Beruflich Dokumente

Kultur Dokumente

Fullwood Indictment

Hochgeladen von

Jacob RodriguezOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Fullwood Indictment

Hochgeladen von

Jacob RodriguezCopyright:

Verfügbare Formate

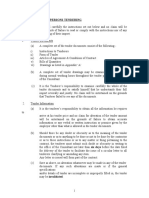

Case 3:16-cr-00048-MMH-JBT Document 1 Filed 04/15/16 Page 1 of 12 PageID 1

FILED

UNITED STATES DISTRICT COURT

2016 APR 15 AK 9: 03

MIDDLE DISTRICT OF FLORIDA

JACKSONVILLE DIVISION

JACKSONVILLE OlSiRiCT

UNITED STATES OF AMERICA

V.

CASE NO.

3:16-cr- ^-1^-3"- 3M3Br

Cts.

18 U.S.C. 1343

1-10:

Cts. 11-14: 26 U.S.C. 7203

Forfeiture: 18 U.S.C. 981(a)(1)(C) and

28 U.S.C. 2461(c)

REGINALD FULLWOOD

a/k/a Reggie Fullwood

INDICTMENT

The Grand Jury charges:

COUNTS ONE THROUGH TEN

(WIRE FRAUD)

A.

Introduction

At times material hereto:

THE DEFENDANT

1.

REGINALD FULLWOOD (FULLWOOD) was a resident of

Jacksonville, Florida.

FULLWOOD was first elected in 2010 as a member of the

Florida House of Representatives, initially representing the 13"' District.

Following redistricting in 2012, FULLWOOD was reelected as a member of the

Florida House of Representatives, representing the 15'" District. In early 2015,

FULLWOOD was reelected to represent the IS''* District.

Case 3:16-cr-00048-MMH-JBT Document 1 Filed 04/15/16 Page 2 of 12 PageID 2

ENTITIES AND ACCOUNTS USED IN THE FRAUDULENT SCHEME

2.

FULLWOOD maintained "Reggie Fullwood Campaign" as a fictitious

name registered with the Florida Department of State.

3.

FULLWOOD maintained a business bank account at Atlantic Coast

Bank, in Jacksonville, Florida, under the organizational name "Reggie Fullwood

Campaign," in which to deposit and maintain campaign funds from campaign

contributors. This campaign account was opened in October 2009, connection

with FULLWOOD's run for election to the Florida House of Representatives and

FULLWOOD was the sole authorized signatory on the campaign account.

4.

FULLWOOD was the owner of an entity named Rhino Harbor, LLC

(Rhino Harbor) registered with the State of Florida Division of Corporations.

5.

FULLWOOD maintained a business bank account at Atlantic Coast

Bank, in Jacksonville, Florida, under the name Rhino Harbor, LLC. FULLWOOD

was the sole authorized signatory on the Rhino Harbor bank account.

6.

FULLWOOD was identified as the Deputy Treasurerof his campaign

for a seat on the Florida House of Representatives.

Case 3:16-cr-00048-MMH-JBT Document 1 Filed 04/15/16 Page 3 of 12 PageID 3

ELECTION LAWS OF THE STATE OF FLORinA

7.

Pursuant to Florida Statutes 106.021 and 106.1405, a state political

candidate's campaign account must be separate from any personal orother

account and must be used only for the purpose ofdepositing contributions and

making expenditures for the candidate.

8.

In the State of Florida, a candidate or the spouse of a candidate may

not use funds on deposit in a campaign account of such candidate to defray

normal living expenses for the candidate or the candidate's family, other than

expenses actually incurred for transportation, meals, and lodging by the candidate

ora family member during travel In the course of the campaign.

9.

In the State of Florida, campaign treasurers designated by a

candidate are required to file regular reports with the State of all contributions

received, and all expenditures made, by or on behalf of the candidate.

B. Scheme and Artifice

From at least September 2010 and continuing thereafter through in or about

December 2011, in Jacksonville, within the Middle District ofFlorida; Tallassee,

Florida: and elsewhere,

REGINALD FULLWOOD,

a/k/a Reggie Fullwood

the defendant herein, did knowingly and willfully devise and participate in, and

Intend to devise and participate in, a scheme and artifice to defraud and for

Case 3:16-cr-00048-MMH-JBT Document 1 Filed 04/15/16 Page 4 of 12 PageID 4

obtaining money and property by means ofmaterially false and fraudulent

pretenses, representations, and promises.

