Beruflich Dokumente

Kultur Dokumente

The Loewen Group, Inc

Hochgeladen von

Manvi GovilOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Loewen Group, Inc

Hochgeladen von

Manvi GovilCopyright:

Verfügbare Formate

1/22/2015

TheLoewenGroup,Inc.(Abridged)

The

Loewen Group, Inc. (Abridged)

Thedecisiontosellabusinesstoadistressedfirmlargely

dependsonthecash:equityratioinwhichIwillreceivethe

paymentandthecurrentbusinessgrowth.Inascenariowherethe

businessisnorperformingandwegettoreceivemorethan40%

Would

you be willing to sell your business to Loewen and receive equity from a distressed

ofthevalueascashandremainingasequity,Iwillpreferselling

firm?

todistressedfirmconsideringthelowproductivityofthebusiness.

Alsodistresscouldbeatemporaryphaseandoncethecompany

isoutofdistresstheequitycangeneratemorevalue.

ButinthecurrentscenarioLoewenhastoomuchaccrueddebt,

thusthefeasibilityofcashislowandtheequityisararescenario

evenforthepreferredstockholders,asthecompanyhastoo

muchdebt,incaseofbankruptcytheliquidatedvaluewillbe

spendpayingthedebtandthusequityholderswillincurlosses

andthusIwouldnotsellmybusinesstoadistressedfirm.

Why is distress costly? Is this just the capitalized value of legal bills? What are the assets

of the firm that will be damaged or destroyed if the firm becomes distressed?

Distressleadstohugeimpactonthecompanyimageandgivesa

immediatepushdowntothestockprices.Alsothedistresscomes

withalotoflegalandconsultingfeeswhichmakesitfurthermore

costlier.

Theassetsofthecompanycomeunderbankruptcyclausesand

mightbeundervaluedbythegovernment.

What is Loewens immediate problem?

Loewensimmediateproblemislongaccrueddebt,whichhasled

todeclineinthestockratesfrom25.75to9.44withinayear.The

companyhasbeenonaspreetogrowthebusinessthrough

acquisitionswhichhadbeenfundedthroughdebtsandthusthe

debtincreasedtoapprox.$2.3billionbytheendof1998.Inthis

$42milliondebtwasdueinfirst2weeksofAprilandtheydidnot

haveanyagreementwiththebankonrestructuring.The

companysratinghasbeendegradedfromB+Bandtoaddtothe

currentfinancialcrunchthenumberofdeathsinUShasbeen

reducingovertheyearsandthusreducingthenetincome.With

thecurrentdebtstructurethecompanyhastoberestructureand

Theorganisationcangoforthefollowingoptions:

What

are Loewens alternatives? What would you recommend to John Lacey?

goforassetsellingtopaythedebtsandpendingpayments.

1. Goforrestructuringandworkonthedebt/equityratioofthe

companytoimprovethemarketimage

2. Generatecashflowsthroughsellingassetsandstop

acquisitions

3. Stopworkingonpreneedmodel

4. Filebankruptcy

FilingbankruptcyisthebestoptionIwouldsuggesttoLacyas

withthisamountofdebtandprevalentmarketconditions,thisis

themostfeasibleoption.Thecompanydoesn'thavemuchtime

Why Loewen might be finding itself in difficulties?

https://docs.google.com/forms/d/1qiVkwaeUMTizbGZEuTv90M_34u28yhvpuL2SruBTVfw/viewform?c=0&w=1

1/5

1/22/2015

TheLoewenGroup,Inc.(Abridged)

1.Highoutstandingdebtandlackoftimetoplan

2.ConflictingrulesinfilingbankruptcyduetostakesinbothUSand

Canada

3.Difficultiesinrestructuringduetomultipleclausesofassetand

bondrestructuringcovenantswiththelenders

4.Industrysufferingduetodeclineindeathrates

How was the Loewen Group able to grow explosively for the first half of the 1990s? What

were advantages of debt financing enjoyed by the firm in this phase?

Itgrewexplosivelybyacquiringsmallindependentfuneralhomes

andcemeteriesindenselypopulatedurbanmarkets.

Thefirmkeptonacquiringandincreasingitscapitalbytaking

debtsandrunningbusinessinanerawhenpreneedsalesof

funeralserviceswererepresentinganincreasingshareofdeath

carebusiness.Thesefundswereinvestedineithersecuritiesor

insurancecontractwhichhelpedthemmultiplythecapitaland

helpedthempaytheinterestondebtandmaintainastablemarket

image.Taxshieldwasanotheradvantagetheyhadbecuaseof

debtfinancing

Would lenders want to lend to a distressed firm?

