Beruflich Dokumente

Kultur Dokumente

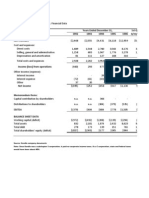

Consolidated Income Statement: in Millions, Excpet Per Share Data

Hochgeladen von

rranjan27Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Consolidated Income Statement: in Millions, Excpet Per Share Data

Hochgeladen von

rranjan27Copyright:

Verfügbare Formate

Wall Street Prep, Inc.

Sample Trainning Model:

CVS (CVS)

Consolidated Income Statement

Fiscal Year

In millions, excpet per share data

Net sales

CGS, buying and warehousing costs

Gross margin

SG&A expenses

Depreciation and amortization (D&A)

Total operating expenses

Operating profit (EBIT)

Interest expense, net

Unusual Items (in CGS)

Unusual Items (in SG&A)

Earnings before income tax provision

Income tax provision

Net earnings

Dilutive earnings adjustment

Preference dividends

Net earnings to common shareholders

Forward Estimates

1999

January 1, 2000

53 weeks

2000

December 30, 2000

52 weeks

2001

December 29, 2001

52 weeks

2002

December 28, 2002

52 weeks

$18,098.3

13,236.9

4,861.4

3,448.0

277.9

3,725.9

$1,135.5

59.1

0.0

0.0

1,076.4

441.3

635.1

$20,087.5

14,725.8

5,361.7

3,761.6

296.6

4,058.2

$1,303.5

79.3

0.0

(19.2)

1,243.4

497.4

746.0

(0.7)

14.6

731.4

$22,241.4

16,544.7

5,696.7

4,256.3

320.8

4,577.1

$1,119.6

61.0

5.7

343.3

709.6

296.4

413.2

(4.8)

14.7

398.5

$24,181.5

18,112.7

6,068.8

4,549.1

310.3

4,859.4

$1,209.4

50.4

0.0

3.2

1,155.8

439.2

716.6

(6.7)

14.8

701.8

$26,478.7

19,885.5

6,593.2

4,925.0

303.9

5,228.9

$1,364.3

48.7

0.0

0.0

1,315.5

499.9

815.6

$28,861.8

21,718.5

7,143.3

5,310.6

317.4

5,628.0

$1,515.3

17.4

0.0

0.0

1,497.8

569.2

928.7

$31,315.1

23,611.6

7,703.5

5,699.3

332.5

6,031.8

$1,671.7

15.0

0.0

0.0

1,656.6

629.5

1,027.1

14.8

800.8

14.8

913.9

14.8

1,012.3

14.8

1,123.2

$1.56

$0.07

$1.63

392.2

408.3

228.4

$0.56

$1.76

$0.00

$1.76

392.3

405.3

2.0

$0.00

$2.02

$0.00

$2.02

391.1

404.1

0.0

$0.00

$2.31

$0.00

$2.31

389.9

402.9

0.0

$0.00

$2.56

$0.00

$2.56

388.6

401.6

0.0

$0.00

$2.84

$0.00

$2.84

387.4

400.4

0.0

$0.00

14.7

620.4

2003E

December 31, 2003

53 weeks

2004E

December 31, 2004

52 weeks

2005E

December 31, 2005

52 weeks

2006E

December 31, 2006

52 weeks

$33,820.3

8.7%

25,551.2

9.0%

8,269.1

6,087.7

350.6

6,438.3

$1,830.8 10.9%

(4.8)

0.0

0.0

1,835.5

697.5

1,138.0

Diluted EPS

Goodwill amortization per share

Diluted EPS - Goodwill adjusted

Basic Shares O/S

Diluted Shares O/S

Unusual Items (After-tax)

Unusual Items (After-tax)/Share

$1.55

$0.10

391.3

408.9

0.0

$0.00

$1.80

$0.08

$1.88

391.0

408.0

(11.5)

($0.03)

