnover, Mattel out

matches Hasbro in each ratio. Mattel collects cash from credit sales a little over five

times a year or nearly one and a quarter more often than Hasbro. Mattels Inventory

Turnover ratio is 6.18, showing us that Mattel will sell and replace their inventory

roughly six times during the year.

Solvency Ratio

Solvency ratios measure the risk and strength of a business. The debt to

equity ratio measures specifically the financial leverage of a company. This indicates

the proportion of debt and equity being used to finance a companys assets. The

times interest earned ratio is a metric used to measure the ability of a company to

meet its financial obligations. The cash to debt ratio is used to indicate a

companys ability to cover its total debt with the cash flow from operations during

the year. Creditors use these ratios to measure how well a company manages its

debt. Investors use these ratios to know where the company stands financially.

12 | P a g e

Ontrac Financial Consulting, LLC

Solvency Ratio

Debt to Equity

Times Interest

Earned

Cash/Debt

Hasbro

1.87

4.97

Mattel

1.13

11.49

.3

.37

Coverage

Hasbros high debt to equity ratio, compared with Mattel, though, not a

terrible ratio, could spell trouble for investors due to the lack of increased revenue

between 2011 and 2012. Mattel, on the other hand, has a relatively high times

interest earned. This could indicate that Mattel has an undesirable lack of debt or is

paying too much down with earnings that could otherwise be spent on other

projects to help generate revenue and grow the company. Despite this ratio, Mattel

is in a stronger overall position.

Profitability Ratio

Gross margin helps measure how the cost of goods are being managed,

where as profit margin measures how much, for every dollar there is in revenues,

does the company actually keep as earnings. Return on Assets indicates how

efficient management is at using its assets to generate a profit. Return on equity

demonstrates how profitable a company is with the amount investors are putting

into the business. Investors will use these ratios to help determine how profitable a

company is.

13 | P a g e

Ontrac Financial Consulting, LLC

Profitability

Hasbro

Mattel

Ratios

Gross Margin

Profit Margin

Return on

59.84%

8.22%

7.95%

53.10%

12.09%

12.73%

Assets

Return on

22.98%

27.35%

Equity

Mattel has a higher profit margin than Hasbro, despite Hasbros gross margin.

Mattel seems to use their assets more efficiently to generate revenue and increase

profitability. Hasbro though manages its cost of goods effectively, still lacks in

comparison to Mattels profitability ratios.

Valuation Ratio

Valuation ratios are used by investors to compare the overall position of a

company compared to other companies for investment decisions. The priceearnings ratio measures how much an investor is willing to pay per dollar of

earnings. It also measures future anticipated growth. The payout ratio indicates the

amount of earnings paid to investors through dividends.

Valuation

Hasbro

Mattel

Ratios

P/E Ratio

Payout Ratio

13.97

.9

15.93

.55

Hasbro has a fairly high payout ratio, indicating that they attract investors

through means of dividends being paid out, where as Mattel has a somewhat lower

payout ratio which may indicate that they are keeping some of their earnings for

14 | P a g e

Ontrac Financial Consulting, LLC

other uses such as investments in other projects to develop and grow. Mattel has a

relatively high P/E ratio compared to Hasbro, which may indicate that they are

expecting future continued growth.

Conclusions and Recommendations

The toy industry is a risky industry, and subject to a quick change of taste. In

order to do well in this industry, each company needs to use its resources wisely,

and be able to predict where trends are going, and act accordingly. Further, toy

lines tend to have relative short lives, and what may be popular and well-selling one

year may lose popularity the next.

Hasbro has been relying heavily on licensed properties and a strong media

presence to sell toys. Nearly all of their lines rely on television shows, movies, and

other media to sell to kids. Unfortunately, this leads to instability in selling their toy

lines consistently over time. Hasbro does give more from their net income, and for

a medium term investor looking for a consistent dividend payout; Hasbro is a better

investment than Mattel. Hasbro also has done a great job of handling their debt,

having high current and quick ratios. Further, it appears that their debt load in

relation to their assets is relatively lower. As a creditor, we would suggest giving a

loan to Hasbro if they need it. Hasbro has been cutting overhead by reducing head

count. Further, lower turnover ratios indicate that the management does not do as

good of a job at managing assets compared to Mattel, and it may lead to situation

where an employee working for Hasbro one year may lose his job in the next. Thus,

we would not recommend working for Hasbro.

