Beruflich Dokumente

Kultur Dokumente

Article 89

Hochgeladen von

ranjit12345Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Article 89

Hochgeladen von

ranjit12345Copyright:

Verfügbare Formate

STRAIGHT TALK IS GOOD BUSINESS.

Ar ticles

"The Chicken or the Egg - Insurance and Indemnification Clauses in the Same

Contract"

James Stilwell

March 29, 2004

It seems that more and more contracts contain both insurance and indemnity provisions. A business may have contracts

requiring the other party to indemnify it and to include it as an additional insured under the other partys insurance. Or

vice-versa a business may sign contracts that require it to indemnify and name the other party as an additional insured.

Either way, while these provisions may be written and/or negotiated separately, the interplay between the provisions must

be thought through. Otherwise, consequences beyond what the parties intend may result! Here are a few tips that may help

when confronted with contracts having both insurance and indemnity provisions:

1. Chicken or the Egg: Does the contract state which provision is supposed to act first the indemnification provision or the

insurance provision? That is, whether or not the indemnification provision is intended to be excess to the coverage required

by the insurance provision?

The United States Fifth Circuit Court of Appeals has repeatedly held that in contracts including both indemnification and

insurance clauses, the indemnity requirement acts subsequent to the insurance coverage that is, the insurance coverage

offers the first line of protection and the contractual indemnification only comes into play upon exhaustion or failure of the

insurance. Stated differently, the indemnity provision in a contract may apply only to amounts exceeding the coverage

provided pursuant to the insurance provision. If the parties to the contract desire the indemnification to apply in the first

instance (that is, even in the face of an insurance requirement under the contract), the parties should expressly state that

desire.

2. Hold the pickles: Does the indemnity provision in the contract expressly include the word negligence when protecting

against the consequences of the contracting partys own negligence?

The express negligence doctrine requires a party protecting itself from the consequences of its own negligence to express

that intent in specific terms (using the word negligence) within the four corners of the contract. Absent the use of the word

negligence, a contracts indemnity provision typically will not require one contracting party to indemnify the other for the

others own negligence.

3. Does that have MSG: Is the indemnification provision conspicuous that is, set out in larger type; bold, italics, and/or

underlined typeset; in a markedly different font; or in a different color?

Using different sized type, different text effects, different fonts, or different colors than other parts of the contract draws

attention to the indemnity clause the eye is naturally drawn to it. The conspicuousness doctrine requires an indemnity

provision to be conspicuous; or, absent proof of actual awareness of the provision, it may not be enforceable. If the terms of

the indemnification provision are not actually negotiated with the other contracting party, text features that make the

provision stand out will help enforce it when/if trouble arises.

4. Does it come with a salad: Does the indemnification provision merely provide for indemnification, or does it also require

the defense of the party being protected by the provision?

Check carefully -- the indemnification provision may also include a duty of defense. Look to see if the language states that

one of the contracting parties agrees to defend the other against loss, damage, or expense by reason of suits, claims, or

causes of action arising out of the performance of the contract. A provision that includes the word defend has been held in

court to mean just that to require the defending party to pay the others defense costs. The indemnity provision may

provide more than just indemnity with the right language, it may cover defense costs too.

STRAIGHT TALK IS GOOD BUSINESS.

Ar ticles

5. What about dessert: Does the insurance clause obligate the party providing insurance to obtain coverage of the

contractual indemnification clause?

Absent insurance coverage, an agreement to indemnify is only as solid as the financial condition of the protecting party.

But, requiring an indemnity obligation to be covered by insurance (or securing insurance coverage for an agreement to

indemnify another) provides an additional level of security. Typical commercial general liability policies contain a contractual

liability exclusion that often operates to eliminate the insurers liability for these provisions. However, insurance policy

endorsements are available to change the language and eliminate the exclusion. If the risk management department,

insurance procurer, or insurance broker is made aware of these provisions in a companys contracts, an endorsement

meeting this need can usually be added to the companys insurance coverage.

6. How about a combo meal: If contractually required to name others as additional insureds to a commercial general liability

insurance, does the insured business have a broad form/blanket endorsement under its commercial general liability

insurance that fulfills the agreement and conforms the coverage to the contract?

It may be time for an insurance check-up! Endorsements are available that provide blanket additional named insured

coverage under a commercial liability policy for whomever the business is contractually obligated to provide it for. These

same endorsements may include provisions that expressly conform the coverage to the business contract (thereby also

potentially covering the indemnification provision if this has not been separately caught and covered by an endorsement)!