Dividends/Share

$0.23

$0.23

$0.23

$0.23

$0.23

$0.23

$0.23

$0.23

$1,413.4

$1,600.1

$1,440.4

$1,519.7

$1,668.2

$1,832.7

$2,004.2

$2,181.4

26.86%

19.05%

1.54%

6.27%

7.81%

5.95%

3.51%

41.00%

26.69%

18.73%

1.48%

6.49%

7.97%

6.19%

3.71%

40.00%

25.61%

19.14%

1.44%

5.03%

6.48%

3.19%

1.86%

41.77%

25.10%

18.81%

1.28%

5.00%

6.28%

4.78%

2.96%

38.00%

24.90%

18.60%

1.15%

5.15%

6.30%

4.97%

3.08%

38.00%

24.75%

18.40%

1.10%

5.25%

6.35%

5.19%

3.22%

38.00%

24.60%

18.20%

1.06%

5.34%

6.40%

5.29%

3.28%

38.00%

24.45%

18.00%

1.04%

5.41%

6.45%

5.43%

3.36%

38.00%

11.0%

14.8%

13.2%

34.2%

17.5%

15.8%

10.7%

(14.1%)

(10.0%)

(23.1%)

(44.6%)

(13.3%)

8.7%

8.0%

5.5%

(17.4%)

73.4%

7.8%

9.5%

12.8%

9.8%

(3.3%)

13.8%

14.9%

9.0%

11.1%

9.9%

(64.2%)

13.9%

14.2%

8.5%

10.3%

9.4%

(13.7%)

10.6%

10.9%

8.0%

9.5%

8.8%

(131.7%)

10.8%

11.1%

EBITDA

Margins

Gross Profit (FIFO)

SG&A

Total D&A

EBIT

EBITDA

Pretax

Net Earnings

Tax rate

Growth Rate

Total Sales

EBIT

EBITDA

Interest Expense

Net Earnings

EPS - Goodwill adjusted

For Illustrative Purposes Only

02-06

CAGR

12.8%

9.5%

2003 Edition COPYRIGHT 2003 By Wall Street Prep

Das könnte Ihnen auch gefallen

- Financial ReportDokument151 SeitenFinancial ReportleeeeNoch keine Bewertungen

- Financial ReportDokument151 SeitenFinancial ReportleeeeNoch keine Bewertungen

- Consolidated Profit & Loss Account For Continuing OperationsDokument13 SeitenConsolidated Profit & Loss Account For Continuing OperationsAlok JainNoch keine Bewertungen

- Verizon Communications Inc. Condensed Consolidated Statements of Income Before Special ItemsDokument9 SeitenVerizon Communications Inc. Condensed Consolidated Statements of Income Before Special ItemsvenkeeeeeNoch keine Bewertungen

- Cisco Systems, Inc. Historical Financials Income Statement AnalysisDokument3 SeitenCisco Systems, Inc. Historical Financials Income Statement AnalysisSameh Ahmed HassanNoch keine Bewertungen

- Case Study - So What Is It WorthDokument7 SeitenCase Study - So What Is It WorthJohn Aldridge Chew100% (1)

- Financial ReportDokument135 SeitenFinancial ReportleeeeNoch keine Bewertungen

- Financial ReportDokument135 SeitenFinancial ReportleeeeNoch keine Bewertungen

- Case 21 Aurora Textile Company 0Dokument17 SeitenCase 21 Aurora Textile Company 0nguyen_tridung250% (2)

- Financial ReportDokument135 SeitenFinancial ReportleeeeNoch keine Bewertungen

- Financial ReportDokument135 SeitenFinancial ReportleeeeNoch keine Bewertungen

- Att Ar 2012 ManagementDokument35 SeitenAtt Ar 2012 ManagementDevandro MahendraNoch keine Bewertungen

- Krispy Kreme Doughnuts Forecasting: Group: Tammy Cheung, Shelly Khindri, Parm Marway, Hari StirbetDokument31 SeitenKrispy Kreme Doughnuts Forecasting: Group: Tammy Cheung, Shelly Khindri, Parm Marway, Hari StirbetWidodo MohammadNoch keine Bewertungen

- Sadlier WH 2009 Annual ReportDokument17 SeitenSadlier WH 2009 Annual ReportteriksenNoch keine Bewertungen

- L.E.K. Valuation Toolkit GuideTITLEL.E.K. Business Valuation Model InstructionsTITLEL.E.K. Toolkit for Valuing CompaniesDokument10 SeitenL.E.K. Valuation Toolkit GuideTITLEL.E.K. Business Valuation Model InstructionsTITLEL.E.K. Toolkit for Valuing Companiesmmitre2100% (1)

- PepsiCo's Quaker BidDokument54 SeitenPepsiCo's Quaker Bidarjrocks23550% (2)

- Hls Fy2010 Fy Results 20110222Dokument14 SeitenHls Fy2010 Fy Results 20110222Chin Siong GohNoch keine Bewertungen

