Beruflich Dokumente

Kultur Dokumente

The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015

Hochgeladen von

srichardequipOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015

Hochgeladen von

srichardequipCopyright:

Verfügbare Formate

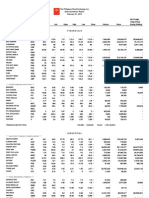

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 03 , 2015

Name

Symbol

Bid

Ask

Open

High

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

69.7

69.8

67,290

4,697,091.5

2,327,391

Low

FINANCIALS

**** BANKS ****

ASIATRUST

ASIA UNITED

ASIA

AUB

69.7

69.8

69.95

69.95

BDO UNIBANK

BDO

111.5

111.8

111.7

112

110

111.5

2,116,340

235,716,966

(34,058,443)

BANK PH ISLANDS

BPI

97.85

97.95

99

99

97.1

97.95

1,953,830

191,433,718.5

68,524,787

CHINABANK

CHIB

46.9

46.95

47

47

46.85

46.95

410,700

19,263,975

CITYSTATE BANK

EXPORT BANK A

EXPORT BANK B

EAST WEST BANK

CSB

EIBA

EIBB

EW

9.01

26

12.6

26.2

26.35

26.4

26

26

626,400

16,411,825

6,804,240

METROBANK

MBT

93.2

93.3

93.5

93.85

93.1

93.3

3,515,990

328,027,599

(60,382,411.5)

PB BANK

PBB

18.5

18.52

18.7

18.7

18.5

18.52

2,230,100

41,278,684

37,000,000

PBCOM

PBC

31.85

32.5

31.85

31.85

31.85

31.85

300

9,555

PHIL NATL BANK

PNB

85

85.05

85.45

85.6

85

85

1,006,630

85,652,868.5

39,367,639.5

PSBANK

PSB

PHILTRUST

RCBC

SECURITY BANK

PTC

RCB

SECB

UNION BANK

UBP

99.1

100

100

101.5

100

100

5,400

541,500

82.05

47.4

152.7

47.5

152.9

47.5

151.5

47.6

152.9

47.5

151.1

47.5

152.7

1,468,000

5,941,380

69,761,760

900,525,897

18,073,440

(119,217,836)

71.6

71.95

71.7

72

71.5

71.95

14,620

1,046,747

(42,224.5)

**** OTHER FINANCIAL INSTITUTIONS ****

AG FINANCE

BRIGHT KINDLE

BDO LEASING

COL FINANCIAL

AGF

BKR

BLFI

COL

4.01

3.04

2.3

15.96

4.1

3.15

2.35

16.3

4.1

2.3

16.16

4.1

2.3

16.3

4.1

2.3

15.96

4.1

2.3

15.96

5,000

47,000

61,700

20,500

108,100

993,632

(30,780)

FIRST ABACUS

FILIPINO FUND

FAF

FFI

0.77

7.3

0.84

7.62

7.29

7.29

7.29

7.29

3,100

22,599

IREMIT

MEDCO HLDG

I

MED

1.64

0.45

1.7

0.47

0.45

0.455

0.45

0.455

290,000

131,900

MANULIFE

MFC

750

780

745

789

745

789

140

107,380

(55,230)

NTL REINSURANCE

NRCP

1.01

1.07

1.03

1.03

1.01

1.01

176,000

178,680

PHIL STOCK EXCH

PSE

355

356

353.8

357.8

349

355

26,660

9,495,066

(35,500)

SUN LIFE

SLF

1,361

1,400

1,361

1,400

1,361

1,400

700

979,595

(664,620)

VANTAGE

2.89

2.98

2.89

2.89

2.89

2.89

2,000

5,780

FINANCIALS SECTOR TOTAL

VOLUME :

19,969,280

VALUE :

1,906,411,418.5

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ALSONS CONS

ACR

ABOITIZ POWER

AP

1.99

2.01

2.03

1.99

1.99

1,285,000

2,574,740

44.15

44.4

44

44.95

43.85

44.4

4,189,000

184,943,015

(55,902,400)

ENERGY DEVT

EDC

FIRST GEN

FGEN

8.43

8.44

8.49

8.49

8.41

8.44

33,703,900

284,771,356

63,263,647

30.05

30.25

30.4

31.35

30.05

30.05

4,398,700

134,398,005

(17,816,235)

FIRST PHIL HLDG

FPH

100.9

PHIL H2O

H2O

4.21

101

99

102.5

98.6

100.9

1,640,620

165,096,213

6,488,977

4.7

4.7

4.7

4.7

4.7

1,000

4,700

MERALCO

MER

4,700

269.4

270.2

272

272

269

269.4

150,960

40,796,254

(7,403,470)

MANILA WATER

PETRON

MWC

32.4

32.5

32.45

32.75

32.05

32.5

876,800

28,390,750

17,435,075

PCOR

9.81

9.82

9.49

9.9

9.45

9.81

16,483,500

161,017,184

46,466,503

PHX PETROLEUM

PNX

3.94

3.98

3.91

4.25

3.87

3.94

2,858,000

11,464,610

(2,758,410)

SPC POWER

TA OIL

SPC

TA

4.41

2.33

4.54

2.34

2.31

2.33

2.3

2.33

703,000

1,623,920

(46,000)

VIVANT

VVT

22

22.5

21

22.5

21

22

10,200

220,480

(81,900)

57.2

89.5

10

2,380

572

213,804

(41,770)

