Beruflich Dokumente

Kultur Dokumente

CA Question 21 7 Revised Version

Hochgeladen von

Deepak SimonCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CA Question 21 7 Revised Version

Hochgeladen von

Deepak SimonCopyright:

Verfügbare Formate

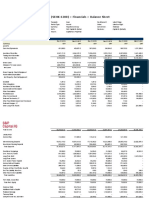

Question 21-7

Acquisition analysis

1 July 2016

Net fair value of identifiable assets

and liabilities of Seal Ltd

= ($120 000 + $90 000) (equity)

+ $30 000 (1 30%) (BCVR - land)

+ $9 000 (1 30%) (BCVR - plant)

+ $6 000 (1 30%) (BCVR - inventory)

= $241 500

(a) Consideration transferred

= $191 000

(b) Non-controlling interest

= $63 000

Aggregate of (a) and (b)

= $254 000

Goodwill

= $254 000 $241 500

= $12 500

Goodwill of Seal Ltd

Fair value of Seal Ltd

= $63 000 x (100/25)

= $252 000

Net fair value of identifiable assets

and liabilities of Seal Ltd

= $241 500

Goodwill of Seal Ltd

= $252000 - $ 241500

= $10 500

Goodwill of Fur Ltd

Goodwill acquired

= $12 500

Goodwill of Seal Ltd

= $10 500

Goodwill of Fur Ltd control

= $2 000

premium

1. Consolidation Worksheet Entries - 1 July 2016

1. Business combination valuation entries

Accumulated depreciation - machinery

Machinery

Deferred tax liability

Business combination valuation reserve

Dr

Cr

Cr

Cr

20 000

Inventory

Deferred tax liability

Business combination valuation reserve

Dr

Cr

Cr

6 000

Goodwill

Business combination valuation reserve

Dr

Cr

10 500

11 000

2 700

6 300

1 800

4 200

10 500

QUESTION 21.7 (contd)

2. Pre-acquisition entries

Retained earnings (1/7/16)

Share capital

Asset revaluation surplus

Business combination valuation reserve

Goodwill

Shares in Seal Ltd

Dr

Dr

Dr

Dr

Dr

Cr

67 500

90 000

15 750

15 750

2 000

Dr

Dr

Dr

Dr

Cr

22 500

30 000

5 250

5 250

191 000

3. NCI share of equity at 1 July 2016

Retained earnings (1/7/16)

Share capital

Asset revaluation surplus

Business combination valuation reserve

NCI

(NCI - 25% of balances at 1 July 2016)

2.

63 000

Consolidation Worksheet Entries - 30 June 2017

1. Business combination valuation entries

Accumulated depreciation machinery

Machinery

Deferred tax liability

Business combination valuation reserve

Dr

Cr

Cr

Cr

20 000

Depreciation expense

Accumulated depreciation - machinery

(1/3 x $9 000 p.a.)

Dr

Cr

3 000

Deferred tax liability

Income tax expense

Dr

Cr

900

Cost of sales

Income tax expense

Transfer from business combination

valuation reserve

Dr

Cr

6 000

Goodwill

Business combination valuation reserve

11 000

2 700

6 300

3 000

900

1 800

Cr

Dr

Cr

4 200

10 500

10 500

QUESTION 21.7 (contd)

2. Pre-acquisition entry

Retained earnings (1/7/16)

Share capital

Asset revaluation surplus

Business combination valuation reserve

Goodwill

Shares in Seal Ltd

Dr

Dr

Dr

Dr

Dr

Cr

67 500

90 000

15 750

15 750

2 000

Transfer from business combination

valuation reserve

Business combination valuation reserve

(75% x $4200)

Dr

Cr

3 150

Dr

Dr

Dr

Dr

Cr

22 500

30 000

5 250

5 250

191 000

3 150

3. NCI share of equity at 1 July 2016

Retained earnings (1/7/16)

Share capital

Asset revaluation surplus

Business combination valuation reserve

NCI

63 000

4. NCI share of equity: 1 July 2016 - 30 June 2017

NCI share of profit

Dr

NCI

Cr

(25% [$15000 ($3 000 - $900) ($6 000 - $1 800)])

Transfer from business combination

valuation reserve

Business combination valuation reserve

(25% x $4200)

Gain on Asset revaluation

NCI

(25% x $3000)

$3000 share

2 175

2 175

Dr

Cr

1 050

Dr

Cr

750

1 050

750

QUESTION 21.7 (contd)

3.

