Beruflich Dokumente

Kultur Dokumente

Vijaya Bank

Hochgeladen von

Rakesh113Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Vijaya Bank

Hochgeladen von

Rakesh113Copyright:

Verfügbare Formate

A study on the deposit schemes at Vijaya Bank

Chapter – I

Introduction

In an organization there will be a normal of activities carried on like

production, Marketing, planning, financier etc., among all these faineances

plays a major role, Which made to study on this.

Finance came to studied as a part of Economics before the turn of the

present category formation of large sized undertakings by consolidating the

smaller ones brought before the Managements the problem of financing to

these enterprises.

The study of potentiality of different securities as a source of procuring

funds form out side world & the role & function of institutional agencies

continue to be emphasized during 1921.

The problem of financing ensured a new dimension in the IInd world

war.

In 1940’s financial wizards continued to be concern with the necessity for

choosing sells a financial structure as would be able to with stand stress &

strains of the part war adjustments.

In 1960’s & 70’s period was marked by a very faithful & exciting Era

for a nor of alternative developments. The financial manager started thinking

on such important issues. As aggregate stock prices, business sale & etc.

Vishnupriya College of Management studies 1

A study on the deposit schemes at Vijaya Bank

The dimension of Business financial that was Earlier limited to period

but in recent years broadened according to- day-to-day operations.

Finance is regarded as lifeblood of an Enterprise. This is because in the

modern money oriented of all Economy finance is one of the basic

foundations of all kinds of economic activities. It is the master key. Which

provides accedes to all sources for being employed in manufacturing

activities. It has been rightly said that business needs money to make more

money, however, it also true that money begets more money only when it is

properly managed: there fore efficient management of every business

enterprise is closely linked with efficient management of its finance.

Meaning: Business finance explains the two terms . They are

“Business “ & “ Finance “. In common speaking the word “Business” is used

to denote merchandising the operation of some sort of a shop or store. Large

or small. It is however giving too narrow.

Definitions: According to Bonneville & Dewey = “Financing consists in the

raising providing & managing of all the money or funds of any kind used in

connection with the business.

According to Prather & wert, “Business Finance deals

primarily with raising administrating & distributing funds by

privately owned business units operating in Non – financial fields of

Industry.

Vishnupriya College of Management studies 2

A study on the deposit schemes at Vijaya Bank

Function of Business Finance:

Finance function can be classified into two types

Recurring finance function

Non- Recurring finance function

1. Recurring function: Recurring finance functions Encompassed all

such

Financial activities as are carried out regularly for the efficient conduct

of a firm planning of funds. Placing of funds, allocation of funds,

income & controlling the uses of funds are the contents of recurring

finance function

Planning for funds

Rising of funds

Allocation of funds

Allocation of income

Control of funds

Non-recurring functions: It refers to the use of functional activities that a

functional activities has to prefer very infreavently, preparation of financial

plant at the time of promotion of the company. The Financial readjustment in

time of liquidity crisis, valuation of the firm at the time of merger Success full

handle of such problems requires financial skills & understanding of principle

& techniques of finances recurring to Non – recurring Situation.

Vishnupriya College of Management studies 3

A study on the deposit schemes at Vijaya Bank

Introduction to Banking

The financial sector plays a major role in the Mobilization & allocation

of financial savings. Financial institutions. Instruments & markets & which

constitute the financial resources from the net savers to net borrowers, the

gains to the real sector of the economy. There fore, depend on how efficiently

the financial sector performs this basic function of intermediation so that the

transaction cost is kept minimum. The banks form the most important

segment of the financial sector. Deregulation of the banking industry through

the abolition of the administrated rates for the deposits & loans gave the

banks the freedom in fixing prices for their products to compete effectively

with Non – bank intermediaries, the banks were permitted to undertake newer

activities live investment banking. Securities trading & insurance business

through on selective basis. The banks were forced to pay maximum attention

on to operational efficiency so that their transactions costs remained at the

Minimum.

Induction of information technology & communications Networking

system is set to change the operating environment of banks drastically.

Technology has already enabled some of the banks to introduce innovation

product to their customers in the from of ATM facility, tale banking & home

banking any time & anywhere banking.

Vishnupriya College of Management studies 4

A study on the deposit schemes at Vijaya Bank

Origin of the word “bank”: - Opinion is not uniform with regard to

the origin of the word “bank”. According to some authors, the word “Bank” is

derived from the words “Banc us” or “Banquet” that is a bench. The early

bankers the Jews in Italy transacted their business on benches in the market

place, when a banker failed his “Bench “ was broken into pieces by the people

which indicated the bankruptcy of the individual banker. But this explanation

was turned out on the ground that the Italian money changers as such were

called bankers in the middle ages. Some others say that the word bank

originally derived from the German word “pack; meaning a Joint stock fund,

which was Italians into ban co when, the Germans were masters of a great

part of Italy according to professor Ramachandra Rao “What ever to the

origin in of the word bank, it would trace the history of banking in Europe

from the Middle Ages.

Bank: A bank is an institution, which deals with money. It means that a

bank recives money in the born of deposits from public & lends money to the

development of trade & commerce.

Prof. Hart says that banker is one who in he ordinary course of his

business. Receives money which, He repays by honoring the cheques of

persons from whom or on whose account he receives it.

Professor Kinely defines a bank as an establishment, which makes to

individuals such advance of money, as may be required, and safely made & to

which individuals entrust money, which it is not required by them for use.

Vishnupriya College of Management studies 5

A study on the deposit schemes at Vijaya Bank

The Indian companies Act defines the term bank as “The accepting for

the purpose of lending or investment of deposits of money from the public

repay able on demand or other wise & withdrawal by cheque, draft, & order

or other wise

Classification of bank:-

Commercial bank

Investment or Industrial Bank

Exchange Bank

Co-operative Banks

Land development Banks

Saving Bank

Central Bank

1. Commercial Bank: Commercial banks perform all the business

transactions of a typical bank Commercial banks accept three types of

deposits. The savings Bank deposits, fixed deposits & current deposits. They

accept these deposits, which are repayable on demand or on short notice. As

such, they send or invest only for shoot durations. They provide funds only

short term funds of trade & commerce. The commercial banks confine their

activities to day –to-day functions of trade & industry. Since the commercial

banks are expected to meet immediate requirement of depositors, they cannot

Vishnupriya College of Management studies 6

A study on the deposit schemes at Vijaya Bank

invest creditors & our drafts. The commercial banks render an important

service by providing to its customers a simple means of exchange

Functions of commercial bank are:

1. Receiving of deposits 2. Lending of funds

3. Investment 4. Creation of Money.

2. Industrial banks or investment banks: Investment Banks are

provides fixed capital or long term loan to industries. As they finance

industries they are called industrical banks. They are also called

investment banks as they invest their funds in subscribing to the shares

& debenture of industries.

The main functions of industrial Banks are :

1. They grant long term loan to industries.

2. They subscribe to the share capital & dentures of

industries.

3. They under write shares & debentures

4. Provide technical assistance

5. Participating in the management by having their

representatives in the board of industry

6. Advice the type of industry to be set up

7. Providing guidance to their customers regard to

purchase & scale of share & debentures

8. Advising the government on matters relating to

industries

Vishnupriya College of Management studies 7

A study on the deposit schemes at Vijaya Bank

3. Agricultural Banks: These are the banks provide finance to

agriculture. As they finance agriculture mainly they are called

agricultural Bank.

Agricultural Banks are in our country based on co-operation

system

They are of 2 types.