Financialdistresscanbeperceivedasatemporaryorpermanent

effecttothefinancialhealthofafirm.Thechanceoffinancial

distressincreaseswhenafirmhashighfixedcosts,illiquidassets,

orrevenuesthataresensitivetoeconomicdownturns.Thusalender

wouldliketoevaluatethenatureofdistressofthefirm.Lendingat

highriskwillenablehighreturn,asevenincaseofbankruptcy,the

liquidationofassetswillrecoverthemoneyandifthefirmrevives

thelenderwillhavegoodstakesinthefirm.

Whether the economic problems that Loewen faced were commonly felt throughout the

industry?

TheeconomicproblemsofLoewenaremainlyduetothedebt

accruedbythecompanyfortheacquisitionsdonebythemtogrow

theirbusiness.Theonlycommonfactorfortheeconomicproblemis

theslowdownindeathratesandthusoverallslumpintheindustry.

How did Loewen get to the position it found itself in 1999?

Thereasonsresponsibleforthepositionin1999areasfollows:

1.Decliningdeathrates

2.ComplexagreementwithBlackstone

3.Highlyaccureddebtduetospreeofacquisitions

4.Covenantswiththelendersregardingtheassetandbond

restructuring

5.10%stakesinCanadaandthusprobleminfilingbankruptcy

Why did Loewen stock trade for $40 when SCI offered $43?

https://docs.google.com/forms/d/1qiVkwaeUMTizbGZEuTv90M_34u28yhvpuL2SruBTVfw/viewform?c=0&w=1

2/5

1/22/2015

TheLoewenGroup,Inc.(Abridged)

BecausejuryhadaunfavorableverdictinMississippi,andstock

pricedepressed,andcompanyhadtopayadebtof$500million,and

thushastotradedor$40.

Loewen as financially distressed. Is this a fair description of its problem?

Financialdistressisconditionwhereacompanycannotmeetorhas

difficultypayingoffitsfinancialobligationstoitscreditors.The

Loewenisinamajorproblemonlybecauseofthedebtthatthey

have.Theotherproblemspertainingtothedebtstructureandfilingof

bankruptcyareonlyduetocompanyseekingsolutiontogetridofthe

debt.

Is there evidence that Loewens distress is costly?

Loewenhasallsecureddebtsandareprotectedbycollaterals.Thus

incaseofbankruptcyallassetswillbeliquidatedandcreditorswill

getthecashfromthebusiness.Thecaseinwhichtheywontbeable

topaythedebt,thedistresswillbeverycostly.

How economic distress and financial distress interact?

Economicdistressisasituationwhenaneconomyissuffering

downturnandthecompanieshavelowrevenueduetotheslow

marketconditions,ifthisconditioniscombinedwithacompany

havinghighdebtandthusincreasetheinterestobligationalongwith

lowsalesandprofit.Thuswhenthe2distressinteractthisfurther

impactsthefinancialstabilityofthecompany

How levered was Loewen?

TotalDebt:$2.3Billion

D/Eratio:1.862

DebtDueinnext3months$4.2milliom

Why did SCI want to pay a premium for Loewen?

https://docs.google.com/forms/d/1qiVkwaeUMTizbGZEuTv90M_34u28yhvpuL2SruBTVfw/viewform?c=0&w=1

3/5

1/22/2015

TheLoewenGroup,Inc.(Abridged)

LoewenwasoneofthebiggestdeathcarecompaniesandSCI

expectedthatthefurthersituationoftheLoewentoimproveand

generatebettercashflowsandexpectedthestockpricetoimprove

whichwouldhavegeneratedprofitforSCI

How much higher are acquisition premia in the death care market with Loewen as a rival

rather than without Loewen?

Theacquisitionrevenueincreasedfrom2.02to2.65inthreeyears,

whichcluldhavegivena31.8%boosttothepremiumreceived.

What incremental cash flows might SCI expect that could explain this premium?

SCIexpectedthatasLoewenwasonacquisitionspreeandthus

wouldcontinuegeneratingdemandandrevenueinturn,whichwould

improvethecashflows.

Would you want to buy pre-need funeral home services from a distressed firm that might

not be around to either deliver the services or keep the properties in a high state of

maintenance?

Asthecompanyisperceivedtobehavinglowfinancialstatus,thus

thegeneralperceptionwouldbethatduetointernaldistressthey

mightnotbeabletodelivertheservices.Thuspreneedwillnot

makemechoosethemduetologicaldecisionmaking

How much acquisition has SCI done (and is it likely to do)?

