Beruflich Dokumente

Kultur Dokumente

Fact Find Sample - Multiple Entities

Hochgeladen von

api-239405473Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Fact Find Sample - Multiple Entities

Hochgeladen von

api-239405473Copyright:

Verfügbare Formate

Fact Find - Private and Confidential

Fact Find

Client 1

Jon-Pierre John Smith

Client 2

Mary Smith

Adviser

Opex Advice

Date completed

16 Dec 2014

Private and confidential

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 1

Fact Find Private and Confidential

Personal information

Personal information

Client 1

Client 2

Title

Mr

Mrs

Given names

Jon-Pierre John

Mary

Surname

Smith

Smith

Preferred name

Jon-Pierre

Mary

Gender

Male

Female

Date of birth

12 Jun 1957

15 Dec 1960

Place of birth

Australian

American

Marital status

Married

Married

Date of marriage

25 Dec 2000

Resident status

Permanent Resident

Australian tax resident

Resident

Resident

Tax file number

Supplied

Not supplied

Contact details

Client 1

Client 2

Home address

555 Torrens Road

Eastside SA 5003

Business address

PO BOX 123

ADELAIDE SA 5000

Address for correspondence

222 Flower Ave

Paradise SA 5555

Home phone

08 8211 2233

Work phone

12234567

Contact information

Mobile

Fax

jpsmith@bigpond.com.au

kelly@opexconsulting.com.au

bedwards@iress.com.au

0415 000 111

Other

Preferred method of contact

jpsmith@bigpond.com.au

12234567

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL

222333444

Page 2

Fact Find - Private and Confidential

Children / dependants

Name

Relationship

Date of birth

Living at home?

Peter

Son

04 Jun 1990 (24)

Yes

No

Daughter

12 Mar 1992 (22)

No

Yes

Support to: 25

Geraldine

Financially dependant?

Additional information

(eg. special needs, education funding requirements, youth allowance or any other government benefit)

This is the dependants box.

Employment

Employment

Client 1

Client 2

Occupation

Chemical Engineer

Teacher

Position

Technical Manager

Industry

Laundries and Dry-Cleaners

Employment status

Full-time

Hours worked per week

40.00

Employer name

GPS Services Pty Ltd

Start date with employer

01 Jan 1997

Years in current occupation

12.00

Any change planned?

If yes, provide details below

No

Salary packaging available?

Yes

Leave details

(annual, sick, LSL)

Annual Leave: 2 weeks

LSL Leave: 12 weeks

Sick Leave: 7 weeks

Unknown

Business structure

(if self employed, record details WAHQ

later in fact find)

Additional information

(eg. salary packaging details, any expected future changes in occupation, pending leave)

Employment additional details

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 3

Fact Find - Private and Confidential

Health details

Client 1

Client 2

Health status

Good

Excellent

Health insurance?

Yes

No

Are their any health conditions

that may impact financial

decisions or investment

timeframes?

Health conditions

Nil

Family history

(eg health issues and

longevity of parents)

Family history

Nil

Description

Name/Company

Contact details

Lawyer

Margaret Johnston

Margaret Johnson Solicitors

444 Charles Road

Adelaide SA 5000

Home Phone Work Phone - (o8) 6666 6666

Name/Company

Contact details

Professional advisers

Referrer details

Description

Referred by

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 4

Fact Find - Private and Confidential

Income

Income

Owner

Amount

Ordinary Wages / Jon-Pierre's salary

Jon-Pierre

$100,000.00

Ordinary Wages / Test

Jon-Pierre

$120,000.00

Bonuses

Jon-Pierre

$10,000.00

Pension Income / OnePath OA

Allocated Pension

Jon-Pierre

$33,000.00

Total income (per annum)

$263,000.00

Expenses

Expense

Owner

Amount

Mortgage Payments

Jon-Pierre

$3,000.00

Gas

Jon-Pierre

$400.00

Home / Lumley Home Plus 221133

Jon-Pierre

$750.00

Health / Bupa Hospital Extras Plus

998877

Jon-Pierre

$2,750.00

Term / Elevate Trauma Plus, Income

Premier, Life Insurance, TPD 889977

Jon-Pierre

$20,710.05

Term / Flexible Insurance 998877

Jon-Pierre

$1,000.00

Term / OneCare Life Cover & TPD &

Trauma Premier Maximiser 7654455

Jon-Pierre

$2,400.00

Other Expenditure / Living expenses

Jon-Pierre

$37,500.00

Term / Term Life Plus 445566

Jon-Pierre & Mary (Joint)

$1,407.36

Total expenses (per annum)

$69,917.41

Other cashflow details

Client 1

Client 2

Able to save?

Yes

No

If Yes, how much?

$2,000.00 per month

Use of savings over the last year

Debt reduction

None

Any capital gains from sale of

investments this year?

$7,500.00

$0.00

Any unused capital losses carried

forward from sale of investments?

$0.00

$0.00

Additional information

(e.g. how expenses will change post retirement, any unusual expenses anticipated in the future)

Cashflow details

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 5

Fact Find - Private and Confidential

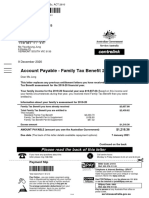

Social Security benefits

Centrelink / DVA detail

Client 1

Client 2

Payment type

Age Pension

Reference No.

222333444

Centrelink assessed assets

250,000.00

Valuation date: 23 May 2013

Valuation date:

Centrelink assessed income

$2,350.00 per annum

Valuation date: 23 May 2013

$

Valuation date:

Are you renting?

No

Gifts in last 5 years

No

PBS registered?

