Beruflich Dokumente

Kultur Dokumente

2014 Volume 2 CH 5 Answers

Hochgeladen von

Girlie SisonOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2014 Volume 2 CH 5 Answers

Hochgeladen von

Girlie SisonCopyright:

Verfügbare Formate

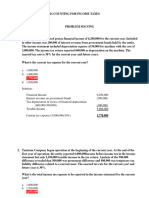

CHAPTER 5

INCOME TAXES

PROBLEMS

5-1.

a.

b.

c.

d.

e.

f.

g.

Nontaxable

Nondeductible

Nondeductible

Temporary difference

Temporary difference

Temporary difference

Temporary difference

Future

Future

Future

Future

taxable amount

taxable amount

deductible amount

deductible amount

5-2.

Pretax financial income

Add Nondeductible expenses (b + c) 400,000 + 40,000

Less Nontaxable income (a)

Financial income subject to tax

Add Future deductible amounts (f + g) 750,000 + 400,000

Less Future taxable amounts (d + e) 1,500,000 + 1,000,000

Taxable income

Income tax expense Current

Income tax payable

30% x 8,090,000

P11,000,000

440,000

(2,000,000)

P 9,440,000

1,150,000

(2,500,000)

P8,090,000

2,427,000

2,427,000

Income tax expense Deferred

Deferred tax liability

30% x 2,500,000

750,000

Deferred tax asset

Income tax expense Deferred

30% x 1,150,000

345,000

750,000

345,000

or one compound entry may be made as follows:

Income tax expense Current

Income tax expense Deferred

Deferred tax asset

Income tax payable

Deferred tax liability

5-3.

(Luzon Corporation)

(a)

Pretax financial income

Future taxable amount

Taxable income

Income tax payable: 30% x 1,200,000

(b)

5-4.

Income tax expense Current

Income tax expense Deferred

Income tax payable

Deferred tax liability

30% x 1,200,000 = 360,000

30% x 1,800,000 = 540,000

(Visayas Corporation)

(a)

Pre tax financial income

Future deductible amount

Taxable income

Income tax payable: 30% x 3,550,000

2,427,000

405,000

345,000

2,427,000

750,000

P3,000,000

(1,800,000)

P1,200,000

P360,000

360,000

540,000

360,000

540,000

P2,000,000

1,550,000

P3,550,000

P1,065,000

Chapter 5 - Income Taxes

(b)

Income tax expense-Current

Deferred tax asset

Income tax payable

Income tax benefit-Deferred

1,065,000

465,000

(Mindanao Corporation)

Income tax expense Current

Deferred tax asset

Deferred tax liability

185,000

Income tax expense Deferred (Benefit)

415,000

Income tax payable

1,560,000

30% x 5,200,000 = 1,560,000

30% x 2,000,000 = 600,000

(30% x 500,000) + (35% x 100,000) = 185,000

1,065,000

465,000

5-5.

1,560,000

600,000

5-6.

(Samar, Inc.)

Income tax expense Current (30% x 2,000,000)

Income tax expense Deferred (267,000 72,000)

195,000

Income tax expense Total

Income tax payable (see above)

Deferred tax asset:

P 600,000

P 795,000

P 600,000

30% x 240,000

72,000

Deferred tax liability: 30% x (530,000 + 360,000 )

5-7.

5-8.

P 267,000

(Bohol Company)

Taxable income

Future deductible amount:

Book depreciation in excess of tax depreciation

Nontaxable income:

Interest on government securities

Pretax financial income

P12,000,000

(430,000)

450,000

P12,020,000

(Wall Services)

(a)

Schedule of reversal of the temporary differences

2014 140,000 x 32%

P 44,800

2015 320,000 x 34%

108,800

2016 240,000 x 36%

86,400

Total

P240,000

(b)

(c)

Pretax financial income

Add nondeductible expenses

Less nontaxable revenues

Financial income subject to tax

Future taxable amounts

Taxable income

Tax rate

Income tax payable

Deferred tax liability (see above)

P2,200,000

400,000

( 140,000)

P2,460,000

( 700,000)

P1,760,000

x 30 %

P 528,000

P 240,000

Income tax expense Current

Income tax payable

528,000

Income tax expense Deferred

Deferred tax liability

240,000

528,000

Income from continuing operations before income tax

61

240,000

P2,200,000

Chapter 5 - Income Taxes

5-9.

