Beruflich Dokumente

Kultur Dokumente

US Rule For Partial Payments

Hochgeladen von

MaryOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

US Rule For Partial Payments

Hochgeladen von

MaryCopyright:

Verfügbare Formate

US Rule for Partial Payments

Interest on a partial payment is calculated from the start of the loan to the time of the first payment. After the first payment interest is calculated on the time between the last payment and the next payment. Interest is added to the principle and then the partial payment is subtracted in order to get the adjusted balance for principle after each partial payment.

Example

Jane borrows $20,000 with an interest rate of 6% for 180 days. She makes partial payments on day 40 of $2,000 and on day 120 of $4,000.

The results are as follows: Interest: 1st partial payment: Interest: 2nd partial payment: Interest: Final payment: Total interest:

$133.33 First Adjusted principle: $241.78 Second Adjusted principle: $143.75 Final payment: $518.86

$18,133.33 $14,375.11 $14,518.86

The interest, if the principle balance is paid at the end of the loan, is: $20,000 X .06 X 180/360 = $600 The savings in interest, by making partial payments during the life of the loan, is: $600 - $518.86 = $81.14 Savings on interest Percentage of savings on interest payment cost is: $81.14 / 600 = .14 or 14%

Systematic Instruction on how to calculate the results

Step 1. Calculate the time between each payment.

Step 2. Multiply the principle times the interest rate times the partial time to determine the interest for the first payment. $20,000 X .06 X 40/360 = $133.33 Interest MJC Revised 1/2012 Page 1

US Rule for Partial Payments

Step 3. Add the interest to the principle. $20,000 + $133.33 = $20,133.33

Step 4. Subtract the partial payment to get the adjusted balance. $20,133.33 $2,000 = $18,133.33 Adjusted principle Step 5. Multiply the adjusted principle times the interest rate times the partial time to determine the interest for the second payment. $18,133.33 X .06 X 80/360 = $241.78 Interest Step 6. Add the interest to the adjusted principle. $18,133.33 + $241.78 = $18,375.11 Step 7. Subtract the partial payment to get the balance for the second adjusted principle. $18,375.11 - $4,000 = $14,375.11 Second adjusted principle Step 8. Interest on final payment. $14,375.11 X .06 X 60/360 = $143.75 Interest Step 9. Add the interest to the principle. The result is the final payment amount. $14,375.11 + $143.75 = $14,518.86 Final payment amount

MJC Revised 1/2012

Page 2

Das könnte Ihnen auch gefallen

- Matheson ElectronicsDokument2 SeitenMatheson ElectronicsReg Lagarteja80% (5)

- ACCT 211 Individual Learning Project Study GuidesDokument4 SeitenACCT 211 Individual Learning Project Study GuidesJohn Liberty0% (3)

- Income Taxation Tabag Answer Keypdf PDF FreeDokument34 SeitenIncome Taxation Tabag Answer Keypdf PDF FreeFreda Mae Pomilban Lumayyong100% (2)

- Securities Regulation Outline #1Dokument50 SeitenSecurities Regulation Outline #1tuyaNoch keine Bewertungen

- Who's Holding The Bag?Dokument64 SeitenWho's Holding The Bag?char1eylu100% (4)

- Comprehensive Problem Accounting 101Dokument2 SeitenComprehensive Problem Accounting 101Heidi Norris Dawson25% (4)

- 2492493Dokument7 Seiten2492493mohitgaba19100% (1)

- Diagram of Accounting EquationDokument1 SeiteDiagram of Accounting EquationMary100% (3)

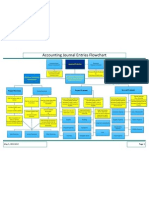

- Accounting Journal Entries Flowchart PDFDokument1 SeiteAccounting Journal Entries Flowchart PDFMary75% (4)

- Basic Everyday Journal Entries For A Sole Propietorship-Colored BackgroundDokument2 SeitenBasic Everyday Journal Entries For A Sole Propietorship-Colored BackgroundMary100% (4)