C,

1.

Manner and Means

Itwas part of the scheme and artifice to defraud that FULLWOOD

would solicit and cause to be solicited individuals and entities to contribute money

to the "Reggie Fullwood Campaign" for the stated purpose ofsupporting his

election and reelection to the Florida House of Representatives.

2.

Itwas part of the scheme and artifice to defraud that FULLWOOD

would, using the internet, fraudulently and unlawfully cause electronic funds

transfers from the Reggie Fullwood Campaign account at Atlantic Coast Bank to

be deposited Into the Rhino Harbor bank account at Atlantic Coast Bank.

3.

It was further part of the scheme and artifice to defraud that

FULLWOOD would fraudulently and unlawfully use funds transferred from the

Reggie Fullwood Campaign account at Atlantic Coast Bank into the Rhino Harbor

bank account at Atlantic Coast Bank for personal expenses unrelated to his

campaign to be elected to the Florida House of Representatives.

4.

It was further part of the scheme and artifice to defraud that

FULLWOOD would use funds he had unlawfully obtained from the Reggie

Fullwood Campaign account by using an ATM card issued on the Rhino Harbor

bank account to pay personal expenses orwithdraw cash at various locations,

including restaurants, grocery stores, retail stores, jewelry stores, florists, gas

stations, ATMs for cash withdrawals, and liquor stores.

Case 3:16-cr-00048-MMH-JBT Document 1 Filed 04/15/16 Page 5 of 12 PageID 5

5.

It was further part of the scheme and artifice to defraud that

FULLWOOD would submit or cause to be submitted false and fraudulent

campaign expenditure reports to the State of Florida which included inflated and/or

non-existent campaign expenses in order to hide and conceal the fact that

FULLWOOD had fraudulently and unlawfully embezzled funds from the Reggie

Fullwood Campaign Account with Atlantic Coast Bank, in violation of campaign

laws of the State of Florida.

D.

Execution

On or about the dates set forth below, in Jacksonville, within the Middle

District of Florida; Cherry Hill, New Jersey: and elsewhere,

REGINALD FULLWOOD,

a/k/a Reggie Fullwood

for the purpose of executing such scheme and artifice to defraud, and for obtaining

money and property by materially false and fraudulent pretenses, representations,

and promises, caused to be transmitted by wire in interstate commerce the

following electronic funds transmissions:

