Beruflich Dokumente

Kultur Dokumente

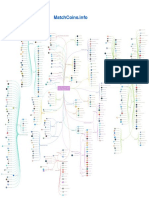

The Block Chain Ecosystem

Hochgeladen von

Luis AlvaradoCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Block Chain Ecosystem

Hochgeladen von

Luis AlvaradoCopyright:

Verfügbare Formate

2016 The Blockchain Ecosystem

Introduction

The blockchain combines cryptography &

distributed computing to deliver secure, direct

peer to peer transactions without the need for a

central party. At its heart is the Distributed Ledger.

This is a tamper proof, public, network-hosted,

record of all consensus verifiedtransactions.

Initially realised via Bitcoin & similar cryptocurrencies, focus & investment is now shifting to the

potential of blockchain technology to revolutionise the infrastructure & processes of established

Financial Institutions & other enterprises.

This Map summarises the key principles behind the

blockchain & the emerging ecosystem addressing

payments, banking & other potential use cases.

Payment Use Cases

Retailing

The Cryptocurrency Ecosystem

blockchain companies

to Oct 2015. $462 million

1

of this in 2015 alone.

$121million

805

30+

Remittances

Merchant

Payment

Processing

Merchants

Exchanges

Bitcoin Processing

Bitcoin PoS

Mining

Multiservice

Companies

Exchange

21 INC

- AntPool

106,000

Number of merchants who

accept Bitcoin 4

$4.9bn

Bitcoin capitalisation Nov 2015.

Bitcoin accounts for around

90% of the capital value of all

cryptocurrencies 5

$2.7bn

value of Bitcoin trading in Sept

2015 6

475

Bitcoin ATMs installed

worldwide 7

- Slush'spool

Bitcoin

The Distributed Ledger

Anatomy of a

Transaction

1 Initiation

sender

Transaction Instruction

-prior transaction(s)

-recipient address

-value & conditions

-digital signature

The Ledger

2 Verification

Consensus

Verified Block

Blockchain

1 CoinDesk & Crunchbase

2 Venturescanner.com reviewed Nov 2015

3 FirstPartner research

4 CoinDesk State of Bitcoin Report Q3 2015

5 Blockchain.info checked 16th Nov 2015

6 Bitcoinity.org

7 Coin ATM Radar checked Oct 2015

Contact us for in-depth insight

into your target markets!

Contacts

hello@firstpartner.net

+44 (0) 870 874 8700

@firstpartner

www.firstpartner.net

www.firstpartner.net

Copyright FirstPartner Ltd 2015

IoT

Registering and validating

connected devices

Data

Distributed storage of and

access to business data

Distributed P2P

Networks

i

L

F VA

e-Identity

Litecoin

Consensus:

Latency:

Currency:

Issuance:

Registering and validating

individual identity

Other Use Cases

Data & Analytics

a

N

P IO

T

t

A

s

r U

Proof of Work

10 minutes

BTC - on and off-network

Mining Reward. 21M Limit

Prevents double spend or validation of fraudulent transactions:

Proof of work: miners compete to validate blocks by solving highly

processor/RAM intensive cryptographic problems for reward

Distributed consensus: majority validation by trusted subnetworks

of peer nodes within the network. Used by Ripple & Stellar

Proof of stake: achieves distributed consensus by network users

proving their ownership of currency. Used by Peercoin & Bitshares

Value

recipient

Validation:

Latency:

Currency:

Issuance:

AKA the Blockchain. A Public record of all

transactions - stored across a distributed P2P

network of servers. Verified transactions are added

in blocks and the history provides proof of value or

assets owned.

the

nodes or miners:

network

-propogate

-group into candidate blocks

-validate signatures

-verify through consensus

3 Completion

The medium for transaction settlement within the

newtork & rewarding miners. Cryptographically

generated, protocol rules detremine issuance &

destruction. May be tradeable off the newtork

(e.g. Bitcoin) or only exist on network (e.g. XRP)

Proof of Work

2.5 minutes

LTC - on and off-network

Mining Reward. 84M Limit

Ripple

Consensus based protocol designed

specifically for existing financial

institutions. Supplementing existing

processes & directly suporting fiat

currencies, lead use cases are

international paymemts & inter

Financial Institution settlement

Validation: Distributed consensus

Latency:

3 seconds

Currency: XRP on-network only

Issuance: At inception -100 BN units

created.

