Beruflich Dokumente

Kultur Dokumente

Cocoaland Holdings BHD RR 3q Fy2015 Factset

Hochgeladen von

jcw288Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cocoaland Holdings BHD RR 3q Fy2015 Factset

Hochgeladen von

jcw288Copyright:

Verfügbare Formate

25/11/2015

WILSON & YORK

31/12/2015

30/09/2015

3Q-2015

Financial Year End

Report Period Ending

Reporting Quarter

Recom m endation

Target Price (MYR)

Current Price (MYR)

BUY

2.40

2.04

Food

Food-Misc/Diversified

Industry Group

Industry Sub Group

Key Com pany Statistics

Bloomberg Ticker

Bursa Stock Code

Issued Capital (mn shares)

Market Capitalisation (MYR mn)

52 w eek High (MYR)

52 w eek Low (MYR)

Average Volume (3 month) 000

1 Yr Return (%)

COLA MK

7205

228.8

466.8

2.27

0.97

237.0

81.5

Major Shareholders (%)

Leverage Success Sdn Bhd

Fraser & Neave Holdings Bhd

Tan Booi Charn

38.0

27.2

2.6

FTSE-BURSA INDEX MEMBERSHIP

FBMKLCI

FBM70

No

No

FBMEMAS FBMHIJRAH

Yes

No

MALAYSIA EQUITY

COCOALAND HOLDINGS BHD

RESULTS REPORT

YTD 3Q FY15 total revenue increased 0.1% vs YTD 3Q FY14; exports

are slowing down, but local sales are increasing. YTD 3Q FY15 net

profits increased 83.3% vs YTD 3Q FY14. YTD 3Q FY15 operating

margins came in at 16.1% vs 9.3% in YTD 3Q 2014. We expect operating

margins of 14-17% to prevail over the next several quarters. Cocoaland

continues to open new markets and is making good progress under

challenging trading conditions. Exports account for about 57% of

Cocoaland sales currently, and are expected to rise to about 60% of

sales in FY 2016. Low commodity prices and the lower value of the

MYR has been a beneficial factor for margins.

INVESTMENT RISKS

Risks to our recommendation and target price include: i) rising trends in

material costs, ii) an increase in the general level of interest rates, and iii)

a sharp slowdown in the general level of economic activity in Malaysia

or in the economies of the companys major own brand export markets

- China/HK and the Middle East.

RECOMMENDATION

We maintain our BUY recommendation on Cocoaland Holdings Bhd, and

raise our fair value estimate to MYR 2.40. It is possible that the share

price will surprise on the upside; sales growth and capacity utilisation

may accelerate more quickly than we expect. Cocoaland has very little

debt on the balance sheet as well as plenty of cash.

Cocoaland has a clean balance sheet and a proven record of growing

export sales. Exports are likely to account for 60% or more of total

revenue by year end 2016. In terms of own brand China/HK remains in

the top spot as the companys largest export market, followed by Saudi

Arabia in importance. Management has been very diligent in developing

new markets that more than compensate for OEM beverage business

lost in the Thai market in 2014.

REPORT INDEX

Contents

Recommendation, Company Profile, Metrics

Quarterly Results, Competitor's Metrics

Analyst's Disclosure, Contact Details

SHARE PRICE LAST 12 MONTHS (MYR)

Page

1

2

3

COMPANY PROFILE

Cocoaland Holdings Bhd is ranked approximately in the middle of the

thirty listed companies in the Malaysian snack food industry. The company is one of the few home grown Malaysian consumer firms that have

successfully penetrated regional markets. Cocoaland Holdings predecessor company, MFESB, was formed in 1980. This company and

others were consolidated and converted to a public limited company in

2000 under the name Cocoaland Holdings Bhd, prior to listing in 2005.

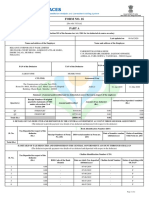

ANNUAL RESULTS AND METRICS (MYR mn)

FY Dec

Revenue

Revenue g (%)

Net Profit

Net Profit g (%)

2013

254.4

14.0

22.1

3.9

2014

260.8

2.5

21.9

-0.6

2015F

254.9

-2.2

31.0

41.4

2016F

269.2

5.6

35.4

14.4

Dividends

Ow ners' Equity

Total Liabilities

Debt/Equity (%)

10.7

207.6

44.5

21.4

11.2

218.3

43.3

19.8

48.6

200.8

46.7

23.2

10.7

225.5

49.5

22.0

9.6

1.9

22.2

2.4

10.6

9.6

1.3

16.0

1.6

10.0

13.5

1.8

15.1

2.3

15.4

15.5

1.7

13.2

2.1

15.7

EPS (sen)

P-S (x)

P-E (x)

P-BV (x)

