Beruflich Dokumente

Kultur Dokumente

Newport Mortgage 2006

Hochgeladen von

xjax0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

77 Ansichten16 SeitenCopyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

77 Ansichten16 SeitenNewport Mortgage 2006

Hochgeladen von

xjaxCopyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 16

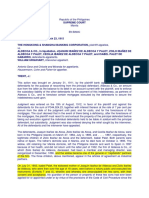

Index MORTGAGES

MONROE COUNTY CLERK'S OFFICE

Return To:

Book 20667 Page 0470

STONER & ASSOCIATES

2540 BRIGHTON HENRIETTA TL RD No. Pages 0016

ROCH NY 14623

Instrument MORTGAGE-OTH

Date : 8/10/2006

Time : 2:31:00

Control # 200608100787

RSM IRONDEQUOIT BAY DEVELOPMEN MTG# M# CX 015026

T Luc

CAPPA

DANIEL P

Employee ID | gMC40

(ORTGAGE TAK

FILE FER-S$ 19.00 MORTGAGE AMOUNT $ — 1,925,000.00

FILE FEE-C § 8.00

REC FEE $ 48.00 BASIC MORTGAGE TAX $ 9,625.00

MISC FEE-C § +00

B MTG TAX $ 9,625.00 SPEC ADDIT MTG TAX $ 4,812.50

SA MTG TAX § 4,812.50

S MTG TAX $ 4,812.50 ADDITIONAL MTG TAX $ 4,812.50

$ +00

$s +00 ‘Total 8 19,250.00

Total: s 19,325.00

STATE OF NEW YORK ‘TRANSFER AMT

MONROE COUNTY CLERK'S OFFICE

WARNING - THIS SHEET CONSTITUTES THE CLERKS © TRANSFER AMT $ +00

ENDORSEMENT, REQUIRED BY SECTION 317-a(5) &

SECTION 319 OF THE REAL PROPERTY LAN OF THE

STATE OF NEW YORK. DO NOT DETACH OR REMOVE. | TRANSFER TAX $ 00

Cheryl Dinolfo

Monroe County Clerk

M20bb 70470

MORTGAGE

$1,925,000.00

THIS MORTGAGE, 1s made this 4” day of August, 2006

BETWEEN, RSM Irondequoit Bay Development LLC, with an office at 197 West Main

Street, Victor, New York, 14564, hereinafter called the "Mortgagor’, and

Daniel P. Cappa, an individual having ts principal office at 14 LaCrom,

Rochester, New York 14809, hereinafter called the “Mortgagee’, witnesseth that

GRANTING CLAUSE

NOW, THEREFORE, to secure the payment of an indebtedness in the principal sum of

‘One Milion Nine Hundred Twenty Five Thousand and 00/100 Dollars ($1,925,000 00),

together with interest thereon, to be paid according to a certain Promissory Note made

and delivered by the Mortgagor to the Mortgagee, bearing even date herewith (the

“Note’), the Mortgagor hereby mortgages to the Mortgage, as continuing secunty for

the payment of any and all indebtedness, liabilities and obligations now existing or

which may hereafter anse by reason of the Note, this Mortgage, or any renewals,

extensions, modifications or substitutions of the Note or this Mortgage (collectively, the

“indebtedness”), and for other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the premises described on Schedule “A”

attached hereto and made a part hereof (the “Premises”),

Together with all buildings, structures and other improvements now or hereafter

erected, constructed or situated on the Premises (the “Improvements”, and together

wath all night, title and interest of Mortgagor now owned, or hereafter acquired, in and to

the following property, rights and interests (the Premises, the Improvements, and such

property, nghts and interests, being heremafter collectively referred to as the

“Mortgaged Property")

{a) all easements, rights-of-way, gores of land, streets, ways, alleys, passages,

sewer rights, waters, water courses, water rights and powers, and all estates, nghts,

title, interests, privileges, liberties, tenements, hereditaments, and appurtenances of any

nature whatsoever, in any way belonging, relating or pertaining to the Premises or the

Improvements, and all right, title and interest of Mortgagor, including any right to

purchase, or to use and occupy, any land adjacent to the Premises and any land lying in

the bed of any street, road or avenue, opened or proposed, in front of or adjoining the

