Beruflich Dokumente

Kultur Dokumente

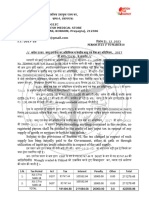

I.T.N.S. 27

Hochgeladen von

Jyoti Sankar BairagiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

I.T.N.S. 27

Hochgeladen von

Jyoti Sankar BairagiCopyright:

Verfügbare Formate

, 1963 226 (3)

I.T.N.S. 27

NOTICE UNDER SECTION 226 (3) OF THE INCOME TAX ACT, 1963

/ Office of the

/Income tax Officer

/Ward

PAN---... G.I.R. No.

/TO

\Dated-

.........................................................................................() /// ....... ..................... . , 1961 226 (3)

/

A sum of `

is due from .

( assessee) of .

on account of Income tax/penalty/interest/fine. You are

hereby required U/s 226(3) of I.T.Act, 1961, to pay to me forthwith any amount due from you to or, held by you,for or on account of said assessee upto the amount of arrears

shown above.

2. / /

I also request you to pay any money which may subsequently become due from you to him/them or which you may subsequently hold for or on account of him/them upto

the amount of arrears still remaining unpaid, forthwith on the money becoming due or being held by you as aforesaid.

3.

Any payment made by you in compliance with this notice is in law deemed to have been made under the authority of the said

assessee and my receipt will constitute a good and sufficient discharge of your liability to the person to the extent of the amount referred to in the receipt.

4. ///

/

Please note that if you discharge any liability to the assessee after receipt of this notice you will be personally liable to me as Assessing Officer/Tax recovery Officer to

the extent of the liability discharged, or to the extent of the liability of the assessee for tax/penalty/interest/fine referred to in the preceding para, whichever is less.

5.

, 1961 222 225

222

Further, if you fail to make payment in pursuance of this notice, you shall be deemed to be an assessee in default in respect of the amount specified on this notice and

further proceeding may be taken against you for the realization of the amount as if it were an arrear of tax due from you in the manner provided in sec. 222 to 225 of the

I.T.Act, 1961 and this notice shall have the same effect as an attachment of a debt u/s 222 of the said Act.

6.

/

The necessary challan(s) for depositing the money to the credit of the Central Govt. is/are enclosed.

7.

A copy of this notice is being sent to the afore-said assessee.

/ Seal

Printed From www.directtaxreport.in

( / )

( Signature of the assessing officer / TRO )

Das könnte Ihnen auch gefallen

- Vijay MechatronicsDokument3 SeitenVijay Mechatronicsbirpal singhNoch keine Bewertungen

- Barod Jeevan SurakshaDokument16 SeitenBarod Jeevan SurakshaamibinNoch keine Bewertungen

- Unit 10Dokument50 SeitenUnit 10Ladoo DivakarNoch keine Bewertungen

- Indemnity BondDokument2 SeitenIndemnity BondRichard PeazoldNoch keine Bewertungen

- Electricity (Late Payment Surcharge and Related Matters) Rules, 2022Dokument12 SeitenElectricity (Late Payment Surcharge and Related Matters) Rules, 2022nfk roeNoch keine Bewertungen

- अति महत्वपूर्ण - MSME पेमेंट- 43BDokument5 Seitenअति महत्वपूर्ण - MSME पेमेंट- 43Bkunalr.dhakateNoch keine Bewertungen

- SCSSGOL17042020Dokument19 SeitenSCSSGOL17042020A BcNoch keine Bewertungen

- DBGB 87 Loan Application Form - Demand LoanDokument3 SeitenDBGB 87 Loan Application Form - Demand LoanMukund BhardwajNoch keine Bewertungen

- Post Office Savings Accoutn Scheme 2019 HindiDokument8 SeitenPost Office Savings Accoutn Scheme 2019 HindiAbhishek BhardwajNoch keine Bewertungen

- ApplicationDokument8 SeitenApplicationRAM PAVNoch keine Bewertungen

- NoticeDokument3 SeitenNoticeRohan SakiNoch keine Bewertungen

- Amnesty Scheme For Condonation of Delay in Filling AppealDokument3 SeitenAmnesty Scheme For Condonation of Delay in Filling AppealBhanuprakash GuptaNoch keine Bewertungen

- GST Gazette Nofication 17oct2017Dokument14 SeitenGST Gazette Nofication 17oct2017Rahul MandalNoch keine Bewertungen

- Notification89 2023Dokument3 SeitenNotification89 2023sarvagya.mishra448Noch keine Bewertungen

- Claim Form-Pmjjby-HindiDokument4 SeitenClaim Form-Pmjjby-HindiJohn UdayNoch keine Bewertungen

- Sebi ESG Rating Provider Regulation 1688923059Dokument40 SeitenSebi ESG Rating Provider Regulation 1688923059Sabreen AhmedNoch keine Bewertungen

- Lesson-5 en HiDokument15 SeitenLesson-5 en Hidevravidhan382Noch keine Bewertungen

- GSR 347E (Rule 5 Compensation Rules)Dokument11 SeitenGSR 347E (Rule 5 Compensation Rules)judiciaryrctamvtNoch keine Bewertungen

- 2023 - AST - ADPPB7911B - Notice Us 143 (2) - 1053899484 (1) - 23062023Dokument4 Seiten2023 - AST - ADPPB7911B - Notice Us 143 (2) - 1053899484 (1) - 23062023nirmalku2061Noch keine Bewertungen

