Beruflich Dokumente

Kultur Dokumente

Entry 1

Hochgeladen von

api-321760329Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Entry 1

Hochgeladen von

api-321760329Copyright:

Verfügbare Formate

CBC New | Business

Friday, March 11th 2016

Canadian dollar above 75 cents US, as oil moves

Ajay Tiwary

higher

March 9th, 2016

The Current Economic Events E-Portfolio: Entry #1

Summary:

This article revolves around the concept the Canadian dollar rising almost a penny against the

U.S. dollar, with respect to its cause and effects. As oil continues to rise, Bank of Canada decides

to maintain their interest rates creating a positive outlook on our economy. With this, Toronto

sticks repeated their growing trend and oil and markets have been rising in hopes to return to

stability. Furthermore, on an international scope, countries that are members of O.P.E.C are now

questioning if a meeting should be held to floor oil prices; as its stomping on their economies.

Economic Concepts:

The Bank of Canada and its monetary policies is a key economics concept mentioned in this

article. This bank has four functions including, supervising the operations of financial markets to

ensure stability. Moreover, they contain monetary policies that deals with contractionary and

expansionary phases for the economy. With the Lonnie increasing slightly, since its drastic

decrease the Bank of Canada can enforce expansionary monetary polices to increase the money

supply and lower interest rates, to eradicate a recessionary gap. For example, if the United States

were in another recession, they can begin cutting discount rates which translates to overall

interest rates. This action will not only prioritize economics activity, but ensure a positive

economic future.

Connections & Implications:

This article pertains to the Canadian dollar, oil, Bank of Canada, and many other economic

concepts. Through analyzing this event I began thinking about an indirect concept, imports and

exports. Exports and imports have a strong correlation with the Canadian dollar and its value.

Exporting is when a country sends goods or services to another country for sale, whereas

importing is the opposite. With the Canadian Lonnie increasing slightly, but still below the USD

exports become less expensive to foreigners. Whereas, a weaker Lonnie can be detrimental to

our imports as foreign products become more expensive. Overall, this article led myself to think

about Canadas export and import rates in relation to its slight increase of the dollar value.

My View:

Comprehensively, I agree with the arguments and its reasoning that this article provided. With oil

being a most-traded commodity, theres no doubt that the Canadian dollar rose above 75 center

as oil moved higher. Given ceteris paribus, the Canadian is an active exporter of importer of

crude oil. With this, when crude prices rise, Canada will receive more currency for selling it.

Resulting in the dollar strengthen through an increase of supply. Through prediction, if oil prices

and the dollar were to increase steadily, this would result in more income through exports.

Edited by:

Thushjan Balakumar

CBC New | Business

Canadian dollar above 75 cents US, as oil moves

higher

March 9th, 2016

Friday, March 11th 2016

Ajay Tiwary

Canadian dollar above 75 cents US, as

oil moves higher

Optimism fuelled by hopes of oil output freeze, but signals from

producers mixed

CBC News Posted: Mar 09, 2016 11:12 AM ET Last Updated: Mar 09, 2016 4:25 PM ET

Traders are hoping for an agreement from oil producers on freezing output. (Matthew Brown/Associated Press)

http://www.cbc.ca/news/business/tax-dollar-markets-1.3483275

The loonie rose by almost a penny against the U.S. dollar on Wednesday, as oil resumed its

climb and the Bank of Canada kept interest rates unchanged.

Toronto stocks also resumed their rally today as crude moved higher in anticipation of an output

freeze by major producers.

Brent oil, the main international contract, was above $40 US a barrel at $40.87, after falling

sharply Tuesday.

West Texas Intermediate, the benchmark North American contract, had risen 4.7 per cent by the

close, to $38.29 US a barrel, after a sharp fall Tuesday.

The TSX broke an eight-day winning streak with a down day Tuesday, but on Wednesday at

midday it was ahead 88 points, to 13,398.

It is seven years since the big market crash of March 9, 2009. The TSX has risen 77 per cent

since that day, when it closed at 7,567.

Edited by:

Thushjan Balakumar

CBC New | Business

Canadian dollar above 75 cents US, as oil moves

higher

March 9th, 2016

Friday, March 11th 2016

Ajay Tiwary

Bank of Canada keeps key interest rate at 0.5%

In late afternoon, the Canadian dollar was at 75.51 cents US, up .93 of a cent, and just below its

peak of the day.

The Bank of Canada's decision to keep its key interest rate unchanged was broadly expected,

but it meant a more positive outlook on the Canadian economy from the central bank.

Oil and markets have been rising for more than three weeks on hopes of a return to stability in

oil prices until Tuesday's rout.

Meeting details in doubt

The signals are mixed from oil producers around the world on whether there will be a concerted

effort to put a floor on oil prices.

An Iraqi oil official told a state newspaper today that there is a plan for members of the

Organization of the Petroleum Exporting Countries to meet March 20 in Moscow with nonOPEC producers.

However, Russian Energy Minister Alexander Novak has said through a spokeswoman there is

no set place or time for such a meeting.

The hope is that large producers such as Saudi Arabia and Russia are tired of selling their oil at

cheap prices, with the corresponding drop in government revenues.

Saudi Arabia, which has had balanced budgets for years, had a deficit equal to 15 per cent of its

GDP in 2015 and is looking at another deficit in 2016. It is expected to tap bond markets for $31

billion US in new debt this year.

Smaller OPEC members such as Venezuela are keen for an agreement as low oil prices have

played havoc with their economies.

But Iran, which has been subject to an embargo for years, is keen to expand its exports. Its

delivery of one million barrels of crude to European shores on Sunday helped depress oil prices

on Monday.

