Beruflich Dokumente

Kultur Dokumente

Investment Appraisal - Payback Computation

Hochgeladen von

411hhap0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

43 Ansichten3 SeitenInvestment Appraisal - Automatic Payback Computation

Copyright

© © All Rights Reserved

Verfügbare Formate

XLSX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenInvestment Appraisal - Automatic Payback Computation

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

43 Ansichten3 SeitenInvestment Appraisal - Payback Computation

Hochgeladen von

411hhapInvestment Appraisal - Automatic Payback Computation

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

WALL ST.

TRAINING

B

1

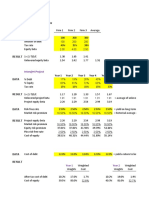

Payback Period Analysis

2

3

Undiscounted Payback Period Analysis

Project

Year 1

Undiscounted Net Cash Flow

Cumulative Net Cash Flow

Positive Cash Flow?

Undiscounted Payback Period

10

Partial Year Payback Period

3.25

Actual Number of Years

11

Partial Year Payback Period (One Cell)

3.25

Using arrays and index

6

7

$ (200,000)

$ 40,000

(160,000)

First Year Positive

12

13

14

15

16

Discounted Payback Period Analysis

Discount Rate

Project

17

Year 1

18

19

Undiscounted Net Cash Flow

20

Cumulative Net Cash Flow

21

Positive Cash Flow?

22

Undiscounted Payback Period

23

Partial Year Payback Period

3.84

Actual Number of Years

24

Partial Year Payback Period (One Cell)

3.84

Using arrays and index

320393034.xlsxPaybackPeriod

$ (200,000)

$ 36,364

(163,636)

-

First Year Positive

Hamilton Lin, CFA, www.wallst-training.com

WALL ST. TRAINING

G

1

2

3

4

Projected

Year 2

Year 3

Year 4

Year 5

$ 60,000

(100,000)

-

$ 75,000

(25,000)

-

$ 100,000

75,000

1.0

$ 125,000

200,000

1.0

Year 4

Year 5

7

8

9

10

11

12

13

14

15

16

17

10.0%

Projected

18

Year 2

Year 3

19

$ 49,587

$ 56,349

$ 68,301

$ 77,615

20

(114,050)

(57,701)

10,600

88,216

1.0

1.0

21

22

23

24

320393034.xlsxPaybackPeriod

Hamilton Lin, CFA, www.wallst-training.com

WALL ST. TRAINING

E9:

Wall St. Training

The Payback Period is the length of time between an initial investment and the recovery of the investment from its annual cash

flow.

E22:

Wall St. Training

Discounted payback period should be greater than undiscounted payback period since the value of future cash flows are worth

less.

320393034.xlsxComments

Hamilton Lin, CFA, www.wallst-training.com

Das könnte Ihnen auch gefallen

- Financial Model - Version 3 (03!10!2020)Dokument41 SeitenFinancial Model - Version 3 (03!10!2020)Fazal ImranNoch keine Bewertungen

- Linear Programming On Excel: Problems and SolutionsDokument5 SeitenLinear Programming On Excel: Problems and Solutionsacetinkaya92Noch keine Bewertungen

- Financial Goal Setting-12012013 - FinalDokument51 SeitenFinancial Goal Setting-12012013 - FinalJaie SurveNoch keine Bewertungen

- Financial Reporting ToolDokument49 SeitenFinancial Reporting ToolGeethaNoch keine Bewertungen

- SSR Stock Analysis SpreadsheetDokument33 SeitenSSR Stock Analysis Spreadsheetpvenky100% (1)

- 2GO Excel Calculation 1Dokument60 Seiten2GO Excel Calculation 1w_fibNoch keine Bewertungen

- Competitive IntelligenceDokument35 SeitenCompetitive IntelligencePatrick AdamsNoch keine Bewertungen

- N ShortDokument12 SeitenN Shortkh8120005280Noch keine Bewertungen

- Profit Planning and Activity Based BudgetingDokument50 SeitenProfit Planning and Activity Based BudgetingcahyatiNoch keine Bewertungen

- Template Stock RecommendationSesaDokument41 SeitenTemplate Stock RecommendationSesaArijit BoseNoch keine Bewertungen

- Indonesia Loss Reserving (Example)Dokument6 SeitenIndonesia Loss Reserving (Example)Setyo Tyas JarwantoNoch keine Bewertungen

