Beruflich Dokumente

Kultur Dokumente

Costof Cap

Hochgeladen von

Aarti JOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Costof Cap

Hochgeladen von

Aarti JCopyright:

Verfügbare Formate

F1 Outline

Cost of Capital

Organization

The Cost of Capital: Some Preliminaries

The Cost of Equity

The Costs of Debt and Preferred Stock

The Weighted Average Cost of Capital

Divisional and Project Costs of Capital

Flotation Costs and the WACC

F2 The Cost of Capital: Issues

Key issues:

What do we mean by cost of capital

How can we come up with an estimate?

Preliminaries

1.

a.

b.

c.

Vocabularythe following all mean the same thing:

Required return

Appropriate discount rate

Cost of capital (or cost of money)

2. The cost of capital is an opportunity costit depends

where the money goes, not where it comes from.

3. For now, assume the firms capital structure (mix of

debt and equity) is fixed.

on

F3 Dividend Growth Model Approach

Estimating the cost of equity: the dividend growth model

approach

According to the constant growth model,

P0 =

D1

RE - g

Rearranging,

RE =

D1

P0

+g

F4 Example: Estimating the Dividend Growth Rate

Dollar Change

Percentage

Change

Year

Dividend

1990

$4.00

1991

4.40

$0.40

10.00%

1992

4.75

0.35

7.95

1993

5.25

0.50

10.53

1994

5.65

0.40

7.62

Average Growth Rate

(10.00 + 7.95 + 10.53 + 7.62)/4 = 9.025%

F5 Example: The SML Approach

According to the CAPM:

RE = Rf +

(RM - Rf)

1. Get the risk-free rate (Rf ) from financial pressmany use the 1-year

Treasury bill rate, say 6%.

2. Get estimates of market risk premium and security beta.

a.

b.

(1)

(2)

Historical risk premium _________%

Betahistorical

Investment information services - e.g., S&P, Value Line

Estimate from historical data

3. Suppose the beta is 1.40, then, using the approach:

RE = Rf +

(RM - Rf)

6% + 1.40 ________

________

F6 Example: The SML Approach

According to the CAPM:

RE = Rf +

(RM - Rf)

1. Get the risk-free rate (Rf ) from financial pressmany use the 1-year

Treasury bill rate, say 6%.

2. Get estimates of market risk premium and security beta.

a.

b.

(1)

(2)

Historical risk premium RM - Rf = 9.4%

Beta historical

Investment information services - e.g., S&P, Value Line

Estimate from historical data

3. Suppose the beta is 1.40, then, using the approach:

RE = Rf +

(RM - Rf)

6% + 1.40 9.4%

19.16%

F7 The Costs of Debt and Preferred Stock

Cost of debt

1. The cost of debt, RD, is the interest rate on new borrowing.

2. The cost of debt is observable:

a. Yield on currently outstanding debt.

b. Yields on newly-issued similarly-rated bonds.

3. The historic debt cost is irrelevant -- why?

Example: We sold a 20-year, 12% bond 10 years ago at par. It

is currently priced at 86. What is our cost of debt?

The yield to maturity is ____%, so this is what we use as

the cost of debt, not 12%.

F8 The Costs of Debt and Preferred Stock

Cost of debt

1. The cost of debt, RD, is the interest rate on new borrowing.

2. The cost of debt is observable:

a. Yield on currently outstanding debt.

b. Yields on newly-issued similarly-rated bonds.

3. The historic debt cost is irrelevant -- why?

Example: We sold a 20-year, 12% bond 10 years ago at par. It

is currently priced at 86. What is our cost of debt?

The yield to maturity is 14.8%, so this is what we use as the

cost of debt, not 12%.

F9 Costs of Debt and Preferred Stock (concluded)

Cost of preferred

1. Preferred stock is a perpetuity, so the cost is

RP = D/P0

2. Notice that cost is simply the dividend yield.

Example: We sold an $8 preferred issue 10 years ago. It

sells for $120/share today.

The dividend yield today is $____/____ = 6.67%, so this

is what we use as the cost of preferred.

F10 Costs of Debt and Preferred Stock (concluded)

Cost of preferred

1. Preferred stock is a perpetuity, so the cost is

RP = D/P0

2. Notice that cost is simply the dividend yield.

Example: We sold an $8 preferred issue 10 years ago. It

sells for $120/share today.

The dividend yield today is $8.00/120 = 6.67%, so this is

what we use as the cost of preferred.

F11 The Weighted Average Cost of Capital

Capital structure weights

1. Let:

E = the market value of the equity.