Yes

(Date: 01 Jul 2008

CSHC registered?

Yes

Annual entitlement

$12,500.00

$0.00

Additional information

Gifted $5,000 to son Peter on 1 May 2010.

Aged Care

Aged care

Client 1

Client 2

- Daily care fee

- Income tested fee

Facility type

Date of entry

Fees

- Entry fee

Status of former home

Total annual fees

Additional information

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 6

Fact Find - Private and Confidential

Assets

Assets lifestyle

Owner

Amount

Life Style / Antiques Antique furniture

Jon-Pierre

Peter Adams

$75,000

Business Assets / Goodwill Jim's

Mowing

Jon-Pierre

Liquid Assets / Current Savings Bank

West Cash Saver

Mary

Costa Filippou

Real Estate / Primary Residence Home

Joint

$750,000

Life Style / Household Contents

Contents

Joint

$50,000

$100,000

$27,500

Total assets

$1,002,500

Assets - investment

Amount

Jon-Pierre

Default Account

Art Work

$100,000.00

Art Work 2

$10,000.00

CBACCA

$1,000.00

GDI Property Group

$860.00

S&P/ASX 200 A-REIT

$1,324.10

Subtotal

$113,184.10

Jon-Pierre's Wrap Account

BT Classic Investment Funds - BT Core Australian Share Fund

$120,480.05

Hunter Hall Australian Value Trust

$114,766.16

Subtotal

$235,246.21

Colonial First State FirstChoice Personal Super 8599

CFS FirstChoice Personal Super - Aberdeen Australian Fixed Income

$70,718.25

CFS FirstChoice Personal Super - Acadian Defensive Income

$67,822.71

CFS FirstChoice Personal Super - Acadian Global Equity

$78,019.91

Subtotal

$216,560.87

Findon Home

Adelaide Home

$400,000.00

Findon Home

$450,000.00

Subtotal

$850,000.00

Macquarie Wrap Pension Manager 6859

AMP Capital Australian Equity Opportunities Fund Class A

$139,884.77

Macquarie Global Infrastructure Trust II - A Class

$143,471.17

Macquarie Master Property Securities Fund

$168,751.28

Subtotal

$452,107.22

Jon-Pierre's Super Fund

Commonwealth Bank of Australia

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

$137,274.48

Page 7

Fact Find - Private and Confidential

Assets - investment

Amount

Perpetual WealthFocus Super Plan - Perpetual Smaller Companies

$128,217.72

Perpetual's Cash Management Fund

$100,000.00

Platinum International Fund

$127,255.07

Telstra Corporation Limited

$132,000.00

Testing the name

$144,110.21

Wesfarmers Limited

$115,421.76

Subtotal

Total

$884,279.24

$2,751,377.64

Mary

Default Account

BHP Billiton Limited

$15,995.00

Telstra Corporation Limited

$3,300.00

Subtotal

Total

$19,295.00

$19,295.00

JPS Company

Default Account

OnePath OA PS - OptiMix Balanced EF/Sel

$1,816.30

Telstra Corporation Limited

$660.00

Woolworths Limited

$32,790.00

Subtotal

Total

$35,266.30

$35,266.30

Smith Family Super Fund

Default Account

Platinum International Fund

$150,993.02

Subtotal

Total

$150,993.02

$150,993.02

Costaki Superfund

Default Account

BHP Billiton Limited

$63,980.00

OnePath OA IP - OptiMix Australian Fixed Interest Trust NEF

$1,543.80

Telstra Corporation Limited

$6,600.00

Subtotal

Total

Total assets

$72,123.80

$72,123.80

$4,630,704.10

Additional information

Asset details

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 8

Fact Find - Private and Confidential

Liabilities

Liabilities

Owner

Outstanding Balance

Loan Limit

Credit Card

Jon-Pierre

Fred Turk

$3,000

$5,000.00

Investment Property Mortgage

Mary

Mazza Turk

$23,750

Primary Residence Mortgage / ANZ

Bank / ANZ Bank

Joint

Total liabilities

$500,000

$526,750

Additional information

(eg. What are the clients attitudes to managing debt? When does the client want all debt to be paid off?

Liability details

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 9

Fact Find - Private and Confidential

Superannuation fund details

Superannuation

Jon-Pierre

Fund name:

Type

Total fund balance as at 19 Feb 2013:

Policy number

Employer contributions (pa)

Salary Sacrifice contributions (pa)

Personal deductible contributions (pa)

Non-Deductible contributions (pa)

Tax-free component:

Taxable component (taxed):

Taxable component (untaxed):

Eligible start date:

Unrestricted non-preserved:

Death cover

TPD cover

Salary continuance

Beneficiary/Type

Access eWrap Super

Accumulation

$625,000

1122334455

$18,000.00

$0.00

$0.00

$0.00

$55,000

$450,000

$120,000

01 Jul 1997

$25,000

$150,000.00

$150,000.00

$150,000.00

Beneficiary name: Mary Smith

* binding: yes

* binding end date: Inception

* relationship to owner: Spouse

* percentage: 100%

Fund name:

Type

Total fund balance as at 12 Aug 2014:

Policy number

Employer contributions (pa)

Salary Sacrifice contributions (pa)

Personal deductible contributions (pa)

Non-Deductible contributions (pa)

Tax-free component:

Taxable component (taxed):

Taxable component (untaxed):

Eligible start date:

Unrestricted non-preserved:

Death cover

TPD cover

Salary continuance

Beneficiary/Type

Advance Retirement Savings Account

Accumulation

$200,000

666666

$0.00

$0.00

$0.00

$0.00

$0

$200,000

$0

Fund name:

Type

Total fund balance as at 14 Jan 2014:

Policy number

Employer contributions (pa)

Salary Sacrifice contributions (pa)

Personal deductible contributions (pa)

Colonial First State FirstChoice Personal Super

Accumulation

$200,000

$0

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 10

Fact Find - Private and Confidential

Superannuation

Non-Deductible contributions (pa)

Tax-free component:

Taxable component (taxed):

Taxable component (untaxed):

Eligible start date:

Unrestricted non-preserved:

Death cover

TPD cover

Salary continuance

Beneficiary/Type

Mary

Fund name:

Type

Total fund balance as at :

Policy number

Employer contributions (pa)

Salary Sacrifice contributions (pa)

Personal deductible contributions (pa)

Non-Deductible contributions (pa)

Tax-free component:

Taxable component (taxed):

Taxable component (untaxed):

Eligible start date:

Unrestricted non-preserved:

Death cover

TPD cover

Salary continuance

Beneficiary/Type

$0.00

$0

$150,000

$50,000

$0

$0.00

$0.00

$0.00

BT SuperWrap Super (Standard)

Accumulation

$0

$0.00

$0.00

$0.00

$0.00

$0

$0

$0

$0

$0.00

$0.00

$0.00

Additional information

Superannuation details

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 11

Fact Find - Private and Confidential

Employment termination payments (ETP)

Termination payment details

Client 1

Client 2

Employment start date

Expected termination date

Tax-free redundancy amount

ETP amount

Unused annual leave

Unused long service leave

Other:

Super and ETP payment history

Jon-Pierre

Payee

Source

Date of payment

Total

Smiths Crisps Pty Ltd

Employer ETP

23 May 2008

$48,000

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 12

Fact Find - Private and Confidential

Pension and Annuity details

Pension / annuities

Jon-Pierre

Provider name/Product name

Account number

Type

TTR?

Current value

Purchase price

Purchase date

Term at purchase

Tax free %

Reversionary

Gross Income

Tax deductible %

Centrelink deductible amount

Beneficiary

OnePath OA Allocated Pension

55228866

Account Based Pension TTR

Yes

$257,890.00

$200,000.00

01 Feb 2010

0 year(s)

45.00%

Yes

$2,750.00 / Monthly

25.00%

$10,000.00

Mary Smith (Non-Lapsing Binding)

Additional information

Pension details

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 13

Fact Find - Private and Confidential

Existing Personal Insurances

Insurer/Product

Owner/

Life Insured

Macquarie Life

OneCare Life Cover & TPD

& Trauma Premier

Maximiser

7654455

Jon-Pierre Smith

Jon-Pierre

AMP

Term Life Plus

445566

AMP

Elevate Trauma Plus,

Income Premier, Life

Insurance, TPD

889977

Waiting

period

Benefit period

Accident

Sickness

Premium

$200.00

$12,750

Monthly

IP

30 Days

Age 65

Age 65

$234.56

Death

$500,000

Jon-Pierre Smith

$1,000.00

Status

Monthly

Inforce

Stepped

Inforce

Monthly

Inforce

Stepped

Inforce

Yearly

Inforce

Mary

Death

$500,000

Stepped

Inforce

Mary

TPD

$250,000

Stepped

Cancelled

Jon-Pierre Smith

Mary

AMP

AMP Life Cover

AC12345

Level

of cover

Jon-Pierre Smith

Smith and Jones

Partnership

Jon-Pierre

AMP

Flexible Insurance

998877

Type

of cover

$20,710.05

Key Body Sys

Additional Life

Yearly

Inforce

$250,000

$75,000

Stepped

Inforce

Jon-Pierre

Death

$1,224,918

Stepped

Inforce

Jon-Pierre

TPD

$500,000

Stepped

Inforce

Jon-Pierre

Trauma

$162,500

Stepped

Inforce

Jon-Pierre

Child Cover

$100,000

$2,750.00

Death

$250,000

Jon-Pierre

IP

$5,897

Monthly

Jon-Pierre

TPD

$250,000

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Notes box

Back exclusion

100% loading for stress related illness

Any Occupation

Any Occupation

Inforce

Smith Family Super

Fund

Jon-Pierre

Notes/Beneficiaries

60 Days

Age 65

Monthly

Inforce

Beneficiaries:

Smith, Mary (100.00%)

Level

Inforce

Renewal date: 4 Sep

Stepped

Inforce

Inforce

Page 14

Any Occupation

Renewal date: 4 Sep

Fact Find - Private and Confidential

Allianz

Test

1546

JPS Company

Jon-Pierre

AMP

Term Life Plus

445566

Death

$500,000

Jon-Pierre Smith

Smith and Jones

Partnership

Jon-Pierre

AC&L

Term and Disability Cover

AC99999

$1,500.00

$234.56

Death

$500,000

Smith and Jones

Partnership

Costa Filippou

Costa

$4,578.99

TPD

$250,000

Inforce

Hybrid

Inforce

Monthly

Inforce

Stepped

Inforce

Yearly

Inforce

Level

Additional information

Insurance details

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Monthly

Page 15

Inforce

Notes box

Back exclusion

100% loading for stress related illness

Any Occupation

Notes box

Neck exclusion

Knee 100% loading

Fact Find - Private and Confidential

General and Health insurance

General Insurer

Type

Lumley General

Insurance (NZ)

Limited

Buildings and

Contents

Residential

Health Insurer/Product

Bupa Hospital Extras Plus

Details

Owner

Sum insured

Premium

Jon-Pierre Smith

$750,000.00

$125.00

111 Big Tree Lane

$650,000.00

Type

Owner

Insured

Family

Jon-Pierre Smith

Mary Smith

Jon-Pierre Smith

Mary Smith

Premium

$5500.00 (AUD)

Additional information

General Insurance details

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 16

Fact Find - Private and Confidential

Estate planning

Estate planning

Client 1

Client 2

Existing Will?

