Beruflich Dokumente

Kultur Dokumente

Coffee Bean Inc

Hochgeladen von

tiff5560 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

202 Ansichten5 SeitenCASE STUDY COFFEE BEAN INC

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCASE STUDY COFFEE BEAN INC

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

202 Ansichten5 SeitenCoffee Bean Inc

Hochgeladen von

tiff556CASE STUDY COFFEE BEAN INC

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 5

COFFEE BEAN INC.

CASE STUDY

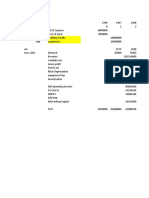

a) Predetermined Overhead Rate

(POHR)can be calculated by dividing

estimated total manufacturing overhead

cost by estimates total activity base.

POHR = Estimated total MOH Cost/

Estimated Total Activity Base

= $ 3.000.000/ 50.000 HDL

= $60 / DLH

Mona Loa

Malaysia

Direct Materials

$4,20

$3,20

Direct Labor

$0,30

$0,30

MOH (0,025 DLH X $60/ DLH)

$1,50

$1,50

Total Unit product cost of one

pound

$6,00

$5,00

POHR by activity center

(a)

Estimated

Overhead cost

Purchasing

$513.000,00

1710

orders

Material

Handling

$720.000,00

1800

setups

Quality Control

$ 144.000,00

600

batches

Roasting

$961.000,00

96100

Blending

$402.000,00

Packaging

$260.000,00

Total MOH

$300.000,00

Expected Activity

roasting

hours

blending

33500

hours

packaging

26000

hours

POHR

$

300,00

$

400,00

$

240,00

$

10,00

$

12,00

$

10,00

MEMO TO THE PRESIDENT :

The Traditional Method results in the allocation of

high per unit costs.

Activity Based Method are more accurately

allocates MOH cost to product; it is likely that its

cost of production will increase many folds

resulting in relatively few amounts of revenue

On the basis of these two important findings, it is

suggested to the organization to use the activity

based methods in allocating the costs. So, it can

increase the efficiency of their cost allocations.

Das könnte Ihnen auch gefallen

- Chapter 2 HomeworkDokument2 SeitenChapter 2 HomeworkAliya KainazarovaNoch keine Bewertungen

- Chapter - 02 Job Order CostingDokument69 SeitenChapter - 02 Job Order CostingGonzalo Jr. RualesNoch keine Bewertungen

- Tugas Akmen 3.2A - 3.3ADokument2 SeitenTugas Akmen 3.2A - 3.3ADias AdhyaksaNoch keine Bewertungen

- Group 1-Java SourceDokument5 SeitenGroup 1-Java SourceLorena Mae LasquiteNoch keine Bewertungen

- TEST BANK Cost Accounting 14E by Carter Ch08 TEST BANK Cost Accounting 14E by Carter Ch08Dokument16 SeitenTEST BANK Cost Accounting 14E by Carter Ch08 TEST BANK Cost Accounting 14E by Carter Ch08mEOW SNoch keine Bewertungen

- Cost SheetDokument20 SeitenCost SheetKeshviNoch keine Bewertungen

- Case 11-1 2004Dokument2 SeitenCase 11-1 2004Bitan BanerjeeNoch keine Bewertungen

- MX - Cost Accounting PDFDokument5 SeitenMX - Cost Accounting PDFZamantha TiangcoNoch keine Bewertungen

- ABC System - Problem (With Answers and Solutions)Dokument9 SeitenABC System - Problem (With Answers and Solutions)Roselyn LumbaoNoch keine Bewertungen

- FA GP5 Assignment 1Dokument4 SeitenFA GP5 Assignment 1saurabhNoch keine Bewertungen

- Variance Analysis AND Standard CostingDokument37 SeitenVariance Analysis AND Standard CostingWaniey HassanNoch keine Bewertungen

- Activity-Based Costing: Coffee Bean IncDokument6 SeitenActivity-Based Costing: Coffee Bean IncNahid Hussain AdriNoch keine Bewertungen

