Beruflich Dokumente

Kultur Dokumente

Kaplan T3 CAT

Hochgeladen von

digitalbooksCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Kaplan T3 CAT

Hochgeladen von

digitalbooksCopyright:

Verfügbare Formate

SESSION 14 BANK RECONCILIATION STATEMENTS

Prepare a bank reconciliation statement as at 31 July.

Cash book

Bank reconciliation statement as at 31 July

$

Balance per bank statement

Less: Unpresented cheque

Add: Uncleared lodgement

Balance per cash book

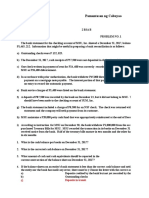

EXAMPLE 4

The following information has been extracted from the records of N. Patel:

Bank account

$

1 Dec

Balance b/d

2 Dec

Able

Chq. no.

16,491

1 Dec

Alexander

782

857

962

6 Dec

Burgess

783

221

Baker

1,103

14 Dec

Barry

784

511

10 Dec

Charlie

2,312

17 Dec

Cook

785

97

14 Dec

Delta

419

24 Dec

Hay

786

343

21 Dec

Echo

327

29 Dec

Rent

787

260

23 Dec

Cash sales

529

30 Dec

Fred

119

31 Dec

Balance c/d

22,262

KAPLAN PUBLISHING

19,973

22,262

1 49

CAT PAPER 3 (INT) MAINTAINING FINANCIAL RECORDS (MFR)

High Street Bank

Bank Statement N. Patel

Date

Details

Withdrawals

Deposits

Balance

1 December

Balance b/f

16,491

5 December

782

5 December

Bank charges

6 December

Deposit

10 December

Standing order (rates)

137

17,515

11 December

783

212

17,303

13 December

Deposit

17 December

784

17 December

Deposit

419

19,523

23 December

Deposit

327

19,850

24 December

Deposit

528

20,378

28 December

786

343

20,035

30 December

310923

297

19,738

31 December

Balance c/f

857

47

15,587

2,065

2,312

511

17,652

19,615

19,104

19,738

Required:

(a)

Update the cash book for December.

(b)

Prepare a bank reconciliation statement at 31 December.

(c)

Why do we prepare a monthly reconciliation statement?

SESSION SUMMARY

These are the steps to completing a bank reconciliation statement:

Tick off the common entries (tick from the cash book to the bank statement).

Ensure that the opening balances can be reconciled:

If the opening balances do not agree, identify the outstanding items from the previous

month. Establish the first cheque number of the current month all previous cheque

numbers are outstanding cheques. If there is still a difference, look at the first lodgements

of the month. Tick off these outstanding items in the bank statement.

Update the cash book with unticked items on the bank statement.

Enter outstanding items in the reconciliation statement, i.e. unticked items in the cash

book.

Correct any errors and complete the reconciliation statement.

1 50

KAPLAN PUBLISHING

Das könnte Ihnen auch gefallen

- Audit Prob - Cash and Cash EquivalentsDokument48 SeitenAudit Prob - Cash and Cash EquivalentsCharis Marie Urgel85% (48)

- Ecklund Pre - General Filing MN03ADokument16 SeitenEcklund Pre - General Filing MN03ASally Jo SorensenNoch keine Bewertungen

- National Inc. cash audit problemDokument25 SeitenNational Inc. cash audit problemAnna Taylor75% (4)

- Bank ReconciliationDokument21 SeitenBank Reconciliationehab_ghazallaNoch keine Bewertungen

- 3Dokument3 Seiten3Lazy LeathNoch keine Bewertungen

- Acct205 Cap8Dokument6 SeitenAcct205 Cap8devoflashNoch keine Bewertungen

- Cash Books QuestionsDokument15 SeitenCash Books QuestionsSigei Leonard57% (7)

- 17640Dokument65 Seiten17640Rachel E. Stassen-BergerNoch keine Bewertungen

- Dave Pinto ReportDokument8 SeitenDave Pinto Reporttheracefor64bNoch keine Bewertungen

- Scott Honour's Campaign Finance Report For Governor - 2013Dokument65 SeitenScott Honour's Campaign Finance Report For Governor - 2013mbrodkorbNoch keine Bewertungen

- BankrecDokument24 SeitenBankrecehab_ghazallaNoch keine Bewertungen

- Bank Reconciliation Four ColumnDokument2 SeitenBank Reconciliation Four ColumnZulfi Rahman Hakim100% (3)

- Bank ReconciliationDokument3 SeitenBank Reconciliationp12400Noch keine Bewertungen

- (A) (B) (C) (D) (E) (F) (G) : Cacwo Fundamentals of AccountingDokument53 Seiten(A) (B) (C) (D) (E) (F) (G) : Cacwo Fundamentals of AccountingacademianotesNoch keine Bewertungen

