Beruflich Dokumente

Kultur Dokumente

IPO Procedure

Hochgeladen von

Abhishek Sharma0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

130 Ansichten2 SeitenDiagrammatic representation of IPO process in India

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenDiagrammatic representation of IPO process in India

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

130 Ansichten2 SeitenIPO Procedure

Hochgeladen von

Abhishek SharmaDiagrammatic representation of IPO process in India

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

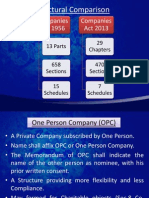

PROCEDURE OF IPO

Central Listing Authority

A department of SEBI

Application to SEBI (CLA) for LPTL

Letter Precedent To Listing

Issued separately for each

Stock

Exchange

where

securities are desired to be

listed.

Maximum 30

days.

SEBI may give LPTL for every stock

exchange where shares are intended to

be listed.

Separate application to each of the

stock exchanges for in-principle

approval

Maximum 30

days.

Appointment of

Stock Exchanges may give in-principle

approval.

MERCHANT BANKER

Drafting of Prospectus by Merchant

Banker

in

consultation

with

Compliance

Officer

i.e.

the

Company Secretary of the Company.

Send Draft Prospectus to SEBI.

Maximum 30

days.

Opening of Escrow Account.

Simultaneously file a copy of Draft Prospectus with:

All Stock Exchanges where

shares are desired to be listed.

SEBI may suggest modifications.

No Communication from SEBI is

deemed as APPROVAL.

Members of Public on demand

Company SHALL carry

modifications suggested.

out

all

Public may suggest any

Modification.

Maximum 21

days.

Company

May

or

May

Not

incorporate any suggestion. If either of

them is not incorporated, the

Company Shall file reasons for not

incorporating.

Printing and Signing of Prospectus

File Prospectus with RoC.

Maximum 90

days.

Minimum 4

days.

Opening of Issue.

Minimum 3

days.

Maximum 10

days.

Closing of Issue.

Maximum 10

WEEKS.

Maximum 30

days.

Issue

of

Allotment

Letter

of

OR

Issue ABRIDGED PROSPECTUS

to public.

No communication from Stock

Exchange is deemed as REFUSAL.

Obtain LISTING PERMISSION

from all the Stock Exchange from

which in-principle approval had

been obtained. If even one Stock

Exchange refuses permission, the

entire issue fails and the money has

to be refunded to investors.

Issue of Letter of Regret

and Refund Order.

Obtain TRADING PERMISSION

from concerned stock exchanges.

As soon as

possible.

Das könnte Ihnen auch gefallen

- BSE SME Listing Requirements for CompaniesDokument4 SeitenBSE SME Listing Requirements for CompaniesShinil NambrathNoch keine Bewertungen

- Companies Act 2017Dokument4 SeitenCompanies Act 2017Ahmad Ali AmjadNoch keine Bewertungen

- Ipo ProcessDokument3 SeitenIpo ProcessAkash SiddhuNoch keine Bewertungen

- All About Initial Public OfferingsDokument20 SeitenAll About Initial Public OfferingsSuyash KejriwalNoch keine Bewertungen

- IPO Process Bangladesh GuideDokument5 SeitenIPO Process Bangladesh GuideSakib AhmedNoch keine Bewertungen

- Initial Public OfferingDokument7 SeitenInitial Public Offeringabhavmehta08Noch keine Bewertungen

- A Company Is An Association of Several PersonsDokument15 SeitenA Company Is An Association of Several PersonsEbadur RahmanNoch keine Bewertungen

- MEETINGSDokument3 SeitenMEETINGSOmama ArifNoch keine Bewertungen

- Topic: - Tax On Goods and Services: A ReviewDokument23 SeitenTopic: - Tax On Goods and Services: A ReviewsurajNoch keine Bewertungen

- IPO Process in India An OverviewDokument15 SeitenIPO Process in India An OverviewYash SonkarNoch keine Bewertungen