Income tax expense:

Current

Deferred

Net income

(Daniel Company)

(a)

Straight Line

2013

500,000

2014

500,000

2015

500,000

2016

500,000

12/31/2013

12/31/2014

12/31/2015

12/31/2016

Taxable income

Future taxable amount

Additional taxable

amount (reversal)

Pretax accounting

income

P528,000

240,000

768,000

P1,432,000

SYD

800,000

600,000

400,000

200,000

Difference

(300,000)

(100,000)

100,000

300,000

Carrying Amount

Tax Base

1,500,000

1,200,000

1,000,000

600,000

500,000

200,000

0

0

2013

800,000

300,000

2014

890,000

100,000

1,100,000

990,000

Difference

300,000

400,000

300,000

0

2015

1,200,000

2016

1,500,000

( 100,000)

1,100,000

(300,000)

1,200,000

(b)

Deferred tax liability at the end of each year is as follows:

2013

300,000 x 30%

P 90,000

2014

400,000 x 30%

120,000

2015

300,000 x 30%

90,000

2016

0

0

(c)

Journal entries to record current income tax:

2013

Income tax expense-Current 240,000

Income tax payable

240,000

(30% x 800,000)

2014

267,000

267,000

(30% x 890,000)

2015

2016

Income tax expense-Current 360,000

450,000

Income tax payable

360,000

450,000

(30% x 1,200,000) (30% x 1,500,000)

Journal entries to record deferred income tax:

December 31, 2013:

Income tax Expense-Deferred

Deferred tax liability

December 31, 2014:

Income tax expense Deferred

Deferred tax liability

30,000

120,000 90,000 = 30,000

December 31, 2015:

Deferred tax liability

Income tax expense-Deferred (Benefit)

30,000

90,000 120,000 = 30,000 decrease

62

90,000

90,000

30,000

30,000

Chapter 5 - Income Taxes

December 31, 2016:

Deferred tax liability

Income tax expense-Deferred (Benefit)

0 90,000 = 90,000 Decrease

90,000

90,000

(d)

2013

Income tax expense:

Current

2014

2015

2016

P

240,000

90,000

P

267,000

30,000

P

360,000

( 30,000)

P

330,000

P

297,000

P

330,000

2013

P1,100,000

2014

P 990,000

2015

P1,100,00

0

Deferred (Benefit)

Total income tax

expense

450,000

(90,000)

360,000

(e)

Income before income

tax

Less income tax

expense (see above)

Net income

330,000

770,000

297,000

693,000

330,000

P 770,000

2016

P1,200,00

0

360,000

840,000

5-10.

(Jude Company)

(a)

Future taxable amount

Carrying amount of inventories > Tax Base

P

100,000

Carrying amount of building & equipment > Tax Base

1,800,000

P 1,900,000

Future Deductible Amount

Carrying amount of accounts receivable < Tax Base

P

200,000

Carrying amount of warranty > Tax Base

800,000

Carrying amount of unearned rent > Tax Base

500,000

P 1,500,000

(b)

(c)

Income tax payable (5,000,000 X 30%)

Deferred tax assets (1,500,000 x 30%)

Deferred tax liability (1,900,000 x 30%)

Income tax expense-Current

Income tax payable

Income tax expense-Deferred

Deferred tax asset

450,000 525,000

Deferred tax liability

Income tax benefit-Deferred

1,400,000 570,000

5-11.

P1,500,000

P 450,000

570,000

1,500,000

1,500,000

75,000

75,000

830,000

830,000

(Capetown Company)

Tax rate = 180,000/600,000 = 30%

Income tax expense current

Income tax payable

30% x 1,000,000

300,000

300,000

63

Chapter 5 - Income Taxes

Deferred tax asset

Income tax benefit deferred

End (30% x 800,000) = 240,000

Beg

180,000

Increase

60,000

5-12

60,000

(Conchita Corporation)

(a)

Deferred tax liability, 12/31/2013

2M x 30%

(b)

5-13

60,000

Income tax expense current

Income tax payable

3M x 30%

Deferred tax liability

Income tax expense deferred

Beg.