Iran's goal is to double its output to two million barrels a day.

Edited by:

Thushjan Balakumar

CBC New | Business

Canadian dollar above 75 cents US, as oil moves

higher

March 9th, 2016

Friday, March 11th 2016

Ajay Tiwary

Also a positive for oil was data from the U.S. Energy Information Administration that showed

crude stockpiles rising in line with expectations, but gasoline stocks falling.

Oil stocks rose by 3.9 million barrels in the previous week to a total of 521.9 million barrels, but

total motor gasoline stockpiles dropped by 4.5 million barrels, and distillate fuel stocks also

decreased by 1.1 million barrels, an indication the demand is rising..

Markets in Europe closed with gains and New York's Dow industrial average edged up 36 points

at 17,000, while the broader S&P rose seven points to 1986.

There is optimism in Europe over the European Central Bank decision on interest rates due

Thursday. The European Central Bank is expected to extend or even expand its stimulus

program.

Edited by:

Thushjan Balakumar

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Business Economics - Question BankDokument4 SeitenBusiness Economics - Question BankKinnari SinghNoch keine Bewertungen

- Bye, Bye Nyakatsi Concept PaperDokument6 SeitenBye, Bye Nyakatsi Concept PaperRwandaEmbassyBerlinNoch keine Bewertungen

- 002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFDokument7 Seiten002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFBenjamin MartinezNoch keine Bewertungen

- QQy 5 N OKBej DP 2 U 8 MDokument4 SeitenQQy 5 N OKBej DP 2 U 8 MAaditi yadavNoch keine Bewertungen

- Fiscal Deficit UPSCDokument3 SeitenFiscal Deficit UPSCSubbareddyNoch keine Bewertungen

- BIR Form 1707Dokument3 SeitenBIR Form 1707catherine joy sangilNoch keine Bewertungen

- E Money PDFDokument41 SeitenE Money PDFCPMMNoch keine Bewertungen

- TCW Act #4 EdoraDokument5 SeitenTCW Act #4 EdoraMon RamNoch keine Bewertungen

- De Mgginimis Benefit in The PhilippinesDokument3 SeitenDe Mgginimis Benefit in The PhilippinesSlardarRadralsNoch keine Bewertungen

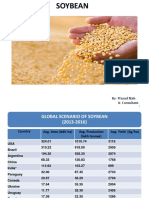

- Soybean Scenario - LaturDokument18 SeitenSoybean Scenario - LaturPrasad NaleNoch keine Bewertungen

- PaySlip 05 201911 5552Dokument1 SeitePaySlip 05 201911 5552KumarNoch keine Bewertungen

- BAIN REPORT Global Private Equity Report 2017Dokument76 SeitenBAIN REPORT Global Private Equity Report 2017baashii4Noch keine Bewertungen

- Manual Goldfinger EA MT4Dokument6 SeitenManual Goldfinger EA MT4Mr. ZaiNoch keine Bewertungen

- VENDOR TBE RESPONSE OF HELIMESH FROM HELITECNICA (Update 11-2)Dokument1 SeiteVENDOR TBE RESPONSE OF HELIMESH FROM HELITECNICA (Update 11-2)Riandi HartartoNoch keine Bewertungen

- Democratic Developmental StateDokument4 SeitenDemocratic Developmental StateAndres OlayaNoch keine Bewertungen

- Company ProfileDokument13 SeitenCompany ProfileDauda AdijatNoch keine Bewertungen

- A Study On Performance Analysis of Equities Write To Banking SectorDokument65 SeitenA Study On Performance Analysis of Equities Write To Banking SectorRajesh BathulaNoch keine Bewertungen

- Fatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournDokument13 SeitenFatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournSunny SinghNoch keine Bewertungen

- Bill CertificateDokument3 SeitenBill CertificateRohith ReddyNoch keine Bewertungen

- Fire Service Resource GuideDokument45 SeitenFire Service Resource GuidegarytxNoch keine Bewertungen

- Chennai - Purchase Heads New ListDokument298 SeitenChennai - Purchase Heads New Listconsol100% (1)

- A View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)Dokument17 SeitenA View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)(FPTU HCM) Phạm Anh Thiện TùngNoch keine Bewertungen

- Pembayaran PoltekkesDokument12 SeitenPembayaran PoltekkesteffiNoch keine Bewertungen

- Production Planning & Control: The Management of OperationsDokument8 SeitenProduction Planning & Control: The Management of OperationsMarco Antonio CuetoNoch keine Bewertungen

- Presentation On " ": Human Resource Practices OF BRAC BANKDokument14 SeitenPresentation On " ": Human Resource Practices OF BRAC BANKTanvir KaziNoch keine Bewertungen

- (Paper) Intellectual Capital Performance in The Case of Romanian Public CompaniesDokument20 Seiten(Paper) Intellectual Capital Performance in The Case of Romanian Public CompaniesishelNoch keine Bewertungen

- Asiawide Franchise Consultant (AFC)Dokument8 SeitenAsiawide Franchise Consultant (AFC)strawberryktNoch keine Bewertungen

- Organic Farming in The Philippines: and How It Affects Philippine AgricultureDokument6 SeitenOrganic Farming in The Philippines: and How It Affects Philippine AgricultureSarahNoch keine Bewertungen

- Business Plan SampleDokument14 SeitenBusiness Plan SampleGwyneth MuegaNoch keine Bewertungen

- CBN Rule Book Volume 5Dokument687 SeitenCBN Rule Book Volume 5Justus OhakanuNoch keine Bewertungen