Beruflich Dokumente

Kultur Dokumente

Quick Review: - Journal Entries and T-Accounts Are Used To Track The Effects of

Hochgeladen von

Anonymous B0XWrB0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

59 Ansichten17 SeitenThe document provides an overview of key accounting concepts including journal entries, T-accounts, the accounting equation, debit and credit rules, and the accounting cycle. It discusses how journal entries are recorded in the general journal and then posted to T-accounts in the general ledger. It also explains the two main steps in the accounting cycle as journalizing transactions and posting journal entries to accounts.

Originalbeschreibung:

Originaltitel

Slides01-04-1.pdf

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe document provides an overview of key accounting concepts including journal entries, T-accounts, the accounting equation, debit and credit rules, and the accounting cycle. It discusses how journal entries are recorded in the general journal and then posted to T-accounts in the general ledger. It also explains the two main steps in the accounting cycle as journalizing transactions and posting journal entries to accounts.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

59 Ansichten17 SeitenQuick Review: - Journal Entries and T-Accounts Are Used To Track The Effects of

Hochgeladen von

Anonymous B0XWrBThe document provides an overview of key accounting concepts including journal entries, T-accounts, the accounting equation, debit and credit rules, and the accounting cycle. It discusses how journal entries are recorded in the general journal and then posted to T-accounts in the general ledger. It also explains the two main steps in the accounting cycle as journalizing transactions and posting journal entries to accounts.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 17

Quick Review

Journal entries and T-accounts are used to track the effects of

transactions

Sum of Debits = Sum of Credits

=> Assets = Liabilities + Stockholders Equity

Debit = left-side entry; Credit = right-side entry

Assets and Expenses have Debit balances

Debits increase assets and expenses

Credits decrease these accounts

Liabilities, Shareholders Equity, and Revenues have Credit balances

Credits increase liabilities, shareholders equity, and revenues

Debits decrease these accounts

KNOWLEDGE FOR ACTION

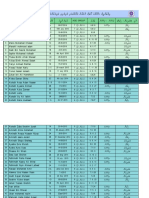

Quick Review: Super T-account

Assets

Assets

Dr.

Cr.

+

-

Liabilities & Shareholders Equity

Liabilities

Dr.

-

Cr.

+

Contributed

Capital

Dr.

-

Cr.

+

Retained Earnings

Dr.

-

Cr.

+

Expenses

Dr.

+

KNOWLEDGE FOR ACTION

Cr.

-

Revenues

Dr.

-

Cr.

+

The Accounting Cycle

Analyze

Start new period Transactions During Period

Journalize

and Post

Closing

Entries

End of Period

Unadjusted

Trial Balance

Financial

Statements

KNOWLEDGE FOR ACTION

Adjusted

Trial Balance

Adjusting

Entries

The Accounting Cycle

Analyze

Transactions During Period

Journalize

and Post

1.

Journalize: recording each transaction as a journal entry in the general

journal

2.

Post: journal entries are transferred to the T-accounts or general ledger

KNOWLEDGE FOR ACTION

Relic Spotter Inc. Case

In March 2012, Rebecca Park identified an excellent business

opportunity while she was a first-year MBA student at Wharton

She read a story about an MBA student who tripped while jogging in

Fairmount Park and found an ancient gold coin in the underbrush. It

was an old Viking coin that was appraised at $77,500

She realized that she could set up a profitable business that rented

out portable Metal Detectors to people that wanted to search

Fairmount Park for more Viking relics

Also, Park had the idea of stocking her store with sundries, such as

water bottles and energy bars, that she could sell at a huge mark-up

to renters before their expedition into the park

KNOWLEDGE FOR ACTION

Relic Spotter Inc. Case

Park prepared a business plan and approached a fellow student, Jay

Girard, who had a sizable trust fund and who she believed would

invest in this new venture

Due to his myriad of other investments, and his heavy course load,

Girard agreed to invest as a silent partner and allow Park to run the

business, which she named Relic Spotter Inc.

We will now record journal entries and post to t-accounts for all of the

transactions of this start-up company

After each transaction is read, you should pause the video and try to do the

journal entry. Think about (1) what accounts are involved? (2) did they increase

or decrease? (3) do we debit or credit?

Then, resume the video to see the answer and the explanation

KNOWLEDGE FOR ACTION

Relic Spotter Inc. Case: Transaction 1

(1) On April 1, 2012, Girard decided to invest $200,000 and Park put

up $50,000 to purchase a total of 25,000 shares in the new company.