640,000

End, revised due to

change in tax rate 600,000

Decrease in DTL

40,000

P600,000

900,000

900,000

40,000

40,000

(Britanny Company)

(a)

Income tax expense current

3M x 30%

Previous payment in 2013

Income tax payable, 12/31/2013

(b)

Income tax expense current

Income tax payable

Deferred tax liability

Deferred tax asset

DTL, 12/31/13 (400,000 x 30%)

DTL, 1/1/13

Decrease in DTL

DTA, 12/31/13 (200,000 x 30%)

DTA, 1/1/13

Decrease in DTA

(c)

P900,000

500,000

P400,000

400,000

400,000

30,000

30,000

120,000

150,000

30,000

60,000

90,000

30,000

Total income tax expense

Current

Deferred

Total income tax expense

P900,000

-0P900,000

Pretax profit

Income tax expense

Profit

P2,800,000

900,000

P1,900,000

MULTIPLE CHOICE QUESTIONS

Theory

MC1

MC2

MC3

MC4

MC5

C

A

C

C

D

Problems

MC17

B

MC18

B

MC19

B

MC6

MC7

MC8

MC9

MC10

D

C

D

A

D

MC11

MC12

MC13

MC14

MC15

MC16

1,800,000 x 35% = 630,000

Excess of Book Value > Tax Basis of Equipment

(2,000,000 x 30%) + (1,000,000 x 35%) = 950,000

64

C

C

C

D

B

B

Chapter 5 - Income Taxes

MC20

MC21

MC22

D

C

B

MC23

MC24

MC25

MC26

MC27

MC28

MC29

C

B

D

C

D

C

D

MC30

MC31

C

B

MC32

MC33

MC34

MC35

MC36

B

D

C

D

D

MC37

MC38

MC39

MC40

MC41

C

C

D

D

B

MC42

MC43

10,000,000 x 30% = 3,000,000

(8,000,000 4,000,000) x 30% = 1,200,000

[(700,000 x 30%) + (1,400,000 x 35%)] [(500,000 x 30%) + (1,000,000

x 35%)] = 700,000 500,000 = 200,000 (all non-current)

1,200,000 750,000 = 450,000; 450,000 x 35% = 157,500

1,500,000 x 30% = 450,000

6,000,000 x 30% = 1,800,000

9,000,000 x 30% = 2,700,000

42,000 / 30% = 140,000; 600,000 + 140,000 = 740,000

150,000 x 30% = 45,000

5,000,000 900,000 + 1,200,000 + 200,000 = 5,500,000;

5,500,000 x 30% = 1,650,000

200,000 40,000 = 160,000; 160,000 x 30% = 48,000

150,000 x 35% = 52,500; 150,000 x 35% = 52,500; 150,000 x 30% =

45,000

52,500 + 52,500 + 45,000 = 150,000

95,000 x 38% = 36,100

6,500,000 x 30% = 1,950,000 900,000 = 1,050,000

(2,600,000 1,400,000) x 38% = 456,000

(3,000,000 x 30%) (5,000,000 x 30%) + (4,000,000 x 30%) = 600,000

OR 2,000,000 X 30% = 600,000

See computation below

See computation below

172,500 / 30% = 575,000; 3,000,000 + 575,000 = 3,575,000

1,800,000 80,000 + 60,000 = 1,780,000; 1,780,000 x 30% = 534,000

2,000,000100,000120,000+180,000 = 1,960,000; 1,960,000 x

30%=588,000

5,000,000 500,000 + 200,000 4,000,000 + 1,800,000 = 2,500,000

2,500,000 x 30% = 750,000

(5,000,000 + 400,000 600,000) x 30% = 1,440,000

Items 37 and 38:

Pretax accounting income

Future deductible amount (accrued warranty cost)

Future taxable amount (accrual basis profit > cash basis profit

Operating loss carry-forward (for tax purposes)

Income tax expense

Increase in deferred tax liability 5,000,000 x 30%

Less: increase in deferred tax asset

(from accrued warranty cost) = 1,200,000 x 30%

(from operating loss carry forward)= 2,800,000 x 30% x

40%

Total deferred tax asset

Income tax expense

65

P 1,000,000

1,200,000

(5,000,000)