1. Agricultural co – operative banks

2. Land development banks.

1. Agricultural co-operative banks land development banks.

The farmer, provides shooter finance to purchase

fertilizers, pesticides, seed & the payment of cages where

as the later provided long term finance to the farmers to

purchase agricultural machinery installing pump set,

improving plants, repayment of old debts, construction of

Irrigation work ele.,

2.Land development banks: LDB's are those banks which

provide finance to the poor people who are having no

land , who are willing to take land's by providing some

finace.

Vishnupriya College of Management studies 8

A study on the deposit schemes at Vijaya Bank

4. Exchange Banks: These are the banks finance mainly the foreign

Exchange business of a country they are called exchange banks because

they finance mainly for the foreign exchange business the main

functions are:

1.Purchasing discounting, export & import of bills

2.Collecting exports Bill of exchange on behalf exporters

3.ccepting Bill of exchange on behalf of Importers

4.Provides necessary trade information to both

5.Provide remittance facility not only to the business men but

also to the tourists

6.They purchase & sell god silver & foreign currency.

5. Savings bank: These are special banks specialize on the Mobile

Station of small savings of middle & low-income groups they are called

savings bank because they are concocted as mobilization of small

savings. In our country the business of selling banks is formed by

commercial banks & post office the principle function are: Mobilizing

small & scattered savings of people promoting the habit of thrift [loess

spending expenses & savings]

Investing major portion of their deposits on government

securities.

Vishnupriya College of Management studies 9

A study on the deposit schemes at Vijaya Bank

6. Central Bank: A central bank is the highest bank & monetary

Institution of a country it operates under the control of state & works

for the promotion of monetary & Economic stability of the country the

main functions are

a. It has monopoly in issuing currency notes

b. Acting as a banker to government

c. Serving as bankers bank & Acting all controller of

credit

d. Acting as custodian of nations gold & foreign

7. Mixed banking: Mixed banking is the system under with the

commercial banks provide shorterm & long-term finance to industrial

concern Here the commercial banks mix or combine the commercial

banking & industrial or investment banking functions.

Commercial Banks: Commercial banks are banks, which accept

deposits from the public & lend them mainly to commerce for short

periods. As they finance mainly commerce, they are called commercial

banks.

Commercial banks are found all over the world & they

dominate the banking system in every country.

Vishnupriya College of Management studies 10

A study on the deposit schemes at Vijaya Bank

Functions of commercial banks: The functions of commercial banks are

numerous they can be broadly divided into two types

1. Primary function

2. Secondary function.

Primary Functions:

The primary function of commercial bank are :

Receiving of deposits

Lending of funds

Investment of funds on securities

Creation of Money

1. Receiving Deposits: Deposits constitute the main source of funds for

Commercial banks. Commercial bank receives deposits form the

public on various accounts. The main types are:

Current Accounts

Savings deposit Account

Fixed deposit account

Recovering deposit account

2. Lending of funds: Lending of funds constitutes the main business

commercial bank. The major portion of the funds of commercial bank

Vishnupriya College of Management studies 11

A study on the deposit schemes at Vijaya Bank

is employed by way of advances. As advances from the chief source of

profit for banks.

Bank lends funds to the public by way of:

Loans

Occur drafts

Cash credit

Discounting of bills

3. Investment of funds on securities: They invest considerable amount

of

their funds in government & industrial securities. In India commercial

banks are required by statute to invest a good portion of their funds in

government & other approved securities.

Creation of Money: Commercial banks not only receive deposits from

the public & lend them to needy. But also create money.

In the process of lending funds they lend many times more than

the cash deposits. They receive from public

Secondary Function:

A part from performing the main fictional of accepting deposits &

granting advances a banker performs a number of subsidiary services banker

will be able to earn the good will of his customer & attract fresh customers.

The secondary services of a banker may be divided into two classes:

Vishnupriya College of Management studies 12

A study on the deposit schemes at Vijaya Bank

Agency services

Miscellaneous services

Agency services:

1. Collection of money on behalf of customers: A Banker undertakes

to collect money on behalf of his customer. He collects crossed &

uncrossed cheques & bank drafts on behalf of the customers &

credits the proceeds to the customers.

1.

2. Making the payment on behalf of customers: A banker under

takes to make payment on behalf on his customers. He pays the bill

of exchange & promissory. Notes on behalf of customers.

3. Purchase & sale of securities on behalf of customers:

As a banker has contact with stockbrokers & as the customer,

generally, not conversant with the procedure for buying & selling

securities in the stock exchange, the banker under takes to buy &

sell securities on behalf of the customers through stock brokers.

4. Advising customers regarding stock exchange investments:

A banker advises his customer regarding investment on stock

exchange securities. When advice sought by the customers

5. Arranging for Remittance of funds on behalf of customers:

Vishnupriya College of Management studies 13

A study on the deposit schemes at Vijaya Bank

A banker arranges for remittance of funds from one place to another

on behalf of their customers by means of bank draft, mail transfer

& telegraphic transfers.

6. Issuing of credit cards; Banks also issue credit cards to their

customers for making purchase & shopping . The credit card facility

Receives the credit card holder from the trouble of carrying cash for

making purchase further, it minimizes the risk of loss of cash. It also

has ATM centers in major cities which provide to his customer 24

hours banking facilities.

7.Acting as trustee, executor, administrator & Attorney of

customer:

Banker acts as a trustee executor, administrator & attorney of

customer

8 Serving as correspondents & representatives of customers:

A banker serves as a correspondent & a representative of his

customers. As a correspondent & a representative of a customer.

The banker prepares income tax returns of the customer.

Corresponds with the income tax authorities on behalf of the

customers.

9. Rendering merchant banking facilities:

Vishnupriya College of Management studies 14

A study on the deposit schemes at Vijaya Bank

Big commercial banks have set up merchant banking division

manned by qualified staff to perform merchant banking facilities to

commercial & industrial houses

2.Missellaneous services:

Services rendered by a banker not only to his customer, But

also to the general public, some of them are :

Receiving valuables & securities for safe custody

Helping foreign trade transaction

Issuing of traveler’s letter of credit, & traveler’s cheque

to the travelers & tourists

Acting as referee regarding financial standing of his

customers

Under writing of shares & debentures

Entrepreneur development programs

Deposit:

Referring to banks, professor ” sayers “have said that bank is a not only

dealer in money but also manufacture of credit money. It is in the sense of

manufacturing that the concept of credit creation is used. The banks

cannot create any money. But they can create money through deposit

creation.

Vishnupriya College of Management studies 15

A study on the deposit schemes at Vijaya Bank

Deposit creation is an important function of commercial banks without

deposits. They cannot lend at all. Deposit creation is by two types. When

the bank receive cash form the customers. Deposits are created. This

deposit may be savings bank deposit or current deposit any amount

deposited in these accounts could be withdrawn by issue of cheques.If

there is no limit for with drawl. Then that deposit is called current account.

If there is any restriction for withdrawal. Then it is called saving bank

account savings deposits may be of several types such as fixed deposit,

recurring deposits etc current deposit are used for payments that may arise

in future. In the case of current deposits the depositor wants the bank to

offer facilities to withdraw in the form of cheques as many times as

possible. In the savings bank account, the depositor does not expect these

facility , but expert compensation in the form of interest.

The Bank attracts deposits from the people either by means offering

interest or other facilities. Business people want facilities with drawl more

than interest. Non-business people opiate savings account. A customer

may open any type of account. If he opens a current accounts & if there is

substantial money in that account. He may transfer money from current

account to the savings account & vice versa. The bank has nothing to do

with this behaviors of the customer.