- ACCCOB3Dokument87 SeitenACCCOB3Lexy SungaNoch keine Bewertungen

- Mystic SportsDokument34 SeitenMystic SportshelloNoch keine Bewertungen

- Bill FrenchDokument5 SeitenBill Frenchabigail franciscoNoch keine Bewertungen

- Prologue: Managerial Accounting and The Business EnvironmentDokument156 SeitenPrologue: Managerial Accounting and The Business EnvironmentMarcus MonocayNoch keine Bewertungen

- Sanders CompanyDokument6 SeitenSanders CompanyculadiNoch keine Bewertungen

- Extra Credit Assignments - Cost AccountingDokument6 SeitenExtra Credit Assignments - Cost Accountingstamford1234Noch keine Bewertungen

- Estimating service costs in a consulting firmDokument11 SeitenEstimating service costs in a consulting firmPat0% (1)

- Assignment No.2 206Dokument5 SeitenAssignment No.2 206Halimah SheikhNoch keine Bewertungen

- Product Mix Decision: IllustrationDokument2 SeitenProduct Mix Decision: IllustrationMeghan Kaye LiwenNoch keine Bewertungen

- Hilton CH 14 Select SolutionsDokument10 SeitenHilton CH 14 Select SolutionsHabib EjazNoch keine Bewertungen

- Managerial Acctg Problems & Exercises in CVP AnalysisDokument4 SeitenManagerial Acctg Problems & Exercises in CVP AnalysisJanelleNoch keine Bewertungen

- 0568-Cost and Management AccountingDokument7 Seiten0568-Cost and Management AccountingWaqar AhmadNoch keine Bewertungen

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDokument19 SeitenAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNoch keine Bewertungen

- Decision MakingDokument8 SeitenDecision MakingkhandakeralihossainNoch keine Bewertungen

- Analyze BJ Company ProfitabilityDokument11 SeitenAnalyze BJ Company ProfitabilityMUHAMMAD AZAMNoch keine Bewertungen

- A. Loan Processing Operation: 87.50%: UtilizationDokument36 SeitenA. Loan Processing Operation: 87.50%: UtilizationQueenie Marie CastilloNoch keine Bewertungen

- Budgeting Profit, Sales, Costs & ExpensesDokument19 SeitenBudgeting Profit, Sales, Costs & ExpensesFarhan Khan MarwatNoch keine Bewertungen

- MBA 504 Ch5 SolutionsDokument12 SeitenMBA 504 Ch5 SolutionspheeyonaNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument5 SeitenNew Microsoft Office Word DocumentTariq RahimNoch keine Bewertungen

- ACC201 Management Accounting 2 Revision QuestionsDokument29 SeitenACC201 Management Accounting 2 Revision QuestionsSritel Boutique HotelNoch keine Bewertungen

- Mid Term Exam - Cost Accounting With AnswerDokument5 SeitenMid Term Exam - Cost Accounting With AnswerPRINCESS HONEYLET SIGESMUNDONoch keine Bewertungen

- CH 1SDokument26 SeitenCH 1Snikhil junnarkarNoch keine Bewertungen

- Model Grace CorporationDokument9 SeitenModel Grace CorporationEhtisham AkhtarNoch keine Bewertungen

- Chapter 12 SolutionsDokument29 SeitenChapter 12 SolutionsAnik Kumar MallickNoch keine Bewertungen

- Chapter 5 Job Order Costing: Multiple ChoiceDokument16 SeitenChapter 5 Job Order Costing: Multiple ChoiceRandy AsnorNoch keine Bewertungen

- 2nd Revised PC-I For Shahhbaz Sharif General Hospital MultanDokument22 Seiten2nd Revised PC-I For Shahhbaz Sharif General Hospital Multanafshan arshadNoch keine Bewertungen

- GG Toys WAC Final PDFDokument9 SeitenGG Toys WAC Final PDFTanaya SahaNoch keine Bewertungen

- Assignment - Cost BehaviorsDokument11 SeitenAssignment - Cost BehaviorsMary Antonette LastimosaNoch keine Bewertungen

