Beruflich Dokumente

Kultur Dokumente

Balanced Budget Multiplier Handout

Hochgeladen von

robtrini0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

170 Ansichten1 SeiteThe balanced budget multiplier describes how national income changes when government spending and taxes increase equally.

- If government spending and taxes both rise by $X, national income will also rise by $X, so the balanced budget multiplier equals 1.

- In an example where spending and taxes both increase by $1 billion, the initial $1 billion in government spending boosts income, but $0.75 billion of this is offset by higher taxes, leaving a $0.25 billion net increase in income. This $0.25 billion increase is then multiplied through the economy, resulting in a final $1 billion increase in national income to match the initial government spending and tax amounts.

Originalbeschreibung:

CAPE BBM Handout

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe balanced budget multiplier describes how national income changes when government spending and taxes increase equally.

- If government spending and taxes both rise by $X, national income will also rise by $X, so the balanced budget multiplier equals 1.

- In an example where spending and taxes both increase by $1 billion, the initial $1 billion in government spending boosts income, but $0.75 billion of this is offset by higher taxes, leaving a $0.25 billion net increase in income. This $0.25 billion increase is then multiplied through the economy, resulting in a final $1 billion increase in national income to match the initial government spending and tax amounts.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

170 Ansichten1 SeiteBalanced Budget Multiplier Handout

Hochgeladen von

robtriniThe balanced budget multiplier describes how national income changes when government spending and taxes increase equally.

- If government spending and taxes both rise by $X, national income will also rise by $X, so the balanced budget multiplier equals 1.

- In an example where spending and taxes both increase by $1 billion, the initial $1 billion in government spending boosts income, but $0.75 billion of this is offset by higher taxes, leaving a $0.25 billion net increase in income. This $0.25 billion increase is then multiplied through the economy, resulting in a final $1 billion increase in national income to match the initial government spending and tax amounts.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

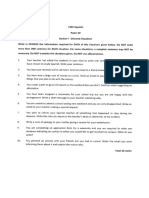

CAPE Economics

Unit 2, Module 1

The Balanced Budget Multiplier

The Balanced Budget Multiplier (BBM)

If government revenues and expenditure increase or decrease

simultaneously and equally, i.e. if G increases/decreases by amount X,

and T also increases/decreases by amount X

Then National Income (Y) will also change in the same amount.

This means that the BBM = 1.

How it Works

Assume that we operate in an economy with an MPC of 0.75.

So the multiplier in this scenario is 1/(1-0.75) = 4

Government increases both spending and taxes by $1b.

The increase in government spending causes an increase in aggregate

expenditure of $1b. Government is doing the spending so it is, in a

sense, autonomous. The MPC doesnt come into play (yet).

The increase in taxes causes a decrease in aggregate expenditure of

$0.75b. Why is this the case? The increase in taxes means a reduction

of $1b in aggregate income in the economy. However, we know that the

MPC = 0.75, i.e. that any change of X in aggregate income will cause a

change of 0.75X in aggregate expenditure. In this case, therefore, the

fall in aggregate expenditure is 0.75 x $1b = $0.75b.

The net increase in aggregate spending by government, therefore, is

$1b - $0.75b = $0.25b.

The multiplier effect kicks in at this point, giving a final increase in

National Income of:

4 x $0.25b = $1b.

Coincidence? Not Really.

Its no coincidence that the BBM = 1, i.e. that an increase of G/T by

some amount triggers an equivalent increase in Y.

In our example, only the initial $1 billion government purchase triggers

an increase in aggregate output.

Each subsequent round of increased consumption that would be

otherwise induced by the multiplier process is offset by decreased

consumption resulting by higher taxes. The only expenditure that does

not go through the household sector and is not cancelled by taxes is the

original government purchase.