P 2,800,000

P 1,500,000

P

360,000

336,000

P

P

696,000

804,000

Das könnte Ihnen auch gefallen

- Chapter 4 - Income Taxes Problems Luzon CorporationDokument8 SeitenChapter 4 - Income Taxes Problems Luzon CorporationJohanna Raissa CapadaNoch keine Bewertungen

- Answers - Chapter 5 Vol 2Dokument5 SeitenAnswers - Chapter 5 Vol 2jamfloxNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Solution - Accounting For Income TaxesDokument12 SeitenSolution - Accounting For Income TaxesKlarissemay MontallanaNoch keine Bewertungen

- Wiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsVon EverandWiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsNoch keine Bewertungen

- Income Tax AccountingDokument3 SeitenIncome Tax Accountinghae1234Noch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- Torres Ma. Deidre Yciar L - Chapter 13 ADokument5 SeitenTorres Ma. Deidre Yciar L - Chapter 13 AAriana Marie ArandiaNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNoch keine Bewertungen

- Gene Justine Sacdalan Test PaperDokument4 SeitenGene Justine Sacdalan Test PaperGene Justine SacdalanNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Tax 2Dokument8 SeitenTax 2Genel Christian DeypalubosNoch keine Bewertungen

- TaxDokument8 SeitenTaxClaire BarrettoNoch keine Bewertungen

- Intacc2 Assignment 6.1 AnswersDokument6 SeitenIntacc2 Assignment 6.1 AnswersMingNoch keine Bewertungen

- Tax SolutionDokument4 SeitenTax Solutiongen eyesNoch keine Bewertungen

- Solman EquityDokument12 SeitenSolman EquityBrunxAlabastroNoch keine Bewertungen

- Example 5.7Dokument7 SeitenExample 5.7Omar KhalilNoch keine Bewertungen

- Answers 2014 Vol 3 CH 6Dokument6 SeitenAnswers 2014 Vol 3 CH 6Gladys100% (2)

- Chapter 13Dokument11 SeitenChapter 13Christine GorospeNoch keine Bewertungen

- Interim Financial ReportingDokument7 SeitenInterim Financial ReportingRey Joyce AbuelNoch keine Bewertungen

- Interim Financial Reporting: Problem 45-1: True or FalseDokument7 SeitenInterim Financial Reporting: Problem 45-1: True or FalseXyverbel Ocampo RegNoch keine Bewertungen

- Interim Financial Reporting: Problem 45-1: True or FalseDokument7 SeitenInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNoch keine Bewertungen

- 93 - Final Preaboard AFAR SolutionsDokument11 Seiten93 - Final Preaboard AFAR SolutionsLeiNoch keine Bewertungen

- 2806-Individuals PPT PDFDokument35 Seiten2806-Individuals PPT PDFMay Grethel Joy PeranteNoch keine Bewertungen

- Income Taxes: ProblemsDokument12 SeitenIncome Taxes: ProblemsCharles MateoNoch keine Bewertungen

- Answers - Chapter 1 Vol 2 2009Dokument10 SeitenAnswers - Chapter 1 Vol 2 2009Shiela PilarNoch keine Bewertungen

- SamigroupDokument9 SeitenSamigroupsamidan tubeNoch keine Bewertungen

- Problem VI Methods of Construction Accounting ASTDokument14 SeitenProblem VI Methods of Construction Accounting ASTMarinella LosaNoch keine Bewertungen

- Problems Accouting For Deferred Taxes Webinar ReoDokument7 SeitenProblems Accouting For Deferred Taxes Webinar ReocrookshanksNoch keine Bewertungen

- Untitled SpreadsheetDokument9 SeitenUntitled SpreadsheetMiguel BautistaNoch keine Bewertungen

- UntitledDokument13 SeitenUntitledAnne GuamosNoch keine Bewertungen

- Answers - V2Chapter 6 2012Dokument6 SeitenAnswers - V2Chapter 6 2012Rhei BarbaNoch keine Bewertungen

- Appendix D Accounting For Deferred Income TaxesDokument2 SeitenAppendix D Accounting For Deferred Income TaxesLan Hương Trần ThịNoch keine Bewertungen