D = the market value of the debt.

Then:

V = E + D, so E/V + D/V = 100%

2. So the firms capital structure weights are E/V and D/V.

3. Interest payments on debt are tax-deductible, so the aftertax cost of

debt is the pretax cost multiplied by (1 - corporate tax rate).

Aftertax cost of debt = RD (1 - Tc)

4. Thus the weighted average cost of capital is

WACC = (E/V) RE + (D/V) RD (1 - Tc)

F12 Example: Eastman Chemicals WACC

Eastman Chemical has 78.26 million shares of common stock

outstanding. The book value per share is $22.40 but the stock sells

for $58. The market value of equity is $4.54 billion. Eastmans

stock beta is .90. T-bills yield 4.5%, and the market risk premium is

assumed to be 9.2%.

The firm has four debt issues outstanding.

Coupon

6.375%

7.250%

7.635%

7.600%

Total

Book Value

$ 499m $

495m

200m

296m

$1,490m

Market Value

501m

463m

221m

289m

Yield-to-Maturity

6.32%

7.83%

6.76%

7.82%

$1,474m

F13 Example: Eastman Chemicals WACC (concluded)

Cost of equity (SML approach):

RE = .045 + .90 (.092) = .045 + .0828 = .1278 12.8%

Cost of debt:

Multiply the proportion of total debt represented by each issue by its yield to

maturity; the weighted average cost of debt = 7.15%

Capital structure weights:

Market value of equity = 78.26 million $58 = $4.539 billion

Market value of debt = $501m + $463m + $221m + $289m = $1.474 billion

V = $4.539 billion + $1.474 billion = $6.013 billion

D/V = $1.474b/$6.013b = .2451 25%

E/V = $4.539b/$6.013b = .7549 75%

WACC = .75 (.128) + .25 .0715(1 - .35) = .1076%

F14 Summary of Capital Cost Calculations

I. The Cost of Equity, RE

A.

Dividend growth model approach

RE = D1 / P0 + g

B.

SML approach

RE = Rf + E (RM - Rf)

II. The Cost of Debt, RD

A.

For a firm with publicly held debt, the cost of debt can be

measured as the yield to maturity on the outstanding debt.

B.

If the firm has no publicly traded debt, then the cost of debt

can be measured as the yield to maturity on similarly rated

bonds.

F15 Summary of Capital Cost Calculations (concluded)

III. The Weighted Average Cost of Capital (WACC)

A.

The WACC is the required return on the firm as a whole. It is the

appropriate discount rate for cash flows similar in risk to The firm.

B.

The WACC is calculated as

WACC = (E/V) RE + (D/V) RD (1 - Tc)

where Tc is the corporate tax rate, E is the market value of the

firms equity, D is the market value of the firms debt, and

V = E + D. Note that E/V is the percentage of the firms

financing (in market value terms) that is equity, and D/V is

the percentage that is debt.

F16 Divisional and Project Costs of Capital

When is the WACC the appropriate discount rate?

When the project is about the same risk as the firm.

Other approaches to estimating a discount rate:

Divisional cost of capital

Pure play approach

Subjective approach

F17 The Security Market Line and the Weighted Average Cost of Capital

F18 The Security Market Line and the Subjective Approach

F19 Quick Quiz

1. What is the relationship between cost of capital and firm value?

Cet. par., the lower the cost of capital, the higher the value of the firm.

2. When we use the dividend growth model to estimate the firms cost of equity, we

make a key assumption about future dividends of the firm. What is that

assumption?

We assume that dividends will grow at a constant growth rate, g.

3. In calculating the firms WACC, we use the market value weights of debt and

equity, if possible. Why?

Because market values reflect the markets expectations about the size, timing,

and risk of future cash flows.

4. What happens if we use the WACC to evaluate all potential investment projects,

regardless of their risk?

Estimated NPVs will be understated (overstated) for projects which are less

risky (riskier) than the firm.

F20 Quick Quiz (concluded)

5. How are flotation costs accounted for in estimating the cost of capital?

a.

First, obtain the flotation costs of each component of capital. Call

the flotation cost of equity f E, and the flotation cost of debt, f D.

b.

Obtain the weighted average flotation cost, f A:

fA = (E/V) fE + (D/V) fD

c.

The true cost of the project = project cost/(1 - f A).

Example:

The Lecter Meat Packing Co. would like to raise $110 million to build a new plant in

Argentina. The flotation costs of debt and equity are 5% and 18%, respectively. The

firms market value capital structure consists of equal amounts of debt and equity. What

is the true cost of the new plant project?

