Beruflich Dokumente

Kultur Dokumente

291 Words

Hochgeladen von

Tehreem MujiebOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

291 Words

Hochgeladen von

Tehreem MujiebCopyright:

Verfügbare Formate

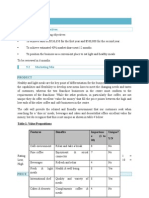

Pure instutions and banks that operate under Islamic Shraih manage over $250 billion of assets

and a further $200- 300 billion is managed by the Islamic windows and subsidiaries of

international banks. The GCC region has been the hotbed of activity as far as the Islamic

Banking industry is concerned, where 41 Islamic financial institutions are currently operating in

the GCC countries (of which 18 are banks). Qatar and Bahrain are the leaders and hold a 70 per

cent share of the assets, while the UAE accounts for 19 per cent of assets. The growth in assets is

estimated at 15 per cent and expected to remain so for several reasons. One is the growth in

overall wealth in the Middle East. Two, is growing awareness about the Islamic products. Three

is the fact that Islamic products are becoming more competitive compared to conventional

products. Four, is the wider availability and variety of Islamic financial products.

In addition, the Equity / Asset ratio of Islamic banks stands at 13.10 per cent compared to 11.30

per cent for conventional banks in the GCC region. This indicates underutilization of capital and

provides a lot of scope for taking on additional risk on the balance sheet.

* Islamic financial intuitions relied more heavily on their equity than conventional banks.

* Islamic financial institutions faced more difficulties in attracting deposits than interest-based

banks.

* Islamic financial institutions had higher cash/deposit ratios than conventional banks.

* Islamic financial institutions tended to channel their funds into direct investment (using

musharakah and mudarabah products), rather than personal loans.

* Within the sample studied, there were no significant differences in profitability and efficiency

between Islamic financial institutions and conventional banks.

* Islamic financial institutions and conventional banks offered their depositors similar returns.

Das könnte Ihnen auch gefallen

- Digital Forensics and Evolving Cyber Law: Case of BIMSTEC CountriesDokument9 SeitenDigital Forensics and Evolving Cyber Law: Case of BIMSTEC CountriesTehreem MujiebNoch keine Bewertungen

- Combatting The Financing of Terrorism in Austria, Germany, Liechtenstein and SwitzerlandDokument14 SeitenCombatting The Financing of Terrorism in Austria, Germany, Liechtenstein and SwitzerlandTehreem MujiebNoch keine Bewertungen

- PPR 2Dokument17 SeitenPPR 2Tehreem MujiebNoch keine Bewertungen

- Digital Forensics and Evolving Cyber Law: Case of BIMSTEC CountriesDokument9 SeitenDigital Forensics and Evolving Cyber Law: Case of BIMSTEC CountriesTehreem MujiebNoch keine Bewertungen

- A 1 B 3Dokument13 SeitenA 1 B 3Tehreem MujiebNoch keine Bewertungen

- Digital Forensics and Evolving Cyber Law: Case of BIMSTEC CountriesDokument9 SeitenDigital Forensics and Evolving Cyber Law: Case of BIMSTEC CountriesTehreem MujiebNoch keine Bewertungen

- Error and Fraud NoresDokument17 SeitenError and Fraud NoresTehreem MujiebNoch keine Bewertungen

- Piza Hut Title PageDokument4 SeitenPiza Hut Title PageTehreem MujiebNoch keine Bewertungen

- Selling ReportDokument4 SeitenSelling ReportTehreem MujiebNoch keine Bewertungen

- QuestionnaireDokument6 SeitenQuestionnaireTehreem Mujieb100% (1)

- Ethics FormDokument7 SeitenEthics FormTehreem MujiebNoch keine Bewertungen

- UAE & Financial SectorDokument6 SeitenUAE & Financial SectorTehreem MujiebNoch keine Bewertungen

- BE-1 Ammended NewDokument24 SeitenBE-1 Ammended NewTehreem MujiebNoch keine Bewertungen

- Business and The Business EnvironmentDokument20 SeitenBusiness and The Business EnvironmentTehreem MujiebNoch keine Bewertungen

- TNDDokument105 SeitenTNDTehreem MujiebNoch keine Bewertungen

- Leader Ship QuestionnaireDokument1 SeiteLeader Ship QuestionnaireTehreem MujiebNoch keine Bewertungen

- Course Project Guidelines PSY 333: Motivation Dr. Tarek Abousaleh Weight: 25 % Semester: Fall 2015 - 2016Dokument13 SeitenCourse Project Guidelines PSY 333: Motivation Dr. Tarek Abousaleh Weight: 25 % Semester: Fall 2015 - 2016Tehreem MujiebNoch keine Bewertungen

- Pizza Hut in MalaysiaDokument13 SeitenPizza Hut in Malaysiavothithugiang0% (1)

- Coping and SupportDokument11 SeitenCoping and SupportTehreem MujiebNoch keine Bewertungen

- The Train Smash: Term 2 2014 Scenario Example Assignment 1 Example - NOT FOR USE IN TERM 2 2015Dokument7 SeitenThe Train Smash: Term 2 2014 Scenario Example Assignment 1 Example - NOT FOR USE IN TERM 2 2015Tehreem MujiebNoch keine Bewertungen

- Labour ForceDokument5 SeitenLabour ForceTehreem MujiebNoch keine Bewertungen

- KeizanDokument1 SeiteKeizanTehreem MujiebNoch keine Bewertungen

- Urbazniation of Gulf RegionDokument4 SeitenUrbazniation of Gulf RegionTehreem MujiebNoch keine Bewertungen

- Proposal SlidesDokument18 SeitenProposal SlidesTehreem MujiebNoch keine Bewertungen

- Plastics Origin and Production RatesDokument29 SeitenPlastics Origin and Production RatesTehreem MujiebNoch keine Bewertungen

- 800 Words ReportDokument2 Seiten800 Words ReportTehreem MujiebNoch keine Bewertungen

- A Workforce That Is More Heterogeneous in Terms of GenderDokument19 SeitenA Workforce That Is More Heterogeneous in Terms of GenderTehreem MujiebNoch keine Bewertungen

- Talent5 PDFDokument10 SeitenTalent5 PDFTehreem MujiebNoch keine Bewertungen

- Apple IncDokument3 SeitenApple IncTehreem MujiebNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)