Meaning of Deposit : Deposits represents the amounts accepts by a bank

from the deposits. It is the most important intern on the liability side

because

1. They are major portion of the funds received by a bank

Vishnupriya College of Management studies 16

A study on the deposit schemes at Vijaya Bank

2. The capacity of a bank to earn profits depends on the volume of

deposits

3. The efficiency of a bank is judged by its ability to attract deposits.

Primary And Derivative Deposits:

Deposits may be created in two ways. When the customer tenders cash

into the bank, then the deposit account is opened & the amount is credited to

his account. It is called primary deposit. Using this cash the bank buys various

assets in the form of short term bills of exchange securities. Share & stocks or

it may lend in the form of cash credit to the industries. While buying these

assets or lending money to the business people, cash is not given to them but

demand deposit are opened, these deposits are called secondary deposits or

derived deposits. If the banks have to create demand deposits. Existence of

primary deposit is essential. The initiative of creating such deposits lies with

the banking system. The banks may either create of May not create such

deposits. If the banks find that there are sufficient short term bills of

exchange. Then they may show interest in creating these deposits. The cash

received in the form of savings deposits will be used by the banking system to

create derived deposit They are called derived deposits because they originate

from the primary deposits. These derived deposits also add to money supply.

Types of Accounts, which are Held in Bank

Vishnupriya College of Management studies 17

A study on the deposit schemes at Vijaya Bank

1. Current deposit account: [Current or Running account}

A current account is an account, which is generally opened by business

people for their convenience. Money can be deposited & withdrawn at any

time. Money can be withdrawn by means cheques. Usually, a banker does

not allow any interest on this account. Even then, people come forward to

deposit money on current account because of two important privileges, which

they can enjoy in a current account Namely:

1. Over draft facility

2. Other facilities like collection of cheques. Transfer of

money & rendering agency & general utility services.

That is why current account holder do not mind a banker chagrin some

commission for services rendered & incidental charges for maintaining

the account whether it is in debit or in credit. Even though a banker

does not allow any interest, he charges interest on overdraft on a day –

to – day basis. In bank of Maharashtra US. United constructions co &

others, it was held that when a customer over-draw the account with or

without express consent, it amounts to a loan & the customer is around

to make good the payment with a reasonable interest.

current Account holders should keep a minimum balance of

Rest 500/- to keep account running. In a mechanized branch, a

minimum balance of Rs 5000 has to be maintained. If this minimum is

not kept, a minimum charge of Rs 11/- per operation will be debited to

the account. The bank sends a statement of account to the customer

every month. As these deposits are repayable on demand. The banker

Vishnupriya College of Management studies 18

A study on the deposit schemes at Vijaya Bank

should keep a large cash reserve. This may be one of the reasons why a

banker does not pay any interest on the current deposit.

2. Fixed Deposit Account: A fixed deposit is one, which is repayable after

the expiry of a predetermined period fixed by the customer himself. The

period varies from 15 days to 3 years. A deposit account can be opened for a

period of more than 3 years & in that case the rate of interest remains the

same level. In England these deposits are not repayable on demand but they

are with draw able subject to a period of notice. Hence, it is popularly known

as “Time Deposit “ or time liabilities. In India also, the banks have began to

call it “term Deposit” Normally the money on a fixed deposit is not repayable

before the expiry of a fixed period.

3. Saving Deposit: This deposit is intended primarily for small-scale

savers. The main object of this account is promotion of thrift. Hence there is

restriction on with drawals in a month. Heavy with drawals are permitted

only against prior notice, generally, the number of with drawals permitted is

50 per half year.

This account can be opened with a minimum of Rs5/= some

banks live state bank of India keeps it as Rs 20/-.

The minimum balance is not maintained, incidental charges will

be levied at the rate of 50 paise per kolio with a minimum of Rs 1 / - &

a maximum of Rs 5/-

Vishnupriya College of Management studies 19

A study on the deposit schemes at Vijaya Bank

It carries an interest rate of 4 % from April 2000 PA Interest is

allowed on minimum monthly balance in steps of Rs. 10/- multiples

there of between the 10th & the last day of each calendar month.

Generally, overdraft facility is not available in the savings Bank

Account, How ever, instant credit facility unto Rs 2500/- only is

available to savings bank customers for their outstation cheques

provided such cheques do not arise out of trade transactions.

The depositor is supplied with a pass book generally no with

drawals are allowed without the presentation of pass book along with

the withdrawn slip. Now –a –days savings account holder are given

cheque facilities & money can be withdrawn by means of cheques

also. Cheques are also collected on this account. The nomination

facility is also available on savings bank account.

4. Recurring Deposit: It is one form of savings deposits depositors save &

deposit regularly every month a fixed installment so that they are assured of

the sizeable amount at a later period. This will enable the depositors to meet

contingent expenses. Banks have found this deposit popular. Many people

would not have saved If these deposits had not been introduced. This deposit

works on the” maximum little drops of water make a big ocean.”

Any person can open this deposit account. He can even have

than one account at a time. This account can be opened in joint name

also.

For deposit of higher installment, the maturity can be

Calculated as multiples of maturity amount for an installment of Rs5/-

Vishnupriya College of Management studies 20

A study on the deposit schemes at Vijaya Bank

Chapter – 2

Research design

Introduction: -

A research design is a plan of action to be carried out in

connection with a research project. The design may be a logical presentation

of the various steps in the process of research. These steps include The

statement of problem , Objectives of the study, Scope of study sampling,

tools & techniques of data collection, Plan of analysis limitation and chapter

schemes.

According to Claire sleets & others “A Research design is a

arrangement for collection and analysis of data in a manner that aims to

combine relevance to the research purpose with economy in procedure.

The study has been undertaken on "the schemes of Deposits at

VIJAYA BANK " the objective of this study envisages on deposits

management on loan portfolio of the bank. Also an attempt has been make to

identify the techniques and suggest stratagies for arresting the existing

Vishnupriya College of Management studies 21

A study on the deposit schemes at Vijaya Bank

deposits and prevent the re- emergence of fresh deposits at the VIJAYA

BANK.

Title of study:

“A Study on the deposit schemes at Vijaya bank”.

Statement of the problem:

In the present scenario, the banks are playing an important role in the

Economic development of our country as they helps in encouraging the

people to make savings. These savings are attracted & made to deposit in the

banks for further productive investment. For the purpose of this the bank has

introduced many deposit schemes according to the convenience of people

based on the different categories. So, it is felt very much essential to make a

study on these deposit schemes that how it influences on the development of

Economy & what are the conditions & terms that are to be fulfilled to make

the deposits under various schemes.

Objectives of the study:

1. To ascertain the problem faced by bank by Public regarding Deposit

2. To know the different schemes of deposits provided by Vijaya bank.

3. To know the methodology used by bank to Mobilize deposit from

public

4. To suggest ways & means of developing the deposit schemes.

Vishnupriya College of Management studies 22

A study on the deposit schemes at Vijaya Bank

5. To know the interest rate & other facilities provided

by bank to deposit holders

6. To study & know the financial problem of Bank

7. To provide manager with report to help them to Encourage

Customers for depositing.

8. To come out with the findings & suggestions

Scope of the study: In today’s world, banking services plays on important

role in every lives of individuals. The technological advancements in the

banking sector have grown rapidly in the last years. This has led to the birth

of new generation banks & competition. The study basically focuses towards

the observation of the operations & performance of Vijaya Bank regarding

deposits. The study with in its scope has tried to find out the new trends

promoted by the Vijaya Bank regarding deposits.

This study attempts at understanding how Vijaya Bank functions in its

changing scenario & how each department at the head office contributes to

the success.

From the management point of view the study helps them to know

whether they are successful with their operations & as management student

this study helps in getting birds eye view of latest development & upcoming

changes in Banking sector.

Vishnupriya College of Management studies 23

A study on the deposit schemes at Vijaya Bank

Methodology: Personal interview was adopted for collecting data

from Vijaya Bank regarding deposits schemes for collecting primary data and

secondary data is collected through the following

1. Financial Books

2. Annual reports

Tools & the techniques of data: Analysis & interpretation of data in based

on both primary & secondary data.

