Beruflich Dokumente

Kultur Dokumente

Acf

Hochgeladen von

pradeep04050 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten2 SeitenAdvanced Corp Finance Qn

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAdvanced Corp Finance Qn

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten2 SeitenAcf

Hochgeladen von

pradeep0405Advanced Corp Finance Qn

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

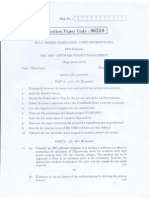

INDIAN INSTITUTE OF MANAGEMENT KOZHIKODE

EXECUTIVE POSTGRAQUATE PROGRAMMES

EPGP-02 and EEPF-03

ADVANCED CORPORATE FINANCE

Ropeat Exam Question Paper ~ January 2011

Note:

Figures to the right indicate marks.

Total Time: 3.00 hrs. {inclusive of 15 mins for q

Total marks End Term (50) quiz (19).

Please return the quiz Il (multiple choice questions) sheet within the first 15 mins.

0)

1. Answer the following question. All questions are compulsory and each question carries equal

marks. Total marks for this section (25)

1. The following was the result of a regression of PE ratios on growth rates, betas, and payout

ratios for stocks listed on NSE in April, 1993.

PE=18.69+0.0695*growth-0.5082* beta-0.4262° payout R=0.35,

You are attempting to value a private firm, JSW Ltd,, with the following characteristics:

4 The firm had net profits of Rs. 10 million. It did not pay dividends, but had depreciation

allowances of Rs. 5 million and capital expenditures of Rs. 12 miliion in the most recent year

Working capital requirements were negligible.

‘* The earnings had grown at 25% over the previous five years and are expected to grow at the

same rate over the next five years.

» The average beta of publically traded firms, in the same line of business, is 1.15 and the average

debt-equity ratio of these firms is 25%. (The tax rate is 40 %.) The private firm is all equity

financed firm,

(i) Estimate the appropriate PE ratio for this private firm using the regression resuft (3)

(i) What would be some of your concerns @

2, Investor A purchased 10,00,000 series A preferred stock of company X at Rs. 1 per share at a pre

‘money valuation of Rs. 30,00,000 for a 25 percent stake on post-financing basis (i. Rs. 40,00,000) in the

company (each series A preferred stock would get converted into a share of common stock). One year

later, company X sells 10,00,000 shares of series B preferred stock at Rs. 0.50 per share {again

convertible one-to-one share of common stock) at @ pre-money valuation of Rs. 20,00,000 for a 20%

stake on post: financing basis (Rs. 25,00,000) in company X. Each question below carries one mark each

(i) With no anti-dilution protection what would be the percentage stake of investor A, post issue of

series 8 preferred stock '

(i) With full ratchet anti-dilution protection, how many stocks of company X would investor A be

holding, post issue of series 8 preferred stock?

{ii) With broad based weighted average anti dilution protection, how many stocks of company X would

investor A be holding, post issue of series 8 preferred stock?

{iv) With narrow based weighted average anti dilution protection, how many stocks of company X

would investor A be holding, post issue of series 8 preferred stock?

(v) Comment on other anti dilution protection measures.

Zz Tht gold ornaments retaling dision of O’ Manas Diamonds Ls earn a return an investment of

15.5%, based on a capital employed of Rs, 26,80,000. The management team of the gold ornaments

retailing division have decided to implement a project which will require an investment of Rs. 3,20,000

‘The project is expected to generate a profit Rs. 53,000 p.a. The divisional cost of capital is 13%. What

will be the residual income of the gold ornaments division after the project is implemented.

A company finds that there is a correlation of 0.80 between the alursinum price at the London Metal

xchange and the aluminum price in india. The volatility of the prices at LME and in India is roughly the

same. If the expected consumption of aluminum is 5,000 tonnes, what is the optimal hedge while using

LIME futures?

5. Firm Ais planning to acquire firm B, Financial information for the two firms prior to and to the merger

is shown below.

5

L2) [Feisishares outstanding

Total Earnings

_ Market Value of Equity.

(504

‘ill this merger have a bootstrap effect? Please show your calculations clearly. faw!4

os

Wl. Write brief notes on the following. All questions are compulsory and carry equal marks. Total ;

marks for this section. (25)

1. AEGand RIV ultimately give the seme value?

2. Comment on the pitfalls of using PE ratio biindly for every company (as is being done in most

cases now). Also suggest the best ratio for a given industry.

3. What alternative ways of measuring EVA performance were discussed in the class such that the

issues raised in the case on Vyaderm Pharmaceuticals Ltd. is addressed.

4. Explain the concept of Bootstrapping with a illustration. aud

5, Ifyou are a the Manager of a PE firm, what are the important clauses that you would include in

route het joe ged Me Vn) hea of vn) "oll had

Aga ee

Pr Qe F) blow fe ater Lhe

; i J o;0%, 0

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- RenaultNissan AMarriageOfReasonDokument13 SeitenRenaultNissan AMarriageOfReasonpradeep0405100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- EPGP 05 Y1 Q4 Question XDokument11 SeitenEPGP 05 Y1 Q4 Question Xpradeep0405Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- EPGP 05 Y1 Q4 QuestionDokument11 SeitenEPGP 05 Y1 Q4 Questionpradeep0405Noch keine Bewertungen

- DMC1802 2010 11Dokument22 SeitenDMC1802 2010 11pradeep0405Noch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- 2011-Sales and Distribution ManagementDokument8 Seiten2011-Sales and Distribution Managementpradeep0405Noch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Investigation of The Jhaiua Coalfield Mine Fires - India' by S. R Michalski E. S. Custer, Jr. Ph.D. and P. L Munshi2Dokument13 SeitenInvestigation of The Jhaiua Coalfield Mine Fires - India' by S. R Michalski E. S. Custer, Jr. Ph.D. and P. L Munshi2pradeep0405Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- C 7013 02629Dokument34 SeitenC 7013 02629pradeep0405Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- C 7013 02629Dokument34 SeitenC 7013 02629pradeep0405Noch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)