Yes

Yes

Date of original Will

01 Jul 2001

01 Jul 2001

Date last reviewed

03 Apr 2008

03 Apr 2008

Name of appointed guardian

Peter Adams

Peter Adams

Location of Will

JP Accounting

Have circumstances changed

since last review?

See Additional Information below

Testamentary trust?

If yes, who are the beneficiaries?

Powers of attorney?

See Additional Information below

Yes

Yes

No

If yes, what types/who?

Enduring

Enduring power of guardianship

Funeral plan?

Not in place

State in which documents

prepared?

SA

Any previous relationships that

may impact on estate planning

arrangements?

Yes. Married for 10 years to Jezzabelle

Witch (2 children both devils).

Any bequests?

See Additional Information below

See Additional Information below

Any other special estate

See Additional Information below

planning issues? (e.g. likelihood of

See Additional Information below

receiving an inheritance, de-facto

relationship, children from previous

relationships)

Any potential beneficiaries in a

vulnerable situation? (e.g.

financial trouble, relationship

problems, disabilities)

See Additional Information below

See Additional Information below

Executors (Client 1)

Notes

Peter Adams

Peter is the family accountant and close friend.

Mary Smith

Executors (Client 2)

Notes

Beneficiaries (Client 1)

Age of entitlement

Andrew Smith

25

Mary Smith

Immediate

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Notes

Page 17

Fact Find - Private and Confidential

Beneficiaries (Client 2)

Notes

Powers of Attorney (Client 1)

Type

Peter Adams

Enduring

Powers of Attorney (Client 2)

Type

Notes

Notes

Additional information

(eg. For business owners, are buy/sell agreements and relevant insurance policies in place? Complete the separate Business Fact Find

where appropriate. )

Estate Planning details

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 18

Fact Find - Private and Confidential

Structures

Associated structures

Name

Type

Ownership

Purpose

Gillard SMSF

SMSF

Julia and Tony

Family fun

Other information

Company Name

Directors

Shareholders

TFN

ABN

SMSF Name

Trustees

Members

TFN

ABN

SFN

JPS Company

Hugo Walters

James Google

- 50 shares

- 50 shares

Supplied

77665544

Smith Family Super Fund

Jon-Pierre Smith

Mary Smith

Jon-Pierre Smith

Mary Smith

Not supplied

111222333

SMSF Name

Trustees

Members

TFN

ABN

SFN

Costaki Superfund

Partnership Name

Smith and Jones Partnership

Pedro Jones (50.00%)

Jon-Pierre Smith (50.00%)

Supplied

222333444

Partners

TFN

ABN

Not supplied

Additional information (eg. entity diagram)

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 19

Fact Find - Private and Confidential

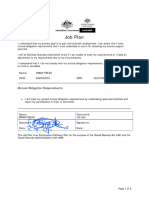

Scope of advice

Initial reason for seeking advice

Record the initial reason why the client is seeking your advice. For example, there may be specific event (eg. house or business purchase,

marriage, birth of child, receipt of an inheritance, redundancy, moved to an aged care facility) or the client may want advice on specific

objectives (eg. retirement planning, estate planning, income protection, business succession insurance).

Initial scope of advice

1. Inheritence

2. Birth of a child

3. Marriage

4. Divorce

Agreed scope of advice

Once you have completed further investigations and discussions with your client, record the agreed scope of advice. Include a clear

explanation of the reasons for any changes from the initial to agreed scope of advice. Has the advice been scaled? If so, include details

that support your judgement to scale your advice. Please note that once the scope of advice has been agreed, you may need to make

further enquiries to be in a position to provide appropriate advice (record any additional information in the relevant section of the Fact

Find).

Agreed scope of advice

Analysis of your personal risk insurance needs.

Advice on insurance products for specific types and amount of cover you nominate.

Advice limitations

Advice limitations

Has the client limited the advice or given directions as to the scope of advice? Yes

Provide details *:

During our discussions, you requested that we limit our advice to the scope of advice and the needs and objectives as

outlined in this Statement of Advice. Because of this request, it is important that you are aware that we have not provided

advice on the following: [insert excluded advice areas excluded and where applicable give the reason for exclusion]

e.g. Trauma insurance because you have indicated you do not currently have the cashflow to afford the

additional premiums.

e.g. Your direct share portfolio as you have this managed by your stockbroker, [name], and you want to continue

with that arrangement.

Due to the reduced scope of our advice, [insert implications] e.g. this SOA may not address all of your issues and

needs/the types and levels of insurance cover may not be appropriate to your needs.

[Insert recommended actions (if any)] e.g. We recommend you review your insurance requirements at your next annual

review meeting or earlier if your circumstances change.

Clearly outline the aspects that the client has taken out of scope. Examples: (i) you may identify an issue with the clients cashflow/debt/retirement or

estate planning position but the client declines advice in those advice areas, (ii) within a particular advice area like Insurance, the client may decline a type

of cover, or they may select the actual amount of cover, or limit the total premium, (iii) the client may wish to retain/purchase/sell a component within

their investment or insurance portfolio without your advice).

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 20

Fact Find - Private and Confidential

Incomplete or inaccurate information

Information limitations

Has the client provided all the information you require and requested?

Yes

Provide details :

We note that you were unable to provide some of the information we requested. In particular, we have not been given

details about abc. You are aware that this limits our ability to provide advice based on a full consideration of your

complete situation. As a result, the recommendations may not be appropriate to your particular financial situation.