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

BOGO MEDELLIN

CNTRL AZUCARERA

ANI

BMM

CAT

2

47.2

89.5

2.09

57.2

90.5

57.2

90

57.2

90.1

57.2

89.5

CENTURY FOOD

CNPF

18.2

18.26

18.1

18.3

18.1

18.2

70,100

1,271,670

DEL MONTE

DMPL

16.6

16.6

15.5

15.62

280,900

4,439,010

288,566

DNL INDUS

DNL

16.66

16.68

16.76

16.76

16.6

16.68

3,129,900

52,236,320

15,369,414

EMPERADOR

EMP

10.08

10.1

10.14

10.14

10

10.08

809,500

8,149,882

2,713,332

ALLIANCE SELECT

FOOD

1.24

1.28

1.26

1.28

1.24

1.28

97,000

122,260

GINEBRA

GSMI

15.3

15.38

15.3

15.3

15.3

15.3

7,900

120,870

(71,910)

JOLLIBEE

JFC

224.8

225

228

228.8

224.2

225

893,670

201,767,896

(123,696,292)

LIBERTY FLOUR

MACAY HLDG

MAXS GROUP

LFM

MACAY

MAXS

25.05

48

34.15

51.45

49

34.2

48

33.2

49

34.5

47.8

33.2

49

34.2

2,400

2,372,400

115,480

80,228,320

(168,815)

PUREFOODS

PF

202

202.2

203.8

203.8

201.6

202

46,130

9,324,366

(3,929,244)

PEPSI COLA

PIP

4.15

4.16

4.06

4.15

4.04

4.15

1,520,000

6,261,930

740,470

ROXAS AND CO

RFM CORP

RCI

RFM

2.71

5.71

2.9

5.75

5.7

5.97

5.7

5.75

672,600

3,891,894

1,249,563

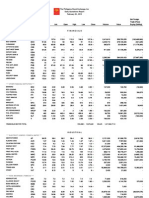

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 03 , 2015

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

ROXAS HLDG

SWIFT FOODS

UNIV ROBINA

ROX

SFI

URC

6.76

0.154

204.6

7.05

0.156

205

0.157

206

0.158

206.4

0.154

204.6

0.156

205

2,040,000

1,372,400

315,780

282,102,808

(77,000)

38,368,622

VITARICH

VICTORIAS

VITA

VMC

0.8

4.6

0.81

4.7

0.81

4.79

0.81

4.8

0.79

4.7

0.8

4.7

722,000

118,000

577,610

562,760

66,400

-

8.25

1.84

8.36

1.9

7.98

1.8

8.15

1.88

7,700

525,000

61,736

971,910

(55,970)

1,426,186

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

CONCRETE A

CONCRETE B

DAVINCI CAPITAL

ABG

CA

CAB

DAVIN

8

51

15

1.85

8.3

64.95

1.88

EEI CORP

FED RESOURCES

EEI

11.14

11.16

10.9

11.22

10.9

11.16

2,102,200

23,249,382

FED

15.94

16

16.02

16.02

15.94

15.94

57,000

910,780

FERRONICKEL

HOLCIM

(320,400)

FNI

HLCM

2.97

14.5

2.98

14.7

3

14.52

3.02

14.7

2.94

14.5

2.98

14.7

382,344,000

6,300

1,141,264,590

91,966

520,415,120

-

LAFARGE REP

LRI

10.9

11

11.32

11.32

10.8

10.9

3,324,400

36,772,426

175,890

MEGAWIDE

MWIDE

8.19

8.2

8.2

8.2

8.19

8.19

284,100

2,329,103

(1,600,740)

PHINMA

PHN

10.36

10.38

10.34

10.38

10.34

10.38

145,700

1,510,536

(442,188)

PNCC

SUPERCITY

TKC STEEL

VULCAN INDL

PNC

SRDC

T

VUL

0.9

1.59

1.55

1.64

1.56

1.59

1.58

1.64

1.58

1.58

1.55

1.64

1.56

77,000

202,000

124,200

314,310

(45,050)

CIP

EURO

LMG

MAH

MAHB

MVC

PPC

105

1.26

2.4

2.43

-

130

1.56

2.44

2.6

-

2.45

-

2.45

-

2.45

-

2.45

-

9,000

-

22,050

-

**** CHEMICALS ****

CHEMPHIL

EUROMED

LMG CHEMICALS

METROALLIANCE A

METROALLIANCE B

MABUHAY VINYL

PRYCE CORP

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CIRTEK HLDG

CHIPS

19.5

19.7

19.68

19.78

19.12

19.7

315,600

6,217,550

315,000

CONCEPCION

CIC

50.1

50.4

50

50.5

50

50.1

310,500

15,538,375

562,790

GREENERGY

GREEN

0.48

0.49

0.5

0.5

0.49

0.49

295,000

145,460

43,990

INTEGRATED MICR

IMI

5.78

5.84

5.98

6.18

5.75

5.84

1,938,200

11,521,061

(939,342)

IONICS

ION

0.61

0.63

0.61

0.61

0.61

0.61

381,000

232,410

PANASONIC

PMPC

4.1

15,000

60,000

PHX SEMICNDCTR

PSPC

2.61

2.64

2.66

2.77

2.61

2.61

10,685,000

28,820,160

(409,770)

FILSYN A

FILSYN B

PICOP RES

SPLASH CORP

FYN

FYNB

PCP

SPH

1.76

1.79

1.84

1.84

1.76

1.79

78,000

139,310

STENIEL

STN

**** OTHER INDUSTRIALS ****

INDUSTRIAL SECTOR TOTAL

VOLUME :

483,597,425

VALUE :