ROE %

Copyright 2015, Wilson & York Global Advisers Sdn Bhd | See important disclosures at end of this report

Page 1 of 3

25/11/2015

WILSON & YORK

MALAYSIA EQUITY

COCOALAND HOLDINGS BHD

QUARTERLY RESULTS TABLE (All figures in MYR mn unless otherwise indicated)

FY Dec

3Q-15

3Q-14

Q-o-Q

%chg

YTD

FY15

YTD

FY14

Y-o-Y

%chg

Revenue

Operating Profit

Other Income

Share of Associates

Depreciation/Amort'n

Finance Costs

Pre Tax Profit

Tax

Minority Interest

Net Prof it to S'holders

Dividends

58.9

9.2

3.1

0.0

-2.7

0.0

9.2

-2.7

0.0

6.6

0.0

63.8

6.7

0.0

0.0

-2.7

0.0

6.7

-2.5

0.0

4.2

0.0

-7.6

37.6

>100

na

-1.3

na

37.6

na

na

55.7

na

188.3

30.3

5.1

0.0

-7.9

0.0

30.3

-8.1

0.0

22.1

4.3

188.1

17.6

1.3

0.0

-8.0

0.0

17.6

-5.5

0.0

12.1

2.6

0.1

72.1

>100

na

-1.7

na

72.1

na

na

83.3

66.7

EPS (sen)

DPS (sen)

Operating Margin (%)

Net Margin (%)

Tax Rates (%)

NTA/share (RM)

2.9

0.0

15.7

11.2

28.8

1.8

0.0

10.5

6.6

37.1

55.7

na

49.0

68.5

-22.3

9.7

1.9

16.1

11.8

26.9

1.03

5.3

1.1

9.3

6.4

31.3

0.95

83.3

66.7

71.9

83.1

-14.2

8.9

Com ments

Revenue increased 0.1% YTD 3Q FY15 vs.

YTD 3Q FY14. Export grow th is slow ing

dow n, but local sales are rising nicely.

Net Profit increased 83.3% YTD

3Q FY15 vs. YTD 3Q FY 14. The company

continues to broaden its export markets

despite challenging trading conditions.

Operating margins continue to improve and

are likely to stay above 10% next 2 qtrs.

Tax rates still above statutory rates, but not

by much.

COMPETITORS METRICS (All figures in MYR mn unless otherwise indicated)

Current Year

Ending*

Cocoaland Apollo Food

Holdings

Holdings

Bhd

Bhd

Dec-15

Apr-16

London

Biscuits

Bhd

Jun-16

Revenue

Net Profit

Ow ners' Equity

Dividends

254.9

31.0

200.8

48.6

199.7

44.7

273.1

20.0

355.3

17.1

500.1

1.4

Market Cap

P-S (x)

P-E (x)

P-BV (x)

Div Yield (%)

466.8

1.8

15.1

2.3

10.4

424.0

2.1

9.5

1.6

4.7

112.2

0.3

6.6

0.2

1.2

Net Margins (%)

ROE (%)

Payout Ratio (%)

Sales Grow th (%)

Total Debt/Equity (%)

12.2

15.4

156.9

-2.2

13.5

22.4

16.4

44.7

-6.1

9.3

4.8

3.4

8.2

-11.7

63.6

Copyright 2015, Wilson & York Global Advisers Sdn Bhd | See important disclosures at end of this report

Page 2 of 3

25/11/2015

WILSON & YORK

MALAYSIA EQUITY

COCOALAND HOLDINGS BHD

ANALYSTS DISCLOSURE

BUY: Share price may exceed 10% over the next 12 months

TRADING BUY: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain

HOLD: Share price may fall within the range of +/- 10% over the next 12 months

TAKE PROFIT: Target price has been attained. Look to accumulate at lower levels

SELL: Share price may fall by more than 10% over the next 12 months

NOT RATED (NR): Stock is not within regular research coverage

All research is based on materials compiled from data considered to be reliable at the time of writing. However, information and opinions

expressed are subject to change at short notice, and no part of this report is to be construed as an offer or solicitation of an offer to transact

any securities or financial instruments whether referred to herein or otherwise.

We do not accept any liability directly or indirectly that may arise from investment decision-making based on this report. The company, its

directors, officers, employees and/or connected persons may periodically hold an interest and/or underwriting commitments in the securities mentioned.

All Rights Reserved. No part of this publication may be used or re-produced without expressed permission from Wilson & York Global

Advisers Sdn Bhd.

J Charles Wilson

Head of Research

QUESTIONS?

CONTACT THE INVESTMENT ADVISER:

Wilson & York Global Advisers Sdn Bhd

Suite B-11-3A, Level 11, Block B, Plaza Mont Kiara

2, Jalan Kiara, Mont Kiara

50480 Kuala Lumpur

Malaysia

Tel: +603 6203 2280

Fax: +603 6203 2281

E-mail info@wygainvesments.com

Website: www.wygainvestments.com

Copyright 2015, Wilson & York Global Advisers Sdn Bhd | See important disclosures on this page.