Solution:

The weighted average flotation cost = .50(5) + .50(18) = 11.5% The true cost of the

project is $110M/(1 - .115) = $124.29M.

F21 A Problem

Elway Mining Corporation has 8 million shares of common

stock outstanding, 1 million shares of 6 percent preferred

outstanding, and 100,000 $1,000 par, 9 percent semiannual

coupon bonds outstanding. The common stock sells for $35 per

share and has a beta of 1.0, the preferred stock sells for $60

per share, and the bonds have 15 years to maturity and sell for

89 percent of par. The market risk premium is 8 percent, T-bills

are yielding 5 percent, and the firms tax rate is 34 percent.

a. What is the firms market value capital structure?

b. If the firm is evaluating a new investment project that is

equally as risky as the firms typical project, what rate should

they use to discount the projects cash flows?

F22 A Problem (continued)

a. MVD =

_____ ($1,000) (.89) = $_____

MVE =

8M($35) = $280M

MVp =

___($60) = $______

$_____+ 280M + ______= $_____

D/V =

$____ /____ = .207,

E/V =

$____/____ = .653, and

P/V =

$____/____ = .140.

F23 A Problem (continued)

a. MVD =

100,000 ($1,000) (.89) = $89M

MVE =

8M($35) = $280M

MVp =

1M($60) = $60M

89M + 280M + 60M = $429M

D/V =

89M/429M = .207,

E/V =

280M/429M = .653, and

P/V =

60M/429M = .140.

F24 A Problem (continued)

b. For projects as risky as the firm itself, the WACC is the appropriate

discount rate. So:

RE = .05 + ____(.08) = ____ = ____ %

B0 = $_____ = $45(PVIFARD,30) + $1,000(PVIFRD,30)

RD = _____ %, and RD (1 - Tc) = (.____)(1 - .34) = ____ = ____%

RP = $ ___ /$ ___ = ___ = ___%

WACC = _____ (_____) + _____ (_____) + _____ (_____ )

= ____%

F25 A Problem (concluded)

b. For projects as risky as the firm itself, the WACC is the appropriate

discount rate. So:

RE = .05 + 1.0(.08) = .13 = 13%

B0 = $890 = $45(PVIFARD,30) + $1,000(PVIFRD,30)

RD = 10.474%, and RD (1 - Tc) = (.10474)(1 - .34) = .0691 = 6.91%

RP = $6/$60 = .10 = 10%

WACC = .653 (13) + .207 (6.91) + .14 (10)

= 11.32%

F26 Another Problem

An all-equity firm is considering the following projects. Assume the Tbill rate is 5% and the market expected return is 12%.

Project

Beta

Expected Return (%)

.60

11

.85

13

1.15

13

1.50

19

a. Which projects have a higher expected return than the firms

percent cost of capital?

12

b. Which projects should be accepted?

c. Which projects would be incorrectly accepted or rejected if the firms

overall cost of capital is used as a hurdle rate?

F27 Another Problem (concluded)

a. Projects X, Y, and Z with expected returns of 13%, 13%, and 19%,

respectively, have higher returns than the firms 12% cost of capital.

b. Using the firms overall cost of capital as a hurdle rate, accept projects W, X,

and Z. Compute required returns considering risk via the SML:

Project W

Project X

Project Y

Project Z

=

=

=

=

.05 + .60(.12 - .05) = .092 < .11, so accept W.

.05 + .85(.12 - .05) = .1095 < .13, so accept X.

.05 + 1.15(.12 - .05) = .1305 > .13, so reject Y.

.05 + 1.50(.12 - .05) = .155 < .19, so accept Z.

c. Project W would be incorrectly rejected and Project Y would be incorrectly

accepted.

F28 Last Problem

Sallinger, Inc. is considering a project that will result in initial

aftertax cash savings of $6 million at the end of the first year,

and these savings will grow at a rate of 5 percent per year

indefinitely. The firm has a target debt/equity ratio of .5, a cost of

equity of 18 percent, and an aftertax cost of debt of 6 percent.

The cost-saving proposal is somewhat riskier than the usual

project the firm undertakes; management uses the subjective

approach and applies an adjustment factor of +2 percent to the

cost of capital for such risky projects. Under what circumstances

should Sallinger take on the project?

F29 Last Problem (continued)

WACC = (_____)(.06) + (_____)(.18) = _____%

Project discount rate = _____% + 2%= _____%

NPV = - cost + PV cash flows

PV cash flows = [$_____ /(_____ - .05)] = $_____

So the project should only be undertaken if its cost is less than

$_____.