Premises,

Record and return to Stoner & Associates

2540 Brighton Hennetta Townline Rd , Rochester, NY 14623

ROCHDOCSA91IS44

(b) all machinery, apparatus, equipment, fittings, fixtures and other property of

every kind and nature whatsoever owned by Mortgagor, or in which Mortgagor has or

shall have an interest, now or hereafter located upon the Premises and/or the

Improvements, or appurtenances thereto, and used or usable in connection with the

present or future operation and occupancy of the Premises and/or the Improvements,

and all building equipment, matenals and supplies of any nature whatsoever owned by

Mortgagor. or in which Mortgagor has or shall have an interest, now or hereafter located

in of upon the Premises and/or the Improvements, and all additions, replacements,

modifications and alterations of any of the foregoing, including, but without limiting the

generality of the foregoing, all heating, lighting, mcinerating and power equipment,

engines, pipes, tanks, motors, condutts, switchboards, plumbing, lifting, cleaning, fire

prevention, fire extinguishing, refrigerating, ventilating, and communications apparatus,

air cooling and air-conditioning apparatus, elevators, ducts and compressors

(collectively, the "Equipment’) All Equipment is part and parcel of the Premises and

appropriated to the use of the Premises and, whether or not affixed or annexed to the

Improvements, shall for the purpose of this Mortgage be deemed conclusively to be real

estate and mortgaged hereby,

(©) all awards or payments, and interest paid or payable with respect thereto,

which may be made with respect to all or any portion of the Premises and/or the

Improvements, whether from the exercise of night of condemnation, eminent domain or

similar proceedings (including any transfer made in eu of the exercise of the right, or by

advance payment agreement), of from any taking for public use, of for any other injury

to or decrease in the value of all or any portion of the Premises and/or the

Improvements (collectively, the "Eminent Domain Awards"),

(d) all leases and other agreements, whiten or oral, affecting the use or

occupancy of the Premises and/or the Improvements now or hereafter entered into

(including, without limitation, ail subleases, licenses, concessions, tenancies, and other

occupancy agreements covering or encumbering all or any portion of the Premises,

and/or the Improvements) together with any modifications, extensions or renewals of

the same, and all contracts of sale of shares (collectively, the "Leases") and the rents,

issues and profits of the Premises and/or the Improvements (the "Rights"), together with

the night, but not the obligation, upon the occurrence of a default (as hereafter

defined), to collect, receive and receipt for the rents and apply the Rents to the payment

of the Debt and to demand, sue for and recover the Rents (when due and payable)

(e) all proceeds of, and any uneamed premiums on, any insurance policies

covering all or any portion of the Premises, the Improvements and/or the Equipment,

including, without limitation, the right to receive and apply the proceeds of any

insurance, judgments, or settlements made in lieu thereof, for damage to all or any

portion of the Premises, the Improvements and/or the Equipment and any interest paid

or payable with respect thereto (collectively, the "Insurance Proceeds"),

(f) the right, in the name and on behalf of Mortgagor, to appear in and defend any

action or proceeding brought with respect to the Premises and/or the Improvements and

ROCHDOCSH201154 -2-

to commence any action or proceeding to protect the interest of Mortgagee in the

Premises and/or the Improvements, and

(g) any and all other, further or additional night, title, estates and interests which

Mortgagor now has, or hereafter acquires in and to the Premises and/or the

Improvements and/or the Equipment, Mortgagor expressly agreeing that if Mortgagor

shall at any time acquire any other right, title, estate or interest in and to the Premises

and/or the Improvements and/or the Equipment, the lien of this Mortgage shall

automatically attach to and encumber such other right, title, estate or interest as a first

lien thereon

And the Mortgagor covenants with the Mortgage as follows

4 That the Mortgagor will pay the Indebtedness as provided in the Note

2 That, except as otherwise provided in a certain Lease of even date

herewith by and between the Mortgagor, RSM Newport Marina LLC and Newport

Manna, Inc (the ‘Marina Lease’) and a certain Lease of even date herewith by and

between the Mortgagor, RSM Newport House Pub & Café LLC and Newport Pub &

Café, Inc (the “Pub & Café Lease”) the Mortgagor will keep the buildings on the

Premises insured against loss by fire or such other hazards for which the Mortgage