Ethereum

The R3 Consortium

Technologyy led

initiative of 30+

banks to design

& apply distributed

ledger technology to

global financial markets

Policy

Crypto 2.0 - Building

on the Bockchain

Encode & validate

conditions for a

transaction between

parties. Potentially

faciliate legally

binding transactions

over the blockchain

Bitcoins altered to

represent an asset.

Exchanged via the

Open Assets

Protocol. Allows

trading of physical &

other assets

Smart Contracts

Enabling Layers

Colored Coins & Open Assets

Core Blockchain Protocols

Stellar

Validation:

Latency:

Currency:

Issuance:

Doge - on & off-network

Mining Reward. Unlimited

Legal

Raising finance & distributing equity

Blockchain Benefits

- Ecosystem simplification

- Faster interbank clearing & settlement

- Lower transaction costs

- Reduced counterparty risk

- Transaparency & auditability

- Ease of software development/integration

Risks

Vs.

- Unproven technology

- Untested capacity/scalabilitty

- Low transaction speed

- Possible concensus prototcol flaws

- Cryptocurrency price volatility

- Uncertain regulatory status

Ripple: facilitating multiple

Financial Institutions focussing on

payment solutions

Consensys: building an

Ethereum based ecosystem &

partnered with Microsoft for

Ethereum Blockchain as a Service

Distributed consensus

2-5 seconds

Lumens on-network only

100 BN then 1% issued PA

Crowd Funding

Executing smart legal

contracts

Protocols,

platforms & SDKs

that build on

top of core

blockchain

protocols to

enable

additional

transaction

types & services

Protocol Commercialisation

Ripple derivative. Financial focus

Proof of Work

1 minute

Institutional Investment

Financial Infrastructure & APIs

Market Places

Trading & sharing of

physical & digital assets &

services

Publishing

Digital asset rights management, distribution &

payment

Balancingthe Benefits

Key Security/HSMs

Complaince

Interbank Networks

Card Schemes

Y

P

Enable implementation

of private Blockchains/

sidechains &/or the

development & securing

of financial applications

Smart contract & distributed app focus

Validation: Proof of Work

Latency:

12 seconds

Currency: ETH on-network only

Issuance: Mining Reward.

Dogecoin

Consensus:

Latency:

Currency:

Issuance:

Central Banks & Initiatives

National Clearing

The following major central banks have undertaken assesments or

issued statements on regulation, potential risks to financial systems

and/or benefits but none yet has a definitive policy stance.

- The Federal Reserve

- Bank of England

- Monetary Authority of Singapore

- Banque de France

- Peoples Bank of China

- Deutsche Bundesbank

- Reserve Bank of India

- European Central Bank

Securities & Derivatives & Asset Trading Platforms

Smart contracts

& blockchain for

transparent

trading & post

trade settlement

Open Protocols for

Institutions

Blockchain

Created as an alternative to central

bank controlled fiat currencies, Bitcoin

was the first working Cryptocurrency.

It remains dominant but lack of

scalability and other inherent flaws will

likely prevent mass adoption.

Protocol Components

The Currency

n

tr O

Commercial platforms &

services targeting Financial

Institutions

Bitcoin Based

Cryptocurrencies

- Ghash.io

- F2Pool

Like what you see?

