Beruflich Dokumente

Kultur Dokumente

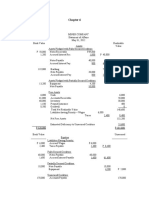

Chapter 10 - Direct Financing Lease-LESSOR

Hochgeladen von

looter198Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 10 - Direct Financing Lease-LESSOR

Hochgeladen von

looter198Copyright:

Verfügbare Formate

Chapter 10 - Direct Financing Lease-LESSOR

GENERAL RULE:

IF THERE IS A TRANSFER = IGNORE RESIDUAL VALUE

IF THERE IS NO TRANSFER = CONSIDER RESIDUAL VALUE

(REGARDLESS IF GUARANTEED OR UNGUARANTEED)

Gross Investment = Gross Rentals + Residual Value (whether

guaranteed or unguaranteed) [THE AMOUNT DEBITED TO LEASE

RECEIVABLE]

= Residual Value is ignored if the lease provides for a

transfer of title

Gross Rentals = Annual Gross Rentals x Lease Term

Annual Gross Rentals = Net Investment in the lease / Present Value

of an annuity of 1 for a number of periods

= (Cost of Asset - PV of residual value)/PV of an

annuity of 1

Net Investment in the Lease = [Cost of the asset + Iniitial Direct

Cost]

= or [Annual Rental x Present Value of an annuity

of 1 + PV of Residual Value (guaranteed or unguaranteed)]

Unearned Interest Income = Gross Rental - Net Investment

- THE BALANCE IS A REDUCTION TO

LEASE RECEIVABLE TO ARRIVE AT ITS CARRYING AMOUNT

-------------------------------------------------------------------------------------------------------------------------------------------------Problems with RESIDUAL VALUE AND THE LEASED ASSET WILL

REVERT BACK TO LESSOR

Annual Rental is computed as:

Net Investment in the Lease - Present Value of RESIDUAL VALUE = Net

Investment to be recovered from RENTAL

Net Investment to be recovered from RENTAL/Present Value of an

annuity of 1 for a number of periods = Annual Rental

note: ignore RESIDUAL VALUE IF THE ASSET WILL NOT REVERT TO

THE LESSOR

-------------------------------------------------------------------------------------------------------------------------------------------------if Fair Value of assset is LOWER than RESIDUAL VALUE

under guaranteed:

Cash

xx (receive the difference

from lessee + guaranteed residual value)

Asset

xx (recorded at the lower of

fair value and carrying amount)

Lease Recievable

xx

under unguaranteed: Loss on finance lease xx (receive the

difference from lessee + guaranteed residual value)

Asset

xx (recorded at the

lower of fair value and carrying amount)

Lease Recievable

xx

-------------------------------------------------------------------------------------------------------------------------------------------------ACTUAL SALE OF LEASED ASSET

CASH RECEIVED - [LEASE RECEIVABLE - UNEARNED INTEREST INCOME

or CARRYING AMOUNT OF LEASE RECEIVABLE] = Gain or Loss on sale

Das könnte Ihnen auch gefallen

- Working Capital and CashDokument41 SeitenWorking Capital and CashasunaNoch keine Bewertungen

- 2017 Vol 2 CH 3 AnsDokument17 Seiten2017 Vol 2 CH 3 AnsJohn Lloyd YastoNoch keine Bewertungen

- STATEMENT II: The Nullity Od The Penal Clause Carries With It The Nullity of The Principal ObligationDokument11 SeitenSTATEMENT II: The Nullity Od The Penal Clause Carries With It The Nullity of The Principal ObligationCrizhae OconNoch keine Bewertungen

- Cost Volume Profit Analysis Review NotesDokument10 SeitenCost Volume Profit Analysis Review NotesAlexis Kaye DayagNoch keine Bewertungen

- True/False: Chapter 11 The Cost of Capital 181Dokument44 SeitenTrue/False: Chapter 11 The Cost of Capital 181Rudford GectoNoch keine Bewertungen