requires coverage including floods and flooding, that the Mortgagor will provide

certifications evidencing such insurance to the Mortgagee, and that the Mortgagor will

reimburse the Mortgage for any premiums paid for surance made by the Mortgagee

on the Mortgagor's default in so insuring the buildings or in so assigning and delivenng

the policies

3 That the Mortgagor warrants the title to the Premises

4 That this Mortgage 1s subject to the trust fund provisions of Section 13 of

the Lien Law

5 That, except as otherwise provided in the Manna Lease and the Pub &

Café Lease, the Mortgagor will pay all taxes, assessments or water rates, and all

payments which are or may become due on any prior mortgage on the Premises

6 That the whole of the Indebtedness shall immediately become due after

default m the payment of any part thereof, or of interest thereon or any part thereof, or

after any default in the payment of the principal or interest, or any installment thereof,

pursuant to the terms of the Note or after default for thirty (30) days after notice and

demand, in the payment of any tax, water rate or assessment, anything herein

contained to the contrary notwithstanding, or upon the occurrence of any other event of

default on the part of Mortgagor under the Note, following the expiration of any grace

periods

ROCHDOCSHISIIS -3-

7 The Mortgagor authorizes the Mortgagee, without notice, to make any and

all payments necessary to correct a default of Mortgagor under Paragraphs 2, 5, and 6

of this Mortgage The Mortgagor shall make repayment of all amounts paid by

Mortgagee under this Paragraph 7 within ten (10) days after the Mortgagor's receipt of

the Mortgagee's written demand for payment, together with interest at the highest

interest rate provided for in the Note, but in no event in excess of the maximum interest

rate allowed by law, from the date such amounts are paid by the Mortgagee until the

date of full repayment of such amount by the Mortgagor All amounts paid by the

Mortgagee pursuant to this Paragraph 7 which remain unpaid shall be added to

Indebtedness and shall be secured by this Mortgage

8 That the whole of the Indebtedness now or hereafter secured hereby shall

become immediately due and payable at the option of the Mortgagee upon a

conveyance of the Premises or any part thereof Notwithstanding the foregoing or any

other provision of this Mortgage or the Note to the contrary, the current members of the

Mortgagor, shall be permitted to transfer their respective membership interests in the

Morigagor to each other and to immediate family members for estate planning

purposes, as long as Robert S Mancini and Steven P Mancini remain members of the

Mortgagor and notice of such transfers is given to the Mortgage

9 That upon the making of an assignment for the benefit of creditors, by or

upon the filing of a petition in bankruptcy by or against the Mortgagor, or upon the

application for the appointment of a receiver of the property of the Mortgagor, or of any

person or corporation which may become and be owner of the Mortgaged Property, or

upon any act of insolvency or bankruptey of the Mortgagor, or of any such owner, the

whole of the Indebtedness shall become due and payable forthwith, without notice or

demand of payment The Mortgagor hereby waives presentment, demand of payment,

protest, notice of nonpayment, and/or of protest of any instrument on which he is or may

become liable, now or hereafter secured hereby, and the Mortgagor expressly agrees

that the Mortgagee may release or extend the time of any party liable on any such

obligation without notice and without affecting his obligation thereon or under this

instrument

10 That if default shall be made in the payment of the Indebtedness now or

hereafter secured by this Mortgage, or any part thereof.or all or any part of the interest

thereon, at the time or times when the same shall become due and payable, or upon

default under any of the provisions of this Mortgage, the Mortgagee shall have the right

forthwith, after any default, to enter upon and take possession of the Mortgaged

Property, and to let the Premises and receive the rents, issues and profits thereof, and

to apply the same (after the payment of all charges and expenses which are necessary

in the absolute discretion of the Mortgage) on the Indebtedness hereby intended to be

secured, and the gross rents and profits are, in the event of any default under the

provisions of this mstrument, hereby assigned to the Mortgagee without notice or

demand The Mortgage shall be entitled to obtain an order from a court of competent

jurisdiction enforcing the terms of this Paragraph 10 without prior notice to Mortgagor

and Mortgagor hereby consents to the jurisdiction of the court im which such application

