Beruflich Dokumente

Kultur Dokumente

Pacific Grove Spice Company Spreadsheet

Hochgeladen von

Anonymous 8ooQmMoNs1Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pacific Grove Spice Company Spreadsheet

Hochgeladen von

Anonymous 8ooQmMoNs1Copyright:

Verfügbare Formate

Pacific Grove Spice Company

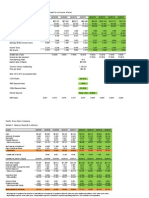

Exhibit 1 - Income Statement ($ in millions except for price per share)

Income Statement

Net Sales

Cost of Goods Sold

Gross Profit Margin

06/30/07

06/30/08

06/30/09

06/30/10

06/30/11

06/30/12

06/30/13

06/30/14

06/30/15

$46.180

26.784

19.396

$53.107

30.802

22.305

$57.887

33.575

24.312

$68.017

39.790

28.227

$80.940

47.512

33.428

$93.081

54.452

38.629

$105.182

61.531

43.650

$116.751

68.300

48.452

$127.259

74.447

52.813

0.739

14.916

3.741

0.850

17.260

4.195

0.926

18.871

4.515

1.088

21.902

5.237

1.295

26.063

6.070

1.489

29.321

7.819

1.683

33.132

8.835

1.868

36.777

9.807

2.036

40.087

10.690

Interest Expense

Earnings Before Income Taxes

2.906

0.835

2.940

1.255

2.668

1.847

2.423

2.814

2.817

3.253

3.237

4.581

3.582

5.254

3.894

5.913

4.124

6.566

Income Taxes

Net Income

0.225

0.610

0.339

0.916

0.499

1.348

0.760

2.054

0.879

2.374

1.237

3.344

1.418

3.835

1.597

4.316

1.773

4.793

15.00%

9.00%

17.50%

19.00%

15.00%

27.00%

13.00%

27.00%

11.00%

27.00%

9.00%

27.00%

R&D Expense

SG&A Expense

Earnings Before Interest & Taxes

Growth rate of sale

Income tax rate assumed

Price/Earnings Ratio

Market Value of Equity

Common Shares Outstanding

Price per share

Note: 2012-2015 are projected data

16.0

$37.990

1,165,327

$32.60

Pacific Grove Spice Company

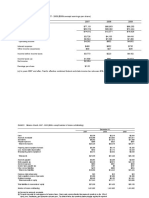

Exhibit 2 - Balance Sheet ($ in millions)

