Beruflich Dokumente

Kultur Dokumente

TDS-ChallanFormat

Hochgeladen von

Anand_Gupta_6499Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TDS-ChallanFormat

Hochgeladen von

Anand_Gupta_6499Copyright:

Verfügbare Formate

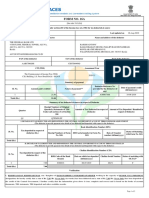

CHALLAN

NO. Tax Applicable Assessment Year

ITNS 281 (0020)COMPANY DEDUCTEES 2010-11

Tax Deduction Account Number

Full Name

Complete Address with City & State

Tel.No Pin

Nature of Payment

Type of Payment

DETAILS OF PAYMENT Amount(in Rs. Only)

Debit to A/c / Chq credited on

Income Tax

Surcharge

Education Cess

Interest

Penalty

Others

Total

Total(in words)

Paid in Cash/Debit to A/c/Cheque No. Dated

Drawn on

Challan Indentification No.

(Name of the Bank and Branch)

Date

Signature of person making payment

Taxpayers Counterfoil

Debit to A/c / Chq credited on

TAN

Received from (Name)

Cash/Debit to A/c/Cheque No. For Rs.

Rs.(in words)

Drawn on

(Name of the Bank and Branch)

Company/Non-Company Deductees

Challan Indentification No.

on account of

Nature of Payment

for the Assesement Year

Das könnte Ihnen auch gefallen

- Challan No. ITNS 281Dokument1 SeiteChallan No. ITNS 281jagdish412301Noch keine Bewertungen

- For Payment From July 2005 OnwardsDokument1 SeiteFor Payment From July 2005 Onwardsvijay123*75% (4)

- Income Tax - Bank Remittance CHALLANDokument1 SeiteIncome Tax - Bank Remittance CHALLANvivek anandanNoch keine Bewertungen

- TDS ChallanDokument1 SeiteTDS ChallanJainsanjaykumarNoch keine Bewertungen

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDokument1 SeiteChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaNoch keine Bewertungen

- Challan 280Dokument1 SeiteChallan 280Jayesh BajpaiNoch keine Bewertungen

- ImportantDokument1 SeiteImportantWilliam SureshNoch keine Bewertungen

- ITNS 280: Challan No. Challan No. ITNS 281Dokument1 SeiteITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNoch keine Bewertungen

- T.D.S. / Tcs Tax Challan: DD MM YyDokument1 SeiteT.D.S. / Tcs Tax Challan: DD MM Yyar8ku9sh0aNoch keine Bewertungen

- Income Tax Challan - 280Dokument1 SeiteIncome Tax Challan - 280Subrata SarkarNoch keine Bewertungen

- TDS ChallanDokument1 SeiteTDS ChallanJayNoch keine Bewertungen

- Challanitns 280Dokument1 SeiteChallanitns 280saritabh05Noch keine Bewertungen

- Itns 285Dokument2 SeitenItns 285Anurag SharmaNoch keine Bewertungen

- Challan No. ITNS 280Dokument2 SeitenChallan No. ITNS 280RAHUL AGARWALNoch keine Bewertungen

- (0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanDokument3 Seiten(0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanRambabuNoch keine Bewertungen

- Single (Copy To Be Sent The ZAO)Dokument1 SeiteSingle (Copy To Be Sent The ZAO)James GonzalezNoch keine Bewertungen

- Form 16 BDokument1 SeiteForm 16 BSurendra Kumar BaaniyaNoch keine Bewertungen

- Challan No./ ITNS 282: Tax Applicable (Tick One)Dokument2 SeitenChallan No./ ITNS 282: Tax Applicable (Tick One)satishkumar.mandora.smNoch keine Bewertungen

- Form 281 Candeur Constructions - 92bDokument1 SeiteForm 281 Candeur Constructions - 92bReddeppa Reddy BisaigariNoch keine Bewertungen

- Challan 280Dokument2 SeitenChallan 280Rahul SinglaNoch keine Bewertungen

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDokument3 SeitenChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNoch keine Bewertungen

- Itns-281 TDS ChallanDokument1 SeiteItns-281 TDS Challanvirendra36999100% (2)

- Self Assessment Tax Challan NiDokument1 SeiteSelf Assessment Tax Challan NiNitin KarwaNoch keine Bewertungen

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Dokument3 SeitenD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarNoch keine Bewertungen

