Beruflich Dokumente

Kultur Dokumente

The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015

Hochgeladen von

srichardequipOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015

Hochgeladen von

srichardequipCopyright:

Verfügbare Formate

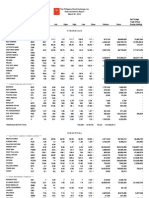

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 30 , 2015

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

FINANCIALS

**** BANKS ****

ASIATRUST

ASIA UNITED

BDO UNIBANK

ASIA

AUB

BDO

BANK PH ISLANDS

BPI

CHINABANK

CITYSTATE BANK

EXPORT BANK A

EXPORT BANK B

EAST WEST BANK

CHIB

CSB

EIBA

EIBB

EW

METROBANK

PB BANK

69.95

114

70

114.5

69

116

70

116

69

113.9

70

114.5

82,130

4,032,140

5,741,297

463,383,271

1,879,237

(100,084,065)

99

99.1

97.95

99

97.95

99

2,060,180

203,351,382.5

142,520,554.5

46.9

9.8

26.35

47

11

26.5

47

25

47

26.7

46.9

24.6

47

26.5

45,300

5,343,400

2,125,760

139,007,465

(47,783,995)

MBT

95.3

95.35

97.95

98.3

94.95

95.3

4,191,370

401,226,719

(40,459,254)

PBB

18.66

18.86

18.7

18.86

18.66

18.86

114,400

2,145,224

112,200

PBCOM

PBC

31.6

32.5

31.7

31.7

31.6

31.6

1,400

44,340

PHIL NATL BANK

PNB

84

84.2

80.05

84.2

80.05

84.2

1,212,250

100,834,488.5

27,008,590.5

PSBANK

PSB

100

101

101

101

100.2

100.2

640

64,280

PHILTRUST

RCBC

PTC

RCB

82.05

47.7

47.75

47.75

47.75

47.5

47.7

478,500

22,839,885

(17,273,645)

SECURITY BANK

SECB

151.9

152

153

153

151.5

152

1,700,960

259,021,912

(72,820,296)

UNION BANK

UBP

71.1

71.8

70.15

71.8

70.1

71.8

46,980

3,335,659

(707,750)

**** OTHER FINANCIAL INSTITUTIONS ****

AG FINANCE

AGF

3.86

4.1

4.09

4.1

4.09

4.1

21,000

86,000

BRIGHT KINDLE

BDO LEASING

COL FINANCIAL

BKR

BLFI

COL

3.05

2.3

15.9

3.14

2.34

16

3.19

2.3

16.34

3.19

2.35

16.5

3.05

2.3

16

3.05

2.3

16

60,000

164,000

667,400

187,440

377,300

10,944,722

200

FIRST ABACUS

FAF

0.76

0.84

0.79

0.84

0.76

0.84

205,000

165,120

FILIPINO FUND

FFI

7.28

7.38

7.28

7.29

7.28

7.28

18,600

135,412

IREMIT

1.7

1.79

1.8

1.8

1.7

1.7

26,000

44,400

MEDCO HLDG

MED

0.47

0.475

0.47

0.5

0.47

0.475

350,000

166,600

MANULIFE

MFC

740

790

745

745

740

745

740

551,100

NTL REINSURANCE

NRCP

1.03

1.05

1.05

1.05

1.03

1.03

139,000

144,810

PHIL STOCK EXCH

PSE

355

355.8

357

357.8

349

355

60,080

21,290,810

(378,318)

SUN LIFE

SLF

1,331

1,365

1,365

1,365

1,331

1,331

265

359,950

(359,950)

VANTAGE

2.9

2.91

2.9

2.9

2.9

2.9

507,000

1,470,300

FINANCIALS SECTOR TOTAL

VOLUME :

21,528,735

VALUE :

1,639,045,647

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ALSONS CONS

ABOITIZ POWER

ACR

AP

ENERGY DEVT

EDC

FIRST GEN

FGEN

FIRST PHIL HLDG

FPH

PHIL H2O

MERALCO

H2O

MER

MANILA WATER

MWC

PETRON

PCOR

PHX PETROLEUM

PNX

SPC POWER

SPC

TA OIL

VIVANT

TA

VVT

2.02

44.5

2.04

44.6

2.02

44.2

2.06

44.6

2

44.1

2.02

44.5

421,000

3,309,000

853,030

147,081,975

43,437,950

8.54

8.55

31.05

31.1

8.46

8.6

8.46

8.55

28,898,200

246,456,597

(14,155,034)

30.9

31.6

30.9

31.1

3,481,500

108,751,355

98.85

23,491,915

98.9

98.4

100

98.4

98.9

790,380

78,225,480.5

(9,526,607.5)

4.5

274.2

4.55

274.4

4.6

274

4.6

277

4.6

274

4.6

274.4

3,000

195,920

13,800

53,919,878

(19,249,684)

32

32.3

31.3

32.3

31.25

32.3

1,132,600

36,202,890

132,990

9.11

9.12

9.1

9.19

9.05

9.12

3,074,700

28,053,006

3,062,099

3.64

3.67

3.69

3.7

3.62

3.63

816,000

2,984,280

(1,820,380)

4.45

4.49

4.45

4.45

4.45

4.45

8,000

35,600

2.33

19

2.34

21

2.34

-

2.36

-

2.32

-

2.34

-

1,586,000

-

3,697,560

-

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

ANI

2.1

2.1

2.1

2.1

2.1

2,000

4,200

BOGO MEDELLIN

CNTRL AZUCARERA

CENTURY FOOD

BMM

CAT

CNPF

47.2

89.05

17.98

57

90

18.02

90.05

18.08

90.05

18.1

90

17.98

90

18

320

897,000

28,808

16,164,406

7,589,790

DEL MONTE

DMPL

16.82

16.88

15.46

17.2

15.46

16.88

443,700

7,315,586

(805,618)

