Beruflich Dokumente

Kultur Dokumente

MAC

Hochgeladen von

almighty08Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MAC

Hochgeladen von

almighty08Copyright:

Verfügbare Formate

Siemens Electric Motor Works(B):

Pricing Interdivisional Sales

By

Prabhanshu Agrawal(91)

Rahul Singh(109)

Ojasvee Khanna(89)

Sravan Kumar(184)

Case study Introduction

Siemens AG was one of the largest producers of electrical and

electronics products.

The largest group under it was Energy Automation group, under it

manufacturing industries under which EMW is operate

EMW produces Low voltage motors.

In 1970s custom motors comprises of 20% and standard motors

comprises 80% of overall production

Huge competition to standard motors from Eastern Bloc

competitors which have a cost advantage of low labor rates.

To improvise they changed the strategy to 10% standard motors

and 90% custom motors.

For successful implementation of new strategy they followed the

following changes such as replacing old machines with

sophisticated machines for customization and vertical integration.

Large Volume Components were manufactured using

automated equipment

Low Volume Components might be made by hand

The Production facilities of the Manufacturing Industries

Group were organized around production technologies

The sales division was organized around customer market

segments

The orders are evaluated based on data provided by

EMW Representative on cost of production.

Sales Representative on customer information.

Cost of Producing an Order :

Total Cost = Direct Material cost + Direct Labor Cost + Overhead Cost

Calculating Overhead Cost :

Overhead

Cost driver

Material related Overhead

Materials consumed

Production related Overhead

Direct labor/ Direct Machine hours

Support related Overhead

Direct materials + Direct Labor +

Manufacturing Overhead + Production

Overhead

Order Processing Overhead

Number of Orders (constant per order)

Special Component handling

Overhead

Number of special components

(constant per component)

Factory Cost Schedule for Low Wattage A/C Motors:

Number of

Discount Factor

pieces per order

1.00

2-4

.70

5-19

.57

20-99

.48

>100

.42

Factory Cost = Standard Cost * Discount Factor. For example motors from

an order of 12 with a standard 1 unit cost of 250 cost at 142.5 per

unit(250*0.57=142.5)

Factory Cost is an approximation to Process-Oriented Costing and both

are not the same

EVALUATING THE ORDERS:

The profitability of the customers total business with Siemens

corporation was analyzed.

A below cost price is accepted if the loss could be made up in

other transactions with the customer.

For all unprofitable orders, a price floor is set at 25% above the

variable cost of production.

The low volume orders are most profitable to the firm.

COMPUTING THE TRANSFER PRICE:

Transfer price is calculated based on the analysis of profit of the order for

the EMW to break even.

For profitable orders,

Transfer price=factory cost +(1/3*profit earned)

For unprofitable orders,

Transfer price=variable cost +(3/4*contribution earned)

The two transfer pricing rules were established by analyzing the cost structure

of low wattage A/C motor business at average capacity utilization over the

business cycle.

For unprofitable orders , 3/4th of contribution goes to EMW and 1/4th of the

contribution goes sales.

2. Outline the transfer pricing rules. What is the relation between

the cost of a product as generated by the product costing

system, the factory cost, and its transfer price?

Transfer Pricing

The price at which EMW transfers motors to the sales division is

called transfer pricing.

It calculated based on whether a motor is profitable or not.

Profitable order:

Transfer price = Factory cost + (1/3) *Profit

Unprofitable order:

Transfer Price = variable cost + (3/4) *contribution margin

Product costing system

1. Direct material cost

2. Direct labour cost

3. Overhead cost

i. Material related overhead (cost of direct materials)

ii. Production related overhead (Machine hours or labour

hours)

iii. Support related overhead (% of sum of direct material,

direct

labour, material related overhead, production related

overhead)

iv. Order processing cost (No. of orders)

v. Costs of handling custom components (No. of types of

special

components)

Factory cost

. Approximates the Process cost system based on the number

of motors per order. It is given by

Factory cost = Standard cost of one unit of one motor *

discount factor

based on no. of motors

1.

