Beruflich Dokumente

Kultur Dokumente

Valuation of Gross Estate Taxes

Hochgeladen von

George Poligratis Rico0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

90 Ansichten1 SeiteValuation of Gross Estate Taxes

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenValuation of Gross Estate Taxes

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

90 Ansichten1 SeiteValuation of Gross Estate Taxes

Hochgeladen von

George Poligratis RicoValuation of Gross Estate Taxes

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

& Valuation of Gross Estate or Donation

= Valuation Date - at the time of Death or Donation

» Basis of Valuation

a. Real Properties - Zonal value or Fair Market Value, whichever

is higher

Prior to August 31, 1969 _ Gomm. Act No. 466

* Sept. 1, 1969 to Aug. 13, 1974 RA 6110

> Aug. 14, 1974 to Nov. 24, 1974 PD 539

= Nov. 25, 1974 to Dec. 31, 1985 PD 1054

> Jan. 1, 1986 to 1994 PD 1994

b. Improvements

= RAMO 2-87/3-86/3-87 - June 10, 1986 to Feb. 4, 1988

= RAMO 1-88 - Feb. 5, 1988 to Feb. 18, 1991

+ RAMO 2-91 - Feb. 19, 1991 to present

= RAMO 1-200 - March 17, 2000

> RAMO 1-201 - Feb. 15, 2001

c. Shares of stocks, obligations or bonds

@. Usuftuct,, annuities, use or habitation - there shall be taken into account

the probable life of the beneficiary in accordance with the formula using

Tropical Experience Table of Tax Code

e. Foreign currency and cash in bank - Peso value at exchange rate at time

of death and balance at time of death, respectively

. Other Personal Properties - Fair market value at the time of death

TMD

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

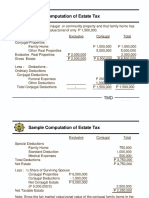

- Sample Computation of Estate TaxDokument2 SeitenSample Computation of Estate TaxGeorge Poligratis RicoNoch keine Bewertungen

- Sample Computation of Estate Tax Part 2Dokument4 SeitenSample Computation of Estate Tax Part 2George Poligratis RicoNoch keine Bewertungen

- Estate TaxesDokument3 SeitenEstate TaxesGeorge Poligratis RicoNoch keine Bewertungen

- Donor's Tax ProblemsDokument3 SeitenDonor's Tax ProblemsGeorge Poligratis RicoNoch keine Bewertungen

- Real Estate Mathematics SAMPLE PROBLEMS (REF: 0505) W/ SolutionDokument11 SeitenReal Estate Mathematics SAMPLE PROBLEMS (REF: 0505) W/ SolutionGeorge Poligratis Rico100% (2)

- Donor Tax Rates and CreditDokument2 SeitenDonor Tax Rates and CreditGeorge Poligratis RicoNoch keine Bewertungen

- Gross Gift Valuation and CompositionDokument2 SeitenGross Gift Valuation and CompositionGeorge Poligratis RicoNoch keine Bewertungen

- Real Estate Mathematics Sample Problems (Ref: 0505) : I. Perimeter Fencing ProblemDokument4 SeitenReal Estate Mathematics Sample Problems (Ref: 0505) : I. Perimeter Fencing ProblemGeorge Poligratis RicoNoch keine Bewertungen

- Real Estate Brokerage PracticeDokument23 SeitenReal Estate Brokerage PracticeGeorge Poligratis Rico67% (3)

- Exemptions From Donor's TaxDokument1 SeiteExemptions From Donor's TaxGeorge Poligratis RicoNoch keine Bewertungen

- Donor's TAxDokument2 SeitenDonor's TAxGeorge Poligratis RicoNoch keine Bewertungen

- Estate Tax New ProvisionsDokument1 SeiteEstate Tax New ProvisionsGeorge Poligratis RicoNoch keine Bewertungen

- Classification of Donors TaxDokument1 SeiteClassification of Donors TaxGeorge Poligratis RicoNoch keine Bewertungen

- Deductions From Gross GiftsDokument1 SeiteDeductions From Gross GiftsGeorge Poligratis RicoNoch keine Bewertungen

- Basis and Rate of Donors TaxDokument2 SeitenBasis and Rate of Donors TaxGeorge Poligratis RicoNoch keine Bewertungen

- Bir-Taxation - Definition of TermsDokument2 SeitenBir-Taxation - Definition of TermsGeorge Poligratis RicoNoch keine Bewertungen

- Administrative Requirements of Donors TaxDokument2 SeitenAdministrative Requirements of Donors TaxGeorge Poligratis RicoNoch keine Bewertungen

- Bir Taxation PurposeDokument2 SeitenBir Taxation PurposeGeorge Poligratis RicoNoch keine Bewertungen

- Accounting & Taxation On Real Estate Transactions by DDV Nov 2015Dokument159 SeitenAccounting & Taxation On Real Estate Transactions by DDV Nov 2015George Poligratis RicoNoch keine Bewertungen

- REVIEWER: Mathematics in Brokerage Practice Problems/QuestionDokument18 SeitenREVIEWER: Mathematics in Brokerage Practice Problems/QuestionGeorge Poligratis Rico100% (1)

- Subdivision Approach Valuation: Drainage, Water & Other Utilities) P 100,000,000Dokument1 SeiteSubdivision Approach Valuation: Drainage, Water & Other Utilities) P 100,000,000George Poligratis RicoNoch keine Bewertungen

- 25 RESA vs. MO 39Dokument37 Seiten25 RESA vs. MO 39George Poligratis Rico100% (2)

- Exponential Geometrical Linear-Growth RateDokument1 SeiteExponential Geometrical Linear-Growth RateGeorge Poligratis RicoNoch keine Bewertungen

- 6-3-Land Rent Theory PDFDokument1 Seite6-3-Land Rent Theory PDFGeorge Poligratis RicoNoch keine Bewertungen

- 1examination On Legal Aspects of Sale PDFDokument53 Seiten1examination On Legal Aspects of Sale PDFGeorge Poligratis RicoNoch keine Bewertungen

- i-PROBLEM CASH FLOW FORMULA EL-377 A MS EXCEL PDFDokument1 Seitei-PROBLEM CASH FLOW FORMULA EL-377 A MS EXCEL PDFGeorge Poligratis RicoNoch keine Bewertungen

- 6-2-Car Appraisal PDFDokument1 Seite6-2-Car Appraisal PDFGeorge Poligratis RicoNoch keine Bewertungen

- ILLUSTRATION - RESIDUAL TECHNIQUE by PDFDokument12 SeitenILLUSTRATION - RESIDUAL TECHNIQUE by PDFGeorge Poligratis RicoNoch keine Bewertungen

- DIFFERENT REPAYMENT PLAN by PDFDokument4 SeitenDIFFERENT REPAYMENT PLAN by PDFGeorge Poligratis RicoNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)