2,944,255,682

HOLDING FIRMS

**** HOLDING FIRMS ****

ASIA AMLGMATED

AAA

1.3

1.55

1.65

1.65

1.55

1.55

24,000

38,100

ABACORE CAPITAL

ABA

0.465

0.48

0.48

0.48

0.465

0.465

90,000

42,750

AYALA CORP

ABOITIZ EQUITY

AC

AEV

715

57.3

716

57.55

712

57.9

724

57.9

712

56

715

57.55

113,120

1,075,370

80,949,685

61,716,151

(10,865,280)

30,417,080

ALLIANCE GLOBAL

ANSCOR

AGI

ANS

25.35

7

25.5

7.09

25.55

7.1

25.8

7.1

25

7

25.5

7

13,555,000

10,600

343,815,535

74,300

16,560,450

-

ANGLO PHIL HLDG

ATN HLDG A

APO

ATN

1.41

2.12

1.48

2.26

1.48

2.27

1.49

2.27

1.48

2.1

1.48

2.1

21,000

41,000

31,100

86,680

ATN HLDG B

ATNB

2.26

2.46

2.36

2.36

2.26

2.26

50,000

113,100

110,740

BHI HLDG

COSCO CAPITAL

BH

COSCO

600

9.16

744

9.17

8.86

9.17

8.86

9.17

12,500,300

113,268,769

(2,405,411)

DMCI HLDG

DMC

15.34

15.36

15.32

15.48

15.28

15.36

9,881,100

151,636,706

79,242,448

FILINVEST DEV

FDC

4.45

4.57

4.5

4.55

4.42

4.55

71,000

317,950

8,970

FJ PRINCE A

FJ PRINCE B

FORUM PACIFIC

FJP

FJPB

FPI

3.13

3.05

0.285

3.31

3.29

0.295

0.275

0.3

0.275

0.29

570,000

159,550

GT CAPITAL

GTCAP

1,199

1,200

1,150

1,225

1,144

1,200

599,360

713,926,470

(86,430,445)

HOUSE OF INV

JG SUMMIT

HI

JGS

6.15

64.2

6.32

64.6

65

65.2

63.6

64.6

2,193,720

140,866,453

(70,062,807)

JOLLIVILLE HLDG

KEPPEL HLDG A

JOH

KPH

4.03

5.22

4.8

5.5

5.4

5.5

5.4

5.5

43,000

236,258

KEPPEL HLDG B

LODESTAR

KPHB

LIHC

4.82

0.7

6.58

0.71

0.72

0.72

0.7

0.71

15,000

10,550

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 03 , 2015

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

LOPEZ HLDG

LPZ

7.72

7.78

7.35

7.78

7.33

7.78

10,736,500

81,728,468

(11,581,412)

LT GROUP

LTG

13.98

14

13.92

14.1

13.92

14

6,035,800

84,594,828

10,338,322

METRO GLOBAL

MABUHAY HLDG

MINERALES IND

MGH

MHC

MIC

0.62

5.15

0.65

5.25

4.9

5.25

4.9

5.25

174,600

894,450

MJC INVESTMENTS

MJIC

3.16

3.5

3.49

3.49

3.49

3.49

2,000

6,980

METRO PAC INV

MPI

5.12

5.17

5.12

5.2

5.12

5.12

14,961,300

76,949,805

7,481,352

PACIFICA

PRIME ORION

PA

POPI

0.039

0.66

0.04

0.68

0.04

0.65

0.04

0.66

0.04

0.65

0.04

0.66

100,000

1,569,000

4,000

1,019,970

PRIME MEDIA

PRIM

1.38

1.46

1.37

1.38

1.37

1.38

3,000

4,130

(2,760)

REPUBLIC GLASS

SOLID GROUP

SYNERGY GRID

SM INVESTMENTS

REG

SGI

SGP

SM

2.4

1.19

252.4

903.5

2.5

1.24

305

904

902

907

902

903.5

482,980

436,578,680

87,695,905

SAN MIGUEL CORP

SMC

77.8

78.2

77

78.2

76.05

78.2

171,320

13,289,042.5

3,871,122.5

SOC RESOURCES

SEAFRONT RES

SOC

SPM

1

2.69

1.04

2.92

1

2.69

1

2.69

1

2.69

1

2.69

50,000

2,000

50,000

5,380

TOP FRONTIER

TFHI

117

119

120

120

120

120

510

61,200

UNIOIL HLDG

UNI

0.34

0.345

0.325

0.345

0.32

0.34

2,800,000

932,050

WELLEX INDUS

WIN

0.232

0.241

0.233

0.235

0.233

0.233

1,730,000

404,210

(9,320)

ZEUS HLDG

ZHI

0.34

0.345

0.345

0.345

0.345

0.345

30,000

10,350

57,000

22,000

280,904,060

(6,395,830)

HOLDING FIRMS SECTOR TOTAL

VOLUME :

79,785,970

VALUE :

2,310,222,835

PROPERTY

**** PROPERTY ****

ARTHALAND CORP

ANCHOR LAND

AYALA LAND

ALCO

ALHI

ALI

0.28

9

35.35

0.285

10.2

35.4

ARANETA PROP

ARA

1.38

1.4

BELLE CORP

BEL

4.51

4.54

A BROWN

BRN

1.07

1.1

CITYLAND DEVT

CDC

0.99

CROWN EQUITIES

CEBU HLDG

CENTURY PROP

CEBU PROP A

CEBU PROP B

CEI

CHI

CPG

CPV

CPVB

0.133

5.11

0.97

6.25

5.98

CYBER BAY

CYBR

EMPIRE EAST

ELI

EVER GOTESCO

FILINVEST LAND

0.285

10

35.5

0.285

10

35.75

0.285

10

35.2

0.285

10

35.4

200,000

2,200

7,938,400

1.4

1.4

1.38

1.38

79,000

109,770

4.64

4.67

4.51

4.51

18,329,000

83,526,060

(18,171,180)