- Three Methods of Estimating Doubtful AccountsDokument8 SeitenThree Methods of Estimating Doubtful AccountsJay Lou PayotNoch keine Bewertungen

- AdjustmentDokument5 SeitenAdjustmentBeta TesterNoch keine Bewertungen

- Practical Accounting One ReviewersDokument2 SeitenPractical Accounting One ReviewersMarc Eric RedondoNoch keine Bewertungen

- The 2001 Balance Sheet and Income Statement For The LewisDokument1 SeiteThe 2001 Balance Sheet and Income Statement For The LewisMuhammad ShahidNoch keine Bewertungen

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Dokument6 SeitenPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)verycooling100% (1)

- Lease ProblemsDokument15 SeitenLease ProblemsArvigne DorenNoch keine Bewertungen

- Reorganization and Troubled Debt Restructuring - 2Dokument32 SeitenReorganization and Troubled Debt Restructuring - 2Marie GarpiaNoch keine Bewertungen

- Cash and Cash Equivalents - REVIEWERDokument15 SeitenCash and Cash Equivalents - REVIEWERLark Kent TagleNoch keine Bewertungen

- Chapter 3 Quiz KeyDokument2 SeitenChapter 3 Quiz KeyAmna MalikNoch keine Bewertungen

- Chapter 12 LiabilitiesDokument5 SeitenChapter 12 LiabilitiesShantalNoch keine Bewertungen

- Answer Summer 2020 Exercise9aDokument2 SeitenAnswer Summer 2020 Exercise9aMiko ArniñoNoch keine Bewertungen

- m2.2f Diy MCQ Answer KeyDokument6 Seitenm2.2f Diy MCQ Answer KeyaapNoch keine Bewertungen

- Mas QuestionsDokument2 SeitenMas QuestionsEll VNoch keine Bewertungen

- Ais CH5Dokument30 SeitenAis CH5MosabAbuKhater100% (1)

- COSTCO Section 1Dokument11 SeitenCOSTCO Section 1Paula BautistaNoch keine Bewertungen

- ReceivablesDokument31 SeitenReceivablesKate MercadoNoch keine Bewertungen

- PFRS 17Dokument2 SeitenPFRS 17Annie JuliaNoch keine Bewertungen

- Cost of Capital Capital BudgetingDokument19 SeitenCost of Capital Capital BudgetingFahad AliNoch keine Bewertungen

- Accounting For LaborDokument43 SeitenAccounting For LaborAmy Spencer100% (1)

- Chapter 26Dokument8 SeitenChapter 26Mae Ciarie YangcoNoch keine Bewertungen

- Responsibility Accounting and Transfer PricingDokument13 SeitenResponsibility Accounting and Transfer PricingNicole Andrea TuazonNoch keine Bewertungen

- Cost Accounting de Leon Chapter 6 SUMMARYDokument3 SeitenCost Accounting de Leon Chapter 6 SUMMARYHarrietNoch keine Bewertungen

- Exercise 1 For Time Value of MoneyDokument8 SeitenExercise 1 For Time Value of MoneyChris tine Mae MendozaNoch keine Bewertungen

- Mas 2605Dokument6 SeitenMas 2605John Philip CastroNoch keine Bewertungen

- Accounting For Business Combination ReviewerDokument21 SeitenAccounting For Business Combination ReviewerJoyce MacatangayNoch keine Bewertungen

- Extra Credit Renee AronhaltDokument12 SeitenExtra Credit Renee Aronhaltapi-240550329Noch keine Bewertungen

- CMPC 131 Finals Quiz 1 Short Term AY 2018 2019 SolutionDokument4 SeitenCMPC 131 Finals Quiz 1 Short Term AY 2018 2019 SolutionAlinah AquinoNoch keine Bewertungen