F30 Last Problem (concluded)

WACC = (.3333)(.06) + (.6666)(.18) = .14

Project discount rate = .14 + .02 = .16

NPV = - cost + PV cash flows

PV cash flows = [$6M/(.16 - .05)] = $54.55M

So the project should only be undertaken if its cost is less than

$54.55M.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Saudi Vision2030Dokument85 SeitenSaudi Vision2030ryx11Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- American Finance Association, Wiley The Journal of FinanceDokument8 SeitenAmerican Finance Association, Wiley The Journal of FinanceAarti JNoch keine Bewertungen

- Hi5019 Individual Assignment t1 2019 Qyuykqw5Dokument5 SeitenHi5019 Individual Assignment t1 2019 Qyuykqw5Aarti J50% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- CostingDokument3 SeitenCostingAarti JNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- NCK - Annual Report 2017 PDFDokument56 SeitenNCK - Annual Report 2017 PDFAarti JNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Accounting Homework Help IliskimeDokument1 SeiteAccounting Homework Help IliskimeAarti JNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- 6 Capital Market Intermediaries and Their RegulationDokument8 Seiten6 Capital Market Intermediaries and Their RegulationTushar PatilNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- CR 1845Dokument90 SeitenCR 1845Aarti JNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- 1 - Sis40215 CPT Case Studies 3Dokument61 Seiten1 - Sis40215 CPT Case Studies 3Aarti J0% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Mgt201 Solved Subjective Questions Vuzs TeamDokument12 SeitenMgt201 Solved Subjective Questions Vuzs TeamAarti JNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Deegan Chapter 10Dokument18 SeitenDeegan Chapter 10Aarti JNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Relevant Cost Examples EMBA-garrison Ch.13Dokument13 SeitenRelevant Cost Examples EMBA-garrison Ch.13Aarti JNoch keine Bewertungen

- Caltex Australia CTX 2017 Annual ReportDokument127 SeitenCaltex Australia CTX 2017 Annual ReportAarti JNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- CH 07 SMDokument11 SeitenCH 07 SMAarti JNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Case Study Ch03Dokument3 SeitenCase Study Ch03Munya Chawana0% (1)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- TFTH C 636639530213947535 31700 2Dokument55 SeitenTFTH C 636639530213947535 31700 2Aarti JNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Chapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Dokument32 SeitenChapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Judith DelRosario De RoxasNoch keine Bewertungen

- Investment Decision MethodDokument44 SeitenInvestment Decision MethodashwathNoch keine Bewertungen

- Mergers Don't Always Lead To Culture Clashes.Dokument3 SeitenMergers Don't Always Lead To Culture Clashes.Lahiyru100% (3)

- 2 Case - 2Dokument10 Seiten2 Case - 2Aarti JNoch keine Bewertungen

- Philanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Dokument2 SeitenPhilanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Aarti JNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Accounting Changes and Errors: HapterDokument46 SeitenAccounting Changes and Errors: HapterAarti JNoch keine Bewertungen

- Coles Year in Review 2017Dokument28 SeitenColes Year in Review 2017Aarti JNoch keine Bewertungen

- Ch03 Prob3-6ADokument9 SeitenCh03 Prob3-6AAarti J100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Organizational CultureDokument21 SeitenOrganizational CultureAarti JNoch keine Bewertungen

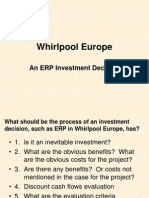

- Whirlpool EuropeDokument19 SeitenWhirlpool Europejoelgzm0% (1)

- The Whirlpool Europe Case: Investment On ERPDokument8 SeitenThe Whirlpool Europe Case: Investment On ERPAarti JNoch keine Bewertungen

- MCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Dokument139 SeitenMCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Aarti J100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- 2010 06 13 - 091545 - Case13 30Dokument6 Seiten2010 06 13 - 091545 - Case13 30Sheila Mae Llamada Saycon IINoch keine Bewertungen

- ACCG315Dokument4 SeitenACCG315Joannah Blue0% (1)

- MFRS 140 Investment Properties - NOTESDokument5 SeitenMFRS 140 Investment Properties - NOTESDont RushNoch keine Bewertungen

- WorldCom Fraud PPT (Accounting Learning)Dokument12 SeitenWorldCom Fraud PPT (Accounting Learning)蒲睿灵Noch keine Bewertungen