1.06

1.1

1.06

1.1

44,000

47,360

0.98

0.98

0.98

0.98

2,100,000

2,058,000

(0)

0.134

5.15

0.98

6.58

6.45

0.135

5.11

0.98

-

0.135

5.11

0.98

-

0.133

5.1

0.96

-

0.133

5.1

0.98

-

4,250,000

2,100

3,149,000

-

565,800

10,730

3,057,880

-

(510)

253,760

-

0.46

0.47

0.45

0.47

0.45

0.47

1,240,000

560,600

157,500

0.9

0.92

0.91

0.91

0.9

0.9

62,000

55,990

EVER

FLI

0.202

1.75

0.214

1.76

1.77

1.77

1.75

1.76

17,972,000

31,488,050

6,889,600

GLOBAL ESTATE

GERI

1.66

1.68

1.66

1.7

1.64

1.68

1,249,000

2,063,900

GOTESCO LAND A

GOTESCO LAND B

8990 HLDG

GO

GOB

HOUSE

9.6

9.62

9.38

9.66

9.29

9.6

6,344,900

60,709,097

23,384,816

IRC PROP

IRC

1.43

1.45

1.42

1.47

1.42

1.47

201,000

287,290

KEPPEL PROP

CITY AND LAND

KEP

LAND

3.86

1.25

4.32

1.28

1.28

1.28

1.28

1.28

10,000

12,800

MARSTEEL A

MARSTEEL B

MEGAWORLD

MC

MCB

MEG

5.16

5.18

5.13

5.18

5.08

5.18

43,893,700

225,169,751

(9,006,999)

MRC ALLIED

MRC

0.12

0.121

0.12

0.121

0.12

0.121

540,000

64,940

PHIL ESTATES

PRIMETOWN PROP

PRIMEX CORP

PHES

PMT

PRMX

0.35

5.51

0.36

5.74

0.36

6.1

0.36

6.1

0.35

5.51

0.36

5.51

1,490,000

781,100

524,700

4,508,882

7,000

419,750

ROBINSONS LAND

PHIL REALTY

ROCKWELL

SHANG PROP

RLC

RLT

ROCK

SHNG

27.35

0.38

1.8

3.18

27.4

0.51

1.81

3.23

27.35

1.8

3.17

27.45

1.83

3.17

27.1

1.8

3.17

27.4

1.8

3.17

1,574,000

607,000

2,000

43,094,775

1,093,920

6,340

11,919,555

566,190

-

STA LUCIA LAND

SLI

SM PRIME HLDG

SMPH

STARMALLS

SUNTRUST HOME

PTFC REDEV CORP

UNIWIDE HLDG

VISTA LAND

0.84

0.86

0.84

0.87

0.84

0.86

336,000

287,240

18.44

18.46

18.56

18.76

18.28

18.44

11,818,500

218,006,446

(779,976)

STR

SUN

6.84

1.11

7.17

1.14

7

1.14

7.17

1.15

7

1.11

7.17

1.11

43,000

670,000

306,230

745,520

TFC

UW

VLL

20

6.86

33.1

6.88

6.89

6.91

6.85

6.88

7,151,600

49,215,156

8,704,360

PROPERTY SECTOR TOTAL

VOLUME :

132,079,500

VALUE :

1,008,560,287

SERVICES

**** MEDIA ****

ABS CBN

ABS

52.5

52.7

50

52.5

50

52.5

173,250

9,037,911

GMA NETWORK

GMA7

5.95

6.05

5.95

5.95

952,200

5,698,017

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 03 , 2015

Name

Symbol

MANILA BULLETIN

MB

MLA BRDCASTING

MBC

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

0.71

0.72

0.71

0.71

0.71

0.71

442,000

313,820

3.1

**** TELECOMMUNICATIONS ****

GLOBE TELECOM

GLO

1,741

1,755

1,750

1,773

1,730

1,755

18,515

32,414,295

5,571,795

LIBERTY TELECOM

LIB

1.92

1.95

1.92

1.93

1.92

1.93

10,000

19,250

PTT CORP

PLDT

PTT

TEL

2,980

2,982

2,958

2,988

2,958

2,980

97,100

288,756,230

58,912,570

**** INFORMATION TECHNOLOGY ****

DFNN INC

DFNN

6.08

6.4

6.4

6.4

6.4

6.4

3,700

23,680

IMPERIAL A

IMPERIAL B

IMP

IMPB

3.51

32

4.5

39.95

39.9

39.9

32

32

200

7,190

ISLAND INFO

IS

0.29

0.295

0.315

0.315

0.285

0.295

99,110,000

29,750,700

132,550

ISM COMM

ISM

1.52

1.55

1.55

1.6

1.52

1.52

4,027,000

6,165,660

133,510

JACKSTONES

MG HLDG

JAS

MG

3.24

0.36

3.49

0.37

0.36

0.365

0.36

0.36

130,000

47,300

NOW CORP

NOW

0.55

0.57

0.54

0.56

0.54

0.56

81,000

44,210

TRANSPACIFIC BR

PHILWEB

TBGI

WEB

1.94

12.38

2.04

12.4

12.48

12.48

11.88

12.38

740,800

9,077,964

4,833,244

YEHEY CORP

YEHEY

1.24

1.31

1.28

1.28

1.28

1.28

12,000

15,360

75,750

**** TRANSPORTATION SERVICES ****

2GO GROUP

2GO

4.1

4.15

4.28

4.28

4.05

4.1

453,000

1,873,080

ASIAN TERMINALS

ATI

12.2

12.46

12.38

12.46

12.38

12.46

300

3,722

CEBU AIR

CEB

89.85

89.9

90.4

90.4

88.5

89.85

1,066,900

95,878,042.5

(9,286,594.5)