DNL INDUS

DNL

16.98

17

17.1

17.4

16.9

17

12,694,500

215,925,962

190,685,688

EMPERADOR

EMP

10

10.04

9.91

10.1

9.91

10

6,881,400

68,843,463

(10,699,854)

ALLIANCE SELECT

FOOD

1.22

1.23

1.2

1.23

1.19

1.23

359,000

433,650

GINEBRA

GSMI

15.1

15.4

15.1

15.4

15.1

15.4

1,100

16,640

JOLLIBEE

JFC

231.4

232

226

234

225

232

1,693,160

387,321,240

84,871,054

LIBERTY FLOUR

MACAY HLDG

LFM

MACAY

32.05

46.85

39.95

47.1

45.45

47.1

45.45

47.1

44,000

2,050,200

MAXS GROUP

MAXS

32.2

32.3

30.25

33

30.25

32.2

4,139,500

133,487,745

10,788,490

PUREFOODS

PF

203.8

204.2

204.2

205.8

204

204

41,100

8,393,864

(3,038,682)

PEPSI COLA

PIP

3.99

4.01

4.04

7,544,000

30,193,020

7,233,220

ROXAS AND CO

RCI

2.71

2.9

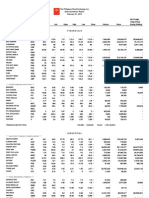

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 30 , 2015

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

RFM CORP

RFM

6.03

5.95

6.09

5.9

4,895,500

29,260,788

13,422,048

ROXAS HLDG

SWIFT FOODS

UNIV ROBINA

ROX

SFI

URC

6.76

0.154

207

7.05

0.155

207.6

7

0.154

204.2

7

0.157

208

7

0.154

204.2

7

0.155

207

2,000

3,050,000

2,420,560

14,000

471,030

499,383,944

24,640

46,911,782

VITARICH

VICTORIAS

VITA

VMC

0.8

4.6

0.81

4.8

0.8

4.79

0.81

4.8

0.8

4.79

0.8

4.8

637,000

27,000

510,220

129,460

8,100

-

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

ABG

8.04

8.15

8.15

8.2

8.05

8.05

11,900

96,659

(53,764)

CONCRETE A

CONCRETE B

DAVINCI CAPITAL

EEI CORP

CA

CAB

DAVIN

EEI

43

15

1.86

10.98

64.95

1.88

11

1.89

10.9

1.89

11

1.84

10.9

1.87

11

101,000

2,144,500

187,840

23,504,716

13,094,832

FED RESOURCES

FED

15.72

16.2

15.6

16.28

15.6

16.28

157,700

2,485,288

(467,748)

FERRONICKEL

FNI

3.03

3.04

3.09

3.13

3.03

3.04

668,366,000

2,066,516,250

3,161,780

HOLCIM

HLCM

14.68

14.72

14.74

14.74

14.72

14.72

16,000

235,640

LAFARGE REP

LRI

11.8

11.82

11.8

12.12

11.54

11.8

3,056,200

36,206,032

2,364

MEGAWIDE

PHINMA

PNCC

SUPERCITY

TKC STEEL

MWIDE

PHN

PNC

SRDC

T

8.28

10.18

0.9

1.59

8.29

10.2

1.63

8.3

10.34

1.58

8.4

10.34

1.67

8.29

10.2

1.58

8.29

10.2

1.67

372,800

11,200

171,000

3,100,128

114,268

278,600

(181,825)

-

VULCAN INDL

VUL

1.57

1.58

1.62

1.62

1.58

1.58

2,838,000

4,509,520

475,600

**** CHEMICALS ****

CHEMPHIL

CIP

86

120

75.1

85

75.1

85

90

7,254

EUROMED

EURO

1.26

1.57

1.57

1.57

1.57

1.57

10,000

15,700

LMG CHEMICALS

METROALLIANCE A

METROALLIANCE B

MABUHAY VINYL

PRYCE CORP

LMG

MAH

MAHB

MVC

PPC

2.3

2.43

-

2.65

2.6

-

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CIRTEK HLDG

CHIPS

CONCEPCION

CIC

19.66

19.94

20

20.25

19.66

19.66

263,000

5,250,597

50.5

51.8

49.8

52.2

49.8

51

45,000

2,316,600

(942,260)

GREENERGY

INTEGRATED MICR

GREEN

IMI

0.5

5.6

0.51

5.65

0.5

5.41

0.51

6.09

0.49

5.38

0.5

5.6

300,000

10,220,800

148,410

58,457,006

40,000

(1,740,126)

IONICS

PANASONIC

ION

PMPC

0.62

4

0.65

4.1

0.62

4.03

0.62

4.1

0.62

4

0.62

4.1

37,000

16,000

22,940

64,260

PHX SEMICNDCTR

PSPC

2.45

2.46

2.44

2.52

2.43

2.46

5,982,000

14,805,960

1,235,830

FILSYN A

FILSYN B

PICOP RES

SPLASH CORP

FYN

FYNB

PCP

SPH

1.75

1.78

1.77

1.79

1.75

1.75

130,000

228,920

STENIEL

STN

**** OTHER INDUSTRIALS ****

INDUSTRIAL SECTOR TOTAL

VOLUME :

783,790,830

VALUE :