ROCHDOCSW29I54

ts made for that purpose

14 That the Mortgagee may immediately, after any such default, vpon a

complaint filed, or any other proper legal proceedings being commenced for the

foreclosure of this mortgage, apply for, and shall be entitled as a matter of right, without

consideration of the value of the mortgaged premises as seounty for the Indebtedness

or of the solvency of any person or persons hable for the payment of such

indebtedness, and without prior notice to mortgagor, to the appointment by any

competent court or tnbunal, of a receiver of the rents and profits of the premises, with

power to lease the same or any part thereof, and with such other powers as may be

deemed necessary, who, after deducting all proper charges and expenses attending the

execution of the trust, as receiver, shall apply the residue of the rents and profits to the

payment and satisfaction of the amount unpaid on the Indebtedness now or hereafter

secured hereby, or to any deficiency which may exist after applying the proceeds of the

sale of the premises to the payment of any and all indebtedness due the Mortgagee

12 tt us further expressly agreed that the Mortgagee may resort for the

payment of the Indebtedness to any other assets held, in such order and manner as it

may see fit, and may maintain an action to foreclose ths Mortgage notwithstanding the

pendency of any action to recover any part of the Indebtedness secured hereby, of the

recovery of any judgment in such action, nor shall the Mortgagee be required, during

the pendency of any action to foreclose this Mortgage, to obtain leave of any court in

order to commence or maintain any other action to recover any part of the Indebtedness

secured hereby If this Mortgage 1s foreclosed, the Premises may be sold in one parcel

13 All notices, demands or requests hereunder or under any applicable law

(including, without limitation, Article 14 of the New York Real Property Actions and

Proceedings Law) will be effective and shall be deemed sufficiently given or served for

all purposes when delivered to Mortgagor in person or deposited in the United States

Mail, first class, postage-paid, addressed to the Mortgagor's address set forth above If

the Mortgagor changes addresses, the Morigagor will notify the Mortgagee of the

Mortgagor’s new address within ten (10) days in writing sent to 14 LaCrox Court,

Rochester, New York 14622

14 No water by the Mortgagee of the breach of any of the foregoing

covenants, or failure of the Mortgagee to exercise any option given to the Mortgagee,

shall be deemed to be a waiver of any other breach of the same or any other covenant,

or of Mortgagee's rights thereafter to exercise any such option

15 The Mortgagor may prepay all or any part of the Indebtedness at any time

without penaity Any partial prepayments shall be applied first to amounts due under

Paragraphs 2, 5, 6, 7, or 17, second to unpaid interest and late charges, third to any

deferred interest, and fourth against the remaining principal amount of the Indebtedness

outstanding Prepayments shall not postpone the due date of any subsequent monthly

installments which become due and payable unless the Mortgagee shall otherwise

agree in writing

ROCHDOCSH2911541 5+

16 Except as otherwise provided in this Mortgage, the Mortgagee may

require immediate payment in full of any outstanding Indebtedness, principal and

interest, due on the note which is secured by this Mortgage if all or any part of the

Mortgaged Property (or any right(s) in the Mortgaged Property) is sold or otherwise

transferred including by “land contract” without the por wntfen permission of the

Mortgage

17 If the Mortgagor 1s in default under the terms of the note secured by this

Mortgage, the Mortgagor agrees to pay any reasonable legal fees (including fees

incurred for both attorney and paralegal services) and any other reasonable costs

incurred by Mortgagee as a result of the default, the cost of an environmental

assessment, and a third party appraisal of the value of the Mortgaged Property if this

Mortgage is foreclosed, the Mortgage 1s entitled to recover reasonable attorney's fees

for foreclosure, in addition to statutory costs or disbursements and any additional or

supplemental allowance made pursuant to C PLR Section 8303 or other authority In

addition, the Mortgage shall be entitled to recover, as a part of the Morigagee’s

foreclosure judgment, the cost of a third party appraisal ordered in connection with the

‘commencement of the foreclosure action, and any amount expended by the Mortgage

for the preservation of the Mortgaged Property These fees shall be a lien on the

Mortgaged Property with prionty over the Mortgage, but shall be subject to the

subordination provisions of Paragraph 21 of this Mortgage

18 any required payment of pnncipal or interest is overdue for a penod in

excess of ten (10) days, a late charge as provided in the Note may be charged at the

option of the Mortgagee

19 If the Mortgagor is in default under the terms of the Note this Mortgage,

the Mortgagee may, either with or without entry or taking possession of the Mortgaged

