Beruflich Dokumente

Kultur Dokumente

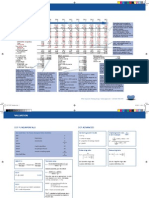

IM&C's guano project cash flow projections

Hochgeladen von

KuntalDekaBaruahOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IM&C's guano project cash flow projections

Hochgeladen von

KuntalDekaBaruahCopyright:

Verfügbare Formate

TABLE 6.

1 IM&C's guano project -- projections ($ thousands) reflecting inflation and straig

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

Capital investment

Accumulated depn.

Year-end book value

Working capital

Total book value (3 + 4)

Sales

Cost of goods sold

Other costs

Depreciation

Pretax profit

Tax

Profit after tax (10 - 11)

0

10,000

10,000

4,000

-4,000

-1,400

-2,600

1

1,583

8,417

550

8,967

523

837

2,200

1,583

-4,097

-1,434

-2,663

2

3,167

6,833

1,289

8,122

12,887

7,729

1,210

1,583

2,365

828

1,537

Period

4

3

4,750

5,250

3,261

8,511

32,610

19,552

1,331

1,583

10,144

3,550

6,593

Notes:

No. of years depreciation

Assumed salvage value in depreciation calculation

Tax rate (percent)

6

500

35

6,333

3,667

4,890

8,557

48,901

29,345

1,464

1,583

16,509

5,778

10,731

lecting inflation and straight line depreciation

5

7,917

2,083

3,583

5,666

35,834

21,492

1,611

1,583

11,148

3,902

7,246

6

9,500

500

2,002

2,502

19,717

11,830

1,772

1,583

4,532

1,586

2,946

7

-1,949

0

0

0

0

0

1,449

507

942

TABLE 6.2 IM&C's guano project -- initial cash flow analysis with straight-line depreciation

0

1

2.

3.

4.

5.

6.

7

8.

9.

Capital investment and disposal

Change in working capital

Sales

Cost of goods sold

Other costs

Tax

Operating cash flow (3 - 4 - 5 - 6)

Net cash flow (1 + 2 + 3)

Present value

Net present value =

Cost of capital (percent)

-10,000

0

0

4,000

-1,400

-2,600

-12,600

-12,600

3,520

20

Go back to Table 6.1 to change Sales, Cost of goods sold, etc.

0

-550

523

837

2,200

-1,434

-1,080

-1,630

-1,358

2

0

-739

12,887

7,729

1,210

828

3,120

2,381

1,654

3

0

-1,972

32,610

19,552

1,331

3,550

8,177

6,205

3,591

s with straight-line depreciation ($ thousands)

Period

4

0

-1,629

48,901

29,345

1,464

5,778

12,314

10,685

5,153

5

0

1,307

35,834

21,492

1,611

3,902

8,829

10,136

4,074

6

0

1,581

19,717

11,830

1,772

1,586

4,529

6,110

2,046

7

1,442

2,002

0

0

0

3,444

961

TABLE 6.4 Tax Depreciation Schedules by Recovery-Period Class

Recovery-Period

Class

3-year

5-year

7-year

10-year

15-year

20-year

1

33.33

20.00

14.29

10.00

5.00

3.75

2

44.45

32.00

24.49

18.00

9.50

7.22

3

14.81

19.20

17.49

14.40

8.55

6.68

4

7.41

11.52

12.49

11.52

7.70

6.18

11.52

8.93

9.22

6.93

5.71

5.76

8.92

7.37

6.23

5.28

8.93

6.55

5.90

4.89

Years

10 11

12

4.46

6.55 6.56 6.55 3.28

5.90 5.91 5.90 5.91 5.90

4.52 4.46 4.46 4.46 4.46

by Recovery-Period Class

ears

13

14

15

16

17

18

19

20

21

5.91 5.90 5.91 2.95

4.46 4.46 4.46 4.46 4.46 4.46 4.46 4.46 2.23

TABLE 6.5 Tax payments on IM&C's guano project ($ thousands

No. of years depreciation (3, 5 or 7 years only)

Tax rate (percent)

5

35

0

MACRS %

Tax depreciation (MACRS % x depreciable investment)

1

2

3

4

5

6

Sales

Cost of goods sold

Other costs

Tax depreciation

Pretax profits

Tax

0

0

4,000

0

-4,000

-1,400

2

20.0

2,000

32.0

3,200

523

837

2,200

2,000

-4,514

-1,580

12,887

7,729

1,210

3,200

748

262

TABLE 6.6 IM&C's guano project -- revised cash flow analysis with MACRS deprecia

0

1

2.

3.

4.

5.

6.

7

8.

9.