- Unit Costs Under Traditional Costing MethodDokument2 SeitenUnit Costs Under Traditional Costing MethodMary67% (3)

- Financial Accounting Valix and Peralta Volume Three - 2008 Edition 1Dokument27 SeitenFinancial Accounting Valix and Peralta Volume Three - 2008 Edition 1jamilahpanantaon83% (12)

- CFW Discussed Reflective EssayDokument6 SeitenCFW Discussed Reflective EssayAila Grace Albero-Quirante MaribaoNoch keine Bewertungen

- AIS Chapter FourDokument14 SeitenAIS Chapter FourNaod MekonnenNoch keine Bewertungen

- F Student Acc111 Exam 2Dokument4 SeitenF Student Acc111 Exam 2anon_317692344Noch keine Bewertungen

- Strategic Investment Decision FrameworkDokument12 SeitenStrategic Investment Decision FrameworkDeepti TripathiNoch keine Bewertungen

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDokument2 SeitenBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- Basic Impact of Everyday Journal Entries On The Income StatementDokument2 SeitenBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

- Circle of LifeDokument1 SeiteCircle of LifeMaryNoch keine Bewertungen

- Journal Entry Format PDFDokument1 SeiteJournal Entry Format PDFMaryNoch keine Bewertungen

- Fun Facts About The History of PrudentialDokument2 SeitenFun Facts About The History of PrudentialJoin RiotNoch keine Bewertungen

- Credit Operational Manual PDFDokument183 SeitenCredit Operational Manual PDFAwais Alvi93% (14)

- Caltex V IacDokument2 SeitenCaltex V IacBGodNoch keine Bewertungen

- How To Create A WorksheetDokument3 SeitenHow To Create A WorksheetMary100% (2)

- Discounting A Interest Bearing NoteDokument1 SeiteDiscounting A Interest Bearing NoteMary100% (2)

- Excel Skills - Basic Accounting Template: InstructionsDokument39 SeitenExcel Skills - Basic Accounting Template: InstructionsStorage BankNoch keine Bewertungen

- Closing Journal Entries-Sole ProprietorshipDokument1 SeiteClosing Journal Entries-Sole ProprietorshipMary100% (3)

- Simple Discount NoteDokument1 SeiteSimple Discount NoteMary100% (2)

- Section 1.8 Equation of ValuesDokument13 SeitenSection 1.8 Equation of ValuesMary Dianneil MandinNoch keine Bewertungen

- Basic Everyday Journal Entries For A Sole PropietorshipDokument2 SeitenBasic Everyday Journal Entries For A Sole PropietorshipMary100% (3)

- Simple Interest and Maturity ValueDokument2 SeitenSimple Interest and Maturity ValueMary100% (6)

- Ledger and Trial BalanceDokument28 SeitenLedger and Trial BalanceJustine Maravilla100% (1)

- General Journal PageDokument1 SeiteGeneral Journal PageMary100% (9)

- Chapter 17 Solutions 7eDokument46 SeitenChapter 17 Solutions 7epenelopegerhardNoch keine Bewertungen

- Sales Journal and Accounts Receivable Subsidiary LedgerDokument4 SeitenSales Journal and Accounts Receivable Subsidiary LedgerMary100% (5)

- Powerpoint - Reversing EntriesDokument13 SeitenPowerpoint - Reversing EntriesUPHSD JPIANoch keine Bewertungen

- The Following Unadjusted Trial Balance Is For Ace Construction CoDokument1 SeiteThe Following Unadjusted Trial Balance Is For Ace Construction Cotrilocksp SinghNoch keine Bewertungen

- Chapter: 1 Meaning, Objectives and Basic Accounting TermsDokument19 SeitenChapter: 1 Meaning, Objectives and Basic Accounting TermsGudlipNoch keine Bewertungen

- Zica t1 Financial AccountingDokument363 SeitenZica t1 Financial Accountinglord100% (2)

- Financial Statements SampleDokument32 SeitenFinancial Statements Sampleraymodo_philipNoch keine Bewertungen

