Beruflich Dokumente

Kultur Dokumente

Emphasis (14 Ed.) - New Delhi, India: Pearson. Ed.) .: Recommended Books

Hochgeladen von

ShaluRajtaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Emphasis (14 Ed.) - New Delhi, India: Pearson. Ed.) .: Recommended Books

Hochgeladen von

ShaluRajtaCopyright:

Verfügbare Formate

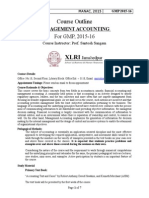

MANAGEMENT ACCOUNTING

L T P Cr.

3 0 0 3.0

Pre-requisite(s): None

Course Objectives:

This course emphasizes the use of accounting information for internal planning and control for

manufacturing and service sector purposes. The course is intended for individuals who make business

decisions and evaluate the performance of business units using data obtained from the cost and

management accounting systems.

Introduction to Cost and Management Accounting: Methods and Techniques of Product and Service

Costing, Cost Management and Value Chain Analysis.

Cost Volume Profit Analysis: Profit-Volume Ratio, Break even Analysis, Relevant Costs for

Decision-Making, Differential Costing,

Job Costing, Process Costing and Service Costing

Cost Allocation: Traditional methods, Activity Based Costing & Activity Based Management.

Budgeting and Responsibility Accounting: Flexible Budgets, Standard Costing and Variance Analysis,

Management Control System.

Contemporary themes in Cost and Management Accounting: Target Costing, Life Cycle Costing,

Balanced Scorecard and Strategic Profitability Analysis, Transfer Pricing.

Learning Outcomes:

Upon successful completion of the course, the students should be able to

1.

2.

3.

4.

5.

Obtain information on planning and control of various costs

Measure performance evaluation of various costs

Analyze the relevant costing information for making strategic decisions

Understand the role and use of financial statements

Make the budgets under various real world conditions

Recommended Books:

1. Horngren, C.T., Datar, S. M., and Rajan, M. V. (2013). Cost Accounting: A Managerial

Emphasis (14th ed.). New Delhi, India: Pearson.

2. Anthony, R. N., Hawkins, D. F. and Merchant, K. A. (2013). Accounting: Text & Cases (13th ed.).

New Delhi, India: McGraw Hill.

Das könnte Ihnen auch gefallen

- Management Accounting (MBA)Dokument5 SeitenManagement Accounting (MBA)Razzaqeee100% (1)

- Managerial Accounting-Qazi Saud AhmedDokument4 SeitenManagerial Accounting-Qazi Saud Ahmedqazisaudahmed100% (1)

- Cost and Management Accounting Learning ObjectivesDokument22 SeitenCost and Management Accounting Learning ObjectivesvyajivvNoch keine Bewertungen

- Rural Marketing Project ReportDokument35 SeitenRural Marketing Project Reportkamdica100% (12)

- Rural Marketing Project ReportDokument35 SeitenRural Marketing Project Reportkamdica100% (12)

- Rural Marketing Project ReportDokument35 SeitenRural Marketing Project Reportkamdica100% (12)

- Value Chain Analysis: A Strategic Management Accounting ToolDokument5 SeitenValue Chain Analysis: A Strategic Management Accounting ToolNehal AbdellatifNoch keine Bewertungen

- Apple UkDokument25 SeitenApple UkShaluRajtaNoch keine Bewertungen

- Cost and Management Accounting PDFDokument2 SeitenCost and Management Accounting PDFRajat Goyal80% (5)

- ACCT 130-Principles of Management Accounting-Abdul Rauf-Ayesha Bhatti-Samia Kokhar-Junaid AshrafDokument7 SeitenACCT 130-Principles of Management Accounting-Abdul Rauf-Ayesha Bhatti-Samia Kokhar-Junaid AshrafmuhammadmusakhanNoch keine Bewertungen

- MBA Project On Job SatisfactionDokument105 SeitenMBA Project On Job SatisfactionSenthilmurugan Paramasivan100% (1)

- MBA Project On Job SatisfactionDokument105 SeitenMBA Project On Job SatisfactionSenthilmurugan Paramasivan100% (1)

- Supply Chain Performance ManagementDokument32 SeitenSupply Chain Performance ManagementAman AgrawalNoch keine Bewertungen

- Management Accounting - Costing and Budgeting (Edexcel)Dokument21 SeitenManagement Accounting - Costing and Budgeting (Edexcel)Nguyen Dac Thich100% (1)

- ACC502Dokument6 SeitenACC502waheedahmedarainNoch keine Bewertungen

- SyllabusDokument1 SeiteSyllabusjessicasudlowNoch keine Bewertungen

- Bmac5203 Accounting For Business Decision Making (Outline)Dokument4 SeitenBmac5203 Accounting For Business Decision Making (Outline)podxNoch keine Bewertungen