Processing

Mining Pools

Liquidity Provision

Enabling the Financial Services Blockchain

Mining

Banks & Financial Institutions known to

be testing, analysing or investing in the

blockchain technologies 3

Richard Warren

rwarren@firstpartner.net

Wallet

Mining Technology & Commercial Operations

of registered Bitcoin wallets in

11m Number

Sept 2015 - up from 6.6m in Sept 2014

r

e

Securities Markets

Trading & Markets

Regulated financial instutions & platform vendors exploring blockchain technology

as an alternative to centralised & correspondent payment processing

Retail & Commercial Banks

Money Transfer Operators

PSPs Supporting Bitcoin

Risk & Fraud

Management

Resilience

Market

Makers

Number of early stage Bitcoin &

blockchain companies identified by

Venture Scanner 2

Author

International

Remittance

BitCoin ATM

FirstPartner

Product

Launch

Forex

Established Financial Ecosystem

Specialist companies facilitating transaction validation, currency exchange,

storage & payment on existing cryptocurrency newtworks (primarily Bitcoin)

Bitcoin Debit Cards

Customer

Engagement

Proposition

Development

Interbank Clearing

Users

Largest cumulative

funding total - raised by

Bitcoin computer

developer 21inc. 1

Sources:

Financial Inclusion

Wallets

Blockchain numbers

VC invest$921million Cumulative

ment in Bitcoin &

Person 2 Person

Market

Insight

Investors

Proof of Ownership

Tamper proof registration &

stamping of physical &

digital assets

Das könnte Ihnen auch gefallen

- How To DeFi Advanced PDFDokument290 SeitenHow To DeFi Advanced PDFNaeem Deen91% (11)

- Basics Blockchain Economics Technology Business PDFDokument482 SeitenBasics Blockchain Economics Technology Business PDFAlbeiro Rojas100% (3)

- Great Chain of Numbers A Guide To Smart Contracts, Smart Property and Trustless Asset Management - Tim SwansonDokument130 SeitenGreat Chain of Numbers A Guide To Smart Contracts, Smart Property and Trustless Asset Management - Tim SwansonTim Swanson100% (5)

- Blockchain 102Dokument255 SeitenBlockchain 102Paulo DuarteNoch keine Bewertungen

- Whitepaper TokenomyDokument66 SeitenWhitepaper TokenomyJulie BrewerNoch keine Bewertungen

- The Anatomy of A Money-Like Informational CommodityDokument318 SeitenThe Anatomy of A Money-Like Informational CommodityTim Swanson100% (5)

- ChainlinkDokument15 SeitenChainlinkPhillip James TanNoch keine Bewertungen

- Blockchain Research-Report IbmDokument209 SeitenBlockchain Research-Report Ibmgb100% (1)

- Blockchain by Example PDFDokument249 SeitenBlockchain by Example PDFNelis Medina100% (3)

- Blocks and Chains: Introduction To Bitcoin, Cryptocurrencies, and Their Consensus MechanismsDokument125 SeitenBlocks and Chains: Introduction To Bitcoin, Cryptocurrencies, and Their Consensus MechanismsonesimusNoch keine Bewertungen

- Stablecoin Report v1.0Dokument139 SeitenStablecoin Report v1.0brineshrimp100% (3)

- Xiwei Xu, Ingo Weber, Mark Staples - Architecture For Blockchain Applications (2019, Springer)Dokument312 SeitenXiwei Xu, Ingo Weber, Mark Staples - Architecture For Blockchain Applications (2019, Springer)FRANKLIN GONZALEZ DORADO100% (1)

- NFT Market Sees Major Developments and High-Profile Auctions in Q2Dokument37 SeitenNFT Market Sees Major Developments and High-Profile Auctions in Q2Robbie Davis100% (1)

- Commercializing Blockchain: Strategic Applications in the Real WorldVon EverandCommercializing Blockchain: Strategic Applications in the Real WorldNoch keine Bewertungen

- Standard Tokenization Protocol Whitepaper EN v4 1Dokument12 SeitenStandard Tokenization Protocol Whitepaper EN v4 1Fere CaoNoch keine Bewertungen