Consolidation Worksheet Entries - 30 June 2018

1. Business combination valuation entries

Accumulated depreciation - plant

Plant

Deferred tax liability

Business combination valuation reserve

Dr

Cr

Cr

Cr

20 000

Depreciation expense

Retained earnings (1/7/17)

Accumulated depreciation - plant

Dr

Dr

Cr

3 000

3 000

Deferred tax liability

Income tax expense

Retained earnings (1/7/17)

Dr

Cr

Cr

1 800

Dr

Cr

10 500

Retained earnings (1/7/17) *

Share capital

Asset revaluation surplus

Business combination valuation reserve**

Goodwill

Shares in Seal Ltd

*RE: [$67 500 + $3 150 BCVR - inventory]

** [$15750 - $3 150 BCVR inventory]

Dr

Dr

Dr

Dr

Dr

Cr

70 650

90 000

15 750

12 600

2 000

Transfer from asset revaluation surplus

Asset revaluation surplus

(75% x $21000)

Dr

Cr

15 750

Dr

Dr

Dr

Dr

Cr

22 500

30 000

5 250

5 250

Goodwill

Business combination valuation reserve

11 000

2 700

6 300

6 000

900

900

10 500

2. Pre-acquisition entries

191 000

15 750

3. NCI share of equity at 1 July 2016

Retained earnings (1/7/16)

Share capital

Asset revaluation surplus

Business combination valuation reserve

NCI

63 000

QUESTION 21.7 (contd)

4. NCI share of equity: 1 July 2016 - 30 June 2017

Retained earnings (1/7/17)

Asset revaluation surplus

Business combination valuation reserve

NCI

(RE: 25% ($15 000 [$3 000 - $900])

ARS: 25% x $3 000

BCVR: 25% x 70% x $6 000 inventory

Dr

Dr

Cr

Cr

3 225

750

NCI share of profit

NCI

(25% ($34 500 [$3 000 - $900])

Dr

Cr

8 100

Transfer from asset revaluation surplus

Asset revaluation surplus

(25% x $21000 plus 25% x $3000)

Dr

Cr

6 000

Gain on Asset revaluation

NCI

(25% x $7 500)

Dr

Cr

1 875

Dr

Cr

Dr

3 000

1 050

2 925

5. NCI share of equity: 1 July 2017 - 30 June 2018

4.

8 100

6 000

1 875

Consolidation Journal entries - 30 June 2019

1. Business combination valuation entries

Depreciation expense - plant

Income tax expense

Retained earnings (1/7/18)

Transfer from business combination

valuation reserve

Goodwill

Business combination valuation reserve

900

4 200

Cr

Dr

Cr

6 300

10 500

10 500

QUESTION 21.7 (contd)

2. Pre-acquisition entries

Retained earnings (1/7/18) *

Dr

86 400

Share capital

Dr

90 000

Business combination valuation reserve

Dr

12 600

Goodwill

Dr

2 000

Shares in Seal Ltd

Cr

191 000

* (75% x $90 000) + 75% x 70% ($6 000 inventory + $30 000 land)

Transfer from business combination

valuation reserve

Business combination valuation reserve

(75% x $6 300 machinery)

Dr

Cr

4 725

Dr

Dr

Dr

Dr

Cr

22 500

30 000

5 250

5 250

Dr

Cr

Cr

Cr

17 325

4 725

3. NCI share of equity at 1 July 2016

Retained earnings (1/7/18)

Share capital

Asset revaluation surplus

Business combination valuation reserve

NCI

63 000

4. NCI share of equity: 1 July 2016 - 30 June 2018

Retained earnings (1/7/18)