15 | P a g e

Ontrac Financial Consulting, LLC

Mattel relies on more proven brands, and doesnt have quite as strong as

media presence as Hasbro. But, despite all of this, they do relatively well over the

years, and have a steady rate of growth. However, Mattel doesnt pay as much as

Hasbro, and for an investor looking for a dividend payout, Mattel wouldnt be

recommended. On the other hand, if an investor were looking for a steady growth

over the long term, Mattel would be recommended over Hasbro. Mattel has a

smaller debt load in terms of assets than Hasbro, and they have fewer current

assets to pay debts than Hasbro. Mattel does have a high times interest earned

ratio indicating that they can handle more debt. As a creditor, I would recommend

extending credit for long-term debt. Finally, with looking at how well Mattel

manages its assets, and reports of Mattel being one of the top places to work, we

would recommend working for Mattel.

Public Perception

In the past year since they last filed their 10-K, Mattel has been doing well.

Mattel has been listed as one of the top 100 companies by Fortune magazine. They

noted that Mattel had 1,292 job openings in the year, but had 164,045 applicants to

those jobs. Also of note is that more than 1,000 employees at Mattel have been

there for over 15 years, indicating employee satisfaction. Mattel has been paying

their dividends on time, and they face no new litigation. The only black spot for

Mattel, though, is that they had a lower than expected showing in last quarter of

2013, causing their stock prices to drop.

Hasbro, on the other hand, has been facing a number of criticisms for a lack

of gender diversity in their toys. For example, one woman claimed that there is a

lack of boys in the packaging for Hasbros Easy Bake Oven, reinforcing the

16 | P a g e

Ontrac Financial Consulting, LLC

stereotype that women cook, men work. Hasbro is continuing to face workforce

issues, with one recent example of a Rhode Island tax credit that was given to

Hasbro on the expectation that Hasbro would create 245 new jobs. Hasbro, instead,

laid off more than 125 workers in that state, with further layoffs in 2013 of more

than 10% of the salaried staff in North America. The bright spot to Hasbro has been

in the recent holiday quarter of 2013, where Hasbro did better than market

estimates.

