Beruflich Dokumente

Kultur Dokumente

Bemco Hydraulics Project at Belgaum

Hochgeladen von

Nadeem AhmedCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bemco Hydraulics Project at Belgaum

Hochgeladen von

Nadeem AhmedCopyright:

Verfügbare Formate

Bemco Hydraulics Ltd.

,Belgaum

CHAPTER I

EXECUTIVE SUMMARY

This project on A STUDY OF WORKING CAPITAL MANAGEMENT AT BEMCO

HYDRAULICS LTD, BELGAUM deals to ascertain the efficiency of working capital

management of the company.

In this project my aim is to know the principle adopted by the company to handle its

working capital & the aim is to study working capital management of Bemco.

Working capital may be regarded as lifeblood of business.Working capital is needed to meet

day-to-day requirement of the business unit.The exploitation of working capital assets is possible

only by efficient working capital management.This study on working capital management is

conducted in Bemco Hydraulics Ltd.

This study focused on the cost of working capital of the organization and also towards some

ratios relating to the working capital of the company.

Type of data collection involved primary data and secondary data for this study.The most of

the required information was collected through secondary sources.

Secondary data were collected from various sources including the annual reports of the

company for the year 2009-10, 2010-11, 2011-12 and 2012-13.

Ratio analysis is the major tool for analyzing the working capital management of Bemco and

also the information for 5 years is collected.

Ratio analysis has been carried out using Financial Information for last five accounting years

i.e. from 2009 to 2013 Ratio have been analyzed.

I hope that the study has fulfilled all its objectives and will b useful for those who are using

this project report in the future.

PROJECT TITLE

A Study on Working Capital Management at Bemco Hydraulics Limited, Belgaum.

A.S.S College Of Business Administration,Gadag

Page 1

Bemco Hydraulics Ltd.,Belgaum

NEED FOR THE STUDY

The project work is made compulsory by Karnataka University Dharwad for the BBA

students for the fulfillment of the requirement of BBA degree as part of our curriculum.

Bemco Hydraulics Ltd., Belgaum also informed me to do project on Working Capital.

And also to get the practical knowledge about the industry on Working Capital management

carried in the organization.

OBJECTIVES OF THE STUDY

This study is being conducted with the following objectives

1. To know the sources for financing working capital

2. To know the working capital requirement of the company

3. To know the principle adopted by the company to manage the working capital

4. To know whether the working capital management position is sound in the company

SCOPE OF THE STUDY

Working capital management being a very important concept in all the companies having

a void coverage often calls for the managerial attention. In the modern times working capital

management has become the integral part of the all companies. So all the firms give special

importance for working capital management. The major objective of the study is to examine the

effectiveness of working capital management system adopted by an industry; the study mainly

focuses on the techniques used by the company to control the working capital.

METHODOLOGY

A.S.S College Of Business Administration,Gadag

Page 2

Bemco Hydraulics Ltd.,Belgaum

The methodology adopted is as follows

SOURCES OF DATA

1. PRIMARY DATA:

Collection of information or data is done through interview method with senior Accountant,

Mr. Rajshekhar Lakkashetti

2. SECONDARY DATA:

Most of the information is collected from secondary data. It is the data that already exist. The

sources of secondary data are:

Balance Sheet of the company

P & L account of the company

Text books

Company website

FINDINGS

A.S.S College Of Business Administration,Gadag

Page 3

Bemco Hydraulics Ltd.,Belgaum

1. Company has adopted the aggressive principle to maintain the working capital.

2. The main and only source for financing working capital is Bank Loan.

3. Bank of Maharashtra and SBI are the banks which provides loan to the company.

4. Though current ratio is not upto the mark, but in five years it never went less than 1.17

which can be considered as good.

5. There is increase in profit and sales

6. Company is growing step by step.

7. By studying the financial growth statements I found that the companys financial position

will be sound in the coming years.

SUGGESTIONS

A.S.S College Of Business Administration,Gadag

Page 4

Bemco Hydraulics Ltd.,Belgaum

1. It is good for the company to move with aggressive principle only, because it is suitable

and benefited to the company.

2. In addition to Bank loan I would like to suggest the following internal sources of

finance for the working capital, because it will result in reduction of cost of working capital that

is 2,51,53,063.28 for past five years.

Cash in hand

Debtors

3. Company prefers Bank of Maharashtra and SBI for loan, they can go for other banks

also which will provide loan at less interest.

4. I would also like to suggest company to improve its working capital position by

reducing its current liabilities like paying the creditors as early as possible.

5. Since company is growing I would like to suggest that it can open its branches in other

cities also that it can spread its operations which will help the company to achieve its vision.

6. Investment in current assets should be increased.

LIMITATIONS OF THE STUDY

The analysis is based on the data collected from the past five years financial reports.

The time allotted to undergo was less to study all the aspects.

Non availability of statement like cost sheet, budget statement became problem to

study in detail.

The study depends more on secondary data

CHAPTER II

A.S.S College Of Business Administration,Gadag

Page 5

Bemco Hydraulics Ltd.,Belgaum

INDUSTRY PROFILE

The Indian Hydraulic Industry was started in early 60s primarily with an objective

of import substitution of some of the hydraulic products being used in various applications.

Since most of the Indian industries have been set up based upon the variety of technological

sources, the range of their specifications is very wide.Due to this range of products in the oil

hydraulic is also quite wide resulting in very small batch for each product.

It is therefore, difficult to specify a minimum economically viable capacity for the

industry. While there has been a continued overall growth in the oil hydraulic products business

due to large variety of specialized products to meet specific individual applications, volume

growth in individual products has been very low. With low volumes and high development costs

concerning tooling, casting and forging, the industry has not been able to adopt modern

production methods. Current production technologies in use are largely dictated by production of

large volumes, quality requirements and costs.

Since the Indian industries have to manufacture a large variety of products with

low volumes, the industry is not able to use the modern high production lines. Most of the

manufacturers, with exception to some(who have installed dedicated SPMs and CNC)machines

with special toolings and some special purpose machines for specialized metal cutting

operations.

Although the industry has shown a reasonable growth over the years, but it is far

away from the volumes which would lead to adopting modern production methods.Also the

limited demand is being shared by over 20 firms resulting in uneconomical volumes for most of

them. It is unlikely that the situation would change drastically in the coming decade due to

various factors mentioned above.

Almost all the major manufacturers of hydraulic equipments have collaboration

with foreign companies. Only two companies viz. Polyhydrons are Oscar Equipments are

manufacturing products based on indigenous development.There has been very little attempt at

developing indigenous technology for these products, although barring few items, all other

equipments have been indigenized.

A.S.S College Of Business Administration,Gadag

Page 6

Bemco Hydraulics Ltd.,Belgaum

CHAPTER III

COMPANY PROFILE

Name of the company

:Bemco Hydraulics Limited Belgaum

Registered Office

:Udyambag,Khanapur Road,Blgaum-590008

Size and Nature of the

:Medium scale,Public Limited company

Company

Total area

:30000 sq.mts.

Total area build-up

:10000 sq.mts.

Phone Number

:+91-831-4219000

Fax Number

:+91-831-2441263

:finance@bemcohydraulics.net

Web site

: www.bemcohydraulics.net

Date of Incorporation

: Originally incorporated on 04/03/1957 as Private Limited and

subsequently incorporated on 19 /04/1972 as Public Ltd

Registration number

: Registered with DGTD on 15/12/1973

Registration No

: 1283

ISO

: 9001:2008

Activity

: Manufacturing and selling of Hydraulic Presses and equipments

Company Secretary

: Mr.S.R.Deshpande (LLB,FCS)

Export to countries

: Ethiopia,Iraq,Israel,Malaysia,Myanmar,Nepal,Oman,Philippines,

Russia,Saudi Arabia,Srilanka,Singapore,Tanzania and Zambia.

A.S.S College Of Business Administration,Gadag

Page 7

Bemco Hydraulics Ltd.,Belgaum

BACKGROUND AND INCEPTION OF THE COMPANY

First Hydraulic Press Ever Developed in 1957;

Bemco is the first company in India to produce hydraulic presses.

Bemco originally was an engineering craftsmans shop in the late 30s has risen to be

primer producer of Hydraulic presses and equipments. Bemco Hydraulics company

started manufacturing presses initially in collaboration with VOGAL & COM

GERMANY ,in the year 1956-57 and subsequently developed innumerable types of

standard & non-standard range of hydraulic presses and special purpose hydraulic

pneumatic machines.