Property as provided in this Mortgage or otherwise, personally or by its agents or

attorneys, and without prejudice to the nght to bring an action for foreclosure of this

Mortgage, sell the Mortgaged Property or any part thereof pursuant to any procedures

provided by applicable law, including, without limitation, the procedures set forth in

Article 14 of the New York Real Property Actions and Proceedings Law (and any

amendments or substitute statutes in regard thereto), and all estate, nght, tile, interest,

claim and demand therein, and night of redemption thereof, at one or more sales as an

entity or in parcels, and at such time and place upon such terms and after such notice

thereof as may be required or permitted by applicable law

The term "Mortgagor" and all words referring to the Mortgagor, shall be deemed to

include any and/or either and/or all of the owner(s) of the Premises descnbed in this

Mortgage, their hems, executors, administrators, successors or assigns

21 This Mortgage and the estate and interest of the Mortgage hereunder

(and those claiming by, through or under the Mortgagee) shall be automatically subject

and subordinate to any construction or permanent mortgage lien or charge created by

the Mortgagor (the “Paramount Mortgage"), which at any time hereafter may be placed

ROCHDOCSHI9IIS

as a first lien upon the Mortgaged Property, and to any renewals, extensions,

modifications or substitutions thereof The Paramount Mortgage shall, be prior and

paramount to this Mortgage and to the nights and interests of the Mortgagee hereunder

and all persons claiming by, through or under the Mortgagee, or otherwise, and the

Mortgagee shall attom to any lending institution with respect to the Paramount

Mortgage and execute and deliver any instrument of subordination requested by such

lending institution In addition, upon the acceptance and recordation in the Monroe

County Clerk’s Office of easements to the Town of Irondequoit for sanitary sewers,

water mains and vehicle turnaround, as shown on a map of the Premises prepared by

Costich Engineering dated July __, 2006, the lien of this Mortgage shall automatically

be subordinated to the lien of such easements

22 (a) If at any time that the Note Is outstanding, the Mortgagor causes to be

placed on the Mortgaged Properly a Paramount Mortgage such that the Mortgage 1s

subject to and subordinate to the lien of the Paramount Mortgage, then, unless the

appraised fair market value of the Premises exceeds one hundred twenty-five percent

(125%) of the combined amount of (1) the principal amount of the Paramount Mortgage,

(u) the principal amount then owed by the Mortgagor pursuant to the Note, (ii!) the

principal amount then owed by RSM Newport House Pub & Café LLC pursuant to the

Promissory Note issued by RSM Newport House Pub & Café LLC to Newport House

Pub & Café, Inc , and (iv) the principal amount then owed by RSM Newport Marina LLC

pursuant to the Promissory Note issued by Newport Marina LLC to Newport Marina,

Inc , within sixty (60) days after the recording of the Paramount Mortgage, Robert S.

Mancini and Steven P Mancini shall provide to the Mortgagee, for informational

purposes only, their personal balance sheets dated as of the date of the closing of the

Paramount Mortgage

(b) Any financial information provided by Robert S Mancini or Steven P

Mancini pursuant to this Paragraph 22 shall be maintained by the Mortgagee in strictest

confidence and shall not be disclosed by Mortgagee to any other person except

Mortgagee’s attorney and accountant Any such permitted disclosure shall only be

permitted if Mortgagee's attorney or accountant agree to be similarly bound to maintain

the content of such financial information in strictest confidence At any time (1) the

value of the Premises as reflected in a certified appraisal exceeds the then combined

outstanding principal amount of the obligations set forth in Paragraph 22 (a)(i) through

(iv) by at least one hundred twenty-five percent (125%), or (u) the Note is paid in full,

then, in any such event, any financial information ever delivered to Mortgagee, and any

copies thereof, shall be returned to Robert S Mancini and Steven P, Mancini as soon

as reasonably possible The return of financial information pursuant to the preceding

sentence shall not in any manner diminish the confidentiality obligations set forth in the

first sentence of this Paragraph 22 (b), which confidentiality obligations shail continue to

remain effective

23 Notwithstanding any contrary provisions of this Mortgage, Mortgage

acknowledges that the transaction with Mortgagor whereby the Mortgagor acquired the

