Beruflich Dokumente

Kultur Dokumente

EUFEMIA EVANGELISTA, MANUELA EVANGELISTA, and FRANCISCA EVANGELISTA, petitioners, vs. THE COLLECTOR OF INTERNAL REVENUE and THE COURT OF TAX APPEALS, respondents

Hochgeladen von

Egay EvangelistaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

EUFEMIA EVANGELISTA, MANUELA EVANGELISTA, and FRANCISCA EVANGELISTA, petitioners, vs. THE COLLECTOR OF INTERNAL REVENUE and THE COURT OF TAX APPEALS, respondents

Hochgeladen von

Egay EvangelistaCopyright:

Verfügbare Formate

EUFEMIA EVANGELISTA, MANUELA EVANGELISTA, and FRANCISCA

EVANGELISTA, petitioners,

vs.

THE COLLECTOR OF INTERNAL REVENUE and THE COURT OF TAX

APPEALS, respondents.

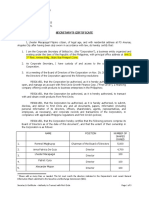

FUCKKKS: Herein petitioners seek a review of CTAs decision holding them

liable for income tax, real estate dealers tax and residence tax. As

stipulated, petitioners borrowed from their father a certain sum for the

purpose of buying real properties. Within February 1943 to April 1994, they

have bought parcels of land from different persons, the management of said

properties was charged to their brother Simeon evidenced by a document.

These properties were then leased or rented to various tenants.

On September 1954, CIR demanded the payment of income tax on

corporations, real estate dealers fixed tax, and corporation residence tax

from 1945-1949 to which the petitioners seek to be absolved from such

payment.

Issue: Whether petitioners are subject to the tax on corporations.

Held: The Court ruled that with respect to the tax on corporations, the issue

hinges on the meaning of the terms corporation and partnership as used

in Section 24 (provides that a tax shall be levied on every corporation no

matter how created or organized except general co-partnerships) and 84

(provides that the term corporation includes among others, partnership) of

the NIRC. Pursuant to Article 1767, NCC (provides for the concept of

partnership), its essential elements are: (a) an agreement to contribute

money, property or industry to a common fund; and (b) intent to divide the

profits among the contracting parties.

It is of the opinion of the Court that the first element is undoubtedly present

for petitioners have agreed to, and did, contribute money and property to a

common fund. As to the second element, the Court fully satisfied that their

purpose was to engage in real estate transactions for monetary gain and

then divide the same among themselves as indicated by the following

circumstances:

1.

The common fund was not something they found already in

existence nor a property inherited by them pro indiviso. It was created

purposely, jointly borrowing a substantial portion thereof in order to establish

said common fund;

2.

They invested the same not merely in one transaction, but in a

series of transactions. The number of lots acquired and transactions

undertake is strongly indicative of a pattern or common design that

was not limited to the conservation and preservation of the

aforementioned common fund or even of the property acquired. In

other words, one cannot but perceive a character of habitually peculiar

to business transactions engaged in the purpose of gain;

3.

Said properties were not devoted to residential purposes, or to

other personal uses, of petitioners but were leased separately to

several persons;

4.

They were under the management of one person where the

affairs relative to said properties have been handled as if the same

belonged to a corporation or business and enterprise operated for

profit;

5.

Existed for more than ten years, or, to be exact, over fifteen

years, since the first property was acquired, and over twelve years,

since Simeon Evangelista became the manager;

6.

Petitioners have not testified or introduced any evidence, either

on their purpose in creating the set up already adverted to, or on the

causes for its continued existence.

The collective effect of these circumstances is such as to leave no room for

doubt on the existence of said intent in petitioners herein.