Appendix A: Horizontal Analysis

Hasbro

Revenues

Gross Profit

Net Income

Income from

Continuing Ops

Net Cash from

Continuing Ops

Total Assets

2012

$4,088,9

83

$2,417,0

03

$335,99

9

$551,78

5

$534,79

6

$4,325,3

87

Chan

ge

4.59%

1.32%

12.81

%

7.10%

35.03

%

4.71%

2011

$4,285,5

89

$2,449,3

26

$385,36

7

$593,98

1

$396,06

9

$4,130,7

74

Chan

ge

7.08

%

5.93

%

3.11

%

1.04

%

7.63

%

0.92

%

2010

$4,002,16

1

$2,312,10

4

$397,752

$587,859

$367,981

$4,093,22

6

*Amounts expressed in thousands of dollars

Mattel

Revenues

Gross Profit

Net Income

Income from Continuing

Ops

Net Cash from

Continuing Ops

Total Assets

2012

$6,420,8

81

$3,409,1

97

$776,464

$1,021,0

15

$1,275,6

50

$6,526,7

85

Chan

ge

2.47%

8.37%

1.04%

1.93%

91.92

%

15.08

%

2011

$6,266,0

37

$3,145,8

26

$768,508

$1,041,1

01

$664,693

$5,671,6

38

Chan

ge

7.00%

6.46%

12.21

%

15.43

%

25.90

%

4.69%

2010

$5,856,1

95

$2,954,9

73

$684,863

$901,902

$527,970

$5,417,7

33

17 | P a g e

Ontrac Financial Consulting, LLC

*Amounts expressed in thousands of dollars

Appendix B: Vertical Analysis - Income

Statement

Hasbro

Year 2012

As a

percentage

of Revenue

Revenues

COGS

Operating

Expense

Interest

Expense

Tax Expense

Net Income

$4,088,983

$1,671,980

$1,865,218

100.00%

40.89%

45.62%

$91,141

2.23%

$117,403

$335,999

2.87%

8.22%

*Amounts expressed in thousands of dollars

Mattel

Year 2012

As a

percentag

e of

Revenue

Revenues

COGS

Operating

Expense

Interest

Expense

Tax Expense

Net Income

$6,420,881

$3,011,684

$2,388,182

100.00%

46.90%

37.19%

$88,835

1.38%

$168,581

$776,464

2.63%

12.09%

*Amounts expressed in thousands of dollars

Appendix C: Vertical Analysis - Balance Sheet

Hasbro

Year

2012

As a

percentag

e of Total

Assets

18 | P a g e

Ontrac Financial Consulting, LLC

Current Assets

PPE

Other Assets

Total Assets

Current Liabilities

Total Liabilities

Total Stockholder's

Equity

$2,508,

202

$230,41

4

$1,586,

771

$4,325,

387

$960,43

5

$2,818,

008

$1,507,

379

57.99%

5.33%

36.69%

100.00%

22.20%

65.15%

34.85%

*Amounts expressed in thousands of dollars

Mattel

Year

2012

As a

percentage

of Assets

Current Assets

$3,556,8

05

$593,21

3

$1,295,9

69

$6,526,7

85

$1,716,0

12

$3,459,7

41

$3,067,0

44

54.50%

PPE

Other Assets

Total Assets

Current Liabilities

Total Liabilities

Total Stockholder's

Equity

9.09%

19.86%

100.00%

26.29%

53.01%

46.99%

*Amounts expressed in thousands of dollars

Appendix D: Ratio Analysis - Hasbro

Hasbro

Year 2012

Liquidity Ratios

Current Assets

$2,508,202

19 | P a g e

Ontrac Financial Consulting, LLC

Current Liabilities

Current Ratio

Current Assets

- Inventory

Current Liabilities

Quick Ratio

Net Cash from Operating

Activities

Average Current Liabilities

Current Cash / Debt

Coverage

$960,435

2.61

$2,508,202

$316,049

$960,435

2.28

$849,701

($960,435+

$942,344)/2

0.89

*Figures used in calculating ratios are expressed in thousands of dollars

Activity or Efficiency Ratios

Revenue

Average Accounts

Receivable

Receivable Turnover

Revenue

Average Total Assets

$4,088,983

($1,029,959+

$1,034,580)/2

3.96

$4,088,983

($4,325,387+

$4,130,774)/2

Asset Turnover

0.97

COGS

Average Inventory

$1,671,980

($342,965+

$325,021)/2

Inventory Turnover

5.14

*Figures used in calculating ratios are expressed in thousands of dollars

Solvency or Financial Strength Ratios

Total Debt

Total Equity

Debt/Equity

$2,818,008

$1,507,379

1.87

20 | P a g e

Ontrac Financial Consulting, LLC

EBIT

Interest Expense, net

$453,402

$91,141

Times Interest Earned

4.97

Net Cash from Operating

Activities

Total Liabilities

$2,818,008

Cash/Debt Coverage

0.30

$849,701

*Figures used in calculating ratios are expressed in thousands of dollars

Profitability Ratios

Gross Profit

Net Sales

Gross Margin

Net Income

Net Sales

Profit Margin

Net Income

Weighted Avg. Common

Shares Outstanding

Earnings Per Share

(EPS)

$2,447,003

$4,088,983

59.84%

$335,999

$4,088,983

8.22%

$335,999

209,694

2.58

Net Income

Average Total Assets

$335,999

($4,325,387+

$4,130,774)/2

Return on Assets

7.95%

Net Income

Average Stockholders'

Equity

Return on Equity

$335,999

($1,507,379+

$1,417,515)/2

22.98%

*Figures used in calculating ratios are expressed in thousands of dollars

Market or Valuation Ratios

Closing Stock Price, Year

$36.04

21 | P a g e

Ontrac Financial Consulting, LLC

End

EPS

2.58

Price/Earnings Ratio

13.97

Cash Dividends

Net Income

$1.44*209,694

$335,999

Payout Ratio

0.90

*Figures used in calculating ratios are expressed in thousands of dollars, EXCEPT for