Ithadboughtbritishfuneralcompany,GreatSouthernfor$200mn

also.ItwantedtoacquireLoewenasitwasamongoneofthefour

largestfirminthedeathcaremarket.

Submit

NeversubmitpasswordsthroughGoogleForms.

https://docs.google.com/forms/d/1qiVkwaeUMTizbGZEuTv90M_34u28yhvpuL2SruBTVfw/viewform?c=0&w=1

100%: You made it.

4/5

1/22/2015

TheLoewenGroup,Inc.(Abridged)

Poweredby

ThisformwascreatedinsideofXLRI.AC.IN.

ReportAbuseTermsofServiceAdditionalTerms

https://docs.google.com/forms/d/1qiVkwaeUMTizbGZEuTv90M_34u28yhvpuL2SruBTVfw/viewform?c=0&w=1

5/5

Das könnte Ihnen auch gefallen

- PMP PDFDokument334 SeitenPMP PDFJohan Ito100% (4)

- NZAA ChartsDokument69 SeitenNZAA ChartsA340_600100% (5)

- Nuclear Power Plants PDFDokument64 SeitenNuclear Power Plants PDFmvlxlxNoch keine Bewertungen

- CV - Assignment - Group 8 - Teuer - Case BDokument6 SeitenCV - Assignment - Group 8 - Teuer - Case BKhushbooNoch keine Bewertungen

- Section I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeDokument11 SeitenSection I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeclendeavourNoch keine Bewertungen

- Ethodology AND Ssumptions: B B × D EDokument7 SeitenEthodology AND Ssumptions: B B × D ECami MorenoNoch keine Bewertungen

- Assignment #2 Workgroup E IttnerDokument8 SeitenAssignment #2 Workgroup E IttnerAziz Abi AadNoch keine Bewertungen

- Seagate NewDokument22 SeitenSeagate NewKaran VasheeNoch keine Bewertungen

- Group 6 M&A MellonBNY Case PDFDokument8 SeitenGroup 6 M&A MellonBNY Case PDFPrachi Khaitan67% (3)

- California Pizza Kitchen Case SolnDokument8 SeitenCalifornia Pizza Kitchen Case Solnkiller dramaNoch keine Bewertungen

- JC Penney CaseDokument8 SeitenJC Penney CaseSebastian MansillaNoch keine Bewertungen

- Session 19 - Dividend Policy at Linear TechDokument2 SeitenSession 19 - Dividend Policy at Linear TechRichBrook7Noch keine Bewertungen

- California Pizza Kitchen Rev2Dokument7 SeitenCalifornia Pizza Kitchen Rev2ahmed mahmoud100% (1)

- Balance Sheet AnalysisDokument3 SeitenBalance Sheet AnalysisNishant SinghNoch keine Bewertungen

- China Fire Case AssignmentDokument3 SeitenChina Fire Case AssignmentTony LuNoch keine Bewertungen

- 10th Grade SAT Vocabulary ListDokument20 Seiten10th Grade SAT Vocabulary ListMelissa HuiNoch keine Bewertungen

- Buckeye Bank CaseDokument7 SeitenBuckeye Bank CasePulkit Mathur0% (2)

- Worldwide Paper CompanyDokument22 SeitenWorldwide Paper Companyroldanvenus89% (9)

- Jones Electrical DistributionDokument5 SeitenJones Electrical DistributionAsif AliNoch keine Bewertungen

- (Bloom's Modern Critical Views) (2000)Dokument267 Seiten(Bloom's Modern Critical Views) (2000)andreea1613232100% (1)

- HBS Case1 CooperDokument6 SeitenHBS Case1 CooperTam NguyenNoch keine Bewertungen

- HertzDokument2 SeitenHertzChhavi AnandNoch keine Bewertungen

- Yell PresentationDokument27 SeitenYell PresentationSounak DuttaNoch keine Bewertungen

- Case 5Dokument15 SeitenCase 5Qiao LengNoch keine Bewertungen

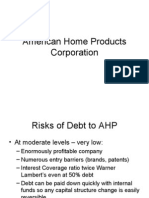

- American Home Products CorporationDokument7 SeitenAmerican Home Products Corporationpancaspe100% (2)

- Roche S Acquisition of GenentechDokument34 SeitenRoche S Acquisition of GenentechPradipkumar UmdaleNoch keine Bewertungen

- LinearDokument6 SeitenLinearjackedup211Noch keine Bewertungen

- Financial Ratio AnalysisDokument47 SeitenFinancial Ratio AnalysisUlash KhanNoch keine Bewertungen