The par value of the shares was $1.00

Journal Entry

(1) 4/1/12

Dr. Cash (+A)

250,000

Cr. Common Stock (+SE)

25,000

Cr. Additional Paid-in-capital (+SE)

225,000

KNOWLEDGE FOR ACTION

Relic Spotter Inc. Case: Transaction 1

Journal Entry

(1) 4/1/12

Dr. Cash (+A)

250,000

Cr. Common Stock (+SE)

25,000

Cr. Additional Paid-in-capital (+SE)

225,000

Cash (A)

(1) 250,000

KNOWLEDGE FOR ACTION

Common Stock (SE)

25,000

Addl Paid-in-Capital (SE)

(1)

225,000

(1)

Relic Spotter Inc. Case: Transaction 2

(2) Lacking the funds for her initial investment, Park borrowed the

$50,000 from the Imperial Bank of Philadelphia on April 1, using her

parents house as collateral

Journal Entry

(2) 4/1/12

Park's loan of $50,000 not recorded by Relic Spotter

because it is a loan to Park personally, not to the business

KNOWLEDGE FOR ACTION

Relic Spotter Inc. Case: Transaction 3

(3) On April 2, Park hired a lawyer to have the business incorporated.

Because this was a fairly simple organization, the legal fees were

only $3,900

Journal Entry

(3) 4/2/12

Dr. Legal Fee Expense (+E, -SE)

Cr. Cash (-A)

KNOWLEDGE FOR ACTION

3,900

3,900

Relic Spotter Inc. Case: Transaction 3

Journal Entry

(3) 4/2/12

Dr. Legal Fee Expense (+E, -SE)

Cr. Cash (-A)

Cash (A)

(1) 250,000

3,900

Legal Fee Expense (E, SE)

(3)

KNOWLEDGE FOR ACTION

(3)

3,900

3,900

3,900

Relic Spotter Inc. Case: Transaction 4

(4) To house the business, Park bought an abandoned pizza parlor

near Fairmount Park for $155,000 on April 7. The building was old

and needed renovation work. The purchase documents allocated

$103,000 to the land and $52,000 to the building. Park paid for the

building with $31,000 cash and a $124,000 mortgage from the Imperial

Bank

Journal Entry

(4) 4/7/12

Dr. Building (+A)

Dr. Land (+A)

Cr. Mortgage Payable (+L)

Cr. Cash (-A)

KNOWLEDGE FOR ACTION

52,000

103,000

124,000

31,000

Relic Spotter Inc. Case: Transaction 4

Journal Entry

(4) 4/7/12

Dr. Building (+A)

Dr. Land (+A)

Cr. Mortgage Payable (+L)

Cr. Cash (-A)

Cash (A)

(1) 250,000

Building (A)

3,900

(3)

31,000

(4)

(4) 52,000

KNOWLEDGE FOR ACTION

Land (A)

(4) 103,000

52,000

103,000

124,000

31,000

Mortgage Payable (L)

124,000 (4)

Relic Spotter Inc. Case: Transaction 5

(5) Park felt that some renovation work would extend the life of the

building to 25 years (with an expected salvage value of $10,000). She

ordered the renovation work, costing $33,000, to begin immediately.

The work was completed on May 25, at which time she paid in cash

the amount owed for the renovations

Journal Entry

(5) 5/25/12 Dr. Building (+A)

Cr. Cash (-A)

KNOWLEDGE FOR ACTION

33,000

33,000

Relic Spotter Inc. Case: Transaction 5

Journal Entry

(5) 5/25/12 Dr. Building (+A)

Cr. Cash (-A)

33,000

33,000

Cash (A)

(1) 250,000

Building (A)

3,900

(3)

(4)

52,000

31,000

(4)

(5)

33,000

33,000

(5)

KNOWLEDGE FOR ACTION

Relic Spotter Inc. Case: Transaction 6

(6) Park phoned a number of metal detector vendors until she found

one that was willing to give her a volume discount. On June 2, Park

purchased 240 metal detectors at an average cost of $500 per unit

($120,000 total). The innovation in the industry is so rapid that Park

felt the units would only last for two years, at which time they would

have no remaining value

Journal Entry

(6) 6/2/12

Dr. Metal Detectors (+A)

Cr. Cash (-A)

KNOWLEDGE FOR ACTION

120,000

120,000

Relic Spotter Inc. Case: Transaction 6

Journal Entry

(6) 6/2/12

Dr. Metal Detectors (+A)

Cr. Cash (-A)

Cash (A)

(1) 250,000

120,000

Metal Detectors (A)

3,900

(3)

31,000

(4)

33,000

(5)

120,000

(6)