Assets

06/30/07

06/30/08

06/30/09

06/30/10

06/30/11

06/30/12

06/30/13

06/30/14

06/30/15

Cash

Accounts Receivable

Inventories

Prepaid Expenses

Total Current Assets

$2.325

9.489

6.697

0.770

19.281

$2.680

10.912

7.701

0.840

22.133

$2.924

11.895

8.394

0.910

24.123

$3.440

13.976

9.947

0.828

28.191

$4.102

16.632

11.878

0.969

33.581

$4.672

19.126

13.613

1.117

38.528

$5.279

21.613

15.383

1.262

43.537

$5.860

23.990

17.075

1.401

48.326

$6.387

26.149

18.612

1.527

52.675

Net Property & Equipment *

Other Long-Term Assets

Total Assets

15.200

2.241

36.722

16.000

2.479

40.612

17.300

2.671

44.094

19.100

3.074

50.365

22.400

3.639

59.620

25.157

4.189

67.874

28.427

4.733

76.697

31.554

5.254

85.134

34.395

5.727

92.797

10.6%

8.6%

14.2%

18.4%

13.8%

13.0%

11.0%

9.0%

Growth rate of assets

Liabilities & Owners' Equity

06/30/07

06/30/08

06/30/09

06/30/10

06/30/11

06/30/12

06/30/13

06/30/14

06/30/15

Bank Notes Payable

Accounts Payable

Current Portion of Long-Term Debt

Accrued Expenses

Total Current Liabilities

$7.669

2.203

0.973

0.771

11.616

$8.820

2.532

1.060

0.884

13.296

$9.613

2.760

1.124

0.965

14.462

$11.295

3.271

1.240

1.129

16.935

$13.442

3.905

1.483

1.345

20.175

$15.492

4.476

1.614

1.545

23.127

$17.506

5.057

1.751

1.746

26.061

$19.432

5.614

1.842

1.938

28.826

$21.181

6.119

1.869

2.113

31.282

Long-Term Debt

Total Liabilities

14.600

26.216

15.894

29.190

16.862

31.324

18.606

35.541

22.247

42.422

24.204

47.331

26.258

52.319

27.614

56.440

28.028

59.310

Common Stock

Retained Earnings

Total Shareholder Equity

6.881

3.625

10.506

6.881

4.541

11.422

6.881

5.889

12.770

6.881

7.943

14.824

6.881

10.317

17.198

6.881

13.661

20.543

6.881

17.497

24.378

6.881

21.813

28.694

6.881

26.606

33.488

Total Liabilities & Net Worth

36.722

40.612

44.094

50.365

59.620

67.874

76.697

85.134

92.797

* Net property & equipment for all years is calculated as net property & equipment from the prior year, plus capital expenditures in the same year, minus

depreciation expense in the same year. Depreciation expense is included in reported operating expenses; it is not broken out separately.

Note: 2012-2015 are projected data

Pacific Grove Spice Company

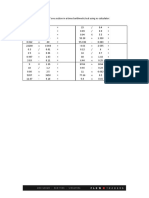

Exhibit 3 - Capital Budgeting Analysis of Television Program Opportunity

Initial Investment Cash Flows

Equipment

Year 0

-$1,440,000

Growth Rate of Sales

Operating Cash Flows

Year 1

Sales

Cost of Goods Sold at 58.5% of sales

Gross Profit Margin

5.0%

Year 2

5.0%

Year 3

5.0%

Year 4

5.0%

Year 5

$8,100,000

4,738,500

3,361,500

$8,505,000

4,975,425

3,529,575

$8,930,250

5,224,196

3,706,054

$9,376,763

5,485,406

3,891,356

$9,845,601

5,759,676

4,085,924

Promotion Expense at 11% of sales

General & Administrative Expense

Depreciation Expense

Incremental Operating Profit

891,000

760,000

288,000

1,422,500

935,550

798,000

288,000

1,508,025

982,328

837,900

288,000

1,597,826

1,031,444

879,795

288,000

1,692,118

1,083,016

923,785

288,000

1,791,123

Income Taxes at 27%

Incremental Net Income

384,075

1,038,425

407,167

1,100,858

431,413

1,166,413

456,872

1,235,246

483,603

1,307,520

+ Depreciation Expense

Incremental Operating Cash Flow

288,000

1,326,425

288,000

1,388,858

288,000

1,454,413

288,000

1,523,246

288,000

1,595,520

Year 1

$1,664,384

1,184,625

389,466

-2,459,543

Year 2

$83,219

59,231

19,473

-122,977

Year 3

$87,380

62,193

20,447

-129,126

Year 4

$91,749

65,302

21,469

-135,582

Year 5

$96,337

68,568

22,543

-142,361

Year 2

Year 3

Year 4

Yearly Net Working Capital Investment

Additional A/R at 75 Days Sales Outstanding

Additional Inventory at 4 Inventory Turns

Additional A/P at 30 Days COGS

Total NWC Investment

Terminal Cash Flows

Recovery of NWC

Total Project Cash Flows

Internal Rate of Return

Net Present Value at 20%

Net Present Value at 15%

Net Present Value at 10%

Year 1

-$1,440,000

41.28%

$1,716,414

$2,405,498

$3,278,174

-$1,133,118

$1,265,881

$1,325,287

$1,387,664

Year 5

$2,989,590

$4,442,748

Pacific Grove Spice Company

Exhibit 4 - High Country Seasonings Income Statement ($ in millions)