Primary data: Primary data are the first hand information collected, through

various methods such as observation, interviews.

Secondary data: Secondary data are obtained from text books, magazines,

news paper & Annual reports & Broachers of the bank & official website.

Limitation of study:

Every efforts has been made to make study complete & has

exhautsive as possible, however the study is not free from certain limitations.

1. Some times respondents dislikes to discuses regarding data collection.

2. Time limit for the study

3. The study is only confined to Vijaya Bank & the performance of other

banking company is not compared with it.

4. The collected information is limited & factual to some extent since

some information is confidencial & Bank opposed to dispose it .

Vishnupriya College of Management studies 24

A study on the deposit schemes at Vijaya Bank

5.The Exhastive study has not been made on Vijaya Bank & is limited

to the partial fullfillment for the degree of B.B.M.

6. Collection of data & study was based purely on observation of the

operation of Vijaya Bank constraint.

Plan of Analysis

The Analysis has been done with the help of scheme of deposits related

to vijaya bank for the past 3 years.

Vishnupriya College of Management studies 25

A study on the deposit schemes at Vijaya Bank

Chapter overview scheme

Chapter-1

Introduction: - It consists brief information about finance, banking and

deposit schemes.

Chapter-2

Research design: - It consists brief information about the design adopted

in preparing the project

Chapter-3

Industry profile: -It consists brief information about the banking

Chapter-4

Company profile: -It consist information about vijaya bank

Chapter-5

Analysis and interpretation: - It consist information about deposit

schemes

Vishnupriya College of Management studies 26

A study on the deposit schemes at Vijaya Bank

Chapter-6

Findings, recommendations and conclusions: - It consist findings,

recommendations for the findings and conclusions

Bibliography: -

Annexure :-

CHAPTER- 3

PROFILE OF THE BANK

Banking has existed ever since man-made money. Money lending,

which is one of the important function of banking is existed even than.

However, the function of the banking is not more about just money

lending it’s about deposits interest rates locker systems etc.

The banking system in our country comprises three constituents public

sector banks, private sector banks & foreign banks, there are 27 public

banks, accounting for 81% of the total of all banks.

We have private sector banks, whose role has considerably narrowed

down after two-step nationalization. The number of private banks stood at

34 as on 31st March, 1999 4172 branches.

Foreign banks in private sector are branches of banks incorporated

outside India. There are 44 such banks with 180 branches on end March

1999.

Vishnupriya College of Management studies 27

A study on the deposit schemes at Vijaya Bank

The Indian commercial banks have played a significant role in the

economic development of the country. Be it branch expansion, deposit

Mobilization credit expansion, Minimizing regional imbalances or

promotion of new entrepreneur ship . The role of commercial banks is

considerable . There are short comings nevertheless. For e.g., The

banking services have not reached all parts of the country, loan recovery

has become a big problem for banks in efficiency & customer complaints

are common in banks & losses have become a way of life. Banks often

find it difficult to strike a balance between their commercial compulsions

& social obligation.

History of Banking:

Bank of Hindustan, setup in 1870, was the earliest Indian Bank,

banking in India on Modern lines started with the establishment of three

presidency banks under presidency banks act in 1876 i.e. banks of

Calcutta, bank of Bombay bank of madras. In 1921, all presidency banks

an alga mated to form the imperial bank of India. Imperial bank of carried

out limited central banking functions also prior to establishment of RBI. It

engaged in all types of commercial banking business except dealing in

foreign exchange.

Reserve Bank of India act was passed in 1934 & Reserve bank of India

was constituted as an apex bank with out major government ownership.

Banking regulation act was passed in 1949. This under government

control, under the act RBI got wide ranging powers for supervision &

Vishnupriya College of Management studies 28

A study on the deposit schemes at Vijaya Bank

control of banks. The act also vested licensing powers & authority to

conduct in- sections in RBI.

In 1955, RBI acquired control of the Imperial Bank of India, which was

renamed as state Bank of India. In 1959 , SBI took our control of eight

private banks floated in the east while princely states, making them as its

100% subsidiaries.

RBI was empowered in 1960, to force compulsory merger of weak

banks with the strong ones . The total number of banks was thus reduced

from 566 in 1951 to 85 in 1969. In July 1969, government nationalized

government nationalized 6 more banks were to make them play the role of

the catalytic agents for economic growth. The Norseman committee report

suggested wide ranging reforms for the banking sector in 1992 to

introduce internationally accepted banking practices.

The amendment of banking regulation act in 1993 saw the entry of new

private sector banks.

The banking scenario has changed immensely after the economic

liberalization & globalization. There is transformation from traditional

banking to modern multifaceted banking system in line with the need to

achieve rapid socio economic progress . There is a clear change in the

philosophy & techniques especially in the field of lending from whole role

nature to retail character of banking activities.

Today, the banking sector is facing severe computation. In order to

survive in this competitive environment, bank now focuses on creating &

delivering customer needed service in a customer satisfying manner.

Vishnupriya College of Management studies 29

A study on the deposit schemes at Vijaya Bank

Meaning : A banking company has been defined under section 5 (1) (

c) of the banking company regulation act of 1949, “any company transacts

the business of banking in India.

According to sec 5(1) (b) of the same act defines the banking has

“accepting for the purpose of lending or investment of deposits of money

from the public, repayable on demand or other wise & withdrawal by

cheques, drafts orders or other wise.

Role of Commercial Banks in a modern Economy:

Banks play significant role in the economic development of the

country. It can be seen from the following points.

1. Deposit Mobilization: Banks play significant role in

mobilizing the savings of people by initiating different deposit schemes

by extending a network of branches through out the country.

2. Granting of credit: Banks credit is essential for financing trade,

commerce, industry, agriculture & other productive activities. Banks

extend credit to this entire field in order to have economic development

of the country.

3. Creation of credit: Commercial banks can increase or decrease

the money supply in the country & inject elasticity in to the credit

system though their function is creation of money.

Vishnupriya College of Management studies 30

A study on the deposit schemes at Vijaya Bank

4. Channelise funds in to productive Investments : Banks not

only and fund but also ensure that funds are lend only for productive

purpose by monitoring properly.

5. Provision of finance to the Government : Banks provide short

term funds by purchasing trustee bills & long term funds by subscribing

government bonds provide finance to the government.

6. Protecting the funds of depositor : Banks provides safety to the

funds of depositor by lending to different kinds of borrowers engaged

in different activities in different areas, to be invested in productive

projects & they also ensure that advances are properly secure & will

come bank in time

7. Provision of Remittance facility : Banks provide remittance

facility through remittance mechanism of bank drafts, mail transfers,

telegraphic transfers, traveler’s heaves, circular note etc., & help the

businessmen to secure funds when needed.

8. Provision of medium of exchange: Bank deposits, with draw

by cheque of transferable by credit transfers serves as a means of

settlement of debts by this it reduces use of legal tender money.

9. Discharge of social Responsibility: Banks have recognized

their social responsibility very well & now days they serve in the best

interest of the society at large. It is their bounder duly to grant credit to

every section of the society.

10. Innovative services: Modern banks under take a number of

innovative services like, merchant banking, underwriting of securities,

Vishnupriya College of Management studies 31

A study on the deposit schemes at Vijaya Bank

factoring, leasing , housing finance setting up of natural funds etc., for

the Economic development of the country.

Books of Accounts to be maintained by Banking Companies:

A banking company is received to maintain various ledger &

registers as per the requirement of the banking regulation act 1949. All

the books & register’s a banks has to maintain can be classified into

the following categories.