4,333,754,319.5

HOLDING FIRMS

**** HOLDING FIRMS ****

ASIA AMLGMATED

AAA

1.25

1.5

1.32

1.6

1.32

1.55

64,000

87,990

11,800

ABACORE CAPITAL

AYALA CORP

ABA

AC

0.47

726.5

0.48

727

0.48

720

0.48

732

0.47

718

0.48

726.5

500,000

414,980

236,400

302,113,930

50,302,455

ABOITIZ EQUITY

AEV

56.6

56.7

56.7

56.85

56.45

56.6

2,083,570

117,997,265

(2,860,770.5)

ALLIANCE GLOBAL

AGI

25

25.05

24.45

25.1

24.4

25.05

12,318,500

307,803,800

55,189,670

ANSCOR

ANGLO PHIL HLDG

ANS

APO

7.05

1.4

7.08

1.46

7.06

1.4

7.07

1.46

7.05

1.4

7.05

1.46

115,500

814,524

22,000

30,910

ATN HLDG A

ATN

2.3

2.34

2.35

2.35

2.34

2.34

22,000

51,650

ATN HLDG B

ATNB

2.36

2.47

2.45

2.47

2.36

2.47

160,000

382,410

120,000

BHI HLDG

COSCO CAPITAL

BH

COSCO

600

8.95

744

8.98

8.81

9.04

8.81

8.98

7,415,000

66,542,437

2,522,230

DMCI HLDG

DMC

15.36

15.4

15.4

15.46

15.2

15.4

7,467,800

114,923,662

(5,547,500)

FILINVEST DEV

FJ PRINCE A

FDC

FJP

4.49

3.12

4.5

3.19

4.49

3.12

4.51

3.12

4.49

3.12

4.49

3.12

1,033,000

2,000

4,645,440

6,240

(1,732,500)

-

FJ PRINCE B

FORUM PACIFIC

GT CAPITAL

HOUSE OF INV

FJPB

FPI

GTCAP

HI

3.02

0.295

1,206

6.25

3.29

0.31

1,210

6.26

1,212

6.23

1,212

6.25

1,179

6.23

1,210

6.25

195,535

551,800

235,089,630

3,448,220

(68,842,875)

(3,149,920)

JG SUMMIT

JGS

65.4

65.5

64.5

65.5

64

65.5

6,638,980

431,785,467.5

23,659,828.5

JOLLIVILLE HLDG

KEPPEL HLDG A

KEPPEL HLDG B

LODESTAR

JOH

KPH

KPHB

LIHC

4.03

5.2

4.78

0.7

5.25

5.4

6.58

0.72

0.74

0.74

0.7

0.72

120,000

85,410

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 30 , 2015

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

LOPEZ HLDG

LPZ

7.37

7.45

7.07

7.5

7.07

7.45

18,705,100

138,611,874

31,458,842

LT GROUP

METRO GLOBAL

MABUHAY HLDG

MINERALES IND

LTG

MGH

MHC

MIC

13.62

0.65

5.15

13.78

0.67

5.2

13.62

4.95

13.88

5.25

13.62

4.9

13.62

5.2

1,609,900

232,000

22,047,712

1,158,700

(10,379,242)

-

MJC INVESTMENTS

MJIC

3.41

3.5

3.41

3.52

3.41

3.5

8,000

27,840

METRO PAC INV

MPI

5.17

5.19

5.1

5.22

5.09

5.17

36,709,100

190,264,684

(30,630,484)

PACIFICA

PRIME ORION

PA

POPI

0.04

0.65

0.041

0.66

0.041

0.66

0.041

0.66

0.041

0.65

0.041

0.65

900,000

3,194,000

36,900

2,086,880

PRIME MEDIA

REPUBLIC GLASS

PRIM

REG

1.41

2.4

1.47

2.45

2.4

2.4

2.4

2.4

16,000

38,400

SOLID GROUP

SYNERGY GRID

SM INVESTMENTS

SGI

SGP

SM

1.2

252.4

929

1.25

305

929.5

1.2

915

1.23

934

1.2

915

1.2

929

127,000

461,110

153,530

428,017,390

(25,410,970)

SAN MIGUEL CORP

SMC

76.15

77

76.9

77

75.5

76.15

175,000

13,362,194

5,062,738.5

SOC RESOURCES

SOC

1.05

10,000

10,000

SEAFRONT RES

TOP FRONTIER

SPM

TFHI

2.71

115

2.93

116

116

118

115

115

33,550

3,877,881

(3,185,571)

UNIOIL HLDG

UNI

0.335

0.345

0.36

0.36

0.335

0.335

3,260,000

1,114,650

WELLEX INDUS

WIN

0.24

0.243

0.241

0.248

0.24

0.243

3,260,000

794,090

ZEUS HLDG

ZHI

0.32

0.34

0.335

0.34

0.325

0.325

4,840,000

1,580,350

163,500

55,000

7,020

741,694,040

101,375,005

HOLDING FIRMS SECTOR TOTAL

VOLUME :

112,950,805

VALUE :

2,430,633,351.5

PROPERTY

**** PROPERTY ****

ARTHALAND CORP

ANCHOR LAND

AYALA LAND

ALCO

ALHI

ALI

0.25

10

36.1

0.26

10.2

36.2

0.25

10.2

35.3

0.25

10.2

36.1

0.25

10

35.2

0.25

10

36.1

ARANETA PROP

ARA

1.38

1.42

1.41

1.46

1.38

1.38

532,000

752,780

BELLE CORP

A BROWN

BEL

BRN

4.59

1.07

4.6

1.09

4.67

1.14

4.69

1.14

4.59

1.1

4.59

1.1

8,198,000

1,463,000

37,887,910

1,616,100

(5,064,160)