Also, petitioners argument that their being mere co-owners did not

create a separate legal entity was rejected because, according to the Court,

the tax in question is one imposed upon "corporations", which, strictly

speaking, are distinct and different from "partnerships". When the NIRC

includes "partnerships" among the entities subject to the tax on

"corporations", said Code must allude, therefore, to organizations which are

not necessarily "partnerships", in the technical sense of the term. The

qualifying expression found in Section 24 and 84(b) clearly indicates that a

joint venture need not be undertaken in any of the standard forms, or in

conformity with the usual requirements of the law on partnerships, in order

that one could be deemed constituted for purposes of the tax on

corporations. Accordingly, the lawmaker could not have regarded that

personality as a condition essential to the existence of the partnerships

therein referred to. For purposes of the tax on corporations, NIRC includes

these partnerships - with the exception only of duly registered general co

partnerships - within the purview of the term "corporation." It is, therefore,

clear that petitioners herein constitute a partnership, insofar as said Code is

concerned and are subject to the income tax for corporations.

As regards the residence of tax for corporations (Section 2 of CA No.

465), it is analogous to that of section 24 and 84 (b) of the NIRC. It is

apparent that the terms "corporation" and "partnership" are used in both

statutes with substantially the same meaning. Consequently, petitioners are

subject, also, to the residence tax for corporations.

Finally, on the issues of being liable for real estate dealers tax, they

are also liable for the same because the records show that they have

habitually engaged in leasing said properties whose yearly gross rentals

exceeds P3,000.00 a year.

TAXABLE BITCHES!

Das könnte Ihnen auch gefallen

- Police Power Case DigestsDokument3 SeitenPolice Power Case Digestsaphrodatee75% (4)

- Conflict RulesDokument5 SeitenConflict RulesEgay EvangelistaNoch keine Bewertungen

- CORPORATION Corporate Secretary's CertificateDokument3 SeitenCORPORATION Corporate Secretary's CertificateMary GonzalesNoch keine Bewertungen

- CIVREV2 1920 Partnership, Agency, TrustsDokument50 SeitenCIVREV2 1920 Partnership, Agency, TrustsVince Llamazares LupangoNoch keine Bewertungen

- Moran, Jr. v. CADokument2 SeitenMoran, Jr. v. CAlealdeosa100% (3)

- PresumptionsDokument8 SeitenPresumptionsEgay Evangelista0% (2)

- 175 SCRA 668 Pioneer Vs CADokument2 Seiten175 SCRA 668 Pioneer Vs CASinetch EteyNoch keine Bewertungen

- Pascual v. Commissioner Ruling on Partnership vs. Co-ownership Tax StatusDokument1 SeitePascual v. Commissioner Ruling on Partnership vs. Co-ownership Tax StatusDani Lynne100% (4)

- Dan Fue Leung v. IACDokument2 SeitenDan Fue Leung v. IACCedricNoch keine Bewertungen

- Tai Tong Chuache v. Insurance CommissionDokument2 SeitenTai Tong Chuache v. Insurance Commissionviva_33100% (1)

- Prenuptial AgreementDokument2 SeitenPrenuptial AgreementEgay EvangelistaNoch keine Bewertungen

- Pascual VS Cir Case DigestDokument1 SeitePascual VS Cir Case DigestSheena Juarez100% (2)

- 236 Mcleod v. NLRC (Adre)Dokument3 Seiten236 Mcleod v. NLRC (Adre)ASGarcia24Noch keine Bewertungen

- Voting Requirements for Philippine Corporation ActionsDokument3 SeitenVoting Requirements for Philippine Corporation ActionsRean Raphaelle Gonzales0% (1)

- Safic Aclan & Cie Vs Imperial Vegetable Oil Co. Inc.Dokument2 SeitenSafic Aclan & Cie Vs Imperial Vegetable Oil Co. Inc.Isha SorianoNoch keine Bewertungen

- 16 Jo Chung Cang Vs Pacific Commercial CompanyDokument2 Seiten16 Jo Chung Cang Vs Pacific Commercial CompanyJudy Ann ShengNoch keine Bewertungen

- Digest LIM TONG LIM Vs Phil FishingDokument1 SeiteDigest LIM TONG LIM Vs Phil FishingMalolosFire Bulacan100% (4)

- Evangelista v. CIRDokument7 SeitenEvangelista v. CIRHudson CeeNoch keine Bewertungen