Das könnte Ihnen auch gefallen

- Fiscal Policy Notes ECON UNIT 2 CAPEDokument7 SeitenFiscal Policy Notes ECON UNIT 2 CAPErobert903Noch keine Bewertungen

- Balance of Payment Slide CAPE ECONDokument28 SeitenBalance of Payment Slide CAPE ECONrobert903Noch keine Bewertungen

- Money UCON UNIT 2 CAPEDokument16 SeitenMoney UCON UNIT 2 CAPErobert903Noch keine Bewertungen

- Summarised Economics NotesDokument52 SeitenSummarised Economics Notessashawoody167Noch keine Bewertungen

- Cape Economics Past Paper Solutions June 2008Dokument11 SeitenCape Economics Past Paper Solutions June 2008Akeemjoseph50% (2)

- As Economics Unit 2 DefinitionsDokument3 SeitenAs Economics Unit 2 DefinitionsJoshShawNoch keine Bewertungen

- CAPE Economics Unit 1 2004 Paper 2Dokument5 SeitenCAPE Economics Unit 1 2004 Paper 2sashawoody167100% (1)

- Accounting Unit 1 NotesDokument20 SeitenAccounting Unit 1 NotesNiranjan Sathianathen0% (2)

- MOB Module 1 NotesDokument29 SeitenMOB Module 1 NotesZachary HaddockNoch keine Bewertungen

- CAPE Economics 2016 U1 P2Dokument20 SeitenCAPE Economics 2016 U1 P2roxanne taylorNoch keine Bewertungen

- CAPE Economics 2011 U2 P1Dokument8 SeitenCAPE Economics 2011 U2 P1Anonymous O6jv4YHPm100% (1)

- CAPE Economics 2015 U2 P1 PDFDokument9 SeitenCAPE Economics 2015 U2 P1 PDFamrit100% (1)

- Economics Unit 2 Revision NotesDokument16 SeitenEconomics Unit 2 Revision NotesJustin Davenport67% (6)

- Regional Integration NotesDokument14 SeitenRegional Integration Notesjuba15Noch keine Bewertungen

- Econ 2017 Spec Paper 1Dokument12 SeitenEcon 2017 Spec Paper 1Ronaldo Taylor67% (3)

- ECON SbaDokument18 SeitenECON SbaLauntia Dollface SalguodNoch keine Bewertungen

- Cape Accounting Unit 1 NotesDokument27 SeitenCape Accounting Unit 1 NotesDajueNoch keine Bewertungen

- CAPE Accounting Unit 1 2009 P2Dokument8 SeitenCAPE Accounting Unit 1 2009 P2Sachin BahadoorsinghNoch keine Bewertungen

- Definitions For Cape Economics Unit 1Dokument3 SeitenDefinitions For Cape Economics Unit 1Rafena Mustapha100% (1)

- Economic Sectors and Legal StructuresDokument21 SeitenEconomic Sectors and Legal Structuresdanielwilo100% (1)

- CAPE Accounting Unit 1 2011 P2Dokument7 SeitenCAPE Accounting Unit 1 2011 P2Sachin BahadoorsinghNoch keine Bewertungen

- Cape Unit 2 Economics Module 1 - Topic 1 - National Income AccountingDokument22 SeitenCape Unit 2 Economics Module 1 - Topic 1 - National Income AccountingJayChiAsh89% (9)

- CAPE Economics 2014 U1 P1Dokument12 SeitenCAPE Economics 2014 U1 P1C H LNoch keine Bewertungen

- Econ IADokument7 SeitenEcon IADA1000039% (18)

- CAPE Economics 2016 U2 P2Dokument20 SeitenCAPE Economics 2016 U2 P2Ronaldo Taylor100% (1)

- CAPE Accounting Unit 1 2012 P2Dokument7 SeitenCAPE Accounting Unit 1 2012 P2Sachin Bahadoorsingh0% (1)

- CAPE Accounting Unit 1 2008 P2Dokument7 SeitenCAPE Accounting Unit 1 2008 P2Sachin Bahadoorsingh0% (1)

- Economic IaDokument36 SeitenEconomic IaSheka Talya Henry67% (9)

- Cape Mob SamplesbaDokument36 SeitenCape Mob Samplesbabadboy114250% (2)

- CAPE Economics 2015 U2 Paper 2Dokument7 SeitenCAPE Economics 2015 U2 Paper 2Ronaldo Taylor100% (3)

- Cape Accts Unit 2 Paper 1 Set 5 PDFDokument10 SeitenCape Accts Unit 2 Paper 1 Set 5 PDFLeshaine Dixon100% (1)

- Accounting 2 Past Papers (2006 - 2010)Dokument23 SeitenAccounting 2 Past Papers (2006 - 2010)John DoeNoch keine Bewertungen