-

CITYLAND DEVT

CROWN EQUITIES

CEBU HLDG

CDC

CEI

CHI

0.99

0.133

5.09

1

0.134

5.1

0.98

0.133

5.15

0.98

0.135

5.15

0.98

0.133

5.09

0.98

0.134

5.09

2,111,000

6,010,000

67,800

2,068,780

805,370

346,658

(0)

(32,669)

CENTURY PROP

CPG

0.97

0.98

0.99

0.99

0.97

0.98

4,417,000

4,311,360

39,500

CEBU PROP A

CEBU PROP B

CYBER BAY

CPV

CPVB

CYBR

6.2

5.92

0.465

6.6

6.46

0.47

0.47

0.47

0.46

0.46

1,560,000

725,900

(241,600)

EMPIRE EAST

EVER GOTESCO

ELI

EVER

0.91

0.203

0.92

0.209

0.92

0.203

0.92

0.203

0.91

0.203

0.91

0.203

27,000

300,000

24,770

60,900

FILINVEST LAND

FLI

1.68

1.7

1.68

1.7

1.66

1.68

18,782,000

31,482,470

3,278,840

GLOBAL ESTATE

GERI

1.68

1.69

1.73

1.73

1.69

1.69

317,000

541,630

GOTESCO LAND A

GOTESCO LAND B

8990 HLDG

GO

GOB

HOUSE

8.98

9.02

8.11

9.11

8.11

8.98

22,676,700

198,483,764

90,594,656

IRC PROP

IRC

1.41

1.43

1.45

1.45

1.41

1.41

229,000

324,530

(42,300)

KEPPEL PROP

KEP

4.32

4.82

4.33

4.33

4.32

4.32

10,000

43,220

CITY AND LAND

MARSTEEL A

MARSTEEL B

MEGAWORLD

LAND

MC

MCB

MEG

1.24

5.2

1.26

5.21

5.14

5.21

5.14

5.2

31,248,100

162,239,329

18,809,763

MRC ALLIED

MRC

0.117

0.118

0.12

0.12

0.118

0.118

270,000

31,970

PHIL ESTATES

PHES

0.37

0.375

0.365

0.375

0.365

0.375

270,000

99,700

PRIMETOWN PROP

PRIMEX CORP

PMT

PRMX

5.53

5.54

5.25

5.53

5.25

5.53

758,900

4,143,665

137,650

ROBINSONS LAND

RLC

26.8

27.8

26.5

27.8

26.5

27.8

2,425,500

65,775,910

(28,648,905)

PHIL REALTY

RLT

0.405

0.47

0.55

0.55

0.47

0.47

920,000

434,370

ROCKWELL

ROCK

1.77

1.78

1.77

1.78

1.77

1.78

726,000

1,286,820

476,230

SHANG PROP

SHNG

3.19

3.25

3.19

3.25

3.19

3.25

23,000

73,480

STA LUCIA LAND

SLI

0.84

0.86

0.88

0.88

0.83

0.87

4,221,000

3,546,380

SM PRIME HLDG

SMPH

18.6

18.74

18.7

19

18.6

18.6

25,035,200

467,660,504

(63,774,548)

STARMALLS

STR

7.13

7.19

7.19

7.13

8,017,300

56,669,079

SUNTRUST HOME

PTFC REDEV CORP

UNIWIDE HLDG

VISTA LAND

SUN

TFC

UW

VLL

1.11

20

6.8

1.13

33.2

6.89

1.13

6.79

1.15

6.89

1.12

6.79

1.12

6.89

208,000

14,486,100

234,460

99,596,361

21,380

(9,618,456)

4,523,830

PROPERTY SECTOR TOTAL

VOLUME :

176,187,900

220,000

700

20,657,600

VALUE :

1,883,024,230

SERVICES

**** MEDIA ****

ABS CBN

ABS

49.85

49.9

49.05

49.85

49.05

49.85

91,400

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 30 , 2015

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

GMA NETWORK

GMA7

6.14

6.15

6.35

6.35

6.15

6.15

390,600

2,422,112

MANILA BULLETIN

MLA BRDCASTING

MB

MBC

0.71

3.1

0.72

-

0.72

-

0.72

-

0.71

-

0.72

-

146,000

-

103,690

-

**** TELECOMMUNICATIONS ****

GLOBE TELECOM

GLO

1,746

1,752

1,760

1,760

1,735

1,746

35,935

62,698,220

(28,297,755)

LIBERTY TELECOM

LIB

1.99

2.01

1.96

1.99

1.96

1.99

16,000

31,630

PTT CORP

PLDT

PTT

TEL

2,968

2,970

2,972

2,978

2,962

2,970

169,490

503,251,530

59,557,330

6.4

3.51

0.335

6.49

4.5

40

0.34

6.15

0.37

6.4

0.37

6.14

0.34

6.4

0.34

111,400

98,930,000

708,335

34,841,100

17,850

-

**** INFORMATION TECHNOLOGY ****

DFNN INC

IMPERIAL A

IMPERIAL B

ISLAND INFO

DFNN

IMP

IMPB

IS

ISM COMM

ISM

1.54

1.55

1.54

1.56

1.52

1.55

3,527,000

5,434,500

JACKSTONES

JAS

3.33

3.59

3.33

3.33

3.33

3.33

1,000

3,330

MG HLDG

MG

0.355

0.36

0.375

0.38

0.35

0.355

9,070,000

3,237,400

15,200

NOW CORP

TRANSPACIFIC BR

PHILWEB

NOW

TBGI

WEB

0.58

1.94

12.1

0.59

2.03

12.54

0.59

12.5

0.59

12.54

0.58

12.08

0.58

12.54

128,000

221,400

74,780

2,745,044

YEHEY CORP

YEHEY

1.23

1.3

1.28

1.32

1.23

1.23

27,000

33,950

**** TRANSPORTATION SERVICES ****

2GO GROUP

2GO

4.08

4.1

4.1

4.1

4.01

4.08

227,000

921,010

(92,580)