- Philex Mining Corp. v. Commissioner of Internal Revenue, 551 SCRA 428 (2008)Dokument2 SeitenPhilex Mining Corp. v. Commissioner of Internal Revenue, 551 SCRA 428 (2008)Ridzanna AbdulgafurNoch keine Bewertungen

- Goquiolay vs. Sycip Case DigestDokument4 SeitenGoquiolay vs. Sycip Case DigestDiannee Romano100% (1)

- Aurbach Vs Sanitary Wares DigestDokument1 SeiteAurbach Vs Sanitary Wares DigestIvy Paz100% (8)

- Chapter 17 Notes (Brinkley)Dokument6 SeitenChapter 17 Notes (Brinkley)Annie LeeNoch keine Bewertungen

- Position Paper - Milo Olivay Mabasa Vs Orbiter-MeyersDokument12 SeitenPosition Paper - Milo Olivay Mabasa Vs Orbiter-MeyersGigi De LeonNoch keine Bewertungen

- Entrep Final ExamDokument3 SeitenEntrep Final Examjoshua baguioNoch keine Bewertungen

- Bus Org Case Digests CompleteDokument39 SeitenBus Org Case Digests CompleteEmiko Escovilla100% (1)

- San Diego V Nombre DigestDokument1 SeiteSan Diego V Nombre DigestHannah SyNoch keine Bewertungen

- TOCAO Vs CADokument3 SeitenTOCAO Vs CAJane Sudario100% (3)

- Alano v Planter’s Bank Mortgage RulingDokument1 SeiteAlano v Planter’s Bank Mortgage RulingKC NicolasNoch keine Bewertungen

- Theories of Corporate PersonalityDokument29 SeitenTheories of Corporate PersonalityRohit Sinha89% (9)

- Cir Vs - SuterDokument1 SeiteCir Vs - SuterZap PilNoch keine Bewertungen

- Ang Pue Co Vs Secretary DigestDokument1 SeiteAng Pue Co Vs Secretary DigestMarry LasherasNoch keine Bewertungen

- Supreme Court Rules Heirs Formed Unregistered Partnership by Managing Inherited Properties JointlyDokument2 SeitenSupreme Court Rules Heirs Formed Unregistered Partnership by Managing Inherited Properties Jointlyhmn_scribd100% (2)

- Tai Tong Vs Insurance CommissionDokument2 SeitenTai Tong Vs Insurance Commission001noone100% (1)

- Supreme Court Rules Defendant Alone Bears Post-1918 Losses of Partnership in De la Rosa v Ortega Go-CotayDokument6 SeitenSupreme Court Rules Defendant Alone Bears Post-1918 Losses of Partnership in De la Rosa v Ortega Go-CotayKahitanoNoch keine Bewertungen

- Kiel vs. Estate of SabertDokument1 SeiteKiel vs. Estate of SabertMis DeeNoch keine Bewertungen

- Secretary's Certificate for Renewable Energy Project RegistrationDokument1 SeiteSecretary's Certificate for Renewable Energy Project RegistrationAnne Marielle MendozaNoch keine Bewertungen

- Munasque Vs CADokument2 SeitenMunasque Vs CAIsha SorianoNoch keine Bewertungen

- Digest of Philex Mining Corp. v. CIR (G.R. No. 148187)Dokument2 SeitenDigest of Philex Mining Corp. v. CIR (G.R. No. 148187)Rafael Pangilinan88% (8)

- Lota vs. Tolentino 90 Phil 829Dokument1 SeiteLota vs. Tolentino 90 Phil 829gsNoch keine Bewertungen

- Digest - Evangelista vs. CIRDokument1 SeiteDigest - Evangelista vs. CIRPaul Vincent Cunanan100% (4)

- Letter of EngagementDokument3 SeitenLetter of EngagementEgay EvangelistaNoch keine Bewertungen

- Partnership Digest Obillos Vs CIRDokument2 SeitenPartnership Digest Obillos Vs CIRJeff Cadiogan Obar100% (9)