- Asset Schedule Corality ModelOff Worked Solution Asset ScheduleDokument23 SeitenAsset Schedule Corality ModelOff Worked Solution Asset ScheduleFelicia Shan SugataNoch keine Bewertungen

- Financial ModellingDokument22 SeitenFinancial ModellingSyam MohanNoch keine Bewertungen

- Boston Scientific PrimerDokument2 SeitenBoston Scientific PrimerZee MaqsoodNoch keine Bewertungen

- CPA113 (Author: Laikwan)Dokument73 SeitenCPA113 (Author: Laikwan)api-371730683% (6)

- Best Strategies in Oil & Gas Financial AnalysisDokument2 SeitenBest Strategies in Oil & Gas Financial Analysis360 International Limited0% (1)

- Ultra Tech Cement CreatingDokument7 SeitenUltra Tech Cement CreatingvikassinghnirwanNoch keine Bewertungen

- @RISK Example File ListDokument24 Seiten@RISK Example File ListPrakhar SarkarNoch keine Bewertungen

- Morningstar® Portfolio X-Ray: H R T y UDokument5 SeitenMorningstar® Portfolio X-Ray: H R T y UVishal BabutaNoch keine Bewertungen

- 3.NPER Function Excel Template 1Dokument9 Seiten3.NPER Function Excel Template 1w_fibNoch keine Bewertungen

- 2011 Pei 300Dokument23 Seiten2011 Pei 300mtrizzle06Noch keine Bewertungen

- ACCT212 WorkingPapers E3-31ADokument2 SeitenACCT212 WorkingPapers E3-31Alowluder0% (1)

- 1.FV Function Excel Template 1Dokument6 Seiten1.FV Function Excel Template 1w_fibNoch keine Bewertungen

- Appendix A. HSE Severity MatrixDokument2 SeitenAppendix A. HSE Severity MatrixRael Zorzo MichelsNoch keine Bewertungen

- Bain Capital's "Take Private" of China FireDokument11 SeitenBain Capital's "Take Private" of China Fireelee 14Noch keine Bewertungen

- 1 - Excel and Finance BootcampDokument38 Seiten1 - Excel and Finance BootcampJason McCoyNoch keine Bewertungen

- Comparable Companies: Inter@rt ProjectDokument9 SeitenComparable Companies: Inter@rt ProjectVincenzo AlterioNoch keine Bewertungen

- MKM704 - Finance For Marketers - Lab 4 Solution: MKM704 - DR Page 1 of 9 08/07/2021 at 14:29:50Dokument9 SeitenMKM704 - Finance For Marketers - Lab 4 Solution: MKM704 - DR Page 1 of 9 08/07/2021 at 14:29:50Marziiya RamakdawalaNoch keine Bewertungen

- Module II Final 04082017Dokument446 SeitenModule II Final 04082017nizam100% (1)

- Valuation CopenhagenDokument103 SeitenValuation CopenhagensuksesNoch keine Bewertungen

- Risk - Lab 2016.04.05Dokument30 SeitenRisk - Lab 2016.04.05Rizki FatakhiNoch keine Bewertungen

- BiiiimplmoniwbDokument34 SeitenBiiiimplmoniwbShruti DubeyNoch keine Bewertungen

- SEEP FRAME Tool, Version 2.02Dokument159 SeitenSEEP FRAME Tool, Version 2.02anish-kc-8151Noch keine Bewertungen

- Cash Flow: AssumptionsDokument3 SeitenCash Flow: AssumptionsGolamMostafaNoch keine Bewertungen

- Value Stock Tankrich v1.23Dokument13 SeitenValue Stock Tankrich v1.23pareshpatel99Noch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument10 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Business ModelDokument111 SeitenBusiness ModelShai BurnovskiNoch keine Bewertungen

- Discount Factor TemplateDokument5 SeitenDiscount Factor TemplateRashan Jida ReshanNoch keine Bewertungen

- Cheat SheetDokument2 SeitenCheat SheetAnonymous ODAZn6VL6Noch keine Bewertungen

- Accretion Dilution ModelDokument10 SeitenAccretion Dilution ModelQuýt BéNoch keine Bewertungen

- TRIAL Palm Oil Financial Model v.1.0Dokument82 SeitenTRIAL Palm Oil Financial Model v.1.0Maksa CuanNoch keine Bewertungen

