Beruflich Dokumente

Kultur Dokumente

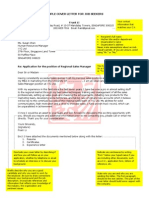

Investment Analysis

Hochgeladen von

Chrystal Joynre Elizabeth JouesCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Investment Analysis

Hochgeladen von

Chrystal Joynre Elizabeth JouesCopyright:

Verfügbare Formate

1.

0 INTRODUCTION

Clear introduction of the companies that covers all the following: the companies names,

establishment year, business activities and development, and financial highlights.

Pengenalan yang jelas mengenai syarikat meliputi semua yang berikut:Nama syarikat,

tahun penubuhan, aktiviti aktiviti perniagaan dan pembangunan, dan sorotan kewangan.

2.0 COMPUTATION OF MONTHLY STOCK RETURNS, AVERAGE STOCK RETURNS,

STANDARD DEVIATION OF STOCK RETURNS, CORRELATION BETWEEN THE

STOCK RETURNS. PENGIRAAN PULANGAN SAHAM BULANAN, PURATA

PULANGAN SAHAM, SISIHAN PIAWAI PULANGAN SAHAM, KORELASI

ANTARA PULANGAN SAHAM.

Able to compute ALL the following correctly:

Monthly stock returns

Average stock returns

Standard deviationof stock returns

Correlation between the stock returns.

The workings were provided.

Dapat mengira SEMUA yang berikut dengan betul:

Pulangan saham bulanan

Purata pulangan saham

Sisihan piawai pulangan saham

Korelasi antara dua pulangan saham.

Jalan kerja diberikan

3.0 COMPUTATION OF PORTFOLIO RETURNS AND STANDARD DEVIATIONS FOR

FOLLOWING PORTFOLIOS:

Portfolio 1: consists of first and second stocks.

Portfolio 2: consists of first and third stocks.

Portfolio 3: consists of second and third stocks.(Assume equally-weighted portfolios).

Pengiraan pulangan portfolio dan sisihan piawai bagi portfolio berikut:

Portfolio 1: merangkumi saham pertama dan saham kedua.

Portfolio 2: merangkumi saham pertama dan saham ketiga.

Portfolio 3: merangkumi saham kedua dan saham ketiga. (Andaikan portfolio-sama

berwajaran)

Able to compute all the portfolios returns and standard deviations correctly.Detailed

workings were provided.

Dapat mengira SEMUA pulangan dan sisihan piawai portfolio dengan betul. Jalan kerja

yang terperinci diberikan

4.0 ANALYSIS OF PORTFOLIOS CONSTRUCTED AND RECOMMENDATION FOR

INVESTMENT.

Analisis portfolio yang dibina dan pengesyoran untuk pelaburan.

Clear and detailed explanation on the effect of correlation on portfolio risk and able to

compare and

explain

clearly the

portfolios

in

terms

of risk and

return.

Able to identify the best and worst performance among the portfolios constructed and

able to recommend the right portfolio for investment.

Penerangan yang jelas dan terperinci mengenai kesan korelasi terhadap risiko portfolio

dan dapat membandingkan dan menerangkan dengan jelas portfolio-portfolio tersebut

dari segi risiko dan pulangan. Dapat mengenal pasti prestasi terbaik dan tercorot antara

portfolio yang dibina dan dapat mengesyorkan portfolio yang tepat sebagai pelaburan.

5.0 SUMMARY. All relevant key points were clearly summarised and written in a precise and

coherent manner. Semua isi utama yang relevan diringkaskan dengan jelas dan ditulis

dengan cara yang tepat dan tersusun.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- BisCom1 Group Project ReportDokument4 SeitenBisCom1 Group Project ReportChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Assigment 3 MethodologyDokument5 SeitenAssigment 3 MethodologyChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Lu 14Dokument9 SeitenLu 14Chrystal Joynre Elizabeth JouesNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- LU 1 IntroductionDokument71 SeitenLU 1 IntroductionChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Assigment 3 MethodologyDokument5 SeitenAssigment 3 MethodologyChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- 18 Perk Hid MatanDokument36 Seiten18 Perk Hid MatanSha SmileNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Asg. IBDokument16 SeitenAsg. IBChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Objectives Problem StatementDokument3 SeitenObjectives Problem StatementChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- 2185 ResumePacketDokument21 Seiten2185 ResumePacketSahibzada KhalidNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Cover Letter JobseekersDokument1 SeiteCover Letter JobseekersChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- InventoryDokument27 SeitenInventoryMuhammad HijaziNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Objectives Problem Statemen.ADokument5 SeitenObjectives Problem Statemen.AChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- An Introduction To MusicDokument15 SeitenAn Introduction To MusicChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Basic Guitar Chords PDFDokument4 SeitenBasic Guitar Chords PDFSamNoch keine Bewertungen

- Discussion Question 4Dokument1 SeiteDiscussion Question 4Chrystal Joynre Elizabeth JouesNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Unics Gathering: ThemeDokument5 SeitenUnics Gathering: ThemeChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- Pb502 - Insurance and Takaful: Principle and Practice - Chapter 1 Introduction To InsuranceDokument6 SeitenPb502 - Insurance and Takaful: Principle and Practice - Chapter 1 Introduction To InsuranceChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- Discussion Question 5Dokument2 SeitenDiscussion Question 5Chrystal Joynre Elizabeth JouesNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Discussion Question 6Dokument3 SeitenDiscussion Question 6Chrystal Joynre Elizabeth JouesNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- APA Style ReferencesDokument3 SeitenAPA Style ReferencesDru051150% (2)

- House Owner Policy: Section I - BuildingsDokument12 SeitenHouse Owner Policy: Section I - BuildingsChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Form For Missing Assignments and Request For Corrections For Carry MarkDokument1 SeiteForm For Missing Assignments and Request For Corrections For Carry MarkChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- Cover Letter JobseekersDokument1 SeiteCover Letter JobseekersChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- Fundamentals of MusicDokument119 SeitenFundamentals of MusicChrystal Joynre Elizabeth Joues100% (2)

- Presentation 1Dokument13 SeitenPresentation 1Chrystal Joynre Elizabeth JouesNoch keine Bewertungen

- 4 EmoConnectionDokument6 Seiten4 EmoConnectionWine BloodNoch keine Bewertungen

- Dusun DayDokument1 SeiteDusun DayChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- Effect of CorupptionDokument2 SeitenEffect of CorupptionChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Star Sign Profile-AquariusDokument3 SeitenStar Sign Profile-AquariusChrystal Joynre Elizabeth JouesNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)