- BBBY Case ExerciseDokument7 SeitenBBBY Case ExerciseSue McGinnisNoch keine Bewertungen

- Winfield ManagementDokument5 SeitenWinfield Managementmadhav1111Noch keine Bewertungen

- Case Study - Linear Tech - Christopher Taylor - SampleDokument9 SeitenCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193Noch keine Bewertungen

- (Holy Balance Sheet) Jones Electrical DistributionDokument29 Seiten(Holy Balance Sheet) Jones Electrical DistributionVera Lúcia Batista SantosNoch keine Bewertungen

- Kohler CompanyDokument3 SeitenKohler CompanyDuncan BakerNoch keine Bewertungen

- Continental CarriersDokument10 SeitenContinental Carriersnipun9143Noch keine Bewertungen

- Jones Electrical DistributionDokument3 SeitenJones Electrical DistributionAnirudh Kowtha0% (1)

- 2839 MEG CV 2 CaseDokument10 Seiten2839 MEG CV 2 CasegueigunNoch keine Bewertungen

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDokument12 SeitenBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNoch keine Bewertungen

- Loewen Group CaseDokument2 SeitenLoewen Group CaseSu_NeilNoch keine Bewertungen

- The Loewen Group IncDokument7 SeitenThe Loewen Group IncKamal NagvaniNoch keine Bewertungen

- Loewen Group Inc.Dokument18 SeitenLoewen Group Inc.Muntasir Bin MostafaNoch keine Bewertungen

- Case Summary Financial Management-II: "The Loewen Group, Inc. (Abridged) "Dokument4 SeitenCase Summary Financial Management-II: "The Loewen Group, Inc. (Abridged) "Rishabh Kothari100% (1)

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Dokument3 SeitenSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNoch keine Bewertungen

- Winfield CaseDokument8 SeitenWinfield CaseAbhinandan Singh67% (3)

- DeluxeDokument4 SeitenDeluxeshielamaeNoch keine Bewertungen

- Tecson VS Glaxo LaborDokument2 SeitenTecson VS Glaxo LaborDanyNoch keine Bewertungen

- LoewenDokument3 SeitenLoewenAmit SurveNoch keine Bewertungen

- Surahduha MiracleDreamTafseer NoumanAliKhanDokument20 SeitenSurahduha MiracleDreamTafseer NoumanAliKhanspeed2kxNoch keine Bewertungen

- Case StudyDokument5 SeitenCase StudynanthamkNoch keine Bewertungen

- Analysis of Business EnvironmentDokument6 SeitenAnalysis of Business EnvironmentLapi Boy MicsNoch keine Bewertungen

- Kohler Co. (A)Dokument18 SeitenKohler Co. (A)Juan Manuel GonzalezNoch keine Bewertungen

- Linear Technology Payout Policy Case 3Dokument4 SeitenLinear Technology Payout Policy Case 3Amrinder SinghNoch keine Bewertungen

- The Loewen GroupDokument13 SeitenThe Loewen GroupAmit SurveNoch keine Bewertungen

- Glossary of Important Islamic Terms-For CourseDokument6 SeitenGlossary of Important Islamic Terms-For CourseibrahimNoch keine Bewertungen

- DuPont QuestionsDokument1 SeiteDuPont QuestionssandykakaNoch keine Bewertungen

- Winfield PPT 27 FEB 13Dokument13 SeitenWinfield PPT 27 FEB 13prem_kumar83g100% (4)

- Caso HertzDokument32 SeitenCaso HertzJORGE PUENTESNoch keine Bewertungen

- Wrigley CaseDokument12 SeitenWrigley Caseresat gürNoch keine Bewertungen

- WrigleyDokument14 SeitenWrigleysotki4100% (1)

- CASE Exhibits - HertzDokument15 SeitenCASE Exhibits - HertzSeemaNoch keine Bewertungen

- Paginas Amarelas Case Week 8 ID 23025255Dokument4 SeitenPaginas Amarelas Case Week 8 ID 23025255Lesgitarmedit0% (1)

- SFM Wrigley JR Case Solution HBRDokument17 SeitenSFM Wrigley JR Case Solution HBRHayat Omer Malik100% (1)

- Buffets Bid For Media GeneralDokument23 SeitenBuffets Bid For Media GeneralTerence TayNoch keine Bewertungen

- Sealed Air Corporation's Leveraged Recapitalization (A)Dokument7 SeitenSealed Air Corporation's Leveraged Recapitalization (A)Jyoti GuptaNoch keine Bewertungen

- Case Background: Kaustav Dey B18088Dokument9 SeitenCase Background: Kaustav Dey B18088Kaustav DeyNoch keine Bewertungen