It started in 1956 with group of people like Late Shri Baburao Pusalkar and some other

members.

The company started initially with 25 people with Rs.10000 turnover.

BEMCO stands for

B-Belgaum

E-Engineering

M-Motors

CO-Company

MAJOR CHANGE

Every company after 6 years and within 10 years suffers from recession.

A.S.S College Of Business Administration,Gadag

Page 8

Bemco Hydraulics Ltd.,Belgaum

And so happened with Bemco,during 1970s the company became weak in finance

and Mr.M Mohta who purchased the maximum shares of Bemco became the

chairman of the company.

During 1975 the strength of the company almost reached to 450 employed with a

turnover of 5 crores.

By now the major item produced by the company changed from motors to hydraulic

line process in large scale.

The company became pioneer in India in making various types of hydraulic process

as per the need of customers.

NATURE OF BUSINESS CARRIED

The company is engaged in manufacturing:

Throat type hydraulic presses.

Four pillar hydraulic presses.

Closed fame hydraulic presses.

Power compacting presses.

A.S.S College Of Business Administration,Gadag

Page 9

Bemco Hydraulics Ltd.,Belgaum

Mounding, Straightening and bending presses.

Scrap balling presses.

Deep drawing, trimming, forging, crankshaft twisting and coining presses.

Railway wheel fitting, spring bucking, axle fitting, different spotting and quenching

presses.

Stabilizer bar correction presses.

Broaching for horizontal and vertical machines.

All types of special purpose oil hydraulic machines.

Hydraulic power packs.

Hydraulic cylinders.

Hydraulic pumps and valves.

Hydraulic motors.

During the year 2004-05 the company made re-railing equipment first time in India

and supplied to Indian Railways.

VISION,MISSION AND QUALITY POLICY

VISION

The vision of Bemco is to be highly visible company known for its highest technology

driven products, superior trimming and surpassed service in the engineering field, out products

will be marked worldwide and will be looked at as leader in customer made machines, Bemco

will market the world class prestigious products through best distribution network.

MISSION STATEMENT

A.S.S College Of Business Administration,Gadag

Page 10

Bemco Hydraulics Ltd.,Belgaum

Our mission is to provide innovative, practical and world class quality product that

improves the workman to perform their job. We believe that our first responsibility to our

customer who use our products.

QUALITY POLICY

We are a growth oriented organization in terms of technology, quality and quantity

whose underlying principle is timely delivery of long term, cost effective products and services

to our customers.

OBJECTIVES

To offer flawless services to customers.

To offer support in:

1.Selection of machinery

2.Design and development

3.Installation and commission

4.Supply of components and sears

5.Promote after sales services

To provide wide range of presses for various applications in metal working, plastic,

wood working, rubber electronic industries.

PRODUCT PROFILE

The company is engaged in manufacturing Hydraulic Pumps, Valves, Straightening

Presses, Steel Metal Forming Presses, Horizontal Boring Machines, Throat Type Hydraulic

Presses, Four pillars hydraulic presses etc. Apart from the standard range Hyloc supplies large

number of special fittings and also develops fittings for specific needs.

VALVES

A.S.S College Of Business Administration,Gadag

Page 11

Bemco Hydraulics Ltd.,Belgaum

The designs are carried out using exclusive specialist manifold software programs used,

constantly updated and enhanced over the last 5 years. These programs run on 3D solid modeling

CAD software.

STRAIGHTENING PRESSES

These are hand operated open throat presses with bar straightening attachment for

straightening cam shafts, axle shafts and crank shafts

Presses from 63 KN to 2000 KN capacity and straightening attachment for bar length 100

mm to 5000 mm can be supplied.

SHEET METAL FORMING PRESSES

Deep drawing presses are for sheet metal forming like LPG, bottles, automobiles sheet

metal parts, Domestic appliances etc. These metals come in four pillar closed frame and

stretched rod type construction with die cushion/blank holder for bank holdings. Press

capabilities of 2000 tonnes and table sizes of 4000 mm x 4000 mm are already built and even

larger presses can be built.

AREA OF OPERATION

Bemco is an authorized and certified supplier for:

AUTOMOBILE INDUSTRIES

Hyundai Motors Ltd.

Maruti Udyog Ltd.

Tata Motors Ltd.

A.S.S College Of Business Administration,Gadag

Page 12

Bemco Hydraulics Ltd.,Belgaum

TVS Motors Ltd.

Hero Honda Motors Ltd.

Bajaj Auto Ltd.

Honda Motors Pvt Ltd.

HEAVY ENGINEERING & ELECTRICALS

Bharat Heavy Electrical Ltd

Hindustan Aeronautics Ltd

L & T Ltd

Bharat Forge Ltd

INDIAN RAILWAYS

All Zonal Works Shop

ART

HRD

SPACE

Indian space research organization Trivandram

R & D Engg Organization Pune

Vikram Sarabhai Space Research center.

With its registered office/Head office at

Udyambag Belgaum-590008

Karnataka.

finance@bemcohydraulics.net

www.bemcohydraulics.net

Regional offices/Branches at

A.S.S College Of Business Administration,Gadag

Page 13

Bemco Hydraulics Ltd.,Belgaum

New Delhi

907,Padma Towers I,

Rajendra palace,

New Delhi-110008.

newdelhi@bemcohydraulics.net

Kolkata

Dakshini Para Road,

P.O.Tharurpukr,

Kolkata-700063.

Kolkata@bemcohydraulics.net

Chennai

Flat 3E,J.P.Tower,

Nungambakkam High Road,Chennai-600034.

Chennai@bemcohydraulics.net

BEMCO PRODUCTS ARE EXPORTED TO

Ethiopia

Iraq

Israel

Malaysia

Nepal

A.S.S College Of Business Administration,Gadag

Page 14

Bemco Hydraulics Ltd.,Belgaum

Oman

Philippines

Russia

Saudi Arabia

Srilanka

Singapore

Zambia

From the following information imparted regarding the Area of Operation it is clear that

Bemco Hydraulics Ltd supply its products to various regional industries with three branches in

the prominent places in India and also export to many countries in the glob that is the supply of

products to the International customers. Hence from this study we say that Bemcos area of

operation is regional as well as globe in nature.

Bemco Private Ltd has successfully carried out its business with the immense support of their

financers and bankers.Those are:

1. Bank of Maharashtra, Main Branch, Kirloskar, Belgaum.

2. State Bank of India, Commercial Branch, Belgaum.

OWNERSHIP PATTERN

The company was incorporated in the state of Karnataka on 14 th March 1957 as New

Bemco Engineering Products Private Limited by Mr.Vishnu Nimbakar, Mr. B. V. Pusalkar and

Mr. M. B. Jambeau. The name of the company was changed to NEW BEMCO ENGINEERING

PRODUCTS LIMITED on 19th April 1972. In the year 1974,the company was taken over by the

A.S.S College Of Business Administration,Gadag

Page 15

Bemco Hydraulics Ltd.,Belgaum

present promoters, the Mohta group. Mr. M. M. Mohta is the present Chairman and Managing

Director of the company.

The name of the company was further changed to BEMCO HYDRAULICS

LIMITED,on 6th December 1976.In the year 1986, the company made its initial public offer and

its equity shares were listed on the Stock Exchange.

In the year 1991 he took the charge of the company as the Chairman and Managing

Director.

In the year 1992 Mrs. Urmila Devi Mohta was appointed as a Non Executive Director.

In the year 1994 Mr.Anirudh Mohta,the son of M. M. Mohta was appointed as the Joint

Managing Director of the company.

In the year 1998 Shri R. M. Shah and Shri N. K. Daga were appointed as independent

Directors of the company.

In the recent year 2004 Shri. Dilip Chandak has also been appointed as an independent

Director of the company.

COMPETITORS INFORMATION

The company has competition from the unorganized sector consisting of a number of

small players who supply to the automobile industries. Over the years of existence, the company

has been able to develop a satisfied customer base both in India and Abroad and in the coming

year moving towards standardization of its products.

Some of the major competitors of Bemco Hydraulics Private Limited in Belgaum are:

Siddhartha Industries

Hydro pack private ltd

S.P.M Control

Plus one Hydraulics

A.S.S College Of Business Administration,Gadag

Page 16

Bemco Hydraulics Ltd.,Belgaum

Some major competitors of BEMCO Hydraulics Ltd in India are:

Iszac,Pune

HMT

Electro Pneumatic

INFRASTRUCTURAL FACILITIES

Power

The peak hour requirement of power to the company is 250 KVA. The company presently has

arrangements with HESCOM for supply of 250 KVA or more, if required. The company also has

three DG sets with the capacity of 125 KVA each as stand by arrangements.

