Beruflich Dokumente

Kultur Dokumente

MNJEC DEPARTMENT OF MANAGEMENT STUDIES MBA ACCOUNTING MODEL EXAM

Hochgeladen von

Ram VasuOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MNJEC DEPARTMENT OF MANAGEMENT STUDIES MBA ACCOUNTING MODEL EXAM

Hochgeladen von

Ram VasuCopyright:

Verfügbare Formate

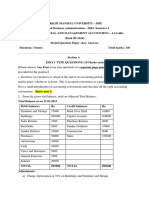

MISRIMAL NAVAJEE MUNOTH JAIN ENGINEERING COLLEGE

DEPARTMENT: MANAGEMENT STUDIES DEGREE PROGRAMME : MBA

ACADEMIC YEAR: 2015-16

: SEMESTER I

SUBJECT CODE : BA 7106 TITLE : ACCOUNTING FOR MANAGEMENT

DATE: /12/2014

MODEL EXAM

TIME: 3 Hrs MAX. MARKS: 100

---------------------------------------------------------------------------------------------------------------------------------------------

Answer all the Questions

Part A (10 x 2 = 20 Marks)

1. What is financial Accounting?

2. What are personal accounts?

3. What is allotment of shares?

4. What is forfeiture of shares?

5. Write short note on operating ratio?

6. Define cash flow statement?

7. What are the essentials of a good costing system?

8. Define process costing?

9. Why is there a need for computeriseed accounting?

10. Write a note on reserved account groups?

Part B ( 5 x 16 = 80 Marks)

11. (a) State the function of accounting. Elaborate?

[OR]

(b) Write an essay on Human resource accounting and inflation accounting

12. (a) (i) Write the company share capital of journal entries?

(ii) Write the format of final accounts?

[OR]

(b) AC Ltd offered 100000 equity shares of nominal value of Rs 10 each for public subscription at Rs 12.

Amount payable Application: 4.50 on Allotment: 4.50(Including premium) on First & Final call Rs 3

Subscription made was only for 90,000 Shares. All money received except from Ravi. Who had taken

1000 shares failed to pay the final call. His shares were forfeited and reissued to Kumar at Rs 6 each.

Show the journal entries in the books of company.

13.

(a) Explain the sources of funds and application of funds to be presented in Fund Flow Statement and

Explain the uses and limitation of fund flow statement?

[OR]

(b) From the following balance sheet. Prepare fund flow statement

Particulars

2010

2011

Particulars

2010

2011

Share capital

70000

74000 Cash

9000

7800

Debentures

12000

14900

17700

Creditors

10360

11840 Stock

49200

42700

P&L Account

10740

11360 Goodwill

10000

5000

20000

30000

103100

103200

6000 Debtors

Land

103100

103200

Additional Information:

1. Dividend were paid Rs. 4000

2. Land was purchases Rs.10000

14 (a) (i) Describe various methods of Cost Accounting.

(ii) Explain the inventory pricing and valuation method with suitable examples

[OR]

(b) The sales turnover and profit during the years were as follows.

Year

Sales(Rs)

Profit(Rs)

2000

1,40,000

15,000

2001

1,60,000

20,000

You are required to calculate (i) P/v ratio (ii) Sales required to earn a profit of Rs 40,000

(iii) Profit When sales are Rs 1,20,000.

15. (a) Discuss the significance of computerized accounting?

(b) Discuss the various packaged accounting softwares

[OR]

Das könnte Ihnen auch gefallen

- Statement of Cash Flows: Preparation, Presentation, and UseVon EverandStatement of Cash Flows: Preparation, Presentation, and UseNoch keine Bewertungen

- VEC Dept of Mgt Studies BA7106 QBDokument12 SeitenVEC Dept of Mgt Studies BA7106 QBSRMBALAANoch keine Bewertungen

- MB0041 - Summer 2014Dokument3 SeitenMB0041 - Summer 2014Rajesh SinghNoch keine Bewertungen

- PDFDokument3 SeitenPDFPooja RanaNoch keine Bewertungen

- Get Answers of Following Questions Here: MB0041 - Financial and Management AccountingDokument3 SeitenGet Answers of Following Questions Here: MB0041 - Financial and Management AccountingRajesh SinghNoch keine Bewertungen

