Beruflich Dokumente

Kultur Dokumente

Elements To Look Into As A Smart Investor

Hochgeladen von

Grace Ho0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

6 Ansichten5 SeitenElements to look into as a smart investor

Originaltitel

Elements to look into as a smart investor

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenElements to look into as a smart investor

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

6 Ansichten5 SeitenElements To Look Into As A Smart Investor

Hochgeladen von

Grace HoElements to look into as a smart investor

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 5

grace

Overall Comparison Maxis

Vs DiGi

Overall, Maxis Bhds performance

has improved compared with year

2013 and year 2014

For example, both profit margin of

Maxis Bhd increases rapidly, both

current ratio and acid test ratio are

higher than previous year

Maxis Bhds performance can be

considered as good in business

based on the fundamental analysis

used by majority investors, Maxis

Bhd is not a good investment

ROSF

Dividend

Payout Ratio

Earnings Per

Share

ROSF ratio is relatively low as it is an

important measure on a companys

earnings performance

the dividend payout ratio has dropped

in year 2014

earnings per share of Maxis Bhd also

dropped as well

Thus, Digi is a better investment

compared to Maxis

Das könnte Ihnen auch gefallen

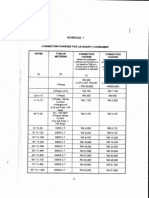

- TNB ChargesDokument6 SeitenTNB Chargesjamescad4259Noch keine Bewertungen

- Effects of Store Loyalty On Shopping Mall Loyalty 2012 Journal of Retailing and Consumer ServicesDokument8 SeitenEffects of Store Loyalty On Shopping Mall Loyalty 2012 Journal of Retailing and Consumer ServicesGrace HoNoch keine Bewertungen

- Thirteenth ScheduleDokument28 SeitenThirteenth ScheduleGrace HoNoch keine Bewertungen

- Malaysian Shopping Mall BehaviorDokument22 SeitenMalaysian Shopping Mall BehaviorGrace HoNoch keine Bewertungen

- Retail DevelopmentDokument14 SeitenRetail DevelopmentGrace HoNoch keine Bewertungen

- Investigation of The Effects of Stores' Tenant Mix and Internal andDokument7 SeitenInvestigation of The Effects of Stores' Tenant Mix and Internal andGrace HoNoch keine Bewertungen

- Store Managers - The Seismographs in Shopping CentresDokument28 SeitenStore Managers - The Seismographs in Shopping CentresGrace HoNoch keine Bewertungen

- A Theoretical Model of The Impact of A Bundle of Determinants Visiting and Shopping IntentionsDokument13 SeitenA Theoretical Model of The Impact of A Bundle of Determinants Visiting and Shopping IntentionsGrace HoNoch keine Bewertungen

- A Theoretical Model of The Impact of A Bundle of Determinants Visiting and Shopping IntentionsDokument13 SeitenA Theoretical Model of The Impact of A Bundle of Determinants Visiting and Shopping IntentionsGrace HoNoch keine Bewertungen

- SummaryDokument2 SeitenSummaryGrace HoNoch keine Bewertungen

- The Management of Housing Supply in Mala PDFDokument19 SeitenThe Management of Housing Supply in Mala PDFGrace HoNoch keine Bewertungen

- Higher Algebra - Hall & KnightDokument593 SeitenHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Industrial Training DiaryDokument27 SeitenIndustrial Training DiaryGrace HoNoch keine Bewertungen

- Land Acquisition ActDokument76 SeitenLand Acquisition ActragasvarupNoch keine Bewertungen

- Higher Algebra - Hall & KnightDokument593 SeitenHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 20.9.2019 DSK IBF7712 Financial InclusionDokument88 Seiten20.9.2019 DSK IBF7712 Financial InclusionIsnan Hari MardikaNoch keine Bewertungen

- Procter Gamble AnalysisDokument37 SeitenProcter Gamble Analysisapi-115328034100% (2)

- Internation Al Financial ManagementDokument17 SeitenInternation Al Financial ManagementDr-Rajshree Sharma PathakNoch keine Bewertungen

- p6 7 You Are Given The Following Details For The Year PDFDokument1 Seitep6 7 You Are Given The Following Details For The Year PDFhassan taimourNoch keine Bewertungen