- Oracle Istore Implementation AdminDokument1.062 SeitenOracle Istore Implementation AdminkmehsramNoch keine Bewertungen

- W6 - ANALYTICAL TOOLS AND TECHNIQUES FOR FINANCIAL ANALYSIS - 2020 - Final PDFDokument158 SeitenW6 - ANALYTICAL TOOLS AND TECHNIQUES FOR FINANCIAL ANALYSIS - 2020 - Final PDFjeremy AntoninNoch keine Bewertungen

- Cell Name Original Value Final ValueDokument5 SeitenCell Name Original Value Final ValueDiv_nNoch keine Bewertungen

- Pro Excel Financial Modeling - Company Business Model - (CBM)Dokument393 SeitenPro Excel Financial Modeling - Company Business Model - (CBM)Tanzeel Ur Rahman GazdarNoch keine Bewertungen

- MECON TENDER Vol - I - Web - 20181008 - 140852Dokument587 SeitenMECON TENDER Vol - I - Web - 20181008 - 140852mazheraliNoch keine Bewertungen

- Lutilsky - Accounting Lecture/predavanja BDIBDokument464 SeitenLutilsky - Accounting Lecture/predavanja BDIBreny_ostojic100% (1)

- Complete P&L Statement TemplateDokument4 SeitenComplete P&L Statement TemplateGolamMostafaNoch keine Bewertungen

- Cargill // Steel SwapsDokument14 SeitenCargill // Steel Swapsinfo8493Noch keine Bewertungen

- QGIS 3.28 DesktopUserGuide enDokument1.489 SeitenQGIS 3.28 DesktopUserGuide enHARI PRASADNoch keine Bewertungen

- Memoire Finance Julien BOUSQUET Synergie Valuation in M ADokument77 SeitenMemoire Finance Julien BOUSQUET Synergie Valuation in M AManal DassallemNoch keine Bewertungen

- SuccessFactors WBSTreeDokument194 SeitenSuccessFactors WBSTreeCleberton Antunes0% (1)

- Economy Part 5Dokument13 SeitenEconomy Part 5Shilpi PriyaNoch keine Bewertungen

- DPS ValuationDokument44 SeitenDPS ValuationAlex ElliottNoch keine Bewertungen

- Core Chapter 04 Excel Master 4th Edition StudentDokument150 SeitenCore Chapter 04 Excel Master 4th Edition StudentDarryl WallaceNoch keine Bewertungen

- Budgetary Control As Control ToolDokument45 SeitenBudgetary Control As Control ToolMahtab AlamNoch keine Bewertungen

- Capital-Budgeting TechniquesDokument88 SeitenCapital-Budgeting TechniquesAnukriti SethNoch keine Bewertungen

- 562 Spring2003Dokument5 Seiten562 Spring2003Emmy W. RosyidiNoch keine Bewertungen

- FCF 9th Edition Chapter 09Dokument43 SeitenFCF 9th Edition Chapter 09AlmayayaNoch keine Bewertungen

- Cash Flow EstimationDokument9 SeitenCash Flow EstimationCassandra ChewNoch keine Bewertungen

- Firm Case AnalysisDokument10 SeitenFirm Case Analysis411hhapNoch keine Bewertungen

- Strategic Choice DjordjevicDokument9 SeitenStrategic Choice Djordjevic411hhapNoch keine Bewertungen

- 4 Administration Fullstrategicplan 06052015Dokument9 Seiten4 Administration Fullstrategicplan 06052015411hhapNoch keine Bewertungen

- Grand and Generic StrategyDokument2 SeitenGrand and Generic Strategy411hhapNoch keine Bewertungen

- Chart of Account - MediaDokument1 SeiteChart of Account - Media411hhapNoch keine Bewertungen

- 2012 Linking Strategy To Value Deloitte Ireland PDFDokument11 Seiten2012 Linking Strategy To Value Deloitte Ireland PDFFrederic DucrosNoch keine Bewertungen

- Article 06 Strategic Management An Organisational Risk Management2Dokument11 SeitenArticle 06 Strategic Management An Organisational Risk Management2411hhap100% (1)

- Sage Accounting A Step by Step Guide 2012Dokument22 SeitenSage Accounting A Step by Step Guide 2012411hhap100% (1)

- Linking Strategic Objectives To OperationsDokument9 SeitenLinking Strategic Objectives To Operations411hhapNoch keine Bewertungen