- CH 8 Answers 2008Dokument5 SeitenCH 8 Answers 2008ergiesonaNoch keine Bewertungen

- Q3a. Capital Budget AssignmentDokument1 SeiteQ3a. Capital Budget AssignmentMorgan MunyoroNoch keine Bewertungen

- Key To Correction - Intermediate Accounting - Midterm - 2019-2020Dokument10 SeitenKey To Correction - Intermediate Accounting - Midterm - 2019-2020Renalyn ParasNoch keine Bewertungen

- Chap15 Tax PbmsDokument10 SeitenChap15 Tax PbmskkNoch keine Bewertungen

- Chapter 25 and 26Dokument10 SeitenChapter 25 and 26Sittie Aisah AmpatuaNoch keine Bewertungen

- Assignment 1 - Taxation On Individuals-SolutionsDokument5 SeitenAssignment 1 - Taxation On Individuals-SolutionsCleofe Mae Piñero AseñasNoch keine Bewertungen

- Magsino Hannah Florence Activity 5 Discounted Cash FlowsDokument36 SeitenMagsino Hannah Florence Activity 5 Discounted Cash FlowsKathyrine Claire Edrolin100% (2)

- Orca Share Media1540033147945Dokument17 SeitenOrca Share Media1540033147945Melady Sison CequeñaNoch keine Bewertungen

- Group 1 - Chapter 16Dokument8 SeitenGroup 1 - Chapter 16Cherie Soriano AnanayoNoch keine Bewertungen

- Lobrigas - Week6 Ia3Dokument18 SeitenLobrigas - Week6 Ia3Hensel SevillaNoch keine Bewertungen

- Note On Tax Rebate On Takaful Contribution 2019 20 SalariedDokument1 SeiteNote On Tax Rebate On Takaful Contribution 2019 20 SalariedRoy Estate (Sajila Roy)Noch keine Bewertungen

- Income Tax TableDokument6 SeitenIncome Tax TableMarian's PreloveNoch keine Bewertungen

- Matheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following inform... - HomeworkLibDokument1 SeiteMatheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following inform... - HomeworkLibVarun Sharma0% (1)

- Answers Chapter 9 Income TaxesDokument17 SeitenAnswers Chapter 9 Income TaxesJeannamy PanizalesNoch keine Bewertungen

- Group4 SectionA SampavideoDokument5 SeitenGroup4 SectionA Sampavideokarthikmaddula007_66Noch keine Bewertungen

- Nur Atiqah Binti Saadon (Kba2761a) - 2023448576Dokument3 SeitenNur Atiqah Binti Saadon (Kba2761a) - 2023448576nuratiqahsaadon89Noch keine Bewertungen

- ExampleDokument8 SeitenExampleAli Akand AsifNoch keine Bewertungen

- Lobrigas Unit6 AssessmentDokument4 SeitenLobrigas Unit6 AssessmentClaudine LobrigasNoch keine Bewertungen

- Insurance Expense Allocated To The Quarter: SolutionDokument4 SeitenInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNoch keine Bewertungen

- Chapter 2 AssignmentDokument8 SeitenChapter 2 AssignmentRoss John JimenezNoch keine Bewertungen

- Cpa Reviewschool of The Phlppnes Man It A Auditeng Problems Fena Pre-Board Examination Problem2 - Everlasting CompanyDokument6 SeitenCpa Reviewschool of The Phlppnes Man It A Auditeng Problems Fena Pre-Board Examination Problem2 - Everlasting CompanyLexuz Mar DyNoch keine Bewertungen

- Chapt. 12 Accounting Exercise QuestionDokument10 SeitenChapt. 12 Accounting Exercise QuestionChristel NazarethNoch keine Bewertungen

- Tax Chapter 3 AssignmentDokument5 SeitenTax Chapter 3 AssignmentAriin TambunanNoch keine Bewertungen

- Lab Chapter 17Dokument5 SeitenLab Chapter 17Tran Kim Tram PhanNoch keine Bewertungen

- Long-Term Construction ContractsDokument12 SeitenLong-Term Construction Contractsblackphoenix303Noch keine Bewertungen

- 1617 2ndS MX TVenturanzaDokument8 Seiten1617 2ndS MX TVenturanzaGirlie SisonNoch keine Bewertungen