- Ic26 1Dokument30 SeitenIc26 1ANAND KUMARNoch keine Bewertungen

- वित्तीय सेवा समझौतेDokument5 Seitenवित्तीय सेवा समझौतेRoj MarraNoch keine Bewertungen

- Dinesh Medical Store 17-18 DRC 07Dokument2 SeitenDinesh Medical Store 17-18 DRC 07skd9559Noch keine Bewertungen

- 6 Axp Wo KXRW LMQ Om WHPSL HDokument6 Seiten6 Axp Wo KXRW LMQ Om WHPSL HinfoNoch keine Bewertungen

- India TypingDokument3 SeitenIndia Typingminakshitiwari7Noch keine Bewertungen

- New Aadhar Seeding Form HindiDokument2 SeitenNew Aadhar Seeding Form Hindisuvankar mandalNoch keine Bewertungen

- Company Winding Up Rules 2020 MCADokument241 SeitenCompany Winding Up Rules 2020 MCATULIP TARUN BHATIANoch keine Bewertungen

- Part ADokument4 SeitenPart ASiva PrasadNoch keine Bewertungen

- P.G.S National College of Law, Mathura Paper-VIII Paper Name-Income Tax Act Unit - 2Dokument10 SeitenP.G.S National College of Law, Mathura Paper-VIII Paper Name-Income Tax Act Unit - 2RISHINoch keine Bewertungen

- EWS Complete Form CenterDokument7 SeitenEWS Complete Form Centerms starNoch keine Bewertungen

- EWS Category Application Form PDFDokument3 SeitenEWS Category Application Form PDFGaurav BissaNoch keine Bewertungen

- Ews Form PDFDokument3 SeitenEws Form PDFvikassomaniNoch keine Bewertungen

- Ews FormDokument3 SeitenEws FormvikassomaniNoch keine Bewertungen

- Ews Form PDFDokument3 SeitenEws Form PDFvikassomaniNoch keine Bewertungen

- Indemnity BondDokument2 SeitenIndemnity BondFaishal khanNoch keine Bewertungen

- E F201P048056c3dcDokument9 SeitenE F201P048056c3dcShiekhNoch keine Bewertungen

- Morgage Deed HindiDokument2 SeitenMorgage Deed HindiL GuptaNoch keine Bewertungen

- Amendment in CCS Leave RulestaTxBDokument3 SeitenAmendment in CCS Leave RulestaTxBALOK MISHRANoch keine Bewertungen

- 31 LetterofUndertakingDokument2 Seiten31 LetterofUndertakingShyam PrasadNoch keine Bewertungen

- Income Expenditure Assets Liabilities Affidavit Format in HindiDokument6 SeitenIncome Expenditure Assets Liabilities Affidavit Format in HindiManoj TripathiNoch keine Bewertungen

- Jyoti PharmaDokument2 SeitenJyoti PharmayogeshNoch keine Bewertungen

- EL Application Form. (Bilingual)Dokument2 SeitenEL Application Form. (Bilingual)Bishwanath Bagchi67% (6)

- अपना फोटो चपकाएँ / Paste Your Photo: Claim Application FormDokument3 Seitenअपना फोटो चपकाएँ / Paste Your Photo: Claim Application Formbikashmaity030Noch keine Bewertungen

- Revised Customer Request Form 10 18Dokument6 SeitenRevised Customer Request Form 10 18Imran JamadarNoch keine Bewertungen

- Sahara HindiDokument3 SeitenSahara Hindigbeena899Noch keine Bewertungen

- Gazette of India PDFDokument22 SeitenGazette of India PDFAjith KumarNoch keine Bewertungen

- Werize PolicyDokument16 SeitenWerize PolicyJagruti NaiyyaNoch keine Bewertungen

- रजिस्ट्री सं. डी.एल.-33004/99 REGD. No. D. L.-33004/99: CG-DL-E-24032021-226082Dokument3 Seitenरजिस्ट्री सं. डी.एल.-33004/99 REGD. No. D. L.-33004/99: CG-DL-E-24032021-226082sanjaypunjabi78Noch keine Bewertungen

- Sahara (Asoke)Dokument2 SeitenSahara (Asoke)Asoke AdhikariNoch keine Bewertungen

- New OneDokument2 SeitenNew OneSanchita PaulNoch keine Bewertungen

- मजदूरी भुगतान की मुख्य रीतियों को बताइए तथा इनमें से किन्ही तीनDokument7 Seitenमजदूरी भुगतान की मुख्य रीतियों को बताइए तथा इनमें से किन्ही तीनRohan Pandey: 40Noch keine Bewertungen

- 95 - SD-23 Debit Balance Confirmation DBCDokument2 Seiten95 - SD-23 Debit Balance Confirmation DBCMantu Kumar0% (3)

- View PDFServletDokument1 SeiteView PDFServletAaditya PandeyNoch keine Bewertungen

- TaxationDokument3 SeitenTaxationSanjay MeenaNoch keine Bewertungen

- 34 LetterofUndertakingDokument2 Seiten34 LetterofUndertakingShyam PrasadNoch keine Bewertungen

- AffidavitDokument2 SeitenAffidavitmovari9890Noch keine Bewertungen

- Shivam Pharma and SurgicalDokument3 SeitenShivam Pharma and Surgicalkk5860232Noch keine Bewertungen

- Mani Ram - HindiDokument4 SeitenMani Ram - Hindibhupender singhNoch keine Bewertungen

- ViewPDFServlet 3Dokument1 SeiteViewPDFServlet 3Kumar GauravNoch keine Bewertungen