'Stock Price' & EPS

Appendix E: Ratio Analysis - Mattel

Mattel

Year 2012

Liquidity Ratios

Current Assets

Current Liabilities

Current Ratio

Current Assets

- Inventory

Current Liabilities

Quick Ratio

Net Cash from Operating

Activities

Average Current Liabilities

Current Cash / Debt

Coverage

$3,556,805

$1,716,012

2.07

$3,556,805

$487,000

$1,716,012

1.79

$1,275,650

($1,716,012+

$1,038,928)/2

0.93

*Figures used in calculating ratios are expressed in thousands of dollars

22 | P a g e

Ontrac Financial Consulting, LLC

Activity or Efficiency Ratios

Revenue

Average Accounts

Receivable

Receivable Turnover

Revenue

Average Total Assets

$6,420,881

($1,226,833+

$1,246,687)/2

5.19

$6,420,881

($6,526,785+

$5,671,638)/2

Asset Turnover

1.05

COGS

Average Inventory

$3,011,684

($487,000+

$487,000)/2

Inventory Turnover

6.18

*Figures used in calculating ratios are expressed in thousands of dollars

Solvency or Financial Strength Ratios

Total Debt

Total Equity

Debt/Equity

EBIT

Interest Expense, net

Times Interest Earned

Net Cash from Operating

Activities

Total Liabilities

Cash/Debt Coverage

$3,459,741

$3,067,044

1.13

$1,021,015

$88,835

11.49

$1,275,650

$3,459,741

0.37

*Figures used in calculating ratios are expressed in thousands of dollars

23 | P a g e

Ontrac Financial Consulting, LLC

Profitability Ratios

Gross Profit

Net Sales

Gross Margin

Net Income

Net Sales

$3,409,197

$6,420,881

53.10%

$776,464

$6,420,881

Profit Margin

12.09%

Net Income

Weighted Avg. Common

Shares Outstanding

$776,464

Earnings Per Share

(EPS)

342,269

2.25

Net Income

Average Total Assets

$776,464

($6,526,785+

$5,671,638)/2

Return on Assets

12.73%

Net Income

Average Stockholders'

Equity

Return on Equity

$776,464

($3,067,044+

$2,610,603)/2

27.35%

*Figures used in calculating ratios are expressed in thousands of dollars

Market or Valuation Ratios

Closing Stock Price, Year

End

EPS

Price/Earnings Ratio

$35.84

2.25

15.93

Cash Dividends

Net Income

$1.24*342,269

$776,464

Payout Ratio

0.55

*Figures used in calculating ratios are expressed in thousands of dollars, EXCEPT for

'Stock Price' & EPS

24 | P a g e

Ontrac Financial Consulting, LLC

Appendix F: Analyst Recommendations

Hasbro (HAS)

Current

Year

*Analyst recommendations current as of February 21, 2014

25 | P a g e

Ontrac Financial Consulting, LLC

Mattel (MAT)

Year 2012

*Analyst recommendations current as of February 21, 2014

Appendix G: Stock Performance

Hasbro (HAS)

Year 2012

26 | P a g e

Ontrac Financial Consulting, LLC

Mattel (MAT)

Year 2012

Appendix H: References

1. "Mattel - Best Companies to Work For 2013 - Fortune". Money.cnn.com. 2013-0204. Retrieved 2013-07-10.

27 | P a g e

Ontrac Financial Consulting, LLC

2. "Guess Whos sexist? Classic board games gender bias leaves six-year-old

fuming from "The Independent"

3. Business | Hasbro Continues To Lay Off Workers Despite Expansion Plans.

GoLocalProv (2013-04-30). Retrieved on 2013-09-27.

4. "Six-year-old schools Hasbro on gender equality" from "Yahoo Games"

5. "Hasbro: Feature boys in the packaging of the Easy-Bake Oven" from

"Change.org"

28 | P a g e

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

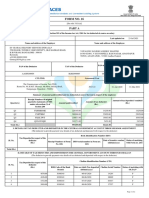

- Form ITR-VDokument2 SeitenForm ITR-VSumit ManglaniNoch keine Bewertungen

- Market Failures and Government InterventionDokument20 SeitenMarket Failures and Government InterventionGiorgi TediashviliNoch keine Bewertungen