Manpower

The company has total of 287 employees out of which,224 employees are permanent, 10

employees are on contract and 53 employees are working apprentices. Both skilled and unskilled

manpower is available locally.

Raw materials and consumables

A.S.S College Of Business Administration,Gadag

Page 17

Bemco Hydraulics Ltd.,Belgaum

The main raw materials for the company is steel, which is procured by the company from the

large suppliers like SAIL and also from local vendors. The main varieties of steel consumed by

the plant Plates, Bars, Rounds, Pipes etc.

The company also requires hydraulics pumps, electric motors, PLC & welding wires, which

are being procured from Siemens, Bosch & other vendors.

The consumables such as oil, electrical parts and other store items are available in

abundance locally.

Canteen

The canteen facilities are provided for the employees. Through canteen, snacks and tea is

served to the employees at the workshop and to the staff. It will be supplied to the workshop

workers at 8.30 am and other staff after 9.15 am.

Afternoon tea will be supplied at 2 pm to the workers and to the staff at 2.30 pm. The

company is giving snacks and tea almost at free of cost (per head at 0.40 paisa).The canteen runs

under the subsidies rates.

ACHIEVEMENTS

1.Bemco has achieved extensive success as a remark of which it celebrated the 50th

Excellence Golden Jubilee in the year 2007.

2.It has achieved a outstanding turnover from 1 crore to 20 crores.

3.Bemco got ISO certificate during the year 2009-10.

FUTURE GROWTH AND PROSPECTS

The Hydraulic Presses manufactured by the company are primarily used in the Automobile

sector. On the canvas of Indian economy, Auto Industry occupies a prominent place. Due to its

A.S.S College Of Business Administration,Gadag

Page 18

Bemco Hydraulics Ltd.,Belgaum

deep forward linkages with several key segments of the economy, automotive industry has a

strong multiplier effect and is capable of being the driver of economic growth. The automotive

sector is one of the core industries of the Indian economy, whose prospect is reflective of the

economic resilience of the country. With 4% contribution to the GDP and nearly 5% of the total

industrial output, the automotive sector has become a significant contributor to the exchequer.

Technical collaboration with PINETTE EMIDCAU INDUSTRIES

Bemco has entered into a technical collaboration with PINETTE EMIDCAU

INDUSTRIES OF FRANCE FOR MANUFACTURE of SMC Moulding Machines of high

ranges. This would help the company in adding new customers and industries in its portfolio.

Collaboration with DUNKS COMPANY,GERMANY:

Bemco has entered into collaboration with DUNKS COMPANY for fitting press for

INDIAN RAILWAYS and many other which signifies growth of Bemco.

Collaboration with SECOND MONA,ITALIAN COMPANY:

This collaboration rates to HCL products. Bemcos target is to standardize product with

technology with outstanding products other than common. In terms of finance 30% growth is the

target of Bemco.

PRODUCT CAPACITY AND PRODUCTION

PRODUCT

UNIT

INSTALLED

CAPACITY

1000(1000)

PRODUCTION

Hydraulic presses

Nos.

Axial piston pumps

Nos.

300(300)

86(89)

Hydraulic equipment

Nos.

800(800)

604(529)

Hydraulic jacks

Nos.

100(100)

NIL(NIL)

59(79)

SPECIAL FEATURES OF THE BANK

A.S.S College Of Business Administration,Gadag

Page 19

Bemco Hydraulics Ltd.,Belgaum

1. Bank of Maharashtra, Main Branch at Kirloskar Road, Belgaum and SBI, Commercial Branch,

Belgaum are the only banks which are proving loan to the company.

2.Company prefers Bank of Maharashtra and SBI because they give loan at less interest.

3.Relationship between the company and both the banks is good since both the banks are

providing loans to the company from many years.

SWOT Analysis of the company

Strength

1.Large number of orders.

2.High quality.

3.One of the top five jobbing foundries in India.

4.Efficient manpower.

5.Good infrastructure facility.

6.Good financial condition.

A.S.S College Of Business Administration,Gadag

Page 20

Bemco Hydraulics Ltd.,Belgaum

7.Various awards and achievements.

Weakness

1.High transportation cost.

2.High rejection.

3.High absenteeism of workers.

Opportunities

1.Increase in demand order.

2.Permanent and new customers.

3.Increase in production capacity.

4.Advancement in technology.

5.Qualified employees.

Threats

1.Environmental problems.

2.Environmental policy.

3.Competition.

LEARNING EXPERIENCE

My learning experience during the project was very good

1. First thing I came to know is importance of time management.

A.S.S College Of Business Administration,Gadag

Page 21

Bemco Hydraulics Ltd.,Belgaum

2. In Bemco I got the opportunity to meet the C.As while they are auditing the financial

statements of the company, they were speaking to each other that at least they need three

seconds to check one page, that time I came to know we have to develop doing things

very quickly.

3. This project helped me in knowing the importance of group efforts when compared to the

individual efforts.

4. I also came to know how work and things are getting done through others and with

others.

5. I got the opportunity to meet the H. R. Manager Mr. Mundri from whom I came to know

the importance of good human relationship in the company.

So totally my experience during the project was very nice.

WORKING CAPITAL MANAGEMENT

1. Introduction

2. Need of Working Capital

3. Gross Working Capital and Net Working Capital

4. Types of Working Capital

5. Determinants of Working Capital

6. Importance of Working Capital

A.S.S College Of Business Administration,Gadag

Page 22

Bemco Hydraulics Ltd.,Belgaum

CHAPTER IV

THEORETICAL FRAMEWORK

INTRODUCTION

Working Capital Management

Working capital management is concerned with the problems which arise in attempting

to manage the current assets,the current liabilities and the interrelationship that exist between

them.The term current assets refers to those assets which in ordinary course of business can be or

will be turned into cash within one year without undergoing a diminution in value and without

disrupting the operation of th firm.The major current assets are cash,marketable

securities,account receivale and inventory.Current liabilities were those liabilities which intend at

A.S.S College Of Business Administration,Gadag

Page 23

Bemco Hydraulics Ltd.,Belgaum

their inception to be paid in ordinary course of business,within a year,out of the current assets or

earnings of the concern.The basic current liabilities are account payable,bill payable,bank overdraft and outstanding expenses.

The goal of working capital managemwnt is to manage the firms current assets and

current liabilities in such a way that the satisfactor level of working capital is mentioned.The

current assets should be large eneogh to cover its current liabilities in order to ensure a

reasonable margin of safety.

DEFINITION

According to Guttmann & DougallExcess of Current Assets over Current Liabilities.

According to Park & GladsonThe excess of current assets of business (i.e. cash,accounts recivable,inventories)

over current items owned to employess and others ( such as salaries & wages,account

payable,taxes owned government).

NEED OF WORKING CAPITAL MANAGEMENT

The need of working capital gross or current assets cannot be over emphasized.As

already observed,the objective of financial decision making is to maximize the shareholders

wealth.To achieve this,it is necessary to generate sufficient profits can be earned will naturally

depend upon the magnitude of the sales among other things but sales cannot convert into

cash.There is need for working capital in the form of current assets to deal with the problem of

arising out of lack of immediate realization of cash against goods sold.Therefore sufficient

working capital is necessary to sales activity.Technically this refers to cash or operating cycle.If

the company has certain amount of cash it will be required for purchasing the raw material may

be available in credit basis.Then the company has to spend some amount for labour and factory

overhead to convert raw material into work in progress, and ultimately finished goods.These

A.S.S College Of Business Administration,Gadag

Page 24

Bemco Hydraulics Ltd.,Belgaum

finished goods convert into sales on credit basis in the form of sundry debtors.Sundry debtors are

converting into cash after expiry of credit period.Thus some amountof cash is blocked into raw

materials,WIP,finished goods,sundry debtors and day to day cash requirements.However some

part of current assets may be financed by current liabilities also.The amount required to be

invested in this current assets is always higher than the funds available from current

liabilities.This is the precise reason why the needs of working capital arise.

GROSS WORKING CAPITAL AND NET WORKING CAPITAL

There are two concepts of working capital management.