INTL CONTAINER

ICT

113

113.4

113.3

113.6

113

113

1,704,550

193,114,958

32,886,507

LORENZO SHIPPNG

MACROASIA

PAL HLDG

GLOBALPORT

HARBOR STAR

LSC

MAC

PAL

PORT

TUGS

1.34

2.27

5

1.52

1.35

2.3

5.1

1.56

1.27

2.26

5

1.52

1.35

2.31

5.4

1.58

1.27

2.25

4.99

1.51

1.35

2.3

5

1.56

50,000

145,000

12,000

380,000

65,420

330,260

60,699

577,970

(126,550)

-

ACESITE HOTEL

BOULEVARD HLDG

DISCOVERY WORLD

ACE

BHI

DWC

1.09

0.111

1.63

1.2

0.112

1.72

0.11

1.66

0.114

1.85

0.11

1.66

0.111

1.72

26,360,000

23,000

2,943,590

40,040

11,100

-

GRAND PLAZA

WATERFRONT

GPH

WPI

24.15

0.365

29.95

0.375

0.375

0.375

0.37

0.37

960,000

355,850

CENTRO ESCOLAR

CEU

9.88

10.44

10.46

10.46

10.44

10.44

1,000

10,452

FAR EASTERN U

IPEOPLE

STI HLDG

FEU

IPO

STI

980

10.78

0.67

11.9

0.68

0.69

0.69

0.67

0.68

1,586,000

1,079,390

(67,000)

BERJAYA

BLOOMBERRY

BCOR

BLOOM

23.05

11.86

27.5

11.88

11.94

12.06

11.86

11.88

8,064,400

95,876,594

(344,746)

IP EGAME

PACIFIC ONLINE

LEISURE AND RES

EG

LOTO

LR

0.014

17.58

9.9

0.015

17.84

9.98

0.014

10.34

0.014

10.36

0.014

9.78

0.014

9.98

30,000,000

1,306,000

420,000

12,942,936

1,047,212

MELCO CROWN

MCP

10.84

10.86

11.9

11.9

10.86

10.86

12,509,200

138,685,368

3,197,892

MANILA JOCKEY

PRMIERE HORIZON

MJC

PHA

2.01

0.6

2.1

0.61

0.59

0.6

0.59

0.6

2,075,000

1,240,740

PREMIUM LEISURE

PLC

1.7

1.71

1.8

1.8

1.69

1.71

56,065,000

96,625,890

(8,295,780)

PHIL RACING

TRAVELLERS

PRC

RWM

9

7.01

9.25

7.02

7.01

7.08

7.01

495,900

3,481,216

1,214,212

**** HOTEL & LEISURE ****

**** EDUCATION ****

**** CASINOS & GAMING ****

**** RETAIL ****

CALATA CORP

CAL

PUREGOLD

PGOLD

4.39

4.44

4.4

4.61

4.37

4.44

4,111,000

18,307,360

(92,000)

41.65

41.8

41.5

41.95

41.45

41.8

1,061,200

44,287,105

(1,586,285)

ROBINSONS RTL

PHIL SEVEN CORP

RRHI

78

78.6

78

79

77.8

78

988,870

77,675,479.5

(6,114,996.5)

SEVN

90.5

91.1

90.5

91

90.5

91

12,660

1,151,330

SSI GROUP

1,028,250

SSI

10.1

10.2

10.4

10.58

10.1

10.1

6,613,000

67,949,298

(43,597,540)

APC

ECP

PAX

PHC

0.7

2.82

3.1

-

0.71

3.2

3.19

-

0.72

-

0.72

-

0.71

-

0.71

-

1,549,000

-

1,101,010

-

**** OTHER SERVICES ****

APC GROUP

EASYCALL

PAXYS

PHILCOMSAT

SERVICES SECTOR TOTAL

VOLUME :

266,143,015

MINING & OIL

VALUE :

1,282,149,010.5

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 03 , 2015

Name

ATOK

APEX MINING

Symbol

AB

APX

Bid

10.86

2.97

Ask

11.8

2.99

Open

3.08

High

3.08

Low

2.97

Close

2.97

Volume

135,000

Value, Php

407,360

Net Foreign

Buying/(Selling),

Php

(15,000)

ABRA MINING

AR

0.0062

0.0063

0.0062

0.0063

0.0061

0.0062

315,000,000

1,951,300

(167,400)

ATLAS MINING

AT

9.54

9.56

9.46

9.6

9.46

9.54

744,200

7,111,151

(2,397,841)

BENGUET A

BENGUET B

COAL ASIA HLDG

CENTURY PEAK

BC

BCB

COAL

CPM

7.5

7.3

0.89

0.99

8.6

8.3

0.9

1.03

0.91

0.99

0.91

1.03

0.89

0.99

0.9

1.03

3,236,000

1,324,000

2,894,840

1,353,700

3,960

DIZON MINES

DIZ

GEOGRACE

GEO

LEPANTO A

LC

LEPANTO B

MANILA MINING A

MANILA MINING B

MARCVENTURES

NIHAO

7.5

7.75

7.99

7.99

7.5

7.75

58,700

452,447

0.345

0.35

0.355

0.355

0.34

0.35

1,820,000

632,800

0.26

0.265

0.25

0.27

0.25

0.26

27,650,000

7,299,600

LCB

MA

MAB

MARC

NI

0.265

0.015

0.016

5.92

2.75

0.27

0.016

0.017

5.95

2.77

0.27

0.015

0.016

5.94

2.8

0.275

0.016

0.016

5.94

2.83

0.26

0.015

0.016

5.85

2.72

0.265

0.015

0.016

5.94

2.75

4,380,000

6,800,000

1,500,000

142,500

1,813,000

1,172,600

102,200

24,000

842,902

5,007,220

(68,900)