- Corporate Officers: 2. All Are Methods of Voting Except: Methods of VotingDokument44 SeitenCorporate Officers: 2. All Are Methods of Voting Except: Methods of VotingNicolas BrentNoch keine Bewertungen

- University of San Carlos School of Business and Economics Department of Accountancy AC 1103 3rd Long Exam Name: - Schedule: - CourseDokument7 SeitenUniversity of San Carlos School of Business and Economics Department of Accountancy AC 1103 3rd Long Exam Name: - Schedule: - CourseChristine NionesNoch keine Bewertungen

- ASCA301 PrelimDokument22 SeitenASCA301 PrelimJr Reyes PedidaNoch keine Bewertungen

- ACC 211 Review AssignmentDokument5 SeitenACC 211 Review Assignmentglrosaaa cNoch keine Bewertungen

- Cash & Cash Equivalents, Lecture &exercisesDokument16 SeitenCash & Cash Equivalents, Lecture &exercisesNMCartNoch keine Bewertungen

- Pre-Quali - 2016 - Financial - Acctg. - Level - 1 - Answers - Docx Filename UTF-8''Pre-quali 2016 Financial Acctg. (Level 1) - AnswersDokument10 SeitenPre-Quali - 2016 - Financial - Acctg. - Level - 1 - Answers - Docx Filename UTF-8''Pre-quali 2016 Financial Acctg. (Level 1) - AnswersReve Joy Eco IsagaNoch keine Bewertungen

- Kinney 8e - CH 05Dokument16 SeitenKinney 8e - CH 05Ashik Uz ZamanNoch keine Bewertungen

- Fischer - Pship LiquiDokument7 SeitenFischer - Pship LiquiShawn Michael DoluntapNoch keine Bewertungen

- Solution Chapter 6Dokument17 SeitenSolution Chapter 6Mazikeen DeckerNoch keine Bewertungen

- NCR Cup JR Basic Accounting FinalDokument6 SeitenNCR Cup JR Basic Accounting FinalNicolaus CopernicusNoch keine Bewertungen

- An Analysis On The Financial Awareness and Literacy Among The Students of Cagayan State University Andrews CampusDokument30 SeitenAn Analysis On The Financial Awareness and Literacy Among The Students of Cagayan State University Andrews CampusVic Annielyn CoronelNoch keine Bewertungen

- Solution Chapter 9Dokument20 SeitenSolution Chapter 9Francine Alyssa GaliciaNoch keine Bewertungen

- Finacc 3 Question Set BDokument9 SeitenFinacc 3 Question Set BEza Joy ClaveriasNoch keine Bewertungen

- Practical Accounting 2: BSA51E1 &BSA51E2Dokument68 SeitenPractical Accounting 2: BSA51E1 &BSA51E2Carmelyn GonzalesNoch keine Bewertungen

- Quiz InventoriesDokument2 SeitenQuiz InventoriesKimboy Elizalde PanaguitonNoch keine Bewertungen

- Ias 11 SummaryDokument6 SeitenIas 11 Summarypradyp15Noch keine Bewertungen

- Sim For Special Journal Week 15Dokument16 SeitenSim For Special Journal Week 15MAXINE CLAIRE CUTINGNoch keine Bewertungen

- PART I: True or False: Management Accounting Quiz 1 BsmaDokument4 SeitenPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNoch keine Bewertungen

- Farparcor 2 Chapter 1 Exercises Problem AnswersDokument10 SeitenFarparcor 2 Chapter 1 Exercises Problem AnswersWillnie Shane LabaroNoch keine Bewertungen

- PAS 16 Test BankDokument2 SeitenPAS 16 Test BankLouiseNoch keine Bewertungen

- A Favorable Materials Price Variance Coupled With An Unfavorable Materials Usage Variance Would Most Likely Result FromDokument5 SeitenA Favorable Materials Price Variance Coupled With An Unfavorable Materials Usage Variance Would Most Likely Result FromHey BeshywapNoch keine Bewertungen