Do you agree with Siemenss decision to set up both Sales and EMW as

profit Centres? What are some of the costs and benefits associated with

this decision?

A: No.

. When there are two profit centers, the actual potential

profit of EMW is not revealed as a part of the profit goes to

sales.

.

When there is only one profit center the actual profit to

EMW can be shown.

If there is only one profit center , shipping and marketing

costs increases.

Administrative costs are lower when there is one profit

center.

3. If Herr Lottes asked for your analysis of his situation and a

recommended course of action, how would you respond?

Processing and special components handling overhead allocation is

done on lot produced

Maximum of the sales are with lot size 20 - 99

Increasing the discount factor for this lot size while calculating the

factory cost will increase the contribution margin and in turn

increase the overall contribution

This will bring contribution margin to 40% which will be breakeven

for EMW

Das könnte Ihnen auch gefallen

- Creating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowVon EverandCreating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowBewertung: 4 von 5 Sternen4/5 (1)

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesVon EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Siemens Electric Motor WorksDokument4 SeitenSiemens Electric Motor WorksmansNoch keine Bewertungen

- MA Session 6 PDFDokument48 SeitenMA Session 6 PDFArkaprabha GhoshNoch keine Bewertungen

- Siemens CaseDokument4 SeitenSiemens Casespaw1108Noch keine Bewertungen

- Siemens Electric Motor WorksDokument6 SeitenSiemens Electric Motor Workseddy12345test0% (2)

- Managerial EconomicsDokument22 SeitenManagerial EconomicsKarla YamsonNoch keine Bewertungen

- OverheadsDokument25 SeitenOverheadslalitNoch keine Bewertungen

- Absorption Costing: Is One of The Traditional Costing MethodsDokument27 SeitenAbsorption Costing: Is One of The Traditional Costing MethodsNokutenda K GumbieNoch keine Bewertungen

- Unit-1:: Introduction To Basics of Industrial AutomationDokument23 SeitenUnit-1:: Introduction To Basics of Industrial Automationanuj jain100% (1)

- Cost and Revenue of Production: Dr. S P SinghDokument36 SeitenCost and Revenue of Production: Dr. S P SinghDuma DumaiNoch keine Bewertungen

- Basic of Programmable Logic ControllerDokument146 SeitenBasic of Programmable Logic ControllerNishant SaxenaNoch keine Bewertungen

- Seimens EMW Handouts PGP Nov 21Dokument18 SeitenSeimens EMW Handouts PGP Nov 21yashashree barhateNoch keine Bewertungen

- Computer Integrated Manufactu Ring: Unit 1 Gaurish M SamantDokument19 SeitenComputer Integrated Manufactu Ring: Unit 1 Gaurish M SamantGaurish M SamantNoch keine Bewertungen

- CMA Class 5 Sec A 2020 FDokument82 SeitenCMA Class 5 Sec A 2020 FRithesh KNoch keine Bewertungen

- Ma2 - Acca - Chapter 1Dokument24 SeitenMa2 - Acca - Chapter 1leducNoch keine Bewertungen

- Lesson About CostDokument8 SeitenLesson About CostMariana MogîldeaNoch keine Bewertungen

- Cost Theory Word FileDokument11 SeitenCost Theory Word FileGaurav VaghasiyaNoch keine Bewertungen

- Machine Hour RateDokument9 SeitenMachine Hour RateSoumya Ranjan SahooNoch keine Bewertungen

- SiemensDokument10 SeitenSiemenssharadharjai100% (2)

- Huron AutomotiveDokument8 SeitenHuron Automotiveanubhav1109Noch keine Bewertungen

- Design For ManuFacturingDokument46 SeitenDesign For ManuFacturingxxxpressionNoch keine Bewertungen