KNOWLEDGE FOR ACTION

120,000

(6) 120,000

Das könnte Ihnen auch gefallen

- George Littlechild Started A New Kitchen and Bath Design BusinessDokument1 SeiteGeorge Littlechild Started A New Kitchen and Bath Design BusinessHassan JanNoch keine Bewertungen

- Abe Factor Opened A New Accounting Practice Called X Factor AccountingDokument1 SeiteAbe Factor Opened A New Accounting Practice Called X Factor AccountingFreelance WorkerNoch keine Bewertungen

- 1 Finance-Exam-1Dokument22 Seiten1 Finance-Exam-1ashish25% (4)

- The Future of Freedom: Illiberal Democracy at Home and AbroadDokument2 SeitenThe Future of Freedom: Illiberal Democracy at Home and AbroadRidho Shidqi MujahidiNoch keine Bewertungen

- Project Driven & Non Project Driven OrganizationsDokument19 SeitenProject Driven & Non Project Driven OrganizationsEkhlas Ghani100% (2)

- Coursework Assignment: Graduate Job ImpactDokument13 SeitenCoursework Assignment: Graduate Job ImpactmirwaisNoch keine Bewertungen

- Lecture Slides Video01!04!1Dokument13 SeitenLecture Slides Video01!04!1Axce1996Noch keine Bewertungen

- Introduction To Accounting and BusinessDokument54 SeitenIntroduction To Accounting and BusinessAje AndiartaNoch keine Bewertungen

- Accounting in ActionDokument47 SeitenAccounting in ActionAbdullah Al AminNoch keine Bewertungen

- Relic Spotter Inc. CaseDokument9 SeitenRelic Spotter Inc. CaseC DonisNoch keine Bewertungen

- ExerciseDokument4 SeitenExerciseICS TEAM50% (2)

- Accounting in ActionDokument43 SeitenAccounting in ActionA.N.M. Khaleqdad KhanNoch keine Bewertungen

- Relic Spotter Inc. Case: Transaction 25Dokument8 SeitenRelic Spotter Inc. Case: Transaction 25osogboandrew_9480574Noch keine Bewertungen

- Tatap Muka Ol 2Dokument25 SeitenTatap Muka Ol 2Friska SimanjuntakNoch keine Bewertungen

- Week 2 - Accrual Accounting and The Income Statement PDFDokument50 SeitenWeek 2 - Accrual Accounting and The Income Statement PDFHisham ShihabNoch keine Bewertungen

- Week 3Dokument46 SeitenWeek 3BookAddict721Noch keine Bewertungen

- Accounting Principles (I)Dokument17 SeitenAccounting Principles (I)ramiNoch keine Bewertungen

- Introduction To Accounting and BusinessDokument38 SeitenIntroduction To Accounting and BusinessWima DudinNoch keine Bewertungen

- Chapter 2Dokument67 SeitenChapter 2Galata NugusaNoch keine Bewertungen

- Chapter 8 Types of Major AccountsDokument39 SeitenChapter 8 Types of Major AccountsJc LocsinNoch keine Bewertungen

- Chapter 01 Principles of AccountingDokument52 SeitenChapter 01 Principles of AccountingAnonymous EvbW4o1U7100% (1)

- Financial Accounting CH2Dokument38 SeitenFinancial Accounting CH2SaudksnNoch keine Bewertungen

- Accounting Presentation COUNTPADokument118 SeitenAccounting Presentation COUNTPADennis Esik MaligayaNoch keine Bewertungen

- Basic Accounting For Non-Accountants (A Bookkeeping Course)Dokument49 SeitenBasic Accounting For Non-Accountants (A Bookkeeping Course)Diana mae agoncilloNoch keine Bewertungen

- Lecture Slides Case-Relic SpotterDokument10 SeitenLecture Slides Case-Relic SpotterLoraine Julio JimenezNoch keine Bewertungen

- Introduction To Accounting and Business: Maestría en Administración de Hospitales Educación A DistanciaDokument49 SeitenIntroduction To Accounting and Business: Maestría en Administración de Hospitales Educación A DistanciaCesar CabreraNoch keine Bewertungen

- Case-Relic-Spotter PDFDokument10 SeitenCase-Relic-Spotter PDFdbh jNoch keine Bewertungen

- Module 1Dokument45 SeitenModule 1by ScribdNoch keine Bewertungen

- Accounting in ActionDokument52 SeitenAccounting in ActionBader_86Noch keine Bewertungen

- QuestionsDokument3 SeitenQuestionsRaca DesuNoch keine Bewertungen

- Dick Reber Created A Corporation Providing Legal Services DickDokument1 SeiteDick Reber Created A Corporation Providing Legal Services DickM Bilal SaleemNoch keine Bewertungen