ROCHDOCSH291155¢ 7+

Mortgaged Property and pursuant to which this Mortgage has been granted, are part of

a series of simultaneous transactions relating to the Newport House Pub & Café, Inc

Asset Purchase Agreement and the Newport Marina, Inc. Asset Purchase Agreement,

each of even date with a Land Purchase Agreement by and between the Mortgagor

and the Mortgagee for the purchase and sale of the Mortgaged Property In

recognition of the simultaneous occurrence of these transactions, as to which

Mortgagee acknowledges having received substantial benefits thereunder, the

following nghts of offset are hereby granted to Mortgagor, and to the other parties

referenced herein, by the Mortgagee"

{a) The Mortgagee acknowledges and agrees that the Mortgage will

receve substantial benefit from the closing of the transactions contemplated by the

Newport House Pub & Café, Inc Asset Purchase Agreement and the lease entered into

pursuant thereto (the “Pub & Café Lease") and by the Newport Marina, Inc Asset

Purchase Agreement and the lease entered into pursuant thereto (the "Manna Lease”)

‘As such, the Mortgagor has the right to offset any obligation or payment that the

Mortgagor is obligated to pay to the Mortgage pursuant to the Land Purchase

Agreement, the Note, or this Mortgage (1) mn the event of any default or breach by

Mortgage or Newport House Pub & Café, Inc of the terms of the Newport House Pub &

Café, Inc Asset Purchase Agreement, or (u) in the event of any default or breach by

Mortgage of the terms or conditions of the Land Purchase Agreement, or (ii) m the event

of any default or beach by Newport Marina, Inc or the “Shareholders” (as defined in the

Newport Marina, Inc Asset Purchase Agreement) of the terms or conditions of the

Newport Marina, Inc Asset Purchase Agreement, or (Iv) in the event of any default or

breach by the Mortgage or Newport House Pub & Café, Inc of the terms and conditions

of the Pub & Café Lease; or (v) in the event of any default or breach by Newport Marina,

Inc or the “Shareholders” of the terms or conditions of the Marna Lease

(b) The Mortgage acknowledges and agrees that, in the event of any

default or breach by the Mortgagee of any of the terms or conditions of the Land

Purchase Agreement (i) RSM Newport House Pub & Cafe LLC may offset against any

obligation or payment that RSM Newport House Pub & Cafe LLC 1s obligated to make to

the Mortgagee and Newport House Pub & Café, Inc pursuant to the Newport House Pub

& Café, Inc Asset Purchase Agreement, or the Promissory Note issued pursuant thereto,

the amount or value of all such defaults or breaches, and (u) the Mortgagor may offset

against the Mortgagee any obligation or payment that the Mortgagor is obligated to make

to the Mortgage pursuant to the Land Purchase Agreement or the Note, the amount or

value of all such defaults or breaches, and (i) RSM Newport Manna LLC may offset

against Newport Marina, Inc and the “Shareholders” any obligation or payment that RSM

Newport Marina LLC 1s obligated to make to Newport Manna, Inc and the “Shareholders”

Pursuant to the Newport Manna, Inc Asset Purchase Agreement or the Promissory Note

'ssued pursuant thereto, the amount or value of all such defaults or breaches

(©) Without in any manner diminishing the obligations of any other

parties pursuant to this Paragraph 23, this Mortgage is made with the express reliance

upon the agreement of the Mortgage that the Mortgagee's obligations with regard to

ROCHDOCSH91IS <8.

the offset rights of the Mortgagor, of RSM Newport House Pub & Cafe LLC and of RSM