- Audit of Cash 6Dokument2 SeitenAudit of Cash 6Raz MahariNoch keine Bewertungen

- Filed: State Board of Accounts 302 West Washington Street Room E418 INDIANAPOLIS, INDIANA 46204-2769Dokument42 SeitenFiled: State Board of Accounts 302 West Washington Street Room E418 INDIANAPOLIS, INDIANA 46204-2769sivaganesh1903Noch keine Bewertungen

- General Ledger of Jl. Ki Hajar Dewantara No. 1 PEMALANGDokument33 SeitenGeneral Ledger of Jl. Ki Hajar Dewantara No. 1 PEMALANGMuhammad Fajrul UmamNoch keine Bewertungen

- Report of Receipts and Expenditures For Principal Campaign CommitteeDokument43 SeitenReport of Receipts and Expenditures For Principal Campaign CommitteeRachel E. Stassen-BergerNoch keine Bewertungen

- Bank Reconciliation GuideDokument21 SeitenBank Reconciliation GuidePrassanna Kumari100% (2)

- Audit of CashDokument7 SeitenAudit of CashEvelynGonzalesNoch keine Bewertungen

- Prelim-Pr 2a14fb4488c3b5b235Dokument11 SeitenPrelim-Pr 2a14fb4488c3b5b235Romina LopezNoch keine Bewertungen

- 3 GL LectureDokument20 Seiten3 GL LectureimranmughalmaniNoch keine Bewertungen

- Manage petty cash and bank reconciliation reportsDokument2 SeitenManage petty cash and bank reconciliation reportsAlwidg WidgNoch keine Bewertungen

- LaValle January 2012 PeriodicDokument20 SeitenLaValle January 2012 PeriodicRiverheadLOCALNoch keine Bewertungen

- Randiddle Comprehensive Solution 1 0Dokument26 SeitenRandiddle Comprehensive Solution 1 0Jaudi89100% (1)

- Losquadro January 2012Dokument13 SeitenLosquadro January 2012RiverheadLOCALNoch keine Bewertungen

- P1-01 Cash and Cash EquivalentsDokument5 SeitenP1-01 Cash and Cash EquivalentsRachel LeachonNoch keine Bewertungen

- Audit of Cash: Problem No. 1Dokument4 SeitenAudit of Cash: Problem No. 1Kathrina RoxasNoch keine Bewertungen

- Computer Services LTD Bookkeeping ProjectDokument8 SeitenComputer Services LTD Bookkeeping ProjectAlex GrecuNoch keine Bewertungen

- Mark Dayton's Campaign Finance Report For Governor - 2013Dokument106 SeitenMark Dayton's Campaign Finance Report For Governor - 2013mbrodkorbNoch keine Bewertungen

- AP-5907 CashDokument12 SeitenAP-5907 CashAiko E. LaraNoch keine Bewertungen

- Viaions of The EndDokument5 SeitenViaions of The EndDon PayneNoch keine Bewertungen

- Report of Receipts and Expenditures For Principal Campaign CommitteeDokument42 SeitenReport of Receipts and Expenditures For Principal Campaign CommitteeRachel E. Stassen-BergerNoch keine Bewertungen

- Wionthl Y Operating Report Summary For Month Of:: De1ta Produce, LP 12... 00073-lmc-11Dokument13 SeitenWionthl Y Operating Report Summary For Month Of:: De1ta Produce, LP 12... 00073-lmc-11Chapter 11 DocketsNoch keine Bewertungen

- Due To BIR AnalysisDokument8 SeitenDue To BIR AnalysisJeremiah TrinidadNoch keine Bewertungen

- Cce 3Dokument2 SeitenCce 3Charish Jane Antonio CarreonNoch keine Bewertungen

- Empleo Chapter 2 Finacc 1Dokument9 SeitenEmpleo Chapter 2 Finacc 1kim tumanganNoch keine Bewertungen

- Online Auditing II Seatwork Proof of Cash - LizaDokument2 SeitenOnline Auditing II Seatwork Proof of Cash - LizaNicolas ErnestoNoch keine Bewertungen

- TH TH TH TH TH RD TH ND TH TH TH THDokument2 SeitenTH TH TH TH TH RD TH ND TH TH TH THselina fraserNoch keine Bewertungen

- Petty Cash Book BDokument15 SeitenPetty Cash Book Bgnanaselvi88Noch keine Bewertungen

- Bank Recon - November 2014Dokument69 SeitenBank Recon - November 2014Jonathan MalongNoch keine Bewertungen

- Bank Reconciliation Statement - Docx QueDokument5 SeitenBank Reconciliation Statement - Docx QueannahkaupaNoch keine Bewertungen

- A Cash JacjakDokument7 SeitenA Cash JacjakIsaacNoch keine Bewertungen

- Accounting SolutionsDokument30 SeitenAccounting SolutionsmerityesNoch keine Bewertungen

- Acctg 3 OutputDokument39 SeitenAcctg 3 Outputjack9olorvidaNoch keine Bewertungen

- Fundamental of Accounting Assignment I Group 2Dokument3 SeitenFundamental of Accounting Assignment I Group 2robsancryptoNoch keine Bewertungen