- Ch.9 - Shareholders' Equity - MHDokument41 SeitenCh.9 - Shareholders' Equity - MHSamZhaoNoch keine Bewertungen

- Chapter 14 - Post Employment BenefitsDokument4 SeitenChapter 14 - Post Employment Benefitslooter198Noch keine Bewertungen

- Studet Practical Accounting Ch17 PPE AcquisitionDokument16 SeitenStudet Practical Accounting Ch17 PPE Acquisitionsabina del monteNoch keine Bewertungen

- CFAS FinalsDokument7 SeitenCFAS FinalsMarriel Fate CullanoNoch keine Bewertungen

- Notes Chapter 5 FARDokument6 SeitenNotes Chapter 5 FARcpacfa100% (10)

- F M S Investment Appraisal: Inancial AnagementDokument50 SeitenF M S Investment Appraisal: Inancial AnagementsaadaltafNoch keine Bewertungen

- Finance Lease ReviewerDokument9 SeitenFinance Lease Reviewerian_dazoNoch keine Bewertungen

- (ToA) Liabilities - Finance LeaseDokument15 Seiten(ToA) Liabilities - Finance Leaselooter198Noch keine Bewertungen

- (P2) Consignment Sales - Quick NotesDokument3 Seiten(P2) Consignment Sales - Quick Noteslooter1980% (1)

- (P1) Retained EarningsDokument6 Seiten(P1) Retained Earningslooter198Noch keine Bewertungen

- Chapter 14 - Post Employment BenefitsDokument4 SeitenChapter 14 - Post Employment Benefitslooter198Noch keine Bewertungen

- (P1) Shareholders' EquityDokument4 Seiten(P1) Shareholders' Equitylooter198100% (2)

- Chapter 9 - Finance Lease-LESSEEDokument2 SeitenChapter 9 - Finance Lease-LESSEElooter198Noch keine Bewertungen

- Chapter 12 - Sale and LeasebackDokument1 SeiteChapter 12 - Sale and Leasebacklooter198Noch keine Bewertungen

- (ToA) Cash & Cash EquivalentsDokument1 Seite(ToA) Cash & Cash Equivalentslooter198Noch keine Bewertungen

- (P1) InventoriesDokument1 Seite(P1) Inventorieslooter198Noch keine Bewertungen

- Chapter 8 - Operating LeaseDokument2 SeitenChapter 8 - Operating Leaselooter198Noch keine Bewertungen

- Ordinary StandarizationsDokument1 SeiteOrdinary Standarizationslooter198Noch keine Bewertungen

- Segregation of Duties MatrixDokument13 SeitenSegregation of Duties MatrixForumnoj100% (1)

- World LiteratureDokument6 SeitenWorld Literaturelooter198Noch keine Bewertungen

- Chapter 17 - Financial Asset at Amortized CostDokument2 SeitenChapter 17 - Financial Asset at Amortized Costlooter198100% (1)

- Chapter 10Dokument4 SeitenChapter 10looter198Noch keine Bewertungen

- Chapter 14 - Financial Asset at Fair ValueDokument3 SeitenChapter 14 - Financial Asset at Fair Valuelooter198Noch keine Bewertungen

- EtaxDokument1 SeiteEtaxlooter198Noch keine Bewertungen

- One Piece - Episode of Merry One Piece 3D: Gekisou! Trap Coaster Gintama: Dai Hanseikai Gintama Kanketsu-Hen - Yorozuya Yo Eien NareDokument1 SeiteOne Piece - Episode of Merry One Piece 3D: Gekisou! Trap Coaster Gintama: Dai Hanseikai Gintama Kanketsu-Hen - Yorozuya Yo Eien Narelooter198Noch keine Bewertungen

- Financial Accounting Day 1Dokument12 SeitenFinancial Accounting Day 1looter198100% (1)

- Auditing Theory FinalsDokument11 SeitenAuditing Theory Finalslooter1980% (1)