- Blockchain Revolution: Understanding the Crypto Economy of the Future. A Non-Technical Guide to the Basics of Cryptocurrency Trading and InvestingVon EverandBlockchain Revolution: Understanding the Crypto Economy of the Future. A Non-Technical Guide to the Basics of Cryptocurrency Trading and InvestingNoch keine Bewertungen

- Ebook: Blockchain Technology (English)Dokument25 SeitenEbook: Blockchain Technology (English)BBVA Innovation Center100% (2)

- Think Blockchain. BookDokument130 SeitenThink Blockchain. Bookvarun upadhyaya100% (14)

- The Blockchain: Down The Rabbit Hole: Discover The Power of The Blockchain - Free PreviewDokument51 SeitenThe Blockchain: Down The Rabbit Hole: Discover The Power of The Blockchain - Free PreviewTim Lea92% (13)

- Educhain Blockchain Insights Report enDokument20 SeitenEduchain Blockchain Insights Report enWooj BianconeroNoch keine Bewertungen

- Roadmap For Blockchain Standards ReportDokument24 SeitenRoadmap For Blockchain Standards ReportCrowdfundInsider100% (2)

- PoW Vs PoSDokument3 SeitenPoW Vs PoSRao ZaryabNoch keine Bewertungen

- The Blockchain For Global FreightDokument13 SeitenThe Blockchain For Global Freightjvr001100% (1)

- SmartContract Audit Solidproof CryptalkDokument26 SeitenSmartContract Audit Solidproof CryptalkMuhd ZulQarnainNoch keine Bewertungen

- Blockchain A CatalystDokument44 SeitenBlockchain A CatalystsankhaNoch keine Bewertungen

- Scaling Ethereum Applications and Cross-Chain Finance @stse Harmony - One/talkDokument11 SeitenScaling Ethereum Applications and Cross-Chain Finance @stse Harmony - One/talkstargeizerNoch keine Bewertungen

- BlockChain in Indian ContextDokument57 SeitenBlockChain in Indian ContextManiNoch keine Bewertungen

- Banking On BlockchainDokument28 SeitenBanking On Blockchainldhutch100% (2)

- Blockchain TechnologyDokument37 SeitenBlockchain Technologyabdulaziz saif ali mansoor100% (1)

- According To CMC: DeFi AdditionDokument17 SeitenAccording To CMC: DeFi AdditionMolly Zuckerman100% (6)

- Deloitte UK Blockchain (Full Report)Dokument25 SeitenDeloitte UK Blockchain (Full Report)Syndicated News100% (3)

- How Blockchain Technology Is Changing Real Estate211112Dokument24 SeitenHow Blockchain Technology Is Changing Real Estate211112minho jungNoch keine Bewertungen

- Smart Contracts: A Concise History of Contracts and Their Evolution into CodeDokument33 SeitenSmart Contracts: A Concise History of Contracts and Their Evolution into CodepacdoxNoch keine Bewertungen

- Cryptocurrency PredictionDokument8 SeitenCryptocurrency PredictionAnonymous hRQYK3JL0% (1)

- SECTOR 19 001 Blockchain LowresDokument28 SeitenSECTOR 19 001 Blockchain LowreshishamuddinohariNoch keine Bewertungen

- BlockchainDokument25 SeitenBlockchainCash Cash Cash100% (1)

- Lecture 2 Smart Contracts and Solidity Basics1Dokument133 SeitenLecture 2 Smart Contracts and Solidity Basics1anon_349229941Noch keine Bewertungen

- Sec18-Reverse Engineering EthereumDokument16 SeitenSec18-Reverse Engineering EthereumShuixin ChenNoch keine Bewertungen

- The Future of Blockchain in Asia Pacific Codex3240 PDFDokument28 SeitenThe Future of Blockchain in Asia Pacific Codex3240 PDFEng Eman HannounNoch keine Bewertungen