- Accounting Equation Service Business 6Dokument21 SeitenAccounting Equation Service Business 6udayraj_vNoch keine Bewertungen

- Accounting 2Dokument52 SeitenAccounting 2Shahab JanNoch keine Bewertungen

- CH 01Dokument39 SeitenCH 01Sheikh Azizul IslamNoch keine Bewertungen

- 2 - Accounting Principles - Chapter (1) Accounting in ActionsDokument11 Seiten2 - Accounting Principles - Chapter (1) Accounting in ActionsMahmoud Mohamed BadwiNoch keine Bewertungen

- Accounting Equation - Useful NotesDokument19 SeitenAccounting Equation - Useful Notessam guptNoch keine Bewertungen

- HW01 2014S AccountingBasics BSvaluationDokument5 SeitenHW01 2014S AccountingBasics BSvaluationBethany Wong0% (1)

- Lesson 2 (Basic Accounting Equation)Dokument47 SeitenLesson 2 (Basic Accounting Equation)GRADE TEN EMPATHYNoch keine Bewertungen

- The Bookkeeping Process and Transaction AnalysisDokument54 SeitenThe Bookkeeping Process and Transaction AnalysisdanterozaNoch keine Bewertungen

- Dan Oliver Worked As An Accountant at A Local AccountingDokument1 SeiteDan Oliver Worked As An Accountant at A Local Accountinghassan taimourNoch keine Bewertungen

- Chapter Lecture - RemovedDokument43 SeitenChapter Lecture - RemovedCJ MacasioNoch keine Bewertungen

- The Accounting EquationDokument13 SeitenThe Accounting EquationJooneel Vlogs100% (1)

- Lesson 4-2Dokument28 SeitenLesson 4-2Alexis Nicole Joy Manatad86% (7)

- ACT2111 Fall 2019 Ch2 - Lecture 3&4 - StudentDokument73 SeitenACT2111 Fall 2019 Ch2 - Lecture 3&4 - StudentKevinNoch keine Bewertungen

- Objectives: Introduction To Accounting and BusinessDokument7 SeitenObjectives: Introduction To Accounting and BusinessKetrineNoch keine Bewertungen

- It Quiz Journal EntriesDokument4 SeitenIt Quiz Journal EntriesLino Gumpal0% (1)

- Lesson 02 - Practice of Book Keeping Including Ledgers and Trial BalanceDokument3 SeitenLesson 02 - Practice of Book Keeping Including Ledgers and Trial Balancepulitha kodituwakkuNoch keine Bewertungen

- CH 03 Alt ProbDokument8 SeitenCH 03 Alt ProbMuhammad Usman25% (4)

- 1 Introduction To Accounting and BusinessDokument46 Seiten1 Introduction To Accounting and BusinessAradi WisnuNoch keine Bewertungen

- Chapter 1Dokument28 SeitenChapter 1Gazi JayedNoch keine Bewertungen

- Week 2 - Ch.1 Accounting Equation and Financial Statements-W12-SlidesDokument9 SeitenWeek 2 - Ch.1 Accounting Equation and Financial Statements-W12-SlidesKumar AbhishekNoch keine Bewertungen

- Aqua Ponic FailuresDokument51 SeitenAqua Ponic FailuresfireoniceNoch keine Bewertungen

- SSGPDokument60 SeitenSSGPElaika DomingoNoch keine Bewertungen

- Midterm 1 Fall 19Dokument17 SeitenMidterm 1 Fall 19shaimaaelgamalNoch keine Bewertungen

- Accounting Chapter 3 Accounting CycleDokument194 SeitenAccounting Chapter 3 Accounting CycleRahim MashaalNoch keine Bewertungen

- Balance SheetDokument29 SeitenBalance SheetGrow GlutesNoch keine Bewertungen

- PPT 2 - Business TransactionDokument29 SeitenPPT 2 - Business Transactionthinkaboutbe14Noch keine Bewertungen

- Journal EntriesDokument55 SeitenJournal Entriesmunna00016100% (1)

- Chapter 1 (Introduction To Accounting and Business)Dokument94 SeitenChapter 1 (Introduction To Accounting and Business)Kiky_Arizky_6781Noch keine Bewertungen

- Accounting Equation: Fundamentals of ABM 1Dokument97 SeitenAccounting Equation: Fundamentals of ABM 1ediwowNoch keine Bewertungen

- Hbs 201 Accounting PrinciplesDokument83 SeitenHbs 201 Accounting PrinciplesTawanda MahereNoch keine Bewertungen

- Regulation A+ and Other Alternatives to a Traditional IPO: Financing Your Growth Business Following the JOBS ActVon EverandRegulation A+ and Other Alternatives to a Traditional IPO: Financing Your Growth Business Following the JOBS ActNoch keine Bewertungen