Therefore, you should carefully assess the appropriateness of the recommendations in light of your overall financial

situation. Of course, we will endeavour to provide appropriate advice based on the information you have provided.

Steps taken to obtain information box.

*

Clearly outline what information is incomplete and/or inaccurate and the steps you have taken to obtain the information you require.

Adviser expertise

Adviser expertise

Do you have the necessary expertise to give the advice?

No

Do you have the relevant proper authority to give the advice?

If No, provide relevant information and actions taken (eg decline to give advice, referral to other parties):

Adviser expertise box.

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 21

Fact Find - Private and Confidential

Needs and objectives

Use the tables below to record the needs and objectives you and the client have agreed will be addressed. Aim to be specific when stating

the clients objectives (eg. include a purpose, amount and timeframe where appropriate). You may wish to prioritise each need/objective

and include details about how the client wishes them to be funded (e.g. savings, sale of assets, pension etc).

Description

You have reduced your work hours and wish to access your super to top up your reduced work income with

pension income. You want to increase your take home pay by $12,000 per annum to $70,000 per annum.

To protect your family/dependants in the event of death.

To review your Estate Planning arrangements to ensure that your wishes will be followed in relation to your

financial and personal matters in the event of your death. Also, you want to ensure that your affairs are taken

care of in the event you are incapacitated.

Planning priorities and preferences*

Jon-Pierre and Mary have asked us to review their portfolios to ensure they are well placed for the future and will meet

their needs and objectives. When designing out advice solustions they would like us to take into account their

preferences:

they are comfortable with their current 'balanced' investor profile

a well diversified portfolio that is actively managed so that it works hard for them

the ability to incorporate direct shares and term deposits in their portfolio as well as the 'usual' sector specialist

managed funds

an administration system that provides 24/7 access to their portfolio status and the ability to obtain good online

portfolio reports

regular access to our services so they can 'keep on top of' everthing that's going in their portfolio.

Include any client concerns and preferences that the client wants you to consider when formulating your advice. For example, access to funds, security of

capital or income, desire for tax efficiency, portfolio style (active/passive/control) and make-up (direct v managed, access to cash/TDs/shares), desired

features of superannuation platform (e.g. auto-rebalancing, daily unit pricing, ability to select and maintain exact amount of cover, allows TTR pensions and

binding nominations, view account balances online, make contributions by BPay, contribution splitting, overseas pension transfers), particular financial

products the client wants you to consider, attitudes to managing debt (is repaying debt a priority? at what age does the client want all debts repaid)

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 22

Fact Find - Private and Confidential

Personal risk needs analysis

Jon-Pierre Smith

Requirements - Jon-Pierre

Calculation Mode

Analysis Mode

Hide Null Rows

Assumptions

Present Value

Detailed

Yes

Income

Protection

pa

Business

Expenses

pa

$56,250

$0

Life

TPD

Trauma

$250,000

$731,106

$250,000

$0

$62,500

$0

$0

$0

$0

$0

$250,000

$100,000

$0

$0

$0

$0

$0

$30,000

$0

$0

$0

Total Capital Required

Total Upfront Needs

$981,106

$250,000

$530,000

$530,000

$162,500

$162,500

Capital Provisions

Disposable Assets

Continuing Income (PV)

$0

$438,664

$0

$438,664

$0

$0

Total Capital Available

$438,664

$438,664

$0

Insurance Needs

Total Cover Required

Existing Cover

$542,443

$0

$500,000

$0

$162,500

$0

$56,250

$0

$0

$0

-$542,443

-$500,000

-$162,500

-$56,250

$0

Partner Life Exp.

Partner Life Exp.

30 years *

30 years *

Partner Life Exp.

Upfront Costs Only

*

Capital Requirements

Liabilities to clear

Future Expenditure Required

Future Education Expenses

(PV)

Medical costs/Recovery

income

Provision for Tax

Other Provisions

Other

Surplus/Shortfall

Projection/Funding Period

Actual Funding Period

* Based on cashflow

projection

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 23

Fact Find - Private and Confidential

Mary Smith

Requirements - Mary

Calculation Mode

Analysis Mode

Hide Null Rows

Assumptions

Present Value

Detailed

Yes

Income

Protection

pa

Business

Expenses

pa

$0

$0

Life

TPD

Trauma

Capital Requirements

Liabilities to clear

Future Expenditure Required

Future Education Expenses (PV)

Medical costs/Recovery income

Provision for Tax

Other Provisions

Other

$250,000

$169,088

$0

$0

$0

$0

$0

$250,000

$169,088

$0

$0

$0

$0

$0

$0

$169,088

$0

$0

$0

$0

$0

Total Capital Required

Total Upfront Needs

$419,088

$250,000

$419,088

$250,000

$169,088

$0

$0

$0

$0

$0

$0

$0

$419,088

$0

$419,088

$0

$169,088

$0

$0

$0

$0

$0

-$419,088

-$419,088

-$169,088

$0

$0

Client Life Exp.

23 years *

Client Life Exp.

23 years *

Client Life Exp.

23 years *

Capital Provisions

Disposable Assets

Continuing Income (PV)

Insurance Needs

Total Cover Required

Existing Cover

Surplus/Shortfall

Projection/Funding Period

Actual Funding Period

* Based on cashflow projection

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 24

Fact Find - Private and Confidential

Additional underwriting details

Underwriting details

Client 1

Client 2

Height

183 cm

155 cm

Weight

80 kg

55 kg

Smoker?

If No, when ceased?