Count

ONE

Date

11/23/2010

Originating Account

Beneficiary Account

Amount

Rhino Harbor, LLC Account #8900

Atlantic Coast Bank, Jacksonville, FL

$1,500.00

Atlantic Coast Bank, Jacksonville, FL

Reggie Fullwood Campaign Account,

TWO

11/30/2010

Reggie Fullwood Campaign Account,

Atlantic Coast Bank, Jacksonville, FL

Rhino Harbor, LLC Account #8900

Atlantic Coast Bank, Jacksonville, FL

$1,000.00

THREE

12/23/2010

Reggie Fullwood Campaign Account,

Atlantic Coast Bank, Jacksonville, FL

Rhino Harbor, LLC Account #8900

Atlantic Coast Bank, Jacksonville, FL

$520.00

FOUR

4/06/2011

Reggie Fullwood Campaign Account,

Atlantic Coast Bank, Jacksonville, FL

Rhino Harbor, LLC Account #8900

Atlantic Coast Bank, Jacksonville, FL

$650.00

Case 3:16-cr-00048-MMH-JBT Document 1 Filed 04/15/16 Page 6 of 12 PageID 6

Count

10/12/2011

FIVE

10/21/2011

SIX

SEVEN

EIGHT

NINE

TEN

Date

10/28/2011

11/1/2011

12/20/2011

12/23/2011

Originating Account

Beneficiary Account

Reggie Fullwood Campaign Account,

Atlantic Coast Bank, Jacksonville, FL

AtlanticCoast Bank, Jacksonville, FL

Reggie Fullwood Campaign Account,

Atlantic Coast Bank,Jacksonville, FL

Atlantic Coast Bank, Jacksonville, FL

Reggie Fullwood Campaign Account,

Atlantic Coast Bank,Jacksonville, FL

AtlanticCoast Bank, Jacksonville, FL

Reggie Fullwood Campaign Account,

Atlantic Coast Bank,Jacksonville, FL

AtlanticCoast Bank, Jacksonville, FL

Rhino Harbor, LLC Account #8900

Rhino Harbor, LLC Account #8900

Rhino Harbor, LLC Account #8900

Rhino Harbor, LLC Account #8900

Reggie Fullwood CampaignAccount,

Rhino Harbor, LLC Account #8900

Atlantic Coast Bank, Jacksonville, FL

AtlanticCoast Bank, Jacksonville, FL

Reggie FullwoodCampaign Account,

Rhino Harbor, LLC Account #8900

Atlantic Coast Bank, Jacksonville, FL

Atlantic CoastBank, Jacksonville, FL

Amount

$1,00.00

$2,000.00

$1,000.00

$2,000.00

$1,000.00

$400.00

In violation of Title 18, United States Code, Sections 1343 and 2.

COUNT ELEVEN

(Failure to File Income Tax Return)

During the calendar year 2010, in the Middle District ofFlorida, and

elsewhere,

REGINALD FULLWOOD,

a/k/a Reggie Fullwood

the defendant herein, who was a resident of Duval County, Florida, had and

received gross income substantially in excess of the minimum filing amounts

established by law for said calendar year. By reason of such gross income

defendant REGINALD FULLWOOD was required by law, following the close of the

calendar year2010, and on or before April 15,2011, to make an income taxreturn

to the Internal Revenue Service Center at Atlanta, Georgia, to the person assigned

to receive returns at the local office ofthe Internal Revenue Service at

Jacksonville, Florida, and to another Internal Revenue Service officer permitted by

Case 3:16-cr-00048-MMH-JBT Document 1 Filed 04/15/16 Page 7 of 12 PageID 7

the Commissioner of Internal Revenue, stating specifically the items of his gross

income and any deductions and credits to which he was entitled. Well knowing

and believing all of the foregoing, defendant REGINALD FULLWOOD did willfully

fail, on or about April 15, 2011, in the Middle District of Florida, and elsewhere, to

make an income tax return.

In violation of Title26, United States Code, Section 7203.

COUNT TWELVE

(Failure to File Income Tax Return)

During the calendar year 2011, in the Middle District of Florida, and

elsewhere,

REGINALD FULLWOOD,

a/k/a Reggie Fullwood

the defendant herein, who was a resident ofDuval County, Florida, had and

received gross income substantially in excess ofthe minimum filing amounts

established by law for said calendar year. By reason of such gross income

defendant REGINALD FULLWOOD was required by law, following the close of the

calendar year 2011, and on or before April 15,2012, to make an income tax return

to the Internal Revenue Service Center at Atlanta, Georgia, to the person assigned

to receive returns at the local office of the Internal Revenue Service at

Jacksonville, Florida, and to another Internal Revenue Service officer permitted by

the Commissioner of Internal Revenue, stating specifically the items of his gross

income and any deductions and credits to which he was entitled. Well knowing

Case 3:16-cr-00048-MMH-JBT Document 1 Filed 04/15/16 Page 8 of 12 PageID 8

and believing all of the foregoing, defendant REGINALD FULLWOOD did willfully

fail, on or about April 15, 2012, in the Middle District of Florida, and elsewhere, to

make an income tax return.

In violation of Title 26, United States Code, Section 7203.

COUNT THIRTEEN

(Failure to File Income Tax Return)

During the calendar year 2012, in the Middle District of Florida, and

elsewhere,

REGINALD FULLWOOD,

a/k/a Reggie Fullwood

the defendant herein, who was a resident of Duval County, Florida, had and

received gross income substantially in excess ofthe minimum filing amounts

established by law for said calendar year. By reason ofsuch gross income

defendant REGINALD FULLWOOD was required by law, following the close ofthe

calendar year 2012, and on or before April 15. 2013, to make an income tax return

tothe Internal Revenue Service Center at Atlanta, Georgia, tothe person assigned

to receive returns at the local office of the Internal Revenue Service at

Jacksonville, Florida, and to another Internal Revenue Service officer permitted by

the Commissioner of Internal Revenue, stating specifically the items of his gross

income and any deductions and credits to which he was entitled. Well knowing

and believing all of the foregoing, defendant REGINALD FULLWOOD did willfully

Case 3:16-cr-00048-MMH-JBT Document 1 Filed 04/15/16 Page 9 of 12 PageID 9

fail, on or about April 15, 2013, in the Middle District of Florida, and elsewhere, to

make an income tax retum.