Asset revaluation surplus

Business combination valuation reserve

NCI

3 375

1 050

12 900

RE: 25% ($15 000 + $34 500 $4 200 machinery + $24 000 transfer from ARS)

BCVR: 25% (70% x $6 000)

ARS: 25% ($3 000 + $7 500 [$3000 + (70% x $30 000)transfer])

5. NCI share of equity: 1 July 2018 - 30 June 2019

NCI

NCI share of profit/loss

(25% [(9 000) ($3000 - $900)])

Transfer from business combination

valuation reserve

Business combination valuation reserve

(25% x $6 300 machinery)

Gain on Asset revaluation

NCI

(25% x $10 500)

Dr

Cr

2 775

Dr

Cr

1 575

Dr

Cr

2 625

2 775

1 575

2 625

QUESTION 21.7 (contd)

5.

Consolidation Journal Entries - 30 June 2020

1. Business combination valuation entries

Goodwill

Business combination valuation reserve

Dr

Cr

10 500

10 500

2. Pre-acquisition entry

Retained earnings (1/7/19) *

Dr

91 125

Share capital

Dr

90 000

Business combination valuation reserve **

Dr

7 875

Goodwill

Dr

2 000

Shares in Seal Ltd

Cr

191 000

* [75% x $90 000 + 75% x 70%($30 000 land + $6 000 inv + $9 000 mach)]

** 75% x $10 500

3. NCI share of equity at 1 July 2016

Retained earnings (1/7/19)

Share capital

Asset revaluation surplus

Business combination valuation reserve

NCI

Dr

Dr

Dr

Dr

Cr

22 500

30 000

5 250

5 250

63 000

4. NCI share of equity: 1 July 2019 - 30 June 2020

Retained earnings (1/7/19)

Dr

16 125

Business combination valuation reserve

Cr

2 625

Asset revaluation surplus

Cr

750

NCI

Cr

12 750

(RE: [25% ($15 000 + $34 500 - $9 000 + ($21 000 + $3 000) tfer from ARS)]

ARS: 25% ($3 000 + $7 500 + $10 500 [$21 000 +$3 000] tfer)

BCVR: 25% x 70% x ($6 000 + $9 000)

5. NCI share of equity: 1 July 2019 - 30 June 2020

NCI share of profit

NCI

(25% x $33 000)

Gain on Asset revaluation

NCI

(25% x $4 000)

Dr

Cr

8 250

Dr

Cr

1 000

8 250

1 000

Das könnte Ihnen auch gefallen

- QA Before Week 8 Tute PDFDokument21 SeitenQA Before Week 8 Tute PDFShek Kwun HeiNoch keine Bewertungen

- Problem 3.3 - AnsDokument4 SeitenProblem 3.3 - Anscharles03281991Noch keine Bewertungen

- HW 3Dokument13 SeitenHW 3Tom Park100% (1)

- Non-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model AnswersDokument8 SeitenNon-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model Answersrwl s.r.lNoch keine Bewertungen

- Chapter 19: Consolidation: Other Issues: Review QuestionsDokument20 SeitenChapter 19: Consolidation: Other Issues: Review QuestionsShek Kwun HeiNoch keine Bewertungen

- CH 5 Answers To Homework AssignmentsDokument13 SeitenCH 5 Answers To Homework AssignmentsJan Spanton100% (1)

- AnswersDokument8 SeitenAnswersTareq ChowdhuryNoch keine Bewertungen

- 4th Assessment STUDENTDokument5 Seiten4th Assessment STUDENTJOHANNA TORRESNoch keine Bewertungen

- Example 8: Appendix - Answers To Examples and End-Of-Chapter QuestionsDokument8 SeitenExample 8: Appendix - Answers To Examples and End-Of-Chapter QuestionsDewan Mahid Raza ChowdhuryNoch keine Bewertungen

- Advance Financial Assignment #2Dokument10 SeitenAdvance Financial Assignment #2peterNoch keine Bewertungen