- Trade DiscountsDokument4 SeitenTrade DiscountsMary100% (2)

- Accounting and Financial Reporting FundamentalsDokument19 SeitenAccounting and Financial Reporting FundamentalstundsandyNoch keine Bewertungen

- Epler Consulting ServicesDokument3 SeitenEpler Consulting ServicesAmmad Ud Din SabirNoch keine Bewertungen

- Chapter 3 - Statement of Financial Position and Income StatementDokument28 SeitenChapter 3 - Statement of Financial Position and Income Statementshemida75% (4)

- Pricing and Short Term Decision Making (Edited)Dokument58 SeitenPricing and Short Term Decision Making (Edited)Vaibhav SuchdevaNoch keine Bewertungen

- 6 Completion of Accounting Cycle UDDokument28 Seiten6 Completion of Accounting Cycle UDERICK MLINGWANoch keine Bewertungen

- Journal EntryDokument30 SeitenJournal EntrySanjay MehrotraNoch keine Bewertungen

- Bell ComputersDokument3 SeitenBell ComputersShameem Khaled0% (1)

- Chapter 12 HomeworkDokument4 SeitenChapter 12 HomeworkMargareta JatiNoch keine Bewertungen

- Managerial Economics: Applying Economic PrinciplesDokument37 SeitenManagerial Economics: Applying Economic PrinciplesCoke Aidenry SaludoNoch keine Bewertungen

- CHAPTER 5 Product and Service Costing: A Process Systems ApproachDokument30 SeitenCHAPTER 5 Product and Service Costing: A Process Systems ApproachMudassar HassanNoch keine Bewertungen

- Chapter 1 Financial AccountingDokument47 SeitenChapter 1 Financial Accountingslipns1ideNoch keine Bewertungen

- Pas 26. GalangDokument1 SeitePas 26. GalangKarlie Pangilinan GalangNoch keine Bewertungen

- Quiz 3 - Cash Flow and Financial PlanningDokument8 SeitenQuiz 3 - Cash Flow and Financial PlanningAries BautistaNoch keine Bewertungen

- Basic Instructions For A Cash Budget StatementDokument4 SeitenBasic Instructions For A Cash Budget StatementMary100% (6)

- Cost Revenue and Profit Functions (English)Dokument75 SeitenCost Revenue and Profit Functions (English)Germy02Noch keine Bewertungen

- Horizontal Analysis of A Balance SheetDokument3 SeitenHorizontal Analysis of A Balance SheetMary100% (6)

- Chapter 3-Adjusting The AccountsDokument26 SeitenChapter 3-Adjusting The Accountsbebybey100% (1)

- ACCT 101 Journal EntriesDokument8 SeitenACCT 101 Journal EntriesJay NgNoch keine Bewertungen

- Bank Reconciliation Statement PracticeDokument16 SeitenBank Reconciliation Statement Practicesyed kabir uddinNoch keine Bewertungen

- Reversing EntriesDokument5 SeitenReversing EntriesRizky AjiNoch keine Bewertungen

- Accounting Principles and Concepts LectureDokument9 SeitenAccounting Principles and Concepts LectureMary De JesusNoch keine Bewertungen

- Management ScienceDokument134 SeitenManagement ScienceIvan James Cepria BarrotNoch keine Bewertungen

- Introduction To Cost Management Systems: Cost Accounting: Foundations and Evolutions, 8eDokument34 SeitenIntroduction To Cost Management Systems: Cost Accounting: Foundations and Evolutions, 8eMichelle RotairoNoch keine Bewertungen

- Description: Tags: Doc3369 BodyoftextDokument2 SeitenDescription: Tags: Doc3369 Bodyoftextanon-470757Noch keine Bewertungen

- Business Mathematics Week 1Dokument24 SeitenBusiness Mathematics Week 1Jewel Joy PudaNoch keine Bewertungen

- TODAY at BULLET Chapter 2 TVM ContinuedDokument8 SeitenTODAY at BULLET Chapter 2 TVM ContinuedSiêng Năng NèNoch keine Bewertungen