- Activity Based Costing and Just in TimeDokument120 SeitenActivity Based Costing and Just in TimePaulo M.P. Harianja100% (2)

- Traditional Cost Management SystemsDokument62 SeitenTraditional Cost Management SystemsaaawhsascribdNoch keine Bewertungen

- Process 08Dokument31 SeitenProcess 08Aditya MishraNoch keine Bewertungen

- P01 - Job Order Process Costing and Service Department Cost AllocationDokument23 SeitenP01 - Job Order Process Costing and Service Department Cost AllocationABBIE GRACE DELA CRUZNoch keine Bewertungen

- 3 SME4833 ch4 New OcwDokument56 Seiten3 SME4833 ch4 New OcwMohamed MansourNoch keine Bewertungen

- Product Life CycleDokument52 SeitenProduct Life CycleMrityunjay JhaNoch keine Bewertungen

- Lecture 10 - DFMDokument42 SeitenLecture 10 - DFMAbuzar AliNoch keine Bewertungen

- Data Model 2 by LakshDokument21 SeitenData Model 2 by LakshLaksh SinghalNoch keine Bewertungen

- CMA - Overhead CostsDokument14 SeitenCMA - Overhead CostsDrbahija Hamed YousefzaiNoch keine Bewertungen

- PAN African E-Network Project D B M: Iploma in Usiness AnagementDokument77 SeitenPAN African E-Network Project D B M: Iploma in Usiness AnagementOttilieNoch keine Bewertungen

- Non-Traditional Machining and Automation: B.Tech. (4 Sem) Spring 2021 Department of Mechanical Engineering NIT SrinagarDokument14 SeitenNon-Traditional Machining and Automation: B.Tech. (4 Sem) Spring 2021 Department of Mechanical Engineering NIT SrinagarJatin prasad TandanNoch keine Bewertungen

- Costing Machine Hour RateDokument27 SeitenCosting Machine Hour RateAjay SahooNoch keine Bewertungen

- Design For ManuFacturingDokument46 SeitenDesign For ManuFacturingGrk GuptaNoch keine Bewertungen

- Machine Hours RateDokument15 SeitenMachine Hours RateRatnakar PatilNoch keine Bewertungen

- Design1 Lesson 9 - Cost EvaluationDokument96 SeitenDesign1 Lesson 9 - Cost EvaluationIzzat IkramNoch keine Bewertungen

- ITT AutoDokument4 SeitenITT AutoKarthik ArumughamNoch keine Bewertungen

- MPA 602: Cost and Managerial Accounting: Costing and Control of Manufacturing OverheadDokument99 SeitenMPA 602: Cost and Managerial Accounting: Costing and Control of Manufacturing OverheadMd. ZakariaNoch keine Bewertungen

- Akansha Dixit.Dokument2 SeitenAkansha Dixit.TAPOSH MUNJALNoch keine Bewertungen

- Overheads and Absorption CostingDokument34 SeitenOverheads and Absorption CostingIndra ThapaNoch keine Bewertungen

- Industrial Automation1Dokument15 SeitenIndustrial Automation1anon_91668243Noch keine Bewertungen

- Maintenance SimulationDokument43 SeitenMaintenance SimulationSundaramali Govindaswamy GNoch keine Bewertungen

- Ebd IvDokument49 SeitenEbd IvSharath NateshNoch keine Bewertungen

- ACT 600 Advanced Managerial Accounting: Accumulating and Assigning Costs To ProductsDokument43 SeitenACT 600 Advanced Managerial Accounting: Accumulating and Assigning Costs To ProductsAli H. AyoubNoch keine Bewertungen

- EEM Lecture 1Dokument41 SeitenEEM Lecture 1ayan khanNoch keine Bewertungen

- Cost of Production: Dr. S P SinghDokument31 SeitenCost of Production: Dr. S P Singhtacamp daNoch keine Bewertungen

- Lec#5 Week#5 ECODokument33 SeitenLec#5 Week#5 ECOZoha MughalNoch keine Bewertungen