- Blockchain in LogisticsDokument28 SeitenBlockchain in Logisticsrami.sweidane125100% (4)

- Blockchain Programming: A Brief Presentation by PradeepDokument10 SeitenBlockchain Programming: A Brief Presentation by Pradeeppradeep mathiannal0% (1)

- B07221VJ1SDokument166 SeitenB07221VJ1Sp863003Noch keine Bewertungen

- Step-By-Step Guide Build & Deploy Ethereum Blockchain Smart ContractDokument44 SeitenStep-By-Step Guide Build & Deploy Ethereum Blockchain Smart ContractKefa Rabah100% (1)

- 15STM Blockchain-101Dokument15 Seiten15STM Blockchain-101Raghu VamsiNoch keine Bewertungen

- Blockchains in DetailsDokument25 SeitenBlockchains in Detailsdineshgomber100% (2)

- 300 Crypto Map Matchcoins InfoDokument1 Seite300 Crypto Map Matchcoins Infoclawmvp100% (1)

- Blockchain MarketDokument156 SeitenBlockchain MarketSandeep BhagatNoch keine Bewertungen

- A Framework For Comparison: ResearchDokument75 SeitenA Framework For Comparison: Researchbriton336Noch keine Bewertungen

- BLOCKCHAIN 101: Setting Up a Development EnvironmentDokument26 SeitenBLOCKCHAIN 101: Setting Up a Development EnvironmentblueiconusNoch keine Bewertungen

- ETP WP Metaverse-whitepaper-v3.0-EN PDFDokument35 SeitenETP WP Metaverse-whitepaper-v3.0-EN PDFhaimkichikNoch keine Bewertungen

- q21 Cryptos Magazine February 2018 PDFDokument81 Seitenq21 Cryptos Magazine February 2018 PDFNhan Phan100% (4)

- Decentralised Finance (De-Fi) : Is This The Future of Finance?Dokument26 SeitenDecentralised Finance (De-Fi) : Is This The Future of Finance?Patrick Kiragu Mwangi BA, BSc., MA, ACSINoch keine Bewertungen

- Bitcoin From Three PerspectivesDokument10 SeitenBitcoin From Three PerspectivescreminssNoch keine Bewertungen

- Yetubit Exchange: Whitepaper V 1.1Dokument22 SeitenYetubit Exchange: Whitepaper V 1.1CRYPTO BEGINNERSNoch keine Bewertungen

- Messari Report Crypto Theses For 2021Dokument134 SeitenMessari Report Crypto Theses For 2021email4logins100% (1)

- Capgemini Smart-Contracts & Blockchain October 2016Dokument28 SeitenCapgemini Smart-Contracts & Blockchain October 2016CrowdfundInsiderNoch keine Bewertungen

- Blockchain PresentationDokument22 SeitenBlockchain PresentationInjam Shovon100% (2)

- What Is Blockchain TechnologyDokument18 SeitenWhat Is Blockchain Technologyinspirohm777Noch keine Bewertungen

- Bitcoin for Nonmathematicians:: Exploring the Foundations of Crypto PaymentsVon EverandBitcoin for Nonmathematicians:: Exploring the Foundations of Crypto PaymentsNoch keine Bewertungen

- Blockchain FundementalsDokument50 SeitenBlockchain FundementalsindramaNoch keine Bewertungen

- HomeCredit Loan Payment ScheduleDokument2 SeitenHomeCredit Loan Payment ScheduleKylyn JynNoch keine Bewertungen

- MD Wasim Ansari, Paytm, PPTDokument20 SeitenMD Wasim Ansari, Paytm, PPTMd WasimNoch keine Bewertungen

- Applied Taxation ACCT 370: Rabia SaleemDokument23 SeitenApplied Taxation ACCT 370: Rabia Saleemsultan siddiquiNoch keine Bewertungen