If Yes, number/day

Yes

No

15

Key duties of occupation

(include details of heights/

underground work etc)

duties for client

Administrative %

100.00%

75.00%

Manual %

0.00%

0.00%

Supervisory %

0.00%

25.00%

Travel %

0.00%

0.00%

Taking or been on any

prescribed medication?

Yes

No

Previous insurance claims?

No

No

Previous insurance declined,

loaded or exclusions applied?

No

No

Hazardous pursuits

Client 1

Client 2

Any special interests (eg

abseiling, car racing, scuba

diving)?

Sky diving

Nil

Additional information

Provide additional details on the information in the above needs analysis and underwriting tables. Explain the reasons why the Agreed

cover is less than the Cover required (if applicable).

Underwriting details

Risk planning priorities and preferences*

Additional info

Include any client concerns and preferences that the client wants you to consider when formulating your advice. For example - Ownership

(super/self/other); Beneficiaries (type/person); Preferences re features of recommended policies (eg. linked or standalone TPD/Trauma cover, TPD

definition, basic or comprehensive IP cover, IP features that provide immediate cover during the waiting period, needlestick benefits, preferred WP/BP),

particular financial products the client wants you to consider

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 25

Fact Find - Private and Confidential

Investment experience and attitude to risk

Please use your Licensees approved Risk Profile Questionnaire and attach a copy to the fact find (if applicable). Outline your discussions

with your client about their investment knowledge, education and experience, their motivation for investing and their attitude to risk.

Have they used other advisers previously? Is the agreed risk profile consistent with the outcome of the questionnaire? Is the profile

appropriate? Would another adviser recommend the same profile? If not, explain why.

Agreed profile

Client 1

Client 2

Moderately aggressive

Moderate

Additional information

Additionsl Info Risk Profiling.

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 26

Fact Find - Private and Confidential

Adviser notes

Adviser notes

Adviser notes

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 27

Fact Find - Private and Confidential

Fee details

Details

Advice fee (preparation of SOA)

$2,750.00

Payment method

I/We have agreed to pay this fee [enter alternative form of payment].

Communication preferences

Communications

Details

Preferred means of communication of advice

documents, PDS, FSG etc

If email, confirm preferred email address

jpsmith@bigpond.com.au

Privacy/FDS/FSG details

FSG details

Details

Privacy discussed?

Yes

Fee Disclosure Statement (FDS) Date

31 Oct 2014

FSG version number

Date FSG provided

03 Oct 2012

Separate fact find worksheets

Client 1

Client 2

Investor risk profile questionnaire

Yes No

Yes No

Investment schedule

Yes No

Yes No

Superannuation contribution history

Yes No

Yes No

Business expenses

Yes No

Yes No

Business insurance

Yes No

Yes No

SMSF information

Yes No

Yes No

Budget

Yes No

Yes No

Yes No

Yes No

Yes No

Yes No

Opex Advice

____________________________________

______________

Signature

Date

ABC Financial Services Pty Ltd | ABN 111 222 333 AFSL 222333444

Page 28

Das könnte Ihnen auch gefallen

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionVon EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNoch keine Bewertungen

- Payslip25797627 PDFDokument1 SeitePayslip25797627 PDFObaid KhanNoch keine Bewertungen

- Retirement Planning With Group SuperannuationDokument5 SeitenRetirement Planning With Group SuperannuationRutul DaveNoch keine Bewertungen

- Application To Copy or Transfer From One Medicare Card To AnotherDokument6 SeitenApplication To Copy or Transfer From One Medicare Card To AnotherDavid LockeridgeNoch keine Bewertungen

- FAO Reco Account Payable J285611951Dokument3 SeitenFAO Reco Account Payable J285611951dotaemumNoch keine Bewertungen

- Client Application DetailsDokument6 SeitenClient Application DetailsSaran Kumar RamarNoch keine Bewertungen

- Borrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramDokument3 SeitenBorrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramNathan BurrisNoch keine Bewertungen

- Payslip Airen ObenzaDokument1 SeitePayslip Airen Obenzamiss_airenNoch keine Bewertungen

- Electronic Record and Signature DisclosureDokument4 SeitenElectronic Record and Signature DisclosureVhince BaltoresNoch keine Bewertungen

- Pay SlipDokument1 SeitePay SlipAzhari NugrahaNoch keine Bewertungen

- Metrobank ADA Enrollment FormDokument1 SeiteMetrobank ADA Enrollment FormPatrick PoculanNoch keine Bewertungen

- Invoice Furniture RepairDokument1 SeiteInvoice Furniture RepairSigit Catur AriwibowoNoch keine Bewertungen

- Invoice 1434857Dokument1 SeiteInvoice 1434857mieayamjamurNoch keine Bewertungen

- JobPlan - PDF 2424Dokument2 SeitenJobPlan - PDF 2424mysteriousnooboNoch keine Bewertungen

- Filled The Dandiwal Family Trust Casual 2019 5179Dokument8 SeitenFilled The Dandiwal Family Trust Casual 2019 5179Annie LamNoch keine Bewertungen

- City of Fort St. John - 2022 Annual Tax Sale ReportDokument5 SeitenCity of Fort St. John - 2022 Annual Tax Sale ReportAlaskaHighwayNewsNoch keine Bewertungen

- Ambulance: VictoriaDokument2 SeitenAmbulance: VictoriaJames WearneNoch keine Bewertungen

- Customer PDFDokument1 SeiteCustomer PDFErwinNoch keine Bewertungen

- Electronic Record and Signature DisclosureDokument6 SeitenElectronic Record and Signature Disclosurecristie oliveiraNoch keine Bewertungen