Change in working capital

Capital investment & disposal

Sales

Cost of goods sold

Other costs

Tax

Operating cash flow (3 - 4 - 5 - 6)

Net cash flow (1 + 2 + 3)

Present value

Net present value =

Cost of capital (percent)

-10,000

0

0

4,000

-1,400

-2,600

-12,600

-12,600

-550

0

523

837

2,200

-1,580

-934

-1,484

-1,237

2

-739

0

12,887

7,729

1,210

262

3,686

2,947

2,047

3,802

20

Note: Vary depreciable life by changing inputs in these tables. Go back to Tables 6.1 or 6.2 to change sales

ano project ($ thousands)

Period

3

4

19.2

11.5

1,920

1,152

32,610

19,552

1,331

1,920

9,807

3,432

48,901

29,345

1,464

1,152

16,940

5,929

11.5

1,152

5.8

576

0.0

0

35,834

21,492

1,611

1,152

11,579

4,053

19,717

11,830

1,772

576

5,539

1,939

0

0

0

0

2,002

701

sis with MACRS depreciation ($ thousands)

3

-1,972

0

32,610

19,552

1,331

3,432

8,295

6,323

3,659

Period

4

-1,629

0

48,901

29,345

1,464

5,929

12,163

10,534

5,080

5

1,307

0

35,834

21,492

1,611

4,053

8,678

9,985

4,013

6

1,581

0

19,717

11,830

1,772

1,939

4,176

5,757

1,928

7

1,949

2,002

0

0

0

701

-701

3,269

912

6.1 or 6.2 to change sales, cost of goods sold, cost of capital etc.

Das könnte Ihnen auch gefallen

- Chap 006Dokument32 SeitenChap 006eaktaNoch keine Bewertungen

- Chapter 6Dokument26 SeitenChapter 6dshilkarNoch keine Bewertungen

- Deliverable #1_Fiat Chrysler and VolkswagenDokument4 SeitenDeliverable #1_Fiat Chrysler and VolkswagenSavitaNoch keine Bewertungen

- Valuation of Companies and Cash Flow Generating Assets SeminarDokument4 SeitenValuation of Companies and Cash Flow Generating Assets SeminarMandeep SNoch keine Bewertungen

- TTR RRL: LimitedDokument5 SeitenTTR RRL: LimitedShyam SunderNoch keine Bewertungen

- MeharVerma IMT Ceres 240110 163643Dokument9 SeitenMeharVerma IMT Ceres 240110 163643Mehar VermaNoch keine Bewertungen

- First Resources 4Q12 Results Ahead of ExpectationsDokument7 SeitenFirst Resources 4Q12 Results Ahead of ExpectationsphuawlNoch keine Bewertungen

- Chapter09 SMDokument14 SeitenChapter09 SMkike-armendarizNoch keine Bewertungen

- EVA ExampleDokument14 SeitenEVA ExampleKhouseyn IslamovNoch keine Bewertungen

- 6a02d65b A005 DCF Discounted Cash Flow ModelDokument8 Seiten6a02d65b A005 DCF Discounted Cash Flow ModelYeshwanth BabuNoch keine Bewertungen

- CongoleumDokument16 SeitenCongoleumMilind Sarambale0% (1)

- EVA ExampleDokument27 SeitenEVA Examplewelcome2jungleNoch keine Bewertungen

- 4 After-Tax Economic AnalysisDokument31 Seiten4 After-Tax Economic AnalysisAngel NaldoNoch keine Bewertungen

- Ceres Gardening CompanyDokument6 SeitenCeres Gardening Companypallavikotha84Noch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Nike Inc - Cost of Capital - Syndicate 10Dokument16 SeitenNike Inc - Cost of Capital - Syndicate 10Anthony KwoNoch keine Bewertungen

- Chapter 6 (10) : Making Capital Investment DecisionsDokument21 SeitenChapter 6 (10) : Making Capital Investment DecisionsHoàng Như NgọcNoch keine Bewertungen

- ITC Affect On CompanyDokument10 SeitenITC Affect On CompanynavpreetsinghkNoch keine Bewertungen

- 2006 To 2008 Blance SheetDokument4 Seiten2006 To 2008 Blance SheetSidra IrshadNoch keine Bewertungen

- AIRTHREAD ACQUISITION Revenue and Expense ProjectionsDokument24 SeitenAIRTHREAD ACQUISITION Revenue and Expense ProjectionsHimanshu AgrawalNoch keine Bewertungen

- Assign 3 - Sem 2 11-12 - RevisedDokument5 SeitenAssign 3 - Sem 2 11-12 - RevisedNaly BergNoch keine Bewertungen