- Green Handwritten Course Syllabus Education PresentationDokument24 SeitenGreen Handwritten Course Syllabus Education PresentationCamela Jane Dela PeñaNoch keine Bewertungen

- Multiple Choice With SolutionsDokument12 SeitenMultiple Choice With Solutionskashif ali0% (1)

- Review Sheet Exam 2Dokument17 SeitenReview Sheet Exam 2photo312100% (1)

- Assignment 3 (f5) 10341Dokument8 SeitenAssignment 3 (f5) 10341Minhaj AlbeezNoch keine Bewertungen

- Lecture-7 Overhead (Part 4)Dokument38 SeitenLecture-7 Overhead (Part 4)Nazmul-Hassan SumonNoch keine Bewertungen

- Dissolution of Partnership Firm Accounting ProblemsDokument5 SeitenDissolution of Partnership Firm Accounting ProblemsPrageeth Roshan WeerathungaNoch keine Bewertungen

- CIMA Process Costing Sum and AnswersDokument4 SeitenCIMA Process Costing Sum and AnswersLasantha PradeepNoch keine Bewertungen

- Practice Set - A3Dokument6 SeitenPractice Set - A3Dayanara VillanuevaNoch keine Bewertungen

- Yuvraj Patil Section B 2010PGP435 Case: Bill French Mac IiDokument4 SeitenYuvraj Patil Section B 2010PGP435 Case: Bill French Mac Iiyuveesp5207Noch keine Bewertungen

- Cost Volume Profit Analysis - Chapter 6Dokument39 SeitenCost Volume Profit Analysis - Chapter 6Maria Maganda MalditaNoch keine Bewertungen

- Understand Support Department Cost Allocation MethodsDokument27 SeitenUnderstand Support Department Cost Allocation Methodsluckystar251095Noch keine Bewertungen

- Wilkerson ABC at CapacityDokument1 SeiteWilkerson ABC at CapacityTushar DuaNoch keine Bewertungen

- Chapter 12 Managerial Accounting and Cost-Volume-Profit RelationshipsDokument15 SeitenChapter 12 Managerial Accounting and Cost-Volume-Profit RelationshipsJue WernNoch keine Bewertungen

- A FM 102 March 112011Dokument5 SeitenA FM 102 March 112011truly wulandariNoch keine Bewertungen

- Factory Overhead PDFDokument18 SeitenFactory Overhead PDFANDI TE'A MARI SIMBALANoch keine Bewertungen

- Zkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSDokument34 SeitenZkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSnabeel nabiNoch keine Bewertungen

- Complete Mock Mcqs DoneDokument49 SeitenComplete Mock Mcqs Doneadil jahangir100% (1)

- Planning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be AnsweredDokument5 SeitenPlanning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be Answeredapi-19836745Noch keine Bewertungen

- 2014 Bep Analysis ExercisesDokument5 Seiten2014 Bep Analysis ExercisesaimeeNoch keine Bewertungen

- Tutorial 5 AnswerDokument5 SeitenTutorial 5 AnswerSyuhaidah Binti Aziz ZudinNoch keine Bewertungen

- MGMT 027 Connect 04 HWDokument7 SeitenMGMT 027 Connect 04 HWSidra Khan100% (1)

- Operations Management Homework AnalyzedDokument6 SeitenOperations Management Homework AnalyzedErfanNoch keine Bewertungen

- Accounting 441Dokument4 SeitenAccounting 441Nahid Hussain AdriNoch keine Bewertungen

- Activity - Based - Costing Case SolutionDokument5 SeitenActivity - Based - Costing Case SolutionRienk HeegsmaNoch keine Bewertungen

- Job Order Costing ProblemsDokument2 SeitenJob Order Costing ProblemsTrine De LeonNoch keine Bewertungen

- 20180731103642D5760 GNBCY Chap05 Absorption Costing and Variable Costing With Cover PageDokument80 Seiten20180731103642D5760 GNBCY Chap05 Absorption Costing and Variable Costing With Cover PageNathania ShianneNoch keine Bewertungen