- Pay SlipDokument1 SeitePay Slipraj Kumar Thapa chhetriNoch keine Bewertungen

- Od 110281678571962000Dokument1 SeiteOd 110281678571962000Pranav SinghNoch keine Bewertungen

- 1420 Form For Applicants PDFDokument21 Seiten1420 Form For Applicants PDFsarangowaNoch keine Bewertungen

- Emergency Recovery Payment Grant K253563563Dokument2 SeitenEmergency Recovery Payment Grant K253563563Ray QuinnNoch keine Bewertungen

- Ubank Verification FormDokument2 SeitenUbank Verification FormRachel ZNoch keine Bewertungen

- Payslip-22 April 22Dokument1 SeitePayslip-22 April 22tammy.shattockNoch keine Bewertungen

- Credit Assessment of Housing Loans in Australia: Data Compiled by Dr. D. Sreenivasa CharyDokument45 SeitenCredit Assessment of Housing Loans in Australia: Data Compiled by Dr. D. Sreenivasa Charysaumya tiwariNoch keine Bewertungen

- Rent Subsidy Review - Your New Rent and Water Charge: Assessment Details Table at The End of This LetterDokument3 SeitenRent Subsidy Review - Your New Rent and Water Charge: Assessment Details Table at The End of This Letteranthony rudduckNoch keine Bewertungen

- 3169 1306enDokument3 Seiten3169 1306enmilitia14Noch keine Bewertungen

- Interim Certificate Amendment: Use This Form IfDokument2 SeitenInterim Certificate Amendment: Use This Form Ifdimuthh7441Noch keine Bewertungen

- Description Rate Hours Earnings Year To Date Taxes Current Year To DateDokument1 SeiteDescription Rate Hours Earnings Year To Date Taxes Current Year To DateCody BryantNoch keine Bewertungen

- IRDDokument6 SeitenIRDKKNoch keine Bewertungen

- Income Tax Account Statement of Account: Miss Melissa L Cooke 53/10 Shortland ST Telopea NSW 2117Dokument4 SeitenIncome Tax Account Statement of Account: Miss Melissa L Cooke 53/10 Shortland ST Telopea NSW 2117melissacooke47Noch keine Bewertungen

- Claims For Fare AllowanceDokument8 SeitenClaims For Fare Allowance*jezzaNoch keine Bewertungen

- Credit Card Statement For The Period: MR RH Van Rensburg 13 Oval North Beacon Valley Mitchells Plain 7785Dokument4 SeitenCredit Card Statement For The Period: MR RH Van Rensburg 13 Oval North Beacon Valley Mitchells Plain 7785RyanNoch keine Bewertungen

- What You Need To Do Now: Manage Your Policy OnlineDokument25 SeitenWhat You Need To Do Now: Manage Your Policy OnlineManish JaiswalNoch keine Bewertungen

- Arshiya Logistics Services Limited: Payslip For The Month of April 2020 Suhas AmbadeDokument1 SeiteArshiya Logistics Services Limited: Payslip For The Month of April 2020 Suhas AmbadeSuhas AmbadeNoch keine Bewertungen

- 4imprint QuoteDokument2 Seiten4imprint QuoteAnonymous 1dpFmxkGNoch keine Bewertungen

- Notice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118Dokument2 SeitenNotice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118shadforth1977Noch keine Bewertungen

- TWP 87187353Dokument2 SeitenTWP 87187353Abilon Smith100% (2)

- ARC Current PayslipDokument1 SeiteARC Current PayslipSaiful IslamNoch keine Bewertungen

- Y3 and Personal Data Form 2Dokument5 SeitenY3 and Personal Data Form 2Shakil AhmedNoch keine Bewertungen

- MyafDokument2 SeitenMyaffNoch keine Bewertungen

- Disabikity Pension Application Form Sa466-2305en-FDokument35 SeitenDisabikity Pension Application Form Sa466-2305en-FdaryltoschNoch keine Bewertungen

- You Can Get This Information in Large Print and Braille. Call 1-800-841-2900 From Monday ToDokument6 SeitenYou Can Get This Information in Large Print and Braille. Call 1-800-841-2900 From Monday ToAbhishek MeeNoch keine Bewertungen

- Oakland Domain Awareness Center - Invoice Binder Scan 11-06-13 (June 2013) 208pgsDokument208 SeitenOakland Domain Awareness Center - Invoice Binder Scan 11-06-13 (June 2013) 208pgsoccupyoaklandNoch keine Bewertungen

- Payout LetterDokument1 SeitePayout LetterPaul LesterNoch keine Bewertungen

- Sareen C K Bike InsuranceDokument1 SeiteSareen C K Bike InsurancesareenckNoch keine Bewertungen

- Statement of Benefits 30 04 2020Dokument10 SeitenStatement of Benefits 30 04 2020Chris MillsNoch keine Bewertungen

- 09.04 - Payslip - PrefeituraDokument1 Seite09.04 - Payslip - PrefeituraCanal do Vinycius AzevedoNoch keine Bewertungen

- Important Information - P236892548Dokument2 SeitenImportant Information - P236892548Jo FrucknowsNoch keine Bewertungen

- Form A PDFDokument2 SeitenForm A PDFSundar SethNoch keine Bewertungen

- 01 0071 0128757 00 - Statement - 2014 08 14 PDFDokument1 Seite01 0071 0128757 00 - Statement - 2014 08 14 PDFverghese17Noch keine Bewertungen

- Pay Slip TemplateDokument1 SeitePay Slip TemplateseriesiigtrsNoch keine Bewertungen