- Course CostDokument3 SeitenCourse CostZekarias KestoNoch keine Bewertungen

- Management Control System CourseDokument3 SeitenManagement Control System CourseKartikeyBhardwajNoch keine Bewertungen

- Teaching and Learning at Cuz-1Dokument12 SeitenTeaching and Learning at Cuz-1KIMBERLY MUKAMBANoch keine Bewertungen

- KU MBA Syllabus 2013Dokument4 SeitenKU MBA Syllabus 2013Vinod JoshiNoch keine Bewertungen

- ManacDokument3 SeitenManacMark Anthony ManarangNoch keine Bewertungen

- Cost and Capital Accounting For Decision MakingDokument2 SeitenCost and Capital Accounting For Decision MakingRishi CharanNoch keine Bewertungen

- Cost &MGMT Acc For ABVMDokument71 SeitenCost &MGMT Acc For ABVMabdigedefa49Noch keine Bewertungen

- Cost Accounting 1 BBA 2020 ManualDokument122 SeitenCost Accounting 1 BBA 2020 ManualSangulukani ChirwaNoch keine Bewertungen

- Managment AccountingDokument9 SeitenManagment AccountingRobel GuiseppeNoch keine Bewertungen

- Cost Sheet-NEW FORMAT - RevisedDokument3 SeitenCost Sheet-NEW FORMAT - RevisedJuhie GuptaNoch keine Bewertungen

- Cost & Management Accounting MBEDokument4 SeitenCost & Management Accounting MBEnobie125Noch keine Bewertungen

- Bac 205 Aeb 403 M.A Course OutlineDokument2 SeitenBac 205 Aeb 403 M.A Course OutlineKelvin mwaiNoch keine Bewertungen

- Strategic Cost ManagementDokument3 SeitenStrategic Cost ManagementShubakar ReddyNoch keine Bewertungen

- Course Title: Advanced Cost and Management Accounting Course Code: ACFN 521 Credit Hours: 3 Ects: 7 Course DescriptionDokument4 SeitenCourse Title: Advanced Cost and Management Accounting Course Code: ACFN 521 Credit Hours: 3 Ects: 7 Course DescriptionSefiager MarkosNoch keine Bewertungen

- BAC3674 - Syllabus Sem1 2013-2014Dokument7 SeitenBAC3674 - Syllabus Sem1 2013-2014secsmyNoch keine Bewertungen

- 1-Accounting For ManagersDokument3 Seiten1-Accounting For ManagersGaurav GoyalNoch keine Bewertungen

- ACC 550 SyllabusDokument8 SeitenACC 550 Syllabusjvj1234Noch keine Bewertungen

- BMT6125 - Costing-Methods-And-Techniques - TH - 1.0 - 55 - BMT6125 - 54 AcpDokument2 SeitenBMT6125 - Costing-Methods-And-Techniques - TH - 1.0 - 55 - BMT6125 - 54 AcpchrisNoch keine Bewertungen

- Accounting III ACCT 1120: Metropolitan Community College Course Outline FormDokument5 SeitenAccounting III ACCT 1120: Metropolitan Community College Course Outline FormHumberto Romero ZecuaNoch keine Bewertungen

- P2 Performance ManagementDokument3 SeitenP2 Performance ManagementShane AndrewNoch keine Bewertungen

- BBA Acct MgrsDokument3 SeitenBBA Acct MgrsKanishq BawejaNoch keine Bewertungen

- TB 1 Akuntansi Manajemen Stratejik - Faiz NarendraputraDokument11 SeitenTB 1 Akuntansi Manajemen Stratejik - Faiz NarendraputraFaiz NarendraputraNoch keine Bewertungen

- Course Outline-MANACDokument7 SeitenCourse Outline-MANACdkrirayNoch keine Bewertungen

- Costing An Overview of Cost and Management Accounting 1 PDFDokument6 SeitenCosting An Overview of Cost and Management Accounting 1 PDFkeerthi100% (2)

- SCM (Chapter1)Dokument19 SeitenSCM (Chapter1)Aryle VillanuevaNoch keine Bewertungen

- UQ Acct2102 Notes (Midsems)Dokument28 SeitenUQ Acct2102 Notes (Midsems)Henry WongNoch keine Bewertungen

- Strategic Cost Management (SCM) - A Re-Vision!!: Prof. Priyanka AcharyaDokument61 SeitenStrategic Cost Management (SCM) - A Re-Vision!!: Prof. Priyanka AcharyaRohit PatilNoch keine Bewertungen

- 1 MGT Accg For MBA Course Outline KMU 2020-21 MTDokument4 Seiten1 MGT Accg For MBA Course Outline KMU 2020-21 MTassuluxuryapartmentsNoch keine Bewertungen

- II 2ManagerialAccountingDokument2 SeitenII 2ManagerialAccountingRaja ShahabNoch keine Bewertungen