- 3.legal and Regulatory EnviornmentDokument16 Seiten3.legal and Regulatory Enviornmentamoldesh29Noch keine Bewertungen

- Requirements of ProspectusDokument7 SeitenRequirements of ProspectusDr.Shaifali GargNoch keine Bewertungen

- Initial Public OfferingDokument7 SeitenInitial Public OfferingAsisclo CastanedaNoch keine Bewertungen

- IPO ProcessDokument6 SeitenIPO ProcessSetu ChawlaNoch keine Bewertungen

- DSE IPO Listing Stages ProcessesDokument5 SeitenDSE IPO Listing Stages ProcessesJustin Louis D CostaNoch keine Bewertungen

- Meetings of A Company: University Businees School, Panjab University ChandigarhDokument24 SeitenMeetings of A Company: University Businees School, Panjab University ChandigarhRamneet ParmarNoch keine Bewertungen

- A Study ON: Corporate Legal Enviroment "General Meetings"Dokument26 SeitenA Study ON: Corporate Legal Enviroment "General Meetings"Siddharth DhamijaNoch keine Bewertungen

- 15 Company Law Notes From Kalpesh Classes For CA FinalDokument259 Seiten15 Company Law Notes From Kalpesh Classes For CA FinalKaustubh BasuNoch keine Bewertungen

- A Company Is An Association of Several Persons AssignDokument16 SeitenA Company Is An Association of Several Persons AssigngeethaNoch keine Bewertungen

- Alteration of Share Capital (Listed Co)Dokument21 SeitenAlteration of Share Capital (Listed Co)Babyzz ShafikahNoch keine Bewertungen

- Key Changes to Indian Company LawDokument52 SeitenKey Changes to Indian Company LawSudhaker PandeyNoch keine Bewertungen

- Meetings and ProceedingsDokument4 SeitenMeetings and ProceedingsArslan QadirNoch keine Bewertungen

- Initial Public Offer (Ipo)Dokument30 SeitenInitial Public Offer (Ipo)Shruti AshokNoch keine Bewertungen

- Buy Back of Securities ObjectivesDokument21 SeitenBuy Back of Securities ObjectivesArchana KhapreNoch keine Bewertungen

- Companies Act MeetingsDokument8 SeitenCompanies Act Meetingssaku_25884Noch keine Bewertungen

- Closing A Private Limited CompanyDokument3 SeitenClosing A Private Limited CompanypratikshaNoch keine Bewertungen

- Exchange Specifications: BSE SME Exhange SpecificationsDokument2 SeitenExchange Specifications: BSE SME Exhange Specificationschintan1806Noch keine Bewertungen

- IPO Process in BangladeshDokument10 SeitenIPO Process in Bangladesharafatrauf100% (4)

- Privileges of A Private CompanyDokument26 SeitenPrivileges of A Private CompanyGhulam Murtaza KoraiNoch keine Bewertungen

- 3 CLSP Incorporation of CompaniesDokument5 Seiten3 CLSP Incorporation of CompaniesSyed Mujtaba HassanNoch keine Bewertungen

- NSE Circular 02112021-SOPDokument2 SeitenNSE Circular 02112021-SOPSwapnita RaneNoch keine Bewertungen

- Preparation of Balance Sheet and Profit and Loss Account: TotalDokument7 SeitenPreparation of Balance Sheet and Profit and Loss Account: TotalAnil ChauhanNoch keine Bewertungen

- CLSP Unit 2Dokument59 SeitenCLSP Unit 2Shikhar BavejaNoch keine Bewertungen

- Corporate Governance Midterm Assesment: Neeraj S 1901099 PGDM BDokument4 SeitenCorporate Governance Midterm Assesment: Neeraj S 1901099 PGDM BNeeraj SNoch keine Bewertungen

- KSE Listing Regulations (Notes)Dokument5 SeitenKSE Listing Regulations (Notes)araza_962307Noch keine Bewertungen

- Securities & Exchange Board of IndiaDokument27 SeitenSecurities & Exchange Board of IndiaApoorva MahajanNoch keine Bewertungen