- Corporate Law Assignment 2Dokument8 SeitenCorporate Law Assignment 2tawandaNoch keine Bewertungen

- Chapter 2 Financial Statement and Cash Flow AnalysisDokument15 SeitenChapter 2 Financial Statement and Cash Flow AnalysisKapil Singh RautelaNoch keine Bewertungen

- Taxation Issues in Cyberspace With Special Reference To Double TaxationDokument5 SeitenTaxation Issues in Cyberspace With Special Reference To Double TaxationMohnish KNoch keine Bewertungen

- RBS - Round Up - 070410Dokument9 SeitenRBS - Round Up - 070410egolistocksNoch keine Bewertungen

- Star Sentral Sold To Serba Dinamik (Failed)Dokument9 SeitenStar Sentral Sold To Serba Dinamik (Failed)Jia Jian TanNoch keine Bewertungen

- Oswaal ISC Class 11 Accounts Revision Notes For 2023 ExamDokument38 SeitenOswaal ISC Class 11 Accounts Revision Notes For 2023 Examharshaverma726Noch keine Bewertungen

- Tutorial 6 SolutionDokument3 SeitenTutorial 6 SolutionConstance KeenanNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Basic Accounting TestDokument4 SeitenBasic Accounting TestMUHAMMAD NADEEMNoch keine Bewertungen

- Ifrs 9 PresentationDokument26 SeitenIfrs 9 PresentationJean Damascene HakizimanaNoch keine Bewertungen

- MCQ Test BankDokument815 SeitenMCQ Test Banklorna100% (1)

- Corporate Restructuring Strategies, Need, Reasons Importance Imjpications, Benefits Types...Dokument22 SeitenCorporate Restructuring Strategies, Need, Reasons Importance Imjpications, Benefits Types...malhotrasourabh100% (1)

- Ratio Analysis Case Study SolutionDokument7 SeitenRatio Analysis Case Study SolutionRanjuNoch keine Bewertungen

- Portfolio Management Through Mutual FundsDokument14 SeitenPortfolio Management Through Mutual FundsMedha SinghNoch keine Bewertungen

- A Comparative Study On FINANCIAL PERFORMANCE OF NEPAL BANGLADESH BANK LIMITED AND HIMALAYAN BANK LIMITEDDokument35 SeitenA Comparative Study On FINANCIAL PERFORMANCE OF NEPAL BANGLADESH BANK LIMITED AND HIMALAYAN BANK LIMITEDhimalayaban76% (55)

- Statement of Financial Position1 (Guided Practice)Dokument4 SeitenStatement of Financial Position1 (Guided Practice)alabmyselfNoch keine Bewertungen

- Decentralization in Operation and Segment ReportingDokument5 SeitenDecentralization in Operation and Segment ReportingMon RamNoch keine Bewertungen

- Business Law PDFDokument189 SeitenBusiness Law PDFNazmus SakibNoch keine Bewertungen

- Forms of Business OrganisationDokument18 SeitenForms of Business OrganisationAyushi Dodhia100% (1)

- Engineering Economics Lecture 1Dokument36 SeitenEngineering Economics Lecture 1NavinPaudelNoch keine Bewertungen

- Pas 36: Impairment of Assets: ObjectiveDokument6 SeitenPas 36: Impairment of Assets: ObjectiveLEIGHANNE ZYRIL SANTOSNoch keine Bewertungen

- Ias 20 - Gov't GrantDokument19 SeitenIas 20 - Gov't GrantGail Bermudez100% (1)

- Pro Forma Financial StatementsDokument3 SeitenPro Forma Financial StatementsWaiLonn100% (1)

- Black Scholes ModelDokument5 SeitenBlack Scholes ModelAnonymous MKcqUbFKrkNoch keine Bewertungen

- Preview of Chapter 10: Intermediate Accounting 17th Edition Kieso Weygandt WarfieldDokument10 SeitenPreview of Chapter 10: Intermediate Accounting 17th Edition Kieso Weygandt WarfieldDavid Bradley BeckNoch keine Bewertungen

- 704Dokument10 Seiten704Bhoomi Ghariwala0% (1)

- Basic Accounting Principles and GuidelinesDokument23 SeitenBasic Accounting Principles and GuidelinesgaurabNoch keine Bewertungen

- Something About Stock Exchange: BY Aman SharmaDokument24 SeitenSomething About Stock Exchange: BY Aman SharmaAman SharmaNoch keine Bewertungen

- B&a - MCQDokument11 SeitenB&a - MCQAniket PuriNoch keine Bewertungen