The interplay between indemnity provisions and insurance requirements under modern contracts requires careful thought.

With good planning, unwanted consequences from their interaction can be avoided!

Unless otherwise indicated, lawyers listed on this website are not certified by the Texas Board of Legal Specialization. A past performance or prior result is no

guarantee of a similar future result in another case or matter. Andrews Kurth is responsible for the content of this website. Andrews Kurth, the Andrews Kurth

logo and Straight Talk Is Good Business are registered service marks of Andrews Kurth LLP. Andrews Kurth LLP is a Texas limited liability partnership. Andrews

Kurth (Middle East) JLT is registered and licensed as a Free Zone company under the rules and regulations of DMCCA. Attorney Advertising.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Bar Prep - Outline - Agency & Partnership - ShortDokument8 SeitenBar Prep - Outline - Agency & Partnership - ShortAnonymous Cbr8Vr2SX100% (2)

- Genealogy of The Vampires in The World of Darkness: This ListDokument511 SeitenGenealogy of The Vampires in The World of Darkness: This ListMan George100% (7)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Dictionary of Canon LawDokument258 SeitenDictionary of Canon LawLon Mega100% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Reducing Truancy and Improving Attendance Using Restorative Conferencin1 PDFDokument14 SeitenReducing Truancy and Improving Attendance Using Restorative Conferencin1 PDFRobert D. SkeelsNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Obligations and Contracts (Chapter 3 Sec 3)Dokument5 SeitenObligations and Contracts (Chapter 3 Sec 3)LeeshNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Chronicles of Narnia The Lion The Witch and The Wardobre (Movie Script)Dokument42 SeitenThe Chronicles of Narnia The Lion The Witch and The Wardobre (Movie Script)Israel OrtizNoch keine Bewertungen

- Re-KYC Diligence & Operationalizing In-Operative' NRI AccountDokument4 SeitenRe-KYC Diligence & Operationalizing In-Operative' NRI Accountranjit12345Noch keine Bewertungen

- Joy James - Resisting State Violence - Radicalism, Gender, and Race in U.S. Culture-University of Minnesota Press (1996) PDFDokument279 SeitenJoy James - Resisting State Violence - Radicalism, Gender, and Race in U.S. Culture-University of Minnesota Press (1996) PDFDiogo Marcal Cirqueira100% (1)

- Lines Plan and Main ParticularsDokument17 SeitenLines Plan and Main ParticularsShaik AneesNoch keine Bewertungen

- Transformation & TransitionDokument14 SeitenTransformation & TransitionRashid NihalNoch keine Bewertungen

- Stationery Books To BuyDokument1 SeiteStationery Books To Buyranjit12345Noch keine Bewertungen

- Banco PopularDokument7 SeitenBanco PopularespaguetesNoch keine Bewertungen

- Stationery Books To BuyDokument1 SeiteStationery Books To Buyranjit12345Noch keine Bewertungen

- Stationery Books To BuyDokument1 SeiteStationery Books To Buyranjit12345Noch keine Bewertungen

- Covid-19 Cases Status As of 20 March 2020Dokument11 SeitenCovid-19 Cases Status As of 20 March 2020ranjit12345Noch keine Bewertungen

- Stationery Books To BuyDokument1 SeiteStationery Books To Buyranjit12345Noch keine Bewertungen

- Dish TV SupportDokument1 SeiteDish TV Supportranjit12345Noch keine Bewertungen

- China Italy Iran Spain Germany S. Korea France USADokument12 SeitenChina Italy Iran Spain Germany S. Korea France USAranjit12345Noch keine Bewertungen

- Risk Management and The Transition of Projects To "Business As Usual"Dokument8 SeitenRisk Management and The Transition of Projects To "Business As Usual"ranjit12345Noch keine Bewertungen

- Attitude: "Happy People Plan Actions, They Don't Plan Results."Dokument1 SeiteAttitude: "Happy People Plan Actions, They Don't Plan Results."ranjit12345Noch keine Bewertungen

- Minimizing Operational Risk in Oil Gas IndustryDokument15 SeitenMinimizing Operational Risk in Oil Gas IndustryGolden PerfectNoch keine Bewertungen