- CAPE Accounting 2007 U1 P1Dokument12 SeitenCAPE Accounting 2007 U1 P1rajkumkarsinglalaNoch keine Bewertungen

- Economics Module2 UnemploymentDokument2 SeitenEconomics Module2 UnemploymentRomeo DuncanNoch keine Bewertungen

- Econ U 20113Dokument9 SeitenEcon U 20113Bheo Belly0% (2)

- Economics HandoutDokument18 SeitenEconomics HandoutCarlos WebsterNoch keine Bewertungen

- Regional Integration PowerpointDokument36 SeitenRegional Integration PowerpointKallissa Anderson100% (1)

- Accounting Unit 1Dokument75 SeitenAccounting Unit 1Huzaifa Abdullah50% (2)

- CAPE Accounting 2018 U1 P2Dokument9 SeitenCAPE Accounting 2018 U1 P2Kimberly MNoch keine Bewertungen

- CAPE Accounting Unit 1 2013 P2Dokument8 SeitenCAPE Accounting Unit 1 2013 P2Sachin BahadoorsinghNoch keine Bewertungen

- Economic EnfranchisementDokument1 SeiteEconomic EnfranchisementArif Mohamed100% (2)

- CAPE CARIBBEAN STUDIES IntegrationDokument33 SeitenCAPE CARIBBEAN STUDIES IntegrationSeondre DayeNoch keine Bewertungen

- Accounting Ia - Doc2Dokument21 SeitenAccounting Ia - Doc2Jamaal Powell85% (39)

- CSEC Economics - Economic Management and Policy Goals PP - SolutionsDokument2 SeitenCSEC Economics - Economic Management and Policy Goals PP - SolutionsKriston KhanNoch keine Bewertungen

- Summary Points For Accounting Unit 1 Module 1Dokument20 SeitenSummary Points For Accounting Unit 1 Module 1abbyplexx0% (1)

- Economic Growth Is Defined As TheDokument20 SeitenEconomic Growth Is Defined As TheAsma ShamsNoch keine Bewertungen

- Economics IA-Verenna AtwellDokument25 SeitenEconomics IA-Verenna Atwellannmaria singh100% (1)

- 2007 - Unit 1 - Paper 1Dokument9 Seiten2007 - Unit 1 - Paper 1capeeconomics100% (3)

- CAPE Economics 2011 U1 P1Dokument9 SeitenCAPE Economics 2011 U1 P1aliciaNoch keine Bewertungen

- 2009 - Unit 1 - Paper 1Dokument7 Seiten2009 - Unit 1 - Paper 1capeeconomics89% (9)

- CSEC June2011 Spanish Paper2 SectionI Directed Situations - ExDokument4 SeitenCSEC June2011 Spanish Paper2 SectionI Directed Situations - ExAlyssa DNoch keine Bewertungen

- Social Studies MC 2018.pdf CXCDokument11 SeitenSocial Studies MC 2018.pdf CXCKriston SmithNoch keine Bewertungen

- Industrialisation by InvitationDokument9 SeitenIndustrialisation by InvitationRandy Self-obsessedNarcissistic CorneliusNoch keine Bewertungen

- CAPE Economics 2013 U1 P1 PDFDokument10 SeitenCAPE Economics 2013 U1 P1 PDFlalalandNoch keine Bewertungen

- Regional Integration HandoutDokument25 SeitenRegional Integration HandoutLavinia LaviaNoch keine Bewertungen

- Cape MOB CompilationDokument63 SeitenCape MOB CompilationSheldane Mitchell100% (1)

- CAPE Accounting 2009 U1 P1Dokument5 SeitenCAPE Accounting 2009 U1 P1Sachin BahadoorsinghNoch keine Bewertungen

- CH - 9 - Income and Spending - Keynesian Multipliers PDFDokument18 SeitenCH - 9 - Income and Spending - Keynesian Multipliers PDFHarmandeep Singh50% (2)

- Different Complex Multipliers - Government, Expenditure, Tax and Balanced Budget MultiplierDokument15 SeitenDifferent Complex Multipliers - Government, Expenditure, Tax and Balanced Budget MultiplierArundhuti RoyNoch keine Bewertungen

- Balanced Budget MultiplierDokument5 SeitenBalanced Budget MultiplierSreyashi GhoshNoch keine Bewertungen