272,300

NICKEL ASIA

NIKL

27.75

27.8

27.4

27.75

26.9

27.75

3,226,800

88,639,635

15,816,405

OMICO CORP

OM

0.68

0.7

0.71

0.74

0.7

0.7

421,000

296,140

ORNTL PENINSULA

ORE

2.2

2.26

2.22

2.26

2.2

2.26

279,000

624,360

PX MINING

PX

8.38

8.39

8.59

8.7

8.39

8.39

996,500

8,455,952

342,400

SEMIRARA MINING

SCC

150

150.1

146.9

150

146.4

150

1,218,250

180,550,519

44,109,381

UNITED PARAGON

UPM

0.011

0.012

0.011

0.012

0.011

0.011

3,100,000

34,200

BASIC ENERGY

BSC

0.265

0.27

0.265

0.27

0.265

0.27

650,000

174,050

13,500

ORNTL PETROL A

OPM

0.013

0.014

0.013

0.013

0.013

0.013

6,000,000

78,000

ORNTL PETROL B

PHILODRILL

PETROENERGY

PX PETROLEUM

OPMB

OV

PERC

PXP

0.014

0.017

5.9

5.2

0.015

0.018

6

5.7

0.018

6

5.32

0.019

6.01

6.4

0.017

6

5.2

0.018

6

5.2

777,000,000

59,500

2,495,600

13,987,300

357,010

14,338,064

145,800

(62,610)

TA PETROLEUM

TAPET

3.82

3.88

3.89

3.98

3.8

3.85

214,000

825,880

(35,820)

**** OIL ****

MINING & OIL SECTOR TOTAL

VOLUME :

1,160,264,050

VALUE :

337,613,230

PREFERRED

ABC PREF

ABS HLDG PDR

ABC

ABSP

52.55

52.95

50.5

53

50.5

52.95

618,490

32,474,857.5

8,520,451.5

AC PREF A

AC PREF B1

AC PREF B2

BC PREF A

DMC PREF

FGEN PREF F

FGEN PREF G

ACPA

ACPB1

ACPB2

BCP

DMCP

FGENF

FGENG

500.5

503

15.02

702

106.2

108.5

502

507

115

109

109

109.9

109

109

30,570

3,338,793

(109,300)

FPH PREF

FPH PREF C

GLO PREF A

GLO PREF P

FPHP

FPHPC

GLOPA

GLOPP

2.51

500

501

499

500

495

500

5,680

2,820,988

GMA HLDG PDR

LR PREF

MWIDE PREF

PF PREF

GMAP

LRP

MWP

PFP

5.92

1.02

103

1,007

6.42

1.03

103.5

1,010

5.92

1,009

5.92

1,009

5.88

1,005

5.92

1,007

356,100

3,295

2,102,648

3,323,135

(1,911,500)

(341,890)

PHOENIX PREF

PCOR PREF

PCOR PREF 2A

PCOR PREF 2B

SFI PREF

SMC PREF 2A

PNXP

PPREF

PRF2A

PRF2B

SFIP

SMC2A

50.05

101

1,017

1,025

1.8

75.8

101.4

1,048

1,035

4.5

75.9

101

75.9

101.5

75.9

101

75.8

101

75.8

2,890

65,910

291,980

4,997,786.5

(3,783,217.5)

SMC PREF 2B

SMC2B

79

79.9

79.9

79.9

79.9

79.9

20

1,598

SMC PREF 2C

SMC PREF 1

PLDT II

SMC2C

SMCP1

TLII

80

-

80.5

-

80.5

-

80.5

-

80

-

80

-

17,460

-

1,399,800

-

PREFERRED TOTAL

VOLUME :

1,100,415

VALUE :

50,751,586

PHIL. DEPOSITARY RECEIPTS

PHIL. DEPOSIT RECEIPTS TOTAL

VOLUME :

VALUE :

WARRANTS

LR WARRANT

LRW

MEG WARRANT 2

MEGW2

4.1

4.11

4.01

4.4

3.9

4.1

1,772,000

7,301,130

2,420

3.89

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 03 , 2015

Name

Symbol

Bid

Ask

Open

WARRANTS TOTAL

High

Low

VOLUME :

1,772,000

Close

Volume

VALUE :

Value, Php

Net Foreign

Buying/(Selling),

Php

7,301,130

SMALL & MEDIUM ENTERPRISES

DOUBLEDRAGON

DD

7.59

7.6

7.65

7.65

7.59

7.59

598,900

4,556,946

123,570

MAKATI FINANCE

IRIPPLE

MFIN

RPL

3.22

82

4.2

86.95

83.5

87.95

83.5

86.95

2,410

204,240

XURPAS

12.4

12.42

12.44

12.66

12.36

12.42

4,368,700

54,553,472

(2,065,978)

465,964

SMALL & MEDIUM ENTERPRISES TOTAL

VOLUME :

4,970,010

VALUE :

59,314,658

EXCHANGE TRADED FUNDS

FIRST METRO ETF

FMETF

EXCHANGE TRADED FUNDS TOTAL

TOTAL MAIN BOARD

122.6

123

123

123

122.5

VOLUME :

3,790

VOLUME :

2,146,813,040

123

3,790

VALUE :

VALUE :

465,964

9,848,993,085

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 03 , 2015

Name

Symbol

Bid

NO. OF ADVANCES:

NO. OF DECLINES:

NO. OF UNCHANGED:

Open

High

Low

Close

Volume

Value, Php

83

84

47

NO. OF TRADED ISSUES:

NO. OF TRADES:

214

62,007

ODDLOT VOLUME:

ODDLOT VALUE:

BLOCK SALE VOLUME:

BLOCK SALE VALUE:

Ask

Net Foreign

Buying/(Selling),

Php

1,213,081

320,111.09

31,018,085

10,480,151,727.68

BLOCK SALES

SECURITY

JFC

TEL

JFC

SM

DNL

DNL

URC

SCC

RFM

GTCAP

GTCAP

PGOLD

GTCAP

MCP

MCP

PRICE

214.8000

2,959.9192

229.4790

909.8861

17.0553

17.0553

206.1455

146.8698

5.9000

1,130.0000

1,130.0000

41.5000

1,180.2910

12.0000

11.6853

VOLUME

VALUE

94,000

20,191,200.00

32,970

97,588,536.02

332,130

76,216,860.27

41,020

37,323,527.82

1,749,708

29,841,794.85

1,249,792

21,315,577.50

200,000

41,229,100.00

300,000

44,060,940.00

9,378,100

55,330,790.00

5,922,290 6,692,187,700.00

2,792,710 3,155,762,300.00

2,500,000 103,750,000.00

25,365

29,938,081.22

2,000,000

24,000,000.00

4,400,000

51,415,320.00

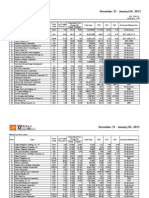

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining & Oil

SME

ETF

PSEi

All Shares

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,767.62

12,559.93

6,779.97

2,967.27

2,139.55

15,719.48

1,770.52

12,614.06

6,782.26

2,981.02

2,147.52

15,938.13

1,762.63

12,542.72

6,717.56

2,943.62

2,136.99

15,719.48

1,767.55

12,559.26

6,772.69

2,958.78

2,143.19

15,938.13

0.02

0

(0.09)

(1.03)

0.2

1.39

0.39

(0.06)

(6.11)

(30.78)

4.25

218.65

19,972,425

496,619,787

88,579,549

132,090,390

275,129,713

1,161,678,542

4,970,010

3,790

1,906,447,090.94

3,188,460,361.96

12,225,492,336.82

1,008,608,317.68

1,558,962,459.69

381,713,734.68

59,314,658.00

465,964.00

7,631.19

4,441.27

7,631.19

4,443.37

7,582.04

4,421.23

7,613.15

4,436.98

(0.23)

(0.09)

(17.56)

(4.06)

2,179,044,206

20,329,464,923.76

GRAND TOTAL

Note: Sectoral and Grand Total include Main Board, Oddlot, and Block Sale transactions.

FOREIGN BUYING:

FOREIGN SELLING:

NET FOREIGN BUYING/(SELLING):

TOTAL FOREIGN:

Php 12,285,909,155.67

Php 4,906,053,999.12

Php 7,379,855,156.55

Php 17,191,963,154.79

Securities Under Suspension by the Exchange as of February 03 , 2015

ABC PREF

AC PREF A

ASIATRUST

EXPORT BANK A

EXPORT BANK B

FPH PREF

FILSYN A

FILSYN B

GOTESCO LAND A

GOTESCO LAND B

METROALLIANCE A

METROALLIANCE B

MARSTEEL A

ABC

ACPA

ASIA

EIBA

EIBB

FPHP

FYN

FYNB

GO

GOB

MAH

MAHB

MC

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 03 , 2015

Name

MARSTEEL B

METRO GLOBAL

PICOP RES

PHILCOMSAT

PRIMETOWN PROP

PNCC

GLOBALPORT

PRYCE CORP

PTT CORP

SMC PREF 1

STENIEL

UNIWIDE HLDG

Symbol

Bid

MCB

MGH

PCP

PHC

PMT

PNC

PORT

PPC

PTT

SMCP1

STN

UW

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

Das könnte Ihnen auch gefallen

- ASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesVon EverandASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015RafaelAndreiLaMadridNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNoch keine Bewertungen

- Stockquotes 02042015 PDFDokument8 SeitenStockquotes 02042015 PDFsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Paul JonesNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 10, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 10, 2015Paul JonesNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report November 03, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report November 03, 2014nadonecNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 27, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 27, 2015Art JamesNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 06, 2015Dokument9 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 06, 2015Melissa BaileyNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 12, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 12, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 08, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 08, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 22, 2013Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 22, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 02, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 02, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2014Chris DeNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 07, 2016Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 07, 2016craftersxNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report July 26, 2016Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report July 26, 2016Paul JonesNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 04, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 04, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2016Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2016J CervNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 11, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 11, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report December 03, 2012Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report December 03, 2012srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report July 12, 2016Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report July 12, 2016Paul JonesNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report December 02, 2011Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report December 02, 2011Richard SzeNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2014Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report July 22, 2016Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report July 22, 2016Paul JonesNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2014Dokument9 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2014John Paul Samuel ChuaNoch keine Bewertungen

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsVon EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNoch keine Bewertungen

- ECCODokument3 SeitenECCOsrichardequipNoch keine Bewertungen

- wk03 Jan2013mktwatchDokument3 Seitenwk03 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNoch keine Bewertungen

- wk01 Jan2013mktwatchDokument3 Seitenwk01 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- Restaurant Operations ManualDokument4 SeitenRestaurant Operations ManualsrichardequipNoch keine Bewertungen

- wk02 Jan2013mktwatchDokument3 Seitenwk02 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- TABLE 1.4 - Population Projection by Age Group, Philippines: 2015 - 2040Dokument1 SeiteTABLE 1.4 - Population Projection by Age Group, Philippines: 2015 - 2040srichardequipNoch keine Bewertungen