- Aleshia Cooper Thursday, 28 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 16-1, 2, 3, 7, 8, 16, and 19 Exercise 16-1Dokument7 SeitenAleshia Cooper Thursday, 28 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 16-1, 2, 3, 7, 8, 16, and 19 Exercise 16-1Cooper89Noch keine Bewertungen

- CHP 3 Problems Student TemplateDokument28 SeitenCHP 3 Problems Student TemplateDarkeningoftheLightNoch keine Bewertungen

- j14 F7int AnsDokument10 Seitenj14 F7int AnsSajidZiaNoch keine Bewertungen

- Final RevisionDokument13 SeitenFinal Revisionaabdelnasser014Noch keine Bewertungen

- Chapter - 14-Working Capital and Current Assets ManagementDokument8 SeitenChapter - 14-Working Capital and Current Assets ManagementShota TsakashviliNoch keine Bewertungen

- Soha Balance SheeDokument7 SeitenSoha Balance SheeMohamed ZaitoonNoch keine Bewertungen

- Ans. Basic Fin. AcctDokument13 SeitenAns. Basic Fin. AcctHashimRazaNoch keine Bewertungen

- CH 7 Vol 1 Answers 2014Dokument18 SeitenCH 7 Vol 1 Answers 2014Jamie Catherine GoNoch keine Bewertungen

- AF210 Unit 4 Tutorial SolutionsDokument5 SeitenAF210 Unit 4 Tutorial SolutionsChand DivneshNoch keine Bewertungen

- MAF253 SS Common Test May 2022Dokument7 SeitenMAF253 SS Common Test May 2022Nurfatihah JohariNoch keine Bewertungen

- Major AssignmentDokument4 SeitenMajor AssignmentRena SinghNoch keine Bewertungen

- HMW 3Dokument1 SeiteHMW 3hankmoody23Noch keine Bewertungen

- CPA 8 - Financial Management - Paper 8 SolutionsDokument15 SeitenCPA 8 - Financial Management - Paper 8 SolutionsjustinorchidsNoch keine Bewertungen

- Advanced Financial Accounting and Reporting ExamDokument10 SeitenAdvanced Financial Accounting and Reporting ExamMuhammad HassaanNoch keine Bewertungen

- TK2Dokument7 SeitenTK2Paramita RusadiNoch keine Bewertungen

- Account Excess FV Over BV $ 200,000 Allocations: TotalDokument6 SeitenAccount Excess FV Over BV $ 200,000 Allocations: TotalMcKenzie WNoch keine Bewertungen

- Statement of Cash Flow Set-2Dokument9 SeitenStatement of Cash Flow Set-2vdj kumarNoch keine Bewertungen

- CH 5 HW Solutions-1Dokument41 SeitenCH 5 HW Solutions-1Jan SpantonNoch keine Bewertungen

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDokument14 SeitenPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNoch keine Bewertungen

- Assigned Problems FinmarDokument8 SeitenAssigned Problems FinmarTABUADA, Jenny Rose V.Noch keine Bewertungen

- Chapter 19 - Corporate Financial ReportingDokument22 SeitenChapter 19 - Corporate Financial ReportingTomás de CallaoNoch keine Bewertungen

- Acc 2103 FWARDokument8 SeitenAcc 2103 FWARfalnuaimi001Noch keine Bewertungen

- 4.01% Is The 1-Year Spot RateDokument6 Seiten4.01% Is The 1-Year Spot RatePaulo TorresNoch keine Bewertungen

- SamigroupDokument9 SeitenSamigroupsamidan tubeNoch keine Bewertungen

- SolutionCH9 CH11Dokument9 SeitenSolutionCH9 CH11qwerty1234qwer100% (1)

- FM AssignmentDokument4 SeitenFM AssignmentDuren JayaNoch keine Bewertungen

- Solution Practice 5 Consolidations 2Dokument7 SeitenSolution Practice 5 Consolidations 2Mya Hmuu KhinNoch keine Bewertungen