In violation of Title 26, United states Code, Section 7203.

COUNT FOURTEEN

(Failure to File Income Tax Return)

During the calendar year 2013, in the Middle District of Florida, and

elsewhere,

REGINALD FULLWOOD,

a/k/a Reggie Fullwood

the defendant herein, whowas a resident of Duval County, Florida, had and

received gross income substantially in excess ofthe minimum filing amounts

established by law for said calendar year. By reason ofsuch gross income

defendant REGINALD FULLWOOD was required by law, following the close ofthe

calendar year 2013, and on or before April 15, 2014, to make an income tax return

tothe Internal Revenue Service Center at Atlanta, Georgia, tothe person assigned

to receive returns at the local office of the Internal Revenue Service at

Jacksonville, Florida, and to another Internal Revenue Service officer permitted by

the Commissioner of Internal Revenue, stating specifically the items of his gross

income and any deductions and credits towhich he was entitled. Well knowing

and believing all of theforegoing, defendant REGINALD FULLWOOD did willfully

Case 3:16-cr-00048-MMH-JBT Document 1 Filed 04/15/16 Page 10 of 12 PageID 10

fail, on or about April 15, 2014, in the Middle District of Florida, and elsewhere, to

make an income tax return.

In violation of Title 26. United States Code. Section 7203.

FORFEITURE

1.

The allegations contained in Counts One through Ten ofthis

Indictment are incorporated by reference for the purpose ofalleging forfeitures

pursuantto Title 18. United States Code, Section 981(a)(1)(C) and Title 28. United

States Code, Section 2461 (c).

2.

Upon conviction of a violation of Title 18, United States Code.

Section 1343, the defendant, REGINALD FULLWOOD, a/k/a Reggie Fullwood,

shall forfeit to the United States of America, pursuant to Title 18, United States

Code. Section 981(a)(1)(C) and Title 28. United States Code, Section 2461(c). any

property, real or personal, which constitutes or is derived from proceeds traceable

to the offense.

3.

The property to be forfeited includes, but is not limited to, the

following:

a money judgment in the amount of at least $65,445.00,

representing the amount of proceeds obtained as a result

of the offense charged in Counts One through Ten.

4.

If any ofthe property described above, as a result ofany act or

omission of the defendant;

10

Case 3:16-cr-00048-MMH-JBT Document 1 Filed 04/15/16 Page 11 of 12 PageID 11

a.

cannot be located upon the exercise of due diligence;

b.

has been transferred or sold to, or deposited with, a third

party:

c.

has been placed beyond the jurisdiction of the court;

d.

has been substantially diminished in value; or

e.

has been commingled with other property which cannot be

divided without difficulty,

the United States of America shall be entitled to forfeiture of substitute property

pursuant to Title 21, United States Code, Section 853(p), as incorporated by Title

28, United States Code, Section 2461(c).

A TRUE BILL,

Foreperson

A. LEE BENTLEY, III

United States Attorney

By:

MARK B. DEVEREAUX

Assigt&rit United States Attorney

By;

MAsii/HEAVENER. Ill

Assistant United States Attorney

Deputy Chief, Jacksonville Division

11

Case 3:16-cr-00048-MMH-JBT Document 1 Filed 04/15/16 Page 12 of 12 PageID 12

FORM OBD-34

APR 1991

No.

UNITED STATES DISTRICT COURT

Middle District of Florida

Jacksonville Division

THE UNITED STATES OF AMERICA

vs.

REGINALD FULLWOOD

a/k/a Reggie Fullwood

INDICTMENT

Violations:

18U.S.C. 1343

26 U.S.C. 7203

A true bill

Foreperson

day

Filed in open court this

of April, 2016.

Clerk

Bail

M.