Income Statement

06/30/08

06/30/09

06/30/10

06/30/11

Net Sales

Cost of Goods Sold

Gross Profit Margin

$15.401

9.887

5.514

$15.919

10.284

5.635

$16.664

10.732

5.932

$17.564

11.329

6.235

R&D Expense

SG&A Expense

Earnings Before Interest & Taxes

0.000

4.359

1.155

0.000

4.553

1.082

0.000

4.816

1.116

0.000

5.041

1.194

Interest Expense

Earnings Before Income Taxes

0.057

1.098

0.072

1.010

0.060

1.056

0.063

1.131

Income Taxes

Net Income

0.297

0.801

0.273

0.737

0.285

0.771

0.306

0.825

Dividends Paid

0.288

0.254

0.422

0.401

Pacific Grove Spice Company

Exhibit 5 - High Country Seasonings Balance Sheet ($ in millions)

Assets

06/30/08

06/30/09

06/30/10

06/30/11

Cash

Accounts Receivable

Inventories

Prepaid Expenses

Total Current Assets

$0.585

3.165

2.060

0.231

6.041

$0.610

3.271

2.142

0.239

6.262

$0.639

3.424

2.236

0.250

6.549

$0.673

3.609

2.360

0.263

6.905

Net Property & Equipment *

Other Long-Term Assets

Total Assets

3.831

0.462

10.334

4.146

0.477

10.885

4.273

0.500

11.322

4.424

0.527

11.856

06/30/08

06/30/09

06/30/10

06/30/11

$0.791

0.813

0.000

0.262

1.866

$0.818

0.845

0.000

0.271

1.934

$0.856

0.882

0.000

0.283

2.021

$0.902

0.931

0.000

0.299

2.132

Long-Term Debt

Total Liabilities

0.000

1.866

0.000

1.934

0.000

2.021

0.000

2.132

Common Stock

Retained Earnings

Total Shareholder Equity

4.584

3.884

8.468

4.584

4.367

8.951

4.584

4.716

9.300

4.584

5.140

9.724

10.334

10.885

11.322

11.856

Liabilities + Owners' Equity

Bank Notes Payable

Accounts Payable

Current Portion of Long-Term Debt

Accrued Expenses

Total Current Liabilities

Total Liabilities & Net Worth

* Net property & equipment for all years is calculated as net property & equipment from the

prior year, plus capital expenditures in the same year, minus depreciation expense in the

same year. Depreciation expense is included in reported operating expenses; it is not

broken out separetely.

Pacific Grove Spice Company

Exhibit 6 - Industry Information

McCormick & Company*

2010

2011

ConAgra Foods**

2010

2011

Pacific Grove Spice Co.

2010

2011

Sales revenue (in millions)

Net income (in millions)

Earnings per share

Closing stock price

Price/earnings ratio

$3,336.8

$370.2

$2.79

$44.01

15.8

$3,440.5

$386.5

$2.92

$49.60

17.0

$12,014.9

$725.8

$1.63

$24.02

14.7

$12,303.1

$817.0

$1.90

$25.76

13.6

$68.0

$2.1

$1.76

$25.87

14.7

$80.9

$2.4

$2.04

$32.60

16.0

Total liabilities (in millions)

Interest-bearing debt (in millions)

$1,957.0

$880.3

$1,947.3

$989.7

$6,809.1

$3,487.2

$6,700.2

$3,233.8

$35.5

$31.1

$42.4

$37.2

Book value of equity (in millions)

$1,462.7

$1,642.1

$4,928.9

$4,708.5

$14.8

$17.2

Shares outstanding (in millions)

Market value of equity (in millions)

133.1

$5,857.7

132.4

$6,567.0

443.6

$10,655.3

429.7

$11,069.1

1.2

$30.1

1.2

$38.0

Equity beta coefficient

0.50

0.60

* McCormick's fiscal year-end is November 30. The 2011 data presents the most recent four quarters of

income statement information and the May 31, 2011, balance sheet information.