- Indirect Taxation Finals Question PaperDokument3 SeitenIndirect Taxation Finals Question PaperShubham NamdevNoch keine Bewertungen

- Assignment 1 CHIPITA INTERNATIONAL Greece 29 06 2018 PDFDokument18 SeitenAssignment 1 CHIPITA INTERNATIONAL Greece 29 06 2018 PDFMyo Pa Pa NyeinNoch keine Bewertungen

- Carlos V DSWD Et. AlDokument2 SeitenCarlos V DSWD Et. AlDanyNoch keine Bewertungen

- Project Report ON: University of MumbaiDokument55 SeitenProject Report ON: University of MumbaiNayak SandeshNoch keine Bewertungen

- Manish Dua: Brand Manish Dua Questions For Ca-Cpt (Economics)Dokument48 SeitenManish Dua: Brand Manish Dua Questions For Ca-Cpt (Economics)gagan vermaNoch keine Bewertungen

- 3Dokument2 Seiten3Carlo ParasNoch keine Bewertungen

- Project On Max Life InsuranseDokument49 SeitenProject On Max Life InsuranseViPul80% (15)

- Compiled Cases Batch1 UpdatedDokument69 SeitenCompiled Cases Batch1 UpdatedLorelieNoch keine Bewertungen

- InvoiceDokument1 SeiteInvoiceAjit SharmaNoch keine Bewertungen

- Sample Questions On WTWDokument1 SeiteSample Questions On WTWBaldovino VenturesNoch keine Bewertungen

- Form No. 16: Part ADokument6 SeitenForm No. 16: Part AVinuthna ChinnapaNoch keine Bewertungen

- 2011 PTD (Trib.) 936 PDFDokument13 Seiten2011 PTD (Trib.) 936 PDFMuhammad Ilyas ShafiqNoch keine Bewertungen

- Long-Term (Capital Investment) DecisionsDokument11 SeitenLong-Term (Capital Investment) DecisionsKariza ReyesNoch keine Bewertungen

- Robert E. KernDokument3 SeitenRobert E. KernRiverheadLOCALNoch keine Bewertungen

- RBC CP Associates Study Material Important Questions FOR ExamDokument15 SeitenRBC CP Associates Study Material Important Questions FOR ExamkhudalNoch keine Bewertungen

- Annex I NHR Activities 2021Dokument1 SeiteAnnex I NHR Activities 2021Francisco Alves FreitasNoch keine Bewertungen

- Silicon TriangleDokument9 SeitenSilicon Trianglealvezthiago2Noch keine Bewertungen

- Public ExpenditureDokument8 SeitenPublic ExpenditureRuchira MahakudNoch keine Bewertungen

- Iiqe Paper 3 Pastpaper 20200518Dokument20 SeitenIiqe Paper 3 Pastpaper 20200518Tsz Ngong Ko100% (1)

- DEFINITION of 'Foreign Direct Investment - FDI'Dokument4 SeitenDEFINITION of 'Foreign Direct Investment - FDI'Azheruddin AhmedNoch keine Bewertungen

- Oner New DN After 20% CDDokument2 SeitenOner New DN After 20% CDUjjwal GuptaNoch keine Bewertungen

- BSBFIM501 AAP v2.0Dokument135 SeitenBSBFIM501 AAP v2.0Alicia AlmeidaNoch keine Bewertungen

- 2.1 Site Selection Criteria and FactorsDokument4 Seiten2.1 Site Selection Criteria and Factorseric swaNoch keine Bewertungen

- 2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFDokument2 Seiten2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFAleezah Gertrude RaymundoNoch keine Bewertungen

- Houlberg & Ejersbo (2020)Dokument10 SeitenHoulberg & Ejersbo (2020)Friets PoetsNoch keine Bewertungen

- Agoda Confirmed Booking at Empire Guest HouseDokument1 SeiteAgoda Confirmed Booking at Empire Guest HouseWahidNoch keine Bewertungen

- QTN Asia Crystal-1 PDFDokument1 SeiteQTN Asia Crystal-1 PDFIJAJ AHAMED MBANoch keine Bewertungen

- Advantages and Disadvantages of Transnational CorporationsDokument10 SeitenAdvantages and Disadvantages of Transnational CorporationsEagleNoch keine Bewertungen