1. Principle ledgers

2. Subsidiary ledgers

3. Other registers & memorandum Books.

1. Principle ledger : A Banking company required maintain the

following principle books :

A. Cash Book: Which provide the summery of collection &

payments of the bank.

B. General ledger : General ledger provides details regarding

assets not covered under subsidiary books & also contain the control

accounts of subsidiary books.

2. Subsidiary ledger:

It Includes;

a. Receiving cash counter cash books

b. Paying cash counter cash books

c. Current accounts ledger

Vishnupriya College of Management studies 32

A study on the deposit schemes at Vijaya Bank

d. Saving bank account ledges

e. Fixed deposit account ledges

f. Investment ledger

g. Cash credit ledger

h. Loan ledger

i. Bills discount & purchased ledger

j. Receiving deposit account ledges

k. Fixed deposit account ledges

l. Customer’s acceptances, endorsement &

guarantee ledger etc.

3. Other registers & memorandum books:

It Includes:

a. Bills for collection register

b. Share security register

c. Jewelry register

d. Demand draft register

e. Safe custody register

f. Standing order register

g. Dishonored check register

h. Letter of credit register

i. Lockers register

Features of Bank Accounting :

Following are some of the feature of Bank accounting :

1. Banking companies have to maintain books of accounts

under double entry system

Vishnupriya College of Management studies 33

A study on the deposit schemes at Vijaya Bank

2. It has to maintain books of accounts as reserved under the

provision of banking regulation act .

3. The posting of transaction in the ledger will be based on

deposit credit slips.

4. Self balancing system of ledger is followed in accounting

by banking companies.

Project Finance Department:

Introduction : Project Finance Department { P F D} is a

professional outfit under the corporate credit wing { CCW} of Vijaya

Bank. The department consists of experienced professionals in the fields

of finance & technical offering various services in the area of corporate

credit, project appraisals, syndication of loan etc to corporate . The

department has successfully executed a variety of assignment in the past in

the area of project financing & other advisory services.

Range of services:

Project advisory services: Review of project feasibility, structuring

of financing plans & advice on financial modeling & preparation of

project in f n memorandum.

Syndication of financial requirements of customers. PFD offers

syndication services in arranging finance to customers funding

requirements.

OFD offers services to new projects or expansion of existing

projects in raising long term debts & or working capital limits. PFD

Vishnupriya College of Management studies 34

A study on the deposit schemes at Vijaya Bank

offers services to customers resorting to restructure their existing

debt profile by swapping high cost debt with low cost debt.

Anywhere banking:

Anywhere Banking is a technology based customer friendly service

designed to provide greater convenience to our customers.

With Anywhere Banking facility, once you have an account with any of

the select branches. You can operate it from any other designated branch

across as cities.

With any where banking you have a lost of facilities to make banking

with us.

Facilities

Individuals / Joint account holder [operated severally] maintaining

current / SB / OD Accounts.

Withdrawal of cash

Remittance of cash

Transfer of funds

Balance Enquiry

Issue of mini statement

Depositing local cheques for collection

Purchase of demand draft.

Vishnupriya College of Management studies 35

A study on the deposit schemes at Vijaya Bank

Firms / companies / other Bodies maintaining current / OD/

OCC Accounts:

Transfer of funds between accounts from one anywhere banking

branch to another anywhere banking branch depositing of local cheques

for collection & crediting to the respective account at any where banking

branch.

Eligibility:

Account holders should have maintained a minimum average balance

of Rs 5000/- in SB Account & Rs 10000/- in current account in the last six

months.

Features:

Cash with draw unto Rs 50000/- per occasion Transactions

permitted on production of Identity card issued exclusively for ANY

WHERE BANKING Facility.

Facilities of both intra – city & inter – city transactions HOME

CLEARING – on line debit of cheques drawn on our own AWB branches.

DD issue – unto a limit of Rs 50000/- at any AWB branch.

Liquidity U/ S profitability:

Liquidity & safety principal aims at meeting demand of depositors for

cash in full & in time & is considered just one principle . That is principle of

liquidity but profitability aims at paying of a hand some dividend to the share

holders.

Vishnupriya College of Management studies 36

A study on the deposit schemes at Vijaya Bank

The objectives of both the principal are complicating in their nature.

These words they are opposing considerations. The most liquid assets if not

at all profitable & the most profitable asset is least liquid.

CHAPTER-4

PROFILE OF THE VIJAYA BANK

Introduction:

Vijaya Bank was founded by Late Shri A.B.Shetty & other enter-

praising formers founded Vijaya Bank on 23rd October 1931 in Mangalore,

Karnataka the objective of the founders was essentially to promote Banking

habit. Thrift & entrepreneurship among the farming community of Dakshina

Kannada district in Karnataka state. The bank become a scheduled bank in

1958, Vijaya Bank steadily grew into a large all India bank with a smaller

banks merging with it during the 1963-68. The credit for this merger as well

as growth goes to late Shri M.Sunder Ram Shetty, who was then the chief

Executive of the bank. The bank was nationalized on 15th April 1980 today,

the bank has built a network of 842 branches that span all 28 states & 4 union

territories in the country.

SHARE CAPITAL :

Vishnupriya College of Management studies 37

A study on the deposit schemes at Vijaya Bank

The share capital of Vijaya Bank is held by government of India and

institutional investor such as mutual funds UTI, Insurance Company. Other

finance institution & private corporate bodies, Indian public NRI s And other

commercials banks, Government of India acts as a promoter of the bank, it

assist & guides the bank in times of financial difficulties.

The distribution of share holding as in 31 –3 – 2005 is given below.

Category No. of shares Amount in Rs % In

held total

A. Promoters holding 23,35,17,800 2,33,51,78,000 53.87

Government of India

B. Banks & financial institutions 1,77,43,420 17,74,34,100 4.09

(central /state institutions

Mutual Fund 1,67,24,545 16,72,45,450 3.86

Body corporate 1,37,73,148 13,77,31,480 3.18

NRI s locb s 6,21,38,548 62,13,85,480 14.33

Resident holdings 8,96,20,349 89,62,03,490 20.67

Vishnupriya College of Management studies 38

A study on the deposit schemes at Vijaya Bank

Total 43,35,17,800 4,33,51,78,000 100

Loans & Advances:

Vijaya Bank provides various types of loans & Advances to all the

classes of people. As its caption ‘Your partner in progress says the services

provides by the bank.

The different types of loan schemes provided

Educational loans

Rent scheme

Liquidity Finance to SSI

Jewel loans

Loans for purchase of equipment

Loans on motor vehicle

Housing loan

Vishnupriya College of Management studies 39

A study on the deposit schemes at Vijaya Bank

Advance to small road transport operators

Finance for trading activities

Loans for investment resumes

Agricultural Finance

Branch Network :

In the year 1963-68 nine small banks merged with the Vijaya

Bank. During the year 2001-02 bank nationalized its branch network by

merging 16 branches with the nearby branches covered its regional foreign

exchange cell at Bangalore in to a specialized over seas branch, as a result

the total number of branches stood at 828 as at the end of 4th March 2002, as

compared to 842 a year ago. During the year the banks has offered 2

extension converters closed on extension counter upgraded an extension

counter into a full pledged branch.

On a international front the bank built a network relationship with over

200 banks in 80 countries across America, Europe & middle cast.

Computerization:

The bank has 87 computerized branches upgrading two partially

computerized branches to total computerization lacking the number of

totally computerized & branches to 328 & 10 respectively, converting

76.73 % of aggregate business of bank.

Vishnupriya College of Management studies 40

A study on the deposit schemes at Vijaya Bank

Credit cards: Vijaya Bank given visa and master card credit for both

individuals & corporate. These cards are accepted at over 100000 members

estimated across the country & Nepal.