1. Gross Working Capital

2. Net Working Capital

1. GROSS WORKING CAPITAL

Gross working capital refers to the firms investment in current assets.Current

assets are the assets which can be converted into cash within a year include cash,short term

securities,debtors,bills receivable and inventory.

2. NET WORKING CAPITAL

Net working capital refers to the difference between current assets and curent

liabilities.Current liabilities are those claims of outsiders which are expected to mature for

payement within an accounting year and include creditors,bills payable and outstanding

expenses.Net working capital can be positive or negative.

A.S.S College Of Business Administration,Gadag

Page 25

Bemco Hydraulics Ltd.,Belgaum

Efficient working capital management requires that firms should operate with

some amount of working capital,the exact amount varying from firm to firm depending among

other things on th nature of industries.Net working capital is necessary because the cash outflows

and inflows do not coincide.The cash outflows resulting from payment of current liabilities are

relatively predictable.The cash inflow are however difficult to predict.The more predictable the

cash inflows are,the less net working capital will be required.

The concept of working capital was first eveolved by Karl Marx.Marx used the

term variable capital means outlays for payolls advanced to workers before the completion of

work.He compares this with constant capital which according to him is nothing but dead

labor.This variable capital is nothing but wage fund which remains blocked in terms of

financial management; work in process along with other operating.

An expense until it is released through sale of finished goods.Although Marx did

not mentioned that workers also gave credit to the firm by accepting periodical payment of

wages which funded apportioned of WIP,the concept of working capital,as we understand today

was embedded in his variable capital.

TYPES OF WORKING CAPITAL

The operating cycle creates the need for current assets ( working capital).However

the need does not come to an end after the cycle is completed.To explain this continuing need of

current assets a distinction should be drawn between permanent and temporary working capital.

1.PERMANENT WORKING CAPITAL

The need for current assets arises,as already observed,because of cash cycle.To

carry on business,certain minimum level of working capital is necessary on continuous and

uninterrupted basis.For all practical purpose,this requirement will have to be met permanent as

with other fixed assets.This requirement refers to as permanent or fixed working capital.

A.S.S College Of Business Administration,Gadag

Page 26

Bemco Hydraulics Ltd.,Belgaum

2.TEMPORARY WORKING CAPITAL

Any amount over and above the permanent working capital is temporary,fluctuating or

variable working capital.This portion of the require working capital is needed to meet fluctuation

in demand consequent upon changes in production and sales as result of seasonal changes.

Temporary Working Capital

Amount Of

Working capital

A.S.S College Of Business Administration,Gadag

Page 27

Bemco Hydraulics Ltd.,Belgaum

Permanent Working Capital

TIME

Graph shows the permanent level is fairly constant while temporary working capital is

fluctuating in the case of an expanding firm the permanent working capital line may not be

horizontal.

This may be because of changes in demand for permanent current assets might be

interesting to support a rising level of activity.

DETERMINANTS OF WORKING CAPITAL

The amount of working capital depends upon the following factors

1. Nature of Business

Some businesses are such, due to their very nature, that their requirement of fixed capital is

more rather than working capital. These businesses sell services and not the commodities and

that too on cash basis. As such, no funds are blocked in piling inventories and also no funds are

blocked in receivables E.g. Public utility services like railways, infrastructure oriented projects

etc. their working capital requirements less. On the other hand, there are some businesses like

trading activity, where requirement of fixed capital is less but more money is blocked in

inventories and debtors.

2. Length of Production Cycle

A.S.S College Of Business Administration,Gadag

Page 28

Bemco Hydraulics Ltd.,Belgaum

In some business like machine tools industry, the time gap between the acquisition of raw

materials till end of final production of finished products itself is quite high. As such amount

may be blocked by either in raw material or work in progress or finished goods or even in

debtors. Naturally the need of working capital is high.

3. Size and Growth of Business

In very small company the working capital requirement is quite high due to high overhead,

higher buying and selling cost etc. as such medium size business positively has edge over the

small companies. But if the business starts growing after certain limit, the working capital

requirements may adversely affect by their increasing size.

4. Business/Trade Cycle

If the company is operating in time of boom, the working capital requirement may be more as

the company may like to buy more raw materials, may increase the production and sales to take

the benefit of favorable market, due to increase in sales, there may be more and more amounts of

funds blocked in stock and debtors etc. Similarly in the case of depressions also, working capital

may be high as the sales terms of value and quantity may be reducing, there may be unnecessary

piling up of stock without getting sold, the receivable may not be recovered in time etc.

5. Terms of Purchase and Sale

Some time due to competition or custom, it may be necessary for the company to extend more

credit to customers, as result in which more and more amount is locked up in debtors or bills

receivables which increase the working capital requirement. On the other hand, in the case of

purchase, if the credit is offered by suppliers of goods and services, a part of working capital

requirement will be higher.

6. Profitability

A.S.S College Of Business Administration,Gadag

Page 29

Bemco Hydraulics Ltd.,Belgaum

The profitability of the business may vary in each and every individual case, which is in turn

depend on numerous factors, but high profitability will positively reduce the strain on working

capital requirement of the company, because the profits to the extent that they earned in cash

may be used to meet the working capital requirement of the company.

7. Operating Efficiency

If the business is carried out on more efficiently, it can operate in profits which may reduce

the strain on working capital it may ensure proper utilization of existing resources by eliminating

the waste and improved.

OBJECTIVES OF WORKING CAPITAL MANAGEMENT

1. To ensure adequate liquidity of firm

2. To minimize the risk

3. To maximize the firms value

IMPORTANCE OR SIGNIFICANCE OF WORKING CAPITAL

1. Feeling of security and confidence

2. Solvency and survival

3. Goodwill and borrowing capacity

4. Good relation with suppliers, bankers and creditors

A.S.S College Of Business Administration,Gadag

Page 30

Bemco Hydraulics Ltd.,Belgaum

5. Research and innovation programs

6. High moral

7. Increased profitability

STATEMENT OF THE PROBLEM

Study and analysis of working capital at BEMCO Hydraulics Ltd.

CHAPTER V

ANALYSIS AND INTERPRETATION

ANALYSIS OF WORKING CAPITAL

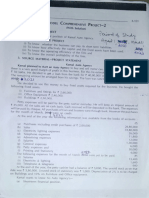

Statement showing changes in working capital for the year 2009 & 2010

A.S.S College Of Business Administration,Gadag

Page 31

Bemco Hydraulics Ltd.,Belgaum

Particulars

Current Assets:

Inventories

Years

2009

Change in working capital

2010

Increase

Decrease

12,32,21,007

16,73,78,152

Debtors

5,07,13,758

3,05,07,099

2,02,06,659

Cash & Bank

1,69,17,676

1,36,32,956

32,84,722

Loans & Advances

1,45,13,798

1,22,66,919

22,46,879

20,53,66,241

22,37,85,126

Liabilities

12,02,85,500

11,31,72,270

Provisions

55,83,967

57,07,608

12,58,69,467

11,88,79,878

7,94,96,774

10,49,05,248

Gross Working

Capital(A)

4,41,57,145

Current Liabilities:

(B)

Net Working Capital(AB)

71,13,230

1,23,641

ANALYSIS OF WORKING CAPITAL

Statement showing changes in working capital for the year 2010 & 2011

Particulars

Years

A.S.S College Of Business Administration,Gadag

Change in working capital

Page 32

Bemco Hydraulics Ltd.,Belgaum

Current Assets:

Inventories

2010

2011

Increase

16,73,78,152

19,61,83,038

2,88,04,886

Debtors

3,05,07,099

7,38,34,741

4,33,27,642

Cash & Bank

1,36,32,956

1,96,45,331

60,12,375

Loans & Advances

1,22,66,919

86,96,231

22,37,85,126

29,83,59,341

Liabilities

11,31,72,270

17,52,51,286

6,27,30,897

Provisions

57,07,608

88,16,724

31,09,116

(B)

11,88,79,878

18,40,68,010

Net Working Capital(AB)

10,49,05,248

11,42,91,331

Gross Working

Capital(A)

Decrease

35,70,688

Current Liabilities:

ANALYSIS OF WORKING CAPITAL

Statement showing changes in working capital for the year 2011 & 2012

A.S.S College Of Business Administration,Gadag

Page 33

Bemco Hydraulics Ltd.,Belgaum

Particulars

Years

Change in Working Capital

Current Assets:

2011

Inventories

2012

Increase

19,61,83,038

25,53,52,991

5,91,69,953

Debtors

7,38,34,741

11,38,07,274

3,99,72,533

Cash & Bank

1,96,45,331

1,21,04,763

86,96,231

1,43,24,302

29,83,59,340

39,55,89,430

Short term

Borrowings

9,37,63,399

12,89,30,694

3,51,76,295

Trade payables

7,33,56,499

8,42,12,763

1,08,56,264

Other Current

Liabilities

7,79,48,196

10,57,11,460

2,77,63,264

88,54,404

97,63,891

9,09,487

25,39,22,498

32,85,28,808

2,54,23,414

6,70,60,621

Loans & Advances

Gross Working

Capital(A)

Decrease

75,40,568

1,34,28,071

Current Liabilities:

Short term Provisions

(B)

Net Working

Capital(A-B)

ANALYSIS OF WORKING CAPITAL

Statement showing changes in working capital for the year 2012 & 2013

Particulars

Years

A.S.S College Of Business Administration,Gadag

Change in

Working

Page 34

Bemco Hydraulics Ltd.,Belgaum

Capital

Current Assets:

2012

2013

Increase

Decrease

Inventories

25,53,52,991

23,92,84,022

Debtors

11,38,07,374

12,21,14,993

Cash & Bank

1,21,04,763

1,09,31,446

Loans & Advances

1,43,24,302

1,76,08,339

39,55,89,430

38,99,38,800

12,89,30,694

17,71,06,940

Trade payables

8,76,52,782

8,49,20,873

27,31,909

Other Current

Liabilities

10,56,43,769

6,40,58,551

4,15,85,218

63,01,564

81,61,506

32,85,28,809

33,42,47,870

6,70,60,621

5,56,90,930

Gross Working

Capital(A)

1,60,68,969

83,07,619

11,73,317

32,84,037

Current Liabilities:

Short term

Borrowings

Short term Provisions

(B)

Net Working

Capital(A-B)

4,81,76,246

18,59,942

GRAPH SHOWING FLUCTUATIONS IN WORKING CAPITAL

A.S.S College Of Business Administration,Gadag

Page 35

Bemco Hydraulics Ltd.,Belgaum

YEAR

WORKING CAPITAL

2009

7,94,66,774

2010

10,49,05,248

2011

11,42,91,331

2012

6,70,60,621

2013

5,56,90,930

Working Capital

140000000

120000000

100000000

Working Capital

80000000

60000000

40000000

20000000

0

2009

2010

2011

2012

2013

INTERPRETATION

The above table and graph shows the working capital of last five years, here we can see that from

2009 to 2011 Working Capital is in increasing order & from 2012 it is in decreasing order.

RATIO ANALYSIS

A.S.S College Of Business Administration,Gadag

Page 36

Bemco Hydraulics Ltd.,Belgaum

MEANING

Ratio is the numerical relationship between two numbers. It may be expressed in quotients, rate

or in percentage. The ratio analysis of working capital helps management in checking upon the

efficiency with which working capital has been used in company.

Ratio analysis is widely used tool of financial analysis. It is defined as the systematic use of

ratios to interpret financial statement so that the strengths and weaknesses of the firm, as its

historical performance and current financial conditions can be determined.

Ratios make related information comparable. A single figure by itself by itself has no meaning.

But when expressed in terms of the related figure, it yields sufficient inferences. Thus ratios are

relative figures reflecting the relationship between related variables. They are used as tools of

financial analysis, which involve their comparison as single ratios which like absolute figures are

not used.

IMPORTANCE OF RATIO ANALYSIS

The following are the importance of ratio analysis

1. Useful in financial position analysis.

2. Useful in simplification accounting purpose.

3. Useful in assessing purpose.

4. Useful in comparison of performance.

5. Useful in forecasting purpose.

A.S.S College Of Business Administration,Gadag

Page 37

Bemco Hydraulics Ltd.,Belgaum

RATIOS

CURRENT RATIO

This is most widely used ratio to know the capital position. These ratios

express the relationship between current assets and current liabilities and give the information

about firm ability to meet short term and long term working capital.

Current Ratio = Current Assets

Current Liabilities

Particulars/Years

Current Assets

Current Liabilities

Current Ratio

2009-10

22,37,85,126

11,88,79,878

1.88

2010-11

29,83,59,341

18,40,68,010

1.62

2011-12

39,65,89,430

32,85,28,808

1.20

2012-13

38,99,38,800

33,42,47,870

1.16

CURRENT RATIOS

2

1.8

1.6

1.4

1.2

CURRENT RATIOS

1

0.8

0.6

0.4

0.2

0

2009-10

2010-11

2011-12

2012-13

INTERPRETATION

This ratio shows the capital position of company to meet short term & long

term working capital, current ratio is decreasing from 2010 till 2013.

A.S.S College Of Business Administration,Gadag

Page 38

Bemco Hydraulics Ltd.,Belgaum

ABSOLUTE LIQUID RATIO

It considers only the absolute liquidity available with the firm means as early as possible

how company will get its cash ready in its hand. Here only cash, bank balance, marketable

securities are taken into consideration. The ideal ratio is 1:2

Absolute Ratio = Cash + Bank Balance + Short Term Marketable Securities

Current Liabilities

Particulars/Years

Cash & Bank

Current Liabilities

Current Ratio

2009-10

1,36,32,856

11,88,79,878

0.11

2010-11

1,96,45,331

18,40,68,010

0.10

2011-12

1,31,04,764

10,57,11,460

0.12

2012-13

1,09,31,446

33,42,47,870

0.03

Absolute Ratio

0.14

0.12

0.1

0.08

Absolute Ratio

0.06

0.04

0.02

0

2009-10

2010-11

2011-12

2012-13

INTERPRETATION

A.S.S College Of Business Administration,Gadag

Page 39

Bemco Hydraulics Ltd.,Belgaum

This Ratio indicates that the company had high absolute liquidity ratio in 2011-12 when

compared with low absolute liquidity ratio in 2012-13 period.

WORKING CAPITAL TO TURNOVER RATIO

This ratio shows the number of times the working capital is turned over within a stated

period. It is calculated as follows:

Working Capital Ratio =

Sales

Net Working Capital

Particulars/Years

2009-10

2010-11

2011-12

2012-13

Sales

17,63,73,995

24,36,43,470

24,91,77,796

38,43,31,995

Net Working

Capital

Ratio

10,49,05,248

11,42,91,331

6,80,60,622

5,56,90,930

1.68

2.13

3.66

6.90

Ratios

8

7

6

5

Ratios

4

3

2

1

0

2009-10

2010-11

2011-12

2012-13

INTERPRETATION

A.S.S College Of Business Administration,Gadag

Page 40

Bemco Hydraulics Ltd.,Belgaum

This Ratio shows that the company had very high turnover ratio of 6.90 of working capital in

2012-13 period.

WORKING CAPITAL TO PROFIT

This ratio shows the relationship between working capital and the profit of the company.

Working Capital to Profit =

Profit

Net Working Capital

Particulars/Years

2009-10

2010-11

2011-12

2012-13

Profit

58,42,534

78,30,116

68,76,506

1,00,64,656

Net Working

Capital

Ratio

10,49,05,248

11,42,91,331

6,80,60,621

5,56,90,930

0.04

0.06

0.10

0.18

Ratios

0.2

0.18

0.16

0.14

0.12

Ratios

0.1

0.08

0.06

0.04

0.02

0

2009-10

2010-11

2011-12

A.S.S College Of Business Administration,Gadag

2012-13

Page 41

Bemco Hydraulics Ltd.,Belgaum

INTERPRETATION

This Ratio indicates that the company had increased ratio of 0.18 in 2012-13 and high profit of

R.s. 1,00,64,656.

FIXED ASSET TURNOVER RATIO

This ratio measures the efficiency of the assets used. The efficient use of the assets will

generate sales. The inefficient use of assets will result in low sales volume coupled with higher

overhead charge and under utilization of the capacity.

Fixed Asset Turn Over Ratio =

Sales

Fixed Assets

Particulars/Years

Sales

Fixed Assets

Ratio

2009-10

17,63,73,995

5,16,56,793

3.41

2010-11

24,36,43,470

5,32,42,884

4.57

2011-12

24,91,77,796

4,49,63,043

5.54

2012-13

38,43,31,995

9,96,90,586

3.85

Fixed Asset Turnover Ratio

6

5

4

Fixed Asset Turnover Ratio

3

2

1

0

2009-10

2010-11

2011-12

2012-13

A.S.S College Of Business Administration,Gadag

Page 42

Bemco Hydraulics Ltd.,Belgaum

INTERPRETATION

This Ratio shows that 2011-12 had high ratio of 5.54 compared to low ratio of 3.85 in 201213.So the company had not utilized its assets efficiently in 2012-13.