- TODAY at BULLET Chapter 2 TVM ContinuedDokument8 SeitenTODAY at BULLET Chapter 2 TVM ContinuedThùy LêNoch keine Bewertungen

- Case Study 3 Wake Up and Smell The CoffeeDokument25 SeitenCase Study 3 Wake Up and Smell The CoffeeCheveem Grace Emnace100% (1)

- 12Dokument8 Seiten12Ishaq EssaNoch keine Bewertungen

- Manage Debt Maturity Structure to Reduce CostsDokument19 SeitenManage Debt Maturity Structure to Reduce CostsfaezaNoch keine Bewertungen

- Business Math Lecture NotesDokument18 SeitenBusiness Math Lecture NotesJean Marie LuposNoch keine Bewertungen

- Business Math Activity 1Dokument6 SeitenBusiness Math Activity 1gabezarate071Noch keine Bewertungen

- Commission NotesDokument2 SeitenCommission Notesivanjade627Noch keine Bewertungen

- Analysis of Financial Statements RatiosDokument2 SeitenAnalysis of Financial Statements RatiosMaryNoch keine Bewertungen

- Make or Buy AnalysisDokument4 SeitenMake or Buy AnalysisMaryNoch keine Bewertungen

- End of The Year Adjustment For Allowance For Doubtful AccountsDokument1 SeiteEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- Special Order AnalysisDokument2 SeitenSpecial Order AnalysisMaryNoch keine Bewertungen

- Cash Flows Statement Indirect MethodDokument2 SeitenCash Flows Statement Indirect MethodMary100% (1)

- Adjusting Entries For Bank ReconciliationDokument1 SeiteAdjusting Entries For Bank ReconciliationMaryNoch keine Bewertungen

- Kirkpatrick + ModelDokument1 SeiteKirkpatrick + ModelMaryNoch keine Bewertungen

- Product Cost AnalysisDokument10 SeitenProduct Cost AnalysisMaryNoch keine Bewertungen

- Horizontal Analysis of A Balance SheetDokument3 SeitenHorizontal Analysis of A Balance SheetMary100% (6)

- Scaffolding MethodDokument1 SeiteScaffolding MethodMaryNoch keine Bewertungen

- Continue or Eliminate AnalysisDokument3 SeitenContinue or Eliminate AnalysisMaryNoch keine Bewertungen

- Chunking Method DiagramDokument1 SeiteChunking Method DiagramMaryNoch keine Bewertungen

- ARCS Method of MotivationDokument1 SeiteARCS Method of MotivationMaryNoch keine Bewertungen

- Current Assets, Liabilities, and Stockholders' Equity Normal BalancesDokument1 SeiteCurrent Assets, Liabilities, and Stockholders' Equity Normal BalancesMaryNoch keine Bewertungen

- Table Factors For Present and Future Value of One DollarDokument6 SeitenTable Factors For Present and Future Value of One DollarMaryNoch keine Bewertungen

- Partial Income Statement For Manufacturing CompanyDokument1 SeitePartial Income Statement For Manufacturing CompanyMary50% (2)

- Simplified Charts - Percentage Method Income Tax Withholding 2012Dokument4 SeitenSimplified Charts - Percentage Method Income Tax Withholding 2012MaryNoch keine Bewertungen

- Labor Variance FormulasDokument2 SeitenLabor Variance FormulasMaryNoch keine Bewertungen

- Calendars For Sales TermsDokument2 SeitenCalendars For Sales TermsMaryNoch keine Bewertungen

- Financial StatementsDokument1 SeiteFinancial StatementsMary100% (4)

- Materials Variance FormulasDokument2 SeitenMaterials Variance FormulasMary100% (1)

- Transaction Analyzes For A CorporationDokument2 SeitenTransaction Analyzes For A CorporationMaryNoch keine Bewertungen

- Simplified Charts-Percentage Method Income Tax Withholding 2008Dokument4 SeitenSimplified Charts-Percentage Method Income Tax Withholding 2008MaryNoch keine Bewertungen