- Companies Bill 2012: Presented by Ca Pratik AroraDokument40 SeitenCompanies Bill 2012: Presented by Ca Pratik Arorababy0310Noch keine Bewertungen

- A Study ON: Corporate Legal Enviroment "General Meetings"Dokument26 SeitenA Study ON: Corporate Legal Enviroment "General Meetings"Mukesh AgrawalNoch keine Bewertungen

- What Is Mean IPODokument13 SeitenWhat Is Mean IPOUtsav SrivastavaNoch keine Bewertungen

- CSR Laws and GuidelinesDokument4 SeitenCSR Laws and Guidelinesanishvijay23Noch keine Bewertungen

- NCLT E-FILING PROCEDURE FOR REDUCTION OF SHARE CAPITALDokument8 SeitenNCLT E-FILING PROCEDURE FOR REDUCTION OF SHARE CAPITALShital Darak MandhanaNoch keine Bewertungen

- WIRC Study Circle Meet ICDR Vs DIP and IPO New ProcessDokument50 SeitenWIRC Study Circle Meet ICDR Vs DIP and IPO New ProcesspatsjitNoch keine Bewertungen

- Steps to Incorporate a Company in Less Than 40 StepsDokument8 SeitenSteps to Incorporate a Company in Less Than 40 StepsManju SujayNoch keine Bewertungen

- Primary Market Issue ManagementDokument47 SeitenPrimary Market Issue Managementvimalprakash55100% (1)

- Company MeetingsDokument14 SeitenCompany MeetingsAnant GargNoch keine Bewertungen

- SEBI Delisting RegulationsDokument19 SeitenSEBI Delisting RegulationsAnwesha HaldarNoch keine Bewertungen

- Companies Act 2016 FAQsDokument14 SeitenCompanies Act 2016 FAQsazilaNoch keine Bewertungen

- Merger and Amalgamation ProcessDokument15 SeitenMerger and Amalgamation ProcessChhaya bardia 8005Noch keine Bewertungen

- A Business Guide To Thailand 2011 1317913244 Phpapp02 111006100313 Phpapp02Dokument129 SeitenA Business Guide To Thailand 2011 1317913244 Phpapp02 111006100313 Phpapp02Freeman HuNoch keine Bewertungen

- Articles of Association PRESENTATIONDokument26 SeitenArticles of Association PRESENTATIONMohsin Mehtab Abbasi100% (1)

- The IPO Process Abu DhabiDokument8 SeitenThe IPO Process Abu DhabiKarthik ShettyNoch keine Bewertungen

- Company EstablishmentDokument13 SeitenCompany EstablishmentKrishna Singh RajputNoch keine Bewertungen

- Genicon Legal Strings: InsideDokument5 SeitenGenicon Legal Strings: Insidecaabhaiagarwal1Noch keine Bewertungen

- Auditor appointment and dutiesDokument10 SeitenAuditor appointment and dutiesVishal ChandakNoch keine Bewertungen

- Class 5 Company MeetingsDokument31 SeitenClass 5 Company MeetingsSwati Sucharita DasNoch keine Bewertungen

- AGM and EGM of A CompanyDokument8 SeitenAGM and EGM of A CompanyPooja BoharaNoch keine Bewertungen

- Requirements For A Private Limited CompanyDokument8 SeitenRequirements For A Private Limited CompanySaurabh SinghNoch keine Bewertungen

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Von EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Noch keine Bewertungen

- IAPL India FourthConference 2017Dokument68 SeitenIAPL India FourthConference 2017Abhishek SharmaNoch keine Bewertungen

- Appreciation of Evidence CriminalDokument18 SeitenAppreciation of Evidence CriminalAbhishek SharmaNoch keine Bewertungen

- SC-UoI Panel 11.12.14Dokument29 SeitenSC-UoI Panel 11.12.14Abhishek SharmaNoch keine Bewertungen

- Agreement To Lease Vs LeaseDokument2 SeitenAgreement To Lease Vs LeaseAbhishek SharmaNoch keine Bewertungen