- MBA ACCOUNTING FOR MANAGERS TRIAL BALANCE AND WORKING CAPITALDokument2 SeitenMBA ACCOUNTING FOR MANAGERS TRIAL BALANCE AND WORKING CAPITALShivang A. KalambekarNoch keine Bewertungen

- QBDokument34 SeitenQBAadeel NooraniNoch keine Bewertungen

- CCE E MBA (Aviation Management) Assignment 1Dokument6 SeitenCCE E MBA (Aviation Management) Assignment 1Sukhi MakkarNoch keine Bewertungen

- 895BCMMDokument4 Seiten895BCMMGanesh AganeshNoch keine Bewertungen

- Accounting For Managers MBA GTUDokument3 SeitenAccounting For Managers MBA GTUbhfunNoch keine Bewertungen

- Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034Dokument3 SeitenLoyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034Mohan MuthusamyNoch keine Bewertungen

- MBA I Semeste Model Question Papers W.E.F (2011-13) StudentsDokument8 SeitenMBA I Semeste Model Question Papers W.E.F (2011-13) Studentsvikramvsu100% (2)

- Get Answers of Following Questions Here: MB0038 - Management Process and Organizational BehaviourDokument4 SeitenGet Answers of Following Questions Here: MB0038 - Management Process and Organizational BehaviourTushar AhujaNoch keine Bewertungen

- MB0041 MQP Answer KeysDokument21 SeitenMB0041 MQP Answer Keysajeet100% (1)

- PAM 1st Sem Final-2016 (03.09.16)Dokument2 SeitenPAM 1st Sem Final-2016 (03.09.16)Sarjeel Ahsan NiloyNoch keine Bewertungen

- MBA Semester 1 Spring 2015 Solved Assignments - MB0041Dokument3 SeitenMBA Semester 1 Spring 2015 Solved Assignments - MB0041SolvedSmuAssignmentsNoch keine Bewertungen

- 2013 PatternDokument232 Seiten2013 PatternPrayank RajeNoch keine Bewertungen

- Accounting For Managers GTU Question PaperDokument3 SeitenAccounting For Managers GTU Question PaperbhfunNoch keine Bewertungen

- Sample PaperDokument28 SeitenSample PaperSantanu KararNoch keine Bewertungen

- Maximum: 100 Marks Part A 40 Marks) : OCTOBER 2008Dokument9 SeitenMaximum: 100 Marks Part A 40 Marks) : OCTOBER 2008shikhatiwari777Noch keine Bewertungen

- MB0041Dokument3 SeitenMB0041Smu DocNoch keine Bewertungen

- Accountancy EngDokument8 SeitenAccountancy EngBettappa Patil100% (1)

- M.COM ( EXT. ) 2013 PATTERNDokument111 SeitenM.COM ( EXT. ) 2013 PATTERNThe HinduNoch keine Bewertungen

- Intermediate Exam Question Compilation for ICWAI Syllabus 2002Dokument30 SeitenIntermediate Exam Question Compilation for ICWAI Syllabus 2002Reshma RajNoch keine Bewertungen

- (2013 Pattern) PDFDokument230 Seiten(2013 Pattern) PDFSanket SonawaneNoch keine Bewertungen

- Accounting For ManagersDokument14 SeitenAccounting For ManagersKabo Lucas67% (3)

- Financial Accounting and Analysis Exam QuestionsDokument2 SeitenFinancial Accounting and Analysis Exam QuestionsPraveena MallampalliNoch keine Bewertungen

- Fundamentals of Accounting Problems and SolutionsDokument7 SeitenFundamentals of Accounting Problems and SolutionsashwinNoch keine Bewertungen

- MCO (P) 94: MCOP94 (SIM Scheme) Commerce Course IV: Accounting Theory and PracticeDokument4 SeitenMCO (P) 94: MCOP94 (SIM Scheme) Commerce Course IV: Accounting Theory and PracticeMustafa PendariNoch keine Bewertungen