- Gross Profit Section of Income Statement-Periodic SystemDokument3 SeitenGross Profit Section of Income Statement-Periodic SystemMary67% (3)

- 2014 15 PDFDokument117 Seiten2014 15 PDFAvichal BhaniramkaNoch keine Bewertungen

- Diliman Preparatory School: Basic Education Department-High School SCHOOL YEAR 2019-2020 First Semester Fabm 2Dokument2 SeitenDiliman Preparatory School: Basic Education Department-High School SCHOOL YEAR 2019-2020 First Semester Fabm 2Althea Nicole CanapiNoch keine Bewertungen

- Social Security Protection in NepalDokument27 SeitenSocial Security Protection in NepalBindu Gaire SharmaNoch keine Bewertungen

- Drill 1: Neat As You Are. So, I Suggest To Make A Separate Summary of Answers For Every ProblemDokument1 SeiteDrill 1: Neat As You Are. So, I Suggest To Make A Separate Summary of Answers For Every ProblemcpacpacpaNoch keine Bewertungen

- A Study On Consumer Perception and Attitude Towards Gold Loan PDFDokument91 SeitenA Study On Consumer Perception and Attitude Towards Gold Loan PDFPratiksha Misal100% (1)

- Analyze financial statements with ratiosDokument13 SeitenAnalyze financial statements with ratiosDiwakar SrivastavaNoch keine Bewertungen

- Project Financial and Investment Criteria AnalysisDokument29 SeitenProject Financial and Investment Criteria Analysislealem100% (1)

- Business FinanceDokument3 SeitenBusiness FinanceRaul Soriano Cabanting100% (2)

- Republic Glass VS QuaDokument2 SeitenRepublic Glass VS QuaannlaurenweillNoch keine Bewertungen

- 11 Lyons V RosestockDokument1 Seite11 Lyons V RosestockNichole LanuzaNoch keine Bewertungen

- UCSB MapDokument1 SeiteUCSB MapXiaoyan WangNoch keine Bewertungen

- Payment Rate Dispute in Engineering Services CaseDokument4 SeitenPayment Rate Dispute in Engineering Services CaseCeline GarciaNoch keine Bewertungen

- Monetary PolicyDokument9 SeitenMonetary Policyrahul5335Noch keine Bewertungen

- Cooper Industries' Potential Acquisition of Nicholson File CompanyDokument12 SeitenCooper Industries' Potential Acquisition of Nicholson File CompanyLutful Kabir71% (7)

- 06 Philex Mining vs. CIRDokument1 Seite06 Philex Mining vs. CIRJoshua Erik Madria100% (1)

- Office Space Lease ContractDokument1 SeiteOffice Space Lease Contractادزسر بانديكو هادولهNoch keine Bewertungen

- Big Red Bicycle Master Budget FY 2011/2012 FY Q1 Q2 Q3 Q4Dokument3 SeitenBig Red Bicycle Master Budget FY 2011/2012 FY Q1 Q2 Q3 Q4rida zulquarnainNoch keine Bewertungen

- Ecran TelefonDokument3 SeitenEcran TelefonAlexandra Adriana RaduNoch keine Bewertungen

- Understanding key concepts of provisions, bonds payable, operating leases and finance leasesDokument20 SeitenUnderstanding key concepts of provisions, bonds payable, operating leases and finance leasesRheu ReyesNoch keine Bewertungen

- Financial Analysis of Everest BankDokument27 SeitenFinancial Analysis of Everest BankRazel TercinoNoch keine Bewertungen

- Problem 3-1 Problem 3-2 Problem 3-3 Problem 3-4 Problem 3-5Dokument22 SeitenProblem 3-1 Problem 3-2 Problem 3-3 Problem 3-4 Problem 3-5Yen YenNoch keine Bewertungen

- Ceda New Guidelines - July 2020Dokument20 SeitenCeda New Guidelines - July 2020BtsibandaNoch keine Bewertungen