ASIAN TERMINALS

ATI

12.2

12.4

12.2

12.38

12.2

12.38

80,100

977,248

974,780

CEBU AIR

CEB

94.65

94.7

94.45

96.15

94.45

94.7

991,560

94,255,493.5

848,166

INTL CONTAINER

ICT

113.9

114

114.3

116

113.6

114

1,853,890

211,452,513

(91,579,219)

LORENZO SHIPPNG

LSC

1.29

1.44

1.28

1.28

1.26

1.28

92,000

117,490

MACROASIA

MAC

2.33

2.34

2.31

2.4

2.31

2.34

127,000

302,170

(7,200)

PAL HLDG

PAL

4.91

4.97

4.71

4.7

4.97

26,300

127,227

GLOBALPORT

HARBOR STAR

PORT

TUGS

1.5

1.52

1.54

1.55

1.5

1.5

290,000

438,020

1.1

0.111

1.2

0.112

0.115

0.116

0.111

0.112

89,670,000

10,108,470

**** HOTEL & LEISURE ****

ACESITE HOTEL

BOULEVARD HLDG

ACE

BHI

DISCOVERY WORLD

DWC

1.66

1.7

1.68

1.69

1.66

1.69

20,000

33,620

GRAND PLAZA

WATERFRONT

GPH

WPI

15.06

0.38

29.95

0.385

0.395

0.395

0.385

0.385

580,000

224,050

CENTRO ESCOLAR

CEU

10.12

10.8

10.8

10.8

10.8

10.8

500

5,400

FAR EASTERN U

IPEOPLE

FEU

IPO

888

11.5

1,300

11.8

11.5

11.8

11.5

11.8

39,800

463,700

STI HLDG

STI

0.66

0.67

0.65

0.67

0.64

0.67

58,907,000

38,308,480

(1,314,500)

**** EDUCATION ****

**** CASINOS & GAMING ****

BERJAYA

BCOR

23

28

28

28

28

28

500

14,000

BLOOMBERRY

BLOOM

12.36

12.38

12.3

12.5

12.3

12.38

5,639,300

69,849,928

(1,243,354)

IP EGAME

EG

0.014

0.015

0.014

0.015

0.014

0.015

160,700,000

2,324,800

PACIFIC ONLINE

LEISURE AND RES

LOTO

LR

17.68

10.4

17.7

10.42

17.9

10.26

17.9

10.5

17.68

10.26

17.68

10.4

12,200

215,740

232,400

2,420,176

MELCO CROWN

MCP

11.88

11.92

11.88

12.2

11.88

11.92

1,560,400

18,597,584

2,287,552

MANILA JOCKEY

MJC

2.05

2.14

2.02

2.14

2.02

2.14

2,000

4,160

PRMIERE HORIZON

PHA

0.6

0.61

0.59

0.61

0.59

0.6

3,517,000

2,109,510

PREMIUM LEISURE

PLC

1.88

1.91

1.86

1.94

1.86

1.88

18,224,000

34,576,740

9,920,260

PHIL RACING

TRAVELLERS

PRC

RWM

9

7.04

9.25

7.1

7.3

7.3

7.04

7.04

2,902,900

20,663,974

(9,865,735)

CALATA CORP

CAL

4.38

4.39

4.34

4.46

4.33

4.38

3,408,000

14,985,550

PUREGOLD

PGOLD

42

42.1

41.2

42.55

41.2

42

6,937,800

292,224,650

56,438,170

ROBINSONS RTL

RRHI

79.2

79.3

79.9

80.05

78.8

79.2

1,172,820

93,020,143

9,390,912.5

PHIL SEVEN CORP

SEVN

89.5

90

89.5

90

89.5

90

11,280

1,015,060

925,060

SSI GROUP

SSI

10.7

10.74

10.76

10.88

10.62

10.7

2,505,700

26,930,054

(178,560)

APC

ECP

PAX

PHC

0.71

2.82

3.03

-

0.72

3.2

3.19

-

0.72

-

0.72

-

0.7

-

0.71

-

1,950,000

-

1,382,260

-

**** RETAIL ****

**** OTHER SERVICES ****

APC GROUP

EASYCALL

PAXYS

PHILCOMSAT

SERVICES SECTOR TOTAL

VOLUME :

478,179,945

VALUE :

1,613,874,476.5

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 30 , 2015

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

**** MINING ****

ATOK

APEX MINING

AB

APX

10.9

3.1

11.8

3.19

11.9

3.18

11.9

3.18

11.9

3.08

11.9

3.11

100

220,000

1,190

684,680

ABRA MINING

ATLAS MINING

AR

AT

0.0063

9.36

0.0064

9.4

0.0063

9.35

0.0065

9.4

0.0063

9.32

0.0064

9.4

444,000,000

304,900

2,857,100

2,853,983

(240,375)