** ConAgra's fiscal year-end is May 31. The 2011 data presents the full 2011 fiscal year.

Current market interest rates in July of 2011:

Long-term U.S. Treasury Bonds

4.25%

Long-term AA Corporate Bonds

5.20%

Long-Term BBB Corporate Bonds

5.65%

Market Risk Premium, S&P 500 vs. Long-term Treasuries

7.00%

0.85

Prime Interest Rate

3.25%

Das könnte Ihnen auch gefallen

- Pacific Grove Spice CompanyDokument5 SeitenPacific Grove Spice Companycvelm00183% (6)

- Sampa Video Solution Harvard Case SolutionDokument11 SeitenSampa Video Solution Harvard Case Solutionhernandezc_joseNoch keine Bewertungen

- Pacific Grove Spice Company Case Write UpDokument3 SeitenPacific Grove Spice Company Case Write UpVaishnavi Gnanasekaran100% (4)

- Assignment 8 - W8 Hand in (Final Project)Dokument3 SeitenAssignment 8 - W8 Hand in (Final Project)Rodrigo Montechiari33% (6)

- Mercury AthleticDokument13 SeitenMercury Athleticarnabpramanik100% (1)

- Mercuryathleticfootwera Case AnalysisDokument8 SeitenMercuryathleticfootwera Case AnalysisNATOEENoch keine Bewertungen

- Flash Memory, IncDokument16 SeitenFlash Memory, Inckiller drama67% (3)

- FlashMemory SolnDokument8 SeitenFlashMemory Solnchopra98harsh3311100% (4)

- Mercury Athletic (Student Templates) FinalDokument6 SeitenMercury Athletic (Student Templates) FinalGarland GayNoch keine Bewertungen

- Harvard Case Study - Flash Inc - AllDokument40 SeitenHarvard Case Study - Flash Inc - All竹本口木子100% (1)

- HBS Mercury CaseDokument4 SeitenHBS Mercury CaseDavid Petru100% (1)

- FIP FIN701-1905-1 - Team 4 - 1Dokument10 SeitenFIP FIN701-1905-1 - Team 4 - 1Jay Prakash SoniNoch keine Bewertungen

- FlashMemory Beta NPVDokument7 SeitenFlashMemory Beta NPVShubham Bhatia100% (1)

- Flash Memory AnalysisDokument25 SeitenFlash Memory AnalysisTheicon420Noch keine Bewertungen

- Ocean Carrier CaseDokument17 SeitenOcean Carrier CasechiaweesengNoch keine Bewertungen

- Butler Lumber Case SolutionDokument4 SeitenButler Lumber Case SolutionCharleneNoch keine Bewertungen

- Tottenham Case HBS Financials ValuationDokument14 SeitenTottenham Case HBS Financials ValuationPaco Colín0% (2)

- Chapter 01 Solutions PalepuDokument3 SeitenChapter 01 Solutions Palepuilhamuh67% (6)

- McVitie's Digestive BiscuitsDokument28 SeitenMcVitie's Digestive BiscuitsAnkit Goyal14% (7)

- Pacific Grove Spice CompanyDokument7 SeitenPacific Grove Spice CompanySajjad Ahmad100% (1)

- Pacific Grove Spice CompanyDokument3 SeitenPacific Grove Spice CompanyLaura JavelaNoch keine Bewertungen

- Polar SportDokument4 SeitenPolar SportKinnary Kinnu0% (2)

- Flash Memory IncDokument7 SeitenFlash Memory IncAbhinandan SinghNoch keine Bewertungen

- Flash Memory CaseDokument6 SeitenFlash Memory Casechitu199233% (3)

- Case - Polar SportsDokument12 SeitenCase - Polar SportsSagar SrivastavaNoch keine Bewertungen

- Flash - Memory - Inc From Website 0515Dokument8 SeitenFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- AirThread G015Dokument6 SeitenAirThread G015sahildharhakim83% (6)

- Heritage CaseDokument3 SeitenHeritage CaseGregory ChengNoch keine Bewertungen

- Mercury AthleticDokument17 SeitenMercury Athleticgaurav100% (1)