- Module For Managerial Accounting-Job Order CostingDokument17 SeitenModule For Managerial Accounting-Job Order CostingMary De JesusNoch keine Bewertungen

- Job-Order Costing: Presented byDokument69 SeitenJob-Order Costing: Presented byUstaz Jibril YahuzaNoch keine Bewertungen

- Unit 4: Cost Accounting Cycle: 4.1 Difference Between Merchandising and Manufacturing OperationDokument13 SeitenUnit 4: Cost Accounting Cycle: 4.1 Difference Between Merchandising and Manufacturing OperationCielo PulmaNoch keine Bewertungen

- Chapter 6 - Job Order CostingDokument63 SeitenChapter 6 - Job Order CostingXyne FernandezNoch keine Bewertungen

- Study Guide 1 StratDokument7 SeitenStudy Guide 1 Stratjecille magalongNoch keine Bewertungen

- Chapter 4-Product Costing SystemsDokument17 SeitenChapter 4-Product Costing SystemsQuế Hoàng Hoài ThươngNoch keine Bewertungen

- Chapter 4Dokument10 SeitenChapter 4Karl Wilson GonzalesNoch keine Bewertungen

- Product Costing SessionDokument63 SeitenProduct Costing SessionAnkitShettyNoch keine Bewertungen

- Product Cost Flows and Business OrganizationsDokument48 SeitenProduct Cost Flows and Business OrganizationsGaluh Boga KuswaraNoch keine Bewertungen

- Chapter 5 - Exercise SolutionDokument7 SeitenChapter 5 - Exercise SolutionLeo PriftiNoch keine Bewertungen

- M4Dokument1 SeiteM4Kendrew SujideNoch keine Bewertungen

- ABC vs Traditional Costing Reveals Profit TruthDokument3 SeitenABC vs Traditional Costing Reveals Profit TruthAbhijit AshNoch keine Bewertungen

- FACTORY OVERHEAD: PLANNED, ACTUAL, AND APPLIEDDokument11 SeitenFACTORY OVERHEAD: PLANNED, ACTUAL, AND APPLIEDMaviel SuaverdezNoch keine Bewertungen

- Full Download Introduction To Managerial Accounting 8th Edition Brewer Test BankDokument12 SeitenFull Download Introduction To Managerial Accounting 8th Edition Brewer Test Bankjosiahhryg100% (37)

- TOPIC 2-Job Order CostingDokument65 SeitenTOPIC 2-Job Order CostingDashania GregoryNoch keine Bewertungen

- Accounting Assignment Unit 2Dokument4 SeitenAccounting Assignment Unit 2Mike Kaboyo AbookieNoch keine Bewertungen

- Exam 2 ReviewDokument18 SeitenExam 2 ReviewBrad MellerNoch keine Bewertungen

- Standard CostingDokument101 SeitenStandard CostingSana IjazNoch keine Bewertungen

- Job Order Costing: Learning ObjectivesDokument60 SeitenJob Order Costing: Learning ObjectivesRanim HfaidhiaNoch keine Bewertungen

- Flexible Budgets and Overhead Analysis: Mcgraw-Hill/IrwinDokument78 SeitenFlexible Budgets and Overhead Analysis: Mcgraw-Hill/Irwinsaka haiNoch keine Bewertungen

- SMT 3 Manajemen Akuntansi - Chap 2Dokument63 SeitenSMT 3 Manajemen Akuntansi - Chap 2AsniNoch keine Bewertungen

- Chapter 6 (Standard Cost)Dokument98 SeitenChapter 6 (Standard Cost)annur azalillahNoch keine Bewertungen

- Acctg201 StandardCostingLectureNotes (FINALS)Dokument19 SeitenAcctg201 StandardCostingLectureNotes (FINALS)Sophia Marie Eredia FerolinoNoch keine Bewertungen

- Document 80Dokument4 SeitenDocument 80Arminder SinghNoch keine Bewertungen