- Aurbach Vs Sanitary Wares DigestDokument3 SeitenAurbach Vs Sanitary Wares DigestMarry Lasheras100% (3)

- Dietrich V FreemanDokument2 SeitenDietrich V FreemanCJ Millena100% (1)

- NG V AlarDokument2 SeitenNG V AlarEgay Evangelista100% (1)

- NG V AlarDokument2 SeitenNG V AlarEgay Evangelista100% (1)

- Elmo Muñasque vs CA partnership disputeDokument2 SeitenElmo Muñasque vs CA partnership disputeCarlo Ilano83% (6)

- Torres Vs CA - DigestDokument2 SeitenTorres Vs CA - Digest001noone75% (4)

- Commercial Law Review Cases Batch 2Dokument42 SeitenCommercial Law Review Cases Batch 2KarmaranthNoch keine Bewertungen

- Whether Olivas entitled to share of profits despite no partnershipDokument1 SeiteWhether Olivas entitled to share of profits despite no partnershipJune Karla LopezNoch keine Bewertungen

- 03 Pacific Commercial Company v. AboitizDokument1 Seite03 Pacific Commercial Company v. AboitizMark Anthony Javellana SicadNoch keine Bewertungen

- 5 Philippine Export and Foreign Loan Guarantee v. VP Eusebio ConstructionDokument2 Seiten5 Philippine Export and Foreign Loan Guarantee v. VP Eusebio ConstructionEmma Ruby AguilarNoch keine Bewertungen

- Calatagan Golf Club Stock Foreclosure CaseDokument2 SeitenCalatagan Golf Club Stock Foreclosure Casejenny martinez100% (1)

- Case Digest - Gatchalian vs. CIR GR 45425Dokument2 SeitenCase Digest - Gatchalian vs. CIR GR 45425TonMaxDrioNoch keine Bewertungen

- Kinds of EvidenceDokument3 SeitenKinds of EvidenceEgay Evangelista100% (1)

- 92 Angeles v. Secretary of JusticeDokument2 Seiten92 Angeles v. Secretary of JusticeIldefonso Hernaez100% (1)

- Mortgage foreclosure rights of bank over vehicles transferred by unregistered partnershipDokument2 SeitenMortgage foreclosure rights of bank over vehicles transferred by unregistered partnershipCourtney TirolNoch keine Bewertungen

- Hung-Man-Yuc vs. Kieng-Chiong-Seng Et Al DigestDokument2 SeitenHung-Man-Yuc vs. Kieng-Chiong-Seng Et Al DigestPaul Jared Quilaneta NgNoch keine Bewertungen

- Industrial Partner Entitled to AccountingDokument2 SeitenIndustrial Partner Entitled to AccountingKate Snchz100% (2)

- Sale of Movables On InstallmentDokument30 SeitenSale of Movables On InstallmentEgay Evangelista50% (2)

- Estrella ruled an industrial partner despite being a judgeDokument4 SeitenEstrella ruled an industrial partner despite being a judgelucky javellana100% (1)

- Siasat Vs IACDokument2 SeitenSiasat Vs IACJo SanchezNoch keine Bewertungen

- Facts: Duterte (Plaintiff-Appellant) Claimed That Rallos (Defendant), and One Castro WereDokument1 SeiteFacts: Duterte (Plaintiff-Appellant) Claimed That Rallos (Defendant), and One Castro WereRoxanne JurialNoch keine Bewertungen

- Salao Vs Salao Partnership DigestDokument1 SeiteSalao Vs Salao Partnership DigestWiem Marie Mendez BongancisoNoch keine Bewertungen

- Evangelista, Et Al. v. CIR, GR No. L-9996, October 15, 1957Dokument3 SeitenEvangelista, Et Al. v. CIR, GR No. L-9996, October 15, 1957Marianne Hope VillasNoch keine Bewertungen

- Teague vs Martin partnership dissolution caseDokument1 SeiteTeague vs Martin partnership dissolution caseElla Tho100% (1)

- Litton Vs Hill and Ceron (DIGEST)Dokument2 SeitenLitton Vs Hill and Ceron (DIGEST)ckarla80100% (1)

