Beruflich Dokumente

Kultur Dokumente

Why the 3 Operating Plans for RJR Nabisco Differed in Valuation

Hochgeladen von

Satyajeet SenapatiOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Why the 3 Operating Plans for RJR Nabisco Differed in Valuation

Hochgeladen von

Satyajeet SenapatiCopyright:

Verfügbare Formate

What accounts for any difference in the value of three operating plans?

Due to the difference in the strategies, there was difference in the valuations of the

3 different operating plans. The reason for the difference in valuation was due to the

fact that the free cash flow projections from the 3 approaches resulted in different

valuations. The management groups strategy was to sell off the food business and

retain the tobacco business since the former was undervalued. They believed that

this approach could change the perception of the market about the association of

tobacco and food business. This would lead to true valuation of each of the

businesses.

The strategy adopted by KKR was based on their assumption that maintaining

both the tobacco and food businesses could result in better valuation of the

company if the operations of the food business was well-managed. They planned to

retain whole of the tobacco business and significant amount of the food business.

They also planned to increase the valuation by selling off assets of the food

business. The pre-bid strategy was essentially following the same operation

strategy that they already had.

The inherent difference in the planned operating strategies and the capital

structures of the 3 approaches account for the difference in the value of the plans.

2. Evaluate the use of an auction of RJR Nabisco by the Special

Committee?

Which bid should the special committee select, if any? What other steps

should it take?

Das könnte Ihnen auch gefallen

- Obscurity: Undesirability: P/E: Screening CriteriaDokument21 SeitenObscurity: Undesirability: P/E: Screening Criteria/jncjdncjdnNoch keine Bewertungen

- SeminarKohlerpaper PDFDokument35 SeitenSeminarKohlerpaper PDFLLLLMEZNoch keine Bewertungen

- Seagate NewDokument22 SeitenSeagate NewKaran VasheeNoch keine Bewertungen

- RJRDokument4 SeitenRJRliyulongNoch keine Bewertungen

- RJRJRJJRJRJRJJR111111Dokument4 SeitenRJRJRJJRJRJRJJR111111John Paul Chua57% (7)

- RJR Nabisco 1Dokument6 SeitenRJR Nabisco 1gopal mundhraNoch keine Bewertungen

- Facebook Inc.: An Analysis of Its Initial Public OfferingDokument32 SeitenFacebook Inc.: An Analysis of Its Initial Public OfferingThái Hoàng NguyênNoch keine Bewertungen

- Wrigley Gum 21Dokument18 SeitenWrigley Gum 21Fidelity RoadNoch keine Bewertungen

- Tax Rate Efectivo 14% Pagina 9Dokument36 SeitenTax Rate Efectivo 14% Pagina 9RodrigoHermosilla227100% (1)

- Ethodology AND Ssumptions: B B × D EDokument7 SeitenEthodology AND Ssumptions: B B × D ECami MorenoNoch keine Bewertungen

- Sun Microsystems Financials and ValuationDokument6 SeitenSun Microsystems Financials and ValuationJasdeep SinghNoch keine Bewertungen

- Burton ExcelDokument128 SeitenBurton ExcelJaydeep SheteNoch keine Bewertungen

- OM Scott Case AnalysisDokument20 SeitenOM Scott Case AnalysissushilkhannaNoch keine Bewertungen

- Butler Lumber CompanyDokument4 SeitenButler Lumber Companynickiminaj221421Noch keine Bewertungen

- Final AssignmentDokument15 SeitenFinal AssignmentUttam DwaNoch keine Bewertungen

- The Home Depot: QuestionsDokument13 SeitenThe Home Depot: Questions凱爾思Noch keine Bewertungen

- Marriott Corporation's Divisional Cost of Capital AnalysisDokument4 SeitenMarriott Corporation's Divisional Cost of Capital AnalysisAsif RahmanNoch keine Bewertungen

- Calculating The NPV of The AcquisitionDokument23 SeitenCalculating The NPV of The Acquisitionkooldude1989100% (1)

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDokument5 SeitenIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenNoch keine Bewertungen

- Cases RJR Nabisco 90 & 91 - Assignment QuestionsDokument1 SeiteCases RJR Nabisco 90 & 91 - Assignment QuestionsBrunoPereiraNoch keine Bewertungen

- In Re RJR Nabisco Inc.Dokument3 SeitenIn Re RJR Nabisco Inc.viva_33Noch keine Bewertungen

- Kraft Foods Case SummaryDokument2 SeitenKraft Foods Case Summaryrkodo1126Noch keine Bewertungen

- Sun Brewing Case ExhibitsDokument26 SeitenSun Brewing Case ExhibitsShshankNoch keine Bewertungen

- RJR Nabisco Holdings Capital CorporationDokument3 SeitenRJR Nabisco Holdings Capital CorporationManogana RasaNoch keine Bewertungen

- Marriot Case Study CalculationsDokument5 SeitenMarriot Case Study CalculationsJuanNoch keine Bewertungen

- RJR Nabisco ValuationDokument33 SeitenRJR Nabisco ValuationKrishna Chaitanya KothapalliNoch keine Bewertungen