- Campbell Soup FInancialsDokument39 SeitenCampbell Soup FInancialsmirunmanishNoch keine Bewertungen

- DFS December 2009 AnswersDokument12 SeitenDFS December 2009 AnswersPhilemon N.MalingaNoch keine Bewertungen

- Hls Fy2010 Fy Results 20110222Dokument14 SeitenHls Fy2010 Fy Results 20110222Chin Siong GohNoch keine Bewertungen

- Airthread WorksheetDokument21 SeitenAirthread Worksheetabhikothari3085% (13)

- SMChap 006Dokument22 SeitenSMChap 006Anonymous mKjaxpMaLNoch keine Bewertungen

- DCF TakeawaysDokument2 SeitenDCF TakeawaysvrkasturiNoch keine Bewertungen

- Managerial-Finance-Project Orascom Report FinalDokument63 SeitenManagerial-Finance-Project Orascom Report FinalAmira OkashaNoch keine Bewertungen

- Milestone Three Consolidated Financials Final Paper - Workbook...Dokument19 SeitenMilestone Three Consolidated Financials Final Paper - Workbook...Ishan MishraNoch keine Bewertungen

- Ten Year Financial Summary PDFDokument2 SeitenTen Year Financial Summary PDFTushar GoelNoch keine Bewertungen

- 07 DCF Steel Dynamics AfterDokument2 Seiten07 DCF Steel Dynamics AfterJack JacintoNoch keine Bewertungen

- Hindalco: Performance HighlightsDokument14 SeitenHindalco: Performance HighlightsAngel BrokingNoch keine Bewertungen

- 5 Solution Maf302Dokument6 Seiten5 Solution Maf302diana.p7reiraNoch keine Bewertungen

- Financial Feasibility of Business PlanDokument14 SeitenFinancial Feasibility of Business PlanRizaldi DjamilNoch keine Bewertungen

- Oman ceramic tiles maker Al Anwar SAOGDokument11 SeitenOman ceramic tiles maker Al Anwar SAOGAnila AslamNoch keine Bewertungen

- AirThread G015Dokument6 SeitenAirThread G015sahildharhakim83% (6)

- Consolidated Income and Cash Flow StatementsDokument30 SeitenConsolidated Income and Cash Flow StatementsrooptejaNoch keine Bewertungen

- Vegetron ExcelDokument21 SeitenVegetron Excelanirudh03467% (3)

- MME 3113 Assignment #2 Financial Ratios & Cash FlowDokument8 SeitenMME 3113 Assignment #2 Financial Ratios & Cash FlowAnisha ShafikhaNoch keine Bewertungen

- Idea Cellular: Previous YearsDokument4 SeitenIdea Cellular: Previous YearsParvez AnsariNoch keine Bewertungen

- IndiaTalent Financial Model proposal breakdownDokument53 SeitenIndiaTalent Financial Model proposal breakdownAbirMukherjee67% (3)

- Burton ExcelDokument128 SeitenBurton ExcelJaydeep SheteNoch keine Bewertungen

- Chapter 3 Problems - Review in ClassDokument9 SeitenChapter 3 Problems - Review in Classjimmy_chou1314Noch keine Bewertungen

- Performance Highlights: NeutralDokument12 SeitenPerformance Highlights: NeutralAngel BrokingNoch keine Bewertungen

- Year-to-Date Revenues and Income Analysis for Period Ending Dec 2010Dokument35 SeitenYear-to-Date Revenues and Income Analysis for Period Ending Dec 2010Kalenga CyrilleNoch keine Bewertungen

- Panda Eco System Berhad - Prospectus Dated 8 November 2023 (Part 3)Dokument172 SeitenPanda Eco System Berhad - Prospectus Dated 8 November 2023 (Part 3)geniuskkNoch keine Bewertungen

- Name Karandeep Singh: $226 (In Thousands)Dokument5 SeitenName Karandeep Singh: $226 (In Thousands)Rishabh TiwariNoch keine Bewertungen

- Balance Sheet: Titan Industries LimitedDokument4 SeitenBalance Sheet: Titan Industries LimitedShalini ShreyaNoch keine Bewertungen

- BudgetBrief 2013Dokument79 SeitenBudgetBrief 2013kurazaNoch keine Bewertungen

- Ceres Gardening Company Submission TemplateDokument9 SeitenCeres Gardening Company Submission TemplateAkshay RoyNoch keine Bewertungen

- Financial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Dokument13 SeitenFinancial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Ghizal NaqviNoch keine Bewertungen

- Attock CementDokument16 SeitenAttock CementHashim Ayaz KhanNoch keine Bewertungen

- Assignments Semester IDokument13 SeitenAssignments Semester Idriger43Noch keine Bewertungen