CASH RATIO

It is the ratio of cash equivalent balance to current liability. It will help the company to

know the cash availability in the company. Company will come to know about, whether money

is blocked or fully utilized in production process. It is calculated as follows:

Cash Ratio =

Cash

Current Liabilities

Particulars/Years

Cash

Current Liabilities

Ratio

2009-10

1,36,32,956

11,88,79,878

0.11

2010-11

1,96,45,331

18,40,68,010

0.10

2011-12

2,20,98,306

10,57,11,460

0.20

2012-13

2,58,69,550

33,42,47,870

0.07

Cash Ratio

0.25

0.2

0.15

Cash Ratio

0.1

0.05

0

2009-10

2010-11

2011-12

2012-13

A.S.S College Of Business Administration,Gadag

Page 43

Bemco Hydraulics Ltd.,Belgaum

INTERPRETATION

This Ratio shows that company had high ratio of cash in 2011-12 at 0.20 & 2012-13 had lower

ratio than other previous years at 0.07.

CURRENT ASSET RATIO

The current asset ratio measures the efficient use of current assets in the production. If the

company utilizes its current assets effectively production and sales will increase, if inefficiently

then production and sales will reduce.

Current Asset Ratio =

Sales

Current Assets

Particulars/Years

Sales

Current Assets

Ratio

2009-10

17,63,73,995

22,37,85,126

0.78

2010-11

24,36,43,470

29,83,59,341

0.81

2011-12

24,91,77,796

39,65,89,430

0.62

2012-13

38,43,31,995

38,99,38,800

0.98

Current Asset Ratio

1.2

1

0.8

Current Asset Ratio

0.6

0.4

0.2

0

2009-10

2010-11

2011-12

2012-13

A.S.S College Of Business Administration,Gadag

Page 44

Bemco Hydraulics Ltd.,Belgaum

INTERPRETATION

This Ratio indicates that company used its current assets efficiently in production which resulted

in more production & sales. The Ratio was increased from 0.62 in 2011-12 to 0.98 in 2012-13.

COMPOSITON OF WORKING CAPITAL

For a proper appreciation and understanding of it, closer look of working capital is

necessary. The following are the constituent parks of working capital.

Current Assets

1. Cash

2. Bank Balance

3. Stock of Inventory

4. Debtors

5. Bills Receivables

6. Prepaid Expenses

7. Outstanding Incomes

Current Liabilities

1. Bills Payable

2. Creditors

A.S.S College Of Business Administration,Gadag

Page 45

Bemco Hydraulics Ltd.,Belgaum

3. Outstanding Expenses

4. Incomes Received in Advance

5. Short term Loans

6. Bank Loans

PRINCIPLES OF WORKING CAPITAL

There are totally three principles which are given below,

1. Matching or Moderate Approach

2. Aggressive Approach

3. Conservative Approach

1. MATCHING APPROACH

In this approach long term financing to finance fixed assets and permanent

current assets. Short term financing to finance temporary or variable current assets.

2. AGGRESSIVE APPROACH

An aggressive policy is said to be followed by the firm when it used more short

term finance. Under this policy the firm finances a part of its permanent current assets with short

term financing

3. CONSERVATIVE APPROACH

A.S.S College Of Business Administration,Gadag

Page 46

Bemco Hydraulics Ltd.,Belgaum

The financing policy of the firm is said to be conservative when it depends more

on long term funds. Under a conservative plan the firm finances its permanent assets and also a

part of temporary current assets with long term financing.

THE PRINCIPLE ADOPTED BY BEMCO HYDRAULICS Ltd.

The company adopted AGGRESSIVE PRINCIPLE because it is using short term bank

loans to finance the working capital. Mainly the company is getting loan from two banks. They

are:

Bank of Maharashtra

State Bank of India

In both the banks the company has three types of accounts:

1.Current Account

These accounts are mainly used by businessmen. These are very helpful to business

organizations because these deposits are more liquid deposits. BEMCO also has its

current accounts in the above mentioned banks and getting the following benefits:

Most liquid deposits

No limits for the number of transactions

No limits for the amount of transactions in a day

Cheque book facility is provided

2.Bank Guarantee Account

Bank guarantee is the guarantee of payment by bank on behalf of customer of the

bank; customer may be individual or a company. BEMCO also has its bank guarantee

account in SBI and Bank of Maharashtra and getting below mentioned benefits Bank guarantee can mitigate risk

A.S.S College Of Business Administration,Gadag

Page 47

Bemco Hydraulics Ltd.,Belgaum

It functions as a safeguard for both parties

It is used to strengthen and secure an obligation under a commercial contract.

3.Letter of Credit

Letter of credit is a binding document that a buyer can request from his bank in

order to guarantee that the payment of goods will be transferred to the seller. Basically a letter of

credit gives the seller reassurance that he will receive the payment for the goods sold.

BEMCO also has Letter of Credit facility from its bank. After a contract is

concluded between buyer and seller, buyers bank supplies a letter of credit to seller. So the short

term loan is the main and only source for financing the working capital in BEMCO.

CALCULATION OF COST OF WORKING CAPITAL

Cost of working capital is nothing but the carrying cost of that working capital means

how much cost the company incurrs to hold the working capital.

It can be calculated by calculating the interest amount of loan taken by the company, the

cost of working capital of BEMCO Hydraulics is as follows:

YEAR

RATE OF

INTEREST

1,45,13,798

12.8%

1,22,66,919

12.8%

86,96,231

12.8%

1,43,42,302

12.8%

1,76,08,339

12.8%

TOTAL COST OF WORKING CAPITAL

2009

2010

2011

2012

2013

LOAN AMOUNT

INTEREST

AMOUNT

18,57,766.14

15,70,165.63

11,13,117.56

1,83,58,146.56

22,53,867.39

2,51,53,063.28

The above table shows the cost of working capital of the company. BEMCO Hydraulics Limited

invests its working capital by taking loan from banks so the interest amount will be the cost of

working capital of the company. The company usually gets loan from two banks,those are:

State Bank of India

Bank of Maharashtra

A.S.S College Of Business Administration,Gadag

Page 48

Bemco Hydraulics Ltd.,Belgaum

By observing the above table we can say that for the past five years the cost of working capital of

the company is 2,51,53,063.28.

In every company working capital is needed and similarly the cost of working capital also

incurrs to hold that capital.

SALES,PROFIT AND WORKING CAPITAL OF THE COMPANY

Every company comes into existence to make profits. Making profits and acquiring most

of the capital share are the main objectives of every company. The below table and graph shows

the sales, profit and working capital of the company of the past five years.

Particulars

2009

2010

2011

2012

2013

Sales

22,50,48,379

17,63,73,995

24,36,43,470

24,91,77,796

38,43,31,995

Profit

33,22,462

58,42,534

78,30,116

68,76,506

1,00,64,656

Working

Capital

7,94,66,774

10,49,05,248

11,42,91,331

6,70,60,621

5,59,60,930

A.S.S College Of Business Administration,Gadag

Page 49

Bemco Hydraulics Ltd.,Belgaum

500000000

450000000

400000000

350000000

300000000

WORKING CAPITAL

250000000

PROFIT

200000000

SALES

150000000

100000000

50000000

0

2009

2010

2011

2012

2013

INTERPRETATION

This Ratio shows that the companys Sales & Profit is increasing year by year and working

capital had increased from 2009 to 2011 but it is decreasing from 2012 and 2013

CHAPTER VI

FINDINGS, SUGGESIONS AND CONCLUSION

FINDINGS

1. Company has adopted the aggressive principle to maintain the working capital.

2. The main and only source for financing working capital is Bank Loan.

3. Bank of Maharashtra and SBI are the banks which provides loan to the company.

A.S.S College Of Business Administration,Gadag

Page 50

Bemco Hydraulics Ltd.,Belgaum

4. Though current ratio is not upto the mark, but in five years it never went less than 1.17

which can be considered as good.

5. There is increase in profit and sales

6. Company is growing step by step.

7. By studying the financial growth the statements I found that the companys financial

position will be sound in the coming years.

SUGGESTIONS

1. It is good for the company to move with aggressive principle only, because it is suitable

and benefited to the company.

2. In addition to Bank loan I would like to suggest the following internal sources of

finance for the working capital, because it will result in reduction of cost of working capital that

is 2,51,53,063.28 for past five years.

Cash in hand

Debtors

A.S.S College Of Business Administration,Gadag

Page 51

Bemco Hydraulics Ltd.,Belgaum

3. Company prefers Bank of Maharashtra and SBI for loan, they can go for other banks

also which will provide loan at less interest.

4. I would also like to suggest company to improve its working capital position by

reducing its current liabilities like paying the creditors as early as possible.

5. Since company is growing I would like to suggest that it can open its branches in other

cities also that it can spread its operations which will help the company to achieve its vision.

6. Investment in current assets should be increased

CONCLUSION

Working capital may be regarded as life blood of a business. Its effective provision can

do much to ensure the success of a business, while its inefficient management can lead not only

to loss of profits but also to the ultimate downfall of what otherwise might be considered as a

promising concern. A study of working capital is of major importance to internal and external

analysis because of its close relationship with the current day to day operations of business.

BEMCO Hydraulics is a private limited company. It is in the field of Hydraulic presses

and equipments, since 1957 and having good sales record. It indicates the managements

effectiveness and efficiency.

A.S.S College Of Business Administration,Gadag

Page 52

Bemco Hydraulics Ltd.,Belgaum

There is a small fluctuation in the companys working capital, sales and profit in these 5

years. By observing the data we can say that company is improving year by year. Though the

company does not have highly qualified employees, they are contributing their skills and

knowledge so effectively that their own employees tell that they have become expert than highly

qualified employees.

The companys financial position will be strong in the coming years. Companys

working capital position is good. The liquidity position of the company is also good.

One important thing is that bank of Maharashtra and SBI are providing loans since so

many years so that the relationship between the company and these two banks is good.

BIBLIOGRAPHY

Books:

1. Financial Management by Khan and Jain

2. Financial Management by I.M.Pandey

Company:

Annual Report

A.S.S College Of Business Administration,Gadag

Page 53

Bemco Hydraulics Ltd.,Belgaum

Balance Sheet

Profit and Loss Statement

Website:

1. http://www.bemcohydraulics.net/index.php?

option=com_content&view=article&id=1&Itemid=2

2. http://www.bemcohydraulics.net/index.php?

option=com_content&view=article&id=3&Itemid=4

3. http://www.bemcohydraulics.net/index.php?

option=com_content&view=article&id=13&Itemid=14

4. http://www.bemcohydraulics.net/index.php?

option=com_content&view=article&id=17&Itemid=17

5. http://www.bemcohydraulics.net/index.php?

option=com_content&view=article&id=30&Itemid=30

6. http://www.bemcohydraulics.net/download/52.pdf

A.S.S College Of Business Administration,Gadag

Page 54

Das könnte Ihnen auch gefallen

- Final DraftDokument61 SeitenFinal DraftJotiba Jadhav100% (1)

- Study On Retailer Perception On NOKIA Mobiles ProjectDokument72 SeitenStudy On Retailer Perception On NOKIA Mobiles Projectsantunusoren100% (3)

- A Study On Customer Satisfaction Towards Shri Kannan Departmental Stores With Special Reference in Namakkal TownDokument3 SeitenA Study On Customer Satisfaction Towards Shri Kannan Departmental Stores With Special Reference in Namakkal Townselmuthusamy100% (2)

- Electronics BBA MBA Project ReportDokument50 SeitenElectronics BBA MBA Project ReportpRiNcE DuDhAtRaNoch keine Bewertungen

- India Cements LTD ReportDokument33 SeitenIndia Cements LTD ReportSathya Priya50% (2)

- Acc CementDokument33 SeitenAcc Cementanon_7046386650% (1)

- A Study On Sales Promotion Strategies Adopted by Acc Cement at Gondia CityDokument46 SeitenA Study On Sales Promotion Strategies Adopted by Acc Cement at Gondia CityUjwal JaiswalNoch keine Bewertungen

- HR Report-Rajashri CementDokument75 SeitenHR Report-Rajashri CementKumar RajadhyakshNoch keine Bewertungen

- A Report On Industrial Exposure Training at Rabwin IndustriesDokument55 SeitenA Report On Industrial Exposure Training at Rabwin IndustriesPavithra Kumaran50% (2)

- Report of Summer Internship Project at Ambuja Cement LimitedDokument5 SeitenReport of Summer Internship Project at Ambuja Cement LimitedKunal ChandelNoch keine Bewertungen

- Mi Report FinalDokument74 SeitenMi Report FinalArittraKar100% (1)

- Full ProjectDokument90 SeitenFull ProjectAmal AugustineNoch keine Bewertungen

- A Project Report On Customer Satisfaction Level at Kirloskar LTDDokument85 SeitenA Project Report On Customer Satisfaction Level at Kirloskar LTDBabasab Patil (Karrisatte)100% (1)

- A Study To Find The Customer Satisfaction of The Customers of Home Appliances Segment of Samsung Electronics India Limited in The Ernakulam RegionDokument61 SeitenA Study To Find The Customer Satisfaction of The Customers of Home Appliances Segment of Samsung Electronics India Limited in The Ernakulam RegionAdarsh Pm80% (5)

- A PROJECT REPORT ON Peps PVT LTDDokument34 SeitenA PROJECT REPORT ON Peps PVT LTDsitanshu kumar100% (1)

- Rakesha PR - Kalyani DummyDokument44 SeitenRakesha PR - Kalyani DummyMr. M. Sandeep KumarNoch keine Bewertungen

- Punch MCPDokument55 SeitenPunch MCPmegha angadiNoch keine Bewertungen

- Bokaro Steel Plant: Analysis of Working Capital ManagementDokument62 SeitenBokaro Steel Plant: Analysis of Working Capital ManagementNishant MishraNoch keine Bewertungen

- BATA Summer InternshipDokument51 SeitenBATA Summer InternshipAlan Miller50% (4)

- ACC Project ReportDokument102 SeitenACC Project Reportmaverick22198657% (7)

- Customer Satisfaction with Chennai SilksDokument8 SeitenCustomer Satisfaction with Chennai SilksMaharajah YogarajahNoch keine Bewertungen

- Project Report On Retailers Perception About Micromaxx Mobile HandsetsDokument82 SeitenProject Report On Retailers Perception About Micromaxx Mobile HandsetsManish Singh77% (13)

- Project Report On Customer Prnneference and Brand Awareness Mahindra PumpsDokument26 SeitenProject Report On Customer Prnneference and Brand Awareness Mahindra PumpsSivaSankaran100% (1)

- Summer Internship Project Report TTTTDokument60 SeitenSummer Internship Project Report TTTTAnonymous Ut4ourcNoch keine Bewertungen

- Vasanth & CoDokument3 SeitenVasanth & CoJegan Joseph0% (1)

- Vasant Brass-Bba-Mba Project ReportDokument72 SeitenVasant Brass-Bba-Mba Project ReportpRiNcE DuDhAtRa100% (5)

- A Study On Meriiboy Ice Cream Company With Special Reference To Human Resource DepartmentDokument46 SeitenA Study On Meriiboy Ice Cream Company With Special Reference To Human Resource DepartmentSruthy psNoch keine Bewertungen

- Winter Training Project ReportDokument42 SeitenWinter Training Project ReportTamanna Rana100% (1)

- Working Capital Management - ultrATECHDokument63 SeitenWorking Capital Management - ultrATECHBalakrishna Chakali71% (7)

- Project Report On Oswal Woolen MillsDokument43 SeitenProject Report On Oswal Woolen Millspabalapreet50% (2)

- Final - A Study On Inventory Management in Chettinad Cement Corporation LimitedDokument51 SeitenFinal - A Study On Inventory Management in Chettinad Cement Corporation LimitedeswariNoch keine Bewertungen

- Fdocuments - in - Summer Project On Dalmia CementDokument98 SeitenFdocuments - in - Summer Project On Dalmia CementGaurav KumarNoch keine Bewertungen

- Summer Training Project Report of Bangur Cement 3Dokument85 SeitenSummer Training Project Report of Bangur Cement 3Gaurav Kumar Shivhare100% (3)

- Ammanarul Spining DoneDokument38 SeitenAmmanarul Spining DonekannanNoch keine Bewertungen

- Traco Cable WCM ProjectDokument77 SeitenTraco Cable WCM ProjectAjeesh K RajuNoch keine Bewertungen

- Project Traditional Retailing WithDokument44 SeitenProject Traditional Retailing WithChaitanya Kasi0% (1)

- Pump IndustyDokument47 SeitenPump IndustyKonguKarthikNoch keine Bewertungen

- Chettinad Cement Corporation LimitedDokument35 SeitenChettinad Cement Corporation LimitedMano Onam100% (1)

- Project AIMA - Marketing Analysis of Havells India LTDDokument72 SeitenProject AIMA - Marketing Analysis of Havells India LTDVikram ThakurNoch keine Bewertungen

- Texmo ProjectDokument82 SeitenTexmo ProjectGanesh Shewale100% (1)

- Main Sources of Recruitment, Selection, Training and Development in IHRMDokument23 SeitenMain Sources of Recruitment, Selection, Training and Development in IHRMchanus92100% (1)

- BIRLADokument70 SeitenBIRLAshikhar_verma100% (2)

- PandisitpDokument40 SeitenPandisitpkrishna0% (1)

- Presentation of Internship in A Startup CompanyDokument26 SeitenPresentation of Internship in A Startup CompanyAnuj SinghNoch keine Bewertungen

- Working Capital Management Techniques at Tata SteelDokument19 SeitenWorking Capital Management Techniques at Tata SteelRam ChandNoch keine Bewertungen

- SFCK PresentnDokument43 SeitenSFCK PresentnFasna FathimaNoch keine Bewertungen

- Bharat Summer Internship Project ReportDokument73 SeitenBharat Summer Internship Project ReportprateekNoch keine Bewertungen

- 1.1 History of The Organization: InnovationDokument38 Seiten1.1 History of The Organization: InnovationVignesh D100% (3)

- A Study On Working Capital ManagementDokument6 SeitenA Study On Working Capital ManagementRagul AnjaneyuluNoch keine Bewertungen

- Working Capital Management of AccDokument52 SeitenWorking Capital Management of AccSoham Khanna67% (3)

- Sail BokaroDokument41 SeitenSail BokaroShambhu KumarNoch keine Bewertungen

- Project CetrificateDokument47 SeitenProject CetrificatePramod SuryataleNoch keine Bewertungen

- Synopsis Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofDokument4 SeitenSynopsis Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofAjit KarkannavarNoch keine Bewertungen

- OUM Human RecearchDokument35 SeitenOUM Human RecearcheddyNoch keine Bewertungen

- Report On FINANCIAL PERFORMANCE ANALYSIS OF CEMENT INDUSTRY AND COMPARISON WITH LAFARGE-HOLCIM BANGLADESH CEMENT LTDDokument34 SeitenReport On FINANCIAL PERFORMANCE ANALYSIS OF CEMENT INDUSTRY AND COMPARISON WITH LAFARGE-HOLCIM BANGLADESH CEMENT LTDavishek karmakerNoch keine Bewertungen

- Working Capital Management PRJCT (BHPV Vizag)Dokument93 SeitenWorking Capital Management PRJCT (BHPV Vizag)Khiladi Sidharth Raj100% (1)

- Project Report On Working Capital of JISLDokument41 SeitenProject Report On Working Capital of JISLanon_241911849100% (2)

- Term Paper Presentation On Topic: "Working Capital Managemnt - A Case Study of Acc Limited"Dokument21 SeitenTerm Paper Presentation On Topic: "Working Capital Managemnt - A Case Study of Acc Limited"anitasndNoch keine Bewertungen

- Project Report in FinanceDokument53 SeitenProject Report in FinanceLekha KoshtaNoch keine Bewertungen

- Project Finance and Evaluation Report at IOCL Barauni RefineryDokument57 SeitenProject Finance and Evaluation Report at IOCL Barauni Refineryanshu276Noch keine Bewertungen

- Management Buyout (Mbo)Dokument11 SeitenManagement Buyout (Mbo)Louis Mourre Del RioNoch keine Bewertungen

- Workbook of Mapit Accountancy of f9Dokument178 SeitenWorkbook of Mapit Accountancy of f9Sumaira Khalid100% (1)

- Proposed Acquisition of The Assets of MemorialDokument11 SeitenProposed Acquisition of The Assets of Memorialsavannahnow.com100% (3)

- Working Capital Productivity The Overlooked Measure of Business Performance Improvement Nov 04Dokument10 SeitenWorking Capital Productivity The Overlooked Measure of Business Performance Improvement Nov 04TommyCasillas-GerenaNoch keine Bewertungen

- Annexure Form for MSE Loan ApplicationDokument24 SeitenAnnexure Form for MSE Loan ApplicationShakeer HussainNoch keine Bewertungen

- Bata BBDokument77 SeitenBata BBSWAG GAMMERNoch keine Bewertungen

- Chapter 1Dokument14 SeitenChapter 1Raunnaq SharnamNoch keine Bewertungen

- Bakery Business PlanDokument30 SeitenBakery Business PlanMwangi JnrNoch keine Bewertungen

- Synopsis: Working Capital ManagementDokument52 SeitenSynopsis: Working Capital ManagementManova KumarNoch keine Bewertungen

- 8th Annual New York: Value Investing CongressDokument53 Seiten8th Annual New York: Value Investing CongressVALUEWALK LLCNoch keine Bewertungen

- Project Report of KMFDokument107 SeitenProject Report of KMFArun NagaNoch keine Bewertungen

- Chapter 15 - Working CapitalDokument19 SeitenChapter 15 - Working CapitalAmjad J AliNoch keine Bewertungen

- Research ProposalDokument10 SeitenResearch ProposalWaqas MehmoodNoch keine Bewertungen

- FIN202 - Chap 3 - Selected ExercisesDokument2 SeitenFIN202 - Chap 3 - Selected ExercisesThanh ThảoNoch keine Bewertungen

- Working Capital Analysis of BPCLDokument82 SeitenWorking Capital Analysis of BPCLIshaan YadavNoch keine Bewertungen

- Chapter 11 Capital Budgeting Cash Flows: Principles of Managerial Finance, 14e (Gitman/Zutter)Dokument18 SeitenChapter 11 Capital Budgeting Cash Flows: Principles of Managerial Finance, 14e (Gitman/Zutter)chinyNoch keine Bewertungen

- BUSINESS FUNCTIONS NOTES: PRODUCTION AND OPERATIONSDokument19 SeitenBUSINESS FUNCTIONS NOTES: PRODUCTION AND OPERATIONSWamema joshuaNoch keine Bewertungen

- Class 12 Solution AccountDokument45 SeitenClass 12 Solution AccountChandan ChaudharyNoch keine Bewertungen

- A Project Report On Working Capital Management of Hindalco For The Last Five YearsDokument83 SeitenA Project Report On Working Capital Management of Hindalco For The Last Five YearsBabasab Patil (Karrisatte)0% (1)

- Accountancy ProjectDokument10 SeitenAccountancy ProjectRAIMA BHANDARI 7503-09Noch keine Bewertungen

- Business Finance AssingmentDokument29 SeitenBusiness Finance AssingmentShivaniNoch keine Bewertungen

- Ratio Analysis of Three Different IndustriesDokument142 SeitenRatio Analysis of Three Different IndustriesAbdullah Al-RafiNoch keine Bewertungen

- MPBF - Tandon CommitteeDokument1 SeiteMPBF - Tandon Committeeneeteesh_nautiyal100% (5)

- Handout Appendix DCF Valuation 2023Dokument21 SeitenHandout Appendix DCF Valuation 2023Akshay SharmaNoch keine Bewertungen

- A Comparative Study On Working Capital Management of Selected Cement Companies in IndiaDokument61 SeitenA Comparative Study On Working Capital Management of Selected Cement Companies in IndiaSatya Prakash SahuNoch keine Bewertungen

- Analysis of Working Capital Management On NALCODokument51 SeitenAnalysis of Working Capital Management On NALCOsachinshinde_tex100% (1)

- Manufacturing HDPE Dhela Project ReportDokument35 SeitenManufacturing HDPE Dhela Project ReportprojectessNoch keine Bewertungen

- Interpretation of Financial Statements - IntroductionDokument19 SeitenInterpretation of Financial Statements - Introductionsazid9Noch keine Bewertungen

- Chapter One: Introduction To Corporate FinanceDokument26 SeitenChapter One: Introduction To Corporate FinanceKids SocietyNoch keine Bewertungen

- Solution Manual For Essentials of Corporate Finance by ParrinoDokument21 SeitenSolution Manual For Essentials of Corporate Finance by Parrinoa8651304130% (1)