- Parent, Inc Actual Financial Statements For 2012 and OlsenDokument23 SeitenParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNoch keine Bewertungen

- Abhishek FRA Quiz 2Dokument17 SeitenAbhishek FRA Quiz 2Fun LearningNoch keine Bewertungen

- Exhibit 1 Kendle International Inc. Financial Data Years Ended December 31Dokument12 SeitenExhibit 1 Kendle International Inc. Financial Data Years Ended December 31Kito Minying ChenNoch keine Bewertungen

- 70 XTO Financial StatementsDokument5 Seiten70 XTO Financial Statementsredraider4404Noch keine Bewertungen

- MM SimulationDokument11 SeitenMM SimulationAmmiraju Gorti ChoudharyNoch keine Bewertungen

- Coca-Cola Financial Statements AnalysisDokument4 SeitenCoca-Cola Financial Statements AnalysisJossy AndrinaNoch keine Bewertungen

- 24 The Elusive Cash BalanceDokument13 Seiten24 The Elusive Cash Balancehaqicohir100% (2)

- Financial Risk AnalysisDokument6 SeitenFinancial Risk AnalysisolafedNoch keine Bewertungen

- Star River ExcelDokument10 SeitenStar River ExcelVrusti RaoNoch keine Bewertungen

- Fin Model Practice 1Dokument17 SeitenFin Model Practice 1elangelang99Noch keine Bewertungen

- Alliance Concrete Financial Statements and Key Metrics 2002-2005Dokument7 SeitenAlliance Concrete Financial Statements and Key Metrics 2002-2005S r kNoch keine Bewertungen

- AAPL Financial ReportDokument110 SeitenAAPL Financial ReportChuks VincentNoch keine Bewertungen

- Macy's 10-K AnalysisDokument39 SeitenMacy's 10-K Analysisapb5223Noch keine Bewertungen

- Assignment 4Dokument12 SeitenAssignment 4giannimizrahi5Noch keine Bewertungen

- I. Case BackgroundDokument7 SeitenI. Case BackgroundHiya BhandariBD21070Noch keine Bewertungen

- Shares in Thousands Cover PageDokument144 SeitenShares in Thousands Cover PageleeeeNoch keine Bewertungen

- Laporan Keuangan - Mki IchaDokument6 SeitenLaporan Keuangan - Mki IchaSempaks KoyakNoch keine Bewertungen

- Q1 2000 Results and Acquisition of Safety 1stDokument1 SeiteQ1 2000 Results and Acquisition of Safety 1stsalehin1969Noch keine Bewertungen

- Scaling Operations Worksheet2Dokument56 SeitenScaling Operations Worksheet2olusegun0% (2)

- Interest Income, Non-BankDokument206 SeitenInterest Income, Non-BankArturo RiveroNoch keine Bewertungen

- 61 JPM Financial StatementsDokument4 Seiten61 JPM Financial StatementsOladipupo Mayowa PaulNoch keine Bewertungen

- Pillsbury AnalysisDokument1 SeitePillsbury AnalysisivanaNoch keine Bewertungen

- Ch03 17Dokument3 SeitenCh03 17Md Emamul HassanNoch keine Bewertungen

- Alphabet 2014 Financial ReportDokument6 SeitenAlphabet 2014 Financial ReportsharatjuturNoch keine Bewertungen

- Trial 2021 FsaDokument2 SeitenTrial 2021 FsaFarah Farah Essam Abbas HamisaNoch keine Bewertungen

- Coca Cola Financial Statements 2008Dokument75 SeitenCoca Cola Financial Statements 2008James KentNoch keine Bewertungen

- Colgate's Summary Financial Data 2006 2005 2004 2003 2002Dokument4 SeitenColgate's Summary Financial Data 2006 2005 2004 2003 2002dwi anitaNoch keine Bewertungen

- Actavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)Dokument3 SeitenActavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)macocha1Noch keine Bewertungen

- Starbucks - SectionA - Group13 - Case4 - Projected StatementsDokument8 SeitenStarbucks - SectionA - Group13 - Case4 - Projected StatementsSandeep ChowdhuryNoch keine Bewertungen

- Financial ReportDokument197 SeitenFinancial ReportErnaFitrianaNoch keine Bewertungen

- Week 2 Homework (Chap. 4) - PostedDokument4 SeitenWeek 2 Homework (Chap. 4) - PostedMs. Nina100% (5)