- Chapter 5 Solutions To PostDokument43 SeitenChapter 5 Solutions To PostJax TellerNoch keine Bewertungen

- Supporting ComputationDokument5 SeitenSupporting ComputationSuenNoch keine Bewertungen

- Sem 7Dokument84 SeitenSem 7Bình QuốcNoch keine Bewertungen

- Solution To CVP ProblemsDokument8 SeitenSolution To CVP ProblemsGizachew NadewNoch keine Bewertungen

- EwtteyeDokument5 SeitenEwtteyeHitekani ImargineNoch keine Bewertungen

- P1 Sept 2010 Answers and Brief GuideDokument14 SeitenP1 Sept 2010 Answers and Brief GuidemavkaziNoch keine Bewertungen

- Mpu3123 Titas c2Dokument36 SeitenMpu3123 Titas c2Beatrice Tan100% (2)

- BBA Program Spring 2022 ACT301: Intermediate Accounting Assignment 2Dokument2 SeitenBBA Program Spring 2022 ACT301: Intermediate Accounting Assignment 2মাহিদ হাসানNoch keine Bewertungen

- Jawaban Soal Quiz No 2 Dan 3Dokument4 SeitenJawaban Soal Quiz No 2 Dan 3Anthony indrahalimNoch keine Bewertungen

- Particulars Parent Share Noncontrolling Share Entire Value: Income StatementDokument2 SeitenParticulars Parent Share Noncontrolling Share Entire Value: Income StatementEkta Saraswat VigNoch keine Bewertungen

- 10 Non-Current AssetsDokument25 Seiten10 Non-Current AssetsDayaan ANoch keine Bewertungen

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions ManualDokument26 SeitenFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manualmisentrynotal6ip1lp100% (16)

- Name: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDokument4 SeitenName: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDuren JayaNoch keine Bewertungen

- 0452 w15 Ms 22 PDFDokument10 Seiten0452 w15 Ms 22 PDFAnonymous ustYBQOaEB100% (2)

- E Learning AKLDokument7 SeitenE Learning AKLSilvia IstimeiriantiNoch keine Bewertungen

- Management Accounting: Page 1 of 6Dokument70 SeitenManagement Accounting: Page 1 of 6Ahmed Raza MirNoch keine Bewertungen

- Engineering Economy 15th Edition Sullivan Test BankDokument30 SeitenEngineering Economy 15th Edition Sullivan Test Bankkieranthang03m100% (36)

- Fast-Track Tax Reform: Lessons from the MaldivesVon EverandFast-Track Tax Reform: Lessons from the MaldivesNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- Climate-Related Financial Disclosures 2021: Progress Report on Implementing the Recommendations of the Task Force on Climate-Related Financial DisclosuresVon EverandClimate-Related Financial Disclosures 2021: Progress Report on Implementing the Recommendations of the Task Force on Climate-Related Financial DisclosuresNoch keine Bewertungen

- Implementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesVon EverandImplementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesNoch keine Bewertungen

- Amalgmation, Absorbtion, External ReconstructionDokument12 SeitenAmalgmation, Absorbtion, External Reconstructionpijiyo78Noch keine Bewertungen

- Application LevelDokument45 SeitenApplication LevelMinhajul Haque SajalNoch keine Bewertungen

- 2857 - Accounting For Governmental and Non-Profit Organizations-203203-Chapter 3Dokument70 Seiten2857 - Accounting For Governmental and Non-Profit Organizations-203203-Chapter 3yared destaNoch keine Bewertungen

- Standard Bank BEE Financing StructuresDokument15 SeitenStandard Bank BEE Financing StructuresKhanyile NcubeNoch keine Bewertungen

- Agricultural Bank of China Limited SEHK 1288 Financials Balance SheetDokument3 SeitenAgricultural Bank of China Limited SEHK 1288 Financials Balance SheetJaime Vara De ReyNoch keine Bewertungen

- Major Accounts: Kelvin Jay S. Sapla, LPT, CTTDokument10 SeitenMajor Accounts: Kelvin Jay S. Sapla, LPT, CTTKelvin Jay Sebastian SaplaNoch keine Bewertungen