BENGUET A

BC

7.11

8.6

7.02

7.5

7.02

7.1

4,200

29,962

BENGUET B

COAL ASIA HLDG

CENTURY PEAK

BCB

COAL

CPM

7.3

0.91

0.97

8.4

0.92

0.99

7.3

0.92

1

7.3

0.93

1

7.3

0.92

0.97

7.3

0.92

0.97

5,000

2,336,000

1,076,000

36,500

2,149,130

1,059,560

248,100

DIZON MINES

DIZ

7.86

8.05

8.28

8.28

7.85

8.05

69,100

556,522

56,700

GEOGRACE

LEPANTO A

GEO

LC

0.35

0.255

0.36

0.26

0.36

0.27

0.37

0.275

0.35

0.255

0.37

0.26

2,300,000

66,650,000

813,750

17,427,250

LEPANTO B

LCB

0.265

0.27

0.275

0.28

0.27

0.27

9,900,000

2,691,650

MANILA MINING A

MA

0.015

0.016

0.015

0.016

0.015

0.015

7,000,000

105,500

MANILA MINING B

MARCVENTURES

MAB

MARC

0.016

5.96

0.017

5.97

0.016

6

0.016

6.04

0.016

5.94

0.016

5.97

52,100,000

562,500

833,600

3,356,607

297,500

NIHAO

NI

2.76

2.79

2.87

2.89

2.76

2.76

1,634,000

4,557,300

(722,670)

NICKEL ASIA

NIKL

27.2

27.25

27

27.5

27

27.25

2,522,200

68,706,810

(35,914,560)

OMICO CORP

ORNTL PENINSULA

OM

ORE

0.69

2.2

0.7

2.25

0.69

2.25

0.71

2.29

0.69

2.2

0.7

2.2

280,000

303,000

194,000

670,970

PX MINING

PX

8.44

8.5

8.68

8.68

8.4

8.44

2,060,000

17,466,678

(285,145)

SEMIRARA MINING

SCC

147

147.1

147.2

148

147

147

476,510

70,154,847

25,807,997

UNITED PARAGON

UPM

0.011

0.012

0.011

0.011

0.011

0.011

300,000

3,300

BASIC ENERGY

ORNTL PETROL A

ORNTL PETROL B

PHILODRILL

BSC

OPM

OPMB

OV

0.265

0.013

0.014

0.017

0.27

0.014

0.015

0.018

0.265

0.014

0.014

0.019

0.265

0.014

0.014

0.019

0.265

0.013

0.014

0.017

0.265

0.013

0.014

0.017

3,060,000

11,200,000

300,000

426,900,000

810,900

150,000

4,200

7,409,900

(6,186,800)

PETROENERGY

PX PETROLEUM

PERC

PXP

5.86

5.2

6.18

5.23

6.2

5.13

6.2

5.2

6.2

5.13

6.2

5.2

100

88,500

620

460,127

(5,200)

TA PETROLEUM

TAPET

3.86

3.97

3.83

3.86

141,000

549,610

**** OIL ****

MINING & OIL SECTOR TOTAL

VOLUME :

1,035,793,110

VALUE :

206,596,246

PREFERRED

ABC PREF

ABS HLDG PDR

ABC

ABSP

50

50.5

49.55

50

49.4

50

833,200

41,484,525

5,380,420

AC PREF A

AC PREF B1

AC PREF B2

ACPA

ACPB1

ACPB2

500.5

503

502.5

508

507

508

507

507

44,500

22,566,850

BC PREF A

DMC PREF

FGEN PREF F

FGEN PREF G

FPH PREF

FPH PREF C

GLO PREF A

GLO PREF P

BCP

DMCP

FGENF

FGENG

FPHP

FPHPC

GLOPA

GLOPP

15.02

105

108

498

114.5

109

505

500

108.5

500

108.5

500

108.5

498

108.5

500

1,870

5,970

202,895

2,981,304

GMA HLDG PDR

GMAP

5.99

6.38

6.03

6.03

5.99

5.99

727,100

4,361,386

(2,924,215)

LR PREF

LRP

1.02

1.03

1.02

1.02

1.02

1.02

500,000

510,000

MWIDE PREF

MWP

103

103.5

103.8

103.8

103.5

103.5

600

62,145

PF PREF

PFP

1,009

1,010

1,010

1,011

1,010

1,010

3,650

3,687,500

101,000

PHOENIX PREF

PCOR PREF

PNXP

PPREF

50.05

100.8

101

101

101.5

100.8

100.8

37,140

3,751,414

50,750

PCOR PREF 2A

PCOR PREF 2B

PRF2A

PRF2B

1,016

1,016

1,060

1,040

1,017

1,030

1,017

1,030

1,016

1,016

1,016

1,016

1,100

140

1,117,700

142,800

(0)

-

SFI PREF

SFIP

2.5

1.8

1.8

7,000

13,600

SMC PREF 2A

SMC2A

75.95

76

76

76

75.9

75.95

69,790

5,301,611

(1,411,550)

SMC PREF 2B

SMC PREF 2C

SMC2B

SMC2C

79

79.1

79.9

80

79.1

80

79.1

80

171,090

13,536,430

SMC PREF 1

PLDT II

SMCP1

TLII

6,358,590

210,480

PREFERRED TOTAL

VOLUME :

2,403,150

VALUE :

99,720,160

PHIL. DEPOSITARY RECEIPTS

PHIL. DEPOSIT RECEIPTS TOTAL

VOLUME :

VALUE :

WARRANTS

LR WARRANT

LRW

4.1

4.13

3.96

4.31

3.85

4.1

1,567,000

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 30 , 2015

Name

MEG WARRANT 2

Symbol

MEGW2

Bid

3.88

Ask

Open

High

WARRANTS TOTAL

Low

VOLUME :

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

1,567,000

VALUE :

6,358,590

SMALL & MEDIUM ENTERPRISES

DOUBLEDRAGON

DD

7.76

7.8

7.7

7.86

7.63

7.8

591,500

4,580,522

(308,800)