Vijaya Bank credit cards come along with unique & attractive feature

like.

Vijaya Cash:

Instant cash withdrawal is available when ever needed. Walk –

in to any of 831 branches across the country draw unto Rs 5000 /- per

month for classic cards and Rs 10000 /- for gold cards through the

passbook supplied along with the card.

Vijaya Security: Vijaya bank credit card brings along 24 hours personal

accident insurance coverage in the unfortunate event of the card holder

death.

Classic card holders – upto Rs 100000

Gold card holders - up to Rs 200000 in case of Road accidents

Rs. 400000 in case of the Death an air crash.

Vijaya Family cards:

Vijaya Bank add on credit cards are available for parents, spouse

children of card holder above the 18 years of age regardless of his/her

income building under the add on is charged to the main card holder.

Board of directors:

Vishnupriya College of Management studies 41

A study on the deposit schemes at Vijaya Bank

The management of broad of the bank is vested with the board of

directors. Board of directors of Vijaya Bank other than director of central

Government elected under the terms of Vijaya bank general regulations,

1998 & sec 9 (3) ( I ) of the banking companies act 1980 read with the

banking regulation act 1949 nationalized banks scheme 1980.

The present strength of board of directors of the bank is 7,

comprising of 1 executing & 6 non executive directors having diversified

professional experience. The directors have been contributing their

professional knowledge, experience & expertise in respective areas of their

specialization for the development.

Vishnupriya College of Management studies 42

A study on the deposit schemes at Vijaya Bank

Sl.No Name of Director Designation Nature of Date of

Directorship assuming

1 Shri M.S.Kapur Chariman Executive 16-8-02

& Managing -Director

Director

2. Shri. M.S. Aftab Executive Executive 02-11-04

Director Director

3. Shri.A.K.RAi nominee-GOI Non Executive 1-6-04

Director

4. Shri . S.P.Krishna Nominee- share Non-exicutive 3-8-02

Swamy holders director

5. Shri ,R.Ashok Nominee- share Non – 3-8-02

kumar Holder ExecutiveDirector

6. Shri,A.Padmanabha office employee Non - Executive 16-9-04

Shetty director Director

7. Shri,P.Krishna Nominee -RBI Non- Executive 31-3-05

Murthy Director

8. Shri, B.K. Jagdish Nominee- share Non- Executive 3-8-02

chandra holders director

9. Shri, S.Ananthan Niminee-Share Non-Executive 3-8-02

holder Director

10. Shri, Manivarjana S. workmen- Non – Executive 3-8-02

Madinur director Directors

Vishnupriya College of Management studies 43

A study on the deposit schemes at Vijaya Bank

CHAPTER-5

ANALISIS AND INTERPRETATION

Deposit: Deposit creation is an important function of commercial

bank. The bank attracts deposits from the people either by means offering

interest or other facilities business people want facilities with draw more then

investment.

Meaning : Deposits represents the amounts accepted by a bank from the

deposits it is the most important item on the liability side because

o They are major portion of the funds received by a Bank

o The capacity of a bank to earn profits depends on the volume of

deposits

o The efficiency of a bank is judged by its ability to attract

deposits.

Types of deposits : There are two types of deposits are :

Deposits

Term Deposits Demand Deposits

Current Account

Fixed Recurring Deposit Saving Bank

Deposit Deposit A/c Deposits

Saving Bank Deposit scheme :

Vishnupriya College of Management studies 44

A study on the deposit schemes at Vijaya Bank

These are opened by middle & low income groups who save then part

of present income for future needs proper introduction is necessary when

accounts are operated by cheques. A low rate of interest provided on the

deposited money.

Terms and conditions in the savings bank deposit scheme :

Conditions which are required for opening Saving Bank Account

Savings Bank Account may be opened by the following, who are known

at the bank or are properly introduced by other.

An individual in His / Her own name

By more than one person in their joint names payable to all of them

jointly or any one of them or more than one or survivor’s

By natural guardian of a minor on behalf of the minor or by a person in

the name of any minor of whom he or she is a guardian appointed by a

competent court. The guardian on behalf of a minor should furnish a

declaration as t the date of the birth of the minor.

By a minor over the age of 12 years in his own name in which case the

maximum balance in the minors account shall be restricted to Rs

10000 / - only, provided the minor produces satisfactory proof of his /

her date of birth such as school certificate etc.

By secretaries, Treasurers, managers or other duly constituted or

authorized officers of any club, school, orphanage, Temple, Mosque,

church or other religious / charitable institutions of like nature provided

the rules & by laws governing such institutions is acceptable to the

bank.

Vishnupriya College of Management studies 45

A study on the deposit schemes at Vijaya Bank

Companies licensed by the central government under section 25 of the

companies Act 1956, & institutions, which are not liable to pay income

tax under income tax act 1961.

How to open savings Bank Deposit Account:

Persons desiring to open savings Bank Accounts are required to fill in

& sign application form [11-394] along with the usual specimen signature

cards, producing two pass port size photographs, details of PAN / GIR

numbers or declaration in form No 60161 as the case may be & an

introduction from a person acceptable to the bank .

Minimum Balance Amount Required to open An Savings Bank

Account :

A savings Bank A / C may be opened with a minimum balance of Rs

250/ in fully computerized branches & Rs 100/- in other branches to keep

the account running . The same minimum balance should always be

maintained. If a cheque book is issued, the account shall have a minimum

balance of Rs 250/-.

The details are specific in a chart i.e. minimum balance / Amount

required to open an savings bank account

Minimum balance to be maintained

Fully computer ised Other

branches branches

For opening / maintaining SB Rs 250 /- Rs 100/-

Account [ with out cheque book]

For opening / maintaining savings Rs 250 /- Rs 250/-

bank a/c s [ with cheque book

facilities]

Vishnupriya College of Management studies 46

A study on the deposit schemes at Vijaya Bank

If the savings bank account shows balance below the minimum for a

continuous period of one year or above, the branch may at its discretion

close such Accounts.

Further Non – maintenance of minimum balance as stipulated above

attracts penalty charges are Rs 12/- per occasion.

Cheque Books: Cheque books shall be issued only against production of

duly signed requisition slip from the previous cheque book issued .

Restriction, conditions for with drawl’s in the Savings Bank Deposit

Account:

There is a restriction for the withdrawal of the amount in the

Savings Bank Deposit Account.

The total number of with drawls i.e. debit in Savings Bank

Account should not exceed 50 every half year. It is the obligation of the

account holder to take care of the cheque books issued to him or her.

Interest paid to Savings Bank Account :

Interest is allowed on the savings bank account on a half yearly

basis at the rate prescribed by the RBI on minimum monthly balance

between the 10th & the lost day of the month at the credit of each

account on a minimum balance of Rs 10/- & above & on multiple of

Rs 10/- provided interest thus calculated does not fall short of Rs 1/-

per half year.

Vishnupriya College of Management studies 47

A study on the deposit schemes at Vijaya Bank

Interest will be calculated for the half year ending 31st January &

31st July each year & will be credited to each account on or before the

10th February & the 10th August respectively each year.

.

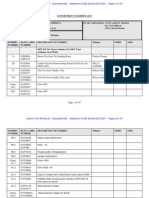

5.1 Table showing % & Increase / Decrease of saving’ s Bank deposit

Account

Years Total amount of % to the Base % of Increase

Deposit year / decrease

2000 – 01 3,81,19,410 100% 0

2001-02 4,23,54,900 112% 12%

2002-03 4,70,61,000 124% 24%

2003-04 5,22,90,000 137% 37%

2004-05 5,81,00,000 152% 52%

INTERPRETATION:-

Vishnupriya College of Management studies 48

A study on the deposit schemes at Vijaya Bank

From the above table, we can observe that the amount deposited

in Saving Bank Account has been increased gradually from 2000-01 to

2004-05 . That is in the base year 2000-01 the % of deposit is 100%

then it has been increased to 112 % in the year 2001-02, 137% in

2003-04, & 152% in the year 2004-05.