- Form No 16Dokument2 SeitenForm No 16scorpio.vinodNoch keine Bewertungen

- It 000130629196 2021 00Dokument1 SeiteIt 000130629196 2021 00muhammad faiqNoch keine Bewertungen

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDokument1 SeiteAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNoch keine Bewertungen

- Tax Payment Challan 280Dokument2 SeitenTax Payment Challan 280analystbankNoch keine Bewertungen

- PrintTDSChallan (281) 2020-2021 PDFDokument1 SeitePrintTDSChallan (281) 2020-2021 PDFAmeyNoch keine Bewertungen

- Form 16 ADokument2 SeitenForm 16 AParminderSinghNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 47684385Dokument1 SeiteIncome Tax Payment Challan: PSID #: 47684385gandapur khanNoch keine Bewertungen

- Form No. 16A (See Rule31 (L) (B) )Dokument4 SeitenForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNoch keine Bewertungen

- GST Invocie Format For ManufacturingDokument1 SeiteGST Invocie Format For ManufacturingFAIZAN IQBALNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 145879823Dokument1 SeiteIncome Tax Payment Challan: PSID #: 145879823farhan aliNoch keine Bewertungen

- TCS TenduDokument1 SeiteTCS TenduSwetha KarthickNoch keine Bewertungen

- FBR ITO Assing Contractor 22feb2024Dokument1 SeiteFBR ITO Assing Contractor 22feb2024Syed TabishNoch keine Bewertungen

- ChallanFormDokument1 SeiteChallanFormmanpreet singhNoch keine Bewertungen

- Adjustable Tax-PSIDDokument1 SeiteAdjustable Tax-PSIDWaris Corp.Noch keine Bewertungen

- It 000141511985 2022 00Dokument1 SeiteIt 000141511985 2022 00Abdul Basit KtkNoch keine Bewertungen

- (See Rule 31 (1) (B) )Dokument2 Seiten(See Rule 31 (1) (B) )B RNoch keine Bewertungen

- Tds ChallanDokument2 SeitenTds Challannilesh vithalaniNoch keine Bewertungen

- Challan No. ITNS 280: Tax Applicable Assessment YearDokument1 SeiteChallan No. ITNS 280: Tax Applicable Assessment YearNalini SenthilkumarNoch keine Bewertungen

- It 000136606018 2022 00Dokument1 SeiteIt 000136606018 2022 00Amazon wall streetNoch keine Bewertungen

- Form 16 Excel FormatDokument4 SeitenForm 16 Excel FormatAUTHENTIC SURSEZNoch keine Bewertungen

- Challan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDokument2 SeitenChallan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDharmeshNoch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From ToRajesh AntonyNoch keine Bewertungen

- Ali HaiderDokument2 SeitenAli Haiderlalo abbasNoch keine Bewertungen

- Request For Payment (RFP) : Payee Bureau of Internal Revenue RFP NoDokument1 SeiteRequest For Payment (RFP) : Payee Bureau of Internal Revenue RFP NoGareth TiuNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 165120097Dokument1 SeiteIncome Tax Payment Challan: PSID #: 165120097FBR GujranwalaNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 146916470Dokument1 SeiteIncome Tax Payment Challan: PSID #: 146916470Madiah abcNoch keine Bewertungen

- Draft Challan IchhaDokument1 SeiteDraft Challan IchhaSneha SharmaNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 143186538Dokument1 SeiteIncome Tax Payment Challan: PSID #: 143186538talhaNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 148473407Dokument1 SeiteIncome Tax Payment Challan: PSID #: 148473407Haseeb RazaNoch keine Bewertungen

- It 000151339382 2023 00Dokument1 SeiteIt 000151339382 2023 00shaheenmagamartNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 43327453Dokument1 SeiteIncome Tax Payment Challan: PSID #: 43327453gandapur khanNoch keine Bewertungen

- A Guide to District Court Civil Forms in the State of HawaiiVon EverandA Guide to District Court Civil Forms in the State of HawaiiNoch keine Bewertungen

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthVon EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNoch keine Bewertungen

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawVon EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawBewertung: 3.5 von 5 Sternen3.5/5 (4)

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Von EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Bewertung: 2 von 5 Sternen2/5 (1)

- Declaration Form For TDSDokument1 SeiteDeclaration Form For TDSMunna Kumar SinghNoch keine Bewertungen