- Franshise Licencse Turnkey ProjectDokument6 SeitenFranshise Licencse Turnkey ProjectVõ Minh QuânNoch keine Bewertungen

- Autocallable Contingent Income Barrier Notes: HSBC Usa Inc. $2,920,000Dokument19 SeitenAutocallable Contingent Income Barrier Notes: HSBC Usa Inc. $2,920,000caslusNoch keine Bewertungen

- SPH AnnualReport PDFDokument259 SeitenSPH AnnualReport PDFWeihong TeoNoch keine Bewertungen

- Introduction To Accounting 1. Definition Accounting Standardcouncil (Asc)Dokument14 SeitenIntroduction To Accounting 1. Definition Accounting Standardcouncil (Asc)Simon Marquis LUMBERANoch keine Bewertungen

- Bombay Stock ExchangeDokument41 SeitenBombay Stock Exchangekhariharan88% (8)

- Great Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted ByDokument6 SeitenGreat Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted ByAbhishek ChaurasiaNoch keine Bewertungen

- Dividend PolicyDokument12 SeitenDividend PolicyAkshita raj SinhaNoch keine Bewertungen

- (Intl Investment) Chapter 2 FDIDokument74 Seiten(Intl Investment) Chapter 2 FDIJane VickyNoch keine Bewertungen

- Financial Analysis AssignmentDokument5 SeitenFinancial Analysis AssignmentSaifiNoch keine Bewertungen

- Basel IV Big BangDokument13 SeitenBasel IV Big BangfilNoch keine Bewertungen

- Essentials of Investments 8th Edition 3 PDFDokument46 SeitenEssentials of Investments 8th Edition 3 PDFRadwan MagicienNoch keine Bewertungen

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDokument12 SeitenUniversity of Cambridge International Examinations General Certificate of Education Ordinary LevelDhoni KhanNoch keine Bewertungen

- Theoretical Framework of Foreign Direct InvestmentDokument18 SeitenTheoretical Framework of Foreign Direct Investmentmahantesh123100% (8)

- Some of The Accounting Recits PointersDokument7 SeitenSome of The Accounting Recits PointersJoseNoch keine Bewertungen

- ENCON Private PlacementDokument56 SeitenENCON Private PlacementKenneth Awoonor-RennerNoch keine Bewertungen

- Financial Management (Keshav Kasyap)Dokument5 SeitenFinancial Management (Keshav Kasyap)keshav kashyapNoch keine Bewertungen

- Solved Kress Products Corporate Charter Authorized The Firm To Sell 800 000Dokument1 SeiteSolved Kress Products Corporate Charter Authorized The Firm To Sell 800 000Anbu jaromiaNoch keine Bewertungen

- Working Capital Management - 1 Assignment 11: M Arbaz Khan 18u00254Dokument1 SeiteWorking Capital Management - 1 Assignment 11: M Arbaz Khan 18u00254Arbaz KhanNoch keine Bewertungen

- 03 - FRM 15. Robert McDonald, Derivatives Markets, 2nd Edition (Ch. 6 Commodity Forwards and Futures)Dokument18 Seiten03 - FRM 15. Robert McDonald, Derivatives Markets, 2nd Edition (Ch. 6 Commodity Forwards and Futures)aditya singhNoch keine Bewertungen

- Economic Diversification in The GCC CountriesDokument55 SeitenEconomic Diversification in The GCC CountriesWinnie YeungNoch keine Bewertungen

- (GEMATMW) InvestagramsDokument3 Seiten(GEMATMW) InvestagramsCourtney TulioNoch keine Bewertungen

- Portfolio Management: Tutorial 4Dokument46 SeitenPortfolio Management: Tutorial 4chziNoch keine Bewertungen

- Nepal Major Contracts PDFDokument1.057 SeitenNepal Major Contracts PDFgau shresNoch keine Bewertungen

- Canada Immigration Forms: 4000EDokument34 SeitenCanada Immigration Forms: 4000EOleksiy Kovyrin100% (4)

- NRI Japan Report enDokument84 SeitenNRI Japan Report enSungyun KimNoch keine Bewertungen

- Filter rule evidence against EMH semi-strong formDokument3 SeitenFilter rule evidence against EMH semi-strong formTaySyYinNoch keine Bewertungen