- Report WritingDokument3 SeitenReport WritingSeema SinghNoch keine Bewertungen

- Down in Porto Rico With A KodakDokument114 SeitenDown in Porto Rico With A KodakBeba Atsg100% (1)

- Disabilities AssignmentDokument8 SeitenDisabilities Assignmentapi-427349170Noch keine Bewertungen

- EnglishDokument3 SeitenEnglishYuyeen Farhanah100% (1)

- Functional Skill: 1. Offering HelpDokument36 SeitenFunctional Skill: 1. Offering HelpAnita Sri WidiyaaNoch keine Bewertungen

- General Terms Conditions For Sales Purchases LPG and Chemical TankersDokument34 SeitenGeneral Terms Conditions For Sales Purchases LPG and Chemical TankersSally AhmedNoch keine Bewertungen

- Who Is He? Where Is He? What Does He Do?Dokument3 SeitenWho Is He? Where Is He? What Does He Do?David Alexander Pacheco Morales100% (1)

- FRA - Project - NHPC - Group2 - R05Dokument29 SeitenFRA - Project - NHPC - Group2 - R05DHANEESH KNoch keine Bewertungen

- .. Anadolu Teknik, Teknik Lise Ve Endüstri Meslek LisesiDokument3 Seiten.. Anadolu Teknik, Teknik Lise Ve Endüstri Meslek LisesiLisleNoch keine Bewertungen

- Simple Compound Complex and Compound Complex SentencesDokument7 SeitenSimple Compound Complex and Compound Complex SentencesRanti HarviNoch keine Bewertungen

- Comprehensive Problem Excel SpreadsheetDokument23 SeitenComprehensive Problem Excel Spreadsheetapi-237864722100% (3)

- Business Enterprise Simulation Quarter 3 - Module 2 - Lesson 1: Analyzing The MarketDokument13 SeitenBusiness Enterprise Simulation Quarter 3 - Module 2 - Lesson 1: Analyzing The MarketJtm GarciaNoch keine Bewertungen

- Chapter 2 - AuditDokument26 SeitenChapter 2 - AuditMisshtaCNoch keine Bewertungen

- Module in Sociology CSPDokument78 SeitenModule in Sociology CSPJanz Vincent ReyesNoch keine Bewertungen

- HDFC Bank Summer Internship Project: Presented By:-Kandarp SinghDokument12 SeitenHDFC Bank Summer Internship Project: Presented By:-Kandarp Singhkandarp_singh_1Noch keine Bewertungen

- Sd/-Dr. M. Raghavendra Rao Director of Medical EducationDokument2 SeitenSd/-Dr. M. Raghavendra Rao Director of Medical Educationpriya swathiNoch keine Bewertungen

- Tail Lamp Left PDFDokument1 SeiteTail Lamp Left PDFFrancis RodrigueNoch keine Bewertungen

- Report of Apple Success PDFDokument2 SeitenReport of Apple Success PDFPTRNoch keine Bewertungen

- How To Write A Driving School Business Plan: Executive SummaryDokument3 SeitenHow To Write A Driving School Business Plan: Executive SummaryLucas Reigner KallyNoch keine Bewertungen

- Nef Elem Quicktest 04Dokument2 SeitenNef Elem Quicktest 04manri3keteNoch keine Bewertungen

- Lecture 3 Islamic StudiesDokument10 SeitenLecture 3 Islamic StudiesDr-Hassan JunaidNoch keine Bewertungen

- Uniform Civil Code and Gender JusticeDokument13 SeitenUniform Civil Code and Gender JusticeS.P. SINGHNoch keine Bewertungen

- "Working Capital Management": Master of CommerceDokument4 Seiten"Working Capital Management": Master of Commercekunal bankheleNoch keine Bewertungen

- Open Quruan 2023 ListDokument6 SeitenOpen Quruan 2023 ListMohamed LaamirNoch keine Bewertungen

- Test Bank For We The People 10th Essentials Edition Benjamin Ginsberg Theodore J Lowi Margaret Weir Caroline J Tolbert Robert J SpitzerDokument15 SeitenTest Bank For We The People 10th Essentials Edition Benjamin Ginsberg Theodore J Lowi Margaret Weir Caroline J Tolbert Robert J Spitzeramberleemakegnwjbd100% (14)

- Rakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)Dokument2 SeitenRakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)HRD CORP CONSULTANCYNoch keine Bewertungen

- Blood Angels Ref SheetsDokument4 SeitenBlood Angels Ref SheetsAndrew ThomasNoch keine Bewertungen