- IMF and World BankDokument100 SeitenIMF and World BankMohsen SirajNoch keine Bewertungen

- Final Report On BankingDokument70 SeitenFinal Report On Bankingbharat sachdevaNoch keine Bewertungen

- Management AccountingDokument42 SeitenManagement AccountingaamritaaNoch keine Bewertungen

- Solution Manual For Advanced Accounting 11th Edition by Beams 3 PDF FreeDokument14 SeitenSolution Manual For Advanced Accounting 11th Edition by Beams 3 PDF Freeluxion bot100% (1)

- TVS CreditDokument4 SeitenTVS CreditAkhil RajNoch keine Bewertungen

- Mbfs NotesDokument2 SeitenMbfs NotesPougajendy SadasivameNoch keine Bewertungen

- Regulation of Currency in IndiaDokument9 SeitenRegulation of Currency in Indiaindiangamer18Noch keine Bewertungen

- Concept Map 2Dokument8 SeitenConcept Map 2mike raninNoch keine Bewertungen

- Weiss Cryptocurrency Ratings Provide Independent, Unbiased InsightsDokument3 SeitenWeiss Cryptocurrency Ratings Provide Independent, Unbiased InsightsMarek KowalskiNoch keine Bewertungen

- Tax Invoice: Mcconnell DowellDokument1 SeiteTax Invoice: Mcconnell DowellAndy HeaterNoch keine Bewertungen

- Problems Chapter 7Dokument9 SeitenProblems Chapter 7Trang Le0% (1)

- 29 06 Main TradingDokument14 Seiten29 06 Main TradingZahir Khan100% (1)

- EMA-RSI-MACD 15min System - ProfitF - Website For Forex, Binary Options Traders (Helpful Reviews)Dokument5 SeitenEMA-RSI-MACD 15min System - ProfitF - Website For Forex, Binary Options Traders (Helpful Reviews)Sonarat MoulnengNoch keine Bewertungen

- ManagmentDokument91 SeitenManagmentHaile GetachewNoch keine Bewertungen

- 2017 Annual Report UpdatedDokument263 Seiten2017 Annual Report UpdatedPat Dela CruzNoch keine Bewertungen

- CH 7 AkmDokument2 SeitenCH 7 AkmVinaNoch keine Bewertungen

- Balance Sheet of Kansai Nerolac PaintsDokument5 SeitenBalance Sheet of Kansai Nerolac Paintssunilkumar978Noch keine Bewertungen

- Chapter 05 TB Answer KeyDokument25 SeitenChapter 05 TB Answer KeyK61 NGÔ TẤN HÀNoch keine Bewertungen

- Set A Merchandising Vat QuizDokument6 SeitenSet A Merchandising Vat QuizJan Allyson BiagNoch keine Bewertungen

- Pairs TradingDokument3 SeitenPairs TradingmfearonNoch keine Bewertungen

- The 5 C's of BankingDokument5 SeitenThe 5 C's of BankingEman SultanNoch keine Bewertungen

- The Financial StabilityDokument10 SeitenThe Financial Stabilityhaque163Noch keine Bewertungen

- Electronic Payment Systems Security and Protocols ExplainedDokument36 SeitenElectronic Payment Systems Security and Protocols ExplainedPaksmilerNoch keine Bewertungen

- Finals - Com 505 ReviewerDokument29 SeitenFinals - Com 505 ReviewerPAULYNE BONGALOSNoch keine Bewertungen

- 2022 07 SBR LessonPlan (PER PO) Sami (Grp1)Dokument3 Seiten2022 07 SBR LessonPlan (PER PO) Sami (Grp1)Loke Su YeeNoch keine Bewertungen

- Mr. Ted Mosby tax filing summaryDokument2 SeitenMr. Ted Mosby tax filing summaryCM LanceNoch keine Bewertungen

- Coffee Table Booklet 19012024Dokument244 SeitenCoffee Table Booklet 19012024Antony ANoch keine Bewertungen