- Write Your Answer For Part A HereDokument9 SeitenWrite Your Answer For Part A HereMATHEW JACOBNoch keine Bewertungen

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioVon EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNoch keine Bewertungen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosVon EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNoch keine Bewertungen

- The Valuation of Digital Intangibles: Technology, Marketing and InternetVon EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNoch keine Bewertungen

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachVon EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachBewertung: 3 von 5 Sternen3/5 (3)

- Kuntal Deka Baruah ResumeDokument2 SeitenKuntal Deka Baruah ResumeKuntalDekaBaruahNoch keine Bewertungen

- 02 Kunst 3500Dokument9 Seiten02 Kunst 3500KuntalDekaBaruah0% (1)

- Publication1 PDFDokument28 SeitenPublication1 PDFRachel YoungNoch keine Bewertungen

- NTT DoCoMo Case: Managing Customer Migration and Marketing FocusDokument4 SeitenNTT DoCoMo Case: Managing Customer Migration and Marketing FocusKuntalDekaBaruah100% (1)

- B2B Interim Report AnalysisDokument1 SeiteB2B Interim Report AnalysisKuntalDekaBaruahNoch keine Bewertungen

- Life QsDokument1 SeiteLife QsKuntalDekaBaruahNoch keine Bewertungen

- Human Resources at The AES CorporationDokument2 SeitenHuman Resources at The AES CorporationDyah Ayu M100% (3)

- Marketing of Organic Ginger Produced by Farmers of Karbi AnglongDokument2 SeitenMarketing of Organic Ginger Produced by Farmers of Karbi AnglongKuntalDekaBaruahNoch keine Bewertungen

- Human Resources at The AES Corporation: Case Analysis OnDokument7 SeitenHuman Resources at The AES Corporation: Case Analysis OnKuntalDekaBaruahNoch keine Bewertungen

- Ginfed Rum ReportDokument16 SeitenGinfed Rum ReportKuntalDekaBaruahNoch keine Bewertungen

- Rural Immersion: Understanding Women's StrugglesDokument2 SeitenRural Immersion: Understanding Women's StrugglesKuntalDekaBaruahNoch keine Bewertungen

- Working Capital QuestionsDokument2 SeitenWorking Capital QuestionsKuntalDekaBaruah100% (1)

- Class Oct12Dokument13 SeitenClass Oct12KuntalDekaBaruahNoch keine Bewertungen

- EBIT-EPS ANALYSISDokument2 SeitenEBIT-EPS ANALYSISKuntalDekaBaruahNoch keine Bewertungen

- Organizational Behavior Study of Bank BranchDokument8 SeitenOrganizational Behavior Study of Bank BranchKuntalDekaBaruahNoch keine Bewertungen

- Assignment 1: Coffee Wars in India: A Report Submitted To Prof. Gita ChaudhuriDokument5 SeitenAssignment 1: Coffee Wars in India: A Report Submitted To Prof. Gita ChaudhuriKuntalDekaBaruahNoch keine Bewertungen

- Demand Survey 155064 Kuntal Deka BaruahDokument9 SeitenDemand Survey 155064 Kuntal Deka BaruahKuntalDekaBaruahNoch keine Bewertungen

- Finance Quiz Oct 13 SolutionsDokument2 SeitenFinance Quiz Oct 13 SolutionsKuntalDekaBaruahNoch keine Bewertungen

- Guitar Theory The Circle of FifthsDokument6 SeitenGuitar Theory The Circle of FifthsKuntalDekaBaruahNoch keine Bewertungen

- Group A1 A WAC II 2 - ProposalDokument9 SeitenGroup A1 A WAC II 2 - ProposalKuntalDekaBaruahNoch keine Bewertungen

- Operations Research - Session2Dokument17 SeitenOperations Research - Session2KuntalDekaBaruahNoch keine Bewertungen

- Corporate Governance of P&G IndiaDokument8 SeitenCorporate Governance of P&G IndiaKuntalDekaBaruahNoch keine Bewertungen

- Inventory MGMT - Practice ProblemsDokument3 SeitenInventory MGMT - Practice ProblemsKuntalDekaBaruahNoch keine Bewertungen

- Kuntal Deka Baruah - P&G IndiaDokument5 SeitenKuntal Deka Baruah - P&G IndiaKuntalDekaBaruahNoch keine Bewertungen

- Nomenclature of ChordsDokument2 SeitenNomenclature of ChordsBuckethead JuniorNoch keine Bewertungen

- Some Points On Hypothesis Test For Population MeanDokument1 SeiteSome Points On Hypothesis Test For Population MeanKuntalDekaBaruahNoch keine Bewertungen