Newport Marina LLC under this Paragraph 23 and this Mortgage are jomt and several

with all other obligations of Newport House Pub & Café, Inc, Newport Marina, Inc and

the “Shareholders” (as defined in the Newport Manna, Inc Asset Purchase Agreement)

and that none of the Mortgagor, RSM Newport Marina LLC or RSM Newport House Pub

& Café LLC are required to pursue or exhaust their nights against any other parties prior

to exercising their rights of offset against the Mortgagee

(d) _ In addition to the nghts of offset desonbed in Paragraph 23(a), (b)

and (c) immediately above, the Mortgagee acknowledges and agrees that the

Mortgagor shall have the right to offset on a dollar for dollar basis against payments due

to the Mortgage under the Note the first $500,000 of “Environmental Costs” (as defined

below) incurred by the Mortgagor (the “First Offset Amount") Mortgagor shall be solely

responsible for, and the Mortgagor shall not have a nght of offset with respect to, the

next $100,000 of Environmental Costs above the First Offset Amount (“Mortgagor's

Environmental Cost Amount") Thereafter, to the extent the Mortgagor incurs

Environmental Costs in excess of the aggregate of the First Offset Amount and

Mortgagor’s Environmental Cost Amount, the Mortgagee agrees that the Mortgagor may

offset on a doliar for dollar basis against payments due to the Mortgage under this

Note the next $400,000 of Environmental Costs As used in this Note, the term

“Environmental Costs” includes, without limitation, all costs and expenses incurred

directly or indwectly by the Mortgagor, as determined by the Mortgagor, in the

Morigagor's reasonable discretion, to be necessary to determine the nature and extent

of contamination, to hold and attend public meetings, to prepare work plans and reports,

to enter into and manage a cleanup agreement with the New York State Department of

Environmental Conservation (‘NYSDEC’), to reimburse State costs, and to contain,

clean up, remove, remediate and restore conditions at the Mortgaged Property to be

protective, at a minimum, for restricted residential, recreational, restaurant and manna

uses, and if deemed necessary by the NYSDEC, to protect groundwater quality and

ecological resources Notwithstanding the foregoing, Environmental Costs shall not

include the costs of any Phase | ESA and Phase Il limited testing performed by

Morigagor, and shall include only testing costs incurred after a Phase II investigation

detects contamination at concentrations in excess of relevant levels (eg NYSDEC

TAGM 4048 recommended soil cleanup objectives, Part 703 surface water and

groundwater quality standards and/or sediment cleanup criteria), and after Mortgagor

determines, in Mortgagor's sole judgment, that NYSDEC involvement 1s necessary in

determining the appropnate remediation Any night of offset provided in this Paragraph

23 shall include the reasonable attorneys’ fees, costs and expenses incurred by

Mortgagor

(e) The Mortgagee hereby acknowledges that the Mortgagee has

applied to the New York State Office of General Services (‘OGS") for an amendment to

the Mortgagee's existing Submerged Land License (License Number LUW00753) (the

"OGS License”) to increase the number of slips permitted by the OGS License from 130

to 187, consisting of 177 rent producing sips, 5 service slips and 5 transient slips (the

“Amended OGS License") The Mortgagee further acknowledges that the Mortgagee's

ROCHDOCSH29IIS -9-

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Conspiracy of The RichDokument198 SeitenConspiracy of The Richthe.reverser100% (1)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- TilaDokument83 SeitenTilafisherre2000100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Financial Policy and Procedure Manual TemplateDokument31 SeitenFinancial Policy and Procedure Manual TemplatevanausabNoch keine Bewertungen

- Modes of Extinguishment of Obligation PDF FreeDokument6 SeitenModes of Extinguishment of Obligation PDF FreeRUBY JAN CASASNoch keine Bewertungen

- 4 CORPO Case Digest 4Dokument37 Seiten4 CORPO Case Digest 4Miko TabandaNoch keine Bewertungen

- Mora Solvendi (Delay of The Debtor)Dokument11 SeitenMora Solvendi (Delay of The Debtor)John Paul100% (1)

- Cambridge Place Investments V JPMorgan Chase, Credit Suisse, Bank of America, Barclays, Citigroup Country Wide, Deutsche Bank, Goldman Sachs, Merrill Lynch, Morgan Stanley, UBS Et AlDokument234 SeitenCambridge Place Investments V JPMorgan Chase, Credit Suisse, Bank of America, Barclays, Citigroup Country Wide, Deutsche Bank, Goldman Sachs, Merrill Lynch, Morgan Stanley, UBS Et AlForeclosure Fraud100% (1)

- PILOT Amended 2011Dokument4 SeitenPILOT Amended 2011xjaxNoch keine Bewertungen

- FYI No North Entry at Marge's FB Page CommentsDokument7 SeitenFYI No North Entry at Marge's FB Page CommentsxjaxNoch keine Bewertungen