- Specifications For 1st Evaluation ExaminationDokument1 SeiteSpecifications For 1st Evaluation ExaminationGirlie SisonNoch keine Bewertungen

- SPECIFICATIONS FOR 1st EVALUATION EXAMINATIONDokument1 SeiteSPECIFICATIONS FOR 1st EVALUATION EXAMINATIONGirlie SisonNoch keine Bewertungen

- Answer Key - Module 7 - Standard Costing For Cost Control 2018 EdDokument3 SeitenAnswer Key - Module 7 - Standard Costing For Cost Control 2018 EdGirlie SisonNoch keine Bewertungen

- Module A Introduction To Information TechnologyDokument2 SeitenModule A Introduction To Information TechnologyAbhilash MenonNoch keine Bewertungen

- Audit of InvestmentsDokument9 SeitenAudit of InvestmentsGirlie SisonNoch keine Bewertungen

- CHAPTER 7 Caselette - Audit of PPEDokument34 SeitenCHAPTER 7 Caselette - Audit of PPErochielanciola60% (5)

- Chapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseDokument4 SeitenChapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseGirlie SisonNoch keine Bewertungen

- Accounting For SMEs QuestionnaireDokument4 SeitenAccounting For SMEs QuestionnaireGirlie Sison100% (1)

- Flowchart P1 1Dokument1 SeiteFlowchart P1 1Girlie SisonNoch keine Bewertungen

- Oblicon QuestionsDokument2 SeitenOblicon QuestionsGirlie SisonNoch keine Bewertungen

- Chapter 5: Database Design 1: Normalization True / False: Cengage Learning Testing, Powered by CogneroDokument6 SeitenChapter 5: Database Design 1: Normalization True / False: Cengage Learning Testing, Powered by CogneroGirlie Sison100% (1)

- Income Taxation Reviewer - San BedaDokument128 SeitenIncome Taxation Reviewer - San BedaJennybabe Peta100% (8)

- Merged Sorry Wala Tong Kwenta XDDokument78 SeitenMerged Sorry Wala Tong Kwenta XDGirlie SisonNoch keine Bewertungen

- Scribd ViewerDokument3 SeitenScribd ViewerGirlie SisonNoch keine Bewertungen

- L'oreal - Global Brand, Local KnowledgeDokument37 SeitenL'oreal - Global Brand, Local KnowledgeANURAG AJMERANoch keine Bewertungen

- The Reward and Remuneration Series Handbook PDFDokument320 SeitenThe Reward and Remuneration Series Handbook PDFOdhis KanayoNoch keine Bewertungen

- Speed-To-Fashion Managing Global Supply Chain in ZaraDokument6 SeitenSpeed-To-Fashion Managing Global Supply Chain in Zararabna akbarNoch keine Bewertungen

- Session 2 - Compensation Income and FBTDokument6 SeitenSession 2 - Compensation Income and FBTMitzi WamarNoch keine Bewertungen

- Ecgc ProjectDokument4 SeitenEcgc ProjectrabharaNoch keine Bewertungen

- IGL BillDokument1 SeiteIGL BillArun KumarNoch keine Bewertungen

- MComDokument32 SeitenMComTuki DasNoch keine Bewertungen

- Ethical Accounting Practices and Financial Reporting QualityDokument16 SeitenEthical Accounting Practices and Financial Reporting QualityApiez ZiepaNoch keine Bewertungen

- Property, Plant and EquipmentDokument45 SeitenProperty, Plant and EquipmentRiyah ParasNoch keine Bewertungen

- Banking ActivitiesDokument15 SeitenBanking ActivitiesRahma HwangNoch keine Bewertungen

- Piyush KushwahaDokument3 SeitenPiyush KushwahaPiyush KushwahaNoch keine Bewertungen

- IS Audit of ERP SoftwareDokument4 SeitenIS Audit of ERP SoftwareujwalNoch keine Bewertungen

- Fom Class Test 1 Ece DDokument2 SeitenFom Class Test 1 Ece DAnurag MunshiNoch keine Bewertungen

- 365 Fact Sheet 2014Dokument2 Seiten365 Fact Sheet 2014Kiho KimuraNoch keine Bewertungen