- 2011 JunDokument10 Seiten2011 JunShihan HaniffNoch keine Bewertungen

- Accounting For Managers 2017 Section A QuestionsDokument2 SeitenAccounting For Managers 2017 Section A QuestionsVishal girdhaniNoch keine Bewertungen

- Mba B0205Dokument3 SeitenMba B0205Ashwani BhallaNoch keine Bewertungen

- Financial Management 1Dokument36 SeitenFinancial Management 1nirmljnNoch keine Bewertungen

- AccontsDokument7 SeitenAccontsAmith MNoch keine Bewertungen

- MBAC1003Dokument7 SeitenMBAC1003SwaathiNoch keine Bewertungen

- Important Questions KMBN103Dokument8 SeitenImportant Questions KMBN103Shivam ChandraNoch keine Bewertungen

- 18516BCH201 - Exam Paper-For Trial Exam (2013) - Sec BDokument5 Seiten18516BCH201 - Exam Paper-For Trial Exam (2013) - Sec Bakki3004Noch keine Bewertungen

- December 2014 FM 11 Exam Cash BudgetDokument5 SeitenDecember 2014 FM 11 Exam Cash BudgetNaman RawatNoch keine Bewertungen

- MB0041 Financial and Management AccountingDokument12 SeitenMB0041 Financial and Management AccountingDivyang Panchasara0% (2)

- Accounting Quiz YP 51 BDokument4 SeitenAccounting Quiz YP 51 Bnicasavio2725Noch keine Bewertungen

- Allama Iqbal Open University, Islamabad (Department of Commerce)Dokument8 SeitenAllama Iqbal Open University, Islamabad (Department of Commerce)Ali TahirNoch keine Bewertungen

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100Dokument11 SeitenUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100kaitokid77Noch keine Bewertungen

- LSC Bscfama May 07 QPMGDokument8 SeitenLSC Bscfama May 07 QPMGbrokencyderNoch keine Bewertungen

- Vakev Entrepreneurship Examination of The Third Term 2021 For s6Dokument13 SeitenVakev Entrepreneurship Examination of The Third Term 2021 For s6vigiraneza0Noch keine Bewertungen

- Mam (Sem. Ii) Theory Exam. 2014-15: Paper Id: 293211Dokument4 SeitenMam (Sem. Ii) Theory Exam. 2014-15: Paper Id: 293211RAJ KUM,ARNoch keine Bewertungen

- MB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereDokument4 SeitenMB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereRajesh SinghNoch keine Bewertungen

- Management Accounting 12Dokument4 SeitenManagement Accounting 12subba1995333333Noch keine Bewertungen

- SAMPLE PAPER - (Solved) : For Examination March 2017Dokument13 SeitenSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavNoch keine Bewertungen

- CA IPCC Nov 2010 Accounts Solved AnswersDokument13 SeitenCA IPCC Nov 2010 Accounts Solved AnswersprateekfreezerNoch keine Bewertungen

- Accounting and Finance Concepts for ManagersDokument3 SeitenAccounting and Finance Concepts for Managersengg.satyaNoch keine Bewertungen

- Vakev Entrepreneurship Examination of The Third Term 2021 For s6Dokument13 SeitenVakev Entrepreneurship Examination of The Third Term 2021 For s6vigiraneza0Noch keine Bewertungen

- M B A PDFDokument169 SeitenM B A PDFAshwini ketkariNoch keine Bewertungen

- ICMA Questions Apr 2011Dokument55 SeitenICMA Questions Apr 2011Asadul HoqueNoch keine Bewertungen

- PefmDokument3 SeitenPefmapi-279049687Noch keine Bewertungen

- 256 - MCO-5 - ENG D18 - CompressedDokument3 Seiten256 - MCO-5 - ENG D18 - CompressedTushar SharmaNoch keine Bewertungen

- MBA Model PapersDokument8 SeitenMBA Model PapersAshish KumarNoch keine Bewertungen

- Foundation Nov 2019Dokument138 SeitenFoundation Nov 2019Ntinu joshuaNoch keine Bewertungen