- Expectations AssumptionsDokument15 SeitenExpectations AssumptionsPrasunkumar PandeyNoch keine Bewertungen

- MIT First Grade College Cost Management Lecture NotesDokument141 SeitenMIT First Grade College Cost Management Lecture NotesprajwalNoch keine Bewertungen

- Cost Accountin Couse Out LineDokument6 SeitenCost Accountin Couse Out Linem_waseem_bariNoch keine Bewertungen

- Temp 1Dokument13 SeitenTemp 1KIMBERLY MUKAMBANoch keine Bewertungen

- (BBA) Managerial Accounting GCUFDokument5 Seiten(BBA) Managerial Accounting GCUFnadirNoch keine Bewertungen

- Introduction to Management AccountingDokument10 SeitenIntroduction to Management AccountingAyub ChowdhuryNoch keine Bewertungen

- Module 1Dokument7 SeitenModule 1RobynNoch keine Bewertungen

- Managerial Accounting Insights for Decision MakingDokument0 SeitenManagerial Accounting Insights for Decision MakingMichael YuNoch keine Bewertungen

- Revenue Management - Course OutlineDokument4 SeitenRevenue Management - Course OutlineNANCY BANSALNoch keine Bewertungen

- Course OutlineDokument4 SeitenCourse OutlineAhmad MuzzammilNoch keine Bewertungen

- Core BBADokument195 SeitenCore BBAMohammed MubeenNoch keine Bewertungen

- Cost AccountingDokument20 SeitenCost AccountingGargi MPNoch keine Bewertungen

- ACC301 Sem1Dokument24 SeitenACC301 Sem1Kei LiewNoch keine Bewertungen

- Cost & MGMT Acct I - ModuleDokument213 SeitenCost & MGMT Acct I - ModuleBereket DesalegnNoch keine Bewertungen

- Title of Degree Program: Defination of Credit Hours: Degree Plan: Prerequisites: Course Offered: Course TtleDokument5 SeitenTitle of Degree Program: Defination of Credit Hours: Degree Plan: Prerequisites: Course Offered: Course TtleHoundsterama50% (2)

- Principles of Management Accounting-Muhammad Junaid Ashraf & Abdul RaufDokument8 SeitenPrinciples of Management Accounting-Muhammad Junaid Ashraf & Abdul RaufAnonymous qAegy6GNoch keine Bewertungen

- Management Accounting IntroductionDokument54 SeitenManagement Accounting IntroductionambrosiaeffectNoch keine Bewertungen

- Mba Semester - 4Dokument8 SeitenMba Semester - 4Janu S VimalNoch keine Bewertungen

- Managerial AccountingDokument74 SeitenManagerial AccountingCodyxanss100% (1)

- HR 6303 Labour Laws and Industrial RelationsDokument4 SeitenHR 6303 Labour Laws and Industrial RelationsShaluRajtaNoch keine Bewertungen

- Team Lead-Role DiscriptionDokument1 SeiteTeam Lead-Role DiscriptionShaluRajtaNoch keine Bewertungen

- Analyze Job Satisfaction of Employees at GNFC PDFDokument106 SeitenAnalyze Job Satisfaction of Employees at GNFC PDFShaluRajta0% (1)

- ReportDokument65 SeitenReportShaluRajtaNoch keine Bewertungen

- C - Workmen Compen ActDokument16 SeitenC - Workmen Compen ActMeiling MizukiNoch keine Bewertungen

- ReportDokument65 SeitenReportShaluRajtaNoch keine Bewertungen

- Reliability and ValidityDokument2 SeitenReliability and ValidityharmanNoch keine Bewertungen

- Waste Into DecorationDokument4 SeitenWaste Into DecorationShaluRajtaNoch keine Bewertungen

- PCM Case StudyDokument10 SeitenPCM Case StudyShaluRajtaNoch keine Bewertungen

- Waste Into DecorationDokument4 SeitenWaste Into DecorationShaluRajtaNoch keine Bewertungen

- Kumudini Manda Summers Report SHRMDokument41 SeitenKumudini Manda Summers Report SHRMYamini SharmaNoch keine Bewertungen

- Hospital Study - Relationship BTWN Emp. Satisfaction and Pt. ExperiencesDokument31 SeitenHospital Study - Relationship BTWN Emp. Satisfaction and Pt. ExperiencesShaluRajtaNoch keine Bewertungen

- Job Satisfaction Among Bank Employees An Analysis of The Contributing Variables Towards Job SatisfactionDokument10 SeitenJob Satisfaction Among Bank Employees An Analysis of The Contributing Variables Towards Job SatisfactionShaluRajtaNoch keine Bewertungen

- Lean and Six SigmaDokument1 SeiteLean and Six SigmaShaluRajtaNoch keine Bewertungen

- Factor AnalysisDokument22 SeitenFactor Analysissubash1983Noch keine Bewertungen