- Estimation HandbookDokument54 SeitenEstimation HandbookMathias Wafawanaka100% (1)

- Activity-Based Costing: © 2009 Cengage LearningDokument30 SeitenActivity-Based Costing: © 2009 Cengage LearningFileuploaderNoch keine Bewertungen

- Cost Estimation Total Product Cost: Malavika M R 2015-09-013Dokument32 SeitenCost Estimation Total Product Cost: Malavika M R 2015-09-013Roman BarboNoch keine Bewertungen

- Cost EstimationDokument35 SeitenCost EstimationPraveen BavanaNoch keine Bewertungen

- ACCTN101 Cheat SheetDokument8 SeitenACCTN101 Cheat SheetNikki MathysNoch keine Bewertungen

- Running / Operating ChargesDokument11 SeitenRunning / Operating ChargesNeo Esun GalmanNoch keine Bewertungen

- Costs of Production PDFDokument31 SeitenCosts of Production PDFmarkNoch keine Bewertungen

- Accounting For Factory OverheadDokument27 SeitenAccounting For Factory Overheadspectrum_480% (1)

- Operator’S Guide to Centrifugal Pumps: What Every Reliability-Minded Operator Needs to KnowVon EverandOperator’S Guide to Centrifugal Pumps: What Every Reliability-Minded Operator Needs to KnowBewertung: 2 von 5 Sternen2/5 (1)

- ProbStats Tutorial # 1 QuestionsDokument9 SeitenProbStats Tutorial # 1 Questionsalmighty08Noch keine Bewertungen

- Wyndor Glass Co. Product-Mix With Setup Costs: Range Name CellsDokument1 SeiteWyndor Glass Co. Product-Mix With Setup Costs: Range Name Cellsalmighty08Noch keine Bewertungen

- Cost of Capital HoldbergDokument4 SeitenCost of Capital Holdbergalmighty08Noch keine Bewertungen

- ProbStats Tutorial # 2 QuestionsDokument8 SeitenProbStats Tutorial # 2 Questionsalmighty08Noch keine Bewertungen

- Case10 MAC-Reflection Paper Arun PGDMB15-023 Section ADokument1 SeiteCase10 MAC-Reflection Paper Arun PGDMB15-023 Section Aalmighty08Noch keine Bewertungen

- Markov's Efficient Frontier CalculationDokument25 SeitenMarkov's Efficient Frontier Calculationalmighty08Noch keine Bewertungen

- IPremier and Denial of Service AttackDokument3 SeitenIPremier and Denial of Service Attackalmighty08Noch keine Bewertungen

- External ForcesDokument5 SeitenExternal Forcesalmighty08Noch keine Bewertungen

- 1 - Reliable CPM Time-Cost - TemplateDokument4 Seiten1 - Reliable CPM Time-Cost - Templatealmighty08Noch keine Bewertungen

- Simulation - IIIDokument8 SeitenSimulation - IIIalmighty08Noch keine Bewertungen

- Software QA 1.2.4 Functional Testing Software Evaluation FormDokument7 SeitenSoftware QA 1.2.4 Functional Testing Software Evaluation FormEmmanuel Evelyn OguntadeNoch keine Bewertungen

- Issues and Challenges in Service MarketingDokument10 SeitenIssues and Challenges in Service MarketingDivya GirishNoch keine Bewertungen

- My Courses: Home FM Internal Tests Assessment 1 Excel Test-NewDokument4 SeitenMy Courses: Home FM Internal Tests Assessment 1 Excel Test-NewTanu Singh 1584Noch keine Bewertungen

- Nike Brand MantraDokument7 SeitenNike Brand MantraAkshath Mavinkurve100% (1)

- Contract Administration Works-Sbd 1Dokument200 SeitenContract Administration Works-Sbd 1Rajaratnam TharakanNoch keine Bewertungen