- Carter LBODokument1 SeiteCarter LBOEddie KruleNoch keine Bewertungen

- Updated Stone Container PaperDokument6 SeitenUpdated Stone Container Paperonetime699100% (1)

- Financial Statements Analysis Formulae AnalysisDokument44 SeitenFinancial Statements Analysis Formulae AnalysisChico ChanchanNoch keine Bewertungen

- Bonus Questions 2021Dokument18 SeitenBonus Questions 2021Lars HultgrenNoch keine Bewertungen

- Debt RatioDokument10 SeitenDebt RatioHera WhitecrownNoch keine Bewertungen

- The Call For The Unity of Religions (Wahdatul Adyaan) A False and Dangerous Call. - An Elimination of The Truth by DR - Saleh As-SalehDokument52 SeitenThe Call For The Unity of Religions (Wahdatul Adyaan) A False and Dangerous Call. - An Elimination of The Truth by DR - Saleh As-SalehMountainofknowledge100% (1)

- PPG Melc 4Dokument17 SeitenPPG Melc 4Jov EstradaNoch keine Bewertungen

- An Introduction: by Rajiv SrivastavaDokument17 SeitenAn Introduction: by Rajiv SrivastavaM M PanditNoch keine Bewertungen

- SMART Train ScheduleDokument1 SeiteSMART Train ScheduleDave AllenNoch keine Bewertungen

- Module in Sociology CSPDokument78 SeitenModule in Sociology CSPJanz Vincent ReyesNoch keine Bewertungen

- Notice - Carte Pci - Msi - Pc54g-Bt - 2Dokument46 SeitenNotice - Carte Pci - Msi - Pc54g-Bt - 2Lionnel de MarquayNoch keine Bewertungen

- Notes Chap 1 Introduction Central Problems of An EconomyDokument2 SeitenNotes Chap 1 Introduction Central Problems of An Economyapi-252136290100% (2)

- Susan Rose's Legal Threat To Myself and The Save Ardmore CoalitionDokument2 SeitenSusan Rose's Legal Threat To Myself and The Save Ardmore CoalitionDouglas MuthNoch keine Bewertungen

- E-Conclave Spon BrochureDokument17 SeitenE-Conclave Spon BrochureNimish KadamNoch keine Bewertungen

- CKA CKAD Candidate Handbook v1.10Dokument28 SeitenCKA CKAD Candidate Handbook v1.10Chiran RavaniNoch keine Bewertungen

- 2016 GMC Individuals Round 1 ResultsDokument2 Seiten2016 GMC Individuals Round 1 Resultsjmjr30Noch keine Bewertungen

- Upcoming Book of Hotel LeelaDokument295 SeitenUpcoming Book of Hotel LeelaAshok Kr MurmuNoch keine Bewertungen

- Integrative Assessment OutputDokument2 SeitenIntegrative Assessment OutputRonnie TambalNoch keine Bewertungen

- Daniel Salazar - PERSUASIVE ESSAYDokument2 SeitenDaniel Salazar - PERSUASIVE ESSAYDaniel SalazarNoch keine Bewertungen

- Unit Test 11 PDFDokument1 SeiteUnit Test 11 PDFYONoch keine Bewertungen

- How To Claim Your VAT RefundDokument5 SeitenHow To Claim Your VAT Refundariffstudio100% (1)

- Italian Budgeting Policy Between Punctuations and Incrementalism Alice Cavalieri Full ChapterDokument51 SeitenItalian Budgeting Policy Between Punctuations and Incrementalism Alice Cavalieri Full Chapterjames.philson408Noch keine Bewertungen

- People v. Bandojo, JR., G.R. No. 234161, October 17, 2018Dokument21 SeitenPeople v. Bandojo, JR., G.R. No. 234161, October 17, 2018Olga Pleños ManingoNoch keine Bewertungen

- Dwnload Full Essentials of Testing and Assessment A Practical Guide For Counselors Social Workers and Psychologists 3rd Edition Neukrug Test Bank PDFDokument36 SeitenDwnload Full Essentials of Testing and Assessment A Practical Guide For Counselors Social Workers and Psychologists 3rd Edition Neukrug Test Bank PDFbiolysis.roomthyzp2y100% (9)

- Final WorksheetDokument13 SeitenFinal WorksheetAgung Prasetyo WibowoNoch keine Bewertungen

- Developing A Business Plan For Your Vet PracticeDokument7 SeitenDeveloping A Business Plan For Your Vet PracticeMujtaba AusafNoch keine Bewertungen