- Michael McClintock Case1Dokument2 SeitenMichael McClintock Case1Mike MCNoch keine Bewertungen

- Impairing The Microsoft - Nokia PairingDokument54 SeitenImpairing The Microsoft - Nokia Pairingjk kumarNoch keine Bewertungen

- Clarkson Lumber Analysis - TylerDokument9 SeitenClarkson Lumber Analysis - TylerTyler TreadwayNoch keine Bewertungen

- Koito Case Questions 2,3,4Dokument2 SeitenKoito Case Questions 2,3,4Simo RajyNoch keine Bewertungen

- RJR 1987 Annual ReportDokument94 SeitenRJR 1987 Annual Reportmilken466100% (1)

- M&a Assignment - Syndicate C FINALDokument8 SeitenM&a Assignment - Syndicate C FINALNikhil ReddyNoch keine Bewertungen

- Lecture Notes Topic 6 Final PDFDokument109 SeitenLecture Notes Topic 6 Final PDFAnDy YiMNoch keine Bewertungen

- This Study Resource WasDokument9 SeitenThis Study Resource WasVishalNoch keine Bewertungen

- Blaine Kitchenware financial analysis and capital structure optimizationDokument11 SeitenBlaine Kitchenware financial analysis and capital structure optimizationBala GNoch keine Bewertungen

- Jacobs Division PDFDokument5 SeitenJacobs Division PDFAbdul wahabNoch keine Bewertungen

- Case QuestionsDokument1 SeiteCase QuestionsParth LuthraNoch keine Bewertungen

- Tata Motors WACC analysisDokument2 SeitenTata Motors WACC analysisTanvi SharmaNoch keine Bewertungen

- Case Analysis - Compania de Telefonos de ChileDokument4 SeitenCase Analysis - Compania de Telefonos de ChileSubrata BasakNoch keine Bewertungen

- Deluxe Corporation Case StudyDokument3 SeitenDeluxe Corporation Case StudyHEM BANSALNoch keine Bewertungen

- CH 02Dokument31 SeitenCH 02singhsinghNoch keine Bewertungen

- Suggested Questions - Baker Adhesives V2Dokument10 SeitenSuggested Questions - Baker Adhesives V2Debbie RiceNoch keine Bewertungen

- A Note On Leveraged RecapitalizationDokument5 SeitenA Note On Leveraged Recapitalizationkuch bhiNoch keine Bewertungen

- RJR Nabisco Pre-Bid Valuation AnalysisDokument13 SeitenRJR Nabisco Pre-Bid Valuation AnalysisMohit Khandelwal100% (1)

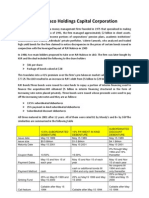

- The Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationDokument24 SeitenThe Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationAhsen Ali Siddiqui100% (1)

- SUN Brewing (A)Dokument6 SeitenSUN Brewing (A)Ilya KNoch keine Bewertungen

- Fixed Income Valuation: Calculating YTM and Prices for Bonds Issued by NTT, Patriot, and NationalisteDokument1 SeiteFixed Income Valuation: Calculating YTM and Prices for Bonds Issued by NTT, Patriot, and NationalisteAbhishek Garg0% (2)

- Debt Policy at Ust Inc Case AnalysisDokument23 SeitenDebt Policy at Ust Inc Case AnalysisLouie Ram50% (2)

- Nova Case Course HeroDokument10 SeitenNova Case Course HerolibroaklatNoch keine Bewertungen

- Integrative Case 4.0Dokument3 SeitenIntegrative Case 4.0Archit SharmaNoch keine Bewertungen

- Corning Convertible Preferred Stock PDFDokument6 SeitenCorning Convertible Preferred Stock PDFperwezNoch keine Bewertungen

- 001 The State of South Carolina - SDokument49 Seiten001 The State of South Carolina - Smeghnakd697625% (4)

- FRAV Individual Assignment - Pranjali Silimkar - 2016PGP278Dokument12 SeitenFRAV Individual Assignment - Pranjali Silimkar - 2016PGP278pranjaligNoch keine Bewertungen

- Group BDokument10 SeitenGroup BHitin KumarNoch keine Bewertungen

- Case 5 Midland Energy Case ProjectDokument7 SeitenCase 5 Midland Energy Case ProjectCourse HeroNoch keine Bewertungen

- FBE 529 Lecture 1 PDFDokument26 SeitenFBE 529 Lecture 1 PDFJIAYUN SHENNoch keine Bewertungen

- Case 3 - Starbucks - Assignment QuestionsDokument3 SeitenCase 3 - Starbucks - Assignment QuestionsShaarang BeganiNoch keine Bewertungen

- Case 32 - CPK AssignmentDokument9 SeitenCase 32 - CPK AssignmentEli JohnsonNoch keine Bewertungen

- Group7_MetabicalDokument4 SeitenGroup7_MetabicalKripa MehtaNoch keine Bewertungen

- PN Professional Nutrition Calendar How It WorksDokument11 SeitenPN Professional Nutrition Calendar How It WorksFeriena KusairiNoch keine Bewertungen