- Global High-End Fashion Companies: Haute-Couture - Luxury - PremiumDokument1 SeiteGlobal High-End Fashion Companies: Haute-Couture - Luxury - PremiumsrichardequipNoch keine Bewertungen

- TABLE 1.4b - Women Population Projection by Age Group, Philippines: 2015 - 2040Dokument1 SeiteTABLE 1.4b - Women Population Projection by Age Group, Philippines: 2015 - 2040srichardequipNoch keine Bewertungen

- TABLE 2.1 - Household Population 15 Years Old and Over by Sex, Philippines: 1998 - 2011Dokument2 SeitenTABLE 2.1 - Household Population 15 Years Old and Over by Sex, Philippines: 1998 - 2011srichardequipNoch keine Bewertungen

- Application of ATCCDokument3 SeitenApplication of ATCCmayur_lanjewarNoch keine Bewertungen

- Database For Delhi-FinalDokument797 SeitenDatabase For Delhi-Finalmailabhinav0% (1)

- Waste ManagementDokument3 SeitenWaste ManagementAgenttZeeroOutsiderNoch keine Bewertungen

- NSTP Mark Welson Chua 1Dokument19 SeitenNSTP Mark Welson Chua 1Archie BanaybanayNoch keine Bewertungen

- S.No Ward Zone License No License Validity Date Hawker Type Name Age Fathar/Husband NameDokument41 SeitenS.No Ward Zone License No License Validity Date Hawker Type Name Age Fathar/Husband NameSandeep DhimanNoch keine Bewertungen

- Statement of Protest by DR D Narasimha ReddyDokument3 SeitenStatement of Protest by DR D Narasimha ReddyFirstpostNoch keine Bewertungen

- Constitution Questions & AnswersDokument80 SeitenConstitution Questions & AnswersCeec GuyNoch keine Bewertungen

- Australian/New Zealand StandardDokument10 SeitenAustralian/New Zealand StandardMatt Fizz0% (2)

- Freedom - What Is Bible Freedom. What Does John 8:32 Promise?Dokument64 SeitenFreedom - What Is Bible Freedom. What Does John 8:32 Promise?kgdieckNoch keine Bewertungen

- Yambao Vs ZunigaDokument2 SeitenYambao Vs ZunigaMaria Cherrylen Castor QuijadaNoch keine Bewertungen

- Production Engineer - NickelDokument1 SeiteProduction Engineer - NickeljejeNoch keine Bewertungen

- Convention Speakers BiosDokument85 SeitenConvention Speakers BiosGMBWatchNoch keine Bewertungen

- Details PDFDokument9 SeitenDetails PDFNureddin Bagirov100% (1)

- Daniel 6:1-10 - LIARS, LAWS & LIONSDokument7 SeitenDaniel 6:1-10 - LIARS, LAWS & LIONSCalvary Tengah Bible-Presbyterian ChurchNoch keine Bewertungen

- Asset Based ValuationDokument11 SeitenAsset Based ValuationShubham ThakurNoch keine Bewertungen

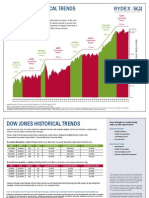

- Rydex Historical TrendsDokument2 SeitenRydex Historical TrendsVinayak PatilNoch keine Bewertungen

- Macasiano vs. Diokno, G.R. No. 97764, August 10, 1992 - Full TextDokument8 SeitenMacasiano vs. Diokno, G.R. No. 97764, August 10, 1992 - Full TextMarianne Hope VillasNoch keine Bewertungen

- Contract of Insurance - Classification of Contract of InsuranceDokument10 SeitenContract of Insurance - Classification of Contract of Insurancesakshi lohan100% (1)

- Willard Williams v. United States, 731 F.2d 138, 2d Cir. (1984)Dokument7 SeitenWillard Williams v. United States, 731 F.2d 138, 2d Cir. (1984)Scribd Government DocsNoch keine Bewertungen

- Afjrotc Creed: Before Self, and Excellence in All We DoDokument1 SeiteAfjrotc Creed: Before Self, and Excellence in All We DoKatlynn McCannNoch keine Bewertungen

- BSPHCL Recruitment Notification For AssistantDokument7 SeitenBSPHCL Recruitment Notification For AssistantSanjana Krishna KumarNoch keine Bewertungen

- Womens Voting Rights Sign On LetterDokument4 SeitenWomens Voting Rights Sign On LetterMatthew HamiltonNoch keine Bewertungen

- Appointment of Beneficiary FormDokument2 SeitenAppointment of Beneficiary FormAnkithaNoch keine Bewertungen

- "Broken Things" Nehemiah SermonDokument7 Seiten"Broken Things" Nehemiah SermonSarah Collins PrinceNoch keine Bewertungen

- Presentation On Home Loan DocumentationDokument16 SeitenPresentation On Home Loan Documentationmesba_17Noch keine Bewertungen

- USX (Questions)Dokument2 SeitenUSX (Questions)DavidBudinas0% (3)

- Xeerka Shirkada Land ServiceDokument20 SeitenXeerka Shirkada Land ServiceHassan Ali50% (2)

- PDS (PNP) - 2Dokument5 SeitenPDS (PNP) - 2Deng HarborNoch keine Bewertungen

- Comprimise, Arrangement and Amalgamation NotesDokument6 SeitenComprimise, Arrangement and Amalgamation Notesitishaagrawal41Noch keine Bewertungen

- Contracts RoadmapDokument7 SeitenContracts RoadmapMeixuan LiNoch keine Bewertungen