$

GP0 663525

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Mall Indictment REDACTEDDokument80 SeitenMall Indictment REDACTEDJacob RodriguezNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- GentrificationAnalysis VulnerabilityIndex 2015 CriteriaMapsDokument1 SeiteGentrificationAnalysis VulnerabilityIndex 2015 CriteriaMapsJacob RodriguezNoch keine Bewertungen

- Tate LetterDokument1 SeiteTate LetterJacob RodriguezNoch keine Bewertungen

- Question #1 of 94: Distinguishable From The Company's Other Lines of BusinessDokument43 SeitenQuestion #1 of 94: Distinguishable From The Company's Other Lines of BusinessShahd OkashaNoch keine Bewertungen

- Illegal Petes LLC CourtDokument7 SeitenIllegal Petes LLC CourtJacob RodriguezNoch keine Bewertungen

- Ex. 4 2017.10.06 Letter To Joel and Mary FloresDokument1 SeiteEx. 4 2017.10.06 Letter To Joel and Mary FloresJacob RodriguezNoch keine Bewertungen

- 1 Complaint and Jury Demand (VPA)Dokument39 Seiten1 Complaint and Jury Demand (VPA)Jacob RodriguezNoch keine Bewertungen

- RTD Counterclaims and AnswerDokument32 SeitenRTD Counterclaims and AnswerJacob RodriguezNoch keine Bewertungen

- 911 Council PresentationDokument22 Seiten911 Council PresentationJacob RodriguezNoch keine Bewertungen

- Lamborn On Ballot PDFDokument25 SeitenLamborn On Ballot PDFJacob RodriguezNoch keine Bewertungen

- Manual Principal Resignation LetterDokument2 SeitenManual Principal Resignation LetterJacob RodriguezNoch keine Bewertungen

- Request For Written Complaint Letter Signed 3-22-18Dokument1 SeiteRequest For Written Complaint Letter Signed 3-22-18Jacob RodriguezNoch keine Bewertungen

- The Order To Remove Flags From Bedigian's PropertyDokument4 SeitenThe Order To Remove Flags From Bedigian's PropertyJacob RodriguezNoch keine Bewertungen

- Organ Donation FormDokument1 SeiteOrgan Donation FormJacob RodriguezNoch keine Bewertungen

- 1994 Heisman Trophy: Rashaan SalaamDokument1 Seite1994 Heisman Trophy: Rashaan SalaamJacob RodriguezNoch keine Bewertungen

- ATF FAQ Organ Donation CO Updated 9.27.17Dokument3 SeitenATF FAQ Organ Donation CO Updated 9.27.17Jacob RodriguezNoch keine Bewertungen

- Complaint - DPD Officers Vs Denver & DPPADokument12 SeitenComplaint - DPD Officers Vs Denver & DPPAJacob RodriguezNoch keine Bewertungen

- Denver Broncos Roster 2017Dokument8 SeitenDenver Broncos Roster 2017Jacob RodriguezNoch keine Bewertungen

- 135124-1985-Rizal Cement Co. Inc. v. Villareal20190320-5466-1tfq0rdDokument7 Seiten135124-1985-Rizal Cement Co. Inc. v. Villareal20190320-5466-1tfq0rdFrance SanchezNoch keine Bewertungen

- Marcelo Steel Corporation vs. Collector of Internal RevenueDokument2 SeitenMarcelo Steel Corporation vs. Collector of Internal RevenuesakuraNoch keine Bewertungen

- Indirect Tax Laws (New)Dokument892 SeitenIndirect Tax Laws (New)Mayank Jain100% (5)

- Income Measurement Income Measurement: Analyzing Operating ActivitiesDokument10 SeitenIncome Measurement Income Measurement: Analyzing Operating ActivitiesVidya RamadhanNoch keine Bewertungen

- Wjec Gcse History Coursework Mark SchemeDokument4 SeitenWjec Gcse History Coursework Mark Schemekylopuluwob2100% (2)

- Https WWW - Onlinesbi.com Sbicollect Paymenthistory Paymenthistoryredirecturl - HTMDokument1 SeiteHttps WWW - Onlinesbi.com Sbicollect Paymenthistory Paymenthistoryredirecturl - HTMPavlov Kumar HandiqueNoch keine Bewertungen