We can analyse that the % of deposit in this deposit scheme is in

increasing trend, so, we can conclude that this scheme is performing

well in attracting the savings of the people.

5.1 Chart showing % & Increase / Decrease of saving’ s Bank deposit

Account

Vishnupriya College of Management studies 49

A study on the deposit schemes at Vijaya Bank

60%

52%

50%

37%

40%

30% 24%

20%

12%

10%

0%

0%

2000 – 2001 2001 – 2002 2002 – 2003 2003 – 2004 2004 – 2005

% of Increase/ decrease

5.2 Table showing New Account opened in Savings Bank Account.

Years Total no. of % to the Base year % of Increase

persons / decrease

Deposited

2000 – 01 3500 100% 0

2001-02 3650 104% 4%

Vishnupriya College of Management studies 50

A study on the deposit schemes at Vijaya Bank

2002-03 3980 114% 14%

2003-04 4390 125% 25%

2004-05 4630 132% 32%

INTERPRETATION:-

From the above table, we can observe, that the no. of persons

deposited in saving Bank A/c has been increased gradually from 2000-

01 to 2004-05 . That is in the base year 2000-01the % of Deposit is

100% ,then it has been increased to 104% in the year 2001-02, 114 %

in the year 2003-03 125% in 2003 –04 , & 132% in the year 2004-05.

We can Analyse that the % of no. of persons deposited in this

scheme is in increasing trend, so, we can conclude that this scheme is

performing well in attracting the saving of the people.

5.2 Chart showing New Account opened in Savings Bank Account.

Vishnupriya College of Management studies 51

A study on the deposit schemes at Vijaya Bank

0.35 32%

0.3

25%

0.25

0.2

14%

0.15

0.1

4%

0.05 0

0

2000 – 2001 2001 – 2002 2002 – 2003 2003 – 2004 2004 – 2005

% of Increase/ decrease

5.3 Table showing total interest amount paid by the bank to savings Bank

Deposit holders.

Years Total amount Rate of interest Interest amount

deposited paid by the bank

2000 – 01 3,81,19,410 3.5% 13,34,179.35

Vishnupriya College of Management studies 52

A study on the deposit schemes at Vijaya Bank

2001-02 4,23,54,900 3.5% 14,82,421.5

2002-03 4,70,61,000 3.5% 16,47,135.0

2003-04 5,22,90,000 3.5% 18,30,150.0

2004-05 5,81,00,000 3.5% 20,33,500.0

INTERPRETATION:-

From the above table, we can observe that the interest amount

paid by Bank to Saving Bank A/c holders it has been increased

gradually from 2000-01 to 2004-05 that is in the base year 2000-01 the

amount of interest is 13,34,179.35 . Then it has been increased to

14,82,421.5 in the year 2001-02, in the year 2002-2003 the amount of

interest is Rs 16,47,1`35 & in the year 2003-04 the amount is 18,30,150

& in the year 2004-05 the amount paid is Rs 20,33,500.

We can analyse that the interest amount of deposit in its scheme

is in increasing trend, so we can conclude that this scheme is

performing well in attracting the savings of people.

5.3 Chart showing total interest amount paid by the bank to savings

Bank Deposit holders.

Vishnupriya College of Management studies 53

A study on the deposit schemes at Vijaya Bank

1334179.35

2033500.00

1482421.50

1830150.00

1647135.00

2000 – 2001 2001 – 2002 2002 – 2003 2003 – 2004 2004 – 2005

5.4. Table showings percentage paid by the bank in savings Bank

Account

Years Total interest % to the Base % of Increase

amt paid year / Decrease

Vishnupriya College of Management studies 54

A study on the deposit schemes at Vijaya Bank

2000 – 01 13,34,179.35 100% 0

2001-02 14,82,421.5 116% 10%

2002-03 16,47,135.0 123 % 23%

2003-04 18,30,150.0 137% 37%

2004-05 20,33,500.6 152 % 52%

INTERPRETATION:-

From the above table, we can observe that the interest amount in

saving Bank A/c has been increased gradually from2000-01 to 2004-05.

I,e in in the base year 2000-01 the % of interest amount is 1005, then it

has been increased to 110% in the year 2001-02, 123% in the year

2002-03, 137% in 2003-04 & 152%in the year 2004-05

We can Analyse that the % of interest amount in this deposit

scheme is in increasing trend, so we can conclude that this scheme is

performing well in attracting savings of the people.

5.4. Chart showings percentage paid by the bank in savings Bank

Account

Vishnupriya College of Management studies 55

A study on the deposit schemes at Vijaya Bank

60% 52%

50%

37%

40%

30%

23%

20%

10%

10%

0%

0%

2000 – 2001 2001 – 2002 2002 – 2003 2003 – 2004 2004 – 2005

% of Increase/ decrease

2. Current Account:

These are opening by trading & industrial concern a

minimum deposit of Rs 200000 Rs 300000 through proper and

satisfactory introduction rate of interest is not provided here, customers

can deposit any amount of money and any number of times and

withdraw & as many times as they want.

Vishnupriya College of Management studies 56

A study on the deposit schemes at Vijaya Bank

Terms & conditions in current Account :

Conditions required for opening current Account :

The following persons, firms etc who are properly introduced,

may open current account by singing the prescribed account opening

form [s] along with PAN / GIR numbers or declaration in form No.

60/61

An individual in his / her own name

More than one individual in their joint names

payable to all of them jointly or any one or more of

them or survivor [s]

A Hindu undivided Family, a proprietor ship

concern, a partnership firm, a company, a trust, a

local body, government department etc., in its own

name by giving clear operational instructions.

Obtaining of photographs :

In terms of reserve Bank of India’s guidelines, photograph should be

given at the of opening of all categories of deposit of opening of all

categories of deposit accounts includes current account of both resident &

Vishnupriya College of Management studies 57

A study on the deposit schemes at Vijaya Bank

Non resident account holders inclusive of persons authorized open /

operate the accounts as application.

Minimum Balance Amount Required to open an Current Account:

A current Account may be opened with a minimum of Rs 1000/- in

fully / partially computerized branches & Rs 500/- in other branches.

However at specialized commercial & branches irrespective of the

location of the branches. However at specialized commercial & personal

banking branches this is Rs 10,000/- for Current Accounts. If the

prescribed minimum balance is not maintained in the current account Rs

28/- per occasion with a maximum of Rs 500/- per month will be collected.

Interest on credit Balance : Interest is not allowed on the credit balance

maintained in current accounts.

Incidental / falio / Handing charges

Bank will collect charges for the ledger folios used in current accounts

at the rate prescribed below :

Rs 66/- per ledger page [ 40 entries or part their of considered as one

ledger page ] & Rs 83/- per computer statement sheet on a half - yearly

basis subject to the concession provided on maintained of average balance

Average credit Balances Free ledger Folio pages

allowed per year

Vishnupriya College of Management studies 58

A study on the deposit schemes at Vijaya Bank

Up to Rs 25000 Nil

Above 25000/- unto Rs 50000/- 3

Above Rs 50000.- Unto Rs 100000/- 6

Above Rs 100000 /- up to Rs 200000/- 11

Above Rs 200000/- All

5.5 Table showing % of Increase / Decrease of current Account

Years Total amount % to the Base % of Increase

deposited year / decrease

2000– 01 11, 90 000 100% 0

2001-02 13, 94 000 117% 17%

2002-03 14, 45, 000 121% 215

2003-04 15,64,000 131% 31%

Vishnupriya College of Management studies 59

A study on the deposit schemes at Vijaya Bank

2004-05 17,00,000 1425 42%

INTERPRETATION:-

From the above table, we can observe that the amount deposited

in current account has been increased gradually from 2001-01 to 2004-

05 . That is in the base year 2000 – 01 to 2004-05. That is in the base

year 2000-01 the % of deposit is 100% . Then it has been increased to

117 % in the year 2001-02, 121 % in the year 2002-03, 131 % in 2—3-

04 & 142 % in the year 2004-05.