- Mayes 8e CH07 SolutionsDokument32 SeitenMayes 8e CH07 SolutionsRamez AhmedNoch keine Bewertungen

- Erro Jaya Rosady - 042024353001Dokument261 SeitenErro Jaya Rosady - 042024353001Erro Jaya RosadyNoch keine Bewertungen

- 2.0 FIN Plan & Forecasting v1Dokument62 Seiten2.0 FIN Plan & Forecasting v1Omer CrestianiNoch keine Bewertungen

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Dokument5 SeitenConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNoch keine Bewertungen

- Case 34 - The Wm. Wrigley Jr. CompanyDokument72 SeitenCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKVon EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKNoch keine Bewertungen

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryVon EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueVon EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueBewertung: 1 von 5 Sternen1/5 (1)

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryVon EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- E Waste ManagementDokument11 SeitenE Waste Managementrranjan27Noch keine Bewertungen

- Cash FlowDokument2 SeitenCash Flowrranjan27Noch keine Bewertungen

- CFA 2024 Curriculum SummaryDokument39 SeitenCFA 2024 Curriculum SummaryANUP MUNDENoch keine Bewertungen

- CAIA 2024 Level 2 Schweser StudyNotes Book 2 sampleDokument20 SeitenCAIA 2024 Level 2 Schweser StudyNotes Book 2 samplerranjan27Noch keine Bewertungen

- Business Insights - Essentials - PDF HistoryDokument6 SeitenBusiness Insights - Essentials - PDF Historyrranjan27Noch keine Bewertungen

- Gics 2010Dokument476 SeitenGics 2010rranjan27Noch keine Bewertungen

- Sheet ExportDokument3 SeitenSheet Exportrranjan27Noch keine Bewertungen

- Linkedin SampleDokument16 SeitenLinkedin Samplerranjan27Noch keine Bewertungen

- Bone ReceiptDokument1 SeiteBone Receiptrranjan27Noch keine Bewertungen

- IncomeDokument8 SeitenIncomerranjan27Noch keine Bewertungen

- LboDokument3 SeitenLborranjan27Noch keine Bewertungen

- AurobindoDokument7 SeitenAurobindorranjan27Noch keine Bewertungen

- RGUHS Payment FormsDokument6 SeitenRGUHS Payment Formsrranjan27Noch keine Bewertungen

- Jisc Shakespeare EvalDokument8 SeitenJisc Shakespeare Evalrranjan27Noch keine Bewertungen

- Balance SheetDokument8 SeitenBalance Sheetrranjan27Noch keine Bewertungen

- Cash FlowDokument2 SeitenCash Flowrranjan27Noch keine Bewertungen

- Business Insights - Essentials - PDF HistoryDokument6 SeitenBusiness Insights - Essentials - PDF Historyrranjan27Noch keine Bewertungen

- Oxford Econ Heat MapDokument13 SeitenOxford Econ Heat Maprranjan27Noch keine Bewertungen

- Business Insights - Essentials - PDF PharmaDokument11 SeitenBusiness Insights - Essentials - PDF Pharmarranjan27Noch keine Bewertungen

- Business Insights - Essentials - PDF Health InsDokument6 SeitenBusiness Insights - Essentials - PDF Health Insrranjan27Noch keine Bewertungen

- RatiosDokument3 SeitenRatiosrranjan27Noch keine Bewertungen

- Datastream Installation GuideDokument26 SeitenDatastream Installation Guiderranjan27Noch keine Bewertungen

- Business Insights - Essentials - PDF BiotechDokument12 SeitenBusiness Insights - Essentials - PDF Biotechrranjan27Noch keine Bewertungen

- Business Insights - EssentialsDokument4 SeitenBusiness Insights - Essentialsrranjan27Noch keine Bewertungen

- Balance SheetDokument8 SeitenBalance Sheetrranjan27Noch keine Bewertungen

- RatiosDokument3 SeitenRatiosrranjan27Noch keine Bewertungen

- Cash FlowDokument2 SeitenCash Flowrranjan27Noch keine Bewertungen

- Smart Health Insuranc BrochureDokument20 SeitenSmart Health Insuranc BrochureRajashekhar PujariNoch keine Bewertungen

- Template For Solid Waste Management by ApnaComplexDokument3 SeitenTemplate For Solid Waste Management by ApnaComplexrranjan27Noch keine Bewertungen