- Leave Certification Requirements: Page 1 of 14Dokument14 SeitenLeave Certification Requirements: Page 1 of 14Anonymous zEf2TWiHgWNoch keine Bewertungen

- 2022 T1 Form - CompletedDokument8 Seiten2022 T1 Form - CompletedARSH GROVERNoch keine Bewertungen

- Pran Application PDFDokument5 SeitenPran Application PDFChandra Sekhar BasamNoch keine Bewertungen

- T1 General PDFDokument4 SeitenT1 General PDFbatmanbittuNoch keine Bewertungen

- SIDS Health Care Pvt. LTD.: Payslip For January-2019Dokument1 SeiteSIDS Health Care Pvt. LTD.: Payslip For January-2019hitesh gandhiNoch keine Bewertungen

- Form Ferick Done - JPGDokument9 SeitenForm Ferick Done - JPGAnnie LamNoch keine Bewertungen

- Transaction Details Amount in PKR Closing Balance DateDokument2 SeitenTransaction Details Amount in PKR Closing Balance DateraisNoch keine Bewertungen

- Aequitas Capital Stipulated Receivership OrderDokument18 SeitenAequitas Capital Stipulated Receivership OrderMatthew KishNoch keine Bewertungen

- Loan On Bottomry and RespondentiaDokument14 SeitenLoan On Bottomry and RespondentiaRio LorraineNoch keine Bewertungen

- Sailboat Fund Newsletter - 2007Dokument5 SeitenSailboat Fund Newsletter - 2007testertestNoch keine Bewertungen

- Finance ReviewerDokument11 SeitenFinance Reviewerlovella lastrellaNoch keine Bewertungen

- Understanding The Concept of Secured Credit Transactions and Secured Transactions On Moveable Assets (Collateral Registry) ACT 2017Dokument7 SeitenUnderstanding The Concept of Secured Credit Transactions and Secured Transactions On Moveable Assets (Collateral Registry) ACT 2017Thethan ArenaNoch keine Bewertungen

- A.C. No. 6933-Benito, Li Carl T. (VAWC)Dokument2 SeitenA.C. No. 6933-Benito, Li Carl T. (VAWC)licarl benitoNoch keine Bewertungen

- Essay Time Value of MoneyDokument4 SeitenEssay Time Value of MoneyArun Kumar AnalaNoch keine Bewertungen

- Financial StressDokument26 SeitenFinancial StressHannah NovioNoch keine Bewertungen

- Lecture 1Dokument15 SeitenLecture 1Rahul KhobragadeNoch keine Bewertungen

- Job Satisfaction at SBI Project Report Mba HRDokument78 SeitenJob Satisfaction at SBI Project Report Mba HRBabasab Patil (Karrisatte)0% (1)

- You Gathered The Following:: Audit of Cash and Cash Equivalents Problem No. 1Dokument3 SeitenYou Gathered The Following:: Audit of Cash and Cash Equivalents Problem No. 1Jeremiah DavidNoch keine Bewertungen

- Estate Tax ProblemsDokument3 SeitenEstate Tax ProblemsGwen BrossardNoch keine Bewertungen

- Integrated Realty Corporation Vs PNBDokument3 SeitenIntegrated Realty Corporation Vs PNBCelinka ChunNoch keine Bewertungen

- Accountancy Paper - IV - Auditing & Cost AccountingDokument296 SeitenAccountancy Paper - IV - Auditing & Cost AccountingVinod pawarNoch keine Bewertungen

- London Oaks - 2009 VADokument250 SeitenLondon Oaks - 2009 VADavid LayfieldNoch keine Bewertungen

- Depo of Craig Edelman Kercado V.Dokument94 SeitenDepo of Craig Edelman Kercado V.Diane SternNoch keine Bewertungen

- Deed of Sale With Assumption of MortgageDokument2 SeitenDeed of Sale With Assumption of MortgageCharles Galvez CaingcoyNoch keine Bewertungen

- BoomgDokument125 SeitenBoomgGagandeep Gill100% (1)

- 1 SEM BCOM - Indian Financial System PDFDokument35 Seiten1 SEM BCOM - Indian Financial System PDFShambhavi JNoch keine Bewertungen

- Torrens TitleDokument5 SeitenTorrens TitleBLP Cooperative100% (1)

- Digest Rule 6 No. 3 DBP v. CADokument3 SeitenDigest Rule 6 No. 3 DBP v. CARomnick JesalvaNoch keine Bewertungen

- RFP1 Indicative Term SheetDokument8 SeitenRFP1 Indicative Term SheetMichael MyintNoch keine Bewertungen

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Dokument12 SeitenP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- Rectification - and - Indemnity, The HMLRA Perspective, 6.11.08 PDFDokument16 SeitenRectification - and - Indemnity, The HMLRA Perspective, 6.11.08 PDFRamesh Babu TatapudiNoch keine Bewertungen

- Keith Brown ResumeDokument2 SeitenKeith Brown ResumekeithbrownfinanceNoch keine Bewertungen

- Jaiib Module ADokument25 SeitenJaiib Module Aeknath2000Noch keine Bewertungen

- Tax Audit ChecklistDokument1 SeiteTax Audit ChecklistSwapnil S DeshpandeNoch keine Bewertungen

- First Metro Investment vs. Este. Del SolDokument10 SeitenFirst Metro Investment vs. Este. Del Solcmv mendozaNoch keine Bewertungen

- Chapter 1 - OverviewDokument9 SeitenChapter 1 - OverviewC12AYNoch keine Bewertungen

- Banas vs. Asia PacificDokument2 SeitenBanas vs. Asia PacificHannah SyNoch keine Bewertungen