- Cma 2011 Ii MidDokument2 SeitenCma 2011 Ii MidchaakreeNoch keine Bewertungen

- Assignment Front Sheet: BusinessDokument13 SeitenAssignment Front Sheet: BusinessHassan AsgharNoch keine Bewertungen

- Format On Report On Faculty Development ProgrammeDokument1 SeiteFormat On Report On Faculty Development ProgrammeRam VasuNoch keine Bewertungen

- QpaperDokument1 SeiteQpaperRam VasuNoch keine Bewertungen

- SIDBI Letter FormatDokument1 SeiteSIDBI Letter FormatRam VasuNoch keine Bewertungen

- Final Qustioner 16Dokument3 SeitenFinal Qustioner 16Ram VasuNoch keine Bewertungen

- Ya Ram Final Notes 1 and 2 Units Foe 1 Unit Test YaDokument79 SeitenYa Ram Final Notes 1 and 2 Units Foe 1 Unit Test YaRam VasuNoch keine Bewertungen

- Unit - 3Dokument33 SeitenUnit - 3Ram VasuNoch keine Bewertungen

- Management Principles OverviewDokument65 SeitenManagement Principles OverviewRam VasuNoch keine Bewertungen

- Thankyou For Your Valuable Time and EffortDokument1 SeiteThankyou For Your Valuable Time and EffortRam VasuNoch keine Bewertungen

- Pom Key Set ADokument12 SeitenPom Key Set ARam VasuNoch keine Bewertungen

- Computerized AccountingDokument50 SeitenComputerized AccountingRam VasuNoch keine Bewertungen

- 1.1 Introduction About The Topic 1.1.1 Indian Economy - OverviewDokument63 Seiten1.1 Introduction About The Topic 1.1.1 Indian Economy - OverviewVankishKhoslaNoch keine Bewertungen

- FM UT 2 Anna UniversityDokument3 SeitenFM UT 2 Anna UniversityRam VasuNoch keine Bewertungen

- EECA - Unit 4 Cost AccountsDokument13 SeitenEECA - Unit 4 Cost AccountsRam VasuNoch keine Bewertungen

- Indian Capital MarketDokument37 SeitenIndian Capital MarketRam VasuNoch keine Bewertungen

- Service Marketing Unit 2Dokument9 SeitenService Marketing Unit 2Ram VasuNoch keine Bewertungen

- Service Marketing Unit 1Dokument18 SeitenService Marketing Unit 1Ram VasuNoch keine Bewertungen

- Marketing Strategy FundamentalsDokument48 SeitenMarketing Strategy FundamentalsRam VasuNoch keine Bewertungen

- FM 2 Marks and 16 Marks For 1 ST Unit Anna UniversityDokument1 SeiteFM 2 Marks and 16 Marks For 1 ST Unit Anna UniversityRam VasuNoch keine Bewertungen

- Marketing Mix Decisions 2 UnitDokument49 SeitenMarketing Mix Decisions 2 UnitRam VasuNoch keine Bewertungen

- Unit 1 Marketing ManagementDokument12 SeitenUnit 1 Marketing ManagementRam VasuNoch keine Bewertungen

- Et QuizDokument117 SeitenEt QuizRam VasuNoch keine Bewertungen

- Unit 1 Marketing ManagementDokument12 SeitenUnit 1 Marketing ManagementRam VasuNoch keine Bewertungen

- 2 and 16 Marks Marketing ManagementDokument143 Seiten2 and 16 Marks Marketing ManagementRam Vasu50% (8)

- POM Unit 1Dokument17 SeitenPOM Unit 1Ram VasuNoch keine Bewertungen

- Stock MarketDokument82 SeitenStock MarketRam VasuNoch keine Bewertungen

- Accounting For MangementDokument2 SeitenAccounting For MangementRam VasuNoch keine Bewertungen

- Financial Management Acc Key AnsDokument17 SeitenFinancial Management Acc Key AnsRam VasuNoch keine Bewertungen

- GlobalizationDokument20 SeitenGlobalizationRam VasuNoch keine Bewertungen

- MG 2451 - Engineering Economics and Cost AnalysisDokument74 SeitenMG 2451 - Engineering Economics and Cost AnalysisRam VasuNoch keine Bewertungen