- Airthread DCF Vs ApvDokument6 SeitenAirthread DCF Vs Apvapi-239586293Noch keine Bewertungen

- Blaine KitchenwareDokument1 SeiteBlaine KitchenwareSam Skf100% (1)

- PM Kraft ExhibitSheetDokument19 SeitenPM Kraft ExhibitSheetkarthik_srinivasa_14Noch keine Bewertungen

- 2006 Stanford Consulting Case Interview PreparationDokument62 Seiten2006 Stanford Consulting Case Interview Preparationr_oko100% (3)

- BeckerDokument30 SeitenBeckerRanie Syafiqah JafferieNoch keine Bewertungen

- 05.C ArteaDokument4 Seiten05.C ArteaCahyo Ady NugrahaNoch keine Bewertungen

- Pacific Spice CompanyDokument15 SeitenPacific Spice CompanySubhajit MukherjeeNoch keine Bewertungen

- Pacific Grove Spice Company SpreadsheetDokument13 SeitenPacific Grove Spice Company SpreadsheetSuziNoch keine Bewertungen

- Pacific Grove Spice Company Case CalculationsDokument11 SeitenPacific Grove Spice Company Case CalculationsMinh Hà33% (3)

- Case Pacific Grove Spice CompanyDokument68 SeitenCase Pacific Grove Spice CompanyJose Luis ContrerasNoch keine Bewertungen

- Question 1Dokument9 SeitenQuestion 1Minh HàNoch keine Bewertungen

- Strategic ManagementDokument9 SeitenStrategic ManagementdiddiNoch keine Bewertungen

- FIP Submission - Pacific Grove Spice Company - CLASS 2 - TEAM 2 - Recorded VersionDokument12 SeitenFIP Submission - Pacific Grove Spice Company - CLASS 2 - TEAM 2 - Recorded VersionSameer KumarNoch keine Bewertungen

- Flash Memory IncDokument3 SeitenFlash Memory IncAhsan IqbalNoch keine Bewertungen

- Flash Memory IncDokument9 SeitenFlash Memory Incxcmalsk100% (1)

- Flash MemoryDokument9 SeitenFlash MemoryJeffery KaoNoch keine Bewertungen

- AirThread Class 2020Dokument21 SeitenAirThread Class 2020Son NguyenNoch keine Bewertungen

- Exhibits of Blaine Kitchenware, Inc - CaseDokument6 SeitenExhibits of Blaine Kitchenware, Inc - CaseSadam Lashari100% (3)

- Mercury QuestionsDokument6 SeitenMercury Questionsapi-239586293Noch keine Bewertungen

- AirThread G015Dokument6 SeitenAirThread G015Kunal MaheshwariNoch keine Bewertungen

- Group19 Mercury AthleticDokument11 SeitenGroup19 Mercury AthleticpmcsicNoch keine Bewertungen

- MercuryDokument5 SeitenMercuryமுத்துக்குமார் செNoch keine Bewertungen

- Ocean CarriersDokument3 SeitenOcean CarriersHarita KuppaNoch keine Bewertungen

- Mercury Athletic FootwearDokument9 SeitenMercury Athletic FootwearJon BoNoch keine Bewertungen

- Mercury Athletic Case SectionBDokument15 SeitenMercury Athletic Case SectionBVinith VemanaNoch keine Bewertungen

- Flash Memory AnalysisDokument25 SeitenFlash Memory AnalysisaamirNoch keine Bewertungen

- Ocean CarriersDokument17 SeitenOcean CarriersMridula Hari33% (3)

- Debt Policy at UST Inc.Dokument47 SeitenDebt Policy at UST Inc.karthikk1990100% (2)

- GableGotwals TW 12-12-13Dokument1 SeiteGableGotwals TW 12-12-13Price LangNoch keine Bewertungen

- Mercury - Case SOLUTIONDokument36 SeitenMercury - Case SOLUTIONSwaraj DharNoch keine Bewertungen