- Bail & Anticipatory BailDokument76 SeitenBail & Anticipatory BailAbhishek SharmaNoch keine Bewertungen

- Circumstantial EvidenceDokument12 SeitenCircumstantial EvidenceAbhishek SharmaNoch keine Bewertungen

- Advanced Rulings - Income Tax PDFDokument222 SeitenAdvanced Rulings - Income Tax PDFAbhishek Sharma0% (1)

- Section Article 14 Bench Strength 8............................................. This Article Corresponds To The EqualDokument34 SeitenSection Article 14 Bench Strength 8............................................. This Article Corresponds To The EqualAbhishek SharmaNoch keine Bewertungen

- Grounds for Framing Charges or Discharging AccusedDokument55 SeitenGrounds for Framing Charges or Discharging AccusedAbhishek SharmaNoch keine Bewertungen

- Entry Pass For Supreme CourtDokument2 SeitenEntry Pass For Supreme CourtArun K Gupta50% (2)

- Sl. No. Legislative Power Bench StrengthDokument6 SeitenSl. No. Legislative Power Bench StrengthAbhishek SharmaNoch keine Bewertungen

- Magistrate's Options When Considering Police Report Under Section 173 of Criminal Procedure CodeDokument9 SeitenMagistrate's Options When Considering Police Report Under Section 173 of Criminal Procedure CodeAbhishek SharmaNoch keine Bewertungen

- Proforma For Mentioning1Dokument1 SeiteProforma For Mentioning1Abhishek SharmaNoch keine Bewertungen

- Signature Not VerifiedDokument28 SeitenSignature Not VerifiedAbhishek SharmaNoch keine Bewertungen

- Excise BookDokument70 SeitenExcise BookAbhishek SharmaNoch keine Bewertungen

- Bar Council of India Rules Part IV As On 01.11.1998Dokument34 SeitenBar Council of India Rules Part IV As On 01.11.1998Abhishek SharmaNoch keine Bewertungen

- Principle of parity in criminal casesDokument4 SeitenPrinciple of parity in criminal casesAbhishek SharmaNoch keine Bewertungen

- Analysis of Sections 320 and 482 of the Code of Criminal ProcedureDokument35 SeitenAnalysis of Sections 320 and 482 of the Code of Criminal ProcedureAbhishek SharmaNoch keine Bewertungen

- Computation of Total Income and Tax LiabilityDokument2 SeitenComputation of Total Income and Tax LiabilityAbhishek SharmaNoch keine Bewertungen

- 397 - 482Dokument33 Seiten397 - 482Abhishek SharmaNoch keine Bewertungen

- Bar Council of India Rules, Part V OnwardsDokument102 SeitenBar Council of India Rules, Part V OnwardsAbhishek Sharma100% (1)

- Computation of Total Income and Tax LiabilityDokument2 SeitenComputation of Total Income and Tax LiabilityAbhishek SharmaNoch keine Bewertungen

- Proforma DuedeligenceDokument9 SeitenProforma DuedeligenceAbhishek SharmaNoch keine Bewertungen

- Bar CounsilDokument52 SeitenBar CounsilshalwNoch keine Bewertungen

- Bar Council of India Rules: (Under The Advocates Act, 1961)Dokument44 SeitenBar Council of India Rules: (Under The Advocates Act, 1961)md4maheshNoch keine Bewertungen

- Sebi Icdr Regulations February 2016Dokument247 SeitenSebi Icdr Regulations February 2016Abhishek SharmaNoch keine Bewertungen

- Foreign Exchange Management Act The RestrictionDokument2 SeitenForeign Exchange Management Act The RestrictionAbhishek SharmaNoch keine Bewertungen

- Punjab and Haryana High Court Rules Volume IVDokument483 SeitenPunjab and Haryana High Court Rules Volume IVAbhishek SharmaNoch keine Bewertungen

- Computation of Total Income and Tax LiabilityDokument2 SeitenComputation of Total Income and Tax LiabilityAbhishek SharmaNoch keine Bewertungen