- Benguet Corporation vs. Central Board of Assessment Appeal (GR No. 106041, January 29,1993)Dokument4 SeitenBenguet Corporation vs. Central Board of Assessment Appeal (GR No. 106041, January 29,1993)Kimberly SendinNoch keine Bewertungen

- The Blanchard (1985) Model of Perpetual Youth: August 28, 2019Dokument13 SeitenThe Blanchard (1985) Model of Perpetual Youth: August 28, 2019utsoreeNoch keine Bewertungen

- BL1 Individual Activity 1 AGDokument1 SeiteBL1 Individual Activity 1 AGSamantha Reynolds-SNoch keine Bewertungen

- Petitioners Vs Vs Respondents: First DivisionDokument7 SeitenPetitioners Vs Vs Respondents: First DivisionGermaine CarreonNoch keine Bewertungen

- Alternative Center For Organizational Reforms and Development, Inc., vs. ZamoraDokument2 SeitenAlternative Center For Organizational Reforms and Development, Inc., vs. ZamoraRiel BanggotNoch keine Bewertungen

- 2015 Financial ReturnDokument27 Seiten2015 Financial ReturnChad O'CarrollNoch keine Bewertungen

- 2Dokument2 Seiten2maeNoch keine Bewertungen

- IRBs Public Ruling No 5 of 2019 - Employee Buy Out Payments Taxable As Perquisites LHAG Update 20200221Dokument4 SeitenIRBs Public Ruling No 5 of 2019 - Employee Buy Out Payments Taxable As Perquisites LHAG Update 20200221Ann YeoNoch keine Bewertungen

- IHRMDokument15 SeitenIHRMShipra ShrivastavaNoch keine Bewertungen

- Sample Investment ReportDokument27 SeitenSample Investment ReportMs.WhatnotNoch keine Bewertungen

- Contabilidad Financiera Iii: Activity #5 Vocabulary About Stockholders' EquityDokument2 SeitenContabilidad Financiera Iii: Activity #5 Vocabulary About Stockholders' EquityMonica JohannaNoch keine Bewertungen

- Benefits To The Tax Payer. For Example Taxes On Income, Wealth, Imports, Exports EtcDokument3 SeitenBenefits To The Tax Payer. For Example Taxes On Income, Wealth, Imports, Exports EtcSaurabhNoch keine Bewertungen

- Form 16 (2022-23) Assessment Year 2023-24Dokument6 SeitenForm 16 (2022-23) Assessment Year 2023-24Hidden future techNoch keine Bewertungen

- Factors That Influence The Performance of Micro and Small Business Enterprises (A Case Study in Arbegona Town)Dokument53 SeitenFactors That Influence The Performance of Micro and Small Business Enterprises (A Case Study in Arbegona Town)Gadisa Gudina100% (1)

- The Impact of Cost of Capital On Financi PDFDokument238 SeitenThe Impact of Cost of Capital On Financi PDFJean Diane JoveloNoch keine Bewertungen

- Proforma Invoice 110 V1-Moh13994-NBDokument1 SeiteProforma Invoice 110 V1-Moh13994-NBTALAL TRADESNoch keine Bewertungen

- HDD InvoiceDokument1 SeiteHDD Invoicearun rayakwarNoch keine Bewertungen

- Liberty Mills Limited: Audit ReportDokument41 SeitenLiberty Mills Limited: Audit ReportAmad MughalNoch keine Bewertungen

- Indonesias Oil and Gas Laws (Oentoeng Suria)Dokument20 SeitenIndonesias Oil and Gas Laws (Oentoeng Suria)upiNoch keine Bewertungen

- The Price System and The Micro Economy: Ideas For Answers To Progress QuestionsDokument6 SeitenThe Price System and The Micro Economy: Ideas For Answers To Progress QuestionsChristy NyenesNoch keine Bewertungen

- Indian Income Tax Return AcknowledgementDokument1 SeiteIndian Income Tax Return AcknowledgementMadan ChaturvediNoch keine Bewertungen

- WeBOC Registration RequirementDokument3 SeitenWeBOC Registration RequirementbehindthelinkNoch keine Bewertungen

- Instruction To TenderersDokument4 SeitenInstruction To TenderersPrinceCollinzeLockoNoch keine Bewertungen