- InvestmentDokument2 SeitenInvestmentMarine ChiuNoch keine Bewertungen

- Chapter 12Dokument13 SeitenChapter 12Mario Alberto PerezNoch keine Bewertungen

- Fu Wang Income Statement 2016 2017 2018 2019Dokument5 SeitenFu Wang Income Statement 2016 2017 2018 2019Md Abil KhanNoch keine Bewertungen

- Vertical Analysis FS Shell PHDokument5 SeitenVertical Analysis FS Shell PHArjeune Victoria BulaonNoch keine Bewertungen

- First Resources: Singapore Company FocusDokument7 SeitenFirst Resources: Singapore Company FocusphuawlNoch keine Bewertungen

- Meerut Adventure Company CV1Dokument9 SeitenMeerut Adventure Company CV1Ayushi GuptaNoch keine Bewertungen

- L5 - OrganisingDokument13 SeitenL5 - OrganisingAnonymous 8ooQmMoNs1Noch keine Bewertungen

- L8 - Human Resource ManagementDokument6 SeitenL8 - Human Resource ManagementAnonymous 8ooQmMoNs1Noch keine Bewertungen

- L7 - Managing DiversityDokument5 SeitenL7 - Managing DiversityAnonymous 8ooQmMoNs1Noch keine Bewertungen

- L6 - LeadershipDokument11 SeitenL6 - LeadershipAnonymous 8ooQmMoNs1Noch keine Bewertungen

- L4 - Managerial Decision MakingDokument9 SeitenL4 - Managerial Decision MakingAnonymous 8ooQmMoNs1Noch keine Bewertungen

- L9 - Dynamics of Behaviour in OrganisationsDokument5 SeitenL9 - Dynamics of Behaviour in OrganisationsAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Sontag Collective MemoryDokument7 SeitenSontag Collective MemoryAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Bill Niven War MemorialsDokument7 SeitenBill Niven War MemorialsAnonymous 8ooQmMoNs1Noch keine Bewertungen

- L3 - Planning and GoalsDokument9 SeitenL3 - Planning and GoalsAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Bill Niven War MemorialsDokument7 SeitenBill Niven War MemorialsAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Portelli Massacre at Fosse ArdeatineDokument9 SeitenPortelli Massacre at Fosse ArdeatineAnonymous 8ooQmMoNs1Noch keine Bewertungen

- 07 AnsDokument5 Seiten07 AnsAnonymous 8ooQmMoNs10% (1)

- L1 - The Changing Paradigm of ManagementDokument8 SeitenL1 - The Changing Paradigm of ManagementAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Richard Osborne - MythDokument3 SeitenRichard Osborne - MythAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Lectures 1-3 COLOURDokument45 SeitenLectures 1-3 COLOURAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Ginsborg History of ItalyDokument8 SeitenGinsborg History of ItalyAnonymous 8ooQmMoNs10% (1)

- Philip Taylor PropagandaDokument3 SeitenPhilip Taylor PropagandaAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Fit Interview 071712 PDFDokument14 SeitenFit Interview 071712 PDFAnonymous 9W8HM1nqXBNoch keine Bewertungen

- Jock Reynolds J LT RookiesDokument14 SeitenJock Reynolds J LT RookiesAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Weak & Strong FormsDokument77 SeitenWeak & Strong FormsAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Arithmetic Test Example PDFDokument1 SeiteArithmetic Test Example PDFAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Grammar Guide 2018Dokument56 SeitenGrammar Guide 2018Tony NguerezaNoch keine Bewertungen

- 08 AnsDokument13 Seiten08 AnsAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Harry HearderDokument15 SeitenHarry HearderAnonymous 8ooQmMoNs1Noch keine Bewertungen