- Finman2 Module 2Dokument17 SeitenFinman2 Module 2Franz Ervy MallariNoch keine Bewertungen

- 3 - A Form of Financial IntermediariesDokument7 Seiten3 - A Form of Financial IntermediariesTaha Wael QandeelNoch keine Bewertungen

- Lone Pine Cafe (A) : Harvard Business Case by Professor Robert N AnthonyDokument2 SeitenLone Pine Cafe (A) : Harvard Business Case by Professor Robert N AnthonyPranav ManianNoch keine Bewertungen

- Accounts Complier (QB) @mission - CA - InterDokument350 SeitenAccounts Complier (QB) @mission - CA - Intershivangi sharma0907100% (1)

- IFRS 17 Module 7 - Revision Pack V3 30-06-2012Dokument35 SeitenIFRS 17 Module 7 - Revision Pack V3 30-06-2012JasonSpringNoch keine Bewertungen

- HCL Technology Financial Analysis: A Project Report OnDokument22 SeitenHCL Technology Financial Analysis: A Project Report OnGoutham SunderNoch keine Bewertungen

- Capii Financial Management July2015Dokument14 SeitenCapii Financial Management July2015casarokarNoch keine Bewertungen

- CC21198 AnnualReturnSummary AR008Dokument3 SeitenCC21198 AnnualReturnSummary AR008Slate WilsonNoch keine Bewertungen

- Effect of Capital Structure On Performance of Listed Pharmaceutical Companies in NigeriaDokument22 SeitenEffect of Capital Structure On Performance of Listed Pharmaceutical Companies in Nigeriayomlaw2003Noch keine Bewertungen

- Fin Man - Module 3Dokument38 SeitenFin Man - Module 3Francine PrietoNoch keine Bewertungen

- Family Business Succession Literature ReviewDokument8 SeitenFamily Business Succession Literature Reviewlbiscyrif100% (1)

- AFSA Cash Flow AnalysisDokument19 SeitenAFSA Cash Flow AnalysisRikhabh DasNoch keine Bewertungen

- Financial Report For Monster Energy & Starbucks CoffeeDokument5 SeitenFinancial Report For Monster Energy & Starbucks Coffeeapi-307927108Noch keine Bewertungen

- Liyu - 2021 G.CDokument8 SeitenLiyu - 2021 G.CElias Abubeker AhmedNoch keine Bewertungen

- Section A Multiple Choice Questions 25 Marks (Answer in Multiple Choice Answer Sheet Provided) (Suggested Time: 36 Minutes)Dokument11 SeitenSection A Multiple Choice Questions 25 Marks (Answer in Multiple Choice Answer Sheet Provided) (Suggested Time: 36 Minutes)wainikitiraculeNoch keine Bewertungen

- GCT BKK NC3 (Lecture 2)Dokument5 SeitenGCT BKK NC3 (Lecture 2)Layla ReksNoch keine Bewertungen

- Business PlanDokument41 SeitenBusiness PlanSuper AmazingNoch keine Bewertungen

- Financial ManagementDokument9 SeitenFinancial ManagementPrincess TaizeNoch keine Bewertungen

- FSET TemplateDokument12 SeitenFSET TemplatePrakriti ChaturvediNoch keine Bewertungen

- Assignment Acc. & Finance Col MBA Semester 1Dokument24 SeitenAssignment Acc. & Finance Col MBA Semester 1Zahid Nazir100% (3)

- ACCT 221 Chapter 2Dokument29 SeitenACCT 221 Chapter 2Shane Hundley100% (1)

- Hutchison Whampoa Case ReportDokument6 SeitenHutchison Whampoa Case ReporttsjakabNoch keine Bewertungen

- Chapter One Marketing StudyDokument48 SeitenChapter One Marketing StudyBab Sita100% (1)

- CRT - Accounting BasicsDokument28 SeitenCRT - Accounting BasicsSiddarth Hari AnantaneniNoch keine Bewertungen