- Minimizing Operational Risk in Oil Gas IndustryDokument15 SeitenMinimizing Operational Risk in Oil Gas IndustryGolden PerfectNoch keine Bewertungen

- MoeDokument1 SeiteMoeranjit12345Noch keine Bewertungen

- CLCJPFDokument41 SeitenCLCJPFranjit12345Noch keine Bewertungen

- IMATools Techniques May 07Dokument34 SeitenIMATools Techniques May 07ranjit12345Noch keine Bewertungen

- 366 RiskDokument206 Seiten366 Riskranjit12345Noch keine Bewertungen

- Babies SuperfoodsDokument27 SeitenBabies Superfoodsranjit12345Noch keine Bewertungen

- 366 RiskDokument206 Seiten366 Riskranjit12345Noch keine Bewertungen

- Formula AC: (Return To Top)Dokument5 SeitenFormula AC: (Return To Top)ranjit12345Noch keine Bewertungen

- Attitude: "Happy People Plan Actions, They Don't Plan Results."Dokument1 SeiteAttitude: "Happy People Plan Actions, They Don't Plan Results."ranjit12345Noch keine Bewertungen

- Nobile v. U.S. Bank Nat'l Ass'nDokument8 SeitenNobile v. U.S. Bank Nat'l Ass'nKenneth SandersNoch keine Bewertungen

- Primary Sources - War For FreedomDokument14 SeitenPrimary Sources - War For Freedomapi-187838124Noch keine Bewertungen

- Act 4Dokument7 SeitenAct 4Elaine BartolayNoch keine Bewertungen

- ErodeDokument26 SeitenErodeRamesh SakthyNoch keine Bewertungen

- 04-09.in Re de Gracia v. The Warden MunicipalDokument4 Seiten04-09.in Re de Gracia v. The Warden MunicipalOdette JumaoasNoch keine Bewertungen

- UNIT 7: Language Test: GrammarDokument2 SeitenUNIT 7: Language Test: GrammarPatricia PerezNoch keine Bewertungen

- Case Studies On Unjust DismissalDokument8 SeitenCase Studies On Unjust DismissalHimanshu AhujaNoch keine Bewertungen

- Nevada Reports 1883-1884 (18 Nev.) PDFDokument334 SeitenNevada Reports 1883-1884 (18 Nev.) PDFthadzigsNoch keine Bewertungen

- Kes ReignmentDokument20 SeitenKes ReignmentAnonymous Vkh7jwhNoch keine Bewertungen

- Clearance ChartDokument2 SeitenClearance ChartBruce QaziNoch keine Bewertungen

- First Battle of Bull Run-WorksheetDokument2 SeitenFirst Battle of Bull Run-WorksheetnettextsNoch keine Bewertungen

- Variations of Two-Transistor CircuitsDokument2 SeitenVariations of Two-Transistor CircuitsKoushik TeslaNoch keine Bewertungen

- Boat InvoiceDokument1 SeiteBoat Invoiceshiv kumarNoch keine Bewertungen

- Case: Tropical Insurance Co. v. Zenith Life Insurance Co: Irregularities Under The ICADokument13 SeitenCase: Tropical Insurance Co. v. Zenith Life Insurance Co: Irregularities Under The ICAAnay MehrotraNoch keine Bewertungen

- Banking Law Lecture 4Dokument10 SeitenBanking Law Lecture 4hannahlouiseisobelNoch keine Bewertungen

- Jackson v. Vazquez - Document No. 2Dokument2 SeitenJackson v. Vazquez - Document No. 2Justia.comNoch keine Bewertungen

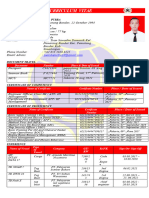

- Cv. Juanda1Dokument2 SeitenCv. Juanda1robyNoch keine Bewertungen

- Stipulated Protective Order by Magistrate Judge Karen E. ScottDokument25 SeitenStipulated Protective Order by Magistrate Judge Karen E. ScottwatermelontacoNoch keine Bewertungen

- SubbhasDokument10 SeitenSubbhasArijit DasNoch keine Bewertungen

- 2.G.R. No. 76573Dokument6 Seiten2.G.R. No. 76573Lord AumarNoch keine Bewertungen

- People Vs Sy Gesiong, 60 Phil 614Dokument2 SeitenPeople Vs Sy Gesiong, 60 Phil 614Divina Gracia HinloNoch keine Bewertungen