- Irondequoit - FEPCDokument7 SeitenIrondequoit - FEPCxjaxNoch keine Bewertungen

- Bid Request May 19 2011Dokument1 SeiteBid Request May 19 2011xjaxNoch keine Bewertungen

- Bid Request May 12 2011Dokument1 SeiteBid Request May 12 2011xjaxNoch keine Bewertungen

- Karnataka Gramin Bank: Hand Book ON Legal Aspects of BankingDokument64 SeitenKarnataka Gramin Bank: Hand Book ON Legal Aspects of BankingDevaki Pradhan KamathNoch keine Bewertungen

- Appropriation, Allotment, Obligation and Disbursements: What Are Common Types of Appropriation?Dokument5 SeitenAppropriation, Allotment, Obligation and Disbursements: What Are Common Types of Appropriation?Niña Kristine AlinsonorinNoch keine Bewertungen

- Atmanirbhar Bharat (Part 1)Dokument19 SeitenAtmanirbhar Bharat (Part 1)Bhavneshsingh BhadauriyaNoch keine Bewertungen

- Mas Must AnswersDokument15 SeitenMas Must AnswersX YlmarixeNoch keine Bewertungen

- Dispute ResultsDokument12 SeitenDispute Resultsrichard winfreyNoch keine Bewertungen

- Numerical On Credit RiskDokument4 SeitenNumerical On Credit RiskLETS MAKE NIKKAH EASY AND HALALNoch keine Bewertungen

- Capital Market ProjectDokument35 SeitenCapital Market ProjectPushpa KamatNoch keine Bewertungen

- Financial Stability Report 2020Dokument95 SeitenFinancial Stability Report 2020RiannaNoch keine Bewertungen

- Caro - Companies (Auditor's Report) Order, 2020Dokument16 SeitenCaro - Companies (Auditor's Report) Order, 2020Ekansh AgarwalNoch keine Bewertungen

- Institutional Contacts:: School InfoDokument79 SeitenInstitutional Contacts:: School InfoMatt BrownNoch keine Bewertungen

- FIN4002 LQ 2122s2Dokument15 SeitenFIN4002 LQ 2122s2YMC SOEHKNoch keine Bewertungen

- Brewer8e GEs PPT Chapter 8 UpdDokument22 SeitenBrewer8e GEs PPT Chapter 8 UpdNguyễn Ngọc Quỳnh TiênNoch keine Bewertungen

- Investing in Corporate BondsDokument40 SeitenInvesting in Corporate BondsOliver LeeNoch keine Bewertungen

- Create A Intelligent Debt Consolidation Loans Plan With One of These Recommendationsapujo PDFDokument3 SeitenCreate A Intelligent Debt Consolidation Loans Plan With One of These Recommendationsapujo PDFforkmaria0Noch keine Bewertungen

- Theory Merged Material SFMDokument108 SeitenTheory Merged Material SFMKC XitizNoch keine Bewertungen

- Description: Tags: Employers HandbookDokument26 SeitenDescription: Tags: Employers Handbookanon-26282Noch keine Bewertungen

- MAC2602 - 2013 Assignment 1 of 2 SemesterDokument22 SeitenMAC2602 - 2013 Assignment 1 of 2 SemesterAmé MoutonNoch keine Bewertungen

- CHAPTER 8 - Audit of Liabilities: Problem 1Dokument27 SeitenCHAPTER 8 - Audit of Liabilities: Problem 1Mikaela Gale CatabayNoch keine Bewertungen

- SOA - LAI-00061947 - Wed Mar 31 10 - 51 - 22 UTC 2021Dokument4 SeitenSOA - LAI-00061947 - Wed Mar 31 10 - 51 - 22 UTC 2021shreeji metalNoch keine Bewertungen

- HSBC Vs ALdecoaDokument14 SeitenHSBC Vs ALdecoaJohn Felix Morelos DoldolNoch keine Bewertungen

- Case Discussion Questions Fall 2014Dokument6 SeitenCase Discussion Questions Fall 2014ketanNoch keine Bewertungen

- P&I Certificate of EntryDokument6 SeitenP&I Certificate of EntryWILLINTON HINOJOSA0% (1)