- Last Three Drawn Salary Slips - PAY SLIP MAY-23Dokument1 SeiteLast Three Drawn Salary Slips - PAY SLIP MAY-23platonic amigo100% (1)

- Karan Peshwani-Payslip - Sep-2023Dokument1 SeiteKaran Peshwani-Payslip - Sep-2023Karan PeshwaniNoch keine Bewertungen

- 4-FCT ExercisesDokument5 Seiten4-FCT Exercisesngothanhthuy829Noch keine Bewertungen

- Report On Tax DecDokument2 SeitenReport On Tax DecJil BongalonNoch keine Bewertungen

- Finance Act 2023 - UpdatedDokument8 SeitenFinance Act 2023 - UpdatedAnnapoorani SNoch keine Bewertungen

- Δήλωση Φορου Γονικής Παροχής English TranslationDokument4 SeitenΔήλωση Φορου Γονικής Παροχής English TranslationAnomeritisNoch keine Bewertungen

- Mio SoulDokument1 SeiteMio SoulWel GadayanNoch keine Bewertungen

- PauslipDokument2 SeitenPauslipAmanNoch keine Bewertungen

- Chapter 1 Introduction To Consumption TaxesDokument1 SeiteChapter 1 Introduction To Consumption TaxesMicko LagundinoNoch keine Bewertungen

- Tax Prelim Exam ReviewerDokument20 SeitenTax Prelim Exam ReviewerWawi Dela RosaNoch keine Bewertungen

- WelCome To E-PaySlip !!!!Dokument1 SeiteWelCome To E-PaySlip !!!!Muhammad Sufyan ImtiazNoch keine Bewertungen

- Community TaxDokument3 SeitenCommunity TaxSuzette VillalinoNoch keine Bewertungen

- PMT-3 PDFDokument2 SeitenPMT-3 PDFHemant KumarNoch keine Bewertungen

- CIR vs. Smart CommunicationsDokument1 SeiteCIR vs. Smart Communicationscorky01Noch keine Bewertungen

- Accounting VoucherDokument1 SeiteAccounting VoucherYash ChaudharyNoch keine Bewertungen

- CIR Vs Inter PublicDokument3 SeitenCIR Vs Inter PublicArrianne ObiasNoch keine Bewertungen

- 10 Task PerformanceDokument5 Seiten10 Task Performancejeffersam31Noch keine Bewertungen

- Authority To Sell and Formal Client RegistrationDokument2 SeitenAuthority To Sell and Formal Client RegistrationEuneun Bustamante100% (1)

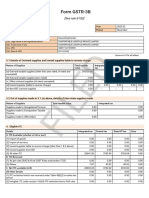

- Filed: Form GSTR-3BDokument2 SeitenFiled: Form GSTR-3Bkrishswat7912Noch keine Bewertungen

- ChallanDokument2 SeitenChallanrchowdhury_10Noch keine Bewertungen

- Trashed-1684049848-Cprs - Payslip1 JSP PDFDokument1 SeiteTrashed-1684049848-Cprs - Payslip1 JSP PDFPrashant SinghNoch keine Bewertungen

- DC 103 Hyd Wash MachDokument4 SeitenDC 103 Hyd Wash Machmrcopy xeroxNoch keine Bewertungen

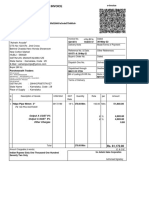

- Invoice PVIZSJDokument1 SeiteInvoice PVIZSJEnginx Consultancy ServicesNoch keine Bewertungen

- Pay Slip BSNLDokument1 SeitePay Slip BSNLJohn FernendiceNoch keine Bewertungen

- Accounting Voucher 1Dokument1 SeiteAccounting Voucher 1Sadiq SultanNoch keine Bewertungen

- Dva Payroll 2022 - Final-2Dokument18 SeitenDva Payroll 2022 - Final-2Danhilson VivoNoch keine Bewertungen

- Novated LeaseDokument7 SeitenNovated LeaseSameerbaskarNoch keine Bewertungen

- Capital Gains Group F6Dokument2 SeitenCapital Gains Group F6Wajih RehmanNoch keine Bewertungen

- Taxation Sia/Tabag TAX.2812-Accounting Methods MAY 2020: Lecture NotesDokument2 SeitenTaxation Sia/Tabag TAX.2812-Accounting Methods MAY 2020: Lecture NotesMay Grethel Joy PeranteNoch keine Bewertungen