- Virtual Account ManagerDokument243 SeitenVirtual Account ManagerChibby GoodhopeNoch keine Bewertungen

- PerdiscoDokument10 SeitenPerdiscogarytrollingtonNoch keine Bewertungen

- Problem 9Dokument5 SeitenProblem 9Tk KimNoch keine Bewertungen

- ACCT1501 Perdisco Bank StatementDokument1 SeiteACCT1501 Perdisco Bank StatementLauren De Zilva50% (2)

- TC Personal BK StatementsDokument59 SeitenTC Personal BK StatementsdiannedawnNoch keine Bewertungen

- Gloria Zaiger ReportDokument6 SeitenGloria Zaiger Reporttheracefor64bNoch keine Bewertungen

- The Panic of 1907: Heralding a New Era of Finance, Capitalism, and DemocracyVon EverandThe Panic of 1907: Heralding a New Era of Finance, Capitalism, and DemocracyBewertung: 4 von 5 Sternen4/5 (2)

- Bs-I To Viii Fep Jun 2012Dokument55 SeitenBs-I To Viii Fep Jun 2012digitalbooksNoch keine Bewertungen

- ReturnDokument12 SeitenReturnfarhanjan_786Noch keine Bewertungen

- E Branch ListDokument9 SeitenE Branch ListdigitalbooksNoch keine Bewertungen

- Taking Your First Objective Test PDFDokument5 SeitenTaking Your First Objective Test PDFPiyal HossainNoch keine Bewertungen

- Comments On SSTA 2014 15Dokument13 SeitenComments On SSTA 2014 15digitalbooksNoch keine Bewertungen

- FBR Sales TaxDokument27 SeitenFBR Sales TaxdigitalbooksNoch keine Bewertungen

- 7100 2015 WinterDokument15 Seiten7100 2015 WinterdigitalbooksNoch keine Bewertungen

- Aca Planner 2016.ashxDokument1 SeiteAca Planner 2016.ashxSelva Bavani SelwaduraiNoch keine Bewertungen

- ProvincialBudget 2015Dokument11 SeitenProvincialBudget 2015Ahmed Imtiaz RaoNoch keine Bewertungen

- Guidance Notes For Tutors and Students - FINALDokument2 SeitenGuidance Notes For Tutors and Students - FINALsatadruNoch keine Bewertungen

- ST Return.v6 (SST03)Dokument5 SeitenST Return.v6 (SST03)digitalbooksNoch keine Bewertungen

- Accounting Guide SecpDokument16 SeitenAccounting Guide SecpadeebNoch keine Bewertungen

- m92 Examination Guide - 01 April 2015 To 30 April 2016Dokument25 Seitenm92 Examination Guide - 01 April 2015 To 30 April 2016digitalbooksNoch keine Bewertungen

- ReturnDokument12 SeitenReturnfarhanjan_786Noch keine Bewertungen

- General Supplies List For Household Items: General Supplies Arts and Crafts Supplies Art (All Grades)Dokument1 SeiteGeneral Supplies List For Household Items: General Supplies Arts and Crafts Supplies Art (All Grades)digitalbooksNoch keine Bewertungen

- JRC - Company ProfileDokument7 SeitenJRC - Company ProfiledigitalbooksNoch keine Bewertungen

- Import Export DocumentationDokument14 SeitenImport Export DocumentationWarisJamalNoch keine Bewertungen

- UokDokument70 SeitenUokdigitalbooksNoch keine Bewertungen

- ReturnDokument12 SeitenReturnfarhanjan_786Noch keine Bewertungen

- Cost Accounting - MaterialDokument3 SeitenCost Accounting - MaterialFarhadMohsinNoch keine Bewertungen

- Part 1-FinObj MCQDokument21 SeitenPart 1-FinObj MCQdigitalbooksNoch keine Bewertungen

- ReturnDokument12 SeitenReturnfarhanjan_786Noch keine Bewertungen

- Air Way Bill SampleDokument1 SeiteAir Way Bill SampledigitalbooksNoch keine Bewertungen

- Imp PointsDokument2 SeitenImp PointsdigitalbooksNoch keine Bewertungen

- Bank Sofp Analysis Consulting DivisionDokument20 SeitenBank Sofp Analysis Consulting DivisionhopeaccaNoch keine Bewertungen

- Question #2 - 30 Marks: Module 9 - Management Accounting ProjectDokument4 SeitenQuestion #2 - 30 Marks: Module 9 - Management Accounting ProjectdigitalbooksNoch keine Bewertungen

- BPTDokument7 SeitenBPTdigitalbooksNoch keine Bewertungen

- Math IGCSE 2010 Paper 2 Marking SchemeDokument3 SeitenMath IGCSE 2010 Paper 2 Marking Schemesabisgeek92% (13)

- Times Are Changing : Your Guide To The Latest Evolution of The AcaDokument24 SeitenTimes Are Changing : Your Guide To The Latest Evolution of The AcahopeaccaNoch keine Bewertungen