- Bearneza vs Dequilla partnership rulingDokument2 SeitenBearneza vs Dequilla partnership rulingAnnaLynneL.TaguilingNoch keine Bewertungen

- Santiago Syjuco, Inc. vs. CastroDokument1 SeiteSantiago Syjuco, Inc. vs. CastroSam Fajardo100% (1)

- Fernandez vs. Dela RosaDokument2 SeitenFernandez vs. Dela RosaCeCe Em50% (4)

- Constructive Trust Existed Between Tenants and Defendant in Barretto Apartments CaseDokument1 SeiteConstructive Trust Existed Between Tenants and Defendant in Barretto Apartments CasesherwincincoNoch keine Bewertungen

- Tacao Vs CA Partnership Case #3Dokument6 SeitenTacao Vs CA Partnership Case #3Jhudith De Julio BuhayNoch keine Bewertungen

- Cir Vs Suter DigestedDokument1 SeiteCir Vs Suter DigestedFrederick Barcelon100% (1)

- Deluao Vs Casteel TRUSTDokument3 SeitenDeluao Vs Casteel TRUSTRamon Joma BungabongNoch keine Bewertungen

- D1. Heirs of Delos Santos Vs CADokument6 SeitenD1. Heirs of Delos Santos Vs CAMarion Yves MosonesNoch keine Bewertungen

- Case Digest - G.R. No. L-9996Dokument2 SeitenCase Digest - G.R. No. L-9996Khalid Sharrif 0 SumaNoch keine Bewertungen

- Corporate Taxation CasesDokument20 SeitenCorporate Taxation CasesMarianne Hope VillasNoch keine Bewertungen

- Evangelista Vs CollectorDokument3 SeitenEvangelista Vs CollectorOne TwoNoch keine Bewertungen

- Evangelista V CirDokument3 SeitenEvangelista V CirSoah JungNoch keine Bewertungen

- Taxation Uniformity RequirementDokument19 SeitenTaxation Uniformity RequirementDee ObriqueNoch keine Bewertungen

- Contract For A Piece of WorkDokument4 SeitenContract For A Piece of WorkEgay EvangelistaNoch keine Bewertungen

- Intellectual Property Rights Technology Transfer ArrangementsDokument16 SeitenIntellectual Property Rights Technology Transfer ArrangementsEgay EvangelistaNoch keine Bewertungen

- Senior Citizen ACTDokument21 SeitenSenior Citizen ACTEgay EvangelistaNoch keine Bewertungen

- Tax Updates 2017 PDFDokument2 SeitenTax Updates 2017 PDFEgay EvangelistaNoch keine Bewertungen

- May 2008 Apprentice OccupationsDokument22 SeitenMay 2008 Apprentice OccupationsNadine DiamanteNoch keine Bewertungen

- Mining Laws & Policies Briefer-1Dokument7 SeitenMining Laws & Policies Briefer-1MadelapizNoch keine Bewertungen

- Cir V The Estate of Benigno Toda and Cir V MarubeniDokument2 SeitenCir V The Estate of Benigno Toda and Cir V MarubeniCarla Carmela Villanueva-CruzNoch keine Bewertungen

- Aznar Ren VoiDokument5 SeitenAznar Ren VoiEgay EvangelistaNoch keine Bewertungen

- CrimesDokument13 SeitenCrimesEgay EvangelistaNoch keine Bewertungen

- Sole ProprietorshipDokument5 SeitenSole ProprietorshipEgay EvangelistaNoch keine Bewertungen

- Crim - Art 14Dokument3 SeitenCrim - Art 14Egay EvangelistaNoch keine Bewertungen

- Model LawDokument4 SeitenModel LawEgay EvangelistaNoch keine Bewertungen

- 1 19Dokument6 Seiten1 19Egay EvangelistaNoch keine Bewertungen

- 1 19Dokument6 Seiten1 19Egay EvangelistaNoch keine Bewertungen

- PrtvcorDokument4 SeitenPrtvcorEgay EvangelistaNoch keine Bewertungen

- AdoptionDokument9 SeitenAdoptionEgay EvangelistaNoch keine Bewertungen

- Midterms TortsDokument31 SeitenMidterms TortsEgay EvangelistaNoch keine Bewertungen