We can Analyse that the % of deposit in this deposit scheme is in

increasing trend, so, we can conclude that this scheme is performing

well in attracting the savings of the people.

5.5 Chart showing % of Increase / Decrease of current Account

Vishnupriya College of Management studies 60

A study on the deposit schemes at Vijaya Bank

42%

45%

40%

35% 31%

30%

25% 21%

17%

20%

15%

10%

5%

0%

0%

2000 – 2001 2001 – 2002 2002 – 2003 2003 – 2004 2004 – 2005

% of Increase/ decrease

5.6 Table showing New Accounts opened in Current Account.

Vishnupriya College of Management studies 61

A study on the deposit schemes at Vijaya Bank

Years Total % to the Basic % of Increase

interest amt year / decrease

paid

2000 – 01 50 100% 0

2001-02 85 170% 70%

2002-03 94 188% 88%

2003-04 108 216% 116%

2004-05 122 244% 114%

INTERPRETATION:-

From the above table, we can observe that the No, of persons

deposited in current A/c has been increased gradually from 2000-01 to

2004-05. That is the base year 2000-01 the % of deposited persons is

100% . Then it is increased to 170% , it is creased to 188 % in the year

2002-01, in 2003-04 it has been increased to 216 % & in 2004-05 it

has been increased to 244%.

We can Analyse that the % of No, of persons deposited in this

scheme is in increasing trend, so, we can conclude that this scheme is

performing well in attracting the current A/c of the people.

5.6 Chart showing New Accounts opened in Current Account

Vishnupriya College of Management studies 62

A study on the deposit schemes at Vijaya Bank

116% 114%

120%

100% 88%

80% 70%

60%

40%

20%

0%

0%

2000 – 2001 2001 – 2002 2002 – 2003 2003 – 2004 2004 – 2005

% of Increase/ decrease

TERM DEPOSIT

Vishnupriya College of Management studies 63

A study on the deposit schemes at Vijaya Bank

Recurring deposit Account; These deposits are meant for

people who have regular monthly incomes. Deposited amounts will be

in the multiples of Rs 5 & Rs10. Here the depositor deposits a fixed

sum of money every month for an agreed period & at the end of the

specific period the deposited money along with the interest can be with

drawn.

This scheme helps in savings easily & systematically, through

either fixed or variable monthly installments. You can choose any

deposit period ranging from 6 to 120 months, in completed 3 months.

Under variable monthly installments you have the option to choose a

core monthly installment [ witha minimum of Rs 10/- or multiples] and

remit any amount subject to this minimum with a maximum of ten

times of the more monthly installment.

It is one form of savings deposits . Depositor save & deposit

regularly every month a fixed installment so that they are assured of the

sizeable amount at a later period. There will enable the depositors at

meet contingent expenses. Banks have found these deposits popular.

Many people would not have saved if these deposits had not been

introduced this deposit works on the maxim “little drops of water

make a big ocean “.

Terms & conditions for opening account:

Vishnupriya College of Management studies 64

A study on the deposit schemes at Vijaya Bank

Any person can open this deposit account he can even have more

than one account at a time. This account can be opened joint names

also.

It may be opened for monthly instilments in sums of Rs 5/- or in

multiples of Rs5/- with a maximum of Rs 1000/- the number of

monthly instilments may very from 12 months to 72. The total amount

is repayable 30 days after the last installment has been paid.

For deposits of higher installments. The maturity amounts can be

calculated as multiples of the maturity amount for an installment of

Rs5.

Every depositor should pay the monthly installments with in 30

days from the due date. If he fails to do so, interest will be charged on

the installments in arrears the rate of 4 paisa for every Rs5/- per month.

A recurring deposit holder can get a loan on the security of a

recurring deposit. The banker may grant 75 % of the total amount paid

as loan & the interest of 2% over the recurring deposit rate is charged.

These accounts are transferable from one branch ot another. A

recurring deposit holder is given the recurring deposit pass book for his

verification. The rate of interest is similar to the rate offered on fixed

but it is compounded

5.7 Table showing % of increase / Decrease recurring deposit

account.

Vishnupriya College of Management studies 65

A study on the deposit schemes at Vijaya Bank

Years Total Amount % to the Base % of Increase

Deposited year / decrease

2000 – 01 2,47,200 100% 0

2001-02 2,87,800 116% 16%

2002-03 2,88,400 117 % 17%

2003-04 3,70,300 150% 50%

2004-05 4,12,000 166 % 66%

INTERPRETATION:-

From the above table we can observe that the amount deposited

in recurring deposit A/c has been increased gradually from 2000-01 to

2004—05 that is in the base year 2000-01 the % of deposit is 100% ,

then it has been increased to 116% , & 117% in the year 2002-03,

150% in 2003-04 , 166% in the year 2004-05.

We can analyse that the % of deposit is this deposit scheme is in

increasing trend; so, we can conclude that this scheme is performing

well in attracting the savings of the people.

5.7 Chart showing % of increase / Decrease recurring deposit account

Vishnupriya College of Management studies 66

A study on the deposit schemes at Vijaya Bank

66%

70%

60%

50%

50%

40%

30%

16% 17%

20%

10% 0%

0%

2000 – 2001 2001 – 2002 2002 – 2003 2003 – 2004 2004 – 2005

% of Increase/ decrease

5.8 Table showing new Account opened in recurring deposit

account .

Vishnupriya College of Management studies 67

A study on the deposit schemes at Vijaya Bank

Years No. person % to the Basic % of Increase

deposited year / decrease

2000 – 01 0 0 0

2001-02 8 100% 0

2002-03 17 212.5% 112.5 %

2003-04 24 300% 200%

2004-05 28 350% 250%

INTERPRETATION:-

From the above table, we can observe that the no. of persons

deposited in recurring deposit A/c has been increased gradually from

2000-01 The % of deposited persons in Nil, i.e. there is no person

invested their money in the recurring deposit A/c. Then it has been

increased to 100% in the year 2000-02, 212.5% in the year 2002-03 &

300% in 2003-04 & in the 2004-05 it has been increased to 350%.

We can analyse that the % of deposit in this deposit scheme is in

increasing trend. So, we can conclude that this scheme is performing

well in attracting the savings of the people.

5.8 Chart showing new Account opened in recurring deposit account

Vishnupriya College of Management studies 68

A study on the deposit schemes at Vijaya Bank

250%

250%

200%

200%

150%

112.50%

100%

50%

0% 0%

0%

2000 – 2001 2001 – 2002 2002 – 2003 2003 – 2004 2004 – 2005

% of Increase/ decrease

5.9 Table showing total interest amount paid by bank on the recurring

deposit account.

Vishnupriya College of Management studies 69

A study on the deposit schemes at Vijaya Bank

Years Total interest % to the Basic % of Intrease

amt paid year / decrease

2000 – 01 2,47,200 3.5 % 8652

2001-02 2,87,400 3.5% 10073

2002-03 2,88,400 3.5% 10094

2003-04 3,70,300 3.5% 12978

2004-05 4,12,000 3.5% 14420

INTERPRETATION:-

From the above table, we can observe that the interest amount

paid by Bank to recurring deposit A/c holders it has been gradually