MAKATI FINANCE

IRIPPLE

MFIN

RPL

3.22

76

4.83

83.95

78

83.95

70

83.95

11,760

886,392

XURPAS

12.28

12.32

12.36

12.6

12.18

12.28

4,840,600

59,544,074

7,114,006

14,893,741

60,270

SMALL & MEDIUM ENTERPRISES TOTAL

VOLUME :

5,443,860

VALUE :

65,010,988

EXCHANGE TRADED FUNDS

FIRST METRO ETF

FMETF

EXCHANGE TRADED FUNDS TOTAL

TOTAL MAIN BOARD

123

123.5

123

124

VOLUME :

VOLUME :

123

120,970

2,613,996,155

123

120,970

VALUE :

VALUE :

14,893,741

12,186,832,999.5

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 30 , 2015

Name

Symbol

Bid

NO. OF ADVANCES:

NO. OF DECLINES:

NO. OF UNCHANGED:

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

93

89

52

NO. OF TRADED ISSUES:

NO. OF TRADES:

234

56,591

ODDLOT VOLUME:

ODDLOT VALUE:

276,463

267,052.81

BLOCK SALE VOLUME:

BLOCK SALE VALUE:

14,064,000

410,736,388.20

BLOCK SALES

SECURITY

PRICE

SCC

147.1422

GTCAP

1,203.3113

MBT

98.4123

AP

44.1391

ABSP

49.5500

MPI

5.1446

VOLUME

400,000

59,000

1,605,000

1,000,000

500,000

10,500,000

VALUE

58,856,880.00

70,995,366.70

157,951,741.50

44,139,100.00

24,775,000.00

54,018,300.00

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining & Oil

SME

ETF

PSEi

All Shares

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,796.87

12,546.48

6,759.2

2,952.67

2,157.12

15,884.22

1,799.99

12,691.84

6,826.59

2,992.9

2,166.7

15,932.41

1,783.26

12,546.48

6,748.21

2,949.78

2,153.13

15,738.96

1,790.12

12,691.84

6,819.64

2,992.9

2,156.11

15,754.19

0.23

1.05

1.46

1.55

0.06

(0.93)

4.13

132.04

97.95

45.59

1.32

(148.5)

23,135,190

784,799,186

123,541,163

176,203,944

478,707,396

1,036,384,909

5,443,860

120,970

1,797,027,368.65

4,377,973,620.03

2,555,690,951.32

1,883,060,779.25

1,638,701,988.61

265,477,003.66

65,010,988.00

14,893,741.00

7,645.52

4,440.48

7,689.91

4,465.28

7,645.52

4,440.48

7,689.91

4,465.28

0.95

0.86

72.61

38.12

2,628,336,618

12,597,836,440.52

GRAND TOTAL

Note: Sectoral and Grand Total include Main Board, Oddlot, and Block Sale transactions.

FOREIGN BUYING:

FOREIGN SELLING:

NET FOREIGN BUYING/(SELLING):

TOTAL FOREIGN:

Php 5,374,158,184.96

Php 5,130,291,472.52

Php 243,866,712.44

Php 10,504,449,657.48

Securities Under Suspension by the Exchange as of January 30 , 2015

ABC PREF

AC PREF A

ASIATRUST

EXPORT BANK A

EXPORT BANK B

FPH PREF

FILSYN A

FILSYN B

GOTESCO LAND A

GOTESCO LAND B

METROALLIANCE A

METROALLIANCE B

MARSTEEL A

MARSTEEL B

METRO GLOBAL

PICOP RES

PHILCOMSAT

PRIMETOWN PROP

PNCC

GLOBALPORT

PRYCE CORP

PTT CORP

ABC

ACPA

ASIA

EIBA

EIBB

FPHP

FYN

FYNB

GO

GOB

MAH

MAHB

MC

MCB

MGH

PCP

PHC

PMT

PNC

PORT

PPC

PTT

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 30 , 2015

Name

SMC PREF 1

STENIEL

UNIWIDE HLDG

Symbol

Bid

SMCP1

STN

UW

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

Das könnte Ihnen auch gefallen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 27, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 27, 2015Art JamesNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015RafaelAndreiLaMadridNoch keine Bewertungen

- Stockquotes 02042015 PDFDokument8 SeitenStockquotes 02042015 PDFsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 31, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 31, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 06, 2015Dokument9 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 06, 2015Melissa BaileyNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report November 03, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report November 03, 2014nadonecNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 10, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 10, 2015Paul JonesNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Paul JonesNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2014Chris DeNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 08, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 08, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 25, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 25, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2016Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2016J CervNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 13, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 13, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 24, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 24, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 18, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 18, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2014Dokument9 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 07, 2016Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 07, 2016craftersxNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report December 03, 2012Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report December 03, 2012srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report July 26, 2016Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report July 26, 2016Paul JonesNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 04, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 04, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013srichardequipNoch keine Bewertungen

- The 10-Minute Millionaire: The One Secret Anyone Can Use to Turn $2,500 into $1 Million or MoreVon EverandThe 10-Minute Millionaire: The One Secret Anyone Can Use to Turn $2,500 into $1 Million or MoreBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Treasury Markets and OperationsVon EverandTreasury Markets and OperationsNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNoch keine Bewertungen

- ECCODokument3 SeitenECCOsrichardequipNoch keine Bewertungen

- wk02 Jan2013mktwatchDokument3 Seitenwk02 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- wk03 Jan2013mktwatchDokument3 Seitenwk03 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- wk01 Jan2013mktwatchDokument3 Seitenwk01 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- TABLE 1.4 - Population Projection by Age Group, Philippines: 2015 - 2040Dokument1 SeiteTABLE 1.4 - Population Projection by Age Group, Philippines: 2015 - 2040srichardequipNoch keine Bewertungen