- Sole ProprietorshipDokument6 SeitenSole ProprietorshipEgay EvangelistaNoch keine Bewertungen

- Stronghold Insurance Company vs. CuencaDokument10 SeitenStronghold Insurance Company vs. CuencaJc IsidroNoch keine Bewertungen

- First Division: Nautica Canning Corporation, First Dominion Prime Holdings, Inc. and Fernando R. Arguelles, JR.Dokument7 SeitenFirst Division: Nautica Canning Corporation, First Dominion Prime Holdings, Inc. and Fernando R. Arguelles, JR.SamNoch keine Bewertungen

- Columbia Pictures Vs CA August 28 1996 DigestsDokument3 SeitenColumbia Pictures Vs CA August 28 1996 DigestsNick Tejada LusticaNoch keine Bewertungen

- First Division (G.R. No. 225409, March 11, 2020)Dokument15 SeitenFirst Division (G.R. No. 225409, March 11, 2020)Auxl Reign Nava0% (1)

- BIR Ruling No. 253-16Dokument4 SeitenBIR Ruling No. 253-16john allen MarillaNoch keine Bewertungen

- Act 553 Insurance Act 1996Dokument141 SeitenAct 553 Insurance Act 1996Adam Haida & CoNoch keine Bewertungen

- Chapter 12 April 5Dokument75 SeitenChapter 12 April 5AaaNoch keine Bewertungen

- Lim Tong Lim v. Phil Fishing Gear IndustriesDokument7 SeitenLim Tong Lim v. Phil Fishing Gear IndustriesEzra Dan BelarminoNoch keine Bewertungen

- 35 Sec V Baguio Country 2015Dokument20 Seiten35 Sec V Baguio Country 2015doc dacuscosNoch keine Bewertungen

- Tax Free Exchange v3Dokument2 SeitenTax Free Exchange v3Lara YuloNoch keine Bewertungen

- Instructions For Form 8810: Corporate Passive Activity Loss and Credit LimitationsDokument12 SeitenInstructions For Form 8810: Corporate Passive Activity Loss and Credit LimitationsIRSNoch keine Bewertungen

- Capacity of Parties in Law of TortsDokument8 SeitenCapacity of Parties in Law of TortsUtkarsh SachoraNoch keine Bewertungen

- Philippine Supreme Court case on Filipino First PolicyDokument1 SeitePhilippine Supreme Court case on Filipino First PolicyMiaka UrginoNoch keine Bewertungen

- Emerging Corporate Governance TrendsDokument16 SeitenEmerging Corporate Governance TrendsSaifu KhanNoch keine Bewertungen

- Subscription Voucher: Doc Type Sub Type Number DateDokument2 SeitenSubscription Voucher: Doc Type Sub Type Number Dateadarsh trivediNoch keine Bewertungen

- Principles of Accounting Needles 12th Edition Test BankDokument70 SeitenPrinciples of Accounting Needles 12th Edition Test BankCharles Lussier100% (30)

- 201 - Boc Secretary of StateDokument3 Seiten201 - Boc Secretary of StateychocmNoch keine Bewertungen

- 16GM0014-Re-ITB - Bid Docs - FINALDokument104 Seiten16GM0014-Re-ITB - Bid Docs - FINALReynaldo PesqueraNoch keine Bewertungen

- Registrar of Companies Vs Rowe and Pal and Ors 130o710104COM978240Dokument2 SeitenRegistrar of Companies Vs Rowe and Pal and Ors 130o710104COM978240srihari mangalamNoch keine Bewertungen

- Law On Secrecy of Bank Deposits (Ra 1405) A. PurposeDokument2 SeitenLaw On Secrecy of Bank Deposits (Ra 1405) A. PurposeAlthea MeodeNoch keine Bewertungen