- 05 AnsDokument8 Seiten05 AnsAnonymous 8ooQmMoNs1Noch keine Bewertungen

- 06 AnsDokument4 Seiten06 AnsAnonymous 8ooQmMoNs1Noch keine Bewertungen

- 04 AnsDokument20 Seiten04 AnsAnonymous 8ooQmMoNs1Noch keine Bewertungen

- 02 AnsDokument10 Seiten02 AnsAnonymous 8ooQmMoNs1Noch keine Bewertungen

- Exercise 3FDokument1 SeiteExercise 3FStickyTeflon12Noch keine Bewertungen

- Schawk-Brand Portfolio OptimizationDokument4 SeitenSchawk-Brand Portfolio OptimizationmakneonNoch keine Bewertungen

- Eli CtricDokument115 SeitenEli CtricYn NucciaNoch keine Bewertungen

- Survey of Accounting 5th Edition Edmonds Test Bank 1Dokument63 SeitenSurvey of Accounting 5th Edition Edmonds Test Bank 1melody100% (43)

- Franchise Accounting: Jovit G. Cain, CPADokument24 SeitenFranchise Accounting: Jovit G. Cain, CPAJao FloresNoch keine Bewertungen

- Chapter 7Dokument7 SeitenChapter 7Fozia Zaka CheemaNoch keine Bewertungen

- Flexible BudgetDokument3 SeitenFlexible BudgetGregorian JerahmeelNoch keine Bewertungen

- IBM Case Study Solution PDFDokument14 SeitenIBM Case Study Solution PDFmdjfldmNoch keine Bewertungen

- AUDIT PLANNING On Beximco Pharmaceuticals LTDDokument25 SeitenAUDIT PLANNING On Beximco Pharmaceuticals LTDNishat FarjanaNoch keine Bewertungen

- Consumer and Producer Surplus: Efficiency and Deadweight LossDokument11 SeitenConsumer and Producer Surplus: Efficiency and Deadweight LossManideep DoddaNoch keine Bewertungen

- Construction Irrigation Business PlanDokument27 SeitenConstruction Irrigation Business Planberhe dargoNoch keine Bewertungen

- MANAC Session 2Dokument18 SeitenMANAC Session 2Abhinav ChauhanNoch keine Bewertungen

- Finall Thesis KuuriyaDokument56 SeitenFinall Thesis KuuriyaMohammed YonisNoch keine Bewertungen

- Current LiabilitiesDokument94 SeitenCurrent LiabilitiesDawit TilahunNoch keine Bewertungen

- Celent Buy Side Risk Impact NoteDokument20 SeitenCelent Buy Side Risk Impact Noteimnowhere62Noch keine Bewertungen

- Analysis of BankruptcyDokument15 SeitenAnalysis of BankruptcyDrRam Singh KambojNoch keine Bewertungen

- Akl1 CH09Dokument41 SeitenAkl1 CH09Candini NoviantiNoch keine Bewertungen

- Analysis of Product OptionsDokument3 SeitenAnalysis of Product OptionsSayak MondalNoch keine Bewertungen

- SC-Case Study CollectionDokument80 SeitenSC-Case Study CollectionMohamed ShafieyNoch keine Bewertungen

- Sadiq ProjectDokument110 SeitenSadiq ProjectSaqlain MustaqNoch keine Bewertungen

- AFM Module 5 ProblemsDokument4 SeitenAFM Module 5 ProblemskanikaNoch keine Bewertungen

- The Complete Guide To Leveraged Buyouts 11Dokument18 SeitenThe Complete Guide To Leveraged Buyouts 11OwenNoch keine Bewertungen

- Working Together For Healthier WorldDokument25 SeitenWorking Together For Healthier WorldKathy RomanNoch keine Bewertungen

- Marketing The Core 5Th Edition Kerin Test Bank Full Chapter PDFDokument67 SeitenMarketing The Core 5Th Edition Kerin Test Bank Full Chapter PDFfelixquan3x8ua2100% (9)

- 1.electronic Design ProcessDokument23 Seiten1.electronic Design ProcessThota DeepNoch keine Bewertungen

- Contoh KuesionerDokument2 SeitenContoh KuesionerMochammad Adji FirmansyahNoch keine Bewertungen

- Installment SalesDokument5 SeitenInstallment SalesMarianne LanuzaNoch keine Bewertungen