- Minimum Wage 2014-2015Dokument3 SeitenMinimum Wage 2014-2015Anand ChinnappanNoch keine Bewertungen

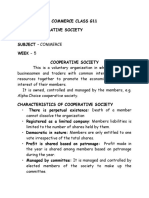

- Commerce Class G11 Topic - Cooperative Society Grade - G11 Subject - Commerce Week - 5 Cooperative SocietyDokument7 SeitenCommerce Class G11 Topic - Cooperative Society Grade - G11 Subject - Commerce Week - 5 Cooperative SocietyAdeola YusufNoch keine Bewertungen

- Inspection and TestingDokument5 SeitenInspection and TestingAhmed Elhaj100% (1)

- New Credit Card Regulations Aid ConsumersDokument1 SeiteNew Credit Card Regulations Aid ConsumersbmoakNoch keine Bewertungen

- VP Director Bus Dev or SalesDokument5 SeitenVP Director Bus Dev or Salesapi-78176257Noch keine Bewertungen

- Organizational Plan Draft 2Dokument5 SeitenOrganizational Plan Draft 2Jeffrey Fernandez75% (4)

- Chapter 6 OrganizingDokument36 SeitenChapter 6 OrganizingMohammed HussienNoch keine Bewertungen

- Economic Transformation and Governance in Oil Industry Benefits of Liquid Fuels CharterDokument18 SeitenEconomic Transformation and Governance in Oil Industry Benefits of Liquid Fuels Charter11soccerdadNoch keine Bewertungen

- EFTA Philippines FTA Factsheet 2021 - 230413 - 015527Dokument3 SeitenEFTA Philippines FTA Factsheet 2021 - 230413 - 015527Evardone CirylNoch keine Bewertungen

- Sajid Ali CVDokument1 SeiteSajid Ali CVAvcom TechnologiesNoch keine Bewertungen

- BUS 6140 Module 5 WorksheetDokument8 SeitenBUS 6140 Module 5 Worksheetoludare dipeNoch keine Bewertungen

- Vending Services Business PlanDokument40 SeitenVending Services Business PlanLiudmyla ShersheniukNoch keine Bewertungen

- Chapter 7 DepreciationDokument50 SeitenChapter 7 Depreciationpriyam.200409Noch keine Bewertungen

- Industrial Visit)Dokument10 SeitenIndustrial Visit)ZISHAN ALI-RM 21RM966Noch keine Bewertungen

- 24-Hour Call Center: 16221 For Overseas Callers: +880 2 55668056Dokument8 Seiten24-Hour Call Center: 16221 For Overseas Callers: +880 2 55668056Number ButNoch keine Bewertungen

- Tds TcsDokument20 SeitenTds TcsnaysarNoch keine Bewertungen

- INX Future Inc Employee PerformanceDokument10 SeitenINX Future Inc Employee Performanceavinash kumar100% (1)

- Learning Activity 5.2 Concept ReviewDokument4 SeitenLearning Activity 5.2 Concept ReviewJames CantorneNoch keine Bewertungen

- Yu V NLRCDokument2 SeitenYu V NLRCStefanRodriguezNoch keine Bewertungen

- AFAR04-10 Business Combination Date of AcquisitionDokument3 SeitenAFAR04-10 Business Combination Date of AcquisitioneildeeNoch keine Bewertungen

- Business To Business Marketing IADokument7 SeitenBusiness To Business Marketing IAKaty CNoch keine Bewertungen

- Essential Operations Management Case Study AnswersDokument69 SeitenEssential Operations Management Case Study Answerswaqas724Noch keine Bewertungen

- What Is The Entrepreneurial Process?Dokument2 SeitenWhat Is The Entrepreneurial Process?MemeowwNoch keine Bewertungen

- Ch.6-9 Review Problems + SolutionsDokument29 SeitenCh.6-9 Review Problems + Solutionsandrew.yerokhin1Noch keine Bewertungen