- Restaurant Operations ManualDokument4 SeitenRestaurant Operations ManualsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNoch keine Bewertungen

- Global High-End Fashion Companies: Haute-Couture - Luxury - PremiumDokument1 SeiteGlobal High-End Fashion Companies: Haute-Couture - Luxury - PremiumsrichardequipNoch keine Bewertungen

- TABLE 1.4b - Women Population Projection by Age Group, Philippines: 2015 - 2040Dokument1 SeiteTABLE 1.4b - Women Population Projection by Age Group, Philippines: 2015 - 2040srichardequipNoch keine Bewertungen

- TABLE 2.1 - Household Population 15 Years Old and Over by Sex, Philippines: 1998 - 2011Dokument2 SeitenTABLE 2.1 - Household Population 15 Years Old and Over by Sex, Philippines: 1998 - 2011srichardequipNoch keine Bewertungen

- Guidebook Access January2016 PDFDokument104 SeitenGuidebook Access January2016 PDFMikka Talento BautistaNoch keine Bewertungen

- Cash Disbursement 2007Dokument48 SeitenCash Disbursement 2007api-3740993Noch keine Bewertungen

- Vinegar BusinessDokument2 SeitenVinegar BusinessLauriz Dillumas Machon100% (1)

- Soln-Pbd-Sd-St-Ba101-B2-10110 Rev0cutting List of Beams & Girders @basement 2 Zone 3 (B2G-17)Dokument1 SeiteSoln-Pbd-Sd-St-Ba101-B2-10110 Rev0cutting List of Beams & Girders @basement 2 Zone 3 (B2G-17)Lee BañezNoch keine Bewertungen

- PRC REAL ESTATE CPD ProviderDokument7 SeitenPRC REAL ESTATE CPD ProvidermaryNoch keine Bewertungen

- Aca SriDokument8 SeitenAca SriJun Rinion TaguinodNoch keine Bewertungen

- Sangalang CaseDokument3 SeitenSangalang CaseMich DejesusNoch keine Bewertungen

- AREIT - Disclosure 2023-03-07 AREIT Board Approval On P23B Property-Share Swap With ALI 2022-03-08 (Amended SEC-PSE)Dokument3 SeitenAREIT - Disclosure 2023-03-07 AREIT Board Approval On P23B Property-Share Swap With ALI 2022-03-08 (Amended SEC-PSE)anj0% (1)

- 7 Eleven Stores 1Dokument71 Seiten7 Eleven Stores 1Clark Son GuilasNoch keine Bewertungen

- New Manila Reclamation Project: Eis Summary For The PublicDokument34 SeitenNew Manila Reclamation Project: Eis Summary For The PublicAaron Patrick Llevado RellonNoch keine Bewertungen

- The Proscenium of RockwellDokument12 SeitenThe Proscenium of RockwellmytrustedbrokerNoch keine Bewertungen

- Magsaysay Center For Hospitality and Culinary Arts - Makati - Tuition & Application - Edukasyon - PHDokument5 SeitenMagsaysay Center For Hospitality and Culinary Arts - Makati - Tuition & Application - Edukasyon - PHDelos Santos JojoNoch keine Bewertungen

- Avida Towers Cebu Condominium: Key PlanDokument1 SeiteAvida Towers Cebu Condominium: Key PlanGrazel MDNoch keine Bewertungen

- The Taguig and Makati DisputeDokument9 SeitenThe Taguig and Makati DisputeGian Lourenz PuraNoch keine Bewertungen

- GEOGRAPHY 2 Midterm ReviewerDokument9 SeitenGEOGRAPHY 2 Midterm ReviewerMelanie LomperoNoch keine Bewertungen

- PP Merchant Directory - tcm91-334163Dokument3.483 SeitenPP Merchant Directory - tcm91-334163Omar CirunayNoch keine Bewertungen

- CPDProvider CE 031220 PDFDokument4 SeitenCPDProvider CE 031220 PDFChristian MirandaNoch keine Bewertungen

- PSC 2011 Amended Annual Report SEC Form 17-A For SECDokument125 SeitenPSC 2011 Amended Annual Report SEC Form 17-A For SECSamantha CabugonNoch keine Bewertungen

- Ojt 2018-2019Dokument1 SeiteOjt 2018-2019Bane BarrionNoch keine Bewertungen

- Delisted 2016Dokument12 SeitenDelisted 2016Raul NaguitNoch keine Bewertungen

- MMTM Makati 103 1 PDFDokument1 SeiteMMTM Makati 103 1 PDFLes ChengNoch keine Bewertungen

- Presentation: Hotels Located at Makati City, PhilippinesDokument55 SeitenPresentation: Hotels Located at Makati City, PhilippinesnightlightprincessNoch keine Bewertungen

- ArchsDokument8 SeitenArchsMark FernandezNoch keine Bewertungen

- HSBC VS CatalanDokument1 SeiteHSBC VS Catalansweet dudeNoch keine Bewertungen

- Kahulugan NG Mga LogoDokument6 SeitenKahulugan NG Mga LogoALVIAH ATILANO84% (19)

- The Metropolitan Theater (FINAL)Dokument9 SeitenThe Metropolitan Theater (FINAL)Lhewiz BrionesNoch keine Bewertungen

- Distibutor ListDokument2 SeitenDistibutor ListRomari MirandaNoch keine Bewertungen

- Practicum Orientation 2017Dokument92 SeitenPracticum Orientation 2017Hyman Jay BlancoNoch keine Bewertungen

- Feb PayableDokument13 SeitenFeb PayableVix CrispinoNoch keine Bewertungen