- 2023.07.07 HS PaeDokument2 Seiten2023.07.07 HS Paehanis0% (1)

- HRM Project Report On Performance Appraisal System at BSNL, Performance Appraisal System Project Report MBA BBA, HRM Project Report, HR Project ReportDokument4 SeitenHRM Project Report On Performance Appraisal System at BSNL, Performance Appraisal System Project Report MBA BBA, HRM Project Report, HR Project ReportDeepti SinghNoch keine Bewertungen

- Tgfinal ReseachDokument50 SeitenTgfinal Reseachbitew yirgaNoch keine Bewertungen

- Financial Accounting: Accounting Basics: Branches of AccountingDokument7 SeitenFinancial Accounting: Accounting Basics: Branches of AccountingLucky HartanNoch keine Bewertungen

- Kristi Noem 4th Quarter ReportDokument211 SeitenKristi Noem 4th Quarter ReportPat PowersNoch keine Bewertungen

- LL Next GenerationDokument56 SeitenLL Next GenerationsilidiriNoch keine Bewertungen

- A Project Report On Study On Foundry Industry BelgaumDokument60 SeitenA Project Report On Study On Foundry Industry BelgaumBabasab Patil (Karrisatte)100% (1)

- Gaps in Customer Satisfaction With Digital Wallets: Challenge For SustainabilityDokument4 SeitenGaps in Customer Satisfaction With Digital Wallets: Challenge For SustainabilityLavenyaGayathriNoch keine Bewertungen

- Finance Final222Dokument7 SeitenFinance Final222Mohamed SalamaNoch keine Bewertungen

- Marketing Literature ReviewDokument17 SeitenMarketing Literature ReviewUday bNoch keine Bewertungen

- Using WBS To Decompose Specific Project TasksDokument9 SeitenUsing WBS To Decompose Specific Project TaskswinsomeNoch keine Bewertungen

- Chambal Fertilizer PO. PDFDokument2 SeitenChambal Fertilizer PO. PDFRizvan QureshiNoch keine Bewertungen

- Annual Report 2011-12Dokument152 SeitenAnnual Report 2011-12Juhi BansalNoch keine Bewertungen

- Kotler Mm15e Inppt 16Dokument19 SeitenKotler Mm15e Inppt 16Faiyazur RahmanNoch keine Bewertungen

- The Financial DetectiveDokument15 SeitenThe Financial Detectiveojsimpson90100% (7)

- SUSEELADokument20 SeitenSUSEELAMoni ShanmugamNoch keine Bewertungen

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyVon EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyBewertung: 4 von 5 Sternen4/5 (52)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingVon EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingBewertung: 5 von 5 Sternen5/5 (3)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProVon EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProBewertung: 4.5 von 5 Sternen4.5/5 (43)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideVon EverandTax Savvy for Small Business: A Complete Tax Strategy GuideBewertung: 5 von 5 Sternen5/5 (1)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyVon EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNoch keine Bewertungen

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesVon EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesBewertung: 4 von 5 Sternen4/5 (9)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.Von EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.Noch keine Bewertungen

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthVon EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNoch keine Bewertungen

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessVon EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNoch keine Bewertungen

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Von EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Bewertung: 4.5 von 5 Sternen4.5/5 (43)

- How to get US Bank Account for Non US ResidentVon EverandHow to get US Bank Account for Non US ResidentBewertung: 5 von 5 Sternen5/5 (1)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesVon EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesBewertung: 3 von 5 Sternen3/5 (3)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessVon EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessBewertung: 5 von 5 Sternen5/5 (5)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCVon EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCBewertung: 4 von 5 Sternen4/5 (5)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionVon EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionBewertung: 5 von 5 Sternen5/5 (27)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionVon EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNoch keine Bewertungen

- The Payroll Book: A Guide for Small Businesses and StartupsVon EverandThe Payroll Book: A Guide for Small Businesses and StartupsBewertung: 5 von 5 Sternen5/5 (1)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsVon EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNoch keine Bewertungen

- Tax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfVon EverandTax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfBewertung: 5 von 5 Sternen5/5 (1)

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesVon EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesNoch keine Bewertungen

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-2-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)