Page 3 of 3

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- IJM Corporation: ResearchDokument4 SeitenIJM Corporation: Researchjcw288Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- KIPREITDokument5 SeitenKIPREITjcw288Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- 2hcy22 Outlook Midf 010722Dokument56 Seiten2hcy22 Outlook Midf 010722jcw288Noch keine Bewertungen

- StrategyDokument6 SeitenStrategyjcw288Noch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- FrontkenDokument6 SeitenFrontkenjcw288Noch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Loan and Security Agreement 10Dokument170 SeitenLoan and Security Agreement 10befaj44984Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Krugman Obstfeld Ch07Dokument26 SeitenKrugman Obstfeld Ch07Ruslan ValiulinNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- HSBC iPad-iPod Touch Application FormDokument1 SeiteHSBC iPad-iPod Touch Application FormBc CyNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Assignment On NCC BankDokument44 SeitenAssignment On NCC Bankhasan633100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Salary Certificate FormatDokument1 SeiteSalary Certificate FormatshajahanNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- 0450 m18 in 22Dokument4 Seiten0450 m18 in 22yoshNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Monetary Policy and Central Banking PDFDokument2 SeitenMonetary Policy and Central Banking PDFTrisia Corinne JaringNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Personal Management: Merit Badge WorkbookDokument19 SeitenPersonal Management: Merit Badge WorkbookRohan PatraNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- CLS Gathers Momentum, Rao, CCILDokument6 SeitenCLS Gathers Momentum, Rao, CCILShrishailamalikarjunNoch keine Bewertungen

- Form No. 16: Part ADokument8 SeitenForm No. 16: Part AParikshit ModiNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Annuity DueDokument2 SeitenAnnuity DueJsbebe jskdbsj50% (2)

- 2307 For EBS Private Individual Percenateg TaxDokument4 Seiten2307 For EBS Private Individual Percenateg TaxAGrace MercadoNoch keine Bewertungen

- Electronic Trading ConceptsDokument98 SeitenElectronic Trading ConceptsAnurag TripathiNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Living Faith Church Proforma InvoiceDokument1 SeiteLiving Faith Church Proforma InvoiceADEMILUYI SAMUEL TOLULOPENoch keine Bewertungen

- Questionnaire For 2018 Tax Returns: Worksheets AvailableDokument7 SeitenQuestionnaire For 2018 Tax Returns: Worksheets Availableparesh shiralNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Week 012-Presentation Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Dokument18 SeitenWeek 012-Presentation Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Alleona EmbolodeNoch keine Bewertungen

- Testing Point FigureDokument4 SeitenTesting Point Figureshares_leoneNoch keine Bewertungen

- Prudential Bank vs. Don A. Alviar & Georgia B. AlviarDokument3 SeitenPrudential Bank vs. Don A. Alviar & Georgia B. AlviarJenine QuiambaoNoch keine Bewertungen

- Chapter 11Dokument43 SeitenChapter 11AdityaPutriWibowoNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Chapter 4 Accounts Receivable Learning Objectives: Receivables."Dokument4 SeitenChapter 4 Accounts Receivable Learning Objectives: Receivables."Misiah Paradillo JangaoNoch keine Bewertungen

- iPAY International S.A. 2014Dokument20 SeiteniPAY International S.A. 2014LuxembourgAtaGlanceNoch keine Bewertungen

- FORM24Dokument3 SeitenFORM24Fayaz KhanNoch keine Bewertungen

- Desirable Corporate Governance: A CodeDokument16 SeitenDesirable Corporate Governance: A CodesiddharthanandNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- INSURANCE TambasacanDokument80 SeitenINSURANCE Tambasacanlee50% (2)

- PG - M.com - Commerce (English) - 31031 Investment Analysis and Portfolio ManagementDokument166 SeitenPG - M.com - Commerce (English) - 31031 Investment Analysis and Portfolio ManagementDeeNoch keine Bewertungen

- More Solved Examples PDFDokument16 SeitenMore Solved Examples PDFrobbsNoch keine Bewertungen

- Budget of Work EntrepDokument5 SeitenBudget of Work EntrepHannah Joy LontayaoNoch keine Bewertungen

- (Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in HedgingDokument79 Seiten(Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in Hedgingsarvesh dhatrakNoch keine Bewertungen

- Solved Rollo and Andrea Are Equal Owners of Gosney Company DuringDokument1 SeiteSolved Rollo and Andrea Are Equal Owners of Gosney Company DuringAnbu jaromiaNoch keine Bewertungen

- Accounting